👋Exciting news! UPI payments are now available in India! Sign up now →

What is a cost sheet? Definition, components, types & examples

As a business owner or manager in India, understanding your costs is crucial for success. A cost sheet is a vital tool that helps you break down expenses, make informed decisions, and boost profitability. This guide explores the definition, components, types, and practical applications of cost sheets, tailored for the Indian market.

Whether you run a manufacturing firm, a startup, or a service-based business, mastering cost sheets can streamline your financial strategy and enhance operational efficiency. Modern businesses utilize cost sheets to maintain competitive advantage and ensure sustainable growth in today's dynamic marketplace.

What is a cost sheet?

A cost sheet is a detailed document that outlines all costs associated with producing a product or delivering a service. It categorizes expenses into direct and indirect costs, helping you calculate the total cost and cost per unit.

Used widely in accounting, cost sheets provide a clear snapshot of production expenses, enabling you to analyze profitability, set prices, and control costs effectively.

In India, businesses across sectors rely on cost sheets to align with financial goals and comply with regulatory standards. These documents serve as essential planning tools for financial forecasting and budget allocation.

Purpose of a cost sheet

The core purpose of a cost sheet is to aid your business in making strategic decisions after compiling and analyzing all the costs associated with a specific product, or service model.

At its core, it is aimed to providing an all-rounded view of costs so you can accurately estimate how much a particular venture will cost the business, and not just the most obvious and upfront costs.

To determine total production cost

Business cost sheets aggregate all costs direct materials, labor, and overheads to understand total production expense.

This comprehensive analysis helps assess operational financial viability, profitability margins, and overall business sustainability. Accurate cost determination enables informed decision-making for manufacturing and service sectors across India's diverse business landscape.

To assist in pricing decisions

Knowing total costs enables competitive pricing that covers expenses and ensures profitability, crucial in India's price-sensitive market environment.

The applications of a cost sheet in business helps establish optimal pricing strategies, maintain market competitiveness, and achieve desired profit margins while considering customer expectations and competitor pricing.

To facilitate cost control and reduction

Cost sheets in accounting highlight areas where expenses can be trimmed, such as excessive material usage or inefficient labor allocation patterns.

These detailed analyses identify cost-saving opportunities, eliminate wasteful expenditures, and improve operational efficiency through systematic monitoring and strategic cost management in accounting initiatives.

To support budgeting and forecasting

Accurate cost data aids in creating realistic budgets and forecasting future expenses, ensuring comprehensive financial preparedness for businesses.

Historical cost information enables reliable projections, facilitates resource planning, and supports strategic financial planning processes essential for sustainable business growth and development.

To provide data for financial reporting

Knowing what is cost sheet data helps to feeds accurate information into financial statements, ensuring compliance with Indian accounting standards like Ind AS and supporting audits.

This information supports regulatory compliance, enhances financial transparency, and provides stakeholders with accurate cost information for informed investment and operational decisions.

Importance of a cost sheet

Enhances transparency in costing

Cost sheet transparency provides clear visibility into where money is spent, fostering trust among stakeholders. Detailed cost breakdowns enable better communication with investors, lenders, and management teams. This transparency builds confidence in financial reporting and supports strategic business relationships across all organizational levels.

Aids in managerial decision-making

Detailed cost breakdowns empower managers to make informed choices about production, pricing, and investments. A cost sheet in business applications supports strategic planning, resource allocation, and operational improvements. Accurate cost information enables executives to evaluate alternatives, assess profitability, and guide organizational direction effectively.

Helps identify inefficiencies

By pinpointing high-cost areas, business cost sheets enable process optimization, such as reducing wastage in manufacturing operations. These analyses reveal bottlenecks, highlight excessive expenditures, and identify improvement opportunities. Systematic cost monitoring helps eliminate redundancies, streamline operations, and enhance overall productivity across business functions.

Useful for internal audits and compliance

Cost sheets ensure accurate records, aligning with India's regulatory requirements like GST and company audits. These documents support internal control systems, facilitate compliance monitoring, and provide audit trails. Cost sheets in accounting help maintain regulatory standards, ensure accurate reporting, and support governance frameworks.

Enables competitive benchmarking

Comparing costs with industry standards helps businesses stay competitive in a dynamic market environment. Cost analysis facilitates performance evaluation, identifies market positioning opportunities, and supports strategic planning initiatives. Benchmarking enables companies to assess competitiveness, optimize pricing strategies, and maintain market leadership positions effectively.

Components of a cost sheet

1. Direct materials

These are raw materials directly used in production, like steel in manufacturing or ingredients in food processing. Business cost sheets categorize these materials separately for accurate tracking. For example, if you produce furniture, then items like timber and nails are direct materials that contribute to the final product's cost structure.

2. Direct labor

Wages are paid to workers directly involved in production, such as machine operators or assembly line workers. Cost sheets in accounting track these expenses separately from indirect labor costs. This includes salaries, overtime payments, and production bonuses paid to employees who physically manufacture products or deliver services.

3. Direct expenses

Costs directly tied to production, like equipment rental or freight charges for raw materials. Knowing what is cost sheet classification means including these traceable expenses that vary with production volume. Examples include specialized tools, patent fees, or subcontractor payments that directly support specific production activities or service delivery.

4. Prime cost

The sum of direct materials, labor, and expenses forms the foundation of your production cost calculation. This represents the core manufacturing cost before adding overhead expenses. Prime cost serves as the baseline for determining product profitability and establishes the minimum pricing threshold for sustainable business operations.

5. Factory or works overheads

Indirect costs like factory rent, utilities, or maintenance of machinery, essential for production but not directly traceable to individual products. These expenses support overall manufacturing operations and must be allocated across all products using appropriate allocation methods for accurate costing.

6. Office and administrative overheads

Expenses like salaries of office staff, stationery, or software subscriptions that support administrative functions. A cost sheet in business applications includes these indirect costs that enable smooth organizational operations. These expenses facilitate management, coordination, and support services across all business departments.

7. Selling and distribution overheads

Costs related to marketing and delivering products, such as advertising, sales commissions, or transportation expenses. These costs bridge the gap between production completion and customer delivery. Effective allocation ensures accurate product profitability assessment and supports strategic pricing decisions.

8. Total cost

The sum of prime cost and all overheads represents the complete cost of production and business operations. This comprehensive figure includes all direct and indirect expenses necessary for manufacturing and delivering products to customers. Total cost serves as the foundation for pricing strategies.

9. Profit margin

Added to the total cost to determine the selling price, ensuring your business earns sustainable profit margins. This component reflects desired profitability levels and market positioning strategies. Profit margins must consider competitive factors, market demand, and long-term business sustainability requirements for effective pricing decisions.

Types of cost sheets

1. Historical cost sheet

Records actual costs incurred in the past, useful for analyzing completed projects or production cycles. Business cost sheets of this type provide valuable insights into actual spending patterns and help identify cost variances. These documents serve as benchmarks for future planning and enable performance evaluation across different time periods.

2. Estimated cost sheet

Projects future costs based on assumptions, aiding in planning and budgeting processes. Cost sheets in accounting use historical data and market trends to forecast expenses accurately. These projections support strategic decision-making, resource allocation, and financial planning initiatives essential for business growth and sustainability in competitive markets.

3. Job cost sheet

Tracks costs for specific jobs or projects, common in industries like construction or custom manufacturing in India. Understanding what is cost sheet application becomes crucial for project-based businesses requiring detailed expense tracking. These sheets monitor materials, labor, and overhead costs for individual contracts, ensuring accurate profitability analysis.

4. Batch cost sheet

Used for products manufactured in batches, like pharmaceuticals or textiles, to calculate per-unit costs accurately. This type allocates shared costs across batch quantities, providing precise unit costing information. Batch costing helps manufacturers optimize production volumes, control quality standards, and maintain consistent pricing strategies across different production runs.

5. Process cost sheet

Applied in continuous production processes, such as chemicals or cement, to allocate costs across different production stages. A cost sheet in business applications tracks expenses through sequential processes, enabling accurate cost accumulation. This method supports process optimization, identifies bottlenecks, and facilitates cost control in multi-stage manufacturing operations.

6. Operating cost sheet

Focuses on service-based industries, detailing costs like employee salaries or software subscriptions in IT firms. These sheets track operational expenses without traditional manufacturing components. Service businesses use operating cost sheets to analyze profitability, optimize resource utilization, and establish competitive pricing for their service offerings.

Uses of a cost sheet

Budgeting and forecasting

You can predict future expenses and allocate resources effectively using historical cost data. Business cost sheets provide a foundation for creating accurate budgets and financial projections.

These tools enable systematic planning, resource optimization, and strategic financial management essential for sustainable business growth and operational efficiency.

Cost control and reduction

Identify high-cost areas to optimize spending, such as reducing energy costs in manufacturing operations. Cost sheets in accounting reveal expense patterns, highlight inefficiencies, and support cost reduction initiatives.

Systematic monitoring enables businesses to implement targeted cost-saving measures and improve overall profitability through strategic expense management.

Pricing decisions

Set prices that cover costs and align with market expectations in India's competitive landscape. Becoming familiar with what is cost sheet analysis helps determine optimal pricing strategies while maintaining profitability margins.

Accurate cost information ensures competitive positioning, supports market penetration strategies, and enables businesses to respond effectively to pricing pressures.

Profitability analysis

Assess which products or services yield the highest margins through detailed cost breakdown analysis. This evaluation helps identify profitable offerings, optimize product mix, and guide strategic business decisions.

Profitability analysis supports resource allocation, investment planning and helps businesses focus on high-margin opportunities for sustainable growth.

Decision-making support

Choose between outsourcing and in-house production based on comprehensive cost data analysis. A cost sheet in business applications provides objective financial information for strategic decisions.

This support enables evaluating alternatives, assessing risks, and making informed choices that optimize operational efficiency and financial performance.

Inventory valuation and management

Accurately value stock for financial reporting and manage inventory levels to avoid overstocking situations. Cost sheets provide precise valuation methods, support inventory control systems, and ensure compliance with accounting standards.

Effective inventory management reduces carrying costs, minimizes waste, and optimizes working capital utilization for sustainable business growth and efficiency.

Benefits of a cost sheet

Transparency in cost structure

You can see exactly where funds are allocated, improving accountability and stakeholder confidence in financial management. This transparency enables better communication with investors, lenders, and management teams about resource utilization.

Clear cost visibility builds trust, supports strategic business relationships, and enhances decision-making processes across all organizational levels for improved operational effectiveness and governance.

Improved managerial control

Monitor costs in real-time to prevent overspending and maintain budgetary discipline across all business operations. Enhanced control mechanisms enable proactive cost management, early identification of budget variances, and timely corrective actions.

Real-time monitoring supports operational efficiency, reduces financial risks, and ensures optimal resource utilization for sustainable business performance and competitive advantage.

Efficient resource allocation

Direct resources to high-impact areas, like investing in efficient machinery and technology upgrades that enhance productivity. Strategic resource allocation based on cost analysis optimizes investment decisions and maximizes return on investment.

Efficient allocation ensures resources flow to areas generating the highest value, supporting business growth, innovation initiatives, and competitive positioning in dynamic markets.

Better strategic planning

Align costs with long-term goals, such as expanding into new Indian markets and developing innovative products. A cost sheet in business planning provides essential data for strategic decision-making and future growth initiatives.

Strategic alignment ensures cost structures support business objectives, facilitates sustainable expansion, and enables companies to capitalize on emerging opportunities while maintaining financial discipline.

Enhanced profit monitoring

Track profitability per product or service to optimize your portfolio and focus on high-margin offerings. What is cost sheet profitability analysis enables detailed performance evaluation and strategic product mix optimization.

Enhanced monitoring supports pricing decisions, product development initiatives, and helps businesses maximize revenue potential while maintaining competitive positioning in target markets.

Support for financial reporting and audit

Provide accurate data for compliance with Indian regulations like GST and Ind AS standards. Business cost sheets ensure regulatory compliance, support audit processes, and maintain accurate financial records.

Comprehensive documentation facilitates smooth audit procedures, reduces compliance risks, and ensures adherence to accounting standards and statutory requirements for sustainable business operations.

Role of cost sheets in strategic decision-making

1. Defining a cost sheet and its components

Understanding cost components helps you focus on key cost drivers and operational priorities. Knowing what is cost sheet analysis reveals critical expense categories, enabling managers to identify areas requiring attention and optimization.

Comprehensive component analysis supports strategic resource allocation, enhances cost visibility, and facilitates informed decision-making across all business functions for improved operational effectiveness and competitive positioning.

2. Aligning costs with business objectives

Ensure spending supports goals like market expansion or product diversification through strategic cost management. Cost sheets in accounting provide a framework for evaluating expense alignment with organizational priorities and strategic initiatives.

This alignment ensures resources support business objectives, facilitates sustainable growth, and enables companies to maintain financial discipline while pursuing expansion opportunities in competitive markets.

3. Supporting pricing and profitability decisions

Past data helps teams to make profitable decisions on how to price the product. Accurate business cost sheets allow for a rigorous and proven track record of performance, which informs smart pricing decisions.

This aids teams to price their products and services in a way that benefits revenue margins, and allows for proper resource allocation and planning in order to sustain the marked prices.

4. Enhancing budget accuracy and forecasting

Use historical data to create reliable financial plans and predictive models for future operations. Business cost sheets provide an essential foundation for accurate budgeting, financial forecasting, and strategic planning initiatives.

Historical cost analysis enables realistic projections, supports resource planning, and facilitates proactive financial management essential for sustainable business growth and operational stability.

5. Facilitating departmental and project-level planning

Allocate budgets to departments or projects based on cost insights and performance metrics. A cost sheet in business applications enables detailed planning at various organizational levels, supporting efficient resource distribution and accountability.

Departmental planning ensures optimal resource utilization, enhances performance monitoring, and facilitates strategic coordination across different business units for improved organizational effectiveness.

How to prepare a cost sheet?

Identify direct and indirect costs

Differentiate between direct costs (e.g., raw materials) and indirect costs (e.g., factory rent) for accurate classification. Knowing what is cost sheet preparation requires the systematic identification of all expense categories and their proper allocation.

This fundamental step ensures comprehensive cost capture, facilitates accurate analysis, and provides a foundation for reliable financial reporting and strategic decision-making processes.

Categorize costs under standard headings

Organize costs into direct materials, labor, expenses, and overheads following established accounting principles and industry standards. Business cost sheets require consistent categorization to ensure comparability and accuracy across reporting periods.

Proper categorization facilitates analysis, supports compliance requirements, and enables effective cost control and management across different business functions and operational areas.

Calculate total cost and cost per unit

Sum all costs and divide by the number of units to find the cost per unit for accurate pricing decisions. This calculation provides essential information for profitability analysis, pricing strategies, and operational efficiency evaluation.

Unit cost calculation enables comparative analysis, supports benchmarking activities, and facilitates strategic planning for sustainable business growth and competitive positioning.

Include opening and closing inventories

Account for inventory at the start and end of the period to adjust costs accurately for financial reporting. Cost sheets in accounting must reflect proper inventory valuation to ensure accurate cost of goods sold calculations.

Inventory adjustments provide realistic cost assessments, support compliance with accounting standards, and enable accurate profitability analysis for informed business decisions.

Present data in a clear, structured format

Use tables or software to ensure readability and accuracy in cost sheet presentation and analysis. A cost sheet in business applications requires professional formatting for effective communication with stakeholders and management teams.

Clear presentation facilitates understanding, supports decision-making processes, and ensures information accessibility for various users across different organizational levels and functional areas.

Practical examples of cost sheets

Cost optimization in a mid-sized manufacturing firm

Manufacturing firms can use cost sheets to reduce material wastage, saving on production costs through systematic analysis. Being aware of what is cost sheet optimization enables the identification of inefficient processes, excessive material consumption, and operational bottlenecks.

This strategic approach results in significant cost savings, improved operational efficiency, and enhanced competitive positioning in challenging manufacturing markets.

Using cost sheets to drive pricing strategy in a startup

Startups can effectively set competitive prices for their products by analyzing cost sheets and market dynamics. Business cost sheets provide essential data for strategic pricing decisions, enabling optimal market positioning while maintaining healthy profit margins.

This analytical approach supports sustainable growth, competitive advantage, and effective resource allocation in the startup ecosystems.

Real-time cost tracking in a SaaS company

SaaS firms use cost sheets to monitor server and labor costs, improving profitability through continuous optimization. Real-time monitoring enables proactive cost management, early identification of expense variances, and timely corrective actions.

This approach enhances operational efficiency, reduced unnecessary expenditures, and supports sustainable business growth in the competitive software-as-a-service industry.

Impact of accurate cost sheets in financial audits

Companies pass audits by maintaining detailed cost sheets, ensuring GST compliance, and regulatory adherence. Cost sheets in accounting provide comprehensive documentation, support audit processes, and demonstrate regulatory compliance.

Accurate record-keeping facilitates smooth audit procedures, reduced compliance risks, and ensures adherence to Indian accounting standards and statutory requirements for sustainable operations.

Lessons learned from cost overruns and corrections

Firms are constantly correcting cost overruns by revising job cost sheets and implementing better controls. Cost sheet in business applications enabled identification of budget variances, analysis of cost escalation factors, and implementation of corrective measures.

This experience highlights the importance of regular monitoring, accurate forecasting, and proactive cost management in project-based industries.

Cost sheet vs. financial statements

Cost sheets and financial statements serve distinct roles in your business. Cost sheets focus on internal cost analysis, while financial statements provide a comprehensive financial overview for external stakeholders. Understanding their differences ensures effective financial management, strategic planning, and compliance in India’s dynamic market.

Purpose and usage

● Cost sheet

You use cost sheets to calculate and analyze production costs, aiding internal decisions like pricing and cost control strategies. These detailed analyses support operational efficiency, resource optimization, and strategic planning. Cost sheets enable managers to identify cost drivers, evaluate profitability, and make informed decisions about production processes, pricing strategies, and resource allocation.

● Financial statements

These summarize your company's financial health (e.g., profit and loss, balance sheet) for external reporting and compliance with Ind AS standards. Financial statements provide a comprehensive overview of business performance, financial position, and cash flows. They ensure transparency, facilitate stakeholder communication, and support regulatory compliance for sustainable business operations.

Audience and stakeholders

● Cost sheet

Primarily for internal stakeholders like managers and accountants to optimize operations and improve decision-making processes. These documents support internal planning, cost control, and performance evaluation. Cost sheets help management teams analyze efficiency, identify improvement opportunities, and make strategic decisions about resource allocation, pricing, and operational optimization.

● Financial statements

Prepared for external stakeholders like investors, regulators, and auditors, ensuring transparency and compliance with reporting standards. These statements communicate financial performance, support investment decisions, and demonstrate regulatory adherence. They provide stakeholders with comprehensive financial information for informed decision-making and assessment of business viability.

Structure and format

● Cost sheet

Organized by cost categories (e.g., direct materials, overheads) in a tabular format for detailed analysis. This structure enables systematic cost tracking, facilitates comparative analysis, and supports operational decision-making. Cost sheets provide granular cost breakdowns, enabling managers to understand cost components and identify optimization opportunities for improved efficiency.

● Financial statements

Follow standardized formats (e.g., balance sheet, income statement) as per Indian accounting standards for consistency and compliance. These formats ensure comparability, facilitate analysis, and support regulatory requirements. Standardized presentation enables stakeholders to evaluate performance, assess financial health, and make informed decisions about business relationships.

Level of detail provided

● Cost sheet

Highly detailed, breaking down costs per unit or process for granular analysis and operational optimization. This detailed approach enables precise cost tracking, facilitates efficiency improvements, and supports strategic planning. Granular analysis helps identify cost drivers, evaluate profitability, and make informed decisions about production processes and resource allocation.

● Financial statements

Provide a high-level overview of financial performance, less focused on production specifics but comprehensive in scope. These statements summarize overall business performance, financial position, and cash flows. High-level perspective enables stakeholders to assess business health, evaluate investment opportunities, and make strategic decisions about business relationships.

Frequency and timing of preparation

● Cost sheet

Prepared frequently (e.g., monthly or per project) for real-time cost tracking and operational decision-making. Regular preparation enables proactive cost management, early identification of variances, and timely corrective actions. Frequent updates support continuous improvement, enhance operational efficiency, and facilitate responsive management in dynamic business environments.

● Financial statements

Typically prepared quarterly or annually for regulatory reporting and stakeholder communication requirements. This timing aligns with regulatory deadlines, supports compliance obligations, and facilitates periodic performance evaluation. Annual preparation provides comprehensive performance assessment, enables strategic planning, and supports long-term business development and growth initiatives.

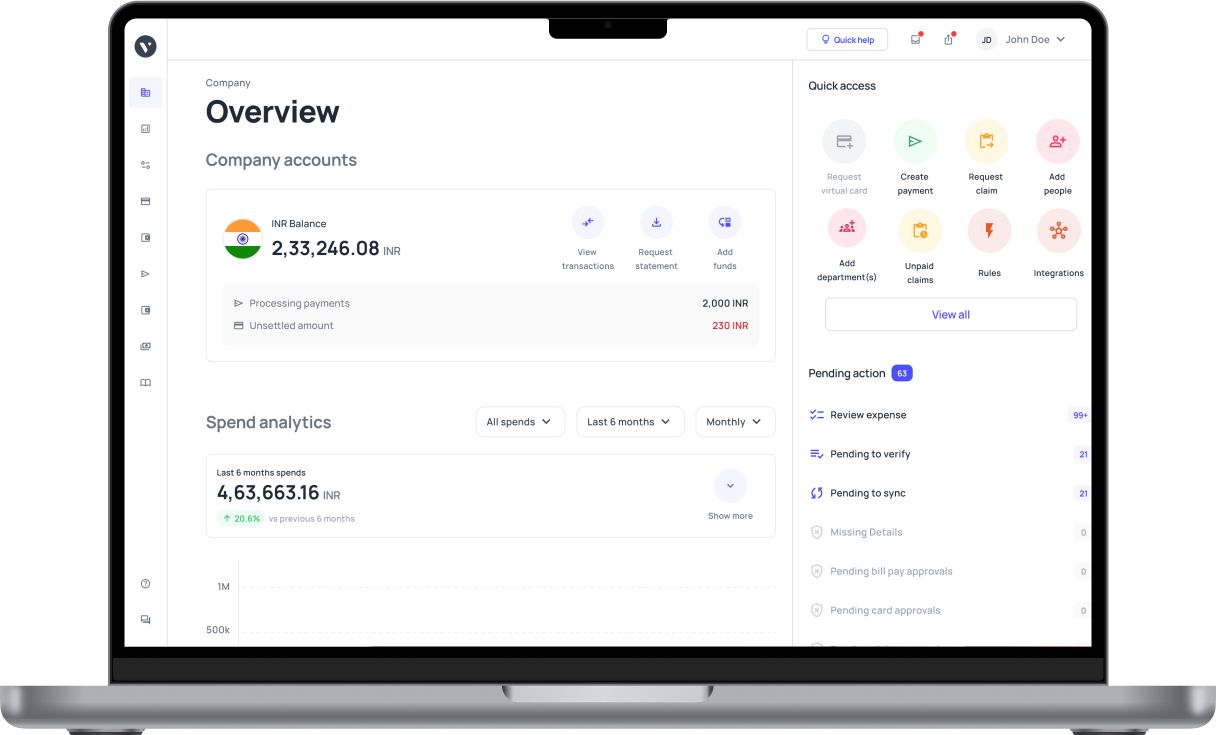

Manage every business cost in one place with Volopay

Industry-specific considerations

1. Manufacturing sector costing requirements

Understanding what is cost sheet becomes crucial in manufacturing industries like textiles and automobiles. These sectors require detailed tracking of direct materials, labor, and factory overheads. Manufacturing cost sheets must capture raw material costs, production wages, machine depreciation, and utility expenses.

Business cost sheets in manufacturing typically include work-in-progress inventory calculations and finished goods costing. Accurate material requisition tracking and overhead allocation methods are essential for determining true product costs in competitive manufacturing environments.

2. Costing in service-based industries

Service sectors, particularly IT and consulting firms, utilize a cost sheet in business differently from manufacturing. These industries emphasize human resource costs, software licensing fees, and infrastructure expenses. Business cost sheets for service companies focus on billable hours, employee salaries, training costs, and technology investments.

Project-based costing becomes vital where cost sheets in accounting help track profitability per client engagement. Service cost sheets often exclude inventory but include substantial overhead allocations for office space and utilities.

3. Seasonal and inventory considerations in retail

Retail businesses face unique challenges in cost sheet preparation, especially during festive seasons. Knowing what is cost sheet in retail involves managing fluctuating inventory costs, seasonal procurement, and storage expenses. Business cost sheets must account for bulk purchasing discounts, inventory holding costs, and seasonal markdowns.

Cost sheets in accounting for retail require careful tracking of FIFO or LIFO inventory methods. Peak season demands affect labor costs, transportation expenses, and warehouse operations, making accurate cost sheet preparation essential for pricing strategies.

4. Cost tracking in project-based industries

Construction and infrastructure industries rely heavily on job cost sheets for project profitability analysis. Understanding what is cost sheet in project-based work involves tracking material costs, labor hours, equipment rental, and subcontractor expenses per project.

Business cost sheets in construction must capture direct costs like cement, steel, and labor, plus indirect costs including site supervision and equipment maintenance. Cost sheets in accounting for projects require detailed work breakdown structures and progress billing alignments for accurate financial reporting.

5. Compliance and reporting differences by sector

Different industries face varying regulatory requirements affecting cost sheet preparation. Understanding what is cost sheet compliance varies significantly between sectors, with manufacturing requiring GST input credit tracking and service industries focusing on professional tax calculations.

Business cost sheets must align with sector-specific regulations, including environmental compliance costs in manufacturing and professional licensing fees in service sectors. Cost sheets in accounting must accommodate industry-specific reporting standards, ensuring accurate tax calculations and regulatory compliance across different business verticals.

Challenges and limitations of cost sheets

Difficulty in allocating overheads accurately

Understanding what is cost sheet reveals significant challenges in overhead allocation. Assigning indirect costs like utilities, rent, and administrative expenses across different products or departments becomes highly subjective. Business cost sheets often struggle with determining appropriate allocation bases for shared resources.

Different allocation methods can drastically alter product costs, affecting pricing decisions. Cost sheets in accounting require careful consideration of allocation principles, yet perfect accuracy remains elusive, leading to potential distortions in true product profitability analysis.

Inconsistent cost classification

Cost sheet in business preparation faces significant challenges when different teams use varying classification methods. What constitutes direct versus indirect costs may differ across departments, creating inconsistencies in business cost sheets. Some teams might classify certain expenses as variable, while others treat them as fixed costs.

Cost sheets in accounting suffer when standardized classification protocols aren't enforced organization-wide. These inconsistencies can lead to comparative analysis errors, making it difficult to benchmark performance across different periods or business units.

Time-consuming manual preparation

The preparation of a traditional cost sheet in business involves extensive manual calculations and data compilation. Knowing what is cost sheet preparation reveals labor-intensive processes requiring significant time investment from accounting teams. Manual business cost sheets are prone to calculation errors, data entry mistakes, and formatting inconsistencies.

Cost sheets in accounting prepared manually often lack real-time accuracy and require frequent updates. The time-consuming nature of manual preparation delays decision-making processes and increases operational costs, making automated solutions increasingly necessary for modern businesses.

Limited use for external reporting

Cost sheets in business cannot replace statutory financial statements required for external stakeholders. Business cost sheets lack standardized formats accepted by regulatory bodies or investors.

Cost sheets in accounting serve internal decision-making but don't meet external reporting requirements like balance sheets or profit-loss statements. Banks, investors, and regulatory authorities require standardized financial reports, making cost sheets supplementary rather than primary reporting tools for external communication.

Lack of real-time updates

The manual preparation of a cost sheet in business creates significant delays in accessing current cost information. Figuring out what is cost sheet accuracy depends heavily on timely data updates, which manual systems cannot provide efficiently. Business cost sheets prepared manually may reflect outdated costs, leading to poor pricing decisions and inventory valuations.

Cost sheets in accounting lose relevance when they don't reflect current market conditions, supplier price changes, or operational modifications. Real-time cost tracking requires automated systems, making traditional manual cost sheets increasingly inadequate for dynamic business environments.

How to mitigate challenges faced during cost sheet preparation

Adopt automated costing tools

Understanding what is cost sheet preparation reveals the need for automation to eliminate manual errors. Software like Volopay streamlines calculations and reduces time-consuming processes.

Business cost sheets become more accurate when automated tools handle complex overhead allocations and cost classifications. Cost sheets in accounting benefit from real-time data integration and standardized formatting features.

Use standardized cost categories and formats

A cost sheet in business requires consistent classification methods across all departments. Standardized formats ensure that business cost sheets maintain uniformity in cost categorization and presentation.

Cost sheet consistency depends on establishing clear guidelines for direct, indirect, variable, and fixed cost classifications. Cost sheets in accounting become more reliable when organizations implement standardized templates and procedures organization-wide.

Train staff on costing principles

An effective cost sheet preparation requires skilled personnel who understand fundamental costing concepts. Training programs help staff comprehend what is cost sheet accuracy and proper allocation methods.

Business cost sheets improve significantly when teams receive education on overhead distribution, cost behavior, and classification principles. Cost sheets in accounting benefit from continuous staff development in modern costing techniques and software applications.

Integrate cost sheets with financial systems

Understanding what is cost sheet integration reveals the importance of connecting costing processes with ERP systems. Seamless data flow between business cost sheets and financial modules eliminates duplicate data entry and reduces errors.

A cost sheet in business operations becomes more efficient when integrated with inventory management and accounting systems. Cost sheets in accounting gain real-time accuracy through automated data synchronization.

Review and update cost sheets regularly

Regular review ensures the cost sheet in business remains relevant and accurate for decision-making purposes. Cost sheet maintenance involves periodic updates to reflect current market conditions and operational changes.

Business cost sheets require systematic review cycles to identify outdated allocation methods and cost classifications. Cost sheets in accounting benefit from scheduled evaluations that incorporate feedback from various departments and stakeholders.

Future trends in cost analysis

Integration of AI and machine learning

Cost sheet evolution reveals AI's transformative impact on cost analysis. Machine learning algorithms predict cost trends and optimize spending patterns automatically. Business cost sheets integrated with AI provide intelligent insights for overhead allocation and expense forecasting.

Cost sheets in accounting benefit from automated pattern recognition that identifies cost anomalies and suggests optimization opportunities for enhanced profitability.

Rise of predictive costing models

Cost sheet preparation increasingly relies on predictive analytics for accurate expense forecasting. Advanced models analyze historical data to predict future costs with greater precision than traditional methods.

Cost sheet accuracy improves significantly through predictive algorithms that consider market volatility and seasonal variations. Business cost sheets equipped with forecasting capabilities enable proactive decision-making and strategic planning.

Real-time cost monitoring and dashboards

Modern cost sheets demand instant access to live cost data for quick decision-making. Real-time dashboards transform how organizations view and analyze their expenses.

A cost sheet's relevance increases when data updates continuously, reflecting current market conditions and operational changes. Cost sheets in accounting become dynamic tools providing immediate insights rather than static historical reports.

Greater focus on sustainability and ESG costs

Environmental, Social, and Governance factors increasingly influence the cost sheet in business preparation, particularly relevant in India's sustainability push. Organizations track carbon footprint costs, renewable energy expenses, and social impact investments.

Business cost sheets now include ESG metrics alongside traditional financial data. Comprehensiveness expands to encompass environmental costs and sustainable business practices for comprehensive reporting.

Cloud-based and collaborative cost platforms

Cloud technology revolutionizes accessibility and collaboration across distributed teams. Real-time collaboration enables multiple departments to contribute simultaneously to business cost sheets.

Efficiency improves through cloud-based platforms offering instant updates and seamless data sharing. Cost sheets in accounting become collaborative documents accessible from anywhere, enhancing team coordination and decision-making speed.

Leveraging technology for smarter cost sheet management

1. Evaluating software based on business scale and complexity

Cost sheet software selection requires careful assessment of business requirements and operational complexity. Small businesses need simple solutions while enterprises require advanced features for multi-location operations.

Cost sheet implementation varies significantly based on transaction volume, product diversity, and reporting needs. Business cost sheets benefit from scalable software that grows with organizational requirements and handles increasing data complexity efficiently.

2. Prioritizing user-friendly interfaces and onboarding speed

An effective adoption depends heavily on intuitive software interfaces that minimize learning curves. User-friendly platforms accelerate team adoption and reduce training costs significantly.

Efficiency improves when staff can navigate software easily without extensive technical knowledge. Cost sheets become more accessible when platforms offer guided tutorials, templates, and simplified data entry processes for enhanced productivity.

3. Ensuring strong data security and regulatory compliance

Cost sheet management requires robust security measures to protect sensitive financial information from unauthorized access. Compliance with data protection regulations and industry standards becomes crucial for business operations.

Business cost sheets contain confidential pricing, supplier, and operational data requiring encryption and access controls. Cost sheet security encompasses backup systems, audit trails, and compliance with local financial regulations.

4. Seamless integration with finance and accounting platforms

Integration reveals the importance of connecting costing software with existing financial systems. Seamless data flow between business cost sheets and ERP platforms eliminates duplicate entries and reduces errors.

A cost sheet in business operations becomes more efficient when integrated with inventory management, payroll, and accounting modules. Cost sheets gain accuracy through automated synchronization with the general ledger and financial reporting systems.

5. Planning for scalability and vendor support over time

Long-term success requires software that adapts to changing organizational needs and growth patterns. Scalable platforms accommodate increased users, transactions, and reporting requirements without performance degradation.

Sustainability depends on reliable vendor support, regular updates, and feature enhancements. Business cost sheets benefit from vendors offering training, technical assistance, and system maintenance for continued operational excellence.

Transforming cost management with Volopay’s smart finance platform

Modern businesses require sophisticated tools to streamline financial operations and enhance cost visibility. Understanding cost sheets reveals the need for integrated platforms that automate calculations and provide real-time insights.

Volopay's smart accounting automation platform revolutionizes cost sheet management by combining expense tracking, budgeting, and advanced reporting software capabilties into one comprehensive solution, making business cost sheets more accurate and accessible.

Real-time expense tracking and control

Volopay transforms your cost sheet in business operations by providing instant expense visibility and control mechanisms. Real-time tracking visibility eliminates delays in cost data compilation, ensuring business cost sheets reflect current spending patterns accurately.

Effectiveness improves significantly when organizations can monitor expenses as they occur, enabling immediate corrective actions. Your teams benefit from automated expense categorization and instant updates that maintain data accuracy throughout the reporting period.

Automation of repetitive financial tasks

Automation eliminates manual data entry and calculation errors. Volopay automates routine financial tasks, allowing teams to focus on strategic analysis rather than administrative work.

Business cost sheets become more reliable when automated systems handle recurring calculations, overhead allocations, and cost classifications consistently. Cost sheet preparation accelerates significantly through automated workflows that reduce human intervention and associated errors in financial reporting processes.

Integrated budgeting and reporting tools

Business planning benefits from Volopay's integrated budgeting software capabilities that connect cost tracking with financial forecasting. Comprehensive reporting tools provide detailed insights into spending patterns and budget variances.

The usability of cost sheet data increases when combined with predictive budgeting features that help organizations plan future expenses effectively. Business cost sheets integrate seamlessly with budget reports, enabling comparative analysis.

Multi-level approval workflows for spending

Volopay's approval workflows ensure accuracy by implementing controlled spending processes across organizational levels. Multi-tier approval systems prevent unauthorized expenses and maintain budget compliance effectively.

Business cost sheets benefit from structured approval mechanisms that track spending authorization and maintain audit trails. Cost sheet governance improves through systematic approval processes that ensure all recorded expenses meet organizational policies and regulatory requirements.

Enhanced visibility and data-driven decisions

Volopay's analytics capabilities transform raw financial data into actionable insights. Enhanced visibility through dashboards and reports enables data-driven decision-making across all organizational levels.

Cost sheets become strategic tools when supported by comprehensive analytics that identify cost trends, optimization opportunities, and performance metrics. Business cost sheets gain strategic value through intelligent reporting that supports informed financial planning and operational improvements.

Bring Volopay to your business

Get started now

FAQs

Yes, cost sheets help service-based industries track labor, software, and overhead costs, enabling accurate pricing, cost control, and profitability analysis for firms like IT or consulting.

Divide the total cost (direct materials, labor, expenses, and overheads) by the number of units produced to calculate the cost per unit in a cost sheet.

Cost sheets are internal tools, not legally mandated, but aligning them with GST and Ind AS ensures accurate financial reporting and compliance during audits in India.

A cost sheet details actual or estimated production costs, while a budget forecasts overall financial plans, guiding resource allocation and expenditure for future periods.

Yes, cost sheets provide detailed cost data, including materials and overheads, to accurately value inventory, supporting financial reporting and compliance with Indian accounting standards.

Cost sheets identify high-cost areas, enabling you to optimize spending, reduce wastage, and implement efficient processes, ensuring cost control and improved profitability in your business.

Volopay automates expense tracking, categorizes costs, and integrates with accounting systems, streamlining cost sheet preparation with real-time data and reducing manual errors for Indian businesses.

Yes, Volopay replaces manual expense reports by automating expense tracking, providing real-time data, and integrating with financial systems, ensuring accuracy and efficiency for Indian businesses.