👋 Exciting news! UPI payments are now available in India! Sign up now →

Cost control: Exploring strategies and techniques

Cost control is a pivotal factor in steering a company toward sustainable growth, heightened profitability, and overall success, especially in the dynamic landscape of business and finance. Navigating the competitive terrain requires astute financial management, and effective cost control stands as a linchpin in maximizing a company's financial gains.

There are many strategies and techniques that businesses can employ to master the art of cost control, ensuring a robust financial foundation for future endeavors. To do this you must understand what cost control exactly is, its primary elements, its advantages, disadvantages, and how it is different from cost reduction.

What is cost control?

At its core, cost control is a multifaceted financial management strategy aimed at curbing expenditures within an organization. In the pursuit of operational efficiency and fiscal prudence, businesses employ various techniques to monitor, assess, and regulate business expenses.

Whether through streamlining processes, implementing better systems, negotiating better deals with suppliers, or optimizing resource allocation, cost control is the proactive approach to managing financial resources judiciously.

It serves as a crucial element for any finance team in fostering financial stability and enhancing a company's competitive edge in the ever-evolving business landscape.

Primary elements of cost control

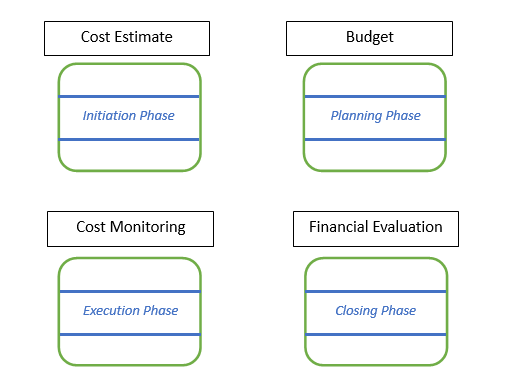

Estimating costs

Accurate cost estimation, which can be done by looking at past expenses and future requirements, lays the groundwork for effective control. This is also the first or initiation phase in cost control.

By meticulously forecasting expenses and using tools to build a financial model, businesses can anticipate financial demands and make informed decisions that align with their budgetary constraints and overarching financial objectives.

Creating budgets

Once you have made the cost estimates, then it’s time to start preparing the budgets. This is also known as the planning phase. Budgets serve as dynamic roadmaps, delineating financial allocations across various departments.

A well-constructed budget not only guides spending but also facilitates proactive decision-making, ensuring resources are optimally distributed to meet operational needs.

Monitoring costs

Real-time vigilance over expenditures is imperative for successful cost control. Once budgets have been allotted and distributed, it is time to start monitoring how resources are being spent.

Continuous monitoring enables swift identification of variances, allowing businesses to implement corrective measures promptly and prevent budgetary deviations that could impact the bottom line. This is also known as the execution phase in cost control.

Financial assessment

Finally, the closing phase is where you assess how budgets were utilized and whether cost control methods, strategies, techniques, or systems helped in doing so. Regular and thorough financial assessments are vital components of cost control.

These assessments involve in-depth analysis of financial data, enabling businesses to gauge their financial health, identify areas of improvement, and fine-tune cost control strategies to align with changing market dynamics.

Importance of cost control in business operations

1. Enhancing profit generation

Cost control is not merely a financial discipline; it's a strategic imperative for profit enhancement in any type of business. By minimizing unnecessary costs and optimizing operational efficiency, businesses can redirect resources toward revenue-generating activities.

This proactive approach ensures that each dollar spent contributes directly to profit generation, maximizing the return on investment.

2. Ensuring financial stability

Financial stability is the bedrock of a resilient business. Cost control practices contribute to this stability by instilling fiscal discipline, not just within the finance team but employees across the organization.

This ensures that financial resources are managed judiciously. This, in turn, enables companies to weather economic fluctuations and uncertainties, providing a secure foundation for sustained success.

3. Boosting competitive edge

In a fiercely competitive business landscape, cost control serves as a potent weapon. It allows businesses to offer competitive prices without compromising on quality. This not only attracts cost-conscious consumers but also positions the company favorably against competitors, boosting market share and overall competitiveness.

4. Optimizing resources

Strategic cost control goes beyond expense reduction; it involves optimizing resource allocation. By preventing waste and inefficiencies, businesses can ensure that every resource is used to its full potential. This optimization leads to enhanced operational efficiency, a key factor in achieving long-term sustainability.

5. Decision-making support

Informed decision-making is contingent on accurate and up-to-date financial data. Cost control mechanisms provide executives with invaluable insights into the financial health of the organization.

Armed with this information, leaders can make informed and strategic decisions that align with the company's overarching financial goals.

6. Flexibility and resilience

Cost control strategies that incorporate flexibility are essential for business resilience. In a dynamic market environment, the ability to adapt swiftly to changing conditions is paramount.

Businesses with flexible cost structures can adjust more effectively to market shifts, ensuring they remain agile and responsive to emerging opportunities or challenges.

7. Achieving sustainable growth

Sustainable growth requires a delicate balance between expansion and financial prudence. Effective cost control not only contributes to short-term profitability but also lays the groundwork for sustained growth.

The savings generated through cost control measures can be strategically reinvested in innovation, market expansion, and talent development, fostering a trajectory of long-term prosperity.

Revolutionize your cost control strategy with Volopay!

10 key techniques for cost control

1. Expense calculation

Accurate expense calculation is the cornerstone of effective cost control. This is where the whole process of cost control starts; so it is crucial to get the calculation or estimation as close to the real value as possible.

Leveraging advanced financial tools like cash or expense management systems and methodologies, businesses can precisely quantify all costs associated with various operational activities. This meticulous approach ensures a comprehensive understanding of financial outlays, laying the groundwork for informed decision-making and targeted cost-reduction strategies.

2. Managing earned value

The management of earned value involves assessing the value of work completed against the planned costs. If the earned value is not greater than the planned costs by whatever margin the business expects to have, then the business will face budget issues.

This technique is particularly crucial in project-based industries. By comparing the actual value achieved to the planned costs, your business can identify discrepancies early on, and enable you to timely intervene and prevent budget overruns and project inefficiencies.

3. Norm-based cost accounting

Norm-based cost accounting establishes benchmarks for different operational activities based on historical data and industry standards. The exact values will differ from one company to another, but benchmarks are based on industry standards and help give you a good estimate.

Comparing your actual costs to these established norms provides businesses with a systematic way to identify areas of improvement. This technique facilitates targeted cost-cutting measures, ensuring that resources are utilized efficiently.

4. External resourcing

Strategic utilization of external resources, such as outsourcing and partnerships, can be a cost-effective approach to maintaining or controlling costs. By tapping into specialized expertise without incurring the full costs associated with internal development, businesses can enhance efficiency and competitiveness.

However, careful consideration of risks and benefits is essential to ensure the success of external resourcing initiatives. You will need to understand what operations can or should be outsourced and which ones should be done internally to not compromise on quality.

5. Deviation analysis

Deviation analysis involves regularly comparing planned costs to actual expenditures. This proactive approach enables businesses to identify discrepancies and deviations from the budget.

Timely recognition of these variations allows for swift corrective actions, preventing budget overruns and ensuring financial control. Deviation analysis not only points out deviations in budget usage but also gives insight into inefficient operations that led to the overuse of budgets.

This helps in spotting management inefficiencies and rectifying them so that they do not hurt the finances of the company.

6. Financial plan

It might seem obvious that any business needs a financial plan, but more often than not, this activity is highly overlooked or not done properly. Developing a comprehensive financial plan is a strategic imperative for effective cost control.

This plan serves as a detailed roadmap, outlining budgetary allocations, financial goals, and the strategies to achieve them. Regularly revisiting and adjusting the financial plan based on your current business needs ensures that it remains aligned with the evolving needs and goals of the organization.

7. Minimizing expenses

The practice of actively minimizing expenses requires a holistic approach and strategic mindset. It involves scrutinizing each cost component, negotiating favorable deals with suppliers, and seeking operational efficiencies.

Businesses must continually explore opportunities to reduce costs without compromising quality or operational effectiveness. Many businesses also implement better expense management systems and processes that help them have complete visibility and control over their budgets.

These systems are often much more efficient than manual financial work thanks to their automation features.

8. Fiscal oversight

Establishing robust fiscal oversight mechanisms is paramount for maintaining control over costs. This involves constant monitoring and evaluation of financial activities, ensuring that cost control measures align with the overall business strategy.

Regular financial audits and reviews contribute to transparency and accountability, fostering a culture of responsible financial management.

Having an expense management system that tracks expenses across the organization can help you generate important financial documents and also add to your company’s fiscal oversight.

10. Continual improvement process (CIP)

Adopting a continual improvement process is fundamental to the sustained success of cost control initiatives. This involves regularly reassessing existing cost control strategies, embracing technological advancements, and incorporating feedback from stakeholders.

The last thing you want to do is get stuck in a cycle where you don’t understand what is going wrong. By fostering a culture of continuous improvement, businesses can ensure that their cost control practices remain dynamic and responsive to evolving market dynamics and organizational needs.

Strategies for cost control

1. Managing inventory

Efficient inventory management is a key strategy for cost control. Balancing stock levels to meet demand without excess reduces carrying costs and prevents overstock situations, freeing up capital for other crucial areas.

If you do not have your own inventory storage space and outsource it to different warehousing services, then it becomes even more important to ensure that there is just enough stock of goods and not in excess as it will add warehousing costs.

2. Pricing strategies

Pricing strategy refers to the approach a business takes in setting the prices for its products or services. It involves determining the optimal price point that aligns with the company's objectives, market conditions, and the perceived value of the product or service.

Implementing strategic pricing models is essential. Businesses can adjust pricing to reflect market conditions, competition, and cost structures, ensuring that products or services remain both competitive and profitable.

3. Optimizing processes

Process optimization is central to cost control. Streamlining workflows, reducing bottlenecks, and enhancing efficiency contribute to overall cost reduction while maintaining or improving output quality.

This can be done in many ways one of which is using automation systems to finish repetitive tasks. Using automated systems optimizes various operational processes providing time freedom for employees to do more strategic work and ensures that costs remain as low as possible.

4. Reducing waste

Minimizing waste is a sustainable cost-control strategy. Whether in manufacturing or daily operations, identifying and mitigating sources of waste, be it material or time, contributes directly to cost savings.

This strategy for cost control not only applies to the company’s finance team but also all the employees across the organization using the financial resources in some way or the other.

5. Handling suppliers

Effective supplier management involves negotiation, strategic partnerships, and sourcing alternatives. On one hand, you should always look for partnerships with vendors and suppliers who get you the best deal for your business.

On the other hand, developing strong relationships with suppliers over a long period can lead to favorable terms, discounts, and overall cost efficiencies. You should make sure that you strike a balance between these two approaches when handling supplier relationships.

6. Comprehensive spending analysis

Conducting a thorough analysis of spending patterns provides insights into where resources are allocated. This understanding allows for targeted interventions, identifying areas where costs can be optimized without compromising operations.

The best way to get a comprehensive analysis of all your costs across the company is to implement an expense management system. This will give you complete visibility over all your business transactions for all employees and teams.

7. Clear spending policies

Establishing transparent spending policies sets clear guidelines for employees. This clarity ensures that expenditures align with organizational objectives, preventing unnecessary or unauthorized spending.

To go a step further and ensure that you can enforce these spending policies, it is a smart move to leverage the benefits of an expense management system that has payment methods with built-in spending limit features. This will help in proactively controlling costs rather than reacting to overspending.

8. Expense tracking systems

Implementing robust expense tracking systems enhances visibility into financial activities. Automated tracking tools provide real-time data, facilitating proactive decision-making and enabling timely corrective actions when deviations occur.

Real-time tracking means that your finance team, management, or admins can see every business transaction as they happen. This helps you take action faster in case you notice something fishy rather than waiting for bank and card statements at the end of each month to reconcile expenses.

9. Cost-saving initiatives

Encouraging a culture of cost-consciousness fosters continuous improvement. Employees can contribute to cost-saving initiatives by identifying areas for efficiency gains, proposing innovative solutions, and actively participating in the organization's cost-control efforts.

Getting feedback from employees can be a great way to get feedback regarding the current process and systems. It can give insights into how they can be improved that you might not have noticed yourself.

Navigate your cost management challenges with Volopay

Cost control across various industries

1. Retail sector

Within the retail sector, maintaining a competitive edge necessitates effective cost-control strategies. One of the ways to control costs in the retail industry is by optimizing inventory management to ensure that products are stocked efficiently, reducing carrying costs.

Negotiating favorable terms with suppliers and embracing technology for streamlined operations enhances overall efficiency while containing costs.

2. Professional services

In the dynamic professional services landscape, cost control is paramount for maintaining profitability. Resource utilization is closely monitored, project management practices are streamlined, and technology is leveraged to enhance service delivery without escalating operational expenses.

The main thing to keep in mind for service providers is to make sure that they are not spending budgets more than necessary on a certain aspect without getting equivalent or more in return.

3. Healthcare industry

Reducing costs in the healthcare industry is tricky as one wants to compromise on the quality of service they provide. But at the same time, they also need to make sure that costs do not exceed a certain limit.

Cost control in healthcare involves a delicate balance between delivering high-quality patient care and managing operational costs. Optimization of operational processes, strategic inventory management, and the implementation of technology solutions contribute to cost containment while maintaining the quality of healthcare services.

4. Transportation and logistics

The transportation and logistics sector grapples with optimizing operations while containing logistics costs as there are many uncertain and uncontrollable factors that can go wrong.

Effective route planning, efficient fuel management, and the integration of technology solutions contribute to streamlined operations and reduced overall costs, ensuring competitiveness in the market.

5. Manufacturing field

In manufacturing, cost control efforts focus on process optimization to enhance efficiency and minimize waste. The industrial or factory-based mindset is all about getting the most with the least.

Adopting technology solutions, such as automation and data analytics, contributes to improved production processes, reduced overall production costs, and enhanced cash flow in the manufacturing business.

6. Information technology sector

In the rapidly evolving IT sector, cost control is essential for sustainable growth. This involves optimizing resource allocation, embracing cost-effective cloud solutions, and implementing agile methodologies for efficient project delivery within budget constraints.

Cost control in this sector will most of the time be all about choosing the best digital infrastructure for the business in terms of price and value offered.

7. Hospitality realm

In the hospitality industry, cost control measures are implemented to balance the delivery of exceptional guest experiences with operational efficiency.

Managing staff costs, optimizing energy consumption, and leveraging technology for improved service delivery contribute to maintaining a competitive edge without compromising on quality.

8. Construction industry

In the construction industry, cost control is critical for project success. Efficient project management practices, strategically simplified procurement processes, and the adoption of technology for streamlined operations contribute to ensuring that construction projects are completed within budgetary constraints, fostering long-term profitability.

Cost control key performance indicators (KPIs)

Variance in costs

Cost variance is the difference between the amount you budget for a project or task and the actual amount you end up spending to complete the project.

Monitoring variance in costs is crucial for identifying deviations from budgeted expenditures, allowing businesses to take corrective actions promptly and maintain financial control.

Cost of goods sold (COGS)

Cost of goods sold (COGS) is a key financial metric that represents the direct costs associated with the production of goods or services that a company sells during a specific period.

Monitoring COGS aids in assessing production efficiency and controlling associated expenses. COGS is a crucial component in determining a company's gross profit and, ultimately, its net profit.

Operational costs

Operational costs, also known as operating expenses (OPEX), are the ongoing, day-to-day expenditures that a business incurs to maintain its normal business operations.

Monitoring operational costs, encompassing day-to-day expenses and petty cash expenses is essential for overall cost control. This KPI provides insights into the efficiency of business operations, helping identify areas for improvement and cost reduction.

Gross profit margin

Calculated by subtracting COGS from revenue and dividing by revenue, the gross profit margin is a crucial KPI. It indicates how efficiently a company is producing and selling goods, guiding strategic decisions to enhance profitability.

It is expressed as a percentage and is calculated using the following formula -

Gross Profit Margin = (Revenue−Cost of Goods Sold (COGS)/Revenue)×100.

ROI - Return on investment

ROI is a comprehensive KPI reflecting the profitability of investments. Evaluating the return on investment provides insights into the effectiveness of resource allocation and the overall financial health of projects.

A higher return on investments means that cost management was efficient.

Experience Volopay's expense management for smarter spending

Advantages of cost control

1. Aligns performance for better returns

Cost control ensures that resources are allocated efficiently, aligning performance with strategic goals and enhancing the potential for better financial returns on investments.

Budgets are distributed in a well-calculated manner that helps to make sure that employees get sufficient funds for operations while still maintaining cost control.

2. Elevates production with limited resources

Effective cost control allows businesses to optimize production processes and use systems to their full potential, maximizing output even with limited resources. This contributes to the operational efficiency and profitability of the company.

Cost control enables the business to invest in the important parts of production that bring the most value and eliminate any waste of resources.

3. Cuts or stabilizes prices via reduced costs

By minimizing operational expenses, cost control enables businesses to either cut prices for competitive advantage or stabilize prices while maintaining profitability. When costs go down, a company can offer its products or services at a lower price as compared to other competitors in the market.

4. Economic resource use outcome

Cost control fosters the prudent use of economic resources, ensuring that every resource is utilized judiciously, minimizing waste, and enhancing overall resource efficiency.

5. Boosts company profits and competitiveness

The primary advantage of cost control is its direct impact on company profits. By reducing unnecessary expenditures, businesses enhance their competitiveness and strengthen their financial position in the market. The better cost control a finance team is able to achieve, the more profitable the company will be.

6. Fosters industry stability and growth

Across industries, cost control contributes to overall stability and growth. Companies practicing effective cost control collectively create a more stable economic environment, fostering industry-wide growth and resilience.

One company can learn from the other and see how cost control has helped them improve their profits and overall scope for growth.

7. Boosts sales and maintains employment

Cost control strategies often result in improved product pricing, contributing to increased sales. Additionally, maintaining financial stability through cost control measures supports employment retention, contributing to broader economic stability. This phenomenon is true for companies in all sorts of industries.

Disadvantages of cost control

1. Reduced flexibility and process enhancement

An excessive focus on cost control may inadvertently lead to reduced flexibility in adapting to changing business dynamics. The stringent adherence to predefined budgets and cost structures can hinder the exploration of innovative processes and improvements, limiting the organization's ability to enhance operational efficiency.

An organization should have reserve funds to experiment and innovate.

2. Innovation restricted to preset standards

When cost control becomes the primary focus, innovation may be confined to predetermined cost standards. This restriction could impede the exploration of innovative solutions and unconventional approaches that could potentially lead to breakthroughs and differentiate the organization in the market.

3. Skilled personnel needed for setting standards

Establishing and maintaining effective cost control standards requires skilled personnel well-versed in financial management and industry dynamics.

This necessity for specialized expertise adds an extra layer of complexity and resource requirements, potentially straining the organization's talent pool.

4. Emphasis on current standards limits creativity

A rigid emphasis on existing cost control standards may create an environment that discourages creativity. Employees might be less inclined to propose novel cost-saving ideas if the prevailing culture emphasizes conformity to current standards over exploring innovative solutions.

5. No direct improvement in standards

While cost control ensures financial stability, it may not directly contribute to improving operational standards.

Focusing solely on cost containment without parallel efforts to enhance operational efficiency might result in missed opportunities for long-term sustainable growth and improvement in overall organizational standards.

Balancing fiscal prudence with a commitment to continuous improvement remains essential for holistic organizational development.

Best practices for efficient cost control

1. Perform consistent cost analysis

Conducting consistent and thorough cost analyses is foundational for efficient cost control. Regular assessments of expenditures, trend analyses, and variance evaluations provide organizations with real-time insights into their financial health.

This ongoing process enables timely identification of cost drivers and deviations, facilitating proactive decision-making to maintain fiscal prudence.

2. Set precise goals and objectives

Clear and precise cost control goals are essential for organizational alignment. By defining measurable objectives, businesses create a roadmap for effective cost management.

These goals should be directly tied to overarching organizational objectives, ensuring that cost control efforts contribute directly to the company's strategic vision and financial health.

3. Manage vendors and suppliers effectively

Vendor and supplier relationships play a crucial role in cost control. Effective management involves strategic negotiations, long-term partnerships, and periodic evaluations.

By fostering strong connections with suppliers, organizations can secure favorable terms, discounts, and reliability, contributing to overall cost savings and operational efficiency.

4. Enforce strong budgeting and forecasting methods

Implementing robust budgeting and forecasting methods is vital for effective cost control.

Accurate capital budgeting provides a baseline for financial expectations, while regular forecasting ensures adjustments based on evolving market conditions. This dynamic approach enables organizations to proactively respond to changes, fostering financial stability and adaptability.

5. Prioritize awareness and accountability for costs

Creating a culture of cost awareness and accountability is crucial for successful cost control. Educating employees about the impact of their actions on costs and involving them in the cost management process instills a collective responsibility for financial prudence.

This cultural shift fosters a proactive approach to identifying and implementing cost-saving opportunities at all organizational levels.

6. Adopt technology and automate processes

Embracing technology is a key enabler for efficient cost control. Automation of routine tasks, implementation of advanced financial software, and the use of analytics tools enhance operational efficiency.

This not only reduces the likelihood of errors but also frees up resources for more strategic, value-added activities, contributing to overall cost-effectiveness.

7. Optimize processes and remove inefficiencies

Continuous process optimization is integral to cost control. Regular assessments of operational workflows help identify and eliminate inefficiencies, ensuring that resources are utilized optimally.

Streamlining processes not only contributes to cost reduction but also enhances overall productivity and quality, creating a more efficient and competitive organization.

Volopay - Your partner in strategic cost management!

Challenges faced while implementing cost control

Cost monitoring and analysis

Establishing robust systems for cost monitoring and analysis presents challenges, including the need for advanced technologies and skilled personnel.

Ensuring that cost data is consistently accurate, up-to-date, and interpreted effectively can be a complex endeavor requiring ongoing refinement of monitoring processes.

Implementing advanced technologies for cost monitoring demands a significant investment in software, tools, and infrastructure. Companies need to choose and integrate suitable systems that align with their specific needs.

Continuous improvement

Once certain cost control measures have been set in place and they show results, it is easy to fall down the hole of following the same methods and approach going forward.

But the reality might be that cost control measures that worked in a particular period may not work in the next month or quarter. Sustaining a culture of continuous improvement can encounter resistance from entrenched practices and organizational inertia.

Overcoming the challenge involves fostering a mindset shift, promoting adaptability, and demonstrating the tangible benefits of evolving cost control strategies.

Employee engagement and communication

Engaging employees in cost control efforts requires effective communication. Overcoming challenges in employee engagement involves clear and transparent communication about the reasons behind cost control measures and how each employee contributes to the overall financial health of the organization.

It can be tough to get employees to understand the importance of cost control. It must be conveyed in a manner that shows them how it benefits them and not just the organization.

Benchmarking and best practices

Identifying relevant benchmarks and adopting industry best practices demands careful consideration. Adapting external standards to fit the unique needs of the organization requires strategic alignment and a deep understanding of the industry context, posing challenges in selecting benchmarks that accurately reflect performance.

Change management

Businesses and employees are often resistant to any kind of change from their set processes. Implementing cost control often involves changes in processes and practices.

The challenges of change management include overcoming resistance, addressing concerns about job security, and ensuring that employees understand and embrace the reasons behind the changes to foster a smooth transition.

Risk management

Balancing cost control with risk management poses complex challenges. Implementing cost reduction measures may introduce new risks, such as compromising product quality or supplier reliability.

Navigating these challenges requires a comprehensive risk management approach that considers the potential consequences of cost control decisions.

Cost tracking and reporting

Efficient cost tracking and reporting are essential for informed decision-making. Challenges may arise in ensuring the accuracy, timeliness, and relevance of financial data.

Overcoming these challenges involves implementing advanced reporting systems, training personnel, and continually refining reporting processes to provide meaningful insights for strategic decision-making.

Cost control and cost analysis

Cost control and cost analysis are interlinked aspects crucial for effective financial management within organizations. While cost control involves the implementation of strategies to manage and regulate common business expenses, cost analysis provides the analytical framework to understand, interpret, and evaluate these costs.

Cost analysis delves into the intricacies of expenditure, offering insights through techniques like variance analysis and cost-benefit assessments.

By integrating cost control measures informed by detailed cost analyses, organizations can optimize resource allocation, enhance operational efficiency, and foster a proactive approach to financial decision-making, contributing to sustained profitability and competitiveness.

Utilising cost analysis insights to formulate effective cost control strategies

Cost analysis serves as a diagnostic tool, revealing the fundamental factors influencing expenditures. Organizations can pinpoint the specific drivers behind costs, allowing for targeted interventions to control and optimize spend management.

Cost analysis enables organizations to benchmark their expenditures against industry standards and competitors. This comparative analysis provides valuable insights for identifying areas where cost control measures can be enhanced, fostering a competitive edge.

Cost analysis plays a pivotal role in optimizing resource allocation. By understanding the cost implications of different activities and projects, organizations can align resource allocation with strategic goals, ensuring a judicious use of resources.

Detailed cost analysis empowers organizations to categorize expenses based on their impact on business objectives. This prioritization ensures that resources are directed toward critical areas, optimizing the allocation of funds for maximum efficiency.

Cost analysis helps organizations identify and assess financial risks. By understanding potential challenges and uncertainties, businesses can proactively implement cost control measures that serve as a form of risk mitigation. This proactive stance enhances financial resilience and stability.

Insights from cost analysis shed light on areas of inefficiency and waste. Organizations can leverage this information to implement targeted strategies for waste reduction, enhancing operational efficiency, and minimizing unnecessary expenses.

Through the analysis of historical cost data, organizations can develop accurate forecasts for future expenditures. This proactive approach enhances long-term financial planning and budgeting, allowing for better anticipation and mitigation of potential financial challenges.

Cost analysis provides a solid foundation for informed decision-making. Executives can make strategic choices based on a thorough understanding of cost structures, ensuring that decisions align with overall financial objectives and contribute to organizational sustainability.

Insights derived from cost analysis highlight specific opportunities for cost savings. Organizations can identify areas where efficiencies can be gained, negotiate better terms with suppliers, or implement process improvements to achieve significant cost reductions.

The role of technology in modern cost control practices

1. Automation's impact

Automation in finance management plays a pivotal role by streamlining routine tasks in cost control processes. From invoice processing to data entry, automation features reduce manual effort, minimize errors, and enhance overall operational efficiency. It saves time and also improves the accuracy of the work that needs to be done.

2. Data analytics

Leveraging data analytics enables organizations to extract valuable insights from vast datasets. This analytical approach aids in understanding cost patterns, identifying trends, and making informed decisions based on a comprehensive understanding of financial data.

Most of the modern cost control management systems that you find will have industry-grade analytics and reporting features to help you gain insights from company spending and improve cost control.

3. Cloud solutions

Cloud technology offers flexibility, scalability, and accessibility in cost control practices. A cloud-based system like an expense management software can be accessed from a compatible device anywhere in the world as long as you have an internet connection.

Real-time collaboration, data storage, and processing in the cloud provide organizations with the agility to adapt quickly to changing financial landscapes.

4. AI and machine learning

AI and machine learning tech are getting better and better each day. These technologies analyze extensive datasets, offering predictive insights. They can identify cost-saving opportunities, optimize resource allocation, and enhance strategic decision-making based on evolving cost dynamics.

The best part is that it can suggest personal solutions by interpreting the cost data of your organization.

5. Mobile applications

Mobile applications bring cost control to fingertips, providing real-time access to financial data. This mobility empowers decision-makers to stay informed and make timely decisions, fostering a responsive approach to cost control wherever they are.

Employees and management don’t have to constantly open their laptops to get updates. They can simply use their phones for the financial task.

6. Integration with ERP systems

Seamless integration with Enterprise Resource Planning (ERP) systems ensures the smooth flow of financial data.

This integration enhances accuracy, efficiency, and transparency in cost control processes, creating a unified and comprehensive financial management ecosystem.

Integration with such systems is especially useful for businesses that deal with a lot of inventory.

7. Cost monitoring tools

Specialized cost monitoring tools offer advanced tracking and reporting capabilities. These tools enable organizations to monitor expenses in real time, identify variances, and generate detailed reports.

This empowers decision-makers to implement targeted in cost-control strategies with a clear understanding of the financial landscape.

The future of cost control: Emerging trends

Advanced AI integration

Future cost control practices will witness a deeper integration of advanced AI technologies. Machine learning algorithms will play a crucial role in predictive analytics, automating decision-making processes, and continuously optimizing cost management strategies based on evolving data patterns.

Cost control measures and suggestions will be at the fingertips of any finance professional without having to dig deep and analyze too much.

Sustainability-centric approaches

Many businesses across the world have started to shift from a pure profit-based business mission to one that is more holistic and cares about the business's impact on the environment. The future of cost control will increasingly align with sustainability goals.

Organizations will integrate eco-friendly practices into their cost control strategies, evaluating the environmental impact of operational decisions to drive long-term financial and ecological benefits.

Data-driven decision-making

The evolution of cost control will place a strong emphasis on data-driven decision-making. Advanced analytics tools will be utilized to extract actionable insights from vast datasets, enabling organizations to make precise and informed decisions in their cost management strategies.

Blockchain for transparency

Blockchain technology will become integral to cost control processes, providing transparency and traceability in financial transactions.

Its decentralized and secure nature will enhance accountability, reduce the potential for fraud, and ensure a high level of transparency in financial dealings.

Personalized cost control

The future will see a shift towards more personalized cost control strategies. Organizations will tailor their approaches to managing expenses based on individual preferences, behaviors, and roles within the organization.

This personalized approach aims to make cost control more effective and aligned with the unique needs of each stakeholder.

Remote work cost management

With the continued rise of remote work, organizations will adopt specialized tools for managing costs associated with virtual collaboration.

This includes tracking expenses related to remote work infrastructure, communication tools, and employee well-being, ensuring efficient cost control in a distributed work environment.

Real-time cost tracking

Real-time cost tracking will become standard practice in the future. Organizations will leverage advanced technology to gain instant visibility into financial data.

This real-time monitoring will empower decision-makers to proactively respond to changing business dynamics, facilitating rapid adjustments to cost control strategies as needed.

How does Volopay assist in managing cost control?

1. Expense tracking

Volopay offers a comprehensive expense tracking system, allowing organizations to monitor and categorize expenditures efficiently. Users can easily track and analyze where funds are being allocated, providing transparency in financial transactions.

2. Budget management

The platform facilitates effective budget management by enabling organizations to set, monitor, and control budgets seamlessly. This feature ensures that spending aligns with pre-established financial plans and objectives. You can set budgets for different teams, projects, and departments in your organization.

3. Automated reporting

Volopay automates the reporting process, generating detailed and accurate financial reports. This automation streamlines the decision-making process by providing stakeholders with real-time insights into the organization's financial health.

4. Spending controls

Volopay provides spending controls that empower organizations to enforce predefined spending limits and policies. Volopay offers corporate cards that can be set with custom spending limits for each employee. This feature prevents overspending, enhances financial discipline, and ensures adherence to budgetary constraints.

5. Real-time insights

Volopay offers real-time insights into financial transactions, providing decision-makers with up-to-the-minute data. Each business transaction that happens can be tracked in real-time through the system.

This feature enables proactive decision-making by offering a current and accurate snapshot of the organization's financial status.

6. Vendor management

Efficient vendor management is facilitated through Volopay, allowing organizations to maintain transparency and accountability in financial transactions.

This includes tracking vendor expenses, managing vendor relationships, and ensuring compliance with contractual terms. You can also schedule payments in advance to vendors so that you do not have to deal with late payments.

7. Integration capabilities

Volopay seamlessly integrates with existing systems, enhancing workflow efficiency and reducing the need for manual data entry.

Integration capabilities ensure a smooth and cohesive financial management ecosystem, minimizing the risk of errors and streamlining processes.

8. Customizable controls

Volopay provides customizable controls, allowing organizations to tailor expense management processes to their unique needs. This flexibility ensures that cost control measures align with specific organizational requirements and policies.

9. Receipt capture

The platform facilitates receipt capture, simplifying the documentation process. Users can easily capture and store receipts digitally, ensuring accurate record-keeping and simplifying the auditing and reimbursement processes.

10. Policy enforcement

Volopay enforces organizational policies related to spending, ensuring compliance with established guidelines. This feature mitigates the risk of policy violations, promotes financial discipline, and contributes to a more controlled and transparent expense management process.

11. Cost allocation

Volopay assists in accurate cost allocation, simplifying the process of attributing expenses to specific projects or departments. This ensures transparent financial tracking and enables organizations to assess the financial impact of various activities within the business.

Streamline your expense management process with Volopay!

FAQ's

Businesses can formulate successful cost control strategies by conducting regular cost analyses, setting clear goals, managing vendors effectively, enforcing strong budgeting, prioritizing cost awareness, adopting technology for automation, optimizing processes, and fostering a culture of continuous improvement.

Common challenges include resistance to change, employee engagement, and communication issues, difficulty in benchmarking and adopting best practices, ensuring effective cost tracking and reporting, balancing cost control with risk management, and addressing reduced flexibility and innovation limitations.

Technology enhances cost control through automation, data analytics for insights, cloud solutions for flexibility, AI and machine learning for predictive analysis, mobile applications for real-time access, integration with ERP systems for seamless workflows, and specialized cost monitoring tools for comprehensive tracking and reporting.

Employee engagement and training foster a cost-conscious culture. Educating employees on cost control importance, involving them in identifying cost-saving opportunities, and providing training on expense policies contribute to a proactive approach, reducing unnecessary expenditures.

Businesses should regularly review and update cost control strategies, ideally as part of an ongoing process. Continuous assessment allows organizations to adapt to changing market conditions, incorporate technological advancements, and respond to internal and external factors affecting cost dynamics.

Cost control focuses on managing and regulating expenses within a predefined budget, ensuring efficiency and prudent resource allocation.

In contrast, cost reduction strategies specifically aim to minimize costs through targeted initiatives, often involving cutting expenses or restructuring processes to achieve long-term savings.

The primary objectives of implementing cost reduction strategies include achieving long-term savings, improving operational efficiency, enhancing profitability, maintaining competitiveness, and adapting to economic fluctuations while ensuring sustainable growth.

Innovation plays a crucial role in reducing costs by identifying new, more efficient processes, technologies, or approaches. Innovative solutions can lead to cost savings without compromising quality, contributing to continuous improvement and maintaining effective cost control.

Volopay contributes to effective cost control by providing features such as expense tracking, budget management, automated reporting, spending controls, real-time insights, vendor management, integration capabilities, customizable controls, receipt capture, policy enforcement, and cost allocation.

Volopay streamlines expense tracking by providing a user-friendly platform that captures and categorizes expenses in real-time.

Automated reporting features generate detailed and accurate financial reports, offering businesses insights into their expenditure patterns for improved cost management.

Volopay seamlessly integrates with existing systems like ERP, HRMS, and accounting software, ensuring a smooth flow of financial data.

This integration enhances efficiency by reducing manual data entry and streamlining workflows, contributing to a cohesive and efficient financial management ecosystem.

Volopay provides support through customizable controls, policy enforcement, and real-time insights. It facilitates expense tracking, budget management, and vendor management, offering businesses the tools needed to enforce cost control strategies aligned with their unique requirements.

Yes, Volopay offers real-time insights and analytics that businesses can leverage to optimize cost control measures. These insights provide visibility into spending patterns, allowing organizations to make informed decisions, identify cost-saving opportunities, and enhance overall cost management strategies.