Pros and cons of accounts payable outsourcing

Accounts payable outsourcing is becoming a popular means of making a business more efficient and therefore profitable. For many companies, the number of invoices and bills they deal with puts a lot of avoidable pressure on accounting teams.

More and more companies are using accounts payable outsourcing solutions every day. In light of this, it makes sense to take a deeper look into what accounts payable outsourcing is, why it has become so popular.

What is accounts payable outsourcing?

Accounts payable outsourcing belongs to the business process outsourcing (BPO) school of business practices.

It typically involves a process of outsourcing or giving a contract to outside or third-party service provider the responsibility of managing all or a certain portion of accounts payable tasks that a company might find difficult to look after in-house.

Accounts payable outsourcing providers are specialized with the necessary tools, skills, and technology required to perform tasks such as purchase order (PO) matching, invoice capture, payments, processing, and expense reporting.

Why do companies outsource their account payables?

There can be a variety of reasons behind why a company may choose to outsource its accounts payable. Given below are some examples of the reasoning behind why companies choose to accounts payable outsource:

The higher workload on AP team

Companies that are in their growing stage often face an increasing AP workload. The increasing number of invoices and bills can overwhelm AP teams and lead to burnout.

Cost of invoice processing is higher

The costs associated with invoice processing can easily skyrocket. Whether it's because of the lack of time and resources or because of inefficient workflows, manually processing invoices in-house can lead to great costs.

Present AP team lacks controls

Lack of control over in-house accounts payable processes can lead to repeated mistakes such as duplicate payments, missed payments, scrupulous reporting, and more. These mistakes, in turn, can cost your business a lot of money and time.

Vendor relationships are suffering

If there are too many payments that are being missed or paid late it is highly likely that vendors will be dissatisfied with your contract. This can damage your relationship with vendors and result in your company losing out on good deals.

Cost is lesser to outsource an AP team than to hire one

Hiring accounts payable team can come with overheads that you may not always want to bear. Additionally, senior management of your company might not always have the time to vet recruits and go over resumes.

Simplify your acconts payable process today

Benefits of accounts payable outsourcing

1. Reduction in costs

Manually processing accounts payable in-house can lead up to costs in the form of duplicate payments, late fees on payments, extra costs for hiring and managing an accounts payable team, and other ancillary costs.

All this can be avoided by simply outsourcing accounts payable to a provider that can supply the same services at a fraction of the cost.

2. Early payment discounts

Outsourcing accounts payable can help you gain early payment discounts by eliminating the probability of late or missed payments. By paying your invoices on time you can benefit from offers that your vendors might provide.

3. Enhances productivity and efficiency

By using accounts payable outsourcing solutions you can free up time and resources for your employees to focus on more important, value-generating tasks.

You can outsource the responsibility to a third-party provider who can help with faster processing of invoices, payments, and reporting.

4. Better fraud mitigation and less errors

Alongside invoice streamlining, AP outsourcing providers are also capable of reducing the likeliness of erroneous invoice processing.

They can run thorough checks to identify and resolve errors in invoices to cut out incorrect payments. Using expert AP providers can help you identify and prevent the prevalence of fraud in your company.

5. Skilled resources & latest technology

Accounts payable outsourcing providers are specialized entities that guarantee a skilled and professional level of service. They are equipped with the most advanced resources and technology for handling accounts payables efficiently.

With an AP provider on board, you can rest assured that your accounts are being handled with precision and acumen.

6. Constant tracking

Accounts payable outsourcing providers are equipped with modern tools and software that can help you gain great visibility into your accounts payable processes.

This means you can constantly track invoices from the moment they’re received to the time they’re paid off, all in real time.

Disadvantages of outsourcing accounts payable

1. Lack of transparency

When you get an AP solutions provider, you have to forgo a certain degree of visibility and transparency. While AP providers are professionals at what they do, you might not always want to give up complete visibility over your systems.

2. Lack of control over AP

With an external accounts payable solutions provider you’re not only giving up transparency and visibility but also a majority of the control you may otherwise have over systems.

You’re likely to be working on the provider’s timelines and they may not always adhere to your workflow.

3. Duplication issues

Accounts payable outsourcing companies often charge their services on the basis of per invoice. In case your business ends up sharing invoices that are duplicates you’re likely to end up paying double what you’re supposed to pay.

Moreover, if your provider does not have duplicate detecting tools you might end up incurring a lot higher costs than necessary.

4. Less flexible

Accounts payable processes always come with exceptions that your AP provider might not always account for in their contract. Even if they do they might require a touch-point from your company to negotiate the way forward.

5. Higher dependency

While outsourcing accounts payable responsibilities may take a burden off your shoulders it is also bound to create dependency on your provider.

In cases where your provider is facing issues with payments, there’s little you can do but wait for them to resolve the problems themselves.

6. Issues related to privacy and security

When you’re outsourcing accounts payable to an external provider there’s always the caveat of sharing sensitive, financial information with them.

AP providers do take measures to ensure security breaches and information leaks do not happen you can never be too sure when you’re not tackling the problem yourself.

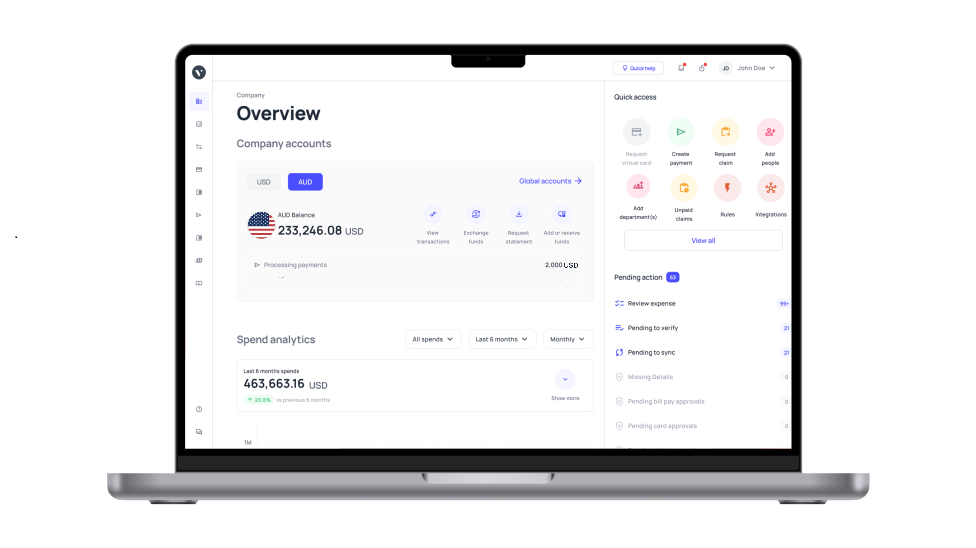

Seamlessly manage your accounts payable in-house with Volopay

With an accounts payable solution like Volopay at your disposal neither will there be a need to outsource accounts payable nor will you have to struggle with the burden of managing accounts payable in-house.

Volopay is an accounting platform that businesses can use to manage their accounts payable process from end to end. The platform can be used to process invoices, automatically capture data, do approval routing, and process payments.

When using Volopay you don’t have to worry about or deal with the uncertainty of depending on an external provider. You can get your business a comprehensive dashboard from where you can automate, control and track everything.

Automated approval workflows, instantaneous error detection, accounting integration, subscription payments, expense reporting, and more, Volopay can do it all for you!

FAQs

Yes, there are many platforms that provide accounts receivable outsourcing services as well.

Commonly outsourced accounts payable processes include accounts payable administration, sending purchase orders, and resolution of invoice discrepancies.