👋Exciting news! UPI payments are now available in India! Sign up now →

How to apply for a prepaid credit card for businesses in India

Managing business expenses securely and efficiently is a priority for every company, especially if you’re running a small or growing business. Prepaid credit cards offer a reliable solution for keeping spending in check while giving you the flexibility of digital payments. Unlike traditional credit cards, prepaid cards allow you to load a fixed amount and spend only what’s available, minimising the risk of debt or overspending.

What are prepaid credit cards in India?

Prepaid credit cards for business are preloaded payment tools that allow companies to control spending by setting limits and using only available funds. They help businesses allocate budgets, track expenses, and maintain control over company finances—without the risk of debt.

Widely accepted across online and offline platforms, prepaid cards are an ideal solution for startups and growing businesses seeking financial discipline.

In India’s fast-evolving payment landscape shaped by UPI, mobile wallets, and contactless options, prepaid credit cards integrate seamlessly to enable convenient, secure transactions.

Benefits of prepaid credit cards for businesses

For businesses looking to simplify financial control, prepaid credit cards offer a practical solution. Especially useful for startups and SMEs, these cards enable you to manage employee spending, streamline bookkeeping, and avoid unnecessary financial risk.

Budget control

With prepaid credit cards for business, you can set custom spending limits for teams, departments, or individuals. This prevents overspending and encourages disciplined budgeting, making sure funds are used where they matter most.

No credit checks

One of the biggest advantages is that you can apply for prepaid credit card for business use without going through a time-intensive application process. This makes them ideal for newly registered businesses or those with limited credit histories.

Fraud protection

Given the fact that prepaid cards are preloaded with fixed amounts, even if details are compromised, potential losses are limited. Advanced encryption and card tokenisation further protect your business from fraud.

Expense tracking

Most prepaid card providers offer real-time expense tracking dashboards. You can also integrate transactions with popular accounting tools, ensuring that every payment is logged accurately and reports are automatically updated.

Eligibility criteria for business prepaid credit cards

Before you apply for prepaid credit card for business expenses, it’s important to understand if your business meets the eligibility requirements. The good news is that most prepaid card providers in India have straightforward criteria designed to support businesses of all sizes.

1. Business types

Whether you’re a sole proprietor, a private limited company, or a growing startup, you’re likely to be eligible for a prepaid credit card for business. These cards are particularly helpful for SMEs and newer businesses looking to simplify their expense management without taking on credit risk.

2. Documentation needs

To complete your application, you'll need to provide essential documents that confirm your business’s identity and operations. These typically include your company’s Permanent Account Number (PAN), proof of GST registration if applicable, and official documents that verify your business address.

Depending on your business type, you may also need to upload incorporation papers or partnership agreements. These documents are required to comply with regulatory standards and ensure that your business is eligible for a prepaid card.

3. No credit history

One of the main reasons to choose a prepaid solution is that it doesn't require a credit check. This is ideal if your business is newly established or has a limited credit history. It allows you to access the benefits of card-based transactions without the barriers of traditional credit systems.

4. India residency

Most Indian prepaid card providers require that your business be registered in India. At least one of the directors or authorised signatories should have a valid Indian address and identification, as per KYC norms.

5. Turnover thresholds

Some providers may set a minimum turnover requirement to issue business prepaid cards. However, many fintech platforms now offer options for smaller businesses and startups with modest annual revenues.

Choosing the right prepaid card provider

Once you’ve decided to apply for prepaid credit card for business purposes, the next step is selecting a provider that fits your specific needs. Not all prepaid card issuers offer the same features or flexibility, so careful comparison is essential.

Feature comparison

Look at the details—monthly fees, load limits, international usability, virtual card availability, and integration with accounting platforms.

These differences in features can significantly impact how efficiently you manage your company’s spending.

Security standards

Ensure that the provider you choose follows RBI regulations and uses strong security practices like end-to-end encryption and multi-factor authentication.

These safeguards help protect your business funds and sensitive information.

Customer support

Strong customer support services are often easily overlooked.

Choose a provider that offers responsive, accessible help through online chat, email, or phone - especially important if you run into issues while managing or reloading your cards.

Steps to apply for a prepaid credit card for business

Research providers

Applying for a prepaid credit card for business is a fairly straightforward process, especially if you choose a digital-first provider. But before you apply for prepaid credit card for business use, take time to compare providers.

Look into features such as spending controls, virtual card options, integration with accounting tools, and regulatory compliance. Choosing an RBI-compliant provider with transparent pricing and real-time expense tracking will make long-term management easier.

Complete application

Once you've selected a provider, head to their website and start the online application. You’ll need to enter basic details about your business, such as company name, registered address, and type of business entity. You’ll also need to submit information about the business owner or directors.

Verify identity

To comply with KYC regulations, you must upload scanned copies of the required documents. These usually include your business PAN, proof of GST registration, company incorporation certificate, and address verification. Make sure the documents are up to date and clearly legible to avoid delays.

Fund card

After approval, you can add money to your prepaid card. This is typically done via UPI, NEFT, or IMPS bank transfers. Some providers also support instant funding through linked business accounts or mobile apps. You can fund the card with a fixed budget to manage spending right from the start.

Review terms

Before submitting your application, carefully review the provider’s terms and conditions. Look for details on fees, usage limits, card validity, and data security. Understanding these terms will help you avoid hidden charges or compliance issues later on.

Activate card

Once the card is issued, you’ll receive activation instructions. For physical cards, this usually involves setting a PIN via the provider’s portal or app. If you’ve opted for a virtual card, it can typically be activated and used immediately for online transactions.

Common business use cases for prepaid credit cards in India

Prepaid cards are ideal for managing business travel expenses.

You can allocate a specific amount for employee trips, covering bookings for flights, hotels, and transport, while ensuring your business spending stays within budget.

From marketing tools to software platforms, prepaid cards simplify payments for recurring online subscriptions.

Using virtual cards also adds a layer of security by preventing unauthorised charges and keeping your main account details protected.

Paying freelancers, suppliers, or service providers becomes more convenient with prepaid business cards.

You can fund cards based on the exact amount needed, making it easier to track payments and maintain control over cash flow.

Managing prepaid credit cards online

After you apply for prepaid credit card for business purposes and begin using it, effective online management becomes essential. Most providers offer intuitive platforms or mobile apps to help you stay in control of spending and streamline your financial workflows.

Set limits

You can assign individual spending limits to employees or departments based on their specific roles or project budgets. This helps avoid overspending and gives you granular control over how funds are distributed across the business.

Monitor spending

Digital dashboards offer a real-time view of all card transactions. You can instantly see where and how money is being spent, which improves transparency and helps you make informed decisions about budgeting and approvals.

Reload funds

Prepaid cards can be conveniently recharged through UPI, net banking, or other supported payment methods. Numerous prepaid card providers offer features such as automated recurring top-ups or low-balance alerts, ensuring uninterrupted operations.

Integrate accounting

To reduce manual work, many prepaid card platforms let you sync transactions with accounting software like Zoho Books or Tally. This integration allows for faster reconciliation, better expense categorisation, and more accurate financial reporting.

Compliance and security considerations

When you apply for prepaid credit card for business use in India, it's important to understand the compliance and security standards associated with it. Proper adherence ensures not just legal protection but also financial integrity.

RBI regulations

Always verify that your chosen provider is authorized by the Reserve Bank of India (RBI).

This guarantees that the card is issued under proper regulatory supervision and that your business transactions are conducted in line with national financial guidelines.

GST reporting

A major benefit of using prepaid cards is the clear, itemised record they create for business spending.

These records simplify GST filing by helping you categorise expenses, track eligible credits, and stay audit-ready.

Security features

Prepaid cards are typically backed by strong security features like dynamic OTPs, data encryption, and usage controls.

These safeguards reduce the risk of misuse, especially during online transactions or while assigning cards to employees.

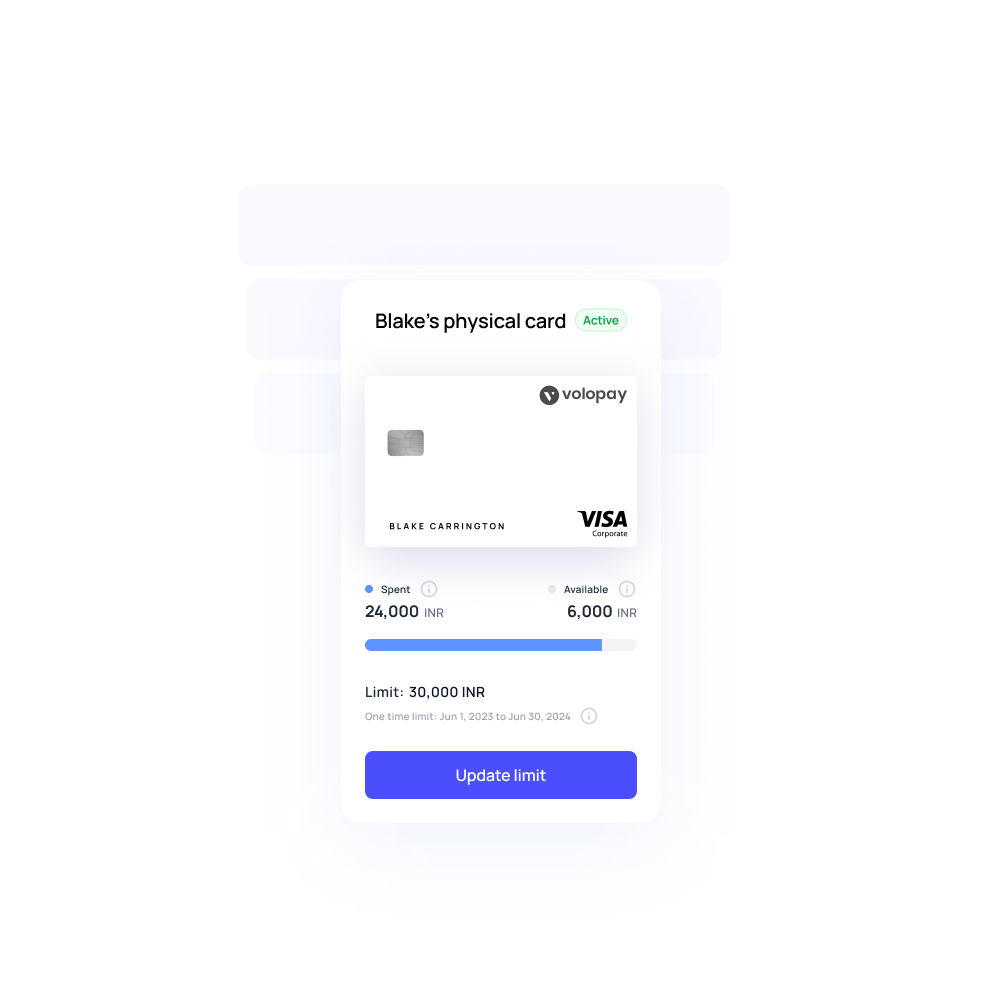

Why choose Volopay prepaid business cards

If you're planning to apply for prepaid business cards, Volopay's prepaid cards are designed to simplify expense management without the complexities of traditional banking tools. It brings together cards, payments, and accounting under one unified system.

Unified platform

Volopay allows you to manage all your business expenses from a single dashboard. You can issue corporate cards, set budgets, approve payments, and track expenses, all in one place. This reduces reliance on multiple tools and improves workflow efficiency.

Virtual cards

You can generate single-use or multi-use virtual prepaid cards for online payments. These are especially useful for managing software subscriptions or one-time purchases, as they reduce the risk of fraud and unauthorised charges.

Real-time analytics

The platform provides instant visibility into spending patterns through real-time dashboards. This helps you adjust budgets proactively and make informed decisions based on current data.

Accounting integration

Volopay supports seamless syncing with tools like Tally and Zoho Books. This allows transactions to be automatically categorised and recorded, saving time on reconciliation and improving financial accuracy.

Bring Volopay to your business

Get started now