Guide to accounting automation with Netsuite API integration

Accounting teams indulge in a diverse range of manual tasks that can be cut down with the help of automation. Technology and automation together help modern applications function in an unrestricted and open manner.

The functionality that makes this happen is API (Application Programming Interface). API integration connects two applications and makes data transfer happen between one another.

Netsuite is a commonly used accounting and ERP application by businesses of all sizes. To make work simpler for them, Netsuite has come up with Netsuite API integration.

Rather than keeping the data restricted, you can extract and tap into it for analytics or other purposes. The list of benefits of Netsuite integration is endless.

What is Netsuite API integration?

Modern-day SaaS applications come with an open API layer that can as a bridge while connecting with other applications.

Through this layer, secure data transfer happens. Manual transfer of data takes time, and it’s won’t be synced and updated unless you update it manually.

Netsuite integration, on the other hand, enables the continuous movement of data of your choice from Netsuite to another software and vice versa. It's your choice to keep the data flow unidirectional or bidirectional.

What are the types of Netsuite API integration?

Every application infrastructure is different. To allow smooth and seamless integration, Netsuite has designed its own integration platform called Netsuite suite cloud program.

Businesses that want to accommodate Netsuite into their ecosystem and connect effectively with this can make use of this platform.

This platform lets you customize the integration to extract the data you want to suit your business needs. Without much technical expertise and coding knowledge, you can make end-to-end data transfer happen and be agile.

How to integrate with Netsuite?

To connect third-party apps and use them like native software within Netsuite, it offers two web-based integration interfaces.

1. SuiteScript

Suitescript is an integration tool that runs on Javascript, and it’s mainly used for integration customization and automation.

This standard Netsuite integration feature extends the current capabilities of Netsuite and gives the developer full control over what kind of data they can access from Netsuite.

There are many modules available in the Suitescript tool that you can load and use as per your script requirements. Modules are the tool's core, so developers must find a way to memorize or recognize the common modules.

Some of the modules are,

• N/Cache module - to enable the cache data reception and improve performance based on it

• N/Auth module - by loading this module, one can change the Netsuite logins

• N/Compress module - to compress, decompress, and archive files

• N/Currency module - to convert one currency into another and find exchange rates

• N/record - to modify, create or delete any Netsuite’s native records

2. SuiteTalk

Suitescript is a programming heavy tool. Even though the interface deals with developer-friendly language, it can still be hard to use and time-consuming. But Suitetalk is different from this.

This tool can create custom applications and build integrations between a third-party application and Netsuite. SuiteTalk can be used to create, modify, delete, or update records and maintain Netsuite user logins.

It doesn’t require any coding and works based on the protocol SOAP (Simple Object Access Protocol). SOAP acts as an interface between applications and transfers the messages in XML (Extensible Markup Language) language.

Though SuiteTalk is simple to use, it limits the number of messages passed over a particular time. And it is not perfect for mobile application integrations. Thus, developers rely more on Suitescript.

Netsuite Suite Cloud platform benefits

Netsuite integration is important for businesses to achieve unified business processes. By leveraging the benefits of Netsuite integration, you can get extended custom functionality to drive the app connection the way you want.

This affordable and sophisticated technical integration solution also has other benefits.

1. Commonly implemented integrations

Netsuite API integration only includes the most commonly used and practiced integration methods and technologies. From interfaces to supporting web language services, common and well-known protocols are put to use (like RESTlets, and SOAP).

Technical teams and accountants find this favorable as they can collaborate and communicate better to achieve the desired outcome.

2. Secure connectivity

Professionals fear application integration with third-party apps due to safety and security reasons. The data that’s shared can be put at risk. With Netsuite API integration, that’s not the case.

You will need the login credentials to connect an application and then perform two-factor authentication to get in. Role-based access control is there to limit what one can view and access based on their account type.

API-level security ensures that the data shared is fully encrypted (certificate-level encryption). So, the data that gets in and goes out is safe and protected.

3. Local language settings

Netsuite has local language settings where you can select your preferred language. Similarly, Netsuite API offers translatability support to developers to work with translation collections.

One string of code can be translated into one or more languages using the module N/translate. Under the manage translations option, you can choose the default language or access the list of languages provided.

This multilingual option helps developers from different parts of the world to use the application without hitches.

4. Developer-friendly

The web services of Netsuite have developer-friendly and uncomplicated interfaces. One doesn’t need to learn extra coding to understand and work with this architecture. The modules of Suitescript are easy to remember.

The names of the modules are directly related to what it does. For example, the N/Search module - performs the search operation to find records, search for duplicate records, or find records that match the filters you set.

You can adapt the technologies and protocols to design the integration that suits the ecosystem of your application.

5. REST & SOAP benefits

REST & SOAP are protocols that developers use when they need API to communicate with other applications. Both offer excellent customization and extensivity options to create and modify the API layer.

While REST has superior advantages over SOAP, developers like it when they are given a choice. Compared to SOAP, REST is more of an architecture that supports a wide range of languages like HTML, JASON, XML, plain text, etc.

But SOAP supports only HTTP and XML. due to its high and tight security, SOAP needs wider bandwidth which can lead to slowness.

They both have their own applications based on their advantages and disadvantages. Netsuite API integration gives both options making it easy to choose one based on the integration kind they want.

6. CSV file import options

Manually transferring data from one application to another can be prone to human errors. That’s where CSV file import helps. It minimizes the time taken and reduces errors.

To transfer medium-sized files quickly, you can download the data in CSV file format and upload it or vice versa. Comma-separated value files don’t need alterations and are supported anywhere and everywhere.

7. Transfer data on a large scale

Netsuite API integration works, in the same way, to transfer data on any scale. Be it data of any scale, it takes lesser time to sync or transfer from Netsuite to another application and the other way around.

Allowing two applications to integrate seamlessly makes data transfer happen within seconds.

8. Simple interface for smoother team collaboration

Netsuite has multi-user logins and user-level controls that are applicable to integrations also.

The user-friendly and convenient interface helps anyone from the team understand what’s expected of them. There will be less communication and more work accomplished.

9. Faster and more efficient app development

As Netsuite API employs common and easy-to-use programming languages, developers take it like a fish to water.

Developing schema to support the integration of your native application with Netsuite will not be complicated. Translated settings make companies from any location get benefit from Netsuite integration.

Automate your reporting with NetSuite integration

How to streamline accounting automation with Netsuite?

Accounting automation must happen to accelerate your business growth. There are way too many economic crises businesses deal with every day. As a solution, they rely on cost-saving measures and strategic budget planning.

Here is what Netsuite’s accounting automation promise to automate your accounting.

General ledger

This is a component of ERP that records every transaction of a company in sync with its business checking account.

Netsuite’s GL has, depreciation, amortization, and allocation - It makes sure that all expenses are recorded and tagged to relevant cost centers (departments to which the cost is applicable).

Accounting and journal entries for revenue - no more manual categorization and expense matching. Netsuite has rule-based automated accounts matching that removes the need for manual categorization.

Accounts payable

Netsuite has ways to automate your outgoing payments and help you with the following.

• Automated three-way matching - Three-way matching of invoices is done to ensure whether goods are delivered before you make the payment.

• Bill creation - Create bills and make business payments automatically.

• Recurring and subscription charges - monthly bills like SaaS payments can be scheduled with Netsuite for automated payments.

Accounts receivable

Netsuite can be used to receive payments from your customers.

• Invoice creation - with one click, you can convert an order into an invoice. Avoid duplicate invoices that are problematic to both you and your customers.

• Bills for subscriptions - send monthly automated bills to your customers and pause when needed. Different pricing scenarios can be applied depending on your pricing plans, customer consumption, and other variable factors.

• Schedule bills - Create and schedule invoices for your customers automatically. Rule-based scheduling is available to keep this process flexible as per your requirements.

• Collections - Send automated payment reminders and receive early payments from customers. Reduce days outstanding and increase cash inflow.

• Process payments - Let customers pay through credit/debit cards, wallets, or other payment modes with easy payment integration options.

• Consolidate invoices - send consolidated invoices by combining multiple invoices of the same customer and send as one.

Close management

To achieve continuous closing and maintain updated books, close management tools can be utilized.

• Reconcile journal entries with bank details - automation helps in matching expense entries to bank account details. Only the discrepancies will be brought to further review.

• Match transactions - Transaction matching is to match customer payments with relevant invoices and note if it’s a full or partial payment. The remaining balance will be updated accordingly.

• Consolidate finances - Quicken the closing process with the help of automated consolidation of subsidiary-level transactions. Maintain compliance according to the accounting standards and tax requirements of your location.

Related read: Mistakes to avoid during a NetSuite implementation

Benefits of automating accounting workflows with Netsuite API integration

Any business can integrate its application with Netsuite and enjoy the above benefits and tools. Your operational efficiency will improve when accounting is sorted automatically.

Here are the benefits you can expect from Netsuite accounts payable automation.

1. OCR

OCR stands for Optical Character Recognition. It reads the characters in manual invoices and translates them into digital format.

Created based on AI algorithms, it can read even unintelligible text and update them into the accounting software. Manual invoices are still in existence, but your accounting team doesn’t have to waste time on them.

2. e-Invoicing

Send electronic invoices to your customers and digitize your payment collection process. eInvoices are easier to process and from there, sending reminders and collecting money fully or in dues is made simpler.

Sending wrong and duplicate invoices can happen anytime when you use manual methods. Here you can straightaway convert an order into an invoice and bill the right way.

3. PO matching

Invoice PO matching is the step to ensure that you pay the right amount for the goods received. A purchase order is a document that carries order instructions, agreed prices and quantities, and other terms.

The software compares the two documents to check if the payment is made only for the ordered goods. If the fields don’t align, the system flags it for further review. This is the best way to chuck duplicate invoices out of the system.

4. Line-level recognition

To understand the characters and fields present in an invoice, OCRs use an advanced level technique called line-level recognition. It splits the invoices into lines as if drawing imaginary horizontal lines over the invoice.

Then it reads each segment and recognizes patterns. All this happens within the software to match and get data out of an invoice.

5. Vendor auto-processing

Modern businesses prefer to automate their vendor invoicing process to pay them on time. It guarantees streamlined invoice scheduling and processing.

Paying vendors on time keeps them satisfied and aligned with your business goals. And by saying goodbye to manual data entry, you achieve higher efficiency and accuracy.

6. Customize workflows

Workflows are necessary to guide automated payment in the process of getting approvals.

Customize them from start to finish for different types of payments with Netsuite and achieve better collaboration among teams. There is no need for verbal communication to get the bill moving.

7. Complete audit trail

Netsuite presents you with the complete audit trail of every incoming and outgoing transaction. You can track the root of a transaction and understand why it happened.

Any transaction from both accounts payable and receivable can be tracked with proper evidence (invoices, receipts, etc.). And Netsuite API integration elevates this benefit by extending the accessibility of data across platforms.

8. Increase efficiency

Accounting has many tasks that fall under repetitive and monotonous task categories. Finishing them takes more resources and time, and one must be careful not to make any mistakes.

They can be handled better with the presence of automation. It helps employees focus on important analyzing and decision-making tasks than copy-pasting data.

9. Reduce manual intervention and costs

More resources and employees are required to carry out manual tasks. You spend more money to hire more people only to make them work in an unproductive environment.

Going fully digital is how you can cut this down. Your employees won’t have to track or follow up but trust the system and monitor the overall process.

10. Prevent manual data errors

Mistakes with numbers are common in manual ways of working. But that will cost a lot for the company to sort out. Tracking down the source of an error is also highly impossible.

Netsuite API integration will make sure that data is passed along as it is. There won’t be any errors as data transfer happens in auto-pilot mode.

11. Mitigate risks

Netsuite can mitigate risk in two ways. It allows data to pass through securely and secretively from one app to another. No one from the external network can tap into the data as it is encrypted.

All data safely resides in the cloud and access is given based on role basis limiting their actions within their role. Besides, by staying compliant with industrial accounting standards, your company avoids legal and regulatory issues.

12. Sync data in real-time

Downloading the data from your application and uploading it into Netsuite is a laborious task. Plus you won’t achieve continuous closing.

With Netsuite integration, continuous, real-time synchronization of data can be enabled. Your employees do nothing here other than push items to be synced in one click.

13. Manage multiple subsidiaries

The term subsidiary here refers to the child companies of a global organization. Group of companies that run as separate legal entities but are rooted in one high-level subsidiary can also use Netsuite.

Netsuite offers multi-level subsidiaries where up to 250 subsidiaries can be managed under one account. You can compare the different levels of subsidiaries to a tree structure with root (child companies) and top (the parent company).

14. Classify transactions and GL codes as per your wish

Each transaction of a company belongs to a specific type of category. This classification happens based on the amount, recipient, notes, proof, included recipients, and other data available.

Netsuite allows custom segmentation. That is, you can classify transactions based on departments, classes, locations, or any other fields.

Related read: Complete guide to Netsuite invoice processing

Streamline accounting automation with Volopay’s Netsuite integration

Many businesses are in the race to automate their accounting section and gain its advantages. The part that interests them the most is the integration.

The integration gives you more options to pick different software for each accounting need. You can have a fully-functional, advanced, and reliable accounts payable software and connect it with Netsuite.

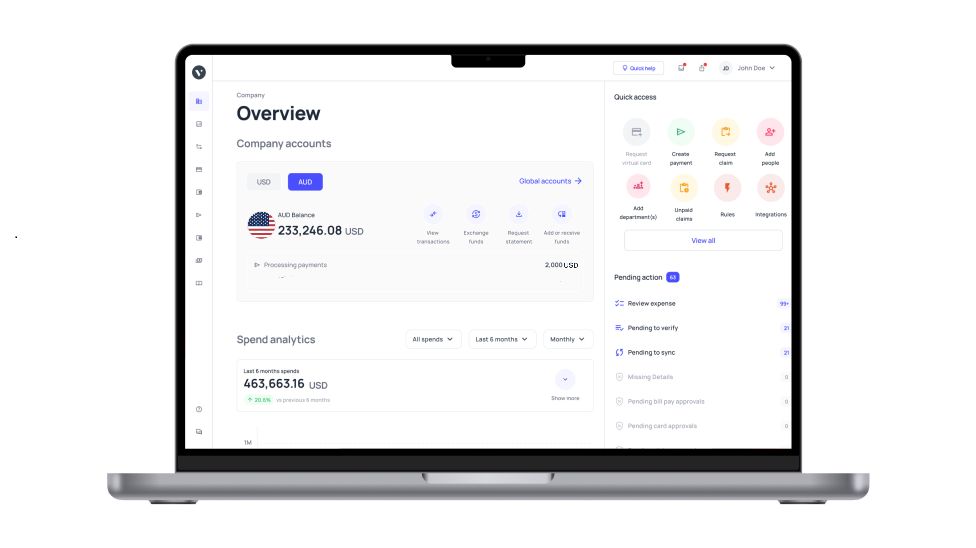

Introducing Volopay, an accounting automation software that is recognized for its ease of use and payment features. Automate your bill payments, create bills, update workflows, and sync payments with GL instantly.

With Volopay’s NetSuite integration, you can effortlessly sync payment data with a one-click transfer.

Volopay grants access to advanced AP options that ERP systems don’t have. Some can have unlimited corporate cards, an in-app reimbursement platform, monthly credit, and more like this.