👋 Exciting news! UPI payments are now available in India! Sign up now →

7 best virtual credit cards for businesses in 2025

In the ever-evolving business landscape, the utility of virtual credit cards has become increasingly apparent. These digital payment tools have witnessed a surge in popularity and are being harnessed by businesses across the globe to streamline their financial operations, enhance security, and gain greater control over their expenses.

There are many virtual credit card providers in India for businesses in 2025. To choose the best virtual credit card in India for your organization, you must know its features and benefits.

What is a virtual credit card?

A virtual credit card, often referred to as a VCC, is a digital alternative to the traditional plastic credit card. It's a unique set of numbers that can be used for online and remote transactions.

Unlike a physical card, a virtual credit card exists only in the digital realm, providing a secure means of making payments without the need for a physical piece of plastic.

How does a virtual credit card work?

Virtual credit cards function in a simple yet ingenious manner. They are typically issued by financial institutions or payment providers. When a business or individual acquires a virtual credit card, they are provided with a set of card details, which include a card number, expiration date, and a CVV code.

These details can be used to make online purchases or payments, just like a physical credit card. However, there are some key differences. Virtual credit cards are often temporary, meaning they can be used for a single transaction or a limited period. They also come with spending limits and can be easily frozen or canceled, adding an extra layer of security for businesses.

Best virtual credit card providers in India

When it comes to virtual credit cards in India, there is no shortage of providers who are giving this service to businesses. And while each one of them is providing the same product, they come at different costs and with a few differing features and capabilities.

Some of the best virtual credit card providers in India are listed below for you to choose from:

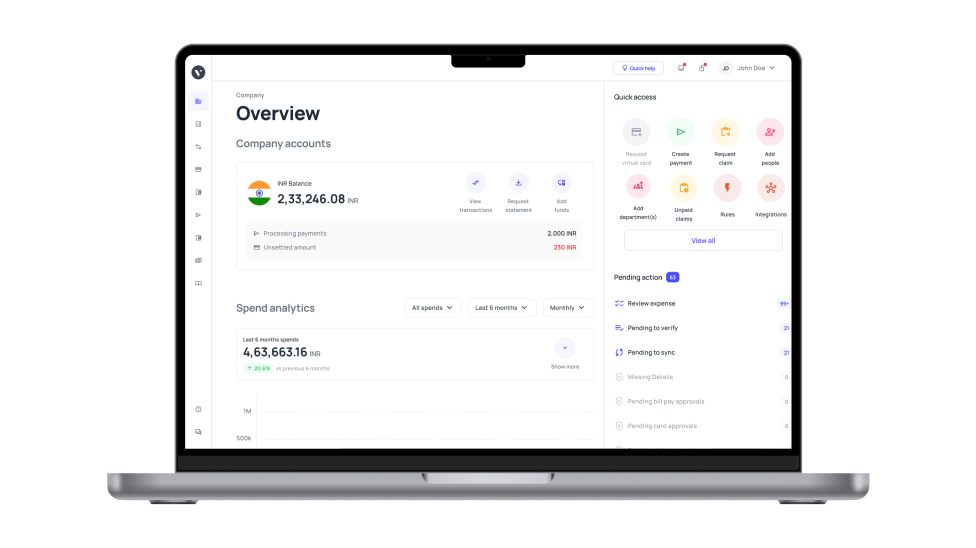

1. Volopay virtual card

● Overview

Volopay's virtual card is gaining attention for its simplicity and effectiveness in managing business expenses. It provides businesses with the flexibility they need for financial transactions.

● Set-up process and requirements

Setting up a Volopay virtual card is a straightforward process. Businesses typically need to register with Volopay, and once approved, they can generate virtual cards as needed.

● Key features of the card

○ Expense categorization and tracking

Employers can easily set expense categories that expenses can be mapped to. All the transactions happening through the virtual cards are also reported in real-time making tracking of business expenses really easy.

○ Instant card generation

New virtual cards can be generated within minutes.

○ Custom spending limits

You can set each card with a custom spending limit so that there is no overspending.

○ Integration with accounting software

Volopay’s software can sync with any accounting software letting your business export all virtual card transactions into your accounting ledger.

○ Multiple currency support

You can use Volopay’s virtual cards to make payments domestically and internationally in multiple select currencies.

● Limitations

Volopay primarily caters to businesses, and its virtual cards are not suitable for personal use.

● Targeted customers

Small to medium-sized businesses looking for a streamlined expense management solution.

● G2 rating

Volopay is rated 4.2/5 stars from a total of 83 reviews on G2’s platform.

2. HSBC virtual card

● Overview

HSBC's virtual card solutions are known for their security and global accessibility. They offer businesses the convenience of digital payments with the backing of a trusted banking institution.

● Set-up process and requirements

Businesses need to have an HSBC business account to access their virtual card services. The setup process is often done through the bank's online portal.

● Key features of the card

○ Strong security measures

Being a global banking institution, HSBC has strict and robust security measures in place to safeguard your money and financial information.

○ Global acceptance

The HSBC virtual corporate cards can be used for transactions online throughout the world.

○ Detailed transaction reporting

Employees can submit transaction data including digital receipts and reasons for making the purchase.

○ Customizable spending limits

Setting spending limits on your HSBC virtual cards helps you stay within the planned budget.

○ Integration with expense management systems

Most of the time you can easily sync your HSBC virtual card with your expense management software to keep track of all your transactions.

● Limitations

Access to HSBC's virtual cards is restricted to businesses with an HSBC account.

● Targeted customers

Businesses seeking the reliability and global reach of a renowned bank for their virtual card needs.

3. SBI corporate virtual card

● Overview

State Bank of India (SBI) offers a corporate virtual card solution, aimed at simplifying business payments and expense management.

● Set-up process and requirements

To acquire SBI's corporate virtual card, businesses typically need to be SBI customers. The setup process can vary based on the specific offering.

● Key features of the card

○ Secure transactions

SBI’s virtual cards are integrated with industry-grade encryption to ensure that your transactions are carried out safely from start to finish.

○ Expense tracking and reporting

The expenses that you make using your SBI virtual card can be easily tracked through their online portal.

○ Multi-tiered approval system

Card issuance and budget approvals for each card can be managed through the online platform provided by SBI.

○ Integration with ERP systems

Being able to integrate your virtual card system with your ERP system helps businesses deal with inventory management.

○ Flexible expense categories

You can set custom expense categories apart from the predefined categories available on the platform.

● Limitations

Access to SBI's corporate virtual card may be limited to businesses with an existing relationship with the bank.

● Targeted customers

Indian businesses, especially those already banking with SBI, looking for a reliable virtual card solution.

4. Open Money

● Overview

Open Money offers virtual cards designed for startups and small businesses in India. Their solutions focus on simplicity and ease of use.

● Set-up process and requirements

Businesses can sign up for Open Money's services online and set up virtual cards quickly.

● Key features of the card

○ Fast card generation

Once your account with Open Money is set up, you can quickly generate and activate your virtual card within minutes.

○ Expense tracking

All the payments that you make via Open Money’s virtual cards are automatically recorded on their platform and can be easily viewed at any time.

○ Real-time notifications

You can set rules to get notified for all transactions and other important information such as budget requests and approvals.

○ Integration with accounting tools

You can easily sync and export all your expense data into your accounting software.

○ API for customization

APIs are available for developers within a company to integrate with their own systems to better operate the cards throughout the organization.

● Limitations

Open Money's services are primarily tailored for small businesses.

● Targeted customers

Startups and small businesses in India seeking a user-friendly virtual card solution.

5. Enkash virtual card

● Overview

Enkash specializes in virtual cards that simplify business payments and provide control over expenses.

● Set-up process and requirements

The setup process typically involves registering with Enkash and verifying the business's credentials.

● Key features of the card

○ Detailed transaction history

With Enkash’s virtual cards, users can see a detailed log of all the transactions that have been made with specifications like the date, time, and vendor.

○ Customizable spend limits

Each Enkash virtual card can be set with a custom spending limit.

○ Integration with accounting software

Enkash’s system can be integrated with accounting software to let your business ensure uniformity of data across different platforms.

○ Vendor payment control

Virtual cards can be set with custom expiry dates to ensure that any vendor isn’t paid beyond the agreed contract terms.

○ Real-time expense monitoring

All the purchases being made using an Enkash virtual card are automatically recorded in a centralized dashboard in real-time.

● Limitations

Enkash's services are primarily geared towards businesses.

● Targeted customers

Indian businesses seeking a virtual card solution with comprehensive expense control.

6. OmniCard

● Overview

OmniCard is India's first UPI payment app combined with a card, offering a multi-purpose prepaid card and a feature-rich mobile app. Ideal for personal and business expenses, OmniCard simplifies financial management.

● Set-up process and requirements

Getting started is straightforward. Download the OmniCard app, register with your details, complete the verification process, and generate a virtual card instantly for immediate use.

● Key features of the card

○ Secure transactions

Payments are protected with high-level encryption for user data safety.

○ Instant card generation

Create virtual credit cards with OmniCard on demand, ready for immediate transactions.

○ Expense management tools

View detailed transaction logs and spending summaries in the OmniCard app.

○ Multi-mode payments

Seamlessly use Omnicard’s virtual credit card for online, in-store, and contactless payments.

● Limitations

Primarily tailored for individual users but increasingly adopted by small businesses for payment management.

● Targeted customers

Individuals and small businesses seeking a flexible and user-friendly payment solution.

7. Standard Chartered virtual credit card

● Overview

Standard Chartered offers virtual credit cards designed for secure, convenient digital payments. These cards are ideal for businesses seeking a reliable payment solution with better control over expenses and global acceptance.

● Set-up process and requirements

Businesses must have an existing Standard Chartered account to access virtual card services. The setup process is completed through the bank’s secure online platform.

● Key features of the card

○ Global payment capability

Standard Chartered virtual credit cards are accepted worldwide for digital transactions across various platforms.

○ Instant approval and card access

Standard Chartered virtual card details are available as soon as the application is approved.

○ Complete transaction reporting

Detailed transaction logs provide insights for expense tracking.

○ Custom spending limits

Manage expenses by setting transaction limits with your Standard Chartered virtual credit card.

○ Integration with expense tools

Sync your card with expense management systems for smooth financial tracking.

● Limitations

Available only for businesses with a Standard Chartered account.

● Targeted customers

Businesses looking for a secure virtual card solution with global acceptance and robust spending controls.

Discover the power of corporate cards

What are the documents required to apply for a virtual credit card?

Obtaining a virtual credit card in India involves a straightforward process, but it does require some essential documentation.

Let's explore the documents you'll typically need to apply for a virtual credit card

1. Identity proof of the business owner or stakeholders and signature

To ensure the legitimacy of the application, the identity proof of the business owner or key stakeholders is crucial. This proof can include Aadhaar cards, passports, or other government-issued identification.

2. Address proof of the business owner

An address proof is essential to establish the residential address of the business owner. This can be a utility bill, a rent agreement, or any other document that confirms the address.

3. GST certificate & GST number of the business

Goods and Services Tax (GST) documentation is often required to verify the business's legal status. You'll need to provide your GST certificate and GST number.

4. CIN Number

For companies, the Company Identification Number (CIN) is necessary. This unique identifier is used to confirm the company's registration.

5. Bank account statements for the last 6 months

Bank account statements are required to assess the financial health of the business and determine creditworthiness.

Typically, the last six months' statements are needed to gauge the financial stability and transaction history of the business.

How to apply for a virtual credit card in India?

Applying for a virtual credit card in India involves a systematic process to ensure a smooth transition to this digital financial tool.

Here are the steps to guide you through the application process:

1. Assess your business needs

Start by evaluating your business's specific requirements for virtual credit cards.

Determine how these cards will be used and what features are essential for your financial operations. This should be the first step in your process to choose a virtual credit card provider.

Only after you are clear with what your business needs will you be able to choose virtual cards appropriately.

2. Establish a clear card usage policy

Define a comprehensive policy outlining the rules and guidelines for card usage. This ensures that employees understand their responsibilities and the expected usage of virtual credit cards.

Without a usage policy that has clear guidelines, virtual cards may be misused and lead to unnecessary expenses.

3. Choose the right provider

Select a virtual credit card provider that aligns with your business needs. Consider factors like fees, security features, and customer support.

Find the right balance of what you are looking for and prioritize what is most important for you and your employees in virtual credit cards.

4. Evaluate credit limits

Determine the credit limits you need for your virtual cards, keeping in mind the financial requirements of your business. Every provider may not provide the credit limit that you need or may have extra fees in the form of interest rates to give you the credit amount you require.

Make sure that you go through a thorough evaluation of all the aspects related to the credit limit that is being provided to you.

5. Submit the required documents and application

As mentioned in the previous section, provide the necessary documentation and complete the application process as per the chosen provider's requirements.

Different providers may have slightly different documentation requirements but most of them will require your main legal business documentation and financial statements.

6. Wait for approval

After submitting your application, patiently await the provider's approval, which may take some time for verification and processing. Approval of your application and registration can take anywhere from a few days to a few weeks depending on the virtual credit card provider.

7. Generate and activate the card

Once approved, a company account will be created by the provider on their platform where you can create and access your virtual cards.

You will be provided access to this online portal through which you will need to activate your virtual cards as per the provider's instructions.

8. Card issuance

Once you have access to the online portal through your company’s account, you will be able to issue your virtual cards and see all their details including the card number, expiration date, and CVV, which are essential for making online transactions.

9. Set spending limits

Customize spending limits for each virtual card, depending on the needs of specific employees or departments. You can do this through the online portal where you manage all your virtual cards.

You can set specific employees such as managers and financial controllers as the administrators on the platform to do this.

10. Train employees

Ensure that your employees are well-informed about using virtual credit cards and adhering to the established usage policy.

You can conduct separate onboarding sessions for employees to help them learn everything about using these cards and solve any doubts or queries they may have.

11. Integrate with an expense management system

If your business uses an expense management system, integrate your virtual cards for streamlined expense tracking and reporting.

In most cases, the virtual credit card providers themselves have an expense management system built into the online portal through which you access your virtual cards.

12. Monitor and review usage

Continuously monitor and review the usage of virtual cards to maintain control over expenses and identify any irregularities promptly.

Analyze data over time to better cater the use of your virtual cards to the expenses that need to be made in the business.

Take charge of your business expenses

What are the key factors when choosing a corporate card provider?

1. Card acceptance

Ensure that the corporate card provider's cards are widely accepted, both nationally and internationally. Widespread acceptance is essential for smooth business transactions.

Considering you will be making online payments using virtual credit cards, there are quite literally no barriers to making purchases from foreign entities that may operate in a different currency than your card’s base currency. This makes it important to have international spending capabilities.

2. Spend controls

Look for a provider that offers robust spend control features. This includes the ability to set individual spending limits, restrict categories of spending, and block specific merchants, providing greater control over employee expenditures.

This will ensure that employees won’t be able to use the cards for expenses that are not compliant with the company policy.

3. Fees and interest rates

Evaluate the fees associated with the corporate card, including annual fees, transaction fees, and foreign transaction fees. Additionally, understand the interest rates for outstanding balances, as these can vary significantly.

Try to choose a provider with the least amount of fees and interest rates while also ensuring that the cards have all the features you need.

4. Rewards and benefits

Many corporate card providers offer rewards and benefits such as cashback, travel rewards, or discounts on business-related expenses. Consider the rewards program that aligns best with your business's needs.

But make sure that this isn’t your priority to choosing a virtual card provider as there are much more important factors.

5. Expense management software integration

Seamless integration with expense management software is crucial for efficient tracking and reporting of expenses.

Choose a corporate card provider that supports the software you use or plans to implement integrations in the future. Most providers will have their own expense management and tracking software by default.

6. Reporting and analytics features

Robust reporting and analytics tools are essential for gaining insights into your business expenses. The ability to generate detailed reports and analyze spending patterns can be invaluable.

Make sure you get at least a basic level of analytics functions to track and measure your company expenses.

7. Compliance

Ensure that the corporate card provider complies with all relevant financial regulations and industry standards. Compliance is vital, especially for businesses operating in highly regulated sectors.

8. Reviews and reputation

Research the provider's reputation by reading reviews and seeking recommendations from other businesses. A provider with a strong track record of reliability and excellent customer service is often a wise choice.

You can check third-party review sites such as G2 to get unbiased opinions from other businesses that have used the product.

Volopay virtual cards - #1 choice for businesses in India

Volopay lets you issue virtual cards for your business in India and manage all your online expenses in an organized manner. You can issue virtual cards and use each one of them to separately manage your subscriptions, issue cards for specific teams & projects, or issue cards for individual employees; you get complete flexibility and freedom to use them as per your business hierarchy and needs.

Each virtual Volopay corporate card can be set with a custom spending limit so that there is no chance of overspending and going over the budget that was decided. With an easy application and registration process, Volopay is one of the best virtual card providers in India.

Vendor payments made easy and fast

FAQs on virtual credit cards

No, virtual credit cards do not have a direct impact on your credit score because they are typically not reported to credit bureaus. They are designed for secure online transactions and expense management, not for building or improving credit.

Yes, virtual credit cards are legal and widely used for online transactions. They are issued by financial institutions and comply with relevant financial regulations.

Companies use virtual cards for several reasons, including enhanced security, streamlined expense management, control over employee spending, and the convenience of digital payments.

Virtual cards are also suitable for online and remote transactions.

In most cases, virtual cards are not designed for ATM withdrawals. They are primarily intended for online transactions and may not have physical counterparts for use at ATMs.

Obtaining a virtual credit card may be challenging if you have a poor credit history. Providers often assess the creditworthiness of applicants, and a history of bad credit can affect your eligibility.

Yes, Volopay virtual cards support cross-border payments, allowing businesses to make international transactions securely. However, it's advisable to check with Volopay for specific currency capabilities.

Yes, many virtual card providers, including Volopay, allow businesses to set spending rules on the virtual cards they generate. This includes setting individual spending limits, restricting categories, and defining merchant-specific rules to control expenses effectively.