Guide on online bill payment for business

Pending and piled-up bills in the accounts payable department often denote the usage of unorganized bill payment processes.

There are many ways a business can transfer money to its vendors. For example, online banking or mobile wallets. More often than not, these methods come with limited features and are expensive.

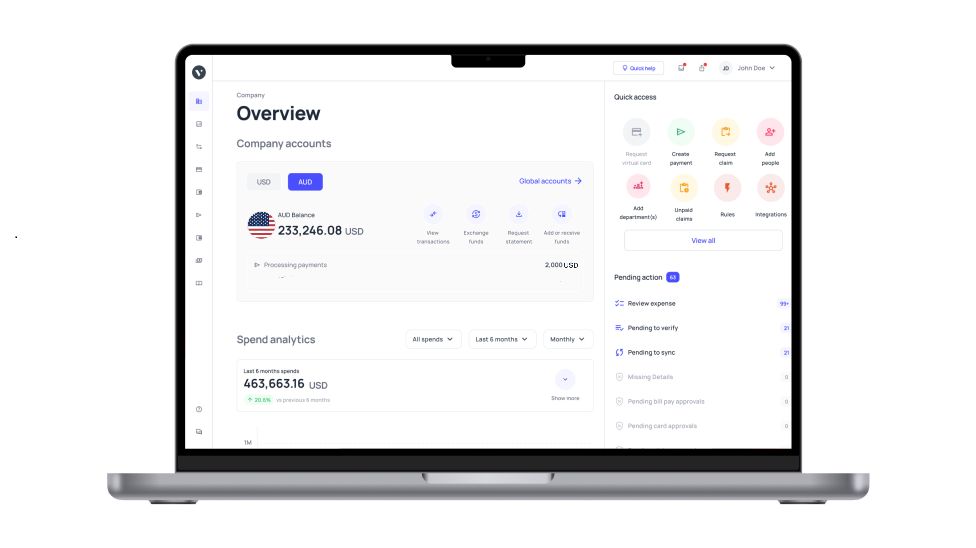

Smart online bill payment software will not just help with automatic bill payments but let you keep track of them. Volopay’s Bill Pay has the above features and many more to enable automated bill pay for small businesses.

What is online bill pay?

Every business has to pay its suppliers. While paying in cash is no longer a viable option, bank account transfers are commonly used.

But bank accounts have limitations when it comes to the number of payments, payment limit, overdraft, etc. International banks are also expensive.

Bill Pay is here to ease the overall bill payment process. With bill pay software, you can create vendor accounts and send local and international payments.

It’s possible to automate bill payments and schedule them earlier. And it’s also possible to access all made payments from one place.

Affordable international payments are a must for SMEs. Bill pay software lets you make international payments at much cheaper rates.

What are the features of Volopay’s bill pay?

Volopay’s Bill Pay is the best mode to pay and track vendor payments in one place. Some of its features that its users love are

Bill payments

Bill payments denote any remittance from your business account to another in exchange for any services or utilities. Most times, they are issued last minute and expected to be paid on time. Don’t keep bills pending beyond deadlines.

Schedule them beforehand and pay instantly to ensure continuity of services. Feed the data from your bills and send it right away.

Vendor payments

Vendors denote other businesses who support you by rendering their services or products. Avoid the complicated bill payment process that will require you to input vendor bank details every time.

Some banks also issue limits on the number of beneficiaries you add or mandate minimal time for its activation. But with Volopay Bill Pay software, you can instantly create vendor accounts and initiate payments.

Gain discounts and concessions from your vendor for making payments early. Anytime you can access your vendor details and your monthly spending on them.

Department budgets

Be able to identify which department spends more and control their spending through department budgets. In Volopay’s bill payment process, each bill payment is initiated by a particular user.

And this user belongs to any one of the departments like marketing, sales, or others. Now, whenever they initiate a bill payment, the bill gets tagged to the department budget.

When you view your monthly spending, you can identify the spending of different teams and assign budgets accordingly. This advantage helps businesses to avoid overspending by teams.

Invoice management

Volopay helps in automatic bill payment as well as invoice management. Invoice management deals with receiving all invoices in one place and adding them to the pipeline of the bill payment process.

Each vendor has its way of sending invoices. Some send paper invoices, and some send them through email or invoice software. Collecting them and updating them into the Bill Pay software can take forever.

An invoice management system minimizes this complexity by providing a unified interface to receive and manage invoices. You can easily capture the data and input it into the automated bill pay system. No more manual efforts or missed invoices.

Exchange rate

The exchange rate is a headache for SMEs who make international payments. The fx rates constantly change, making the businesses spend a bomb along with the actual remittance.

The story isn't much different with private exchange companies too. They charge a significant convenience fee on top of the conversion fee to send the payment through.

Volopay charges the lowest convenient fees, which is very transparent even before you initiate the payment. You see the total breakup of conversion fare and what will be actually transferred.

There isn’t any hidden fee associated with international payments through Volopay.

Simplify online bill payments with Volopay

How does online bill pay work?

Bill Pay module in Volopay works in the following ways. It has both SWIFT and non-SWIFT payment modes that admins can choose from. When the money is sent in US dollars, SWIFT mode is preferred to transfer quickly.

Another exciting feature is automated bill pay. From receiving invoices to making payments to updating them in your books, you can automate everything.

You can create and pay vendors from one platform where you can also track their payments. Set multi-level approvals to authorize the transactions.

Each approver will be sent push and email notifications to notify the payment approval. Post approvals, the bill payment process is automatic, and the amount leaves when it's due.

Once the payment is made, you can download/access the receipt anytime from the dashboard.

Steps to create online bill payments on Volopay

The interactive dashboard of Volopay makes it easy to use for anyone. In a few basic steps, you can perform the following actions on Volopay Bill Pay software.

1. Creating online new bill payment

• You can make bill payments from any existing budget or create a new budget too.

• Ensure that you select the right currency on which the payment must be made.

• Choose the billing cycle (whether it’s one-time or recurring).

• Choose the vendor from your list of vendors.

• Fill in other fields as such amount, approver, and accounting fields.

• Choose the date and time it must go out and finish the bill payment process.

• You can check the status of the payment in the automatic bill payment dashboard.

2. Creating new vendor payments

• When your supplier changes, you will need to onboard their details into Volopay’s Bill Pay software before you initiate a payment.

• Go to the vendor tab to create a new vendor.

• You can create a new vendor during the bill payment process too.

• Enter their name, alias, banking information, country, email, and other information.

• While creating a vendor, you must also present the reason for transactions and the source of funds.

3. Creating invoice payments

• An invoice is a document that carries the remittance information of who owes who and how much.

• To make invoice payments, a bill must be created in automated bill pay with the details from the invoice.

• The Bill creation and payment are similar to the first bill payment process explained above.

Bill pay integration for your accounting software

We have already noticed how Volopay lowers manual tasks. To take it to the next level, Volopay also allows easy integration with other accounting applications. You can connect Volopay with software like Quickbooks, Xero, and many more.

Generally, accountants download and upload reports to keep their books synced and updated. Or worse, manually enter every payment into the records.

To make this easy for you, Volopay has easy integration that quickly syncs your payment data into your accounting software.

Be it a bill payment or vendor payment, within the same application you made payment from, you can sync manually or together.

Experience hassle-free bill payments with Volopay

How does Volopay streamline the accounts payable process?

To sum up, Volopay’s AP automation software is what every small business needs to organize and automate their bill payments. There would be a gradual increase in the number of invoices you handle as you step up.

The bill payment process will be unmanageable if you don’t get help from a time-saving expense app. By automating payments, you save a lot of time and effort shed by accountants.

They don’t have to rummage through files for invoices or receipts as everything is in the cloud. Having proper records favor you during taxation and auditing processes.

Businesses feel that they are in utmost control as they can effectuate budgets and authorize what expenses should go through and what shouldn’t.

Weighing up the above points, Volopay is the best and most reliable bill pay services for small businesses.

Effortless bill payments, powered by Volopay!

FAQs

Both paper and electronic invoices are acceptable by Volopay Bill Pay services for small businesses. In case of paper invoices, scan and upload to capture the invoice data.

Feature-wise, there isn’t any limitation for users accessing the Bill pay software. However, depending on the pricing plan you choose, you will get a certain number of free transactions in the Bill Pay module.

It is possible to schedule bill payments ahead of time using Volopay’s Bill Pay feature. Choose the future time and date while making the payment to mark the time of the delivery.

Automatic bill payment denotes the automatic planning and delivery of payments via third-party payment software.

Volopay allows both recurring and single-term payments. Before initiating any transaction, you can choose the mode of payment and stop a recurring payment post scheduling too.

You are allowed to disable the automated bill pay mode. You can contact the administrator to enable or disable the automatic bill payment mode on Volopay.