👋Exciting news! UPI payments are now available in India! Sign up now →

UPI for businesses: How UPI is revolutionizing transactions for businesses

In today’s digital era, the way we exchange money has also become digital. Most people use digital modes of payment to send or receive money, and UPI (Unified Payments Interface) is one of the most popular ways of exchanging money online.

UPI has revolutionized digital transactions in India by making payments fast, safe, and instant. UPI is a blessing not just for individuals but also for businesses, as it provides a seamless way to receive payments and manage transactions for businesses.

The smooth and efficient transaction process of UPI for businesses has changed how payments are made, making it a necessary asset for businesses to sustain in the digital age.

What is UPI?

UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI) that enables instant fund transfers between two bank accounts through a mobile platform.

It functions as an additional layer on top of the existing banking system, allowing users to connect multiple bank accounts to a single mobile app.

How does UPI work for businesses?

UPI for business works by providing a simple, secure, and real-time method to receive payments directly into the business bank accounts.

Once a business is registered with a UPI-enabled bank or payment service provider, the business is assigned a unique UPI ID or QR code. Customers can make payments by entering this ID or scanning the QR code using any UPI-supported app. This eliminates the need for cash or card transactions.

One of the main advantages of a UPI account for business is its simplicity. Customers can complete payments instantly just by entering the UPI ID or scanning a QR code without needing to input account numbers and IFSC codes.

This makes a UPI business account an efficient and cost-effective solution for businesses of all sizes to manage transactions and improve customer convenience.

The 2 main types of payments supported by UPI for business are:

Push payments

This is when the customer takes the initiative to send money to the business. They either enter the UPI ID or scan a QR code and complete the payment using their UPI app.

It’s quick and straightforward, just like sending money to a friend. This approach is often used in situations like retail purchases, bill payments, and other cases where the customer initiates and completes the payment on their own.

Collect requests

When businesses prefer to initiate the payment process, they use the collect request feature. In this case, the business sends a UPI payment request to the customer, mentioning the amount to be paid.

The customer gets a notification, reviews the details, and approves the transaction by entering their UPI PIN. UPI for business helps businesses streamline their receivables and makes the payment experience smoother and more convenient for customers.

Options for businesses accepting UPI payments

UPI business accounts offer many easy ways to make payments efficient. Here are the different ways businesses can send or receive money via UPI:

1. Entering UPI ID/ mobile number

Customers can simply enter the business UPI ID or registered mobile number into their UPI app, enter the amount to be paid, and make a payment. It’s quick and doesn't require any physical setup. It works great if someone does not want to use QR codes or links.

2. UPI apps and in-app payments

Businesses that have a digital presence and use UPI apps or platforms can let customers pay right inside the app. This makes the transaction easy, and customers don’t have to switch apps to complete it.

3. Entering account number and IFSC

This is the basic way to make a payment. Customers enter the business’s account number and IFSC, then enter the amount and their UPI PIN. The payment gets processed within seconds.

4. UPI QR codes

UPI QR codes are a very popular and convenient way to make payments, especially in physical stores. Customers can easily scan the code and make payments through their UPI-enabled mobile apps. The fast, contactless nature of UPI QR codes makes the payment process smoother and more efficient.

5. UPI payment links

Businesses can generate a payment link and send it to their customers via WhatsApp, SMS, or email. The customer clicks it and pays. UPI payment links are especially useful for online businesses that want a flexible way to accept payments through different communication platforms.

6. UPI-enabled POS terminals

Modern point-of-sale (POS) machines also support UPI. They generate a QR code on the screen that the customer can scan to pay.

This is particularly helpful for physical stores and service providers, as it fits smoothly into their current POS setup and provides a quick, in-person payment option.

7. UPI Autopay

UPI Autopay is a great solution for businesses that offer subscription services. Once customers give their approval, it allows for automatic recurring payments, making it easier for businesses to manage billing while providing customers with a hassle-free way to handle regular payments.

8. Payment gateway integration with UPI

Online businesses can easily add UPI as a payment option on their websites through payment gateways. Using such solutions helps ensure a smooth and reliable UPI payment experience for customers.

As businesses increase their use of UPI, it’s important to keep regulatory aspects in mind. Even though a UPI business account simplifies payments, every transaction is traceable and may come under a financial review, especially if there are very high volumes or unusual activity is suspected.

If you’re using UPI for business transactions, the income received is considered taxable under business or professional earnings. Businesses should also be aware of the tax on UPI transactions, especially under the current compliance norms.

Benefits of UPI for your business

Here are some advantages of UPI for businesses:

Easy and convenient

UPI makes payments simple by allowing users to complete transactions directly from their smartphones. There’s no need to enter bank details or IFSC codes; paying is as easy as sending a quick message.

Instant payments

With UPI, transactions happen in real time, so funds are transferred immediately. This is a big advantage for businesses that depend on fast and timely payments.

Cashless payments made easy

While debit and credit cards have been around for a while, they weren’t always practical for small purchases, like those at grocery or stationery shops.

With UPI, there’s no need to visit an ATM anymore, small payments can be made instantly, even at local stores, which has boosted the adoption of cashless transactions.

Available 24x7

UPI works round the clock, even on weekends and public holidays. So, businesses can receive or send payments anytime and from anywhere they need to. Unlike traditional banks, UPI doesn’t have fixed hours for completing transactions.

Secure transactions

Each UPI payment is protected by two-factor authentication, including a unique UPI PIN, ensuring a secure and reliable payment process.

Cost-effective

Compared to traditional options like NEFT or RTGS, UPI usually comes with lower transaction fees, making it a more economical option for businesses.

Tips for businesses to increase the success rate of UPI transactions

Use these pointers to increase your company's UPI transaction success rate and give your clients a seamless, fulfilling experience:

● To avoid unsuccessful payments, make sure your internet connection is steady.

● Make use of sturdy hardware. Reliable gadgets can reduce technological issues and provide a more seamless consumer experience.

● To make sure the customer is comfortable, offer a variety of payment methods, including UPI ID, QR code, and mobile number.

● To lower the percentage of shopping cart abandonment, offer a customized and simple payment process on the website. This can involve offering linked wallets alongside payment alternatives or a "save card" option on the payment page.

The Unified Payments Interface (UPI), which is governed by the Reserve Bank of India (RBI), has completely changed how Indian businesses send and receive money by providing a quick, affordable, and inclusive payment option.

UPI has become crucial for companies looking to maintain their competitiveness in the digital era due to its ease of use, adaptability, and capacity to combine several UPI solutions via a single interface. In an increasingly cashless market, it helps companies to promote financial inclusion and give consumers a smooth payment experience.

The bottom line

UPI has revolutionized the way businesses handle payments, offering a simple, secure, and efficient solution for managing transactions. UPI has proven to be an essential tool for businesses looking to optimize their financial operations in the digital era.

Its speed, ease of use, security, and cost-effectiveness make it an invaluable resource for businesses of all sizes in India. With its real-time processing and 24/7 availability, UPI ensures that businesses can stay competitive in the fast-paced digital economy.

By using UPI accounts for business, businesses not only simplify their payment processes but also stay on top of their game and are a part of the digital economy.

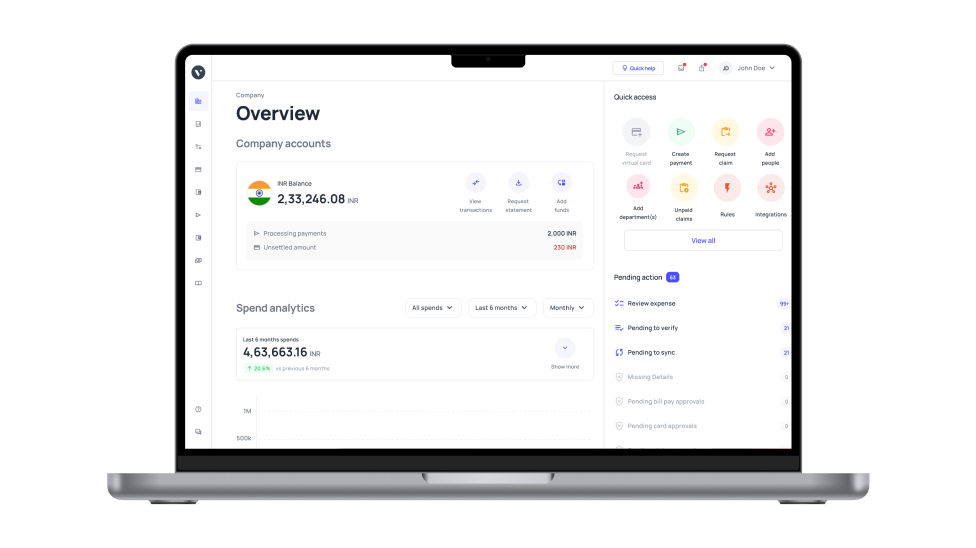

Make UPI payments with Volopay's virtual cards

With UPI becoming the most normalized medium of transaction between customer and vendor in India, it’s no surprise that employees often have to make business-related payments through their personal UPI IDs and then file for reimbursement.

To curb the unnecessary and time-intensive labor of manual filing and approvals, companies are looking for UPI solutions to make B2B payments. That’s where Volopay can help.

Volopay's advanced virtual cards can be issued for any employee, and they can be UPI-enabled, empowering your employees to make UPI payments for business operations. Enjoy all the benefits of virtual cards—spend controls, policy compliance, and real-time updates—for UPI payments as well.

Get started with Volopay's UPI payments today!