👋Exciting news! UPI payments are now available in India! Sign up now →

8 best virtual debit cards in India for businesses (2026)

Virtual debit and credit cards offer relatively higher safety and security compared to traditional payment methods, making them increasingly popular among businesses and individuals in India. Virtual debit cards can be used to make online payments anytime and anywhere through mobile applications, without the need to carry a physical card. These digital payment solutions have revolutionized how you manage financial transactions, offering unprecedented control, security, and convenience.

With instant issuance capabilities and advanced spending controls, virtual debit cards in India represent the future of digital payments. The best virtual debit card providers offer comprehensive features, including real-time tracking, customizable limits, and seamless integration with existing financial systems, making them essential tools for modern businesses seeking efficient expense management and enhanced financial oversight.

What is a virtual debit card?

A virtual debit card is a digital payment method that provides you with temporary card details (number, CVV, expiration date) for online transactions without requiring a physical plastic card. You can generate these cards instantly through your bank's mobile app or online banking platform.

Virtual debit cards are linked to your existing bank account and draw funds directly from your available balance, just like traditional debit cards. They offer enhanced security for online shopping by creating unique card numbers for each transaction or merchant, reducing your risk of fraud and unauthorized purchases.

How does a virtual debit card work?

When you create a virtual debit card through your banking app, the system generates temporary card credentials that you can use immediately for online purchases. You enter these digital details at checkout, and the transaction processes through your linked bank account.

Virtual debit card providers typically allow you to set spending limits, expiration dates, and even restrict usage to specific merchants. Once you complete your purchase, you can delete or deactivate the virtual card number. This process protects your actual account information from being stored by merchants, while still providing the convenience of instant digital payments for your online shopping needs.

Best virtual debit card providers in India: A quick comparison

- Instant issuance

- Customizable spend limits

- Merchant restrictions

- UPI integration

- Unlimited virtual cards

- Multi-currency support

- API & automation

- Security controls

Best virtual debit card providers in India

1. Volopay

● Overview

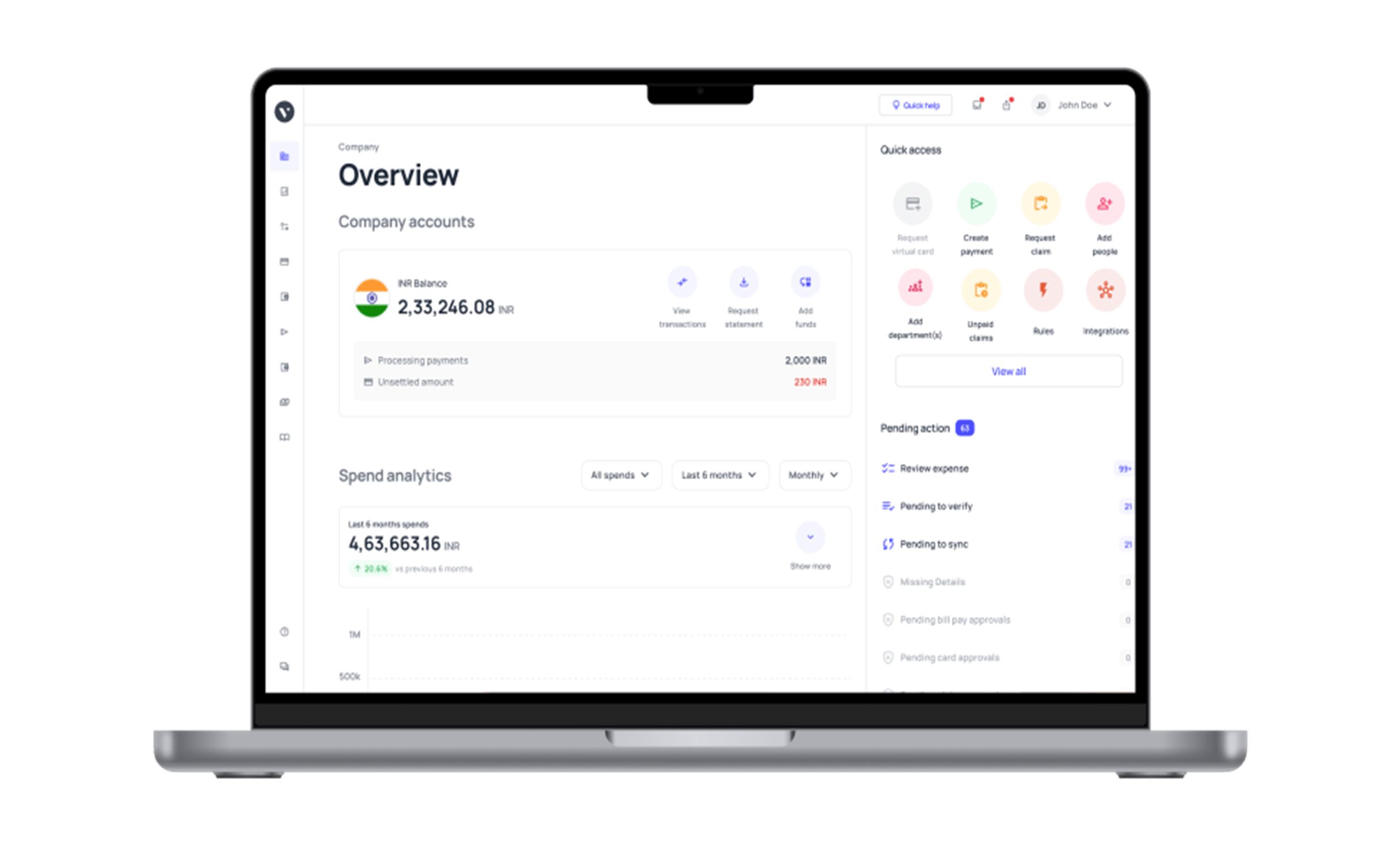

Volopay offers comprehensive virtual debit card solutions designed for modern businesses seeking enhanced expense control and streamlined financial operations.

The platform provides virtual prepaid cards that help companies gain complete control over expenses and streamline business payments with fast and secure payment experiences. These cards integrate seamlessly with expense management workflows, offering real-time visibility into company spending patterns.

● Set-up process and requirements

Businesses can sign up for Volopay by completing an online registration process requiring basic company documentation and KYC verification. The onboarding typically takes 24-48 hours for approval. Once approved, virtual cards can be issued instantly through the Volopay dashboard. Companies need to maintain a minimum balance and complete initial compliance checks before card activation.

● Key features of the card

Volopay operates with complete transparency in pricing with no hidden charges or extra fees, ensuring all transactions and services are clearly communicated. The platform offers customizable spending limits, merchant restrictions, real-time expense tracking, and automated receipt capture. Cards support both single-use and multi-use formats with instant issuance capabilities for different departments or projects.

● Limitations

Virtual cards are restricted to online transactions only and cannot be used for ATM withdrawals or in-store purchases. Some international transactions may incur higher processing fees. The platform requires businesses to maintain minimum wallet balances, and certain advanced features may require higher-tier subscriptions.

● Targeted customers

Volopay primarily serves SMEs, startups, and growing businesses looking for modern expense management solutions. The platform is ideal for companies with frequent online vendor payments, SaaS subscriptions, and digital marketing expenses. Finance teams seeking automated expense tracking and approval workflows benefit most from this solution.

● G2 rating

Volopay maintains strong user ratings for its intuitive interface and comprehensive expense management features. Users particularly appreciate the real-time tracking capabilities and integration options, though some mention the need for more flexible pricing tiers for smaller businesses.

● Security features

The platform implements advanced encryption, tokenized transactions, and real-time fraud monitoring. Cards feature time-bound usage settings, merchant locking capabilities, and instant freeze/unfreeze functionality. Multi-level approval workflows and role-based access controls ensure secure expense management across organizations.

● Integration with accounting software

Volopay offers robust integrations with popular accounting platforms, including Tally, QuickBooks, Xero, and SAP. Automatic expense categorization and real-time data sync reduce manual reconciliation work. API connectivity enables custom integrations for businesses with specific accounting workflows and ERP systems.

2. HSBC

● Overview

HSBC virtual cards provide a secure and flexible tool for businesses to manage digital spending with better control. These cards are designed for one-time or recurring online payments, reducing dependency on physical cards. They help streamline purchasing workflows, improve oversight of vendor payments, and minimize the risk of fraud or misuse.

● Set-up process and requirements

To access HSBC virtual cards, businesses must have an active HSBC corporate banking relationship. Enrollment involves contacting the HSBC relationship manager and completing the required documentation. Once onboarded, cards are issued through HSBC's secure digital platform, where businesses can customize controls such as spending limits, duration, and merchant restrictions.

● Key features of the card

HSBC virtual cards allow customizable spending limits, transaction-specific controls, and real-time monitoring. They support multi-use or single-use formats and offer automated reporting and reconciliation. Cards can be created instantly for different departments or vendors, enabling greater expense visibility and control over company-wide digital transactions.

● Limitations

HSBC virtual cards are not suitable for in-store purchases or ATM withdrawals, as they function solely for online and remote payments. Smaller businesses may face longer onboarding timelines due to compliance requirements. Integration with third-party tools may require additional support or development resources, depending on the business's specific needs.

● Targeted customers

HSBC's virtual cards cater to mid-to-large businesses looking for enhanced payment security and control. Ideal users include procurement teams, finance departments, and businesses managing vendor payments at scale. Enterprises with centralized financial operations or recurring digital transactions will benefit most from this solution.

● G2 rating

HSBC's virtual card service is not independently rated on G2, but the bank's corporate services generally receive favorable feedback. Clients appreciate HSBC's robust global support, data security, and reliable transaction handling. Some reviews mention that platform navigation and response times could be improved for faster access to features.

● Security features

HSBC virtual cards are equipped with advanced security measures such as encryption, tokenized card numbers, and time-bound usage settings. Businesses can restrict cards to specific suppliers or uses, reducing fraud risks. Real-time monitoring alerts ensure a quick response to any suspicious activities or unauthorized charges.

● Integration with accounting software

HSBC offers integration capabilities with major accounting and ERP platforms, enabling automatic expense mapping and faster reconciliation. Businesses can export transaction data for reporting or use HSBC's APIs for deeper connectivity. These integrations help reduce manual work and enhance visibility into payment and expense flows.

3. SBI

● Overview

State Bank of India provides virtual debit card services through its digital banking platform, offering secure online transaction capabilities for personal and business customers. SBI's virtual cards integrate industry-grade encryption to ensure safe transactions from start to finish, with expenses easily tracked through their online portal. The cards serve as digital alternatives to physical debit cards for e-commerce and online payments.

● Set-up process and requirements

SBI virtual debit cards can be obtained by existing account holders through SBI's internet banking portal or mobile app. Customers need an active SBI savings or current account with KYC compliance. The card generation process is instant once logged into the digital banking platform, requiring basic account verification and PIN setup.

● Key features of the card

SBI virtual cards offer customizable transaction limits, instant card generation, and integration with the bank's existing digital ecosystem. Cards support domestic and international online transactions with competitive exchange rates. The platform provides detailed transaction history, SMS alerts, and easy card blocking/unblocking features through mobile banking.

● Limitations

Cards are limited to online transactions only and cannot be used for ATM withdrawals or physical point-of-sale purchases. International transaction fees may apply for foreign currency payments. The card validity period is typically shorter than physical cards, requiring periodic regeneration for continued use.

● Targeted customers

SBI virtual cards primarily serve individual account holders and small businesses requiring secure online payment solutions. The service appeals to customers who frequently make e-commerce purchases, pay utility bills online, or manage digital subscriptions. Students and young professionals benefit from the enhanced security for online transactions.

● G2 rating

SBI's virtual debit card service receives mixed reviews, with users appreciating the security features and ease of use within the SBI ecosystem. However, some customers mention limitations in international acceptance and occasional technical issues with card generation. The service is generally rated as reliable for domestic online transactions.

● Security features

SBI implements multi-factor authentication, OTP verification for transactions, and real-time fraud monitoring. Cards feature dynamic CVV generation, transaction encryption, and immediate blocking capabilities. The bank's security infrastructure includes 24/7 monitoring and instant alert systems for suspicious activities.

● Integration with accounting software

SBI offers basic integration capabilities with popular accounting software through statement downloads and API access for corporate customers. Transaction data can be exported in various formats for reconciliation purposes. However, advanced real-time integration may require additional setup and may not be as comprehensive as specialized fintech solutions.

4. OmniCard

● Overview

OmniCard provides sophisticated virtual debit card solutions tailored for corporate expense management and digital payments. The platform focuses on delivering enterprise-grade virtual card services with advanced controls and reporting capabilities. OmniCard enables businesses to issue multiple virtual cards for different purposes while maintaining centralized oversight and control.

● Set-up process and requirements

Businesses can apply for OmniCard services through their corporate banking partners or directly through the OmniCard platform. The setup process requires company registration documents, KYC verification, and compliance checks. Once approved, cards can be issued instantly through the web-based dashboard or mobile application with customizable parameters.

● Key features of the card

OmniCard offers granular spending controls, real-time transaction monitoring, and multi-currency support. The platform provides instant virtual card creation, automated expense categorization, and detailed analytics dashboards. Cards support both recurring and one-time payments with merchant-specific restrictions and spending limits.

● Limitations

Virtual cards are restricted to online and digital payments only, with no ATM or physical store usage. Some merchants may not accept virtual cards, particularly in sectors with limited digital payment adoption. International transactions may incur additional fees depending on the card configuration and usage patterns.

● Targeted customers

OmniCard primarily serves medium to large enterprises requiring sophisticated expense management solutions. The platform is ideal for companies with complex approval workflows, multiple departments, and significant online vendor payments. Procurement teams, finance departments, and businesses with extensive digital operations benefit most from the solution.

● G2 rating

OmniCard receives positive ratings for its comprehensive feature set and corporate-focused approach. Users appreciate the detailed reporting capabilities and advanced security features. Some reviews mention the need for better user interface design and more flexible pricing options for smaller businesses.

● Security features

The platform implements advanced tokenization, end-to-end encryption, and real-time fraud detection. Cards feature dynamic security codes, transaction-specific authentication, and instant freeze capabilities. Multi-level approval workflows and role-based access controls ensure secure expense management across large organizations.

● Integration with accounting software

OmniCard offers robust API connectivity with major ERP and accounting systems, including SAP, Oracle, and QuickBooks. Real-time data synchronization enables automatic expense posting and reconciliation. The platform supports custom integrations for businesses with specialized accounting workflows and reporting requirements.

5. EnKash

● Overview

EnKash virtual cards provide customizable limits, merchant locking, and transaction-level controls, allowing users to issue multiple cards for different purposes such as travel, SaaS subscriptions, or marketing with real-time tracking and automatic categorization. The platform combines expense management with virtual card technology to deliver comprehensive financial solutions for growing businesses.

● Set-up process and requirements

EnKash onboarding requires basic company documentation, GST registration, and KYC verification for authorized signatories. The digital setup process typically takes 1-2 business days for approval. Once activated, businesses can create virtual cards instantly through the EnKash dashboard with customizable controls and spending parameters.

● Key features of the card

EnKash cards offer granular expense controls, automated receipt capture, and real-time spend analytics. The platform provides instant card creation, merchant category restrictions, and time-based usage limits. Integration with approval workflows ensures policy compliance while maintaining spending flexibility for different business needs.

● Limitations

Cards are limited to online transactions and cannot be used for cash withdrawals or in-store purchases. Some international merchants may not accept the cards, and foreign exchange fees apply for international transactions. The platform requires minimum wallet balances and may have transaction limits based on the subscription tier.

● Targeted customers

EnKash serves SMEs, startups, and growing businesses looking for integrated expense management solutions. The platform is particularly suitable for companies with significant online expenses, SaaS subscriptions, and digital marketing spends. Teams requiring automated expense tracking and policy enforcement benefit most from this solution.

● G2 rating

EnKash maintains positive user ratings for its comprehensive expense management features and intuitive interface. Users appreciate the automation capabilities and detailed reporting, though some mention the need for better mobile app functionality and customer support responsiveness.

● Security features

The platform implements advanced encryption, tokenized transactions, and real-time fraud monitoring. Cards feature merchant locking, spend category restrictions, and instant blocking capabilities. Multi-level approval workflows and automated policy enforcement ensure secure and compliant spending across organizations.

● Integration with accounting software

EnKash offers seamless integration with popular accounting platforms including Tally, QuickBooks, Xero, and Zoho Books. Automated expense categorization and real-time sync capabilities reduce manual reconciliation efforts. API connectivity enables custom integrations for businesses with specific accounting and ERP requirements.

6. Wise

● Overview

Wise virtual debit cards provide international payment capabilities with competitive exchange rates and transparent fee structures. The platform specializes in multi-currency transactions, making it ideal for businesses with global operations or frequent international payments. Wise cards integrate with the company's broader international money transfer and currency exchange services.

● Set-up process and requirements

Businesses can apply for Wise virtual cards by opening a Wise business account and completing identity verification. The process requires company registration documents, director identification, and business purpose verification. Once approved, virtual cards can be generated instantly through the Wise web platform or mobile app.

● Key features of the card

Wise cards support multiple currencies with competitive exchange rates and transparent fee structures. The platform offers real-time currency conversion, spending controls, and detailed transaction tracking. Cards can be used globally with local payment networks, providing better acceptance rates and lower fees compared to traditional international cards.

● Limitations

While globally accepted, some merchants in specific regions may not support virtual cards. The platform has daily and monthly spending limits that may restrict high-value transactions. Currency availability may be limited for certain exotic currencies, and some advanced features require higher account tiers.

● Targeted customers

Wise virtual cards serve businesses with international operations, freelancers working with global clients, and companies making frequent overseas payments. The platform is ideal for e-commerce businesses, digital agencies, and startups with cross-border transactions requiring competitive exchange rates.

● G2 rating

Wise receives excellent ratings for its transparent pricing, competitive exchange rates, and global acceptance. Users particularly appreciate the multi-currency functionality and ease of international payments. Some reviews mention occasional delays in customer support responses and limitations in certain regional markets.

● Security features

Wise implements bank-level security with advanced encryption, two-factor authentication, and real-time transaction monitoring. Cards feature instant freeze/unfreeze capabilities, spending notifications, and fraud detection systems. The platform maintains regulatory compliance across multiple jurisdictions with robust security protocols.

● Integration with accounting software

Wise offers integration capabilities with major accounting platforms through CSV exports and API connections. Transaction data can be automatically categorized and synchronized with accounting systems. The platform provides detailed reporting features and supports integration with expense management tools for comprehensive financial tracking.

7. Bank of Baroda

● Overview

Bank of Baroda's Virtual Debit Card is an electronic debit card used for e-commerce transactions, available instantly through the bob World app. The service provides secure digital payment solutions for online shopping and bill payments while maintaining the security and reliability associated with traditional banking services.

● Set-up process and requirements

BoB virtual debit cards are available to existing account holders through the bank's mobile app or internet banking platform. Customers need an active savings or current account with completed KYC verification. Card generation is instant through the digital channels, requiring basic authentication and PIN setup for activation.

● Key features of the card

Bank of Baroda virtual cards offer secure online transactions, customizable spending limits, and integration with the bank's digital ecosystem. The cards support domestic and international e-commerce payments with competitive transaction fees. Features include instant card generation, transaction alerts, and easy management through mobile banking.

● Limitations

Cards are restricted to online transactions only and cannot be used for ATM withdrawals or physical merchant payments. International transaction fees may apply for foreign currency purchases. The service availability may be limited during maintenance windows, and card validity periods are typically shorter than physical cards.

● Targeted customers

BoB virtual cards primarily serve individual account holders and small businesses requiring secure online payment options. The service appeals to customers making regular online purchases, paying for digital subscriptions, or managing e-commerce transactions. Traditional banking customers seeking digital payment security benefit from this solution.

● G2 rating

Bank of Baroda's digital services receive moderate ratings, with users appreciating the security and reliability of the virtual card service. The integration with existing banking relationships is valued, though some users mention the need for improved user interface design and broader merchant acceptance.

● Security features

BoB implements multi-layer security, including OTP verification, encryption, and real-time fraud monitoring. Cards feature secure payment processing, instant blocking capabilities, and transaction alerts. The bank's established security infrastructure ensures reliable protection for digital transactions.

● Integration with accounting software

Bank of Baroda provides basic integration capabilities through statement downloads and transaction data exports. Corporate customers can access API services for accounting software integration. However, advanced real-time integration features may be limited compared to specialized fintech platforms.

8. Kotak Mahindra Bank (Kotak 811)

● Overview

Kotak 811 delivers seamless digital banking solutions, including virtual debit cards, offering digital savings accounts with 5.75% interest and comprehensive digital banking services. The virtual debit card can be created by downloading the Kotak 811 app, which provides rewards and discounts at online stores across India, and does not charge any maintenance fee.

● Set-up process and requirements

Kotak 811 virtual debit cards are available to account holders through the mobile app with instant generation capabilities. Customers can open a digital savings account entirely online with minimal documentation and KYC verification. The virtual card creation process is seamless within the app interface, requiring basic authentication.

● Key features of the card

Kotak 811 virtual cards offer zero maintenance fees, rewards on online purchases, and integration with the digital banking ecosystem. The cards provide competitive interest rates on linked savings accounts, instant transaction alerts, and comprehensive mobile banking features. Users can customize spending limits and merchant categories.

● Limitations

Cards are designed for online use only and cannot be used for ATM transactions or physical store purchases. Some premium features may require account balance maintenance. International transaction fees apply for foreign currency payments, and merchant acceptance may vary across different platforms.

● Targeted customers

Kotak 811 virtual cards serve digital-savvy individuals, young professionals, and small business owners seeking modern banking solutions. The platform appeals to customers preferring app-based banking, frequent online shoppers, and those seeking zero-fee digital payment options with attractive interest rates.

● G2 rating

Kotak 811 receives positive ratings for its digital-first approach and user-friendly mobile interface. Users appreciate the zero-fee structure and rewards program, though some mention occasional app performance issues and limited physical branch support for complex queries.

● Security features

Kotak 811 implements advanced mobile banking security, including biometric authentication, encryption, and real-time transaction monitoring. Cards feature instant blocking capabilities, transaction notifications, and fraud detection systems. The platform maintains robust security protocols for digital-only banking operations.

● Integration with accounting software

Kotak 811 provides integration capabilities through mobile app exports and basic API access for business accounts. Transaction data can be downloaded in various formats for accounting purposes. However, advanced real-time integration features may require additional setup and may be limited compared to specialized business banking solutions.

Why Indian businesses need virtual debit cards

Supporting digital transactions

Virtual debit cards are designed for online use, making them ideal for India’s increasingly digital business landscape. Whether it's paying for software subscriptions, advertising, or online services, these cards streamline digital purchases.

They work seamlessly with major online platforms and can be used instantly after issuance. This eliminates the wait time and administrative burden tied to physical cards, ensuring businesses can transact online swiftly and securely without disruption. They empower companies to adopt digital tools without operational delays.

Simplified expense management

Managing employee or department spending becomes easier with virtual debit cards. Each card can be assigned for a specific purpose or team, making it simple to monitor and track transactions in real time. This clarity eliminates confusion and allows finance teams to categorize expenses efficiently.

With most virtual card providers offering detailed transaction logs, businesses can ensure all expenditures are properly documented and reconciled, supporting accurate financial reporting and budgeting. This visibility improves accountability at every level of the organization.

Enhancing payment security

Virtual debit cards offer Indian businesses a safer way to manage financial transactions. Since these cards are not physically issued, they reduce the risk of theft, misuse, or loss. Unique card details can be created for specific vendors or employees, minimizing fraud exposure.

Businesses can also instantly deactivate or regenerate a card if suspicious activity occurs. This enhanced control and limited card validity help maintain strong payment security across business operations. They add an extra layer of protection by isolating transactions per use or vendor.

Secure method for international transactions

International transactions are often a bottleneck for many businesses, as international transfers are costly and take time. When you have the best virtual debit card to use, however, use online payment gateways to make secure and instantaneous payments. All you’ll have to do is enter the card details for a payment to be made.

Easy vendor control

The good thing about using a virtual debit card for business transactions is that you’re not limited to just one card. You can generate a virtual card for each vendor to streamline transaction monitoring. This is especially helpful when you have multiple subscriptions to manage and need to make sure that each is paid accordingly.

Enhanced control and customization

Chances are you’ll have to work with more than one budget in a particular period. From departmental budgeting to fund allocations for specific projects, you’ll want a way to control how much money is spent from each budget. Control the way you spend business funds better by customizing each of your virtual debit card’s usage.

Quick and scalable solution

There are several payment methods that you can use for business expenses, but cash and cheques are difficult to scale. Even relying on physical debit cards will require you to constantly order and wait for new cards. The best virtual debit card providers, however, will allow you to quickly scale your operations with ease.

Cost savings

Businesses can reduce administrative and operational costs by switching to virtual debit cards. There’s no need for printing, shipping, or replacing physical cards, which lowers overhead. Many providers also offer zero or minimal maintenance fees, and transaction charges are often lower than traditional banking methods.

Additionally, businesses can prevent unauthorized spending by setting transaction limits, helping avoid unnecessary expenses, and improving financial efficiency across departments. These savings can be redirected to core growth and innovation efforts.

Key features of virtual debit cards

1. Instant issuance and activation

You can generate virtual debit cards instantly through mobile banking apps or online platforms without waiting for physical delivery. The digital card details become available immediately, allowing you to start making online transactions within minutes.

This instant activation eliminates traditional banking delays, providing immediate access to funds for urgent purchases or business expenses requiring quick payment processing.

2. Seamless integration with digital platforms

Your virtual debit cards integrate effortlessly with popular e-commerce platforms, subscription services, and digital wallets. The cards work across various online merchants, mobile apps, and payment gateways without compatibility issues.

This seamless connectivity ensures smooth checkout experiences while maintaining security standards. You can use the cards for recurring payments, one-time purchases, or subscription management.

3. Customizable spending rules

You have complete control over spending parameters by setting custom limits, restricting merchant categories, and defining validity periods for each virtual card. These flexible controls allow you to create specific cards for different purposes, preventing unauthorized transactions while maintaining spending discipline.

You can modify or deactivate these rules anytime, ensuring your financial boundaries align with changing needs.

4. Scalability for growing teams

Virtual debit cards in India offer exceptional scalability, allowing you to create multiple cards instantly for expanding teams or departments. You can issue unlimited virtual cards as your organization grows, assigning specific spending limits and access controls to each team member.

This scalability eliminates administrative overhead while maintaining centralized financial control, making expense management efficient for businesses of all sizes.

5. Audit-friendly transaction records

You receive detailed transaction logs with timestamps, merchant information, and spending categories for every virtual card purchase. These comprehensive records simplify expense reporting, tax preparation, and compliance requirements.

The digital trail provides transparency and accountability, making financial audits straightforward. You can export transaction data in various formats, ensuring seamless integration with accounting systems and expense management tools.

6. Role-based access for admins and employees

You can assign different permission levels to team members, with administrators controlling card creation, limits, and approvals while employees access only their designated cards. This hierarchical access ensures appropriate financial oversight while empowering teams with necessary spending authority.

Role-based controls prevent unauthorized access, maintain security protocols, and establish clear accountability chains within your organization's financial management structure.

Advantages of virtual debit cards for businesses

Faster onboarding and usage

You can onboard new employees instantly by creating virtual debit cards within minutes, eliminating lengthy approval processes and physical card delivery delays. New team members gain immediate access to company funds for business expenses, travel bookings, and vendor payments.

This rapid deployment accelerates productivity, reduces administrative bottlenecks, and ensures seamless business operations without traditional banking constraints or waiting periods.

Better budgetary control

You maintain precise financial oversight by setting individual spending limits, department-wise allocations, and project-specific budgets for each virtual card. Real-time monitoring allows you to track expenses instantly, preventing budget overruns and unauthorized spending.

Automated controls ensure compliance with financial policies while providing detailed insights into spending patterns, helping you optimize resource allocation and maintain fiscal responsibility across your organization.

3. Seamless online payments

You can process vendor payments, subscription renewals, and digital service purchases effortlessly without sharing primary company card details. Virtual cards eliminate payment friction for online transactions while maintaining security protocols.

Your teams can make instant purchases from approved vendors, pay for software licenses, and handle recurring expenses without delays, ensuring smooth business operations and vendor relationships.

Lower administrative costs

Virtual debit card providers significantly reduce your administrative overhead by eliminating physical card management, replacement costs, and manual expense processing. Automated transaction categorization, digital receipts, and integrated reporting systems minimize accounting workload.

You save on card issuance fees, courier charges, and administrative staff time while gaining efficient expense management tools that streamline financial operations and reduce operational complexity.

Flexibility across teams and projects

You can create dedicated virtual cards for specific teams, projects, or campaigns with tailored spending rules and validity periods. This flexibility allows department heads to manage their budgets independently while maintaining centralized oversight.

Project-based cards ensure expense tracking accuracy, simplify cost allocation, and provide clear financial boundaries, enabling efficient resource management across diverse business initiatives and organizational structures.

Limitations of virtual debit cards for businesses

1. No access to physical cash withdrawals

You cannot withdraw cash from ATMs using virtual debit cards, limiting your ability to handle cash-based transactions or emergencies requiring physical currency.

This restriction affects businesses that frequently need petty cash, vendor payments in cash, or operate in markets where digital payments aren't widely accepted. You must maintain separate arrangements for cash requirements, potentially complicating expense management processes.

2. Restricted acceptance at some merchants

You may encounter merchants, particularly smaller vendors or traditional businesses, that don't accept virtual card payments or require physical card verification. Some service providers, hotels, or rental companies still prefer physical cards for security deposits or identity verification.

This limitation can disrupt business operations when dealing with vendors who haven't adopted digital payment systems or require in-person card presentations.

3. Dependent on internet connectivity

You need stable internet connectivity to generate, manage, or use virtual debit cards effectively. Poor network conditions can prevent card creation, transaction processing, or real-time spending monitoring.

This dependency becomes problematic in remote locations, during travel, or when network outages occur. Your business operations may face delays when internet connectivity issues prevent access to virtual card management systems or payment processing.

4. Limited in-person use cases

You cannot use virtual debit cards for face-to-face transactions that require physical card swiping or chip insertion at point-of-sale terminals. This limitation affects in-store purchases, restaurant payments, fuel stations, or any merchant requiring physical card presence for verification.

Your employees may need alternative payment methods for on-ground business activities, retail purchases, or situations where contactless payments aren't supported.

5. Possible compliance and regulatory hurdles

You may face regulatory challenges when using virtual cards across different jurisdictions or industries with specific compliance requirements. Some sectors require additional documentation, audit trails, or regulatory approvals for digital payment methods.

Cross-border transactions encounter varying regulatory frameworks, tax implications, or reporting requirements that complicate your financial compliance processes and increase administrative complexity for multinational business operations.

How businesses can overcome virtual card limitations

1. Integrating virtual cards with accounting systems

You can streamline financial operations by connecting virtual card transactions directly to accounting software like QuickBooks, Xero, or SAP. This integration automatically categorizes expenses, generates reports, and reconciles transactions in real-time.

You eliminate manual data entry, reduce accounting errors, and gain comprehensive visibility into spending patterns. Automated workflows ensure seamless expense tracking, simplifying month-end closures and audit preparations.

2. Enhancing security with policy controls and OTPs

You can implement robust security measures by configuring transaction limits, merchant restrictions, and mandatory OTP verification for high-value payments. Set up automated alerts for suspicious activities, require multi-factor authentication, and establish approval workflows for large expenses.

These security layers protect against fraud while maintaining operational efficiency. Regular policy updates ensure that your virtual card security evolves in line with emerging threats.

3. Using multi-card strategies for vendor management

You can create dedicated virtual cards for specific vendors, projects, or payment categories to enhance expense tracking and control. Assign unique cards for recurring subscriptions, one-time purchases, or high-risk transactions to isolate potential security breaches.

This strategy allows precise budget allocation, prevents unauthorized spending, and simplifies vendor payment management while maintaining clear audit trails for each business relationship.

4. Setting tiered spending limits across departments

You can establish hierarchical spending controls by assigning different budget allocations to departments, teams, and individual employees based on their roles and responsibilities. Create executive-level cards with higher limits, departmental cards for operational expenses, and employee cards with restricted amounts.

This tiered approach ensures appropriate financial authority distribution while maintaining centralized oversight and preventing budget overruns across organizational levels.

5. Combining virtual and physical cards for flexibility

You can maximize payment versatility by using virtual debit cards in India for online transactions while maintaining physical cards for cash withdrawals and in-person purchases. This hybrid approach addresses connectivity issues, merchant acceptance limitations, and emergency cash needs.

Employees can switch between payment methods based on transaction requirements, ensuring business continuity regardless of payment scenarios or merchant preferences.

6. Leveraging provider support for global transactions

You can overcome cross-border payment challenges by partnering with virtual card providers offering multi-currency support, regulatory compliance assistance, and 24/7 customer service. Choose providers with global payment networks, competitive exchange rates, and expertise in international business requirements.

Their support teams can guide you through compliance procedures, resolve transaction issues, and ensure smooth international operations while minimizing regulatory risks.

Choosing the right virtual debit card provider in India

Evaluate ease of setup and onboarding

You should prioritize providers offering streamlined registration processes with minimal documentation requirements and quick approval times. Look for platforms with intuitive user interfaces, step-by-step guidance, and digital KYC completion.

The best providers enable instant account activation, immediate card generation, and seamless integration with existing banking relationships. Evaluate demo accounts, trial periods, and onboarding support to ensure smooth implementation.

Check compatibility with UPI and major payment gateways

You need providers that seamlessly integrate with UPI systems, popular payment gateways like Razorpay, PayU, and CCAvenue, plus major e-commerce platforms. Verify compatibility with your existing payment infrastructure, API availability, and webhook support for real-time notifications.

Ensure the provider supports various payment methods, merchant acceptance networks, and maintains high transaction success rates across different platforms.

Look for advanced spend controls and reporting tools

You should select providers offering granular spending controls, including merchant category restrictions, transaction limits, validity periods, and approval workflows. Evaluate real-time reporting capabilities, expense categorization, automated reconciliation, and export options for accounting integration.

Advanced providers offer customizable dashboards, spending analytics, budget tracking, and comprehensive audit trails for effective financial management and compliance requirements.

Consider international transaction support

You need providers supporting multi-currency transactions, competitive foreign exchange rates, and global merchant acceptance. Evaluate cross-border payment capabilities, currency conversion transparency, and international compliance standards.

Consider providers with partnerships in key business markets, support for various currencies, and expertise in handling international regulatory requirements. This ensures seamless global operations and cost-effective international spending.

Review pricing, fees, and hidden charges

You must carefully analyze pricing structures, including setup fees, monthly charges, transaction costs, and foreign exchange margins. Best virtual debit card providers offer transparent pricing without hidden charges, competitive rates for high-volume usage, and flexible billing options.

Compare the total cost of ownership, including premium features, API usage charges, and additional service fees, to ensure cost-effectiveness for your business requirements.

Assess customer service and support availability

You should evaluate provider support quality through response times, communication channels, technical expertise, and availability hours. Look for providers offering 24/7 support, dedicated account managers, comprehensive documentation, and proactive issue resolution.

Test their support responsiveness during evaluation phases, review customer testimonials, and ensure they provide adequate training resources and ongoing assistance for optimal platform utilization.

Regulatory and compliance aspects of virtual debit cards in India

RBI guidelines for virtual debit cards

You must ensure your virtual debit card provider complies with RBI's Master Direction on Prepaid Payment Instruments and digital payment regulations. The RBI mandates proper licensing, operational guidelines, and consumer protection measures for virtual card issuers.

Your provider must maintain adequate capital reserves, implement robust risk management systems, and follow prescribed reporting standards to ensure regulatory compliance and operational legitimacy.

KYC and verification requirements

You need to complete mandatory KYC procedures, including identity verification, address proof, and income documentation, before accessing virtual debit cards. Banks require Aadhaar linking, PAN card verification, and periodic KYC updates as per RBI norms.

Your provider must maintain comprehensive customer records, conduct due diligence checks, and report suspicious transactions to financial intelligence units for anti-money laundering compliance.

Transaction limits and usage restrictions

You face specific transaction limits based on KYC compliance levels, with minimum KYC allowing lower limits and full KYC enabling higher transaction amounts. RBI prescribes daily, monthly, and annual spending caps for virtual cards.

Your transactions are restricted to approved merchant categories, and certain high-risk transactions may require additional verification. These limits help prevent misuse while ensuring consumer protection.

Data security and PCI-DSS compliance

You benefit from mandatory PCI-DSS compliance requirements that your virtual card provider must maintain for secure payment processing. Providers must implement encryption standards, secure data transmission protocols, and regular security audits.

Your sensitive payment information receives protection through tokenization, multi-factor authentication, and fraud detection systems that meet international security standards and RBI cybersecurity guidelines.

GST and taxation considerations

You must ensure proper GST compliance when using virtual cards for business expenses, maintaining detailed transaction records for tax filing purposes. Virtual card transactions require appropriate tax documentation, input credit calculations, and compliance with GST return filing requirements.

Your business must track expenses accurately, maintain digital receipts, and ensure proper categorization of virtual card spending for taxation purposes.

Penalties for non-compliance

You may face monetary penalties, account restrictions, or legal action for violating virtual card regulations, including improper usage, incomplete KYC, or fraudulent activities. RBI can impose fines on your provider for non-compliance, potentially affecting service availability.

Your business risks regulatory scrutiny, transaction blocks, and financial penalties for inadequate record-keeping or violation of prescribed usage guidelines and reporting requirements.

How to apply for a virtual debit card for your business

Getting started with a virtual debit card for your business is fairly straightforward. However, you’ll want to know what is expected from you during each step of the process, as this will ensure that it goes smoothly.

Here are some things to keep in mind when considering applying for a virtual debit card.

1. Eligibility check

Before you can start using a virtual debit card for business transactions, you’ll have to ensure that your business is eligible for it. Keep in mind that each of the best virtual debit card providers will have its own specific requirements to meet.

Most providers generally will require that you have a registered business under a company in India. Before you begin the application process, ensure that if there are any other additional requirements, your company meets them.

These could be minimum monthly spending, deposit, bank account balance, and more. Your virtual debit card will have to be linked to your business bank account.

2. Verification process and required documents

In the modern day, the best virtual debit card for your business is one that allows you to get started as soon as possible. Luckily, plenty of providers offer a fully online application form. All you have to do is fill it out according to your business information and attach supporting documents.

To make sure that the verification process goes smoothly, it’s important that you have all the required documents. Check for their accuracy before submitting them. These documents may include but are not limited to a business license, the director’s proof of identity, proof of business operations, and any existing bank statements.

3. Setting up and customizing the card for specific use

With a card provider that gives you the ability to generate an unlimited number of cards, you want to take advantage of that. To start with, generate your first card and set it up accordingly. You can configure its specific spending limit and customize what you want the card to be used for.

The great thing about virtual debit cards is that you can create a new one with ease whenever you have a new use case. If you have a new vendor or subscription that you want to manage using virtual cards for payments, all you have to do is repeat the setup process.

Tips for secure virtual debit card usage

1. Regularly monitor transactions

Virtual debit cards often come with a dashboard to track and manage your transactions. Make sure you don’t neglect this feature. Instill a habit in your finance and department managers to regularly monitor transactions made on your virtual debit card. This helps identify any out-of-policy spending and minimizes overspend.

2. Report lost or stolen cards immediately

As a virtual debit card for business purchases doesn’t have a physical form, you won’t have to worry about physically misplacing or losing a card.

However, it’s important to note that should a card be compromised, it gets reported, frozen, and blocked immediately. This is to ensure that no one steals your card details.

3. Regularly review security policies

Implementing virtual debit cards for your business involves some trial and error. While it’s important to set a card policy to ensure that card usage is monitored and secure, you want to regularly review your policies to see if they still hold up. If there are any security gaps, they must be addressed immediately.

4. Implement multi-level approval processes

Card transactions don’t require an authorizer before the transactions happen the way bank transfers do, but having a proper approval process post-transaction is key to managing your expenses.

When employees submit expense reports, route them through a multi-level approval workflow that guarantees that all expenses are in compliance with your policies.

5. Train employees

Host knowledge training sessions for your employees regarding your virtual debit cards. Not only is this useful in helping your employees familiarize themselves with your virtual cards as transaction tools, but it also allows you to address any questions, queries, or issues. It guarantees that all your employees are on the same page.

6. Make transactions only on secure websites/applications

Be careful where you use your cards online. While it’s easy to freeze and block compromised virtual debit cards, the first step to keeping your card details safe is to ensure that you only make transactions on websites or applications you know. It’s important to research their security before you enter your card details.

7. Set spending limits

The best virtual debit card to use for your business expenses is one that allows you to set customizable spending limits. Each card you generate should be in line with its respective budget and usage. Before your employees start using the card for purchases, make sure that you configure the card’s particular limit.

8. Enable OTP authentication

To prevent card misuse, ensure that you enable OTP authentication for online purchases. Considering that virtual debit cards are mainly used online, you can ensure that your online transactions are made safely. Every time a card’s details are entered to make a purchase, the cardholder will have to confirm the transaction via OTP authentication.

Volopay virtual cards—the #1 choice for Indian businesses

You deserve a virtual card solution that transforms your business expense management from chaotic to streamlined. Volopay emerges as the definitive leader in India's corporate payment landscape, offering unmatched control, transparency, and efficiency.

With cutting-edge technology and business-focused features, Volopay empowers you to revolutionize how your organization handles financial transactions, making expense management effortless and intelligent.

Seamless control over company spending

You gain unprecedented visibility and control over every rupee spent across your organization with Volopay's comprehensive spending management platform. Set precise budgets, monitor real-time expenses, and prevent overspending before it happens.

Among the best virtual debit card providers, Volopay stands out by offering intuitive dashboards that transform complex financial data into actionable insights, ensuring your company maintains fiscal discipline effortlessly.

Real-time tracking and reporting

You receive instant notifications and detailed transaction data the moment any purchase occurs, eliminating the guesswork from expense tracking. Volopay's advanced reporting system provides comprehensive analytics, spending patterns, and budget utilization reports that update in real-time.

This immediate transparency allows you to make informed financial decisions quickly, identify spending trends, and maintain complete oversight of your company's financial activities.

Customizable limits for teams and projects

You can create specific spending boundaries for different departments, projects, or individual employees with Volopay's flexible limit-setting capabilities. Assign unique budgets based on roles, set project-specific allocations, and modify limits instantly as business needs evolve.

This granular control ensures each team operates within approved financial parameters while maintaining the autonomy to execute their responsibilities effectively and efficiently.

Instant issuance of unlimited virtual cards

You can generate virtual cards instantly for any business need without quantity restrictions or lengthy approval processes. Whether onboarding new employees, launching projects, or handling vendor payments, Volopay provides immediate card creation with all necessary details.

This unlimited issuance capability eliminates traditional banking constraints, ensuring your business operations never face payment-related delays or administrative bottlenecks that could impact productivity.

UPI integration for faster local payments

You benefit from seamless UPI connectivity that accelerates domestic transactions and simplifies vendor payments within India's digital ecosystem. Volopay's UPI integration enables instant transfers, QR code payments, and peer-to-peer transactions directly from your virtual cards.

This feature ensures you can leverage India's robust digital payment infrastructure while maintaining the security and control advantages of virtual card technology.

Advanced security and fraud protection

You receive enterprise-grade security features, including real-time fraud detection, transaction monitoring, and instant card blocking capabilities. Volopay's advanced algorithms identify suspicious activities, while customizable security rules protect against unauthorized transactions.

Multi-factor authentication, encrypted data transmission, and compliance with international security standards ensure your financial information remains protected from cyber threats and fraudulent activities at all times.

Multi-currency support for global transactions

You can conduct international business effortlessly with Volopay's comprehensive multi-currency capabilities and competitive exchange rates. Handle global vendor payments, international subscriptions, and cross-border transactions without currency conversion hassles.

As one of the best virtual debit cards in India for international operations, Volopay ensures your global expansion isn't limited by payment infrastructure constraints or excessive foreign exchange costs.

Effortless integration with accounting tools

You can connect Volopay seamlessly with popular accounting software like Zoho, QuickBooks, and Tally for automated expense synchronization. This integration eliminates manual data entry, reduces accounting errors, and accelerates month-end reconciliation processes.

Real-time transaction categorization and automated receipt matching streamline your financial workflows, saving valuable time while ensuring accurate financial records and simplified audit preparations.

Simplified GST and compliance management

You automatically receive GST-compliant invoices and detailed transaction records that simplify tax filing and regulatory compliance. Volopay's built-in compliance features ensure proper documentation, input credit calculations, and adherence to Indian taxation requirements.

Automated expense categorization, digital receipt storage, and comprehensive reporting tools make GST compliance effortless while maintaining complete audit trails for regulatory purposes.

FAQs about virtual debit cards in India

Yes, you can use virtual debit cards for international transactions, but availability depends on your provider's multi-currency support and compliance with foreign exchange regulations. Check with your provider for specific country restrictions and applicable fees.

Yes, many virtual debit card providers in India offer UPI integration, allowing you to make instant domestic payments through UPI-enabled platforms. This feature enhances payment flexibility for local transactions and vendor payments.

Yes, you can create multiple virtual debit cards for different team members, departments, or projects. Most providers allow unlimited card generation with individual spending controls and customizable access permissions for each card.

Yes, you can customize virtual debit cards with specific merchant restrictions, spending limits, validity periods, and transaction categories. This customization ensures cards serve particular business purposes while maintaining financial control and security.

Virtual debit cards provide real-time expense tracking, automated categorization, digital receipts, and detailed reporting. You gain complete visibility over spending patterns, eliminate manual expense reporting, and streamline accounting processes for better financial control.

Yes, Volopay integrates seamlessly with popular accounting software like QuickBooks, Xero, Zoho, and various ERP systems. You can automatically sync transaction data, eliminating manual entry and ensuring accurate financial records.

Yes, Volopay virtual cards support international transactions with multi-currency capabilities and competitive exchange rates. You can make global payments, handle foreign vendor transactions, and manage cross-border business expenses efficiently through their platform.

Yes, Volopay offers a comprehensive mobile application where you can create cards, monitor transactions, set spending limits, and manage team expenses. The app provides complete card management functionality for on-the-go financial control.

You can instantly freeze, unfreeze, or delete Volopay virtual cards through their platform or mobile app. Card modifications, limit updates, and security changes take effect immediately, ensuring rapid response to security concerns or changing requirements.

Yes, you can assign Volopay virtual cards to specific projects, cost centers, or budget categories. This feature enables precise expense allocation, project-based spending tracking, and simplified financial reporting for better budget management and accountability.