What is a remittance and how to send one?

With the opening of global markets for trade activities, the payment mechanism also needed a secure and reliable mode for monetary purposes.

People travelled across borders with the motives of high-paying jobs, career advancement opportunities, and permanent citizenship. The massive rise in international transfers was witnessed in sending money to family and friends back home.

To expand their customer base and explore new markets, businesses began with importing and exporting activities. Therefore, they required a centralized medium for transferring goods and services in exchange for money. As businesses grew globally, international money transfers became crucial to ensuring smooth cross-border payments.

This article walks you through the fundamentals of remittance transfer and how companies can send and receive international payments through remittance wire transfer.

What is remittance?

If you've ever sent or received money across borders for business, you're already familiar with the concept of remittance. At its core, remittance refers to the transfer of funds from one party to another, typically across international borders.

In a business context, this often involves payments made to settle invoices, fulfill contracts, or support subsidiaries in other countries. Understanding what is remittance helps you navigate the financial flows that keep global trade moving. Whether you're paying suppliers overseas or receiving funds from foreign clients, remittances play a vital role in international business operations.

How to send a remittance?

Understanding what is remittance isn’t just about definitions it’s also about knowing how to manage these payments efficiently. Whether you're paying overseas vendors or receiving international funds, the process of business remittance involves several important steps.

From initiating payments to tracking them in real-time, managing your company’s global financial operations requires the right tools and knowledge. Below is a breakdown of how remittances work in a modern business setting.

1. Initiating vendor payments

When you're ready to pay international suppliers, initiating a remittance is your first step. With a platform like Volopay, you can streamline vendor payments by selecting the invoice, choosing the currency, and authorizing the transaction often in just a few clicks.

This makes managing cross-border payments feel less like a chore and more like a routine. Knowing what is remittance and using modern solutions to handle it helps ensure your vendors are paid on time, wherever they are in the world.

2. Intermediary banks and networks

Once you’ve sent out a payment, the money doesn’t always go directly from your bank to the recipient. That’s where SWIFT networks and correspondent banks come in. These intermediaries help route your remittance through global banking systems, ensuring it reaches the right account securely.

This network is especially important when using traditional methods of remittance, like wire transfers. Understanding the role of these banks gives you a clearer picture of the behind-the-scenes process.

3. Transaction processing

After your payment is initiated, your bank verifies the transaction details, checks for compliance, and starts the fund settlement process. This is a critical part of what is remittance, especially in the context of business payments where larger amounts and multiple regulations are involved.

Funds are typically converted to the local currency and settled into the recipient’s account after all checks are complete. No matter the methods of remittance you use, this step ensures accuracy and security.

4. Real-time payment tracking

One of the advantages of using platforms like Volopay is the ability to track your remittance in real time. You don’t have to guess when your vendor will receive the funds—status updates are available instantly.

This visibility gives you more control over your cash flow and helps strengthen relationships with overseas partners. By understanding how tracking ties into what is remittance, you can stay informed at every step of the transaction.

5. Managing fees and rates

Remittance isn’t free—there are fees and exchange rates to consider. Some banks charge flat fees, while others take a percentage or add hidden markups to currency conversions.

With modern methods of remittance, such as digital payment platforms, you can often access more transparent pricing and better rates. Understanding these costs is essential to managing international business expenses effectively and gives you deeper insight into the practical side of what is remittance.

Types of business remittance

Now that you understand what is remittance and how it works, it's important to recognize the different ways it applies to your business. Each remittance type serves a distinct purpose, whether you're paying for services, managing payroll, or handling tax obligations.

Knowing the types of remittance that align with your company’s needs helps you stay compliant, efficient, and globally competitive. Below are the most common remittance types used in corporate finance.

1. Supplier remittance

One of the most frequent types of remittance you’ll deal with is supplier remittance. This involves sending payments to international vendors in exchange for goods or services. Whether you’re importing raw materials or outsourcing IT support, timely supplier remittance ensures that operations run smoothly.

Platforms like Volopay simplify this process, enabling you to choose cost-effective methods of remittance, manage currencies, and track delivery timelines. Mastering this type of transaction is essential for any business working with global partners.

2. Payroll remittance

If your team includes overseas employees or contractors, payroll remittance becomes a key function. This refers to transferring salaries or compensation to workers located in other countries.

Understanding this type of remittance is crucial not only for employee satisfaction but also for staying compliant with local labor laws and regulations. Using the right methods of remittance helps you process payments on time, avoid unnecessary fees, and maintain a professional image in the eyes of your global workforce.

3. Tax remittance

When operating internationally, you may be required to pay taxes in foreign jurisdictions. Tax remittance refers to transferring funds to settle your company’s obligations with foreign tax authorities.

This type of remittance can include VAT payments, corporate income taxes, or import/export duties. By choosing reliable methods of remittance, you reduce the risk of penalties and ensure that your business remains compliant with local financial regulations. It's a critical step in international operations that shouldn't be overlooked.

4. Intercompany remittance

If you manage a multinational business with branches or subsidiaries abroad, intercompany remittance becomes essential. This involves transferring funds between your own entities in different countries, often to support operations, manage liquidity, or reallocate resources.

Understanding what is remittance in this context allows you to streamline internal finance flows while meeting local regulatory requirements. Choosing efficient methods of remittance helps avoid delays and improves financial coordination across borders.

Methods of business remittance

Once you understand what is remittance and the various types of remittance your business may encounter, the next step is choosing the best way to send or receive those payments. The right method can make all the difference in cost, speed, and reliability.

Different methods of remittance suit different needs some are ideal for high-value vendor payments, while others work better for day-to-day business expenses. Here's a breakdown of the most commonly used remittance methods in corporate finance.

SWIFT transfers

If you're sending large payments to overseas vendors or suppliers, SWIFT transfers are one of the most trusted methods of remittance. These are secure, bank-to-bank transactions that operate on the global SWIFT network.

You initiate the payment from your business account, and it’s routed through intermediary banks before reaching the recipient. While SWIFT is a reliable solution for high-value remittances, it can involve processing fees and take several days to complete. Knowing what is remittance helps you better plan around these timelines.

Online payment platforms

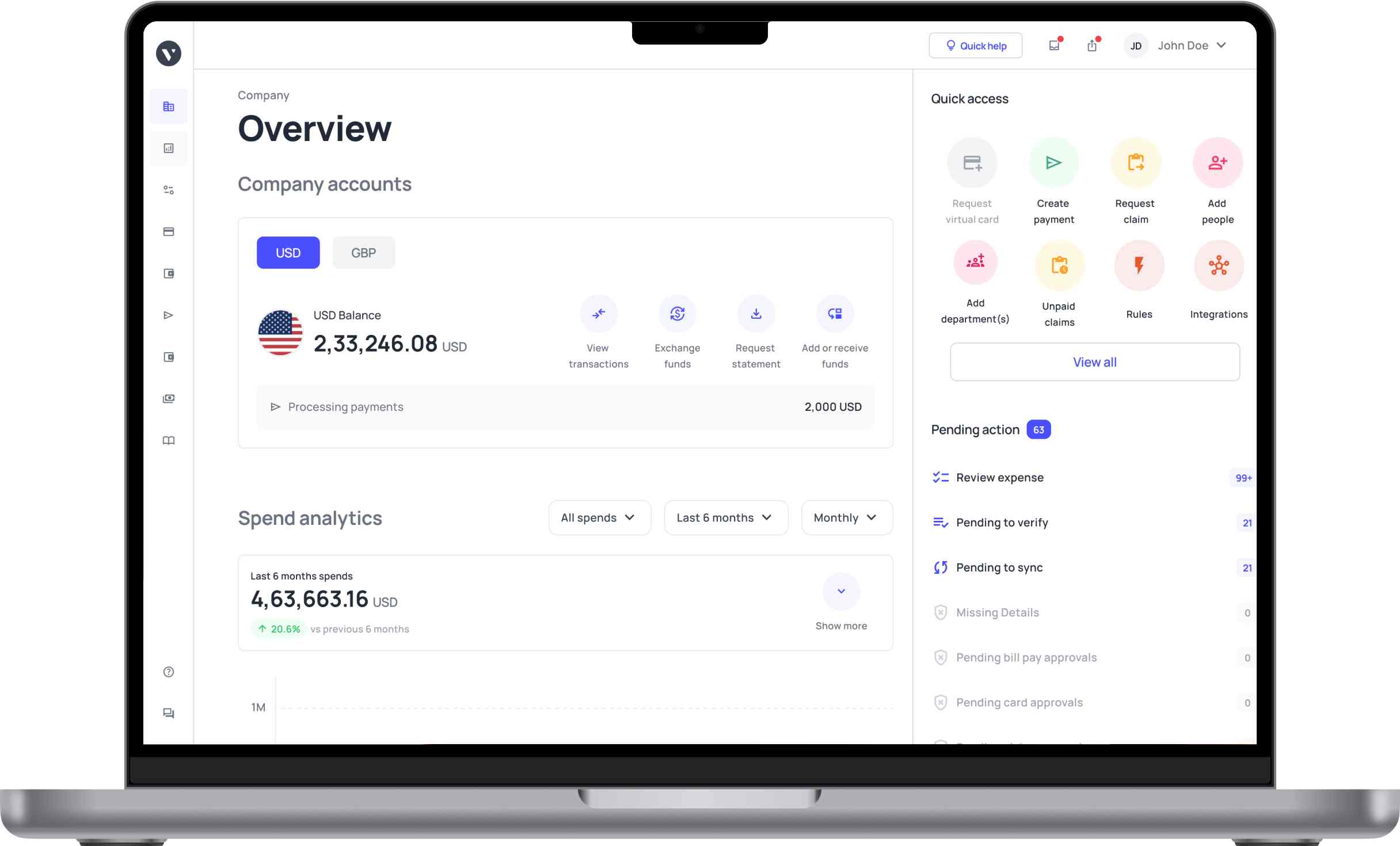

Digital platforms like Volopay are transforming the way companies handle business remittance. These tools offer user-friendly dashboards, multi-currency support, automated approval workflows, and real-time tracking.

They’re ideal if you want to reduce manual errors and streamline cross-border payments. As methods of remittance go, online platforms balance speed, cost-efficiency, and transparency. If you’re serious about optimizing your finance operations, this is one way to modernize how you manage global payments and better understand what is remittance in today’s digital age.

Virtual cards

Virtual cards are an emerging remittance method offering security and control for international transactions. You can issue single-use or recurring virtual cards to pay freelancers, SaaS providers, or small vendors globally.

These cards are tied to your expense management system, giving you detailed oversight on every transaction. They're one of the more flexible methods of remittance, especially for smaller or recurring cross-border expenses. If you’re seeking both fraud protection and convenience, virtual cards might be your go-to solution.

ACH and wire transfers

For domestic payments, ACH transfers are cost-effective and reliable. When dealing with international payments, wire transfers are more commonly used. Both are traditional methods of remittance, but they serve different purposes.

ACH is great for recurring payroll remittance or supplier payouts within the U.S., while wire transfers handle larger, one-time payments abroad. Understanding what is remittance in the context of these systems allows you to choose based on urgency, cost, and destination.

Selecting the right method

With so many methods of remittance available, how do you decide which one fits your needs? It depends on factors like transaction size, destination country, speed requirements, and fees. For high-value payments, SWIFT may be best.

For everyday expenses, online platforms or virtual cards offer efficiency. Matching the right method to the type of transaction not only saves you money but also helps streamline operations. Once you understand what is remittance and the tools at your disposal, making informed choices becomes second nature.

Differences between remittance and bank transfer

A bank transfer and remittance payment are essentially the same and fulfill the typical funds transfer. But there are some differences in the way they operate:

Meaning

A bank transfer is simply a money transfer from one account to another.

At the same time, a remittance is an international transfer between two identical or different banks.

Transfer speed

Remittance is an instant payment method. The money transfer happens expeditiously.

In comparison, the settlement time for an international bank transfer takes up to one or two working days.

Transaction fees

Remittance transfers usually have lower fees as compared to bank transfers.

Remittances have a fixed fee depending on the booking area, but bank transfer fees increase with the amount.

Mode of deposit

In a bank transfer, you cannot deposit the funds in cash. You can transfer from the bank’s net banking services or the linked debit or credit card.

On the other hand, you can bring in the cash and transfer the amount without any hassle.

Business remittance vs. other corporate payments

Once you’ve grasped what is remittance and explored various types of remittance, it helps to distinguish it from other common corporate payment methods.

While all business payments serve financial operations, remittance specifically refers to transferring funds usually across borders for defined purposes like vendor payments or payroll. Let’s break down how remittance compares to other transaction types you may be using.

Remittance vs. wire transfers

While both involve transferring money electronically, remittance focuses on purpose-driven, often cross-border payments like paying suppliers or employees.

Wire transfers, on the other hand, refer to the mechanism of sending funds, typically used for both domestic and international transactions.

Knowing what is remittance helps you recognize it as a business need, while wire transfers are just one of the methods of remittance used to fulfill that need.

Remittance vs. ACH payments

ACH payments are ideal for domestic transfers within the U.S., such as paying local vendors or utilities. Remittance, by contrast, addresses international payment needs.

If your business operates globally, you’ll need remittance tools that handle foreign currencies and regulatory compliance.

Understanding the types of remittance will help you determine when to use an ACH transfer and when a cross-border remittance solution is required.

Remittance vs. card payments

Corporate cards are convenient for day-to-day expenses like travel, software subscriptions, or team lunches. Remittance, however, is designed for transferring funds, especially to external recipients abroad.

While cards offer instant payments, methods of remittance focus on moving money directly from your business account to another party, often through platforms like Volopay or SWIFT.

The use case and financial oversight differ significantly across industries, company sizes, compliance needs, and market conditions.

Remittance vs. internal transfers

Internal transfers typically refer to moving funds within the same company, such as between departments or domestic bank accounts.

Remittance, especially intercompany remittance, involves moving money across borders between subsidiaries or to external entities.

Recognizing this difference ensures you use the appropriate tools and compliance protocols depending on the transaction's nature and destination.

Choosing the best option

The right payment method depends on your goals—are you paying a vendor overseas, reimbursing an employee, or shifting funds internally?

When you understand what is remittance and the methods of remittance available, you can select the best tool for each scenario.

Platforms like Volopay help centralize these options so you can manage them all in one place.

Benefits of streamlined business remittance

Now that you know what is remittance, the different types of remittance, and the best methods of remittance, it’s time to look at the upside—what your company gains by managing remittances effectively.

Streamlined business remittance doesn’t just save time; it enhances your entire financial operation. With the right systems in place, you can reduce costs, improve relationships, and ensure your cross-border payments support growth rather than slow it down.

Reduced transaction costs

Using a platform like Volopay allows you to cut down on excessive banking fees and avoid unfavorable currency markups. Traditional methods of remittance often come with hidden charges that eat into your margins.

By optimizing how you handle payments, you save more with every transfer. Understanding what is remittance and choosing low-cost digital tools ensures that more of your money goes to its intended purpose, not to intermediary fees.

Faster payment cycles

Quick, predictable payments build trust with your global vendors. With streamlined methods of remittance like real-time payments and automated workflows, you can complete transactions in hours instead of days.

This speed strengthens vendor relationships and secures better terms for future contracts. Knowing what is remittance helps you appreciate the business impact of fast, efficient transfers.

Improved cash flow

Efficient remittance processes allow you to better time your outgoing payments and avoid liquidity crunches. You can schedule disbursements strategically, giving your business more breathing room.

Understanding types of remittance also helps prioritize payments like payroll versus supplier invoices—so you can allocate cash where it’s needed most. This proactive management keeps your operations running smoothly.

Enhanced compliance

Cross-border payments come with complex regulations, from OFAC rules in the U.S. to international KYC/AML requirements. A well-managed remittance process ensures you stay compliant with all applicable laws.

Volopay and similar platforms automate much of this work, helping you avoid fines or failed transactions. Once you grasp what is remittance, it becomes easier to see how critical compliance is to your global strategy.

Greater transparency

Having a real-time view of your international payments gives you more control over your finances. With digital methods of remittance, you can track every transaction from initiation to settlement.

This visibility not only supports better reporting but also protects against fraud and errors. The more you understand what is remittance, the more confident you’ll feel making data-backed decisions for your business.

Challenges in business remittance

Even with a solid understanding of what is remittance and the various methods of remittance, managing cross-border payments isn’t always smooth sailing. From high costs to regulatory complexity, businesses often face real hurdles in their global payment processes.

Fortunately, modern tools like Volopay are designed to solve many of these issues. Let’s explore the most common challenges in business remittance and how you can overcome them.

1. High transaction fees

Traditional banks often charge hefty fees for international transfers, especially for certain types of remittance like large supplier payments. These costs can quickly add up, reducing your profit margins.

With Volopay, you get a more cost-effective alternative that offers competitive FX rates and lower transaction charges. Understanding what is remittance empowers you to choose platforms that help your business save with every transfer.

2. Payment delays

Bank transfers especially SWIFT can take several days to complete, causing delays in vendor settlements and payroll disbursements. These slowdowns can strain relationships and disrupt operations.

Using faster methods of remittance, such as Volopay’s real-time transfers, reduces turnaround time and keeps your financial commitments on track. Once you fully understand what is remittance, avoiding delays becomes a priority.

3. Exchange rate risks

Currency volatility can erode the value of your remittance before it reaches the recipient. This is especially problematic for recurring payments like payroll or supplier invoices.

Volopay helps reduce this risk by offering multi-currency wallets and real-time FX rate. Managing types of remittance with this level of control allows you to protect your bottom line in a fluctuating global economy.

4. Compliance complexity

Each country has its own financial regulations, from KYC to anti-money laundering policies. Navigating this compliance landscape is one of the more difficult parts of handling business remittance.

Volopay simplifies this process with automated compliance checks, audit trails, and built-in regulatory frameworks. When you grasp what is remittance in a global context, staying compliant becomes a manageable not overwhelming task.

5. Fraud risks

International transactions are vulnerable to fraud, phishing, and data breaches. Without the right security protocols, your business could be exposed.

Volopay addresses these risks with bank-grade encryption, two-factor authentication, and real-time monitoring. Among the many methods of remittance, secure digital platforms offer peace of mind that your funds are protected at every step.

Best practices for business remittance

Once you understand what is remittance, the various types of remittance, and the potential challenges, the next step is mastering how to manage the process efficiently. By following best practices, you can make your international payments more secure, cost-effective, and compliant.

Whether you're just starting or looking to improve existing workflows, these tips will help you optimize your company’s remittance strategy using the most effective methods of remittance available.

Evaluate providers

Before committing to a remittance provider, take time to compare fees, exchange rates, payment speed, and customer support. Not all methods of remittance offer the same value. Look for platforms that specialize in business payments and provide clear, transparent pricing.

By understanding what is remittance, you’re better equipped to choose a provider like Volopay that aligns with your financial goals and offers the tools needed for international success.

Automate payments

Setting up automated workflows for recurring payments like payroll or vendor invoices saves time and reduces manual errors. Volopay allows you to schedule and approve transactions in advance, streamlining your remittance process.

Automation is one of the most efficient methods of remittance, especially when dealing with multiple currencies or frequent cross-border transfers. Knowing what is remittance empowers you to simplify and scale your global payment operations.

Monitor transactions

Real-time tracking is essential for maintaining control over your financial operations. With platforms like Volopay, you can monitor every remittance from initiation to settlement, ensuring nothing falls through the cracks.

This visibility gives you actionable insights and supports better cash flow planning. Once you’re familiar with types of remittance, keeping a close eye on transactions becomes second nature.

Ensure regulatory compliance

Cross-border payments must meet both U.S. regulations and the requirements of recipient countries. Staying compliant involves accurate documentation, identity verification, and transaction transparency.

Volopay simplifies this by embedding compliance tools directly into the platform. Understanding what is remittance helps you stay on the right side of the law while expanding your business internationally.

Secure payment systems

Fraud and data breaches are serious risks in global payments. Always use platforms that offer end-to-end encryption, multi-factor authentication, and secure APIs. Volopay prioritizes security, helping you safeguard sensitive payment data.

Among all the methods of remittance, secure digital systems are your best defense against cyber threats. The more you know about what is remittance, the more you’ll value security as a critical component of your remittance strategy.

Are remittances taxable?

Remittances are taxable depending on the federal law of each country. Some countries deduct taxes on any amount of remittances. Also, remittances in the form of gifts are tax-bound. But there is a ceiling after which the taxes are deducted.

But because remittance transfers are counted as an income for the recipient and contribute to the GDP, it is always taxable.

In countries like India, inward remittances are not subjected to taxes if you are an NRI. Likewise, in the US, a significant portion of the remittances are not tax-bound.

How Volopay simplifies business remittance

Now that you’ve explored what is remittance, the various types of remittance, and the common challenges businesses face, let’s look at how Volopay simplifies the process.

Designed for modern finance teams, Volopay offers an all-in-one platform that streamlines business money transfers, improves oversight, and cuts costs, making it one of the most effective methods of remittance for businesses today.

Cost-effective transfers

Volopay eliminates the heavy fees you typically face with traditional banking systems. With an affordable fee structure and competitive FX rates, your business can save significantly on international transfers. Once you understand what is remittance, Volopay helps you do it more affordably.

Multi-currency payments

With support for over 65 currencies, Volopay allows you to make and receive payments across a wide range of markets. This capability is essential when managing different types of remittance, from supplier payments to payroll payments, without losing money on conversions.

Seamless integrations

Volopay integrates smoothly with accounting software like Xero, QuickBooks, and NetSuite. These integrations ensure your remittance data is automatically synced with your financial reports, eliminating manual entry and reducing reconciliation errors one more way it supports smart methods of remittance.

Automated workflows

You can automate recurring payments to vendors, employees, or subsidiaries using Volopay’s customizable workflows. Set approvals, payment dates, and amounts in advance. Once you know what is remittance, automating it with Volopay saves time and minimizes mistakes.

Global reach

Volopay enables remittances to over 130 countries, supporting your business as it scales internationally. Whether you're expanding operations or onboarding a foreign supplier, you can confidently send payments with reliable tracking and full compliance. It’s a comprehensive solution among modern methods of remittance.

FAQs

The primary documents include the sender’s home country’s passport, beneficiary passport copy, and bank statement.

No. But if the receiver does not acknowledge the remittance, a non-refundable fee will be charged after one to three years.

The one who intends to send money across the border is said to be the remitter. In simple terms, the sender of funds.

Volopay offers an affordable fee structure and competitive exchange rates, significantly reducing the cost of international transfers. By minimizing fees typically charged by traditional banks, Volopay makes global remittance more affordable for your business, helping you save on each transaction.

Yes, Volopay supports remittance to over 130 countries. This global reach makes it an ideal solution for businesses with international suppliers, ensuring that you can manage payments to vendors anywhere in the world, efficiently and reliably.

Volopay uses bank-grade encryption to protect your sensitive data during all business remittance transactions. With features like two-factor authentication and real-time monitoring, your remittances are secure, reducing the risks associated with fraud and data breaches.

Volopay provides a variety of methods of remittance, including SWIFT transfers, virtual cards, and real-time payment systems. These options allow your business to choose the most efficient and cost-effective way to send payments internationally, all through a single platform.

Volopay seamlessly integrates with accounting platforms like QuickBooks, Xero, and NetSuite. This integration allows for automatic syncing of remittance data, simplifying reconciliation and ensuring accurate financial reporting, saving time for your accounting team.