👋Exciting news! UPI payments are now available in India! Sign up now →

Mastering payables: How to calculate accounts payable days?

Accounts payable days, also known as Days Payable Outstanding (DPO), is a crucial financial metric that tracks the average time your business takes to pay supplier invoices.

It reflects how efficiently your accounts payable process is managed and plays a vital role in maintaining healthy cash flow. A well-optimized DPO ensures that you hold onto cash longer without delaying vendor payments.

Understanding your accounts payable days helps in identifying inefficiencies, negotiating better terms, and improving relationships with suppliers. Monitoring this metric regularly allows you to strike the right balance between business liquidity and timely invoice settlements.

What are accounts payable days?

Accounts payable days, often referred to as Days Payable Outstanding (DPO), represent the average number of days your business takes to pay its suppliers after receiving goods or services. It’s a key metric that offers insights into how efficiently your accounts payable processes are managed.

A higher number of accounts payable days may indicate that your company is effectively managing its cash flow by holding onto funds longer. However, it could also signal potential delays in payment processing.

On the other hand, lower accounts payable days suggest quicker payments, which can strengthen vendor relationships but may reduce liquidity. This metric is essential for understanding your business’s financial rhythm and overall health.

By tracking your accounts payable days regularly, you can ensure smoother operations, optimize working capital, and align payment cycles with your company’s cash inflow. Accurate calculation of accounts payable days also supports better planning, budgeting, and negotiation with suppliers.

Why is it important to calculate accounts payable days?

1. Cash flow management

Calculating accounts payable days enables you to know your payments going out relative to your revenues coming in. This gives you greater control over liquidity and prevents cash shortages from wrecking the business.

Keeping an eye on how long it takes to pay suppliers enables you to plan payment schedules and have a better cash position.

Strategically extending accounts payable days without damaging relationships with suppliers allows you to maximize cash usage, keeping funds in reserve for important business expenses when required.

2. Supplier relationship health

Healthy supplier relationships are based on trust and prompt payments. By regularly calculating accounts payable days, including accounts payable turnover days calculation, you ensure your payments are not too slow or too rapid.

Timely payment allows you to negotiate better terms, take advantage of early payment discounts, and become a responsible business partner.

Your orders can be given preference, or suppliers can offer you good credit terms if they are certain that they can rely on your payment cycle, allowing you to enhance your supply chain and reduce disruptions.

3. Operational efficiency

Calculation of accounts payable days allows you to determine areas of inefficiency in your invoice processing system. Long payment periods may reflect invoice approval lag or process inefficiencies.

By analyzing your DPO regularly, you can identify and fix cash flow blockages within the accounts payable process.

Processing automation and process improvements will cut down on human error, process faster, and pay invoices timely manner, resulting in increased control over finances and improved business performance.

4. Financial forecasting

When you effectively calculate accounts payable days, you establish a sound foundation for cost estimation and working capital planning. DPO trends allow you to anticipate payment obligations and budget, investment, and financing needs more accurately.

Constant payment cycles allow you to make informed decisions, especially during seasonal fluctuations or expansion stages.

Having accounts payable days included in your financial projections allows you to maintain the right balance between paying bills and investing in growth opportunities, thereby making your business more stable in the long term.

5. Benchmarking performance

By calculating accounts payable days, you can benchmark your performance against industry standards or peers.

This tells you if your payment terms are best in class or if they need to be improved. If your DPO is significantly higher or lower than normal, it can indicate risks or opportunities.

Benchmarking your accounts payable days allows you to streamline your payment policies, remain competitive within your industry, and make strategic changes that are in harmony with your financial and operating goals.

Streamline your AP process with Volopay

Formula for calculating accounts payable days

1. The DPO formula

The standard formula to calculate accounts payable days in India is:

DPO = (Average Accounts Payable / Cost of Goods Sold) × Number of Days

Here, the average accounts payable is calculated as:

(Beginning Accounts Payable + Ending Accounts Payable) ÷ 2

The Cost of Goods Sold (COGS) can be found in your company’s profit and loss statement. For annual calculations, the number of days is generally taken as 365.

This accounts payable days formula provides a reliable estimate of your company’s payment cycle and is widely used for internal financial reviews and statutory audits in India. Regularly calculating this accounts payable days ratio promotes strong financial discipline.

2. Step-by-step calculation

To calculate accounts payable days in India, begin by gathering your beginning and ending accounts payable balances for the relevant period.

Next, calculate your Cost of Goods Sold (COGS) using the formula:

COGS = Beginning Inventory + Purchases – Ending Inventory

After determining the average accounts payable and COGS, substitute the values into the accounts payable days formula. This step-by-step process ensures accuracy in your accounts payable days calculation.

Regularly updating these figures enhances financial transparency and gives you a clear view of your payment cycles. Performing this accounts payable turnover days calculation on a quarterly or annual basis allows you to spot trends, identify inefficiencies in your invoice processing, and improve cash flow management.

3. Practical example

Let’s consider an example to calculate accounts payable days for the year 2024. Your business has the following figures:

Beginning Accounts Payable: ₹5,00,000

Ending Accounts Payable: ₹6,00,000

Cost of Goods Sold (COGS): ₹4,00,00,000

First, calculate the average accounts payable:

(₹5,00,000 + ₹6,00,000) ÷ 2 = ₹5,50,000

Next, use the accounts payable days formula:

(₹5,50,000 ÷ ₹4,00,00,000) × 365 = 50.19 days

So, your business takes approximately 50.19 days to pay its suppliers. This accounts payable days calculation allows you to gauge your business’s payment cycle, assess your financial health, and manage cash flow more effectively.

Regularly calculating this helps you maintain a balanced relationship with suppliers and improve overall financial management.

4. Alternative method

An alternative way to calculate accounts payable days is by using the ending accounts payable balance instead of the average.

This snapshot method is particularly useful for rapid reporting:

DPO = (Ending Accounts Payable ÷ COGS) × Number of Days

Using the previous example’s values:

(₹6,00,000 ÷ ₹4,00,00,000) × 365 = 54.75 days

While this method is slightly less accurate, it provides a quick overview of your accounts payable turnover days calculation. It is helpful when you need a fast estimation for monthly or quarterly reviews.

However, for consistent long-term insights into your cash flow and payment cycles, always rely on the complete accounts payable days ratio formula to ensure more precise and reliable results.

How to calculate accounts payable turnover days?

1. AP turnover ratio

To begin the process to calculate accounts payable days, you first need the accounts payable turnover ratio.

The formula is:

AP Turnover Ratio = Total Supplier Credit Purchases ÷ Average Accounts Payable

This ratio shows how many times during a given period your company pays off its accounts payable. To calculate accounts payable days, it’s crucial to obtain the correct purchase data and accurately compute the average accounts payable using beginning and ending balances.

While this ratio alone offers value, it becomes more powerful when paired with the accounts payable days formula to translate turnover frequency into actionable timelines.

2. Turnover in days

Once the turnover ratio is calculated, the next step is to calculate accounts payable days in terms of turnover.

This is done using a simple conversion:

Turnover Days = 365 ÷ AP Turnover Ratio

For example, if your turnover ratio is 8, then:

365 ÷ 8 = 45.63 days

This figure indicates the average time it takes to pay suppliers, enhancing your accounts payable turnover days calculation.

When you calculate accounts payable days using this method, you can assess how your business handles short-term obligations and identify opportunities to optimize payment cycles for better cash flow management.

3. Why it matters

When you calculate accounts payable days and turnover days together, it reveals your business’s actual payment rhythm. These insights inform cash flow strategies and support better vendor negotiations.

Companies that regularly perform accounts payable days calculation and compare them with industry benchmarks using the accounts payable days ratio are more equipped to adapt to economic fluctuations.

Moreover, a consistent accounts payable turnover days calculation can highlight operational inefficiencies and signal areas for improvement. Ultimately, to stay competitive and maintain financial agility, it’s essential to accurately calculate accounts payable days and align those results with broader business objectives.

Stay on top of your payables management with Volopay!

Best ways to reduce your accounts payable days

Reducing your calculated accounts payable days can boost your working capital and improve supplier relationships. By implementing effective strategies, you can streamline your accounts payable processes, improve cash flow, and minimize payment delays.

1. Balance cash outflow/inflow

To reduce DPO, start by aligning your payment terms with your cash inflows. When you calculate accounts payable days, you understand the average time taken to pay vendors, which helps you avoid payment delays due to cash shortages.

Managing the timing between your receivables and payables ensures smoother operations and improves your accounts payable days ratio.

By carefully planning outgoing payments in sync with incoming revenue, you avoid interest charges, maintain a healthy balance sheet, and reinforce your credibility. Always use the accounts payable days formula as a reference when renegotiating terms with suppliers.

2. Cut invoice processing time

Delays in invoice approval often result in longer payment cycles. To reduce DPO, businesses should automate invoice processing. When you use technology to shorten approval timelines, you not only speed up the workflow but also maintain better control over your payment schedule.

Automation helps you calculate accounts payable days more accurately and reduces discrepancies in tracking outstanding invoices.

With faster capture and approval, your accounts payable days calculation becomes more reliable, leading to timely vendor payments and fewer late fees. A streamlined process ensures accuracy and reduces the need for manual interventions.

3. Save on processing costs

Manual processing is time-consuming and expensive. By digitizing workflows, you reduce administrative costs and improve processing speed. Implementing electronic invoicing and integrated AP systems ensures faster turnaround and allows your finance team to calculate accounts payable days with real-time data.

These savings can then be reinvested into optimizing vendor terms or expanding your supplier base. Moreover, accurate and up-to-date accounts payable turnover days calculation helps finance teams identify inefficiencies and refine internal processes. Lowering DPO not only boosts vendor confidence but also adds value to your entire procurement cycle.

4. Pay suppliers on time

Timely payments lead to better supplier terms, early payment discounts, and improved relationships. When you calculate accounts payable days, you can better forecast payment schedules and ensure that due dates are met.

Consistent, on-time payments build long-term trust and may open opportunities for flexible terms. Vendors are more likely to prioritize businesses that demonstrate timely payment practices.

Additionally, keeping a consistent accounts payable days calculation ensures your team is always aware of upcoming liabilities. This practice also reduces the risk of penalties or lost discount opportunities due to late settlements.

5. Streamline AP processes

Implementing accounts payable automation software is a key strategy to reduce DPO. With the right tools, you can centralize invoice management, automate approvals, and generate accurate reports.

This helps finance teams to easily calculate accounts payable days using real-time data and track KPIs over time. Automation supports smoother audits and compliance while reducing human errors.

When your AP processes are efficient, the time required for accounts payable days calculation is reduced, and decision-making becomes more data-driven. Software systems also enable easier benchmarking with peers by generating accounts payable days ratio reports and performance analytics instantly.

How does Volopay help in reducing your accounts payable days?

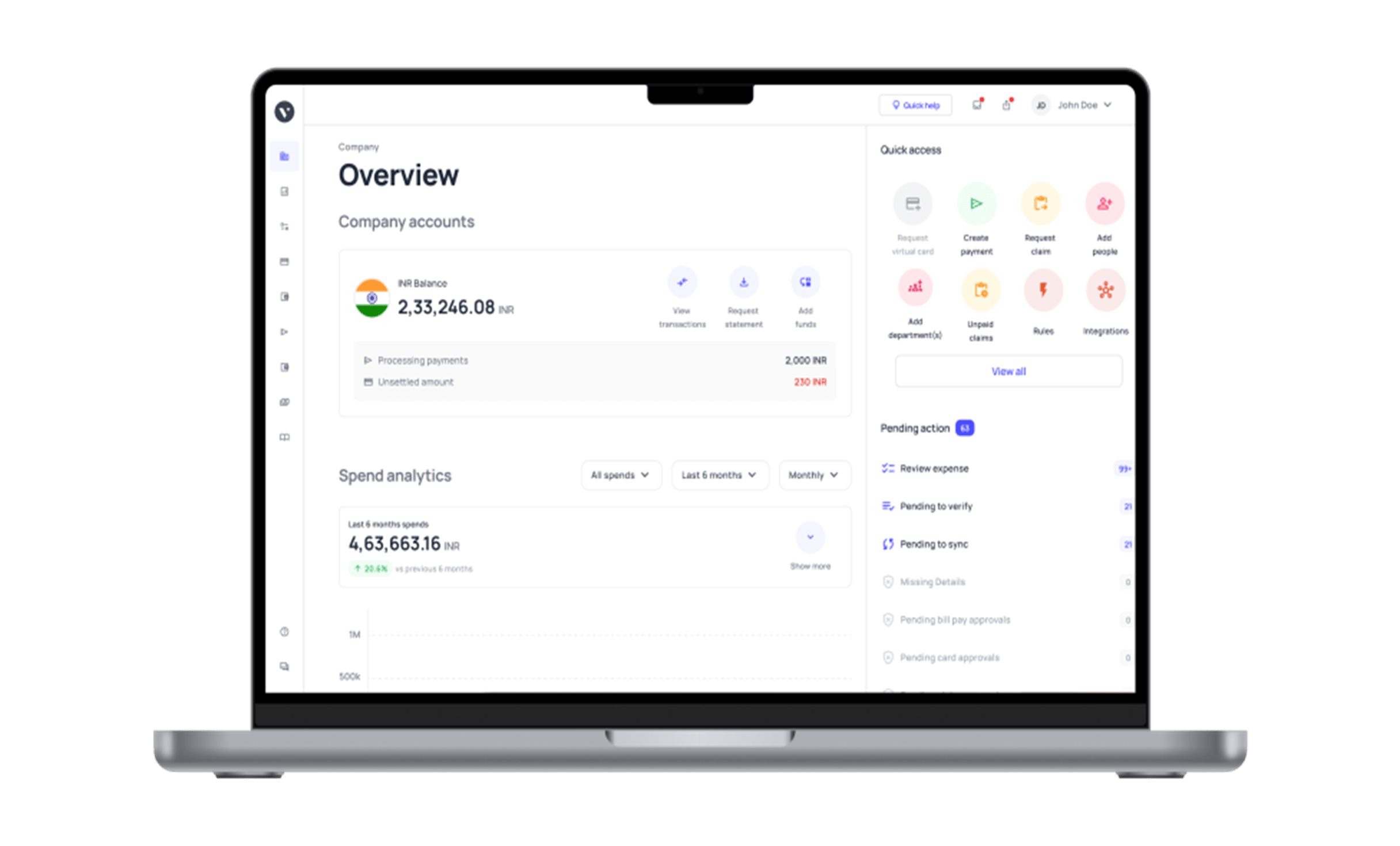

Managing accounts payable effectively is crucial for maintaining strong supplier relationships and optimizing cash flow. One key metric in this process is how you calculate accounts payable days—a reflection of how long your business takes to pay suppliers after receiving an invoice. Volopay's accounts payable software simplifies and accelerates this process with automation.

Volopay uses intelligent OCR to scan and extract invoice data instantly, reducing the time and errors associated with manual data entry. This speeds up approvals and ensures accuracy in every step of your accounts payable workflow.

The system automatically records, organizes, and matches invoices with purchase orders and receipts, eliminating common bottlenecks that delay payments.

With real-time tracking and integrations with popular ERP systems like QuickBooks, Xero, and NetSuite, Volopay ensures a seamless flow of financial data. This makes it easier for finance teams to conduct an accurate accounts payable days calculation without relying on spreadsheets or manual tracking.

Additionally, the platform provides detailed analytics dashboards that help you monitor your accounts payable days ratio and benchmark performance over time. You can also perform an accounts payable turnover days calculation to assess how frequently your business pays its suppliers, critical for evaluating cash flow strategy.

By aligning payments with inflows and identifying inefficiencies, Volopay helps you streamline operations. Whether you're using the standard accounts payable days formula or advanced financial modeling, automation ensures your calculations are timely and precise.

Ultimately, Volopay empowers you to reduce your DPO, improve liquidity, and make informed decisions all through a centralized, automated system.

Optimize finances with accounts payable process automation

FAQ's

High accounts payable days (DPO) mean that your business is paying vendors after a longer period since receiving bills. The longer payment cycle enhances cash flow by keeping cash for a longer time before making payments.

However, it constricts supplier relationships, as vendors may be concerned about delayed payments. Extended DPO also leads to foregone early payment discounts and possible credit term modifications, which will impact your capacity to negotiate better supplier terms in the future.

Low DPO means that your company is paying its vendors promptly, which can reinforce vendor relationships and lead to better payment terms or discounts. By timely payment of bills, you show your suppliers that you are a reliable customer, increasing their confidence and dependability.

However, the trade-off is reduced cash retention since early payments influence the liquidity levels of your business. You have to balance between enjoying good relations with suppliers and enjoying adequate liquidity for fulfilling other operational needs.

Increased accounts payable days will improve your company have improved cash flow because you get to hold money longer before paying it out. It is dangerous, however. Increased DPO can lead to conflict with suppliers because they become more and more worried about not getting paid on time.

Additionally, excessively long delays will incur penalties, like late fees or credit refusal by suppliers. If your business relies on vendor relationships to receive favorable prices or terms, an increased DPO can destroy these benefits and damage long-term relationships.

Whether a lower or higher account payable days is better will depend on what you desire out of your business. A higher DPO improves cash flow by allowing you to keep money longer, which is excellent for liquidity, especially during bad times.

On the other hand, a lower DPO can strengthen supplier relationships, as it shows your commitment to paying on time. Balancing both is key—while higher DPO offers more flexibility with cash flow, it’s crucial not to compromise your supplier relationships by delaying payments for too long.