👋Exciting news! UPI payments are now available in India! Sign up now →

The best corporate card for scaling Indian businesses

Managing corporate expenses requires sophisticated financial tools that can keep pace with your company's growth. Traditional expense management methods often create bottlenecks, compliance issues, and financial visibility gaps that can hinder your business operations.

Corporate cards have emerged as essential financial instruments that streamline expense management while providing enhanced control and transparency for Indian businesses of all sizes.

What is a corporate card?

A corporate card functions as a payment instrument specifically designed for business expenses, allowing companies to maintain better control over their financial operations. Unlike personal credit cards, corporate cards are issued directly to businesses and can be distributed to employees for authorized company purchases.

These cards integrate seamlessly with expense management systems, providing real-time visibility into spending patterns and enabling automated expense tracking.

Corporate cards eliminate the need for employees to use personal funds for business expenses and later seek reimbursement. Your finance team gains immediate access to transaction data, enabling better budget management and financial planning.

The cards can be customized with specific spending limits, merchant restrictions, and approval workflows that align with your company's expense policies and compliance requirements.

Why use corporate cards in India?

1. No credit risk

Corporate cards operate on a prepaid model, ensuring your business never exceeds its allocated budget or incurs unexpected debt obligations. You load funds onto the cards based on departmental budgets or project requirements, eliminating the risk of overspending.

This approach provides complete financial control while ensuring employees have access to necessary funds for legitimate business expenses without creating liability concerns for your organization.

2. Enhanced fraud protection

Advanced security features protect your business from unauthorized transactions and fraudulent activities through multi-layered authentication systems. Real-time monitoring algorithms detect suspicious spending patterns and automatically flag unusual transactions for immediate review.

Your finance team receives instant notifications about potentially fraudulent activities, enabling rapid response to security threats while maintaining business continuity and protecting company assets.

3. Time-saving automation

Automated expense categorization and receipt matching eliminate manual data entry and reduce administrative overhead for your accounting team. Digital receipts are automatically captured and linked to corresponding transactions, creating comprehensive expense records without manual intervention.

This automation reduces processing time from hours to minutes while improving accuracy and ensuring compliance with tax documentation requirements.

4. Global payment flexibility

Multi-currency support enables seamless international transactions without additional conversion fees or processing complications for your global business operations. Your employees can make purchases in local currencies during business travel or international vendor payments without currency exchange hassles.

The cards work across multiple payment networks, ensuring acceptance at millions of merchants worldwide while maintaining consistent expense tracking capabilities.

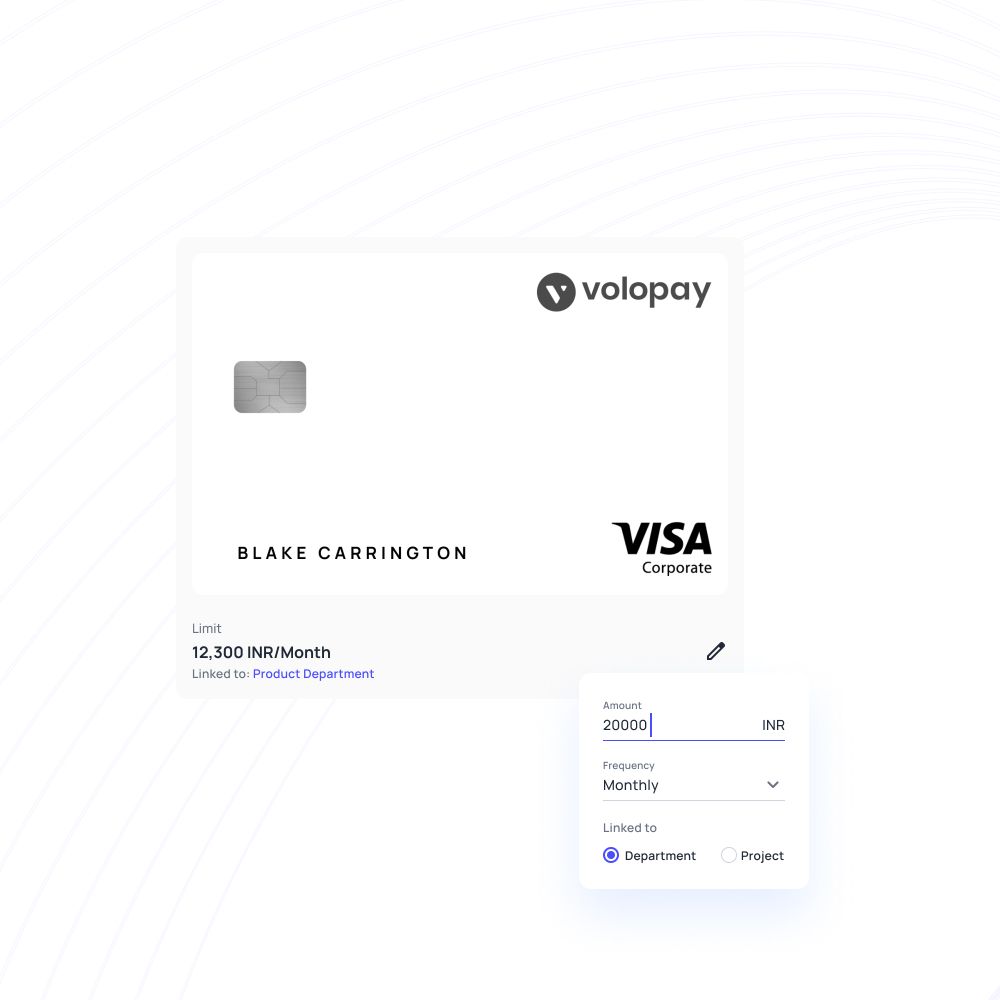

5. Customizable spending limits and policies

Granular control over spending limits allows you to set specific budgets for different employees, departments, or expense categories based on business requirements.

Policy enforcement ensures automatic compliance with company spending guidelines, preventing unauthorized purchases before they occur. You can adjust limits in real-time based on project needs or seasonal business fluctuations while maintaining oversight of all financial activities.

6. Real-time transaction monitoring

Instant transaction visibility provides immediate insights into company spending patterns and enables proactive budget management throughout your organization. Your finance team can monitor expenses as they occur, identifying potential budget overruns before they impact business operations.

This real-time capability supports better decision-making and ensures financial accountability across all departments and business units.

Take the next step in streamlining your company’s financial operations—explore our expert guide on how to choose the right corporate card program tailored to your business needs.

Why Volopay excels as India's best corporate card

Volopay stands out as India's premier corporate card solution, offering innovative features specifically designed for the unique needs of Indian businesses across all industries and sizes. The platform combines cutting-edge technology with a deep understanding of local business requirements, providing comprehensive expense management capabilities that traditional banking solutions cannot match.

Your organization benefits from advanced automation, seamless integrations, and robust security features that simplify financial operations while maintaining complete control over corporate spending and ensuring compliance with Indian regulatory requirements.

Dynamic budget management

Real-time budget adjustments enable your finance team to redistribute funds across departments based on changing business priorities and operational requirements. You can allocate budgets by project, department, or individual employee while maintaining visibility into spending patterns and remaining balances.

Volopay's business budgeting software capabilities ensure optimal resource utilization while preventing budget constraints from hindering critical business activities and supporting dynamic business growth strategies. Your system automatically monitors expenditures against allocated budgets and sends notifications to relevant stakeholders when intervention is required.

Live transaction monitoring

Real-time transaction visibility provide immediate access to all card activities, enabling your finance team to monitor expenses as they occur across your organization. Every purchase generates instant notifications with detailed transaction information, including merchant details, purchase amounts, and employee identification.

Detailed transaction histories create complete audit trails for all corporate spending, supporting compliance requirements and simplifying expense reporting processes.

Streamlined accounting integration

Direct integration with popular accounting software eliminates manual data entry and ensures accurate financial record-keeping across your existing business systems. Your transaction data flows automatically into accounting platforms like Tally, QuickBooks, and NetSuite, maintaining consistency and reducing processing errors.

Intelligent matching algorithms automatically reconcile transactions with corresponding receipts and purchase orders, reducing manual reconciliation time and improving accuracy. Your system identifies and resolves discrepancies while flagging items requiring manual review, streamlining the entire reconciliation process.

Robust security framework

Machine learning algorithms continuously monitor transaction patterns to identify and prevent fraudulent activities before they impact your business operations. The system analyzes spending behaviors, merchant interactions, and transaction timing to detect anomalies that might indicate unauthorized use.

Full compliance with PCI DSS, ISO 27001, and Indian data protection regulations ensures your financial data remains secure and meets regulatory requirements. This comprehensive approach to security and compliance reduces risk exposure while ensuring your business meets all regulatory obligations and industry standards.

Physical and virtual card solutions

Volopay's instant virtual card issuance enables immediate access to corporate spending capabilities, while physical cards provide traditional payment flexibility for offline transactions. This dual approach ensures complete payment flexibility while maintaining security and control over all corporate spending activities.

Your platform can generate unlimited virtual cards for specific projects, vendors, or expense categories while maintaining centralized control and monitoring capabilities. This scalability ensures your payment infrastructure grows with your business while maintaining efficiency and security standards across all operations.

Quick expense reimbursement

Automated expense processing reduces reimbursement cycles from weeks to days, improving employee satisfaction and cash flow management for your organization. Your system automatically validates expenses against company policies and processes approved claims without manual intervention, ensuring prompt payment to employees.

Intelligent routing systems direct expense claims to appropriate approvers based on amount thresholds and organizational hierarchies, ensuring efficient processing and compliance. Your workflow engine automatically escalates claims requiring additional authorization while providing complete visibility into approval status and processing times.

Multi-tier approval workflows

Volopay's flexible multi-level approval structures adapt to your organizational requirements, supporting simple single-approver processes or complex multi-level authorization chains based on expense amounts and categories. Customization ensures proper oversight while maintaining efficiency and supporting compliance with internal controls and authorization policies.

Smart escalation rules ensure the timely processing of expense approvals by automatically routing delayed approvals to backup approvers or higher authority levels. This automation reduces processing delays while providing complete audit trails and ensuring appropriate oversight of all corporate spending activities.

Simplify your business spending with Volopay corporate cards

Volopay vs. other corporate cards

Volopay vs. other corporate cards

Effortless team setup and card activation

Quick card issuance

Streamlined card deployment enables your teams to issue virtual or physical cards to new employees within minutes through an intuitive centralized management platform.

Your system automatically applies appropriate spending limits and policy restrictions based on employee roles and departmental requirements while maintaining complete oversight capabilities.

This rapid issuance process ensures new team members can begin business activities immediately without delays or administrative complications that might impact productivity.

Guided onboarding

Comprehensive in-app tutorials and dedicated live support ensure employees understand card usage protocols and expense submission requirements from their first day.

Your platform provides step-by-step guidance for common transactions while offering immediate assistance for complex scenarios or policy questions.

This thorough onboarding approach reduces support requests while ensuring proper card usage and compliance with company expense policies throughout your organization.

Role-based access controls

Sophisticated permission systems assign customized spending limits and merchant access levels based on specific employee roles and departmental responsibilities within your organization.

The platform automatically applies appropriate restrictions while providing flexibility for role changes and special circumstances that might require temporary adjustments.

This granular control ensures appropriate spending authority while maintaining security and compliance with internal controls and authorization policies.

Seamless system integration

Native connectivity with existing HR, ERP, accounting, and payroll systems ensures automatic employee data synchronization and reduces manual setup requirements for your administrative team.

The platform maintains current employee information while automatically updating card privileges based on role changes or departmental transfers.

This integration eliminates duplicate data entry while ensuring accuracy and consistency across all business systems and maintaining proper controls over card access and usage.

Simplified compliance and audit preparation

Automated policy adherence

Intelligent policy enforcement ensures automatic compliance with company spending rules and regulatory requirements, preventing violations before they occur throughout your organization.

The system applies predefined rules for expense categories, spending limits, and merchant restrictions while providing flexibility for legitimate business exceptions. This automated approach reduces compliance risks while minimizing administrative overhead and ensuring consistent policy application across all departments and business units.

Audit-friendly records

Comprehensive documentation systems maintain detailed, easily accessible records for financial audits and regulatory reviews, supporting compliance requirements and reducing audit preparation time.

The platform automatically generates audit trails with complete transaction histories, approval workflows, and supporting documentation organized for easy review. This systematic approach simplifies audit processes while ensuring compliance with accounting standards and regulatory requirements specific to Indian businesses.

Tax filing efficiency

Automated expense categorization and detailed reporting support accurate tax filings and reduce preparation time for your accounting team during tax season. Your system maintains proper documentation for tax-deductible expenses while providing detailed reports organized by tax categories and time periods.

This comprehensive approach ensures accuracy while reducing the manual work required for tax preparation and compliance with Indian tax regulations and documentation requirements.

Real-time alerts

Proactive notification systems provide instant alerts for policy violations or unusual spending patterns, enabling immediate intervention to maintain compliance and control. The platform monitors all transactions against established policies and sends notifications to appropriate personnel when intervention is required.

This real-time monitoring supports better financial control while ensuring rapid response to potential compliance issues or unauthorized spending activities.

Quick dashboard access

Centralized management interfaces provide finance teams with immediate access to key metrics, spending patterns, and compliance status across your entire organization. Your dashboard consolidates critical information while providing drill-down capabilities for detailed analysis and investigation of specific transactions or spending patterns.

This comprehensive visibility supports better decision-making while ensuring complete oversight of financial activities and compliance status across all business units.

Enhanced employee financial independence

Pre-approved budget access

Employees gain immediate access to approved budgets without requiring advance approval for routine business expenses, improving efficiency and reducing administrative delays throughout your organization.

Your system automatically applies spending limits and policy restrictions while providing employees with clear visibility into available budgets and spending authority. This approach supports better business agility while maintaining appropriate controls and ensuring compliance with company expense policies and authorization procedures.

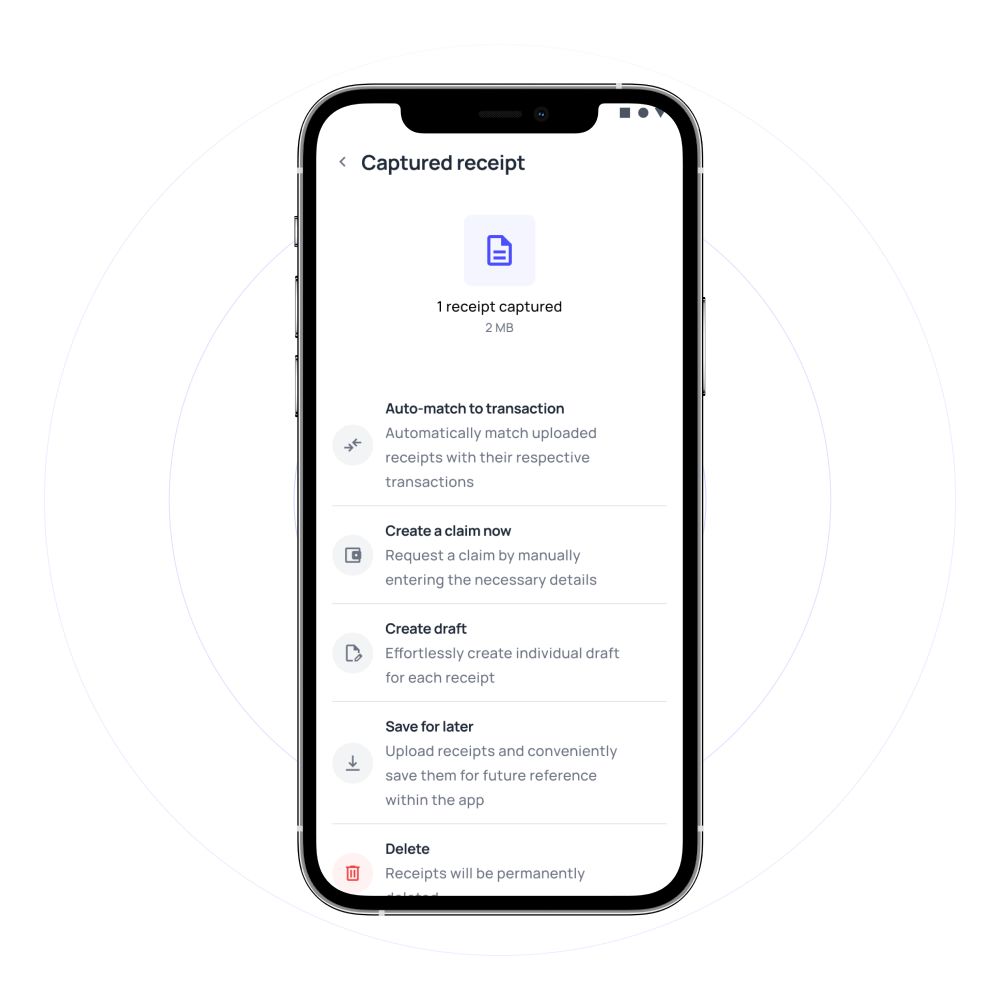

Easy receipt submission

Mobile receipt capture and automated expense reporting eliminate manual paperwork while ensuring complete documentation for all business transactions and regulatory compliance.

Your platform enables employees to photograph receipts and automatically link them to corresponding transactions while providing guided categorization and description entry.

This streamlined process reduces administrative burden while ensuring accurate record-keeping and supporting compliance with documentation requirements for accounting and tax purposes.

Flexible merchant access

Comprehensive merchant network acceptance ensures employees can make necessary business purchases across diverse vendors and service providers without payment limitations.

Your platform supports transactions at millions of merchants worldwide while maintaining spending controls and policy compliance for all purchases.

This flexibility ensures business continuity while providing complete oversight and control over corporate spending activities across all merchant categories and transaction types.

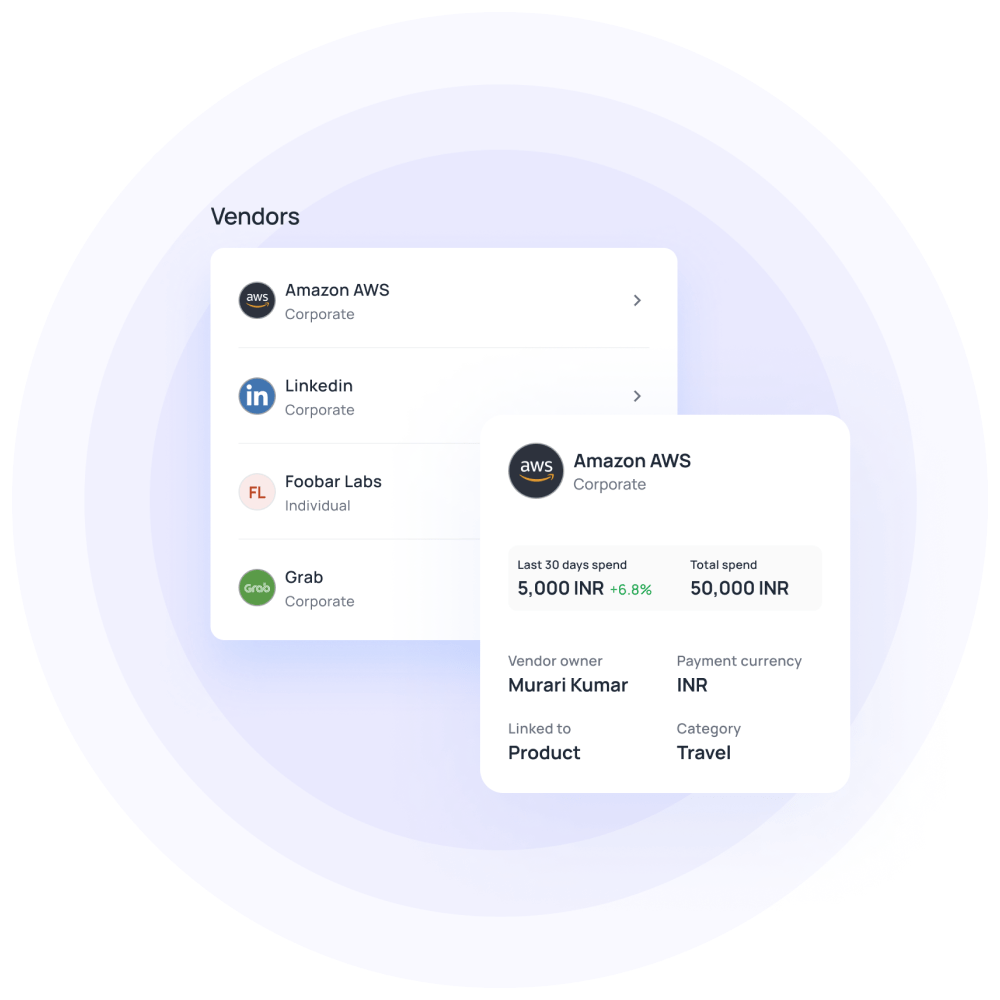

Optimized supplier payment management

Vendor-specific card assignment

Dedicated payment cards for specific suppliers simplify vendor relationships while providing detailed spend visibility and control over all supplier-related expenses.

Your system enables the creation of vendor-specific cards with tailored spending limits and transaction monitoring while maintaining comprehensive records of all supplier interactions.

This targeted approach supports better vendor management while ensuring appropriate controls and oversight of supplier-related spending and payment activities.

Automated payment scheduling

Intelligent payment automation ensures timely vendor payments while maintaining cash flow control and reducing manual payment processing requirements for your accounts payable team.

Your platform schedules recurring payments based on contract terms while providing flexibility for one-time purchases and special circumstances.

This automation improves vendor relationships while reducing administrative overhead and ensuring compliance with payment terms and contractual obligations.

Supplier spend tracking

A comprehensive supplier spending analysis provides detailed insights into vendor relationships and purchasing patterns, supporting better cost optimization decisions.

Your platform tracks spending by vendor, category, and time period while providing comparative analysis and trend identification capabilities.

This detailed visibility supports strategic procurement planning, optimal vendor relationship management and cost control across all supplier interactions with the best corporate card solution for Indian businesses.

Bring Volopay to your business

Get started now