👋 Exciting news! UPI payments are now available in India! Sign up now →

UPI payments for easier and faster transactions

The goal of using an automation solution for your finances is to streamline your processes. This is most effective when your solution is a one-stop shop. You don’t want to have to switch between applications when what you want is to manage all your expenses on a single platform.

But sometimes you might need different payment methods to take care of all your vendor payouts. To ensure smooth sailing expense management through one dashboard, Volopay offers the UPI payment method for settling invoices from vendors and suppliers.

Introducing UPI payments by Volopay

While some vendors in India are content with bank transfers, some might prefer or even require UPI payments. After all, UPI payments can be faster and easier than bank-to-bank transfers. All you need is your vendors’ UPI IDs and you’re good to go.

Considering the growing trend of vendors switching over to UPI payments, it’s no longer sufficient to only offer bank transfers as a payment method. You don’t want to close off potential vendors by saying that you can only do bank transfers.

On the other hand, if you already have a platform where you do your vendor payments, having to switch platforms to take care of payments through UPI is an unnecessary step. Not only that, but you also run into the risk of losing track of which payments are paid through what platform.

The ideal solution is to pay all your vendors through a single platform that enables both bank transfers and UPI payments. Through Volopay, you can set UPI, bank transfer, or both as payment methods for your vendors. When it’s time to settle your invoices, all you have to do is select the appropriate payment method and process those payments.

How UPI payments can benefit your business

Simplifies disbursements

Ideally, you want disbursements to be as painless as possible. The more streamlined the process, the better. This is especially true when you have hundreds of invoices to settle each month.

With the option to do UPI payments on Volopay’s platform, you can apply the same workflow that you do for bank transfer payments to payments made with UPI.

Being able to pay vendors through both the UPI payment method and bank transfers on a single platform makes payment processing much easier.

As soon as you open your Volopay dashboard, you’ll have both options easily accessible to you. You can make all your payments in one go, regardless of the payment method your vendors require.

Opens up more vendor channels

There are some vendors that might prefer UPI payments over bank-to-bank transfers. In fact, there may be vendors who only take UPI payments. You don’t want to miss out on vendors with good offerings because you typically do bank transfers.

When you’re willing to make UPI payments, you’ll naturally have access to more vendors. Utilizing the UPI payment method on Volopay’s platform can indirectly give you more leveraging opportunities.

You won’t have to close any doors to vendors you’re interested in, leaving you with a larger pool to choose from. Negotiations can go smoother when you have more options available to you.

Makes payments faster and easier

Some people prefer UPI payments over bank transfers because they’re easier and faster to do. You can settle and view UPI payments on the go. This is also true for your vendors.

Once a UPI payment has been settled, they can simply open up their UPI account to check if your payment has gone through.

Having the option of UPI payments to settle invoices for vendors also means that your vendors can just give you their UPI ID.

For many, this is much less tedious than having to remember all your bank account details. One UPI ID is all that’s required for payments to be settled.

Consolidates all expenses

While you could use multiple platforms to manage bank transfers and UPI payments, it’s not very convenient. Not only is there an extra step involved in switching between platforms, but there are also other challenges that come with using multiple platforms.

For one, there’s a higher probability that you might miss one or two payments from time to time because you thought you’d paid it on one platform when it needs to be paid on the other. You also have to manually input all your payment data in one place to combine the two platforms. You’ll have less visibility this way.

On the other hand, when you consolidate all your expenses and use a single platform to manage every payment you make, you’ll automatically have access to better data in less time.

Payments are not only faster to do, but they’re also easier to summarize and report. Real-time visibility can be achieved without much of a hassle.

How to use this feature?

1. Create a vendor and choose the UPI payment method

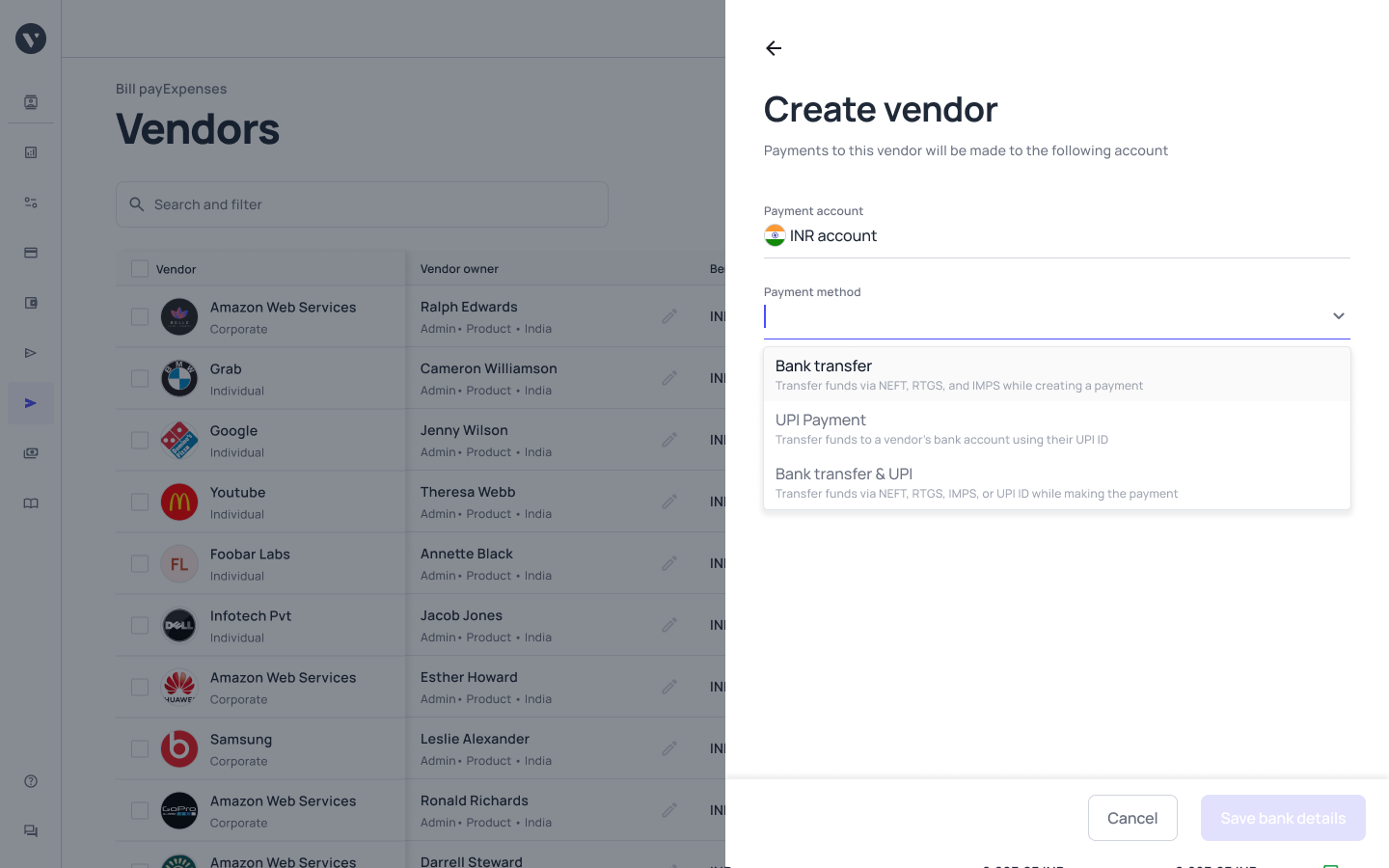

To start using the UPI payment method for your vendor payouts, you first need to create a vendor that you’ll pay through UPI. Go into the “Bill pay” tab of your dashboard to get started.

Under “Bill pay”, you want to select “Vendors”. Click on the “+ Vendor” button to create a new vendor. You will have to fill out the form with your vendor details. Under the “Payout method” field, select “Bank Transfer & UPI” or “UPI only” depending on the appropriate payment method(s) for your vendor.

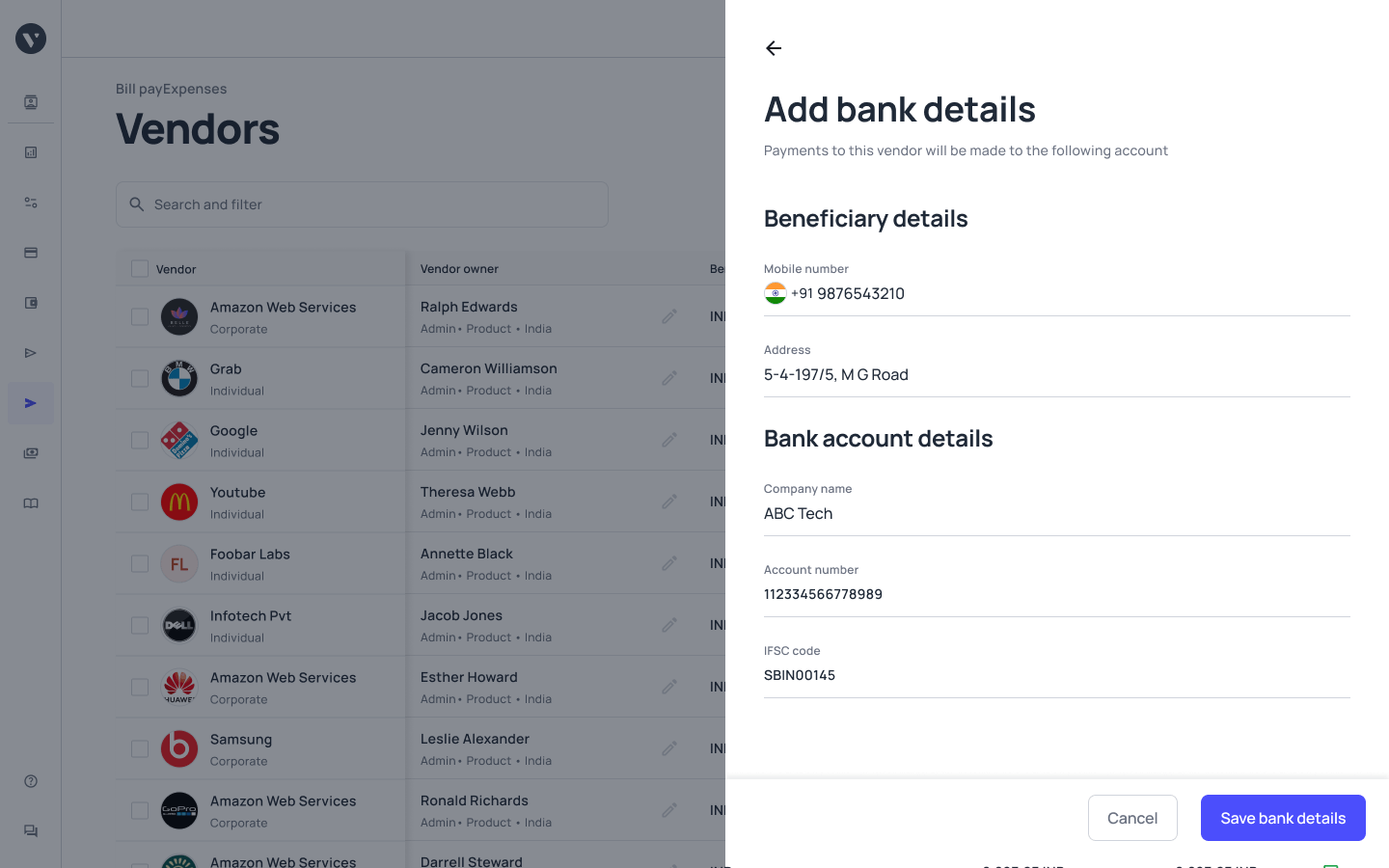

You’ll then be asked for the beneficiary and bank account details. Under the bank account details, make sure to fill out your vendor’s UPI ID.

Once you’ve done that, then you’re all set. You’ll be able to pay that particular vendor through UPI whenever you create a payment for them.

Repeat this process for all your vendors that will be paid through UPI.

2. Pay your vendors through UPI payments

When you’re ready to start paying your vendors, go into the “Payments” tab under “Bill pay”. Click on the “+ Payment” button. As you would with bank transfer payments, you’ll have to select the vendor you want to pay and fill out the payment details.

Be sure that UPI is selected as the payment method when you create the payment. Your vendor will then be paid through the UPI ID that you have previously entered in the vendor details.

Who is eligible to make use of the UPI payment method?

The UPI payment method is available for all Indian businesses that have been onboarded with Volopay. To access this feature, the Volopay team will help you set up your dashboard, where you can access the bill pay module.

You can use UPI payments for any domestic vendor payments within India using the bill pay module. The only thing required to make UPI payments is the UPI ID of your vendors.

Once you have the relevant UPI IDs, all you need to do is create a vendor and start making payments.

Conclusion

Open up more doors and vendor selections for your business by utilizing both bank transfers and UPI payments. You no longer need to worry about having to use multiple platforms to settle payments that require different methods. UPI payments can happen just as easily as bank transfers, if not easier.

With Volopay, you can pay any domestic vendors through UPI. All you need is their UPI ID. Within just a few clicks, you can create and send a UPI payment.

Enjoy a smooth sailing and streamlined payment process while consolidating all your expenses on one platform.