👋Exciting news! UPI payments are now available in India! Sign up now →

What is accrual accounting? Types, benefits, examples and best practices

As a business owner or finance professional, you've likely encountered the term "accrual accounting" in your financial dealings. Understanding what is accrual accounting is crucial for making informed financial decisions and ensuring your business complies with accounting standards, and strengthening your grasp of financial accounting principles.

This comprehensive guide will walk you through the fundamentals of accrual accounting, its various types, and the significant benefits it offers your business. Whether you're a startup founder or managing an established company, mastering accruals in accounting will help you gain better insights into your financial performance and make strategic decisions that drive growth.

What is accrual accounting?

Accrual accounting is a method of recording financial transactions when they occur, regardless of when cash actually changes hands. Unlike cash accounting, which only records transactions when payment is received or made, the accrual basis of accounting recognizes revenues when earned and expenses when incurred.

This means you record a sale the moment you deliver goods or services to a customer, even if they haven't paid yet. Similarly, you record an expense when you receive a bill, not when you pay it.

This approach provides a more accurate picture of your business's financial health by matching revenues with their related expenses in the same accounting period, giving you real-time insights into profitability and cash flow patterns.

Types of accrual accounting methods used in India

There are several distinct accrual accounting methods tailored to different business needs and regulatory requirements. Understanding these variations will help you choose the most appropriate method for your organization.

1. Mercantile system of accounting

The mercantile system is India's traditional approach to accrual accounting, where you record transactions when they occur rather than when cash is exchanged.

Under this system, you recognize income when it's earned and expenses when they're incurred, regardless of payment timing. This method is mandatory for companies and businesses with an annual turnover exceeding specified thresholds under the Income Tax Act.

2. Modified accrual system

You'll find the modified accrual system primarily used by government entities and non-profit organizations in India. This hybrid approach combines elements of both cash and accrual accounting, where you record revenues on an accrual basis but expenses on a cash basis, or vice versa, depending on your organization's specific requirements.

3. Accrual basis under Ind AS

Indian Accounting Standards (Ind AS) mandate a comprehensive accrual basis of accounting for larger companies. Under this framework, you must recognize all assets, liabilities, equity, income, and expenses when they meet specific recognition criteria, ensuring your financial statements reflect true economic substance rather than just cash flows.

4. Accrual accounting for tax purposes

For tax compliance, you must follow prescribed accrual methods based on your business turnover. Companies with turnover above ₹25 crores must compulsorily adopt accrual accounting for tax purposes, ensuring consistency between commercial and tax accounting.

5. Industry-specific accrual methods

Certain industries like banking, insurance, and telecommunications follow specialized accrual accounting norms. These methods address unique revenue recognition patterns and regulatory requirements specific to each sector, ensuring accurate financial reporting within industry frameworks.

How does accrual accounting work?

Understanding how accrual accounting functions is essential for implementing this system effectively in your business. The process involves several interconnected components that work together to provide accurate financial reporting and better decision-making capabilities.

Recognizing revenue when earned

In accrual accounting, you recognize revenue the moment you earn it, not when you receive payment. For example, if you deliver products to a customer in March but receive payment in April, you record the revenue in March.

This approach ensures your financial statements reflect actual business performance during each period. You must document the transaction with proper invoicing and delivery confirmations, creating accounts receivable entries that track what customers owe you.

Recording expenses when incurred

You record expenses when you incur them, regardless of payment timing. If you receive an electricity bill for March services but pay it in April, you record the expense in March. This creates accounts payable entries, helping you track outstanding obligations.

This method provides a clearer picture of your operational costs during each period, enabling better budget planning and cost management.

Matching principle in accrual accounting

The matching principle requires you to record revenues and their related expenses in the same accounting period. When you sell products, you simultaneously record the sale revenue and the cost of goods sold.

This principle ensures your profit calculations accurately reflect the true cost of generating revenue, providing meaningful insights into your business's profitability and operational efficiency.

Role of adjusting journal entries

Adjusting entries are crucial for implementing accruals in accounting. At period-end, you create entries to record earned but unbilled revenue, incurred but unpaid expenses, and other timing differences.

These entries ensure your financial statements comply with the accrual basis of accounting and accurately represent your financial position.

Impact on financial statements

Accrual accounting significantly affects your financial statements by providing a more comprehensive view of your business performance. Your income statement shows actual earnings and costs for each period, while your balance sheet reflects all assets, liabilities, and equity positions.

This comprehensive reporting helps stakeholders understand your true financial health and make informed decisions.

Treatment of accrued vs. Deferred items

You handle accrued items (earned but not yet recorded) differently from deferred items (recorded but not yet earned).

Accrued revenue and expenses require recognition in current periods, while deferred items are allocated across future periods based on when benefits are realized or services are provided.

Monthly and year-end accrual processes

Your accrual processes involve monthly adjustments for routine transactions and comprehensive year-end procedures for complex items.

Monthly accruals ensure timely financial reporting, while year-end processes address annual adjustments, including provisions in accounting such as tax liabilities, doubtful debts, and warranties, maintaining accuracy and compliance throughout your fiscal year.

Accrual accounting vs. Cash accounting

Choosing between accrual and cash accounting methods significantly impacts your business's financial reporting and decision-making processes. Understanding the key differences will help you select the most appropriate method for your organization's specific needs and compliance requirements.

1. Timing of recognition

Accrual accounting

You record transactions when they occur, regardless of cash flow timing. Revenue is recognized when earned, and expenses are incurred when charged. If you deliver services in December but receive payment in January, you record the revenue in December. This provides real-time insights into your business performance and operational efficiency.

Cash accounting

You only record transactions when cash actually changes hands. Using the same example, you would record revenue in January when payment is received. This method is simpler but may not accurately reflect your business's true performance during specific periods, especially for businesses with significant credit transactions.

2. Accuracy of financial position

Accrual accounting

This method provides a more accurate picture of your financial position by including all outstanding receivables, payables, and obligations. Your balance sheet reflects actual assets you own and liabilities you owe, giving stakeholders a comprehensive view of your business's financial health and future cash flow potential.

Cash accounting

Your financial statements only show cash transactions, potentially misleading stakeholders about your true financial position. Outstanding invoices, unpaid bills, and future obligations aren't reflected, making it difficult to assess your business's complete financial status and creditworthiness.

3. Compliance and usage

Accrual accounting

Required for larger businesses, publicly traded companies, and those exceeding specified turnover thresholds. Most accounting standards, including Ind AS and GAAP, mandate this method. Banks and investors typically prefer accrual-based financial statements for credit decisions and investment evaluations.

Cash accounting

Permitted for smaller businesses, sole proprietorships, and those below prescribed turnover limits. While simpler to maintain, it may limit your access to certain business opportunities, loans, or investment options that require accrual-based financial reporting.

4. Tax implications

Accrual accounting

You may pay taxes on income before receiving cash, potentially creating cash flow challenges. However, you can also claim deductions for expenses before paying them, which may provide tax planning opportunities. Tax compliance requires careful coordination between book and tax accounting methods.

Cash accounting

Taxes are based on actual cash receipts and payments, aligning tax obligations with cash flow. This can provide better cash flow management for tax purposes but may limit certain deduction timing strategies and business expense planning opportunities.

5. Financial statement presentation

Accrual accounting

Your financial statements present a comprehensive view of business performance, including earnings quality, profitability trends, and operational efficiency. Stakeholders can better analyze your business cycles, seasonal patterns, and long-term financial sustainability through detailed income statements and balance sheets.

Cash accounting

Financial statements focus primarily on cash flow activities, providing limited insights into business performance, profitability, and financial position. This simplified presentation may be adequate for very small businesses but lacks the depth required for complex business analysis.

6. Decision-making

Accrual accounting

Enables better strategic decision-making by providing accurate profitability analysis, budget planning, and performance evaluation. You can identify trends, manage working capital effectively, and make informed decisions about pricing, inventory, and expansion based on comprehensive financial data.

Cash accounting

Decision-making is limited to cash flow considerations, potentially missing important business performance indicators. While suitable for cash-intensive businesses, it may lead to suboptimal decisions regarding credit policies, inventory management, and long-term strategic planning.

Real-world examples of accruals

Understanding practical applications of accruals in accounting helps you implement this system effectively in your business operations. These real-world examples demonstrate how accrual accounting captures the true economic substance of transactions.

Accrued salaries and wages

You pay your employees on the 5th of every month for the previous month's work.

If your accounting period ends on March 31st, you must accrue salaries for work performed from March 1st to 31st, even if payment is made in April.

This ensures March financial statements accurately reflect labor costs incurred during that period, providing a true picture of operational expenses.

Accrued rent expenses

Your office lease requires monthly rent payment by the 10th of each month.

If your fiscal year ends on March 31st and you haven't paid April's rent yet, you must accrue this expense in March since you occupied the premises.

This accrual ensures your business financial statements reflect all occupancy costs for the accounting period.

Accrued interest income

You've invested in fixed deposits or bonds that pay interest quarterly. Even if interest payment is due in April, you must accrue interest earned from January to March in your March financial statements.

This practice ensures your income statement reflects all business earnings generated during the accounting period, regardless of the timing of the payment.

Accrued utilities and bills

Your electricity bill for March usage arrives in April. Under accrual accounting, you estimate and record this expense in March based on actual consumption.

This ensures your March financial statements include all operational costs incurred during that period, providing stakeholders with accurate expense information.

Accrued taxes payable

You owe corporate income tax for the fiscal year, but payment isn't due until after filing your returns.

You must accrue this tax liability in your year-end financial statements to reflect the true cost of operations and your actual financial obligations to tax authorities.

Accrued service revenue

You provide consulting services throughout March but invoice clients in April.

Under the accrual basis of accounting, you record this revenue in March when your services were delivered to reflect your actual business performance.

Accrued bonuses and incentives

You've committed to paying annual bonuses to employees based on performance, but payment occurs after year-end.

You must accrue these expenses in the current year's financial statements since employees earned these benefits through their performance during the accounting period.

Accrued legal or professional fees

You engaged legal counsel for ongoing business matters, but their bills arrive after your accounting period ends.

You must estimate and accrue these professional fees to ensure your financial statements reflect all costs associated with the current period's operations and legal obligations.

Advantages of accrual accounting

Implementing accrual accounting in your business offers numerous strategic advantages that extend beyond basic compliance requirements. These benefits can significantly enhance your financial management capabilities and business growth potential.

Provides a true financial picture

Accrual accounting gives you a comprehensive view of your business's actual financial performance by recording all transactions when they occur. You can see outstanding receivables, pending obligations, and future cash flow commitments, enabling you to understand your true financial position.

This complete picture helps you identify potential cash flow issues before they become critical problems.

Enables better budgeting and forecasting

With accruals in accounting, you can create more accurate budgets and forecasts based on actual business activity rather than just cash movements.

You can predict future cash requirements, plan for seasonal variations, and make informed decisions about resource allocation. This predictive capability is crucial for maintaining healthy cash flow and avoiding financial surprises.

Aligns with matching principle and GAAP

The accrual basis of accounting ensures your financial statements comply with Generally Accepted Accounting Principles (GAAP) and Indian Accounting Standards.

This alignment maintains consistency in financial reporting, making your statements comparable with industry peers and meeting professional accounting standards that auditors, investors, and regulators expect.

Improves long-term strategic planning

Accrual accounting provides the detailed financial information you need for strategic decision-making. You can analyze trends, evaluate profitability by product lines or departments, and assess the long-term viability of business initiatives.

This comprehensive data supports better strategic planning and helps you make informed decisions about expansion, investment, and operational changes.

Enhances credibility with investors and stakeholders

Banks, investors, and business partners prefer accrual-based financial statements because they provide a more accurate representation of business performance.

This credibility can help you secure financing, attract investors, and build stronger relationships with suppliers and customers who rely on your financial stability.

Supports compliance with regulatory standards

Most regulatory bodies require accrual accounting for businesses above certain thresholds.

By implementing this method, you ensure compliance with tax regulations, corporate governance requirements, and industry-specific standards, avoiding penalties and maintaining good standing with regulatory authorities.

Facilitates accurate profitability analysis

You can accurately measure profitability by matching revenues with their associated costs in the same period.

This analysis helps you identify your most profitable products, services, or business segments, enabling you to optimize pricing strategies and resource allocation for maximum profitability.

Challenges and common mistakes in accrual accounting

While accrual accounting offers significant benefits, implementing it correctly requires careful attention to detail and proper procedures. Understanding common pitfalls will help you avoid costly errors and maintain accurate financial records.

1. Incorrect revenue or expense timing

One of the most frequent mistakes occurs when you record transactions in the wrong accounting period. You might recognize revenue before earning it or delay expense recognition beyond the incurrence date.

For example, recording December sales in January or failing to accrue year-end bonuses can significantly distort your financial statements and mislead stakeholders about your true business performance.

2. Incomplete or missed accrual entries

You may overlook certain accruals, particularly those involving estimates or less obvious transactions. Common missed items include accrued interest, utility bills, professional fees, or amortization in accounting, as well as warranty obligations.

These omissions can understate your liabilities and expenses, presenting an overly optimistic view of your financial position and potentially creating compliance issues.

3. Manual errors in journal entries

When creating adjusting entries for accruals in accounting, calculation errors, incorrect account codes, or reversed debits and credits can occur.

These manual mistakes can compound over time, leading to significant discrepancies in your financial statements. Regular review and approval processes are essential to catch these errors before they impact your reporting.

4. Lack of supporting documentation

Without proper documentation, you cannot substantiate your accrual entries during audits or reviews. Missing invoices, contracts, or agreements that support accrued amounts can create compliance problems and reduce the credibility of your financial statements.

Maintaining organized records is crucial for defending your accrual accounting practices.

5. Misclassification of accrued items

You might incorrectly classify accrued items between current and long-term categories, or between different expense types.

For instance, misclassifying accrued rent as utilities or placing short-term accruals in long-term liability accounts can confuse financial statement users and affect key financial ratios.

6. Inadequate reconciliation processes

Failing to regularly reconcile accrued amounts with actual transactions can lead to persistent errors.

You should establish monthly reconciliation procedures to verify that accrued items are properly reversed when actual transactions occur, preventing double-counting and maintaining accurate balances.

7. Limited staff understanding or training

When your accounting team lacks proper training in the accrual basis of accounting, mistakes become inevitable.

Insufficient understanding of accrual principles, timing rules, and documentation requirements can lead to systematic errors that compromise your financial reporting quality and regulatory compliance.

Best practices to overcome accrual accounting challenges

Successfully implementing accrual accounting requires structured approaches and systematic processes. These best practices will help you minimize errors, improve efficiency, and maintain accurate financial records throughout your organization.

1. Automate recurring accruals with accounting software

You can significantly reduce manual errors by automating recurring accruals such as salaries, rent, and utilities through modern accounting software. Set up templates for monthly accruals that automatically generate journal entries based on predetermined schedules and amounts.

This automation ensures consistency, reduces processing time, and minimizes the risk of missed entries while maintaining accurate records.

2. Standardize accrual policies and procedures

Develop comprehensive written policies that clearly define when and how to record different types of accruals. Create step-by-step procedures for common scenarios, establishing thresholds for materiality and approval requirements.

These standardized processes ensure consistency across your organization and help new team members understand the accrual basis of accounting requirements.

3. Implement regular training for finance teams

Conduct ongoing training sessions to keep your finance team updated on accrual accounting principles, regulatory changes, and best practices. Focus on practical scenarios, common mistakes, and proper documentation requirements.

Well-trained staff are essential for maintaining accurate accruals in accounting and ensuring compliance with accounting standards.

4. Conduct periodic internal audits and reviews

Schedule regular internal reviews of your accrual processes to identify potential issues before they become significant problems. Examine supporting documentation, verify calculation accuracy, and assess compliance with established policies.

These periodic audits help maintain the integrity of your financial reporting and catch errors early.

5. Use checklists for month-end and year-end closings

Create detailed checklists that outline all required accrual entries for each closing period. Include specific items to review, deadlines to meet, and approval requirements.

These checklists ensure you don't miss critical accruals and help maintain consistency in your closing processes across different accounting periods.

6. Ensure proper supporting documentation

Maintain organized files with all supporting documents for accrual entries, including contracts, invoices, estimates, and calculations. Implement document management systems that make it easy to locate and retrieve supporting evidence during audits or reviews.

Proper documentation strengthens the credibility of your financial statements.

7. Integrate accrual accounting with ERP or financial systems

Connect your accrual accounting processes with enterprise resource planning (ERP) systems to automate data flow and reduce manual entry requirements.

This integration improves accuracy, provides real-time visibility into accrued amounts, and streamlines your overall financial reporting processes.

When to use the accrual basis of accounting in India

The Companies Act, 2013 mandates that all companies registered in India must maintain their books of accounts on the accrual basis of accounting.

This requirement applies regardless of company size or turnover, making it a legal obligation for private limited companies, public limited companies, and one-person companies.

Non-compliance can result in penalties and legal consequences for directors and management.

Under the Income Tax Act, businesses with annual turnover exceeding ₹25 crores in any of the three preceding years must compulsorily adopt accrual accounting for tax purposes.

Additionally, certain business types like companies, cooperative societies, and businesses claiming specific deductions must use this method regardless of turnover.

These thresholds ensure larger businesses provide accurate financial reporting.

Companies following Indian Accounting Standards (Ind AS) must implement comprehensive accrual accounting principles.

This includes listed companies, unlisted companies with a net worth exceeding ₹500 crores, and companies with a turnover above ₹1,000 crores.

Indian GAAP also requires accrual accounting for preparing audited financial statements, ensuring consistency with international accounting practices.

Even when not legally required, growing startups should adopt accrual accounting to attract investors and secure funding.

Venture capitalists and angel investors prefer accrual-based financial statements as they provide clearer insights into business performance, growth trends, and financial health.

This method also prepares your startup for future compliance requirements as you scale.

Professional service firms, consultants, and contract-based businesses benefit significantly from accrual accounting.

You can accurately match project revenues with associated costs, track work-in-progress, and manage client billing more effectively.

This method provides better insights into project profitability and helps optimize resource allocation across different engagements.

Regardless of regulatory requirements, you should consider accrual accounting if you need accurate financial planning, budgeting, and analysis capabilities.

This method provides comprehensive insights into your business performance, enabling better strategic decisions, improved cash flow management, and enhanced stakeholder confidence in your financial reporting.

Recording and calculating accruals

Properly recording and calculating accruals requires systematic approaches and a clear understanding of timing principles. These practical examples will help you implement effective accrual processes in your business operations.

Identifying revenue and expenses to be accrued

You must identify transactions where economic benefits have been earned or obligations incurred, but cash hasn't changed hands. Look for completed services not yet billed, received goods or services not yet paid for, earned interest not yet received, or incurred expenses without invoices.

Regular review of contracts, agreements, and business activities helps identify these items systematically.

Journal entries for common accruals

When recording accruals in accounting, you typically debit an expense or asset account and credit a liability or revenue account. For accrued expenses, debit the expense account and credit accrued liabilities.

For accrued revenue, debit accounts receivable and credit revenue. These entries ensure your financial statements reflect actual business activity during each period.

Adjusting entries at period-end

At month-end or year-end, you create adjusting entries to record all accrued items. These entries update your accounts to reflect the accrual basis of accounting principles.

Document each adjustment with supporting calculations, relevant dates, and business rationale to maintain audit trails and ensure accuracy.

Example: Accrued salary expense

Your company pays monthly salaries on the 5th of each month. If your accounting period ends March 31st and you haven't paid April salaries yet, you must accrue March salary expenses.

Journal Entry:

Debit: Salary Expense ₹5,00,000

Credit: Accrued Salaries Payable ₹5,00,000

When you pay salaries in April, you reverse this entry and record the actual payment.

Example: Accrued income from services rendered

You completed consulting services worth ₹2,00,000 in March but will invoice the client in April.

Journal Entry:

Debit: Accounts Receivable ₹2,00,000

Credit: Service Revenue ₹2,00,000

This ensures March revenue reflects actual services delivered during that period.

Reversing accruals in the next period

You should reverse accrual entries in the subsequent period when actual transactions occur. This prevents double-counting and maintains accurate balances.

Set up systematic reversal procedures to ensure all accruals are properly handled.

Tools and techniques for efficient accrual tracking

Use spreadsheet templates, accounting software features, or specialized accrual management tools to track and calculate accruals efficiently.

Implement approval workflows, maintain supporting documentation, and establish regular review processes to ensure accuracy and completeness.

GAAP and Ind AS principles & methods for accrual accounting

Understanding the regulatory framework governing accrual accounting ensures your financial statements meet professional standards and compliance requirements. These principles form the foundation of reliable financial reporting.

Key principles of accrual accounting under GAAP

Under Generally Accepted Accounting Principles, you must follow the revenue recognition principle, matching principle, and conservatism principle.

Revenue is recognized when earned, expenses when incurred, and you should exercise prudence in uncertain situations.

The accrual basis of accounting under GAAP requires you to record transactions based on economic substance rather than cash flow timing, ensuring faithful representation of business performance.

Recognition and matching principles in Ind AS

Indian Accounting Standards emphasize that you recognize revenue when performance obligations are satisfied and expenses when resources are consumed.

The matching principle requires you to match revenues with their directly related costs in the same accounting period.

Ind AS 115 specifically governs revenue recognition, requiring you to identify contracts, performance obligations, and transaction prices before recognizing revenue.

Ind AS vs. Traditional Indian GAAP—Key differences

Traditional Indian GAAP focused on legal form, while Ind AS emphasizes economic substance.

Under Ind AS, you must apply more detailed fair value measurements, comprehensive income reporting, and extensive disclosure requirements.

The accrual concepts remain similar, but Ind AS requires more sophisticated judgment in areas like revenue recognition, lease accounting, and financial instruments.

Double-entry system and its role in accrual accounting

The double-entry bookkeeping system ensures every accrual transaction affects at least two accounts, maintaining the fundamental accounting equation.

When you record accruals in accounting, each entry maintains balance between assets, liabilities, and equity, providing built-in checks for accuracy and completeness of financial records.

Disclosure requirements under Ind AS

Ind AS mandates comprehensive disclosures about your accrual accounting policies, significant estimates, and judgments.

You must disclose revenue recognition policies, major accrued items, and any changes in accounting estimates that materially affect financial statements, ensuring transparency for stakeholders.

Accrual accounting under Indian compliance laws

Navigating India's complex regulatory landscape requires understanding how various laws impact your accrual accounting practices. Compliance with these requirements is essential for legal operations and avoiding penalties.

1. Accrual mandate under the Companies Act, 2013

The Companies Act, 2013 mandates that all companies maintain books of accounts on the accrual basis of accounting. Section 128 requires you to record transactions when they occur, not when cash changes hands.

This legal requirement applies to all companies regardless of size, making accurate accrual accounting essential for statutory compliance and avoiding director liability under the Act.

2. Tax treatment of accruals under the Income Tax Act

Under the Income Tax Act, you must follow the mercantile system (accrual method) if your turnover exceeds ₹25 crores in any of the three preceding years. The Act requires you to offer income for taxation when it accrues or is received, whichever is earlier.

This creates timing differences between book and tax accounting that you must carefully manage through proper documentation and reconciliation.

3. GST implications on accrued sales and purchases

GST liability arises when you issue invoices or receive payments, whichever is earlier. This creates complexities when implementing accruals in accounting, as GST timing may differ from revenue recognition under accounting standards.

You must maintain separate tracking systems for GST compliance while ensuring your accrual accounting accurately reflects business transactions.

4. Reporting obligations and audit readiness

Your accrual accounting system must support various regulatory filings, including annual returns, tax returns, and statutory audits.

Maintain detailed supporting documentation for all accrual entries, implement proper internal controls, and ensure your accounting records can withstand scrutiny from statutory auditors, tax authorities, and regulatory bodies.

5. Industry-specific compliance requirements

Certain industries face additional accrual accounting requirements. Banking companies must follow RBI guidelines, insurance companies adhere to IRDAI regulations, and listed companies comply with SEBI requirements.

These sector-specific rules may mandate particular accrual treatments, disclosure requirements, or reporting formats that you must incorporate into your accounting systems.

Automate manual accounting tasks in a single platform

Modernizing and transitioning to accrual accounting

Transitioning from cash to accrual accounting requires careful planning and systematic implementation. This transformation can significantly enhance your financial reporting capabilities and business decision-making processes.

Assessing readiness for transition

Before implementing accrual accounting, you must evaluate your current systems, staff capabilities, and business processes.

Assess your existing accounting software, documentation procedures, and team's understanding of accrual principles.

Identify gaps in your current cash-based system and determine the resources needed for a successful transition.

This assessment helps you create realistic timelines and budget requirements.

Steps to shift from cash to accrual method

Start by establishing cutoff procedures to separate cash and accrual periods. Create opening balances for accounts receivable, accounts payable, and accrued items.

Implement a new chart of accounts that accommodates accrual transactions.

Develop procedures for identifying and recording accruals in accounting, including month-end closing checklists and approval workflows.

Document all policy changes and train your team on new procedures.

Choosing the right accounting software

Select software that supports automated accrual entries, recurring transactions, and comprehensive reporting capabilities.

Look for features like integration with other business systems, audit trails, and compliance reporting.

The software should handle the accrual basis of accounting requirements, including adjusting entries, reversals, and period-end procedures.

Consider scalability, user-friendliness, and vendor support when making your selection.

Training and change management for finance teams

Provide comprehensive training on accrual accounting principles, new software features, and revised procedures.

Focus on practical scenarios, common mistakes, and proper documentation requirements.

Establish mentoring programs and regular review sessions to ensure smooth adoption.

Address resistance to change by clearly communicating benefits and providing ongoing support.

Common pitfalls to avoid during transition

Avoid rushing the implementation without proper planning or adequate staff training.

Don't neglect data migration and opening balance accuracy.

Ensure you maintain parallel systems during transition periods and verify all accrual calculations.

Avoid inadequate documentation of new procedures or insufficient testing of new processes before full implementation.

Post-implementation monitoring and improvements

Regularly review your accrual processes for accuracy and efficiency.

Monitor key performance indicators like closing timelines, error rates, and compliance metrics.

Gather feedback from users and stakeholders to identify improvement opportunities.

Continuously refine your procedures based on experience and changing business needs.

Modern accounting tools: How to evaluate the right fit for your business

Selecting the right accounting software is crucial for successfully implementing and maintaining accrual accounting systems. The right tools can streamline your processes, reduce errors, and provide valuable insights for business growth.

1. Understand your business’s accounting needs

Before evaluating software options, you must clearly define your specific requirements. Consider your transaction volume, complexity of operations, number of users, and regulatory compliance needs.

Assess whether you need multi-currency support, project tracking, or industry-specific features. Understanding what is accrual accounting means for your business helps determine which software capabilities are essential versus nice-to-have features.

2. Prioritize accrual accounting capabilities

Look for software that naturally supports the accrual basis of accounting with features like automated recurring accruals, adjusting entries, and period-end closing procedures. The system should handle accounts receivable, accounts payable, and accrued expenses efficiently.

Ensure it can generate proper journal entries for accruals in accounting and provide clear audit trails for all transactions.

3. Evaluate integration with existing systems

Your accounting software should seamlessly integrate with your existing ERP, CRM, payroll, and banking systems. This integration eliminates manual data entry, reduces errors, and provides real-time financial visibility.

Look for APIs, pre-built connectors, or certified integrations that can synchronize data automatically across your business applications.

4. Look for automation and workflow features

Modern accounting tools should automate routine tasks like recurring accruals, invoice processing, and bank reconciliations. Seek features like approval workflows, automated alerts, and scheduled reporting.

These capabilities reduce manual work, improve accuracy, and allow your team to focus on analysis and strategic activities rather than data entry.

5. Ensure scalability for future growth

Choose software that can grow with your business. Consider factors like user limits, transaction volumes, and additional modules you might need. The system should handle increased complexity as your business expands without requiring a complete replacement.

Look for flexible pricing models and upgrade paths that accommodate your growth trajectory.

6. Check reporting, analytics, and dashboard capabilities

Your accounting software should provide comprehensive financial reporting, customizable dashboards, and analytical tools. Look for real-time reporting capabilities, drill-down features, and the ability to create custom reports.

These features help you leverage your accrual accounting data for better decision-making and strategic planning.

7. Consider security, compliance, and support

Ensure the software meets industry security standards, offers data backup and recovery, and provides compliance features for Indian regulations. Evaluate vendor support quality, training resources, and implementation assistance.

Consider cloud-based solutions for better accessibility and automatic updates.

How Volopay simplifies accrual-based cost management for Indian companies

Managing expenses under the accrual basis of accounting can be complex for Indian businesses, especially when dealing with multiple vendors, approval processes, and compliance requirements.

Volopay's comprehensive accounting automation platform addresses these challenges by providing integrated solutions that streamline accrual accounting processes while ensuring accuracy and compliance with Indian regulations.

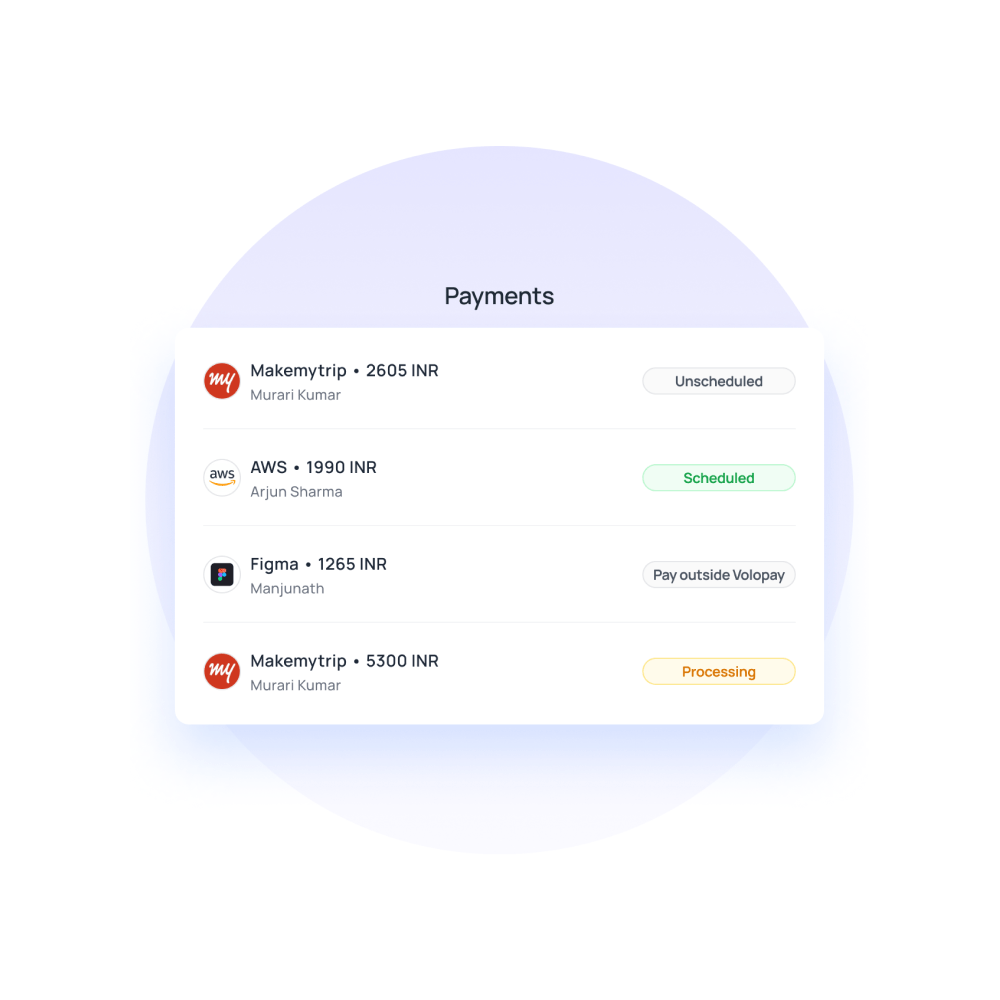

Real-time expense recognition

Volopay enables you to capture and record expenses the moment they occur, aligning perfectly with accrual accounting principles.

The platform automatically timestamps transactions, categorizes expenses, and creates digital receipts, ensuring you recognize costs when incurred rather than when paid.

This real-time recognition helps you maintain accurate financial records and provides immediate visibility into your spending patterns, supporting better cash flow management and budget control.

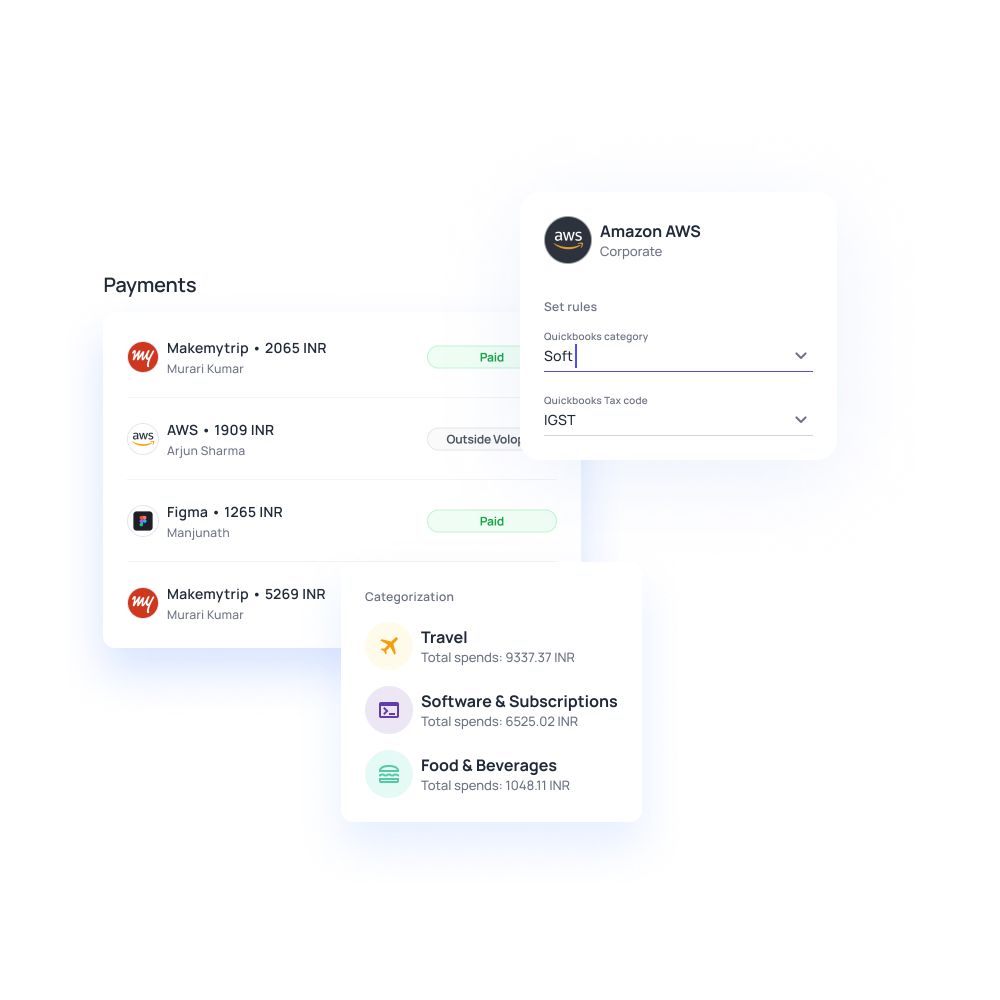

Automated invoice matching and categorization

The platform automatically matches invoices with corresponding purchase orders and receipts, eliminating manual reconciliation work.

Volopay's intelligent invoice categorization system assigns expenses to appropriate accounting codes, ensuring proper classification for accruals in accounting.

This automation reduces errors, speeds up processing time, and ensures consistent expense categorization across your organization, making period-end closing procedures more efficient.

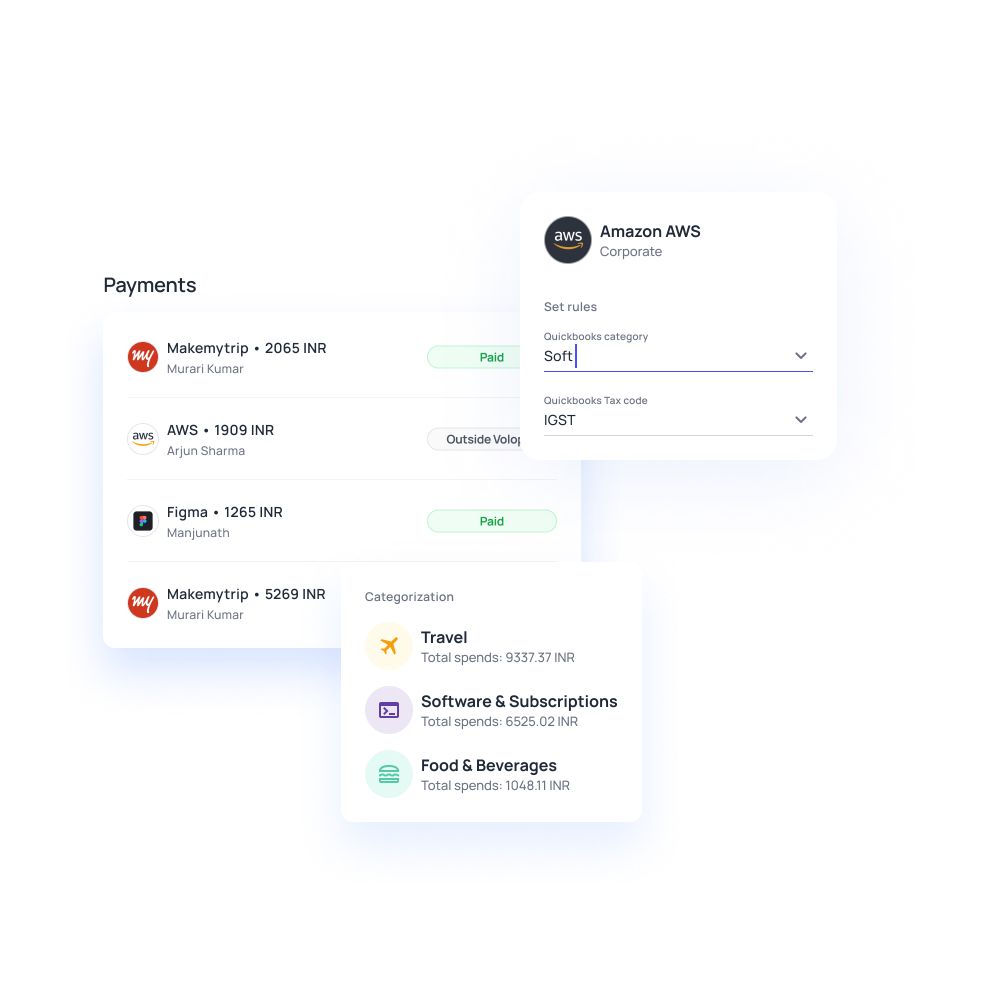

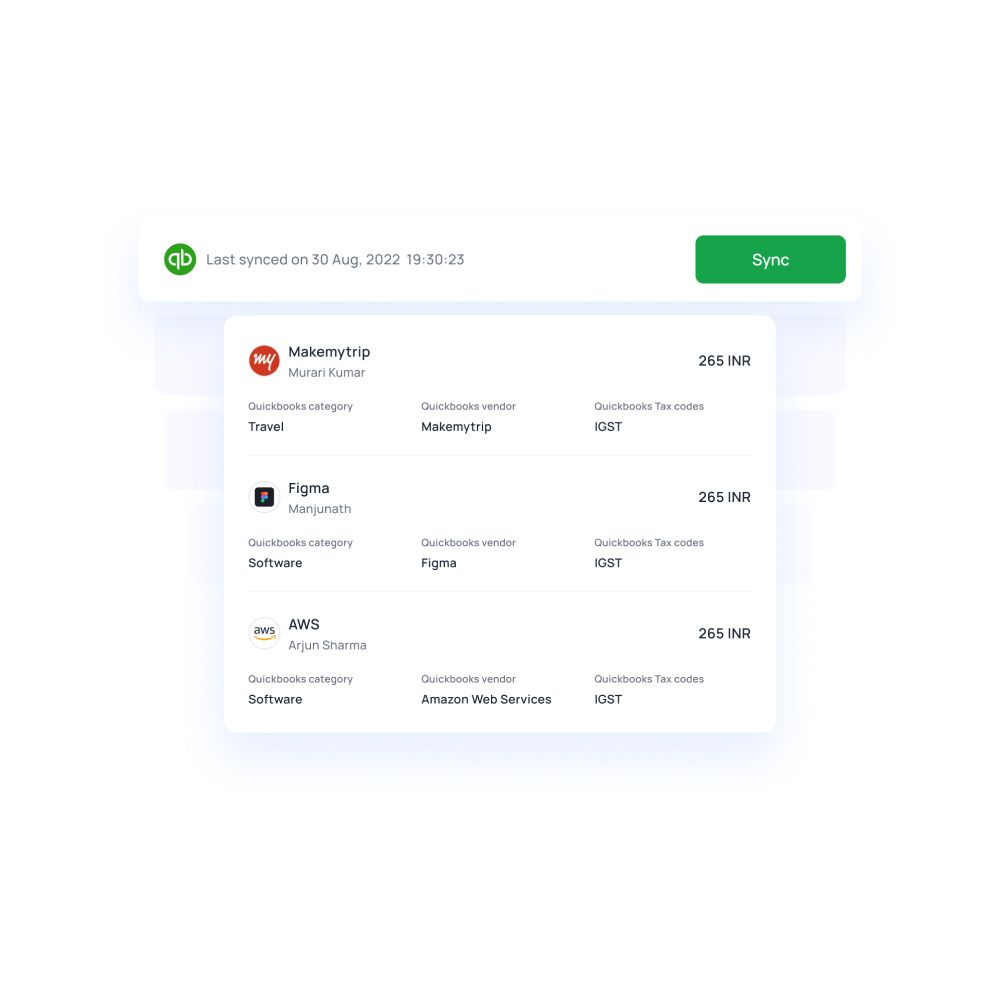

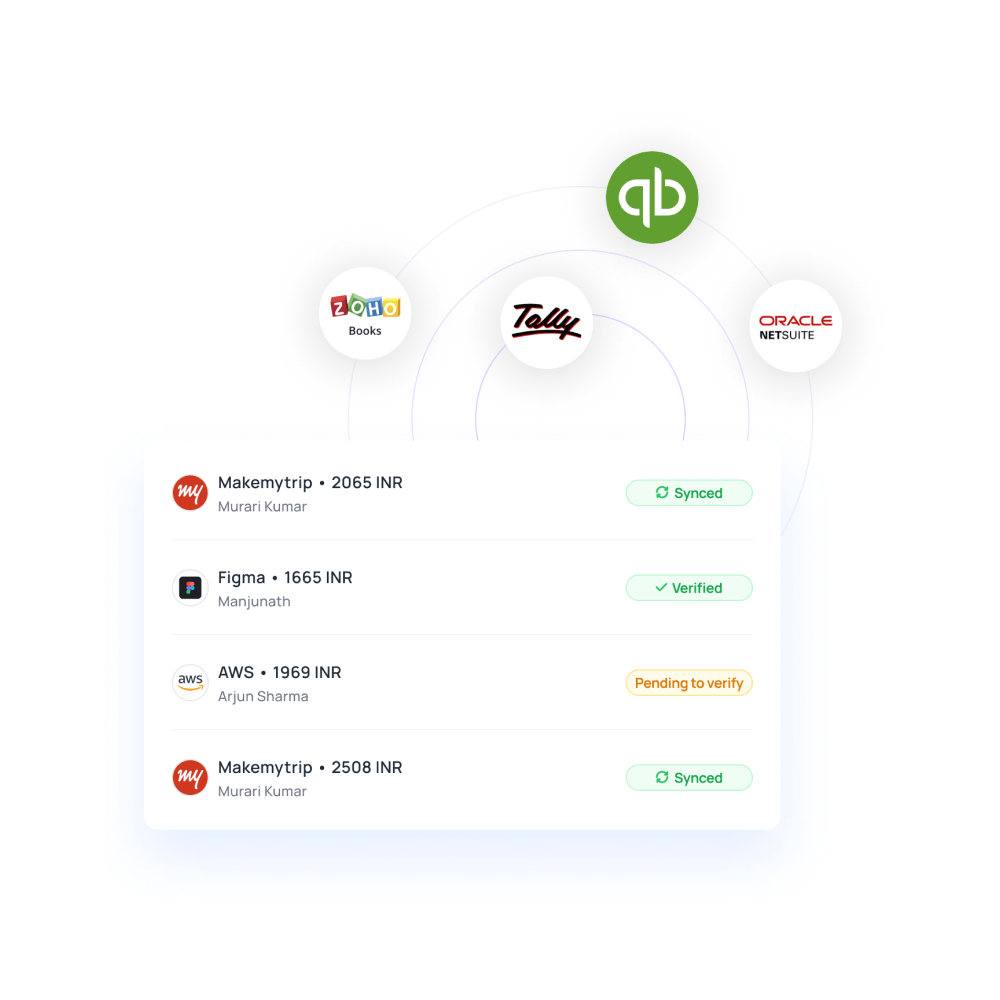

Seamless integration with Indian accounting platforms

Volopay integrates seamlessly with popular Indian accounting software like Tally, QuickBooks, and Zoho Books, automatically synchronizing expense data with your accounting systems.

This integration ensures that accrued expenses are properly recorded in your general ledger without manual data entry.

The platform supports Indian tax compliance requirements, including GST calculations and reporting, making it easier to maintain accurate books under Indian regulations.

Customizable reporting for compliance and audits

You can generate comprehensive reports that support your accrual accounting requirements and regulatory compliance needs. Volopay provides customizable dashboards showing accrued expenses, pending approvals, and outstanding obligations.

These reports help you track the impact of what is accrual accounting doing to your financial statements and provide auditors with detailed expense documentation, supporting smooth audit processes and regulatory compliance.

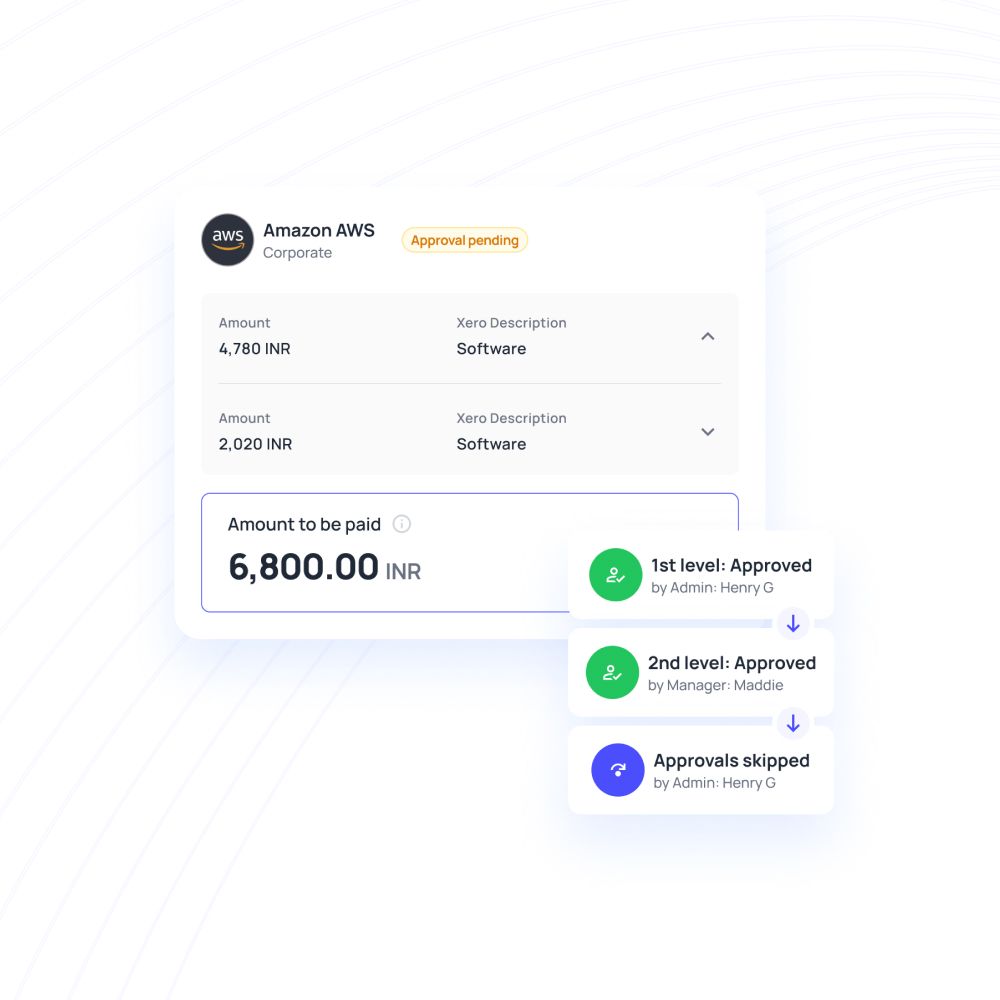

Multi-level approval and cost allocation features

The platform supports complex approval workflows that align with your organizational hierarchy and spending policies. You can set up multi-level approvals for different expense categories and amounts, ensuring proper authorization before recording accrued expenses.

Cost allocation features allow you to distribute expenses across departments, projects, or cost centers, providing detailed insights into operational costs and supporting accurate profitability analysis.

Bring Volopay to your business

Get started now

FAQs

Yes, startups should invest in robust accounting software early, especially if planning to raise funding or expecting rapid growth. Proper accrual accounting systems attract investors and ensure compliance.

Check for GST compliance, Companies Act 2013 support, Ind AS compatibility, and audit trail features. Verify the vendor's understanding of Indian regulations and local support availability.

Yes, Volopay supports accrual accounting by capturing expenses when incurred, automating categorization, and integrating with accounting software to ensure proper accrual recognition and compliance.

Volopay automates expense categorization, invoice matching, approval workflows, GST calculations, receipt management, and synchronization with accounting software, reducing manual data entry and errors.

Yes, Volopay supports multi-entity and multi-department configurations with separate cost centers, customizable approval workflows, and detailed reporting capabilities for complex organizational structures.