Complete guide to Netsuite invoice processing

Managing purchase invoices is a crucial function of the finance and accounting team at any organization. It is one of the most tedious tasks to complete if proper systems are not set in place by the company.

Tracking, matching, and paying invoices becomes a hassle when there isn’t a centralized system and processes rely heavily on manual efforts.

Thanks to advancements in technology, the landscape is changing and finance & accounting teams across the globe are moving away from the traditional or manual methods of handling invoices.

And instead are adopting digital invoice management systems to tackle the various challenges of invoice processing.

What Is Netsuite invoice management?

The Netsuite platform first came into existence in 1998 and has since become one of the most popular cloud computing software across the world.

Netsuite’s invoice management system is one of the most well-known and industry-leading services out there thanks to their years of experience handling clients of different scales and from various industries.

There are many problems that an accountant faces when it comes to managing purchase invoices.

Netsuite’s invoice automation system is built to make invoice processing workflows faster by minimizing the need for manual intervention and hence reducing errors at different stages to improve efficiency.

Challenges businesses face with B2B invoice processing

Most issues that accountants and finance professionals face when dealing with invoices are due to the stubbornness of businesses that do not change their methodologies and stick to outdated practices.

Processes that involve a lot of manual work make things time-consuming and also the absence of a centralized system leads to multiple errors.

Unreliable and dated invoice processing systems lead to errors

While companies might have shifted from physical paper invoices to digital ones that can be created from software like Microsoft Excel, etc.

It is still not enough to avoid the errors that occur from disorganized management of invoices even as digital files.

Invoice matching is time-consuming

Matching the data on an invoice with other supporting documents like a purchase order or goods receipt is important to verify the legitimacy of the invoice.

The struggle every accounting team faces while doing this is that it consumes a lot of time.

Blinkered visibility leads to confusion

When there are multiple identical invoices from a vendor and no proper way to segregate them through a system, it can lead to confusion in the minds of the accountants who have to process them.

Disorganized systems lead to payment delays and issues

When there isn’t a proper system to track and store invoices, these documents can easily get lost in long email threads. This makes it hard to find invoices that are pending and can cause late payment issues.

Manual intervention and reconciliation lead to mistakes

Whenever there is human effort involved in completing a task, errors are bound to happen. On top of that, the traditional ways of invoice processing relied heavily on accountants to manually check and match invoices.

When done in larger quantities, even the smallest of errors in monetary details can cause a huge loss to your business.

Unknown vendor invoices

A byproduct of no proper system and lack of visibility is dealing with invoices from unknown sources.

A common occurrence among finance and accounting teams is that they receive invoices from unknown sources that they are unable to verify and know whether an expense has been legitimately made by the company’s employee or not.

Overpayment

Another byproduct of the lack of a proper system is the error of paying for duplicate invoices. Sometimes, it doesn’t even have to be duplicate invoices.

A simple mishap of entering an extra number on the amount to be paid for an invoice can lead to a huge loss and extra efforts are spent to get the amount refunded.

How does Netsuite’s invoice management automation work?

Netsuite has a dynamic invoice management system that allows you to generate invoices quickly and help clients pay you faster.

1. Create the purchase or sales order

The advantage of using Netsuite’s cloud software is that it acts as a central system for sales, finance, and operational data.

This allows your teams to always be in sync with each other and know how crucial aspects of other departments affect their own.

Within this centralized system, whenever the company makes a sale, the respective team member must create a sales order.

2. Approval of sales order

Once this sales order is created it is automatically sent for approval within the system itself.

The first step of Netsuite’s automated invoicing happens when the respective authority approves a sales order; an invoice is automatically generated for the same with all the necessary order details including tax.

3. Send invoices to your clients electronically

Once the invoices are prepared, sending the invoices as per a schedule to your clients can also be automated.

This is done using a pre-selected method based either on the status of the relevant project, the shipment confirmation status, or other custom criteria.

These invoices once scheduled can be sent electronically as an email or in the form of an XML document and also printed and delivered via mail services or faxed.

4. A customer receives the invoice details and pays you

Netsuite gives you the option to create payment links for the invoices you send out to clients so that they can easily make payments.

When they receive the invoice digitally, they will be able to click the link that redirects them to the payment page and allow them to use payment methods like ACH payments, PayPal, Master Card, Visa, Discover, American Express.

The invoice also includes a QR code so that clients receiving physical invoices can scan it through the camera app on their mobiles and it will redirect them to the same payment link page.

5. Customers can save the details and method of payment for the future

Your customers can easily save their preferred payment details so that they don’t have to re-enter all of their details the next time they are paying another invoice from you.

6. Invoice is fulfilled

Once your client makes the payment, the Netsuite system will automatically update the status of your invoice to ‘Paid in Full.’

If a partial payment has been made, then the invoice status will remain open, but the amount that is due will be adjusted accordingly.

7. Businesses can record the invoice payment

Once the payments have been made, a business can record these documents as legal proof of payment.

8. Receive payment and immediately sync with your Netsuite dashboard

Once the payment has been received, your invoice status will change and reflect on the Netsuite dashboard.

This will give the finance and accounting team a better picture of the overall state of invoices and record them in the general ledger of the company.

9. Incentivize payments

If you want your clients to pay in a certain way, then offering incentives to do that is a great method. For example, you can charge a convenience fee to your customers in place of processing credit card transaction fees.

You can also enable zero-fee payments for direct bank-to-bank transfers at the same time. When you do this, you promote free B2B payments, which are much more cost-effective than using a credit card.

You can also incentivize early payments by setting discount rates that a client will get if they pay before a certain date.

Steps to Process invoice payment with Netsuite

Apart from sending invoices, Netsuite’s invoice management system also allows you to process invoices that you receive from your vendors or suppliers.

1. Receive receipt and verify procurement

When you receive a receipt of the invoice, the finance team of the business will have to verify if such a product or service was procured.

They must coordinate with the respective team members either manually or use Netsuite’s centralized system where they can view and check the sales or operations data.

2. Match billing details with the original purchase order

The data must then be matched with the relevant purchase order to verify whether the invoice details are the same as what was procured.

3. Resolve any discrepancies or unmatched data

If there are any discrepancies, it must be alerted to the team immediately to rectify the situation.

Thanks to Netsuite’s 3-way matching technology, it automatically detects discrepancies in order quantities, rate of goods, and duplicate invoices, and flags them so that the AP team can immediately take the next steps to correct the errors.

4. Route the invoice to the right admins for approval

Once the invoice has been verified, it is ready to be sent to the necessary team members who are responsible for approvals.

5. Set the invoice for payment depending on the agreement

Once approved, based on the agreed terms and conditions with your vendor, set the invoice to be paid.

6. Pay the invoice

You can either schedule the invoice for payment or pay it early to get the early payment discount from your vendor if it has been offered. If your vendor has allowed partial payments, you can also opt for that method.

7. Send documentation and details to your accounting department

Once the payment has been made, the necessary information must be forwarded to the accounting department so that they can update it in the general ledger.

8. General ledger updation

Once the invoice is paid, the amount is removed from accounts payable with debit and an offsetting credit to cash.

Netsuite invoice approval workflow

Netsuite's invoice management system allows you to create approval workflows and ensure that your company only pays for what they have procured through checks and approvals.

Initiation stage

Netsuite allows you to create invoice approval workflows within its system to easily coordinate with team members and process invoices.

The first step in the workflow is the initiation/bill validation stage where an employee who is responsible for handling AP is checking to see if there are any errors. During this stage, they can edit and save the invoice details as per the verification.

After the checking and verification are done, the invoice will move forward in the workflow once they click the submit for approval button on the invoice within the Netsuite system.

Purchase approval stage

Once the submit for approvals button is clicked by the AP employee, it is moved to the next stage of the workflow where the invoice is sent to the respective team members who were added as approvers when the workflow was set up.

Now, the ‘Approve’ and ‘Reject’ buttons will only show up for the people who are added as approvers. The invoice is also locked and they will not be able to edit any fields or values.

Rejected stage

If the approvers find any discrepancies, they cannot directly edit the field or values as it is locked. They must add notes and reject the invoice.

This puts the invoice in a ‘Rejected’ stage and an email is sent out to the AP employee informing the same.

This will allow the AP employee to rectify any errors that got the invoice rejected and the invoice will now show a ‘Resubmit for Approval’ button to push it back into the ‘Pending for Approval’ stage.

Approved stage

Once the approver sees that all changes have been made and rectified, they can hit the ‘Approve’ button and the invoiced will move to the ‘Approved’ stage and be ready for payment.

How to manage and improve Netsuite’s invoice processing workflow?

There are certain things that finance and accounting teams can keep in mind and follow to ensure a smooth invoice processing workflow.

1. Know and understand how the Netsuite dashboard works

Getting yourself familiarized with how the Netsuite dashboard works and understanding each aspect will help you carry out your tasks smoothly without any roadblocks.

Netsuite has made its platform extremely simple and intuitive for all users so that there is minimal room for confusion.

2. Record Vendor details efficiently

To process invoices as fast as possible, you must ensure that you are not spending time manually entering vendor details each time you have to process an invoice.

Netsuite’s system allows you to create and save vendor details so that you can automatically fill in their details when necessary.

3. Know how to create new vendors, suppliers, and contacts

The benefit of creating and saving vendor or supplier details including their contact information is that you get to process payments for them much faster and avoid time-intensive manual work that could lead to errors.

4. Create purchase receipts with expense reports

Another best practice is to request purchaser receipts from vendors when paying their invoices. This receipt will act as proof of payment for both parties.

5. Receive invoice, enter the purchase into Netsuite directly as the bill

Netsuite’s automated invoicing is such that it can directly use an uploaded purchase order in the system to turn it into an invoice to send to your vendor or supplier.

6. Get accurate data on payables during the billing cycle

Since Netsuite is a centralized system for finance, sales, and operations, an AP employee can easily check data on purchases made by employees that need to be paid for within a specific billing cycle.

This visibility helps the team stay on top of payments and get them processed in a timely manner.

7. Bill payment with multiple payment methods

When sending invoices through Netsuite, the system allows you to select the options that you would give a client to pay through. Enabling multiple payment options gives the client flexibility to pay as and gets you paid faster.

8. Create reports, monitor payments, and create audit trails

Netsuite’s dashboard and AP reporting capabilities allow your accounting team to monitor payments of all vendors or suppliers so that you can manage cash flow effectively and efficiently.

The system will give you the ability to create expense reports from commonly used accounting report templates for payment history and AP aging.

These reports can also be customized as per your specific needs. The data for these reports are updated in real-time and you can filter them by the department, location, vendors, or category of the expense.

9. Track and process vendor returns and credits

There might be instances where you have to return certain goods to your vendors due to various reasons.

These vendor returns need to be managed properly so that when the vendor credits you it is adjusted in the accounting books accordingly.

10. Tax calculation

Another benefit of using Netsuite’s invoice automation system is that it automatically adds the relevant tax percentage and amount when an invoice is generated within the system.

This allows for easier overall calculation of the amount that needs to be paid by a client to you.

Netsuite invoice management features

Netsuite’s system doesn’t stop at the basic functionality for processing invoices. It takes it a step further by providing specific pre-invoicing and post-invoicing features that make the entire process easier.

Item Receipt

Netsuite allows you to add the item receipt that you receive from a vendor when they supply you with goods. The item receipt can be attached to its specific purchase order in the system.

You can also add the item receipt in case of partial delivery as the system allows you to change the order quantity when attaching the item receipt.

Once all the necessary details have been changed and validated by the person handling the goods at the warehouse, you can simply save item receipts data to the purchase order and this will help create a proper invoice.

Vendor bills

You can easily create bills or invoices for your vendors through the ‘Enter Bills’ shortcut on the AP role’s home dashboard or use the global search bar to search for a specific saved vendor in your database.

And then create an invoice from their details so that you don’t have to fill in all the information again.

You can make changes to various fields like the posting period, select the currency you want to pay in and the payment terms, the location, and the expense account that you want to pay from.

Three-way matching

Three-way matching is a method by which the details on an invoice are cross-checked with the relevant purchase order and the delivery receipt.

This is done to ensure that all the details mentioned on a supplier invoice are accurate and you don’t end up paying more than you actually owe a vendor.

Only when all three documents match with the correct details can it move to the approval stage and then finally for the payment.

Save time and money with Netsuite integrations for invoicing

Using different product integrations with Netsuite such as expense management systems solves the major challenges in invoice processing and helps you to ultimately save both time and money.

Fast and accurate payment collection - There are many accounts receivable specialized products in the market that can integrate with Netsuite and make receiving payments a breeze. Then all Netsuite will have to take care of is the accounting.

Ease payments and reduce follow-ups - Similar to AR solutions, there are many accounts payable solutions in the market that can integrate with Netsuite to carry out payments in an automated and controlled manner.

Eliminate manual intervention - The best part about integrations is that they allow for seamless connectivity between different applications and hence improve workflows making the need for manual intervention as low as possible.

Customer-first approach - When you get the option to integrate with various different services out there, you truly see how a company is focused on making its product user-friendly and suitable for its customers through the variety of integrations it offers.

Move to electronic payments - Making payments digitally is more convenient than ever thanks to the internet and cloud systems. Shifting to a digital payment infrastructure also enables complete visibility and the ability to control the flow of money.

How to find the best Netsuite integration for invoice automation?

Since there are so many product options available that you can integrate with Netsuite for better invoice automation, choosing the right becomes difficult.

Listed below are a few points that companies should consider for the expense management systems they are thinking of opting in for.

1. Better management of AP and AR

You should always look for an expense management system that gives you visibility and control over all spending through a single dashboard and has various ways to make and receive payments.

Certain aspects like setting spending limits, approval policies for money transfers, submission policies for reimbursements & card expenses are things you should be able to do easily when choosing a payable product.

2. Allow clients to pay numerous bills at once and accept partial payments

Another factor that you should consider when choosing an expense management solution is whether it allows you to consolidate invoices into one single payment.

This makes it easier for your clients to make payments without spending a lot of time processing separate invoices. Another crucial feature to check for is whether it allows for partial payments.

This might be an important thing that is necessary for your clients to maintain a stable cash flow.

3. Support multi-currency invoicing

If your business deals with international vendors and suppliers, having the ability to pay in different currencies through an expense management system can be very beneficial.

You can avoid certain payment network fees and also the forex charges that are incurred.

4. Sync data

The expense management system that you choose should integrate with Netsuite in such a way that it is able to carry out a two-way sync with the platform.

This will help you retrieve and send crucial data without having to make changes to transactions manually.

5. Automated syncing

Many solutions might integrate with Netsuite but would require manual intervention to sync data.

You should ideally choose a solution that allows you to set automatic sync periods for transactions to directly be synced into Netsuite’s accounting system.

Integrate with Netsuite for seamless accounting with Volopay

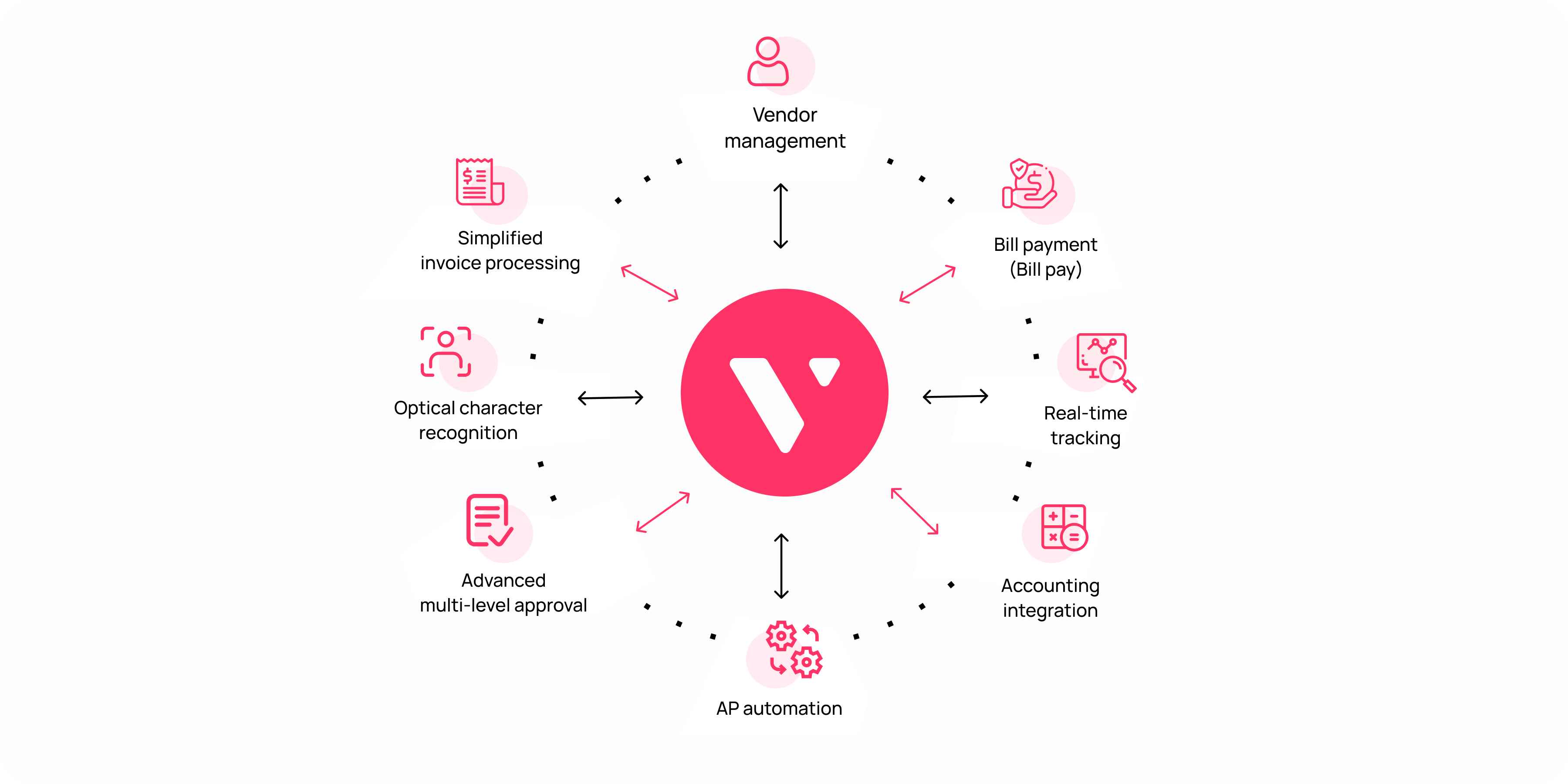

Volopay is an all-in-one spend management platform that allows businesses to track and control all their expenses.

Volopay’s financial suite includes physical corporate cards for each employee, unlimited virtual cards, an easy-to-use mobile app for employees to submit reimbursement claims.

It also provides domestic and multi-currency business account for international transfers, and a vendor management system. With Volopay's NetSuite integration capabilities, your company can benefit from invoice processing and accounting automation with Volopay, streamlining financial operations and saving time.

By automatically capturing invoice information, you may enter data more quickly

Using OCR technology the system detects crucial information from invoices received via email or uploaded manually and turns it into a bill that can be processed further for payments.

Send individualized reminder emails and route invoices to the proper person or people for approval

Once an invoice has been created on Volopay, it can easily be forwarded to the respective team members who have been set as approvers for that particular type of expenditure.

You can also set automatic email reminders to be sent to your clients before the invoice due date so that they don’t miss out on the payment and end up having to pay a late fee.

Eliminates back-and-forth exchanges by centralizing invoice interactions on the digital invoice

Instead of following the traditional way of constantly having to communicate over email threads, now invoice processing is done through a centralized platform that is meant for processing invoices.

Any rectifications needed before an invoice is approved can easily be flagged by the approver and sent back for rectifications with a custom note to avoid any sort of confusion.

Increases the transparency of the billing process and address process inefficiencies

Since all the invoices are processed through a single channel, there is more transparency and visibility for the AP department. This helps them in making the process more efficient.

Creates an audit trail that can vastly enhance audit effectiveness and control

Having a single source of truth like a dashboard where you can track and view all payments makes the auditing process much more efficient than having to manually create reports and maintain files in accordance with each other.

Workflows are streamlined by working with your present finance systems and procedures

Volopay allows you to customize your expense workflows so that it aligns with the methods that you were following previously. This helps reduce the friction that comes along with making a shift to a new system.

Related read: Guide to accounting automation with Netsuite API integration

FAQs

There are many challenges in invoice processing. Some of the most common ones include outdated invoice processing systems, time-consuming manual invoice matching, low visibility, payment delays, reconciliation errors, overpayment, and vendor invoices from unknown sources.

Before processing an invoice for payment you should check whether all the vendor details on it are accurate, if the order quantity, price, etc. matches the purchase order, the payment terms and conditions, and any other specific notes that are mentioned on it.

The multi-currency support for our Netsuite integration basically enables you to sync transactions in different currencies. For this, you must enable multi-currency transactions on your Netsuite account.

Yes, Netsuite allows you to customize the category that a particular vendor falls under when you are creating a vendor account on the platform. If you change the category for an already existing vendor, any journal entries of that vendor in the GL will also get updated for the category change.

When you’re using a system like Volopay to manage all your reimbursements, our native integration with Netsuite allows you to automatically sync all the reimbursement claims that have been processed and verified into Netsuite’s accounting system.