A complete guide to corporate virtual credit and debit cards

Managing business expenses has become increasingly complex as companies expand their operations and embrace remote work. Traditional corporate cards often fall short in providing the control and visibility modern businesses require.

Corporate virtual cards represent a revolutionary approach to business spending, offering enhanced security, granular controls, and real-time expense management.

This comprehensive guide will walk you through everything you need to know about virtual corporate cards, from understanding their fundamental differences to choosing the right provider for your business needs.

What are corporate cards?

Corporate cards serve as essential financial tools that businesses use to manage employee spending and streamline expense processes. These cards are issued directly by financial institutions to companies, allowing designated employees to make business-related purchases without using personal funds.

Unlike personal credit cards, corporate cards are linked to the company's account and provide businesses with centralized control over spending activities.

Traditional corporate cards have evolved significantly from simple payment methods to sophisticated expense management tools. Modern corporate cards offer features like spending limits, category restrictions, and detailed reporting capabilities.

They help businesses maintain better cash flow control, reduce administrative overhead, and provide clear audit trails for all transactions. Companies can issue these cards to various employees based on their roles and spending requirements, creating a structured approach to business expense management.

What are corporate physical and virtual cards?

Corporate cards come in two primary forms: physical cards and virtual cards. Physical corporate cards are traditional plastic cards issued to employees for expenses like travel, meals, or office purchases. They work like standard debit or credit cards but are harder to control in terms of spend limits, tracking, and misuse prevention.

Virtual corporate cards, on the other hand, are digital-only and can be issued instantly. They are not tied to a single piece of plastic, which makes them flexible and safer to use online or across distributed teams.

One key distinction is how virtual cards are more secure than physical cards. Since they can be generated for single use, locked to specific vendors, or set with exact spending limits, the risk of fraud or misuse is drastically reduced.

The benefits of virtual cards include greater control, real-time visibility, and ease of integration with accounting systems. Finance leaders can assign unique cards per project, subscription, or employee, eliminating the hassle of shared physical cards. This ensures transparency, simplifies reconciliation, and gives businesses full control over how money flows.

What are corporate virtual credit cards?

Corporate virtual credit cards are digital payment solutions that exist entirely online without physical plastic cards. These cards generate unique 16-digit card numbers, expiration dates, and security codes that function exactly like traditional credit cards for online and phone transactions.

The virtual nature allows businesses to create, configure, and distribute cards instantly through digital platforms, eliminating the wait time associated with physical card delivery.

Virtual corporate cards operate on credit lines extended by financial institutions or payment processors to the issuing company. This means purchases made using these cards are essentially borrowed funds that the company must repay according to the agreed terms.

The credit-based structure provides businesses with flexibility in cash flow management, allowing them to make purchases even when immediate funds aren't available in their accounts, while building business credit history through responsible usage.

What are corporate virtual debit cards?

Corporate virtual debit cards function as digital payment instruments that draw funds directly from the company's bank account or pre-loaded balance. Unlike their credit counterparts, these cards require available funds before any transaction can be processed.

This direct debit structure provides immediate spending control and eliminates the risk of accumulating debt, making it ideal for businesses that prefer cash-based operations.

Virtual cards for business in debit format offer the same digital convenience as credit versions but with enhanced spending discipline. When you issue a corporate virtual debit card, you're essentially creating a controlled access point to your company's funds.

The card can only process transactions up to the available balance, preventing overspending and providing natural budget enforcement. This makes them particularly valuable for managing departmental budgets, contractor payments, and subscription services where spending predictability is crucial.

Different types of virtual cards for business

Single payment

Single payment cards originated from gift cards. Designed for one-time use, they have not become helpful for companies that need to provide employees with cards for a single event or transaction.

They’re quite easy to create. You simply need to specify the expiration date for each card, as well as the amount of credit you wish to load. With companies like Volopay, you can also link these cards to your policies to ensure they follow the correct protocol for use. Additionally, they can be linked to budgets for improved bookkeeping.

Recurring payments

Recurring payments make up a large portion of spends in any department or company. Usually SaaS, but also for fixed contract vendors, these invoices have a tendency to get lost. There is even a risk of making payments twice.

Having a dedicated corporate card for vendors and recurring payments significantly smooths the management process. Corporate virtual prepaid cards can be created specifically for individual vendors, and all invoices and receipts can be conveniently attached to that card. This greatly enhances spending analysis and accounting efficiency, reducing errors considerably.

How do corporate virtual cards work?

Corporate virtual cards operate through a sophisticated digital ecosystem that transforms traditional payment processes into streamlined, controlled experiences. The system begins when businesses partner with virtual card providers who offer web-based platforms or mobile applications for card management.

The entire process revolves around policy-driven automation and real-time transaction processing. The result is a payment ecosystem that provides both control and convenience, allowing businesses to maintain tight financial oversight while empowering employees to make necessary purchases efficiently.

1. Request/approval process

Your employees initiate card requests through the company's designated virtual card platform, specifying the purpose, amount, and duration needed.

The system automatically routes these requests through your pre-configured approval workflows, which can include manager approval, finance team review, or automatic approval for amounts below certain thresholds.

2. Virtual card creation

Once approved, the platform instantly generates a unique virtual card with a 16-digit number, expiration date, and CVV code.

This process takes seconds rather than the days required for physical cards, enabling immediate use for urgent business purchases or time-sensitive transactions.

3. Card configuration (limits, restrictions)

You can customize each corporate virtual card with specific spending limits, merchant category restrictions, and usage timeframes.

These controls ensure cards can only be used for their intended purpose, whether that's a one-time software purchase or monthly recurring subscriptions.

4. Transaction execution (payment made)

When cardholders use their virtual cards for purchases, the transaction processes through standard payment networks just like physical cards.

The payment processor verifies the card details, checks against your configured limits and restrictions, and then either approves or declines the transaction in real-time.

5. Real-time expense capture & reconciliation

Every transaction immediately appears in your expense management dashboard with detailed merchant information, timestamps, and amounts.

This real-time capture eliminates manual receipt collection and enables automatic reconciliation with your accounting systems, streamlining your monthly closing processes.

Corporate virtual credit vs debit cards: A comparison

Understanding the fundamental differences between corporate virtual credit cards and debit variants is crucial for making informed decisions about your business payment strategy.

Both options serve distinct purposes within corporate expense management, and the choice between them often depends on your company's financial policies, cash flow requirements, and risk tolerance preferences.

The comparison extends beyond simple funding mechanisms to encompass various operational aspects that can significantly impact your business processes. From approval workflows to spending controls, each type offers unique advantages that align with different business scenarios and organizational structures.

1. Purpose

Corporate virtual credit cards

Corporate virtual credit cards serve businesses that need flexible payment solutions with extended payment terms and the ability to make purchases beyond current cash availability.

These cards are ideal for companies managing seasonal cash flow variations, large capital expenditures, or situations where building business credit history is important for future financing opportunities.

Corporate virtual debit cards

Corporate virtual debit cards cater to organizations prioritizing immediate expense control and cash-based operations. They're perfect for businesses that want to eliminate debt accumulation risks, maintain strict budget adherence, or operate with predictable cash flows where funds are available before purchases are made.

2. Funding method

Corporate virtual credit cards

Corporate virtual credit cards draw from credit lines established with financial institutions or payment processors. Your business receives a predetermined credit limit based on creditworthiness, revenue, and other financial factors.

Purchases create a balance that must be repaid according to agreed terms, typically within 30 days to avoid interest charges.

Corporate virtual debit cards

Virtual cards for business in debit format require pre-funding through bank transfers or maintaining sufficient account balances. Each transaction immediately reduces your available funds, creating natural spending boundaries.

This direct debit mechanism eliminates credit approval processes and provides immediate clarity on spending capacity.

3. Spend controls

Corporate virtual credit cards

Corporate virtual credit cards offer sophisticated control mechanisms, including spending limits per card, per employee, or per department, along with merchant category restrictions and transaction frequency controls.

However, these controls operate within the overall credit limit, allowing temporary overspending in individual categories if the total limit isn't exceeded.

Corporate virtual debit cards

Corporate virtual debit cards provide inherent spending control through balance limitations, where insufficient funds automatically prevent transactions.

Additional controls include daily spending limits, merchant restrictions, and time-based usage windows. These controls work in conjunction with available balance rather than against credit limits.

4. Use cases

Corporate virtual credit cards

Corporate virtual credit cards excel in scenarios requiring payment flexibility, such as large vendor payments, emergency purchases, travel expenses, or situations where payment terms negotiation provides business advantages.

They're also valuable for building business credit scores and managing seasonal cash flow fluctuations effectively.

Corporate virtual debit cards

Virtual cards for business in debit format work best for subscription management, small vendor payments, departmental budgets, contractor payments, and situations where spending predictability is crucial.

They're ideal for businesses with steady cash flows and those prioritizing debt avoidance.

5. Selection criteria

Corporate virtual credit cards

Choose corporate virtual credit cards when your business has established credit history, needs payment flexibility, manages variable cash flows, or wants to build credit relationships.

Consider factors like interest rates, credit limits, reward programs, and integration capabilities with your existing financial systems.

Corporate virtual debit cards

Select corporate virtual debit cards when prioritizing spending control, operating with predictable cash flows, wanting to avoid debt accumulation, or managing teams with varying financial responsibility levels.

Evaluate factors like funding mechanisms, transaction limits, real-time reporting capabilities, and integration with your accounting platforms.

For a more detailed comparison, refer our article on the key differences between physical and virtual cards.

Benefits of virtual cards for business

Corporate virtual cards offer instant issuance, allowing you to generate a card number immediately. This feature is especially beneficial for onboarding new employees or handling urgent business expenses without waiting for physical cards to arrive.

Virtual cards offer unparalleled flexibility for your business. You can issue and manage cards remotely, making them ideal for remote teams and international operations. This flexibility ensures that your business remains agile and responsive to changing needs.

A corporate virtual credit card significantly reduces fraud risk by eliminating the need for physical cards. You can deactivate a card instantly if suspicious activity is detected, protecting your business from unauthorized transactions and financial loss.

Corporate virtual cards simplify the reconciliation process by recording transactions in real time. This feature allows you to effortlessly match expenses with invoices, reducing the time spent on manual checks. The efficiency of this process minimizes errors and ensures your financial records are accurate and up to date.

Using virtual corporate cards enhances your budgeting capabilities by allowing you to assign specific budgets to different departments or projects. You can monitor spending in real-time, ensuring that you stay within budget. This approach helps you maintain financial discipline and make informed financial decisions.

You can fully customize virtual corporate cards to fit your business's specific needs. You can set spending limits, restrict card usage to particular vendors, and even define expiration dates. This high level of customization ensures that your business maintains strict control over expenses while effectively meeting unique operational and financial requirements.

Corporate virtual cards provide enhanced visibility and control over your business expenses. You can track every transaction, identify spending patterns, and gain insights into your financial operations. This transparency supports better decision-making and financial planning.

Corporate virtual cards streamline your AP process by automating vendor payments, minimizing manual errors, and improving payment accuracy. This efficiency saves time and resources, allowing your AP team to focus on strategic activities and boosting overall productivity in your operations.

Simplify expense reporting with virtual cards by enabling employees to submit expenses electronically. This reduces paperwork, speeds up reimbursement, and boosts productivity. The system ensures timely, accurate expense management, benefiting both employees and your financial management.

Drawbacks of virtual cards for business

1. Limited acceptance

Corporate virtual cards may face limited acceptance with some vendors, especially those who prefer traditional payment methods.

This limitation can restrict your business’s ability to use corporate virtual credit card universally, necessitating alternative payment solutions in certain situations.

2. Challenges with integration

Integrating virtual corporate cards with existing financial systems and software can present challenges.

Your business may need to invest time and resources in ensuring that corporate virtual cards work seamlessly with accounting, payroll, and expense management systems.

3. Limited to online payments

Corporate virtual credit card are primarily designed for online transactions. If your business frequently requires in-person payments, the absence of a physical card can be a drawback, requiring you to rely on other payment methods for such situations.

4. Lack of physical card presence

The lack of a physical card can be a disadvantage for businesses that need to make payments in physical stores or during travel.

While virtual corporate cards offer convenience for online subscription management, and are ideal for online transactions, they may not be suitable for all business scenarios.

5. Reliance on technology

Using corporate virtual cards means relying heavily on technology. Any technical issues, such as system outages or connectivity problems, can disrupt your ability to make payments.

This reliance requires robust IT support to ensure continuous and reliable access to virtual corporate cards.

Who is eligible to apply for virtual corporate cards in the U.S.?

Eligibility for corporate virtual cards in the U.S. depends on several factors that financial institutions and payment processors use to assess business credibility and financial stability.

Most providers require businesses to be legally registered entities with valid tax identification numbers, though specific requirements can vary significantly between different card providers and their target market segments.

The application process typically involves a comprehensive financial evaluation where providers assess your company's ability to manage corporate payment responsibilities effectively.

This evaluation encompasses everything from basic business registration requirements to detailed financial documentation that demonstrates your company's operational stability and growth potential.

Business entity requirements

Your business must be registered as a legal entity in the United States, whether as an LLC, corporation, partnership, or sole proprietorship.

You'll need a valid Employer Identification Number (EIN) from the IRS, active business registration with your state, and current business licenses relevant to your industry operations.

Financial documentation

Providers typically require recent bank statements showing business activity, P&L statements, business tax returns from previous years, and documentation of current revenue streams.

Some providers may also request accounts receivable reports or cash flow projections, depending on your business type.

Credit history evaluation

Both business and personal credit histories may be evaluated, especially for newer businesses or smaller companies.

Providers assess payment history, existing credit relationships, outstanding debts, and overall creditworthiness to determine approval and credit limits for virtual corporate cards.

Employee or team size

Many providers have minimum requirements regarding business size, whether measured by employee count, annual revenue, or monthly transaction volume.

Some specialize in small businesses while others focus on mid-market or enterprise clients, affecting both eligibility requirements and available features.

Industry and use case

Certain high-risk industries may face additional scrutiny or restrictions, while some providers specialize in specific sectors like technology, retail, or professional services.

Your intended use cases for virtual cards for business also influence approval decisions and available card features.

Provider-specific criteria

Each provider maintains unique eligibility requirements based on their risk models, target markets, and business strategies.

Some focus on high-growth startups, others prefer established businesses, and some cater specifically to remote-first companies or international businesses operating in the U.S.

How to apply for corporate virtual cards in the U.S.

Applying for corporate virtual cards involves a systematic process that varies among providers but generally follows similar fundamental steps. The application journey typically takes anywhere from a few days to several weeks, depending on your business complexity, chosen provider, and completeness of submitted documentation.

Modern providers increasingly offer streamlined digital applications that can significantly reduce approval timeframes.Successful applications require thorough preparation and understanding of each provider's specific requirements and evaluation criteria.

The key to a smooth application process lies in having all necessary documentation organized beforehand and choosing a provider whose services align with your business needs and qualification profile.

Choose a card provider for your business

Research different virtual corporate card providers, comparing their features, fees, integration capabilities, security features and eligibility requirements.

Consider factors like credit limits, spending controls, reporting tools, customer support quality, and how well their platform integrates with your existing financial systems and workflows.

Prepare business documentation

Gather essential documents, including business registration certificates, tax identification numbers, recent financial statements, bank statements, business licenses, and personal identification for key business owners.

Organization and completeness of documentation significantly impact application processing speed and approval likelihood.

Submit the application

Complete the provider's application form with accurate business information, financial details, intended use cases, and required documentation uploads.

Many providers offer online applications that guide you through each step, while others may require phone consultations or in-person meetings.

Undergo credit and risk review

The provider conducts comprehensive credit checks on both business and personal credit histories, reviews submitted financial documentation, and assesses risk factors associated with your industry and business model.

This process typically takes several business days to complete.

Complete onboarding

Once approved, you'll participate in platform training, configure account settings, establish user roles and permissions, integrate with accounting systems, and set up initial spending policies.

This onboarding process ensures you maximize the benefits of your new corporate virtual cards.

Issue virtual cards

Begin creating and distributing virtual cards for business to team members, configure spend controls for each card, approval workflows, and start using the platform's features.

Most providers allow immediate card creation upon successful onboarding completion.

How to choose a corporate virtual card provider for your business

Selecting the right corporate virtual cards provider requires careful evaluation of multiple factors that directly impact your business operations, financial processes, and team productivity.

The decision extends beyond simple feature comparisons to encompass considerations like scalability, integration capabilities, support quality, and alignment with your company's specific use cases and growth trajectory.

The provider selection process should involve key stakeholders from finance, accounting, and operations teams to ensure the chosen solution addresses all relevant business requirements.

Take time to evaluate providers through demonstrations, pilot programs, or trial periods when available, as hands-on experience often reveals important details not apparent in marketing materials.

1. Identify business use cases

Clearly define how your business intends to use virtual corporate cards, whether for subscription management, vendor payments, travel expenses, or departmental budgets.

Understanding your specific use cases helps narrow down providers that specialize in your requirements and offer relevant features and controls.

2. Assess spend control features

Evaluate each provider's ability to implement spending limits, merchant restrictions, approval workflows, and real-time monitoring capabilities.

Look for granular control options that allow you to customize card behavior based on user roles, purchase categories, and business policies specific to your operational needs.

3. Review eligibility requirements

Ensure your business meets the provider's eligibility criteria regarding company size, revenue requirements, credit history, and industry focus.

Some providers specialize in specific business types or sizes, so alignment with their target market often results in better service and more favorable terms.

4. Check accounting integrations

Verify that your potential provider offers seamless integration with your existing accounting software, ERP systems, and expense management platforms.

Strong integrations eliminate manual data entry, reduce errors, and streamline reconciliation processes, significantly improving operational efficiency with virtual cards for business.

5. Compare fees and limits

Analyze the complete fee structure, including setup costs, monthly fees, transaction fees, foreign exchange rates, and any additional charges for premium features.

Also, compare credit limits, spending controls, and transaction volume capabilities to ensure they meet your business requirements.

6. Evaluate security and fraud protection

Assess each provider's security measures, including data encryption, fraud monitoring systems, transaction alerts, and dispute resolution processes.

Strong security features protect your business from unauthorized transactions and provide peace of mind when distributing corporate virtual cards across your organization.

7. Consider rewards and perks

Review available rewards programs, cashback opportunities, and additional perks that could provide value to your business.

While not the primary selection criteria, these benefits can add meaningful value, especially for businesses with high transaction volumes or specific spending patterns.

8. Test support and onboarding

Evaluate the quality of customer support, availability of technical assistance, onboarding process comprehensiveness, and ongoing account management services.

Strong support becomes crucial when implementing new financial processes and ensuring smooth adoption across your organization.

For expert recommendations on the best business virtual credit card platforms, read our blog on best virtual credit card providers in the US to optimize your card management.

Best practices to manage virtual credit and debit cards

1. Establish a clear policy

Create a comprehensive corporate card policy outlining the use of corporate virtual cards. Define acceptable expenses, reporting procedures, and compliance requirements.

By establishing these guidelines, you ensure consistent use and prevent misuse across your business, helping maintain financial discipline and clear communication of expectations.

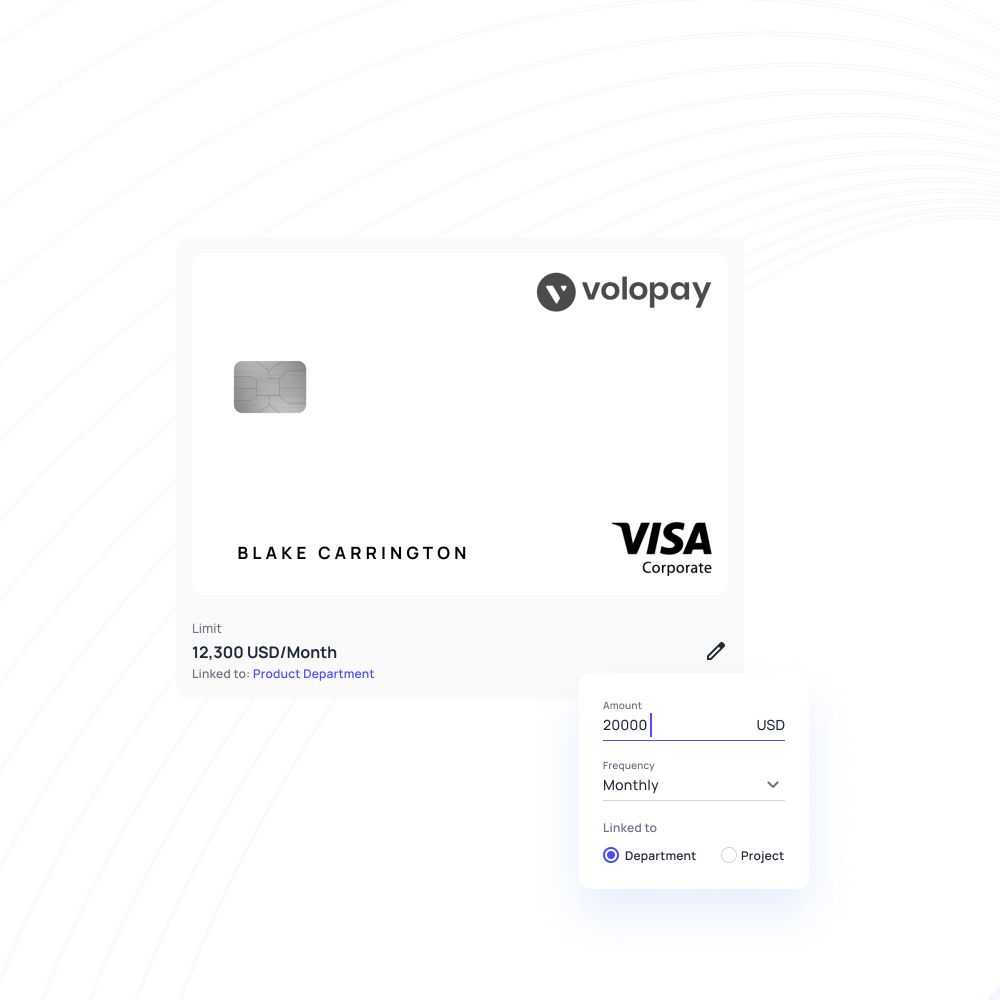

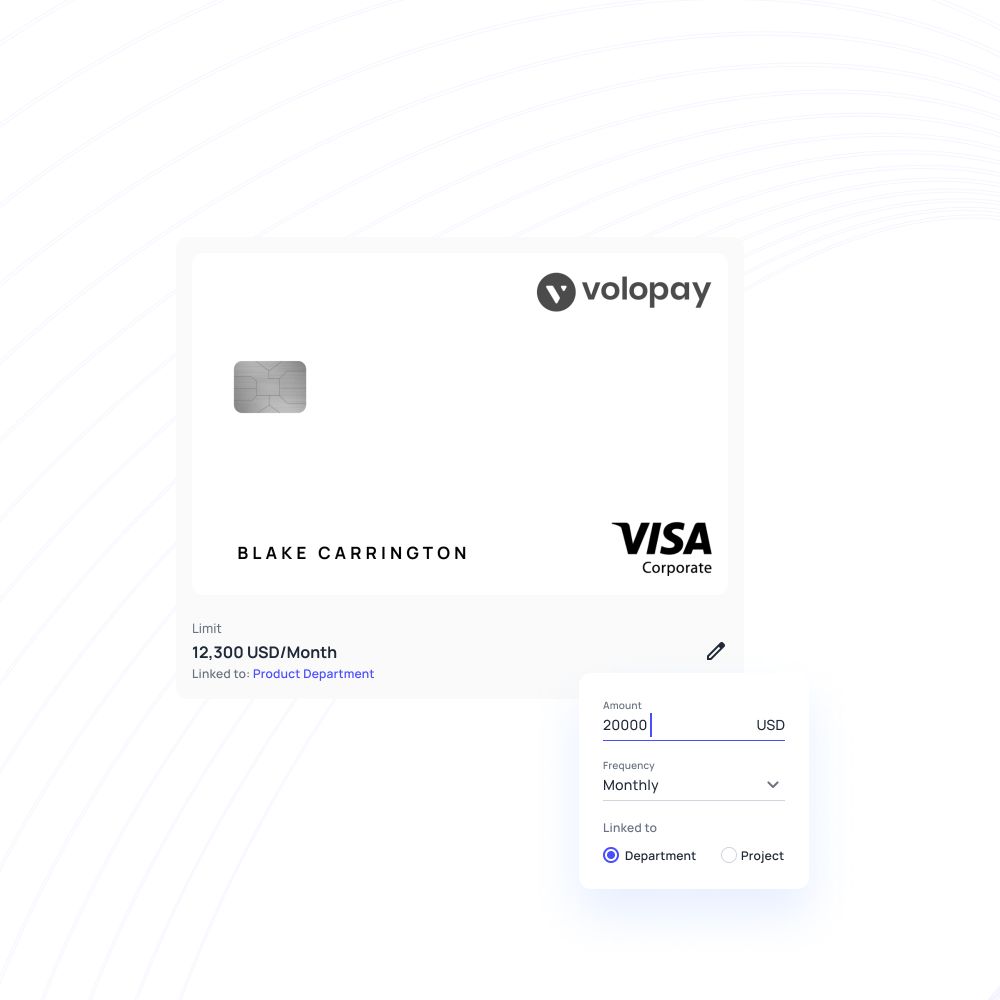

2. Set spending limits on each card

Implement spending limits on each corporate virtual credit card to control expenses effectively, including marketing expense management.

Customize these limits according to roles and responsibilities within your business. This practice ensures you control spending and align financial management with operational needs, maintaining discipline and avoiding overspending.

3. Manage employee authorization

Carefully manage who is authorized to use corporate virtual cards. Assign cards only to trusted employees, and regularly review and update authorization lists.

This process helps you maintain control, prevent unauthorized use, and ensure that only appropriate personnel have access to the cards.

4. Utilize a centralized platform

Use a centralized platform to manage all your virtual corporate cards. Ensure the platform offers real-time transaction visibility, easy card issuance and deactivation, and streamlined expense tracking.

Centralizing management simplifies oversight and helps you maintain control over your business’s financial transactions.

5. Monitor expenses regularly

Regularly monitor expenses made with corporate virtual cards. Review transactions frequently to identify any discrepancies or unusual activity.

Staying vigilant ensures you are aware of your financial status and can address issues quickly, maintaining accurate records and preventing potential problems.

6. Provide employee training

Train your employees on the proper use of virtual corporate cards.

Educate them about your policies, spending limits, and the importance of accurate expense reporting to promote responsible card usage, ensure compliance with your business standards, and minimise the risk of errors or misuse.

7. Enforce spending controls

Enforce spending controls by setting up automated alerts and notifications for transactions exceeding limits or falling outside approved categories.

These controls help you maintain oversight, prevent overspending, and detect potential fraud, ensuring that your business remains within budget and secure.

Why choose Volopay as your virtual card provider

Volopay stands out in the crowded corporate virtual cards market by offering a comprehensive spend management platform that goes beyond simple card issuance to provide complete expense visibility and control.

Unlike traditional providers that focus solely on payment processing, Volopay integrates expense management, approval workflows, and accounting reconciliation into a single, unified platform that scales with your business growth.

The platform's design reflects a deep understanding of modern business needs, particularly for companies managing remote teams, multiple currencies, and complex approval processes.

Volopay's approach to virtual cards for business emphasizes automation, policy enforcement, and real-time insights that help finance teams maintain control while enabling operational efficiency across all departments and geographical locations.

Unified spend management platform

Volopay combines corporate cards, expense reporting, bill payments, and budget management in one comprehensive platform.

This integration eliminates the need for multiple vendors and provides complete spending visibility across all payment methods, enabling better financial control and streamlined operations.

Unlimited virtual card issuance

Create unlimited virtual corporate cards for different use cases, employees, or departments without additional per-card fees.

This flexibility allows you to implement granular spending controls and dedicated cards for specific purposes, from subscription management to vendor payments.

Policy-based spend controls

Configure sophisticated spending policies that automatically enforce limits, restrictions, and approval requirements based on user roles, merchant categories, and transaction amounts.

These policies ensure compliance with company spending guidelines while reducing manual oversight requirements for finance teams.

Integrates with your accounting stack

Seamlessly connect with popular accounting software, including QuickBooks, Xero, NetSuite, and more, enabling automatic transaction categorization and reconciliation. This integration eliminates manual data entry and ensures accurate financial reporting with minimal administrative overhead.

Supports multi-currency transactions

Handle international payments and multi-currency transactions with competitive exchange rates and transparent fee structures.

This capability is essential for businesses operating globally or working with international vendors and service providers requiring payments in various currencies.

Built for global and remote teams

Designed specifically for distributed organizations, Volopay enables easy card distribution and expense management across multiple locations and time zones.

Remote employees can access cards instantly while managers maintain real-time visibility into spending patterns and budget utilization.

Quick onboarding and dedicated support

Experience streamlined setup processes with dedicated customer success managers who ensure smooth platform adoption and optimal configuration for your business needs.

Ongoing support includes training, troubleshooting, and strategic guidance to maximize platform benefits.

Scales with your business needs

Volopay grows with your organization, accommodating increasing transaction volumes, additional users, and evolving spend management requirements.

Flexible pricing models and feature sets ensure you pay only for what you use while maintaining access to advanced capabilities as needed.

Issue virtual cards for every business use case

Create single-use virtual cards for business with predetermined spending limits and expiration dates for specific vendor payments or project expenses.

These cards automatically deactivate after use, providing security and preventing unauthorized transactions while simplifying vendor payment processes.

Issue dedicated cards for software subscriptions, service contracts, and recurring vendor payments with appropriate spending limits and merchant restrictions.

This approach provides clear expense categorization, prevents subscription overlap, and simplifies subscription management across departments and providers.

Distribute departmental budget cards that enable team leads to manage their allocated spending while providing finance teams with real-time budget utilization insights.

Each department receives cards configured with appropriate limits, merchant categories, and approval workflows that align with their specific operational requirements.

Finance-led spend, company-wide ease

Volopay's approach to corporate virtual cards empowers finance teams to maintain strict spending oversight while enabling operational teams to execute necessary purchases efficiently.

Our policy-driven automation ensures compliance with financial guidelines without creating bottlenecks that slow down business operations or frustrate employees who need to make legitimate business purchases.

This balance between control and convenience is achieved through intelligent automation that handles routine approvals, real-time monitoring that flags unusual activities, and comprehensive reporting that provides complete spending visibility.

Finance teams can focus on strategic activities while maintaining confidence that all spending aligns with company policies and budget constraints.

Real-time spend visibility

Access comprehensive dashboards showing all transaction activity, budget utilization, and spending trends across departments, projects, and individual cardholders.

This immediate visibility enables proactive budget management and helps identify spending patterns that require attention or optimization.

Smart spend limits by role

Configure role-based spending limits that automatically adjust card capabilities based on employee positions, departments, and responsibilities.

These intelligent controls ensure appropriate spending authority while preventing unauthorized transactions and maintaining budget discipline across the organization.

Automated multi-level approvals

Implement sophisticated approval workflows that route purchase requests through appropriate managers and stakeholders based on transaction amounts, merchant categories, and company policies.

These automated processes eliminate manual delays while ensuring proper oversight and compliance with spending guidelines.

FAQ's

Right now, Volopay virtual cards are available in Singapore, Australia, India, Singapore, Indonesia, and the Philippines.

Virtual cards are legal to use for both customers and business users. They are accepted everywhere for online transactions. As long as you get your virtual cards from a valid provider, you won’t land in trouble. As they exist online, it’s impossible for others to steal your card information. So, they are safe to use too.

Volopay virtual cards are multi-purposeful. They can be used in eCommerce platforms and online payment gateways of vendors. Your employees can use virtual cards to book flight tickets, make hotel reservations, and buy equipment online. You can automate your monthly SaaS payments using virtual cards.

In-store payments are possible with virtual cards if you connect them to mobile wallet applications. But this is available in certain locations only. You can connect your virtual card with Google Pay (Singapore users) or Apple Pay (Australian users) and use them to scan and pay.

Yes, corporate virtual cards can be used for travel and entertainment expenses, provided the vendor accepts virtual payments. You can issue virtual corporate cards for specific trips or events, set spending limits, and monitor transactions in real-time, ensuring that your business travel expenses remain controlled and within budget.

Corporate virtual cards can seamlessly integrate with various expense management systems. This integration allows you to automate expense tracking, streamline reporting, and maintain accurate financial records. Using a centralized platform, your business can enhance efficiency and reduce manual entry errors.

If a corporate virtual credit card is lost or compromised, you can instantly deactivate it through your management platform. This immediate action minimizes the risk of unauthorized transactions and financial loss. You can then issue a new corporate virtual credit card without any delay, ensuring continuity in your business operations.

Virtual credit cards for business differ from traditional corporate credit cards in several ways. They are digital and lack a physical form, offering enhanced security and flexibility. Virtual corporate cards can be issued instantly, customized for specific uses, and easily managed through a centralized platform, providing your business with greater control over expenses.

Corporate virtual cards are managed with robust compliance and audit trails. Every transaction is recorded in real time, providing detailed reports and visibility into spending patterns. This transparency helps your business maintain compliance with financial regulations and simplifies the auditing process, ensuring accountability and accurate financial management.