👋Exciting news! UPI payments are now available in India! Sign up now →

Smart company debit cards designed for Indian teams

As Indian companies embrace digital-first finance, outdated systems like employee reimbursements or shared cards fall short, lacking speed, control, and visibility. The smarter alternative? Company debit cards tailored for modern teams.

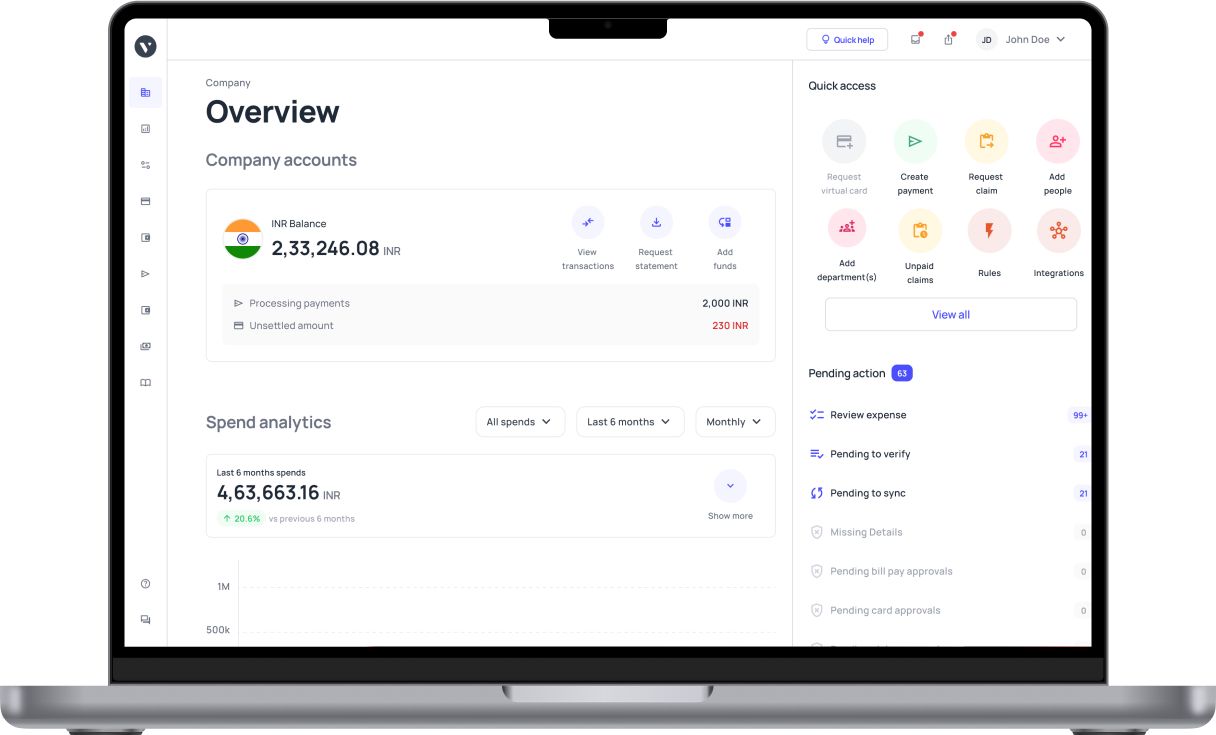

With Volopay’s unified spend platform, you can issue company debit cards for employees, automate controls, and scale operations with full compliance. Want to see how smart cards can transform the way your team spends? Let’s dive in.

What are company debit cards in India?

Designed for Indian businesses

Say goodbye to outdated spend methods like shared corporate credit cards, scattered UPI payments, and untracked petty cash. Smart, preloaded company debit cards give Indian businesses a better way to manage team expenses.

These cards are issued to individual employees as employee debit cards with pre-approved budgets, enabling accountability and eliminating the need for reimbursements. Whether you're funding department operations or project-specific needs, you gain complete control and visibility over every transaction without bottlenecks or back-and-forth with finance.

Plus, you reduce financial risk by eliminating shared access to company funds. It’s a modern, policy-compliant solution that fits seamlessly into today’s agile work environments.

Digital-first, secure, and scalable

Modern debit cards for company use are built to streamline spending in real time. Once funds are loaded, every transaction is tracked instantly with smart controls in place. You can set card limits, restrict merchants, or block specific categories all from a central dashboard.

This means less manual work, fewer errors, and stronger compliance. Automated alerts and audit trails keep your finance team informed without chasing down receipts.

As your workforce grows, you can issue and manage hundreds of cards in minutes no paperwork, no delays. With everything digitized, you gain full transparency and control over company-wide spending at any time.

Why traditional expense management slows down growing Indian teams

Manual paybacks delay & demoralize

When employees have to pay out of pocket and wait weeks for reimbursement, it affects productivity and motivation.

The delay in claim processing also leads to frustration and avoidable back-and-forth with finance teams.

This outdated system creates friction that slows down business operations significantly.

Lack of visibility wastes budgets

Without real-time expense tracking, finance teams are forced to rely on delayed reports and fragmented data.

This lack of transparency leads to budget overruns, unplanned cash flow issues, and poor decision-making.

Misreporting also increases the risk of audit complications down the line.

Policy violations go unnoticed

In traditional workflows, there are no proactive controls to flag out-of-policy purchases.

This allows unauthorized spending and non-compliant transactions to slip through unnoticed.

Company debit cards enforce spending rules automatically, helping teams stay compliant without micromanagement.

Why Indian companies prefer debit cards over credit

No debt, no interest, no surprises

With company debit cards, you only spend what’s already been funded, eliminating the risk of overspending. There are no interest rates, billing cycles, or hidden charges to worry about. This makes them ideal for startups and growing companies looking to stay lean and financially disciplined.

Instant control without bank dependencies

Unlike traditional credit systems, debit cards for company use can be issued and managed directly from your spend platform. No paperwork, branch visits, or approval delays from banks.

You can instantly block, reload, or customize card rules keeping full control at your fingertips. This agility allows businesses to adapt spending policies on the fly without waiting on third-party approvals.

Empower teams, not overspend

Give departments or project teams spending freedom without compromising control. Budgets can be pre-assigned, monitored, and adjusted as needed in real time.

Company debit cards allow you to distribute responsibility while maintaining oversight and policy compliance. This builds a culture of accountability, where every team owns its spending within guardrails.

Ready to simplify spending and stay in control? Discover the Best business debit cards in India to empower your teams, streamline finance operations, and maintain complete visibility over every transaction.

Volopay debit card features for Indian teams

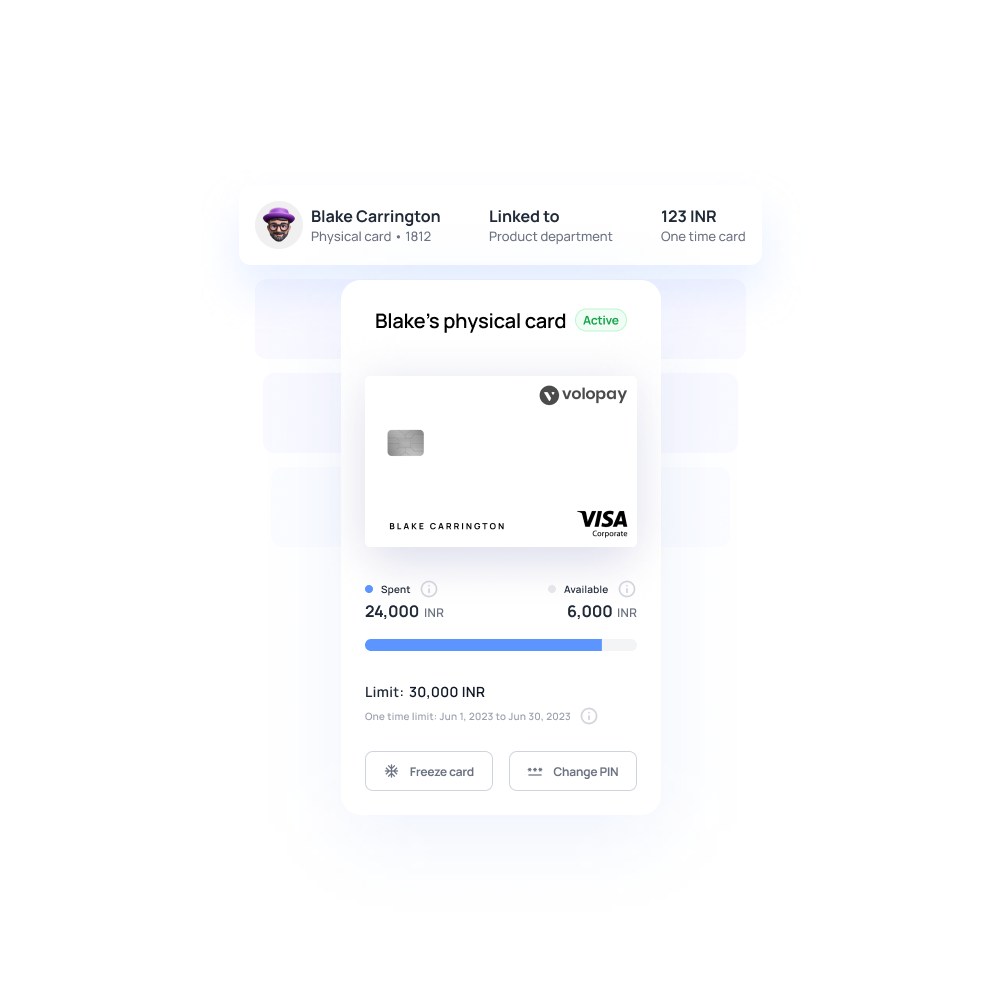

Virtual and physical cards issued in seconds

Instantly generate physical cards or virtual cards for employees, tools, or campaign needs no delays or paperwork. These cards can be used online or in-store, locally or internationally.

With Volopay, company debit cards are ready to use right from your dashboard, ensuring fast, flexible spending.

Spend limits that match budgets

Apply specific rules to each card daily caps, monthly limits, merchant restrictions, or category blocks. This ensures that every rupee spent aligns with your budget plans.

Finance teams gain control without micromanaging each transaction. You can pause, modify, or cancel cards instantly if a project ends or an employee exits.

GST-friendly receipts and tagging

Automatically collect receipts and assign cost center tags at the time of purchase. Make GST reconciliation easier by attaching the right tax data to each transaction.

This keeps audits smooth and finance records clean. Every transaction is recorded with the correct vendor and tax classification to simplify input credit claims.

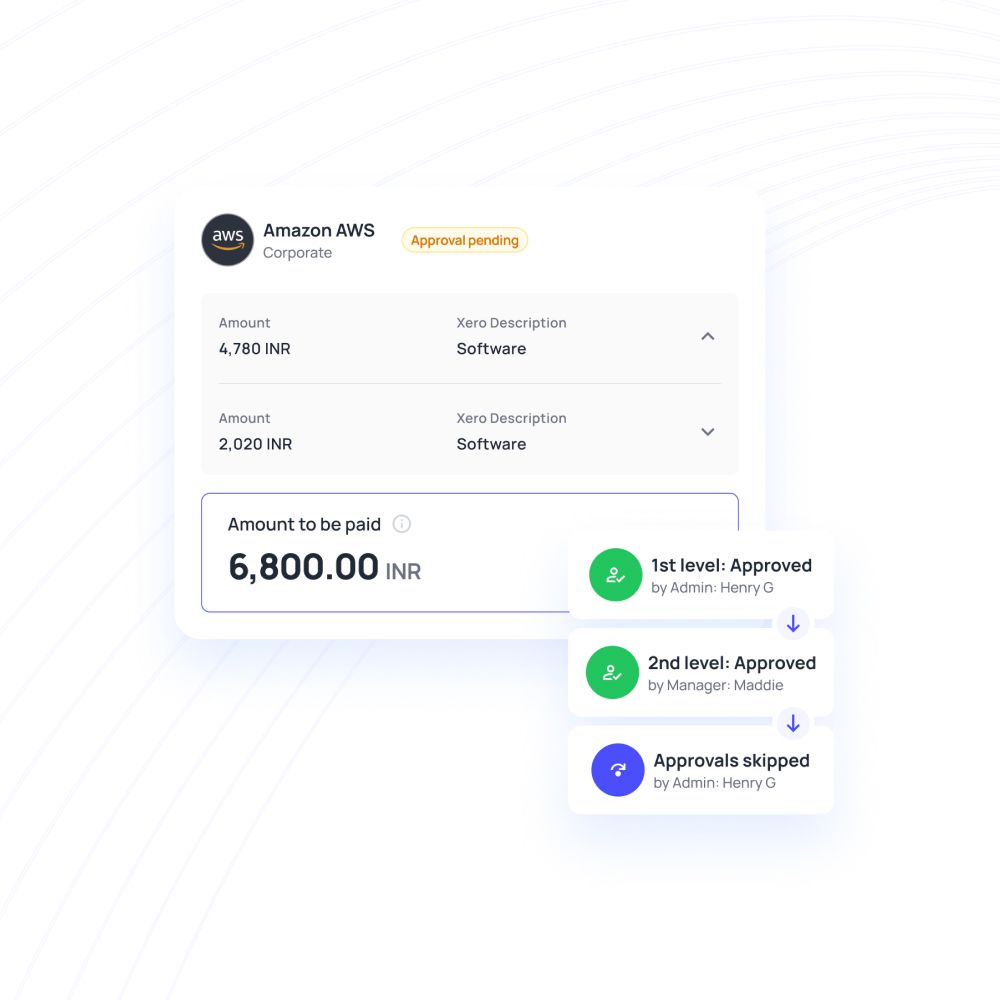

Custom workflows with role-based access

Set up customizable approval workflows based on your organization’s reporting structure. Define who can view, approve, or modify card settings based on role. This ensures compliance while giving teams the autonomy they need.

From interns to CXOs, everyone gets access aligned with their responsibilities. You can also set escalation paths for faster decisions on urgent spend requests.

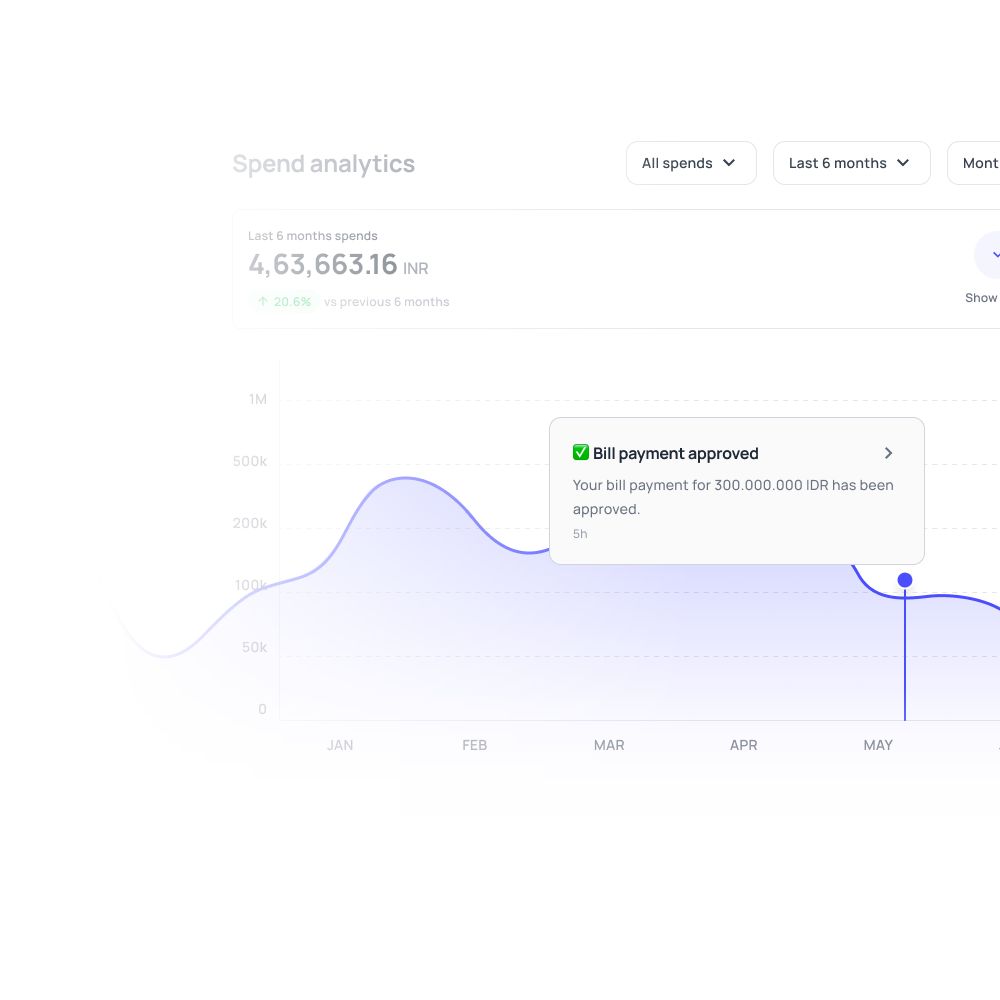

Real-time visibility for finance teams

Monitor every payment, refund, or swipe as it happens—no waiting for reports. Filter and export data by employee, vendor, or card to simplify reviews. This helps you stay proactive with spend control and forecasting.

Finance teams get real-time alerts for unusual activity or threshold breaches. Real-time data empowers smarter planning, tighter compliance, and faster month-end closes.

Use company debit cards to close your books faster

1. Auto-match receipts with card transactions

Employees can upload receipts directly through the app, which are instantly matched to the correct transaction. No more chasing team members for paperwork or sorting through folders at month-end.

This saves hours of manual work and ensures accurate recordkeeping using company debit cards for employees. Every receipt is linked to its expense entry, making audits stress-free.

2. Skip manual entries and ledger mapping

Volopay automatically categorizes each transaction and maps it to your chart of accounts. Spend data flows seamlessly into your accounting software be it Tally, Zoho Books, or a custom ERP. You eliminate tedious data entry and reduce the risk of human error. It’s a plug-and-play process built for financial efficiency.

3. Export GST-compliant reports in seconds

Every transaction is tagged with the appropriate GST rate and cost center at the point of purchase. This means your finance team can generate accurate, export-ready reports for filings or audits in just a few clicks. Stay compliant without the last-minute rush. GST inputs and credits are calculated and sorted automatically.

How Volopay debit cards improve financial discipline

Predefined usage, not post-approval

With Volopay, you set exact spend rules in advance amount, category, and timeline so every transaction is automatically pre-approved. This prevents overspending before it happens and reduces reliance on manual checks.

Unlike traditional methods, debit cards for company use give real-time control at the point of spend. Every swipe stays within your policy no exceptions.

Full context for every transaction

Each expense is logged with complete details, including employee name, vendor, receipt, expense purpose, and relevant tags. This level of transparency eliminates ambiguity and supports cleaner audits.

Finance teams no longer need to piece together missing information after the fact. It’s easy to trace every transaction back to its source.

Lock down by vendor, category, or location

Control card usage by defining where, how, and on what the funds can be spent. Block disallowed merchants, restrict spend categories, or limit usage to approved geographies.

These proactive controls minimize policy violations and improve operational accountability. You stay in control without slowing your teams down.

One platform to align all departmental functions

One tool, role-specific views

Volopay provides a unified platform where finance has complete visibility, while departments see only their own spend and budgets. Each role gets tailored access based on responsibilities, keeping sensitive data protected.

This clarity improves accountability without overwhelming users with unnecessary information. Everyone stays informed without compromising on data security.

Department-level card tracking

Cards can be grouped by team, project, or function giving finance and managers a clear picture of how budgets are being used. It’s easy to analyze spending patterns and adjust allocations as needed.

This structure supports smarter planning and avoids cross-team confusion. Teams can focus on delivery while finance ensures budget alignment.

Real-time sync, no manual follow-ups

With live data across the platform, there's no need to chase teams for updates or reports. Everyone from finance to operations can see transaction status and budget usage as it happens.

This eliminates delays and keeps all stakeholders aligned. Approvals, receipts, and records update instantly for full transparency.

Everyday scenarios where Indian teams use company debit cards

Employee per diems and travel expenses

Equip employees with cards to cover daily expenses during work trips.

No need to carry cash or wait for reimbursements. Cards are preloaded, secure, and controlled by policy-based limits.

Each transaction is automatically tagged to the right cost center, making reporting seamless. This setup ensures both employee convenience and financial accountability.

Marketing and SaaS subscriptions

Assign dedicated cards to platforms like Meta, Google Ads, or CRM tools with predefined budgets.

Avoid billing failures and overspending via real-time tracking. Each subscription stays organized under its own card for cleaner reconciliation.

Marketing teams get the flexibility they need without risking budget overruns. Finance gains visibility into campaign-specific spend without chasing down reports.

Vendor procurement and logistics

Operations teams can pay approved vendors, book services, or handle event logistics without delays.

Eliminate manual payment processes and enable faster execution on time-sensitive tasks. Card usage stays visible and policy-compliant.

Set vendor-specific rules to ensure funds are used with approved partners, speeding procurement while maintaining control over disbursals.

Team budgets, not just finance-led spend

Give departments control over their own spending while finance retains oversight.

Teams can manage P&L ownership without compromising accountability. Spending is tracked live and aligned with company-wide financial goals.

Department heads can reallocate funds quickly based on changing needs. This empowers teams while keeping spending guardrails intact.

Why Volopay is more than a debit card

Volopay isn’t just a card provider it’s a complete spend management platform. Get real-time visibility, budget controls, and automated compliance in one place.

Finance teams can enforce policy without slowing teams down, while every transaction is tracked and audit-ready.

It’s a powerful ecosystem built for accountability, ease of use, visibility, control, and speed.

From approvals to policy enforcement, every step is streamlined, tracked, and auditable within the same unified, real-time platform.

Volopay integrate seamlessly with accounting software like Tally, Zoho Books, QuickBooks, and more, making bookkeeping effortless.

Transactions are auto-categorized, matched with receipts, and synced to your ledger without manual work. Audit trails are clean, and exports are fully GST-compliant.

Month-end close becomes faster, simpler, and more accurate across all teams. You reduce manual errors while saving time on reconciliation and reporting.

Even complex multi-entity or multi-currency accounting can be handled with ease.

Whether you’re a 10-person startup or a 500-employee enterprise, Volopay seamlessly adapts to your scale.

Set up layered permissions, assign role-based access, and automate approval workflows easily. As your teams grow, smart controls stay tight and processes remain efficient.

You can issue cards and manage budgets, without adding complexity. It’s a future-ready system that grows with your business.

With centralized control and decentralized execution, you empower teams without compromising governance.

Why growing Indian companies choose Volopay to scale finance

All-in-one spend management

Volopay brings every element of business spend card issuance, expense tracking, approvals, and accounting—into one connected system. You no longer need to juggle multiple tools or manually reconcile expenses.

From card creation to ledger sync, the entire flow is automated. Everything from employee travel to vendor payments runs through one unified dashboard. This reduces friction across departments and gives finance teams total control.

Expand card programs effortlessly

Scale your card infrastructure as your team grows, whether you're adding new hires, departments, or locations. Issue corporate cards in seconds, assign roles, and define budgets without waiting on banks or paperwork. It’s built to grow with your company at every stage.

You can clone settings for new departments or apply unique rules based on team needs. This flexibility supports rapid expansion without compromising financial discipline.

Track every rupee, tag every transaction

Automatically categorize each transaction with the correct vendor, tax rate, and cost center. Gain complete visibility across teams and streamline monthly reporting. Whether it’s GST filing or audit prep, everything is already in place no cleanup required.

Filters and reports can be customized by department, project, or timeline. This ensures that finance has precise, real-time data whenever needed.

Build smart workflows

Design multi level approval workflows that mirror your finance policy, no matter how complex. Create layered permissions, card-specific rules, and automated notifications to ensure compliance. Teams move faster, and finance retains complete control over every spend.

You can set escalation paths, time-based approvals, or exception handling for one-time needs. These smart workflows reduce bottlenecks while maintaining accountability.

Get started with Volopay company debit cards in India

Register online and submit KYC

Sign up on the Volopay platform with your business details and complete a quick KYC process. Upload your documents digitally no physical paperwork required. Verification is fast, so you can start setting up your account without delay.

The process is fully compliant with Indian regulatory standards. You’ll be guided at every step to ensure a smooth onboarding experience.

Load INR and activate cards instantly

Once your account is verified, load funds in INR directly from your business bank account. You can issue volopay's physical cards or virtual cards to employees immediately. Cards are ready to use the moment funds are available.

There’s no need to wait for external approvals or complex integrations. This lets you get up and running in just a few clicks.

Set rules, roles, and access

Configure spending limits, approval layers, and role-based access for each team member. You control who can spend, how much, and on what right from the dashboard. Every card follows your internal finance policy by default.

You can tailor controls based on departments, seniority, or project needs. These settings can be updated anytime as your organization evolves.

Get a personalised product demo

Schedule a live walkthrough with a Volopay expert to explore features that fit your business. Learn how to automate current processes, improve visibility, and stay compliant. The demo is tailored to your industry, team size, and goals.

You’ll get answers to your questions and a custom plan for implementation. It’s the easiest way to see Volopay in action before committing.

Bring Volopay to your business

Get started now

FAQs

Company debit cards are prepaid, so you can only spend what’s loaded unlike credit cards, which allow borrowing and come with interest, billing cycles, and credit risk. This ensures better cash flow control and prevents overspending across teams.

Yes, Volopay lets you create and assign cards by department, project, or vendor, making it easier to manage budgets and track spending across various business functions. Each card can have unique limits and rules based on the team's purpose.

Absolutely. Volopay cards are enabled for secure online and international transactions, with smart controls to manage spend limits, merchant types, and real-time alerts. You can also freeze or disable cards instantly in case of suspicious activity.

You can instantly load funds from your Volopay INR wallet to any team member’s card, ensuring uninterrupted access to approved budgets whenever needed. There’s no delay or manual approval needed once your wallet is funded.

Yes, you can restrict card usage by merchant category, vendor, or location. These controls can be set in advance to align with your internal expense policies.

The requirement for minimum employees varies from provider to provider. If you’re unsure about how you qualify, sign up for a demo with our team and have a chat to see how your team could implement and benefit from Volopay’s debit cards.