Remittance advice - Definition, types, and template

In today's interconnected global economy, financial transactions occur across borders with remarkable frequency. Among the myriad of financial tools facilitating these transactions, remittance advice stands out as a crucial component to help businesses keep track of payments made and for the reconciliation of accounts.

This comprehensive guide aims to elaborate on what is remittance advice, the importance it holds for an organization’s finance department, the different types of remittance advice, the information such a document must include, challenges faced when sending remittance advice, and its practical applications in business finance.

What is remittance advice?

Remittance advice, often abbreviated as "RA," serves as a document sent by a customer to a supplier, informing them of a payment made. It notifies the supplier of the payment's purpose, amount, and date.

Remittance advice serves as a receipt detailing transaction specifics, ensuring transparency and smooth financial operations. It typically includes the invoice number, payment amount, date of payment, and relevant reference numbers.

Different organizations have slightly different structures for their remittance advice, but they largely remain the same. This documentation is vital for both the payer and the payee, as it serves as a record of the transaction and aids in accounts reconciliation.

Why is remittance advice important?

There is consistent evolution around accounting and payment methods. If you have observed, small and medium-sized businesses are moving from traditional payment methods like a check to digital payment solutions, ACH, wire transfer, and remittance transfers through online wallets.

As a rule, remittance advice has always been sent along with the check to the vendor. As we are leaning away from the check/cash payments, why is a remittance receipt still in the picture?

A remittance slip, often overlooked in its simplicity, holds significant importance in financial transactions.

Here's a deeper dive into specific aspects of this document that outline why it's so crucial:

1. Act of courtesy

In the world of business, professionalism and courtesy go hand in hand. Including remittance advice with the payment signals to suppliers that you value transparency and clear communication.

It's like saying, "Here's your payment, and here's all the relevant information about it." This act of transparency fosters trust and goodwill between parties, laying the groundwork for enduring business relationships.

2. Improved vendor relationships

In any business relationship, trust is paramount. Timely and accurate remittance advice goes a long way in nurturing this trust. When suppliers receive prompt notification of payments along with detailed information, it demonstrates reliability and commitment on the part of the payer.

This, in turn, strengthens the bond between suppliers and customers, paving the way for smoother transactions and potentially more favorable terms in the future. The vendors themselves are more likely to support and help your business in ways they might not help others due to your professionalism.

3. Invoice matching

One of the practical functions of remittance advice is its role in invoice matching. By providing comprehensive payment details such as invoice numbers, payment amounts, and dates, remittance advice simplifies the process of reconciling payments with outstanding invoices.

It makes the task of reconciling payments for the finance teams of both businesses much easier. This reduces the likelihood of discrepancies or disputes, saving both parties time and effort in resolving payment-related issues.

4. Streamlines record-keeping

In today's complex business landscape, accurate record-keeping is non-negotiable. Remittance advice serves as a vital tool in this regard.

By documenting payment details in a clear and structured manner, it streamlines the task of maintaining financial records. Whether for internal audits, regulatory compliance, or strategic financial analysis, having well-documented remittance advice facilitates accurate and efficient record-keeping practices.

5. Reduces errors

Errors in payment processing can have costly repercussions for businesses. However, detailed remittance advice serves as a safeguard against such errors.

By providing a clear breakdown of payment information, including the purpose of the payment and any relevant reference numbers or codes, remittance advice minimizes the likelihood of misunderstandings or misallocations. This not only saves time and resources but also helps maintain the integrity of financial data.

6. Supports efficient accounting

Efficiency is the lifeblood of any accounting department. Remittance advice plays a crucial role in supporting this efficiency by expediting the reconciliation process. With all the necessary payment details readily available, accountants can quickly match payments to invoices, verify transactions, and update records accordingly.

It aids even if you use an expense management system for your business. This frees up valuable time and resources that can be redirected towards more strategic financial tasks, ultimately contributing to better financial management and decision-making.

Streamline your remittance advice payments with ease

Learn moreTypes of remittance advice

In the intricate web of financial transactions, remittance advice takes on various forms, each tailored to meet specific needs and preferences. Below, we delve into the different types of remittance advice and their respective ideal use cases:

Basic remittance advice

Considered the fundamental form of remittance advice, the basic version provides essential payment details in a clear and concise format.

Typically, it includes mainly vital information such as the payment amount, invoice number, payment date, and any relevant reference numbers or codes.

This type of remittance advice is particularly suitable for payment transactions where comprehensive details are not necessary. It is adequate for routine payments or transactions with trusted partners, basic remittance advice suffices to convey the necessary information without overwhelming recipients with extraneous details.

Removable invoice advice

In certain scenarios, physical documentation remains essential despite the prevalence of digital transactions.

Removable invoice advice incorporates a detachable portion that serves as a convenient payment stub or receipt. This allows recipients to easily detach and retain a physical record of the transaction while processing the payment electronically.

Commonly utilized in situations where traditional payment methods such as checks are still prevalent or where regulatory requirements mandate the retention of physical records, removable invoice advice offers a seamless blend of digital convenience and tangible documentation.

Scannable remittance advice

In an era dominated by automation and digitization, businesses seek ways to streamline their payment processing workflows and minimize manual intervention.

Scannable remittance advice addresses this need by incorporating machine-readable elements such as barcodes or QR codes into the documentation. These codes encode key payment information for quick and accurate scanning and processing by automated systems.

By leveraging scannable remittance advice, businesses can cut down on time and resources required for manual data entry and reconciliation and aim to optimize accuracy, and efficiency in payment processing.

Who uses remittance advice?

A remittance slip serves as a vital tool in the financial ecosystem, utilized by many to facilitate transparent and efficient transactions. Let's explore the key users of remittance advice:

1. Businesses

Businesses of all sizes and sectors, no matter how big or small, rely on remittance advice to streamline their payment processes. Whether paying suppliers, vendors, or service providers, businesses utilize remittance advice to communicate essential payment details accurately.

By providing clarity regarding payment amounts, invoice references, and transaction dates, businesses ensure smooth financial transactions and maintain healthy supplier relationships.

2. Banks

Banks play a pivotal role in the processing and verification of payments. Remittance advice serves as a crucial tool for banks to reconcile incoming payments with customer accounts.

By cross-referencing the information provided in remittance advice with transaction records, banks verify the authenticity of payments, detect potential discrepancies, and allocate funds promptly and accurately. This enhances the efficiency of fund management and fosters trust between banks and their customers.

3. Insurance companies

Remittance advice plays a pivotal role in premium collection and claims settlement processes. Insurance companies rely on remittance advice to track and verify premium payments from policyholders. Additionally, when processing claims, insurers utilize remittance advice to reconcile payments with policy terms and coverage details.

Ensuring timely and accurate disbursement of funds is crucial when it comes to claiming your insurance policy. This transparency in financial transactions enhances customer satisfaction and promotes trust in insurance providers.

4. Government agencies

Government entities, entrusted with public funds, leverage remittance advice to facilitate revenue collection and expenditure management.

Tax authorities utilize remittance advice to track tax payments from individuals and businesses, ensuring compliance with tax regulations. Similarly, social service agencies use remittance advice to disburse benefits and subsidies to eligible recipients, maintaining transparency and accountability in welfare programs.

By leveraging remittance advice, government agencies can track and manage public funds effectively, promoting fiscal responsibility and trust in government institutions.

What information should remittance advice include?

Remittance advice serves as a crucial document in financial transactions, providing essential details to both the payer and the payee. Here's a breakdown of the key information that should be included in remittance advice:

1. Payer information

The remittance advice must clearly outline details about the entity making the payment. This includes the payer's name, address, contact information, and any pertinent identification or account numbers.

By providing comprehensive payer information, the remittance advice facilitates easy identification and verification of the source of the payment. This helps the payee identify from whom and when the payment was made.

2. Payee information

Similarly, comprehensive details about the recipient of the payment must be included in the remittance advice. This encompasses the payee's name, address, contact details, and any relevant identifiers such as account numbers or vendor codes.

Clear payee information ensures accurate allocation of funds and enables seamless reconciliation of payments on the recipient's end. It helps the payer understand to whom the payment has been made.

3. Invoice number and date

To facilitate precise reconciliation of payments with outstanding invoices, the remittance advice should reference the invoice(s) being settled.

This includes the invoice number(s) and the date(s) of issuance, enabling the payee to match the payment with the corresponding invoices accurately. This is to make sure that the payment has been made for the correct invoice.

4. Payment amount

This is one of the most basic pieces of information that the remittance advice must include—explicitly stating the amount being paid.

By clearly indicating the financial value of the transaction, the remittance advice eliminates ambiguity and ensures both parties are in agreement regarding the payment amount.

5. Payment date

Including the date on which the payment was made is essential for tracking and recording purposes.

The payment date enables the payee to accurately timestamp the transaction and facilitates timely reconciliation of accounts. Including the date on the remittance advice also helps finance teams sort documents and improves accessibility.

6. Payment mode

Specifying the method utilized to make the payment is crucial information that should be included in a remittance slip. It helps the payer and the payee check for transactions of that particular payment method and easily track them.

Whether the payment was made via check, electronic transfer, credit card, or any other means, providing details about the payment mode aids in reconciling the payment with the payer's records.

7. Expected date of payment delivery

Certain payment methods do not transfer money immediately. They take time and the money is transferred at a later date.

In scenarios where payment delivery may be delayed, such as with physical checks or certain electronic transfers, it's beneficial to include the expected date of payment delivery. This allows the payee to anticipate the arrival of funds and plan accordingly.

8. Tax information

In instances where tax considerations are relevant to the transaction, remittance advice may need to incorporate pertinent tax information.

This could include tax identification numbers, details regarding tax deductions or withholdings, or any other tax-related information necessary for compliance and reporting purposes.

9. Additional notes or messages

Lastly, providing space for additional notes or messages can enhance the clarity and context of the transaction.

Whether conveying instructions, referencing specific agreements or contracts, or communicating any other relevant information, including additional notes facilitates clear communication between the payer and payee.

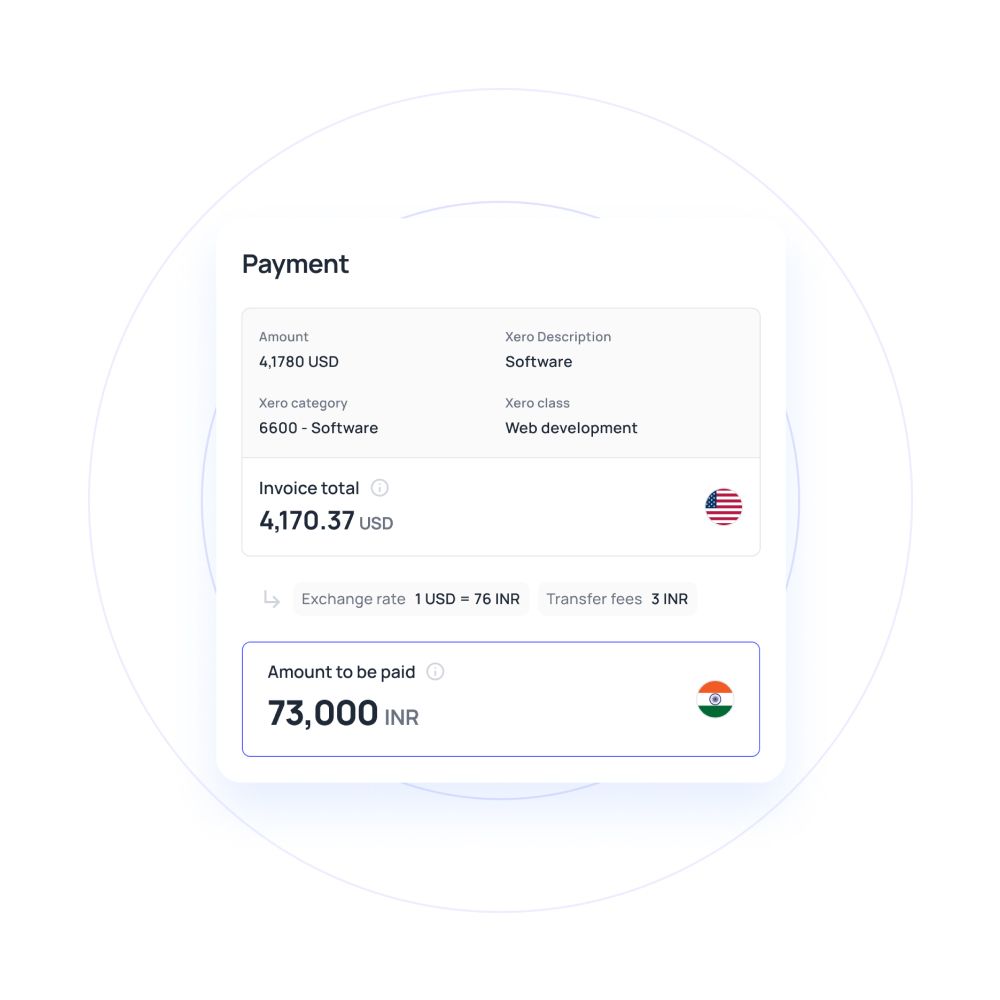

Remittance advice template

Here is an example of a simple remittance advice:

As you can see in the example above, the remittance advice contains important information such as the date it was generated, the name and address of the payee, the invoice number, the amount paid, and the date on which payment will be credited to the payee’s bank account.

Want to send a remittance advice to your vendors?

Try Volopay nowHow to send remittance advice?

In today's digital age, businesses have a multitude of options to send remittance advice to their counterparts. Here's a detailed look at the various methods available:

Send as a slip

A traditional yet effective method involves physically attaching a remittance advice slip to the payment. This slip accompanies the payment when delivered to the recipient.

This method is very helpful when there is a delivery of physical goods by transporters through whom the remittance advice can be sent back.

Send by fax

While somewhat antiquated compared to modern digital methods, faxing remains a viable option for transmitting remittance advice.

This method involves using a fax machine to send a copy of the remittance advice document to the recipient's fax number. This method is not very common in the modern era.

Send by post

For those who prefer a more tangible approach, remittance advice can be sent via traditional mail services. The sender prints out the remittance advice document and dispatches it to the recipient's postal address.

This is also a similar method to sending a slip but is a little more costly or time-consuming depending on the courier method.

Send by email

Email has become a preferred mode of communication for its speed and convenience. Sending remittance advice via email allows for rapid delivery, instant access by the recipient, and easy archiving for future reference.

There probably isn’t any other method that can beat the speed and convenience of sending a remittance advice document through email.

Electronic Data Interchange

Electronic data interchange (EDI) systems enable the electronic exchange of business documents, including remittance advice, between trading partners.

This method ensures secure and standardized transmission of payment details, eliminating the need for manual intervention and reducing the risk of errors.

Let the software do it for you

With advancements in technology, businesses can automate remittance advice generation and delivery using specialized accounting or payment processing software, which integrates seamlessly with payment workflows.

This saves time and effort while ensuring consistency and accurate payment information delivery of the remittance advice.

Differentiating remittance advice from proof of payment and payment remittance

Remittance advice, proof of payment, and payment remittance serve distinct purposes, each playing a crucial role in facilitating transparent and efficient payments. Here's a breakdown of the differences between these three concepts:

Remittance advice, often abbreviated as "RA," is a document sent by a payer to a payee, providing detailed and concise information about a transaction that has been made or is being made.

Remittance advice typically includes important details such as the payment amount, invoice number, payment date, and any additional notes or messages related to the transaction.

It is an essential communication tool, facilitating reconciliation of payments and ensuring documentation accuracy.

It also promotes transparency between all parties involved in financial transactions, which is crucial for maintaining trust and clarity throughout the payment process.

Proof of payment refers to documentation that serves to verify the completion of a financial transaction, providing a tangible record that confirms the transfer of funds.

This documentation can take various forms, such as a receipt, bank statement, or confirmation email, depending on the payment method used.

Unlike remittance advice, which primarily serves to communicate payment details to the recipient, proof of payment serves as a tangible evidence that a payment has been made.

Hence, it can be used for record-keeping, auditing, and resolving disputes effectively between parties involved in financial transactions.

Payment remittance, also known simply as remittance, refers to the transfer of funds and a proof of payment from one party to another as part of a payment transaction.

It encompasses the entire process of initiating, authorizing, and executing a payment, from the point of initiation by the payer to the receipt of funds by the payee.

Payment remittance involves various intermediaries, such as banks or payment processors, depending on the payment method used.

Unlike remittance advice, which is a communication tool, payment remittance facilitates and executes the actual transfer of funds between parties.

Challenges with remittance advice

Despite being a critical component of financial transactions, remittance advice encounters several challenges that can hinder its efficacy. Let's delve into some common hurdles associated with remittance advice:

Inconsistency in formats

One of the primary challenges is the lack of standardized formats for remittance advice. Different businesses and industries may use varying templates or methods for conveying payment information, leading to confusion and inefficiencies in payment processing and reconciliation.

Data entry errors

Manual entry of remittance advice information is susceptible to human errors. Typos, misinterpretation of handwriting, or misprinting/modification of numbers, can result in inaccuracies in payment details, potentially leading to discrepancies in accounting and financial records.

Manual processing

Traditionally, remittance advice generation and processing have relied heavily on manual methods. This manual process not only increases the likelihood of errors but also consumes time and resources, leading to delays in payment processing and reconciliation.

Security concerns

Remittance advice often contains sensitive financial information, including bank account details and payment amounts. Transmitting such information electronically or via paper documents poses security risks, such as interception or unauthorized access, potentially exposing both the payer and payee to fraud or data breaches.

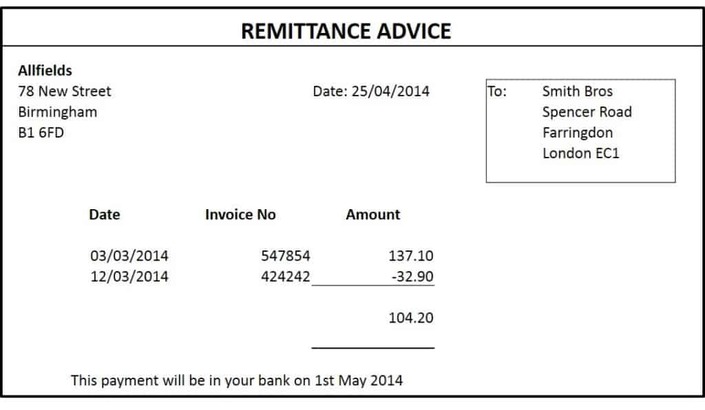

Difficulty with international payments

Cross-border transactions introduce additional complexities to remittance advice processing. Factors such as currency conversions, compliance with foreign regulations, and differences in banking systems can complicate the generation, transmission, and interpretation of remittance advice, making international payment processing more challenging than domestic transactions.

How can Volopay help with remittance advice challenges?

Volopay is a financial solution provider that offers corporate cards, automated expense management, accounting integrations and business accounts that streamline financial operations, helping businesses save time and money while elevating the role of their finance teams.

Volopay's desktop and mobile platforms include expense management features to manage day-to-day expenses, accounts payable, and automation workflows to make managing finances easier.

Efficient invoice processing

Volopay streamlines invoice processing through automation, minimizing manual errors and ensuring the accuracy of payment details. The software is capable of automatically sourcing invoices from different sources like email and extract data automatically.

Real-time invoice tracking

With Volopay, users gain access to real-time tracking of invoices, enhancing transparency and enabling prompt action on outstanding payments. From entering the payment information from the invoices, all the way to the payment completion, each stage of the payment is recorded on the platform for reference purposes.

Seamless expense reporting integration

Volopay seamlessly integrates with existing expense reporting systems, simplifying the documentation and submission of expense reports for enhanced efficiency.

Simplified vendor payouts

Volopay facilitates easy and efficient vendor payouts, reducing administrative overhead and ensuring timely payments to suppliers, thereby strengthening vendor relationships. You get the option to choose from various different payment methods that make it easier to pay vendors faster.

Structured multi-level approval processes

Volopay provides structured multi-level approval workflows, enabling organizations to enforce compliance with internal policies and regulations while maintaining control over expenses. This ensures that no payment to a vendor goes unchecked. An authorization workflow ensures that payments are made only after approvals from seniors.

Accounting automation

Volopay automates various accounting processes, including expense tracking and reconciliation, streamlining financial operations, and improving accuracy in financial reporting. Volopay’s system is also capable of integrating with any accounting software in the market thanks to its Universal CSv feature, which makes the process of accounts payable easier for businesses.

Prepare and export expenses easily

With Volopay, users can effortlessly prepare and export expense reports in desired formats, saving time and effort in the reporting process and ensuring compatibility with existing accounting systems.

Faster expense and receipt reconciliation

Volopay expedites expense and receipt reconciliation processes, enabling faster identification and resolution of discrepancies, thereby facilitating quicker and more accurate financial analysis and reporting.

Supported by

We are proud to be supported by world's leading investors, founders and senior leadership of world's leading companies.

Bring Volopay to your business

Get started free

FAQs

Remittance advice is typically provided by the payer, whether it's an individual or a business entity. It serves as a notification to the payee about a payment made or to be made, along with relevant details.

No, remittance advice and invoices serve different purposes in financial transactions. While an invoice is a request for payment issued by the seller to the buyer, remittance advice accompanies the payment and provides details about the transaction, such as the payment amount, invoice number, and payment date.

Remittance advice is issued by the payer or their financial institution. It can be generated manually or automatically depending on the payment process and the systems used by the payer.

A remittance advice check is a payment instrument that includes remittance advice details along with the payment. It typically consists of a physical check accompanied by a detachable portion containing remittance advice information.

Yes, a remittance advice check can be cashed or deposited like any other check. The remittance advice portion of the check provides important details about the payment, such as the purpose, amount, and recipient.

The timing of remittance advice delivery depends on various factors, including the payer's internal processes, the chosen delivery method (e.g., mail, email), and the location of the recipient. It can range from immediate electronic delivery to several days for postal delivery.

Remittance advice is not mandatory for every transaction, but it is commonly used in business transactions to provide transparency and facilitate reconciliation between parties. Its usage may vary depending on the industry, payment method, and specific agreements between parties.

Inaccurate remittance advice can lead to payment disputes and may have legal implications depending on the specific circumstances and agreements between parties. It's essential for remittance advice to accurately reflect the details of the payment to avoid misunderstandings and disputes.

Yes, remittance advice can be sent electronically via email, Electronic Data Interchange (EDI), or other digital channels. Electronic delivery offers speed, convenience, and cost-effectiveness compared to traditional mail delivery.

While remittance advice is more common in business transactions, individuals can also use it for personal transactions if they want to provide clarity and documentation about a payment. It can be particularly useful when making significant payments or when clarity is needed for record-keeping purposes.

Related pages to remittance

Learn about remittance money transfer, its process, types, associated fees, risks and how to mitigate them. Read to know more.

Essential guide for small businesses on international money transfers, including transfer methods, advantages, security, and key considerations.

Learn about remittance in our comprehensive guide: what it is, how it works, and its benefits for international money transfers.