👋 Exciting news! UPI payments are now available in India! Sign up now →

10 best accounting software in India in 2025

Accounting software plays a crucial role in managing financial operations for businesses of all sizes. In today's fast-paced and digitally-driven world, efficient financial management is vital for small businesses to thrive.

By automating and streamlining accounting processes, businesses can save time, reduce errors, and make better-informed decisions. But it can be tough to choose the best accounting software for small businesses in India.

To make the right choice, you need to understand the importance of accounting software for small businesses in 2023 and highlight the top ten accounting software solutions available.

What is accounting software?

Accounting software refers to specialized computer programs designed to help businesses manage their financial transactions, recordkeeping, and reporting. These software solutions provide tools and features that simplify various accounting tasks, including invoicing, bookkeeping, payroll management, tax calculations, and financial analysis.

There are many different types of accounting systems available in the market.

From small business accounting software to those that are flexible and can accommodate the requirements of a business of any size, there is plenty of choices for organizations to choose from.

10 Best accounting software in India for 2025

In 2025, the accounting software landscape in India continues to evolve, offering businesses a variety of options to streamline financial management processes and drive growth. 10 of the best accounting software solutions that are currently making massive waves in India include:

1. Volopay

Overview

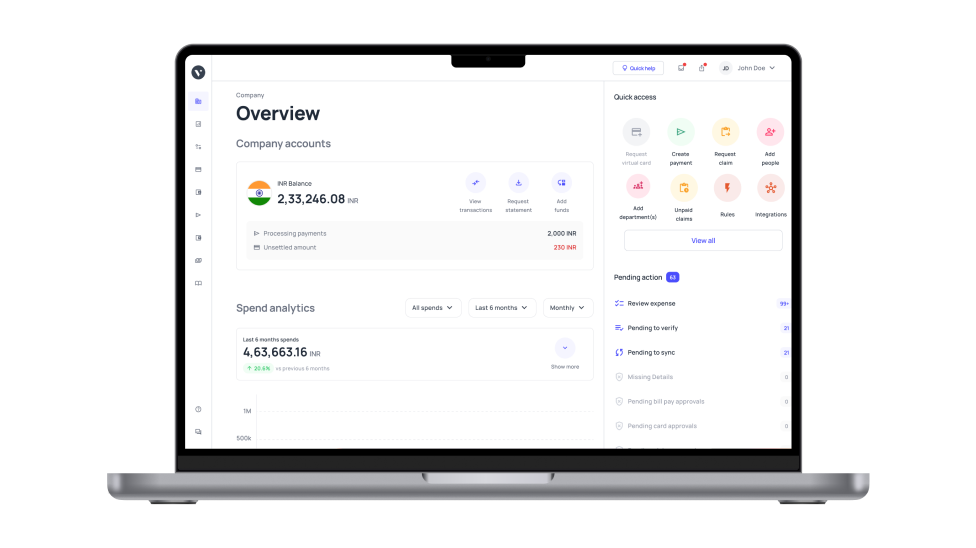

Volopay distinguishes itself as an all-encompassing expense management platform crafted to streamline corporate expenditures, monitor expenses, and manage accounting processes.

It boasts features such as automated expense reporting, expense management, corporate cards, instantaneous insights into expenditure trends, management of corporate cards, and seamless integration with accounting software for efficient financial administration.

Features

Volopay offers features for expense tracking, expense approvals, virtual corporate cards, and bill payments. It also provides real-time financial reporting and integration with popular accounting software.

Reviews and ratings

Volopay receives positive reviews for its comprehensive financial management capabilities, ease of use, and customer support. Users appreciate its seamless integration of expense management and accounting.

Integration capabilities

Volopay integrates with accounting software such as QuickBooks, Xero, and Netsuite, ensuring smooth data flow between expense management and accounting systems.

Pricing

Volopay offers customized pricing based on the specific requirements of each business. Interested users can contact Volopay for detailed pricing information.

2. Oracle Netsuite

Overview

Oracle Netsuite is an integrated cloud-based business management suite that includes accounting, ERP, CRM, and e-commerce functionalities.

It offers businesses in India features such as financial management, order management, inventory control, CRM, and business intelligence, providing a unified platform for managing all aspects of their operations.

Features

Netsuite provides modules for general ledger, accounts payable and receivable, billing, budgeting, and reporting. It also offers multi-currency support, tax management, and integration with other business systems.

Reviews and ratings

Users praise Netsuite for its scalability, robustness, and extensive features. It has received positive ratings for its financial reporting capabilities and ease of use.

Integration capabilities

Netsuite integrates with various applications and platforms, including CRM, e-commerce, and payroll systems, offering seamless data flow and enhanced business efficiency.

Pricing

Oracle Netsuite offers pricing plans based on the specific requirements of each business. For detailed pricing information, users can contact the Netsuite sales team.

3. QuickBooks

Overview

QuickBooks remains a popular choice among small and medium-sized businesses in India for its user-friendly interface, robust features, and scalability.

It offers functionalities such as invoicing, expense tracking, tax management, financial reporting, and integration with banking systems, making it a versatile solution for managing finances effectively.

Features

QuickBooks offers tools for invoicing, expense tracking, bank reconciliation, and financial reporting. It also provides options for payroll management, inventory tracking, and tax preparation.

Reviews and Ratings

QuickBooks receives positive reviews for its simplicity, affordability, and accessibility. Users appreciate its intuitive design and time-saving features.

Integration capabilities

QuickBooks integrates with numerous third-party applications, including payment processors, CRM systems, and e-commerce platforms, allowing seamless data synchronization.

Pricing

QuickBooks provides various pricing plans, including options for self-employed individuals, small businesses, and accountants. The pricing varies based on the plan chosen and the additional features required.

4. FreshBooks

Overview

FreshBooks is a user-friendly accounting software solution designed for self-employed professionals and small businesses.

It offers features such as invoicing, time tracking, expense management, project management, and client communication tools, helping businesses streamline their financial operations and focus on growth.

Features

FreshBooks provides tools for creating professional invoices, tracking expenses, and generating financial reports. It also offers features like project management, team collaboration, and client communication.

Reviews and ratings

FreshBooks receives positive feedback for its user-friendly interface, excellent customer support, and time-saving features. Users appreciate its invoicing capabilities and mobile accessibility.

Integration capabilities

FreshBooks integrates with popular business applications, including CRM systems, payment gateways, and project management tools, enabling efficient data transfer.

Pricing

FreshBooks offers various pricing plans based on the number of clients and additional features required. Users can choose a plan that suits their business needs and budget.

5. Xero

Overview

Xero is renowned for its cloud-based accounting software, which affords businesses real-time insight into their financial performance.

It encompasses features such as invoicing, bank reconciliation, inventory management, payroll processing, and collaboration tools for accountants and advisors. This makes it an ideal solution for businesses of varying sizes.

Features

Xero provides tools for invoicing, bank reconciliation, expense tracking, and financial reporting. It also offers features like inventory management, payroll processing, and project tracking.

Reviews and ratings

Xero is highly regarded for its user-friendly interface, robust features, and excellent customer support. Users appreciate its ease of use and comprehensive financial reporting.

Integration capabilities

Xero integrates with numerous third-party applications, including payment processors, CRM systems, and e-commerce platforms, allowing seamless data integration and automation.

Pricing

Xero offers pricing plans based on the specific needs of businesses, with options for different sizes and requirements. Users can choose a plan that aligns with their business needs.

6. Zoho

Overview

Zoho provides a collection of cloud-based business tools, including Zoho Books, its accounting software solution.

Zoho Books equips businesses with functions like generating invoices, tracking expenses, managing inventory, reconciling bank accounts, and ensuring compliance with GST regulations, rendering it a favored option for small enterprises and independent professionals in India.

Features

Zoho Books provides tools for creating invoices, managing expenses, tracking inventory, and generating financial reports. It also offers features like project management and time tracking.

Reviews and ratings

Zoho Books receives positive feedback for its affordability, ease of use, and integration capabilities. Users appreciate its comprehensive features and responsive customer support.

Integration capabilities

Zoho Books integrates with other Zoho applications, as well as popular third-party platforms like payment gateways and CRM systems, facilitating smooth data transfer.

Pricing

Zoho Books offers pricing plans based on the number of users and additional features required. Users can choose a plan that fits their business needs and budget.

7. TallyPrime

Overview

TallyPrime is a popular accounting software solution widely used by businesses in India for its simplicity, reliability, and comprehensive features.

It offers functionalities such as accounting, inventory management, invoicing, GST compliance, and financial reporting, making it a preferred choice among small and medium-sized enterprises.

Features

TallyPrime provides tools for bookkeeping, invoicing, inventory management, and tax calculations. It also offers features like bank reconciliation, payroll processing, and budgeting.

Reviews and ratings

TallyPrime is appreciated for its strong accounting capabilities, user-friendly interface, and local tax compliance features. Users find it reliable and suitable for Indian businesses.

Integration capabilities

TallyPrime offers limited integration capabilities with other business applications. However, it provides import and export functionality for data exchange.

Pricing

TallyPrime offers different pricing plans based on the number of users and additional features required. Users can contact TallyPrime for detailed pricing information.

8. Sage Business Cloud Accounting

Overview

Sage Business is a comprehensive accounting and business management platform crafted to cater to the requirements of growing businesses in India.

It provides features like invoice generation, expense monitoring, inventory supervision, project accounting, and advanced reporting tools, enabling businesses to leverage data-driven insights and foster expansion.

Features

Sage Business Cloud Accounting provides tools for creating invoices, managing expenses, reconciling bank transactions, and generating financial reports. It also offers features like inventory management and project tracking.

Reviews and ratings

Sage Business Cloud Accounting receives positive reviews for its ease of use, robust reporting capabilities, and good customer support. Users appreciate its intuitive interface and comprehensive features.

Integration capabilities

Sage Business Cloud Accounting integrates with various business applications, including payment processors, CRM systems, and e-commerce platforms, ensuring smooth data flow and process automation.

Pricing

Sage Business Cloud Accounting offers pricing plans based on the specific needs of businesses. Users can choose a plan that aligns with their requirements and budget. You can use the list of accounting software systems mentioned above to determine and choose which one suits your needs the best.

Importance of accounting software for businesses

Streamlining financial processes

No matter how tedious of a process accounting may be, it is an important function that cannot be avoided. But by using accounting software, you can automate routine tasks, such as data entry and transaction categorization, speeding up processes and reducing manual errors.

Your accountant won’t have to spend too much time on repetitive tasks and instead will be able to focus on more strategic tasks.

Accurate financial recording and reporting

One major drawback of the traditional accounting process where things are done manually is that the chances of human errors occurring are quite high.

But when you shift to an automated accounting system with built-in checks and balances, it ensures accurate and up-to-date financial records, facilitating error-free reporting.

Better financial decision-making

A company’s management and senior executives cannot make sound financial decisions unless and until they have a clear picture of the current status of their finances.

By providing real-time access to financial data, accounting software enables businesses to make informed decisions based on accurate financial insights. Clear insights lead to better decisions which in turn lead to favorable business outcomes.

Compliance and tax management

Accounting software helps businesses stay compliant with accounting standards and tax regulations, simplifying tax calculations and filing.

There are many modern and new-age accounting software providers that have developed their products in a way that allows companies to easily calculate tax when creating invoices for payments and other tasks where tax calculations are needed.

Enhanced financial analysis

This is something that can be done through the traditional process of having an accountant and analyst do it manually but is very time-consuming.

It is much easier to let the accounting software system prepare financial reports and present data in a manner that gives you insights much quicker.

Advanced reporting and analysis features allow businesses to gain deeper insights into their financial performance, aiding in strategic planning and identifying growth opportunities.

Improved collaboration and accessibility

Last but not least, when a company does not use an accounting system that has an online version, it can be troublesome to coordinate and keep data up to date across business locations.

Cloud-based accounting software allows for seamless collaboration among team members and provides remote access to financial data from anywhere, at any time.

Who needs an accounting software?

Accounting software is essential for various stakeholders, including:

1. Small business owners and entrepreneurs

Small business owners and entrepreneurs who handle their own finances. Time is a critical resource for any small business. They need to optimize it as much as possible.

Using accounting software to automate processes and save time calculating their finances, including cost accounting, will help them focus on their business tasks.

2. Accountants and bookkeepers

Accountants and bookkeepers are responsible for managing financial records and providing advisory services. Accounting software is a tool to help finance professionals improve their efficiency and deliver better results.

3. Startups and growing businesses

Startups and growing businesses looking to establish robust financial systems. Any startup that plans to scale has to set up a smooth functioning finance and accounting system in order to avoid any kind of hiccup in operations due to financial errors.

4. Freelancers and independent professionals

Freelancers and independent professionals require efficient invoicing and expense tracking. Just like small business owners even solopreneurs and freelancers need to use most of their time developing their service and working for clients rather than managing finances.

5. Non-profit organizations and associations

Non-profit organizations and associations are in need of accurate financial reporting for transparency and compliance. Using accounting software is an ideal solution for non-profit organizations to show and prove compliance with their financial activities.

Different types of accounting software

Accounting software can be categorized into different types based on their implementation structure and capabilities. Let's explore these categories:

1. Based on the implementation structure

● On-premises accounting software

This type of software is installed and hosted on the company's local servers or computers. It requires manual installation, maintenance, and updates by the business itself.

On-premises software provides full control and data security but may involve higher upfront costs and IT infrastructure requirements.

● Cloud-based accounting software

Also known as web-based or online accounting software, this type operates on remote servers and is accessed through a web browser.

Cloud-based software offers the advantage of remote access, automatic updates, and data backups. It is typically subscription-based and offers scalability, ease of use, and lower upfront costs compared to on-premises solutions.

2. Based on capabilities

● Basic accounting software

These software solutions provide essential features for managing financial transactions, such as recording income and expenses, creating invoices, and generating basic financial reports.

They are suitable for small businesses with straightforward accounting needs.

● Small business accounting software

This type of software caters specifically to small businesses and offers additional features like inventory management, payroll processing, and tax preparation.

It provides more comprehensive financial management capabilities tailored to the needs of small enterprises.

● Enterprise accounting software

Designed for larger organizations with complex accounting requirements, enterprise accounting software offers advanced features for multi-currency transactions, consolidation of financial data, and advanced reporting capabilities.

These solutions are scalable and can handle high volumes of transactions.

● Industry-specific accounting software

Certain industries, such as construction, hospitality, or nonprofits, have unique accounting needs.

Industry-specific accounting software is tailored to meet these specific requirements, incorporating features and functionalities relevant to the particular industry.

● Integrated accounting software

Integrated software solutions combine accounting functionality with other business management modules, such as customer relationship management (CRM), inventory management, or project management.

These integrated systems provide seamless data flow between different departments, streamlining business processes.

Say goodbye to manual tasks and embrace efficiency

Essential features to look for in an accounting software

Accounting software plays a pivotal role in managing finances for businesses of all sizes. From tracking transactions to generating reports, these platforms offer a wide range of features to streamline financial operations.

Below are some essential features found in all the best accounting software and their significance in facilitating efficient financial management:

1. Double-entry accounting

Double-entry accounting is a fundamental feature in accounting software that ensures accuracy and integrity in financial records. It follows the principle of recording every transaction with corresponding debit and credit entries in two separate accounts.

This method provides a comprehensive view of a company's financial position and aids in identifying errors or discrepancies in the accounting records.

2. Accounts payable

Accounts payable functions enable businesses to oversee and monitor the funds owed to vendors and suppliers for goods and services rendered. It simplifies the recording of invoices, monitors payment deadlines, and efficiently handles the vendor payment process.

Through the streamlined management of accounts payable, businesses can enhance cash flow management and foster positive relationships with their suppliers.

3. Accounts receivable

Accounts receivable functionality enables businesses to track and manage money owed by customers for goods or services provided on credit. It includes features such as invoicing, payment tracking, and accounts receivable aging analysis.

Efficient management of accounts receivable ensures timely collection of outstanding payments, improves cash flow, and reduces the risk of bad debts.

4. Invoicing

Invoicing functionality allows businesses to create and send professional invoices to clients for products or services rendered. It streamlines the billing process, helps in tracking outstanding payments, and provides a record of transactions for accounting purposes.

Customizable invoice templates, automatic invoice generation, and integration with payment gateways are essential features that enhance invoicing efficiency.

5. Reporting

Reporting functionalities provide essential perspectives on a company's financial status. Users can generate various financial reports, including balance sheets, income statements, cash flow statements, and customizable reports tailored to the specific needs of the business.

These reports are pivotal in recognizing trends, tracking key financial metrics, and facilitating informed decision-making to enhance business expansion.

6. Integration with other systems

Integration features enable the software to integrate smoothly with various other systems of the business, including ERP, CRM, payment gateways, and e-commerce platforms.

This integration minimizes errors, eliminates the need for manual data entry, and enables real-time data synchronization across different departments. It fosters collaboration, enhances operational efficiency, and offers a comprehensive overview of business operations.

7. Multiple user access

Multiple user access enables collaboration among team members and stakeholders by granting them controlled access to the accounting software.

Administrators can assign different user roles and permissions based on job responsibilities, ensuring data security and confidentiality. This feature promotes teamwork, enhances productivity, and facilitates efficient workflow management.

8. Bank reconciliation

Bank reconciliation functionality automates the process of matching transactions recorded in the accounting software with bank statements.

It helps in identifying discrepancies, such as missing or duplicate transactions, and ensures that the company's financial records accurately reflect its bank account balances.

Bank reconciliation streamlines financial reporting, reduces errors, and improves the accuracy of financial data.

9. Payroll processing

Payroll processing features enable businesses to manage employee compensation, including salary calculations, deductions, taxes, and direct deposits.

It automates payroll tasks, ensures compliance with tax regulations, and generates payroll reports for record-keeping and tax-filing purposes. Efficient payroll processing enhances employee satisfaction, minimizes payroll errors, and saves time for HR staff.

10. Inventory management

Inventory management functionality helps businesses track and control their inventory levels effectively, contributing to cost reduction. It includes features such as stock tracking, reorder point management, inventory valuation, and inventory turnover analysis.

By optimizing inventory levels, businesses can reduce holding costs, prevent stockouts or overstocking, and improve overall operational efficiency.

11. Scalability

Scalability is a critical feature that allows accounting software to adapt and grow along with the business. It should be capable of handling increased transaction volumes, expanding user base, and accommodating additional features or modules as the business expands.

Scalable accounting software ensures long-term viability and provides flexibility to meet evolving business needs. This feature is particularly important in choosing the best accounting software for small businesses.

12. Mobile app

A mobile application integrated with accounting software provides users with the convenience of accessing financial information and carrying out necessary functions while on the move.

This includes tasks such as invoice creation, expense tracking, report viewing, and contact management directly from their smartphones or tablets.

Mobile accessibility fosters increased flexibility, productivity, and responsiveness, empowering businesses to remain connected and make well-informed decisions regardless of their location.

13. Security and compliance

Security and compliance functionalities play a critical role in safeguarding confidential financial information and adhering to regulatory requirements.

Accounting software must incorporate strong security protocols like encryption, user verification, and consistent data backups to mitigate the risk of unauthorized access and data breaches.

Adherence to industry standards such as GDPR, HIPAA, and PCI DSS guarantees data integrity and fosters confidence among customers and stakeholders.

Manage your business accounting easily with Volopay!

Volopay is a financial solution provider that offers corporate cards, automated expense management, and accounting integrations that streamline financial operations, helping businesses save time and money while elevating the role of their finance teams.

While Volopay isn’t an accounting system, it is a great expense tracking and payment management software with the capability to integrate with any accounting software in India. This makes it the best expense management tool for any business as it not only helps you control, track, and make business expenses but also allows you to easily sync with your accounting tool to keep your company ledger up to date.

Our platform has native integrations with some of the industry-leading accounting software such as Netsuite, Xero, Quickbooks, Tally, Deskera, MYOB, Zoho Books, and more! Apart from this, using our Universal CSV feature, you can sync and export your business expense data to any accounting tool even if we do not have a native integration with that platform.

Streamline accounting process with automation

FAQ

Yes, accounting software typically allows you to manage bills and expenses by recording, tracking, and categorizing them, which helps in maintaining accurate financial records and managing cash flow effectively.

Accounting software provides real-time insights and accurate financial data, enabling businesses to make informed decisions, forecast future performance, identify trends, and allocate resources effectively.

While accounting software focuses on managing financial transactions and reporting, ERP (Enterprise Resource Planning) software integrates various business processes, including accounting, inventory management, human resources, and supply chain management, to streamline overall operations.