Management accounting: Importance, types, techniques & limitations

Discover how businesses turn numbers into strategy with the power of management accounting. More than just crunching figures, it’s a dynamic tool that helps leaders make smarter decisions, sharpen operations, and stay ahead of the competition.

In this blog, you'll explore what management accounting really is, how it differs from traditional accounting, and why it’s indispensable for modern business success. Uncover the different types, key functions, and the strategic value it brings to the table, especially in today’s fast-paced, results-driven environment.

What is management accounting?

Management accounting refers to the process of preparing financial and non-financial information for internal use by management. Unlike financial accounting, which focuses on external reporting, management accounting emphasizes data analysis, planning, and control to assist in strategic decision-making.

It supports budgeting, performance evaluation, cost management, and risk assessment. The significance of management accounting lies in its ability to transform raw data into actionable insights, enabling managers to make informed choices.

Using historical data, forecasts, and key metrics helps in optimizing resources and improving operational efficiency. The types of management accounting practices vary depending on organizational needs, including cost accounting, standard costing, and marginal costing.

Ultimately, the importance of management accounting cannot be overstated—it empowers leaders with the tools necessary to align goals, monitor performance, and steer the company toward long-term success. As businesses grow more complex, management accounting becomes essential in maintaining agility and strategic focus.

What is the importance of management accounting in business?

The importance of management accounting in business lies in its ability to guide internal decision-making through data-driven insights. It plays a key role in aligning financial planning with operational goals. By offering timely and relevant information, it enables managers to make informed choices that boost productivity and profitability.

The significance of management accounting becomes more evident as organizations strive to stay agile and competitive in an ever-evolving market environment. It acts as a bridge between financial data and strategic execution, driving more sustainable business growth.

1. Informed strategic decision-making

Management accounting provides critical insights that support long-term business planning and strategic decisions. It helps managers evaluate potential outcomes using forecasts, budgets, and cost analyses.

By focusing on both financial and non-financial data, decision-makers can assess market opportunities, allocate resources effectively, and establish realistic goals that align with company objectives. It also enables leadership to test different scenarios before committing to significant investments or initiatives.

2. Greater operational efficiency

Through cost analysis and process evaluation, management accounting identifies inefficiencies and waste in operations. It enables businesses to streamline workflows, reduce overhead costs, and improve resource utilization.

These insights help teams focus on value-adding activities, ultimately boosting productivity while maintaining quality standards across departments. It further aids in benchmarking internal processes against industry best practices for continuous improvement.

3. Effective performance monitoring and control

Management accounting enables real-time performance monitoring and tracking through variance analysis and key performance indicators. Managers can compare actual results with planned outcomes, identify deviations, and implement corrective actions promptly.

This level of control promotes accountability and ensures departments stay aligned with strategic business goals. Additionally, it fosters a culture of continuous performance improvement throughout the organization.

4. Strengthened risk management

Risk identification and mitigation are core functions of management accounting. Analyzing internal and external factors helps businesses prepare for uncertainties and reduce exposure to financial loss.

It also supports contingency planning and creates transparency around potential threats, allowing for proactive and informed decision-making. The ability to quantify and prioritize risks ensures better allocation of resources to mitigate the most impactful threats.

5. Sustained competitive edge

The importance of management accounting extends to gaining a competitive edge through better insights, agility, and responsiveness. Companies can quickly adapt to market changes, optimize pricing strategies, and control costs more effectively.

These capabilities help build sustainable growth and deliver superior value to customers compared to competitors. Over time, it helps organizations innovate faster and respond to opportunities with confidence.

Key terms in management accounting

Understanding key terms in management accounting is essential for interpreting financial data and making sound business decisions. These concepts help managers evaluate performance, control costs, and align operations with strategic goals. Familiarity with these terms strengthens internal decision-making and enhances financial planning across departments.

1. Cost of goods sold (COGS)

Cost of goods sold (COGS) refers to the direct costs involved in producing goods or services sold by a company. It includes expenses like raw materials, labor, and manufacturing overhead. Accurate calculation of COGS is crucial in determining gross profit and overall business profitability within management accounting.

2. Budget variance

Budget variance is the difference between budgeted figures and actual financial performance over a specific period. A positive variance indicates better-than-expected results, while a negative variance shows underperformance. Tracking variances is a core function within many types of management accounting and helps ensure financial discipline.

3. Break-even point

The break-even point is the level of sales at which total revenues equal total costs, resulting in zero profit or loss. It helps businesses understand the minimum performance required to avoid losses. This metric supports the significance of management accounting in strategic planning and cost control.

4. Return on investment (ROI)

Return on investment (ROI) measures the profitability of an investment relative to its cost. It is calculated by dividing net returns by the investment cost and expressing the result as a percentage. ROI is widely used in management accounting to evaluate the efficiency of business initiatives.

5. Standard cost

Standard cost is the predetermined cost of manufacturing a product under normal conditions. It serves as a benchmark for evaluating actual performance and controlling expenses. Management accounting uses standard costs to identify variances and improve operational efficiency by addressing areas where actual costs differ from expectations.

6. Activity-based costing (ABC)

Activity-based costing (ABC) allocates overhead and indirect costs to specific activities related to production. This method provides more accurate cost information than traditional costing methods.

It helps managers understand which processes drive costs, enabling better pricing, budgeting, and strategic decisions within the framework of management accounting.

7. Contribution margin

Contribution margin is the amount remaining from sales revenue after variable costs are deducted. It indicates how much revenue contributes to covering fixed costs and generating profit.

Managers use this metric to assess product profitability and guide decisions on pricing, product lines, and resource allocation.

8. Cost-volume-profit (CVP) analysis

Cost-volume-profit (CVP) analysis examines the relationship between cost, volume, and profit. It helps determine how changes in sales and production levels affect profitability.

This tool is essential in management accounting for setting sales targets, evaluating business risks, and making informed operating and investment decisions.

9. Variance analysis

Variance analysis involves comparing actual financial outcomes with budgeted or standard figures. It helps identify the reasons for discrepancies in costs, revenues, or performance metrics.

Through this analysis, management accounting enables businesses to adjust strategies, tighten controls, and improve accountability across departments and functions.

10. Just-in-time (JIT)

Just-in-time (JIT) is an inventory management system that aims to reduce waste by receiving goods only when needed in the production process.

It minimizes storage costs and improves cash flow. JIT reflects the significance of management accounting in supporting lean operations and enhancing efficiency.

Management accounting vs. financial accounting

Management accounting and financial accounting are two essential branches of accounting, each serving different purposes. While management accounting focuses on internal decision-making and operations, financial accounting provides an overview of financial health for external stakeholders. Here's a look at financial accounting.

What is financial accounting?

Financial accounting involves the preparation of financial statements, such as the income statement, balance sheet, and cash flow statement, for external stakeholders like investors, creditors, and regulatory bodies. It ensures accurate reporting of a company’s financial performance and position.

This type of accounting follows established standards, such as Generally Accepted Accounting Principles (GAAP), and is typically retrospective, offering a historical perspective on the company’s financial situation.

What are the types of management accounting?

Management accounting involves various techniques that help businesses assess financial performance, optimize resources, and support decision-making. These methods, including margin analysis and breakeven analysis, provide valuable insights that assist in managing costs, profitability, and overall financial health.

1. Margin analysis

Margin analysis focuses on evaluating the profitability of a company by analyzing the difference between sales revenue and variable costs. It helps businesses determine how much money is made from each unit sold after covering the variable costs.

This type of analysis is critical for setting pricing strategies and assessing whether a company’s products are contributing positively to overall profitability. By understanding margins, businesses can optimize product lines and boost profitability.

2. Breakeven analysis

Breakeven analysis helps determine the point at which total revenues equal total costs, resulting in no profit or loss. This analysis identifies how many units of a product must be sold to cover fixed and variable costs.

By knowing the breakeven point, businesses can make informed decisions regarding pricing, cost control, and production volume. It also assists in assessing the potential impact of market changes on profitability and pricing strategies, allowing businesses to evaluate risk and adjust operations accordingly.

3. Constraint analysis

Constraint analysis focuses on identifying and managing limitations or bottlenecks that hinder a company’s ability to achieve its financial objectives. By analyzing constraints such as limited resources, production capacity, or market restrictions, businesses can prioritize actions that alleviate these challenges.

This type of analysis helps maximize efficiency by ensuring that resources are used effectively to meet demand. It also facilitates decision-making by highlighting areas where improvements can lead to better overall performance.

4. Inventory turnover analysis

Inventory turnover analysis evaluates how often a company’s inventory is sold and replaced over a period. A high turnover rate indicates efficient inventory management, while a low turnover may suggest overstocking or sluggish sales.

By analyzing this metric, businesses can optimize their inventory levels, reduce holding costs, and improve cash flow. Effective inventory management is crucial for maintaining profitability and ensuring that resources are not tied up in unsold goods, which could otherwise be reinvested in more profitable opportunities.

5. Cash flow analysis

Cash flow analysis helps businesses assess the inflow and outflow of cash within a given period. It provides insights into a company’s liquidity and ability to meet short-term obligations.

By analyzing cash flow, businesses can identify potential cash shortages, manage working capital effectively, and plan for future investment opportunities.

This analysis is essential for maintaining financial health and ensuring that a company can continue operations without facing liquidity issues, particularly during periods of economic uncertainty or unexpected expenses.

6. Financial leverage metrics

Financial leverage metrics measure the extent to which a company uses debt to finance its operations and investments. By analyzing ratios such as debt-to-equity or interest coverage, businesses can assess the risks associated with high leverage.

Proper financial leverage helps maximize returns on investment, but excessive debt can lead to financial instability. Monitoring leverage ratios is essential for maintaining an optimal balance between debt and equity to ensure sustainable growth and avoid overburdening the company with excessive financial obligations.

What are the techniques of management accounting?

Management accounting uses various techniques to evaluate financial performance, control costs, and support decision-making. These techniques include costing methods, performance analysis, and budgeting, which help businesses optimize resources, improve profitability, and maintain financial stability.

1. Costing techniques

Costing techniques are methods used to determine the cost of producing goods or services. They help businesses understand their cost structure and assess profitability. By applying different costing methods, companies can set appropriate pricing strategies, control expenses, and identify areas for cost reduction.

● Standard costing

Standard costing involves setting predetermined costs for various elements of production, such as materials, labor, and overheads. It compares these standard costs with actual costs to identify variances and analyze performance.

This technique helps management control costs, identify inefficiencies, and improve budgeting accuracy. By regularly monitoring variances, businesses can take corrective actions to maintain financial discipline and achieve profitability targets.

● Marginal costing

Marginal costing focuses on calculating the cost incurred by producing one additional unit of a product. It includes only variable costs, such as raw materials and labor, excluding fixed costs.

This technique helps businesses understand the impact of producing additional units on profitability. By assessing the contribution margin, businesses can make pricing and production decisions that optimize profits while maintaining cost efficiency.

● Activity-based costing (ABC)

Activity-based costing (ABC) allocates overhead costs based on the actual activities that drive costs, rather than just spreading them across all products. ABC identifies cost drivers and assigns costs to specific activities, helping businesses understand the true cost of producing individual products or services.

This method improves cost accuracy, leading to better pricing decisions and more efficient resource allocation. ABC allows companies to manage costs more effectively by focusing on key activities that consume resources.

2. Budgeting and forecasting

Budgeting and forecasting are essential processes that help businesses plan their financial activities and predict future performance. Budgeting involves setting financial targets for a specific period, while forecasting updates these targets based on current trends.

Both tools are vital for managing cash flow, controlling costs, and ensuring the business stays on track to achieve its financial goals. They help organizations adapt to changing circumstances and make informed decisions.

3. Variance analysis

Variance analysis is the process of comparing actual financial performance with budgeted or planned figures. It helps identify discrepancies in revenues and expenses, providing insights into areas that need attention.

By analyzing variances, companies can pinpoint causes of deviations, such as inefficiencies or market changes, and take corrective actions. This analysis is crucial for improving budgeting accuracy, enhancing decision-making, and ensuring better financial control within the organization.

4. Performance measurement

Performance measurement involves evaluating a company’s progress toward achieving its financial and operational goals. It includes metrics like profitability, productivity, and return on investment (ROI).

By using performance indicators, businesses can track their success, identify strengths and weaknesses, and make adjustments where necessary.

Regular performance measurement helps align activities with organizational objectives, improve efficiency, and drive continuous improvement to achieve sustainable growth and profitability.

5. Capital budgeting

Capital budgeting is the process of planning and evaluating long-term investments, such as new projects or equipment. It involves assessing the expected costs, returns, and risks of each investment.

Techniques like net present value (NPV), internal rate of return (IRR), and payback period are used to determine whether the investment will generate a sufficient return. Effective capital budgeting ensures that resources are allocated to projects that maximize value and align with strategic goals.

What is the process of management accounting?

Management accounting works through a structured process that transforms raw financial data into useful business insights. It involves several key steps such as data collection, classification, budgeting, and reporting. These steps help managers make informed decisions, improve efficiency, and support strategic planning across all areas of the organization.

Collecting financial data

The process begins with gathering relevant financial data from various departments and sources within the organization. This includes income statements, expense records, and operational data.

Accurate data collection ensures a strong foundation for effective management accounting and allows for better tracking of business performance over time. The data is typically collected from accounting systems, financial transactions, and direct reports from various teams within the organization, ensuring comprehensive coverage.

Classifying and analyzing data

Once collected, the financial data is sorted into categories such as fixed costs, variable costs, and revenue streams. Analysts then study these categories to identify trends and patterns.

This step helps highlight areas needing attention and forms the basis for budgeting and performance evaluation. The classification helps in identifying where the business is over- or underspending, which can then be addressed to improve financial control.

Setting budgets

Budgets are established based on past trends, current goals, and future projections. This step involves estimating revenues and setting cost limits for departments.

Well-planned budgets serve as financial roadmaps, enabling management to allocate resources effectively and control expenditures throughout the business cycle. The process of setting budgets often involves input from multiple departments to ensure accuracy and alignment with strategic goals.

Cost estimation

Cost estimation calculates the expected expenses associated with various business activities or projects. This includes materials, labor, and overhead.

Accurate estimates help companies prepare for future operations, prevent budget overruns, and enhance decision-making in areas like pricing, procurement, and project planning. Cost estimation provides a framework for setting pricing strategies and financial forecasts.

Tracking actual performance against budgets

This step involves monitoring real-time financial activity and comparing it with budgeted figures. It identifies any deviations from planned performance and flags areas for corrective action.

Regular tracking keeps financial activities aligned with organizational goals and ensures efficient use of resources. Variances are analyzed to determine the root causes of discrepancies and to identify trends for future planning.

Performance analysis

After tracking performance, the next step is to evaluate results and determine whether goals have been met. This analysis highlights strengths, uncovers inefficiencies, and reveals the financial impact of decisions.

It allows managers to make adjustments and refine their strategies for better results. Performance analysis includes both qualitative and quantitative data, providing a comprehensive view of business performance.

Preparing financial reports

Detailed reports are generated to present financial performance and insights to internal stakeholders. These reports include summaries of revenues, expenses, variances, and cost breakdowns.

Accurate reporting supports transparency and ensures that decision-makers have the data they need to guide the organization effectively. These reports are often tailored to different audiences, from department heads to executive teams, providing them with relevant insights.

Communicating financial information

The final step involves sharing financial insights with relevant stakeholders such as department heads and senior executives. Clear communication ensures that financial data is understood and used appropriately in decision-making.

This step strengthens accountability and promotes informed collaboration across the organization. Effective communication fosters a culture of transparency and trust, enabling decision-makers to act swiftly based on accurate data.

What are some of the objectives of management accounting?

The objectives of management accounting are designed to ensure that businesses effectively manage their financial resources and achieve their strategic goals. Through financial planning, analysis, and control, management accounting helps organizations maximize profitability, improve efficiency, and make informed decisions to support long-term success.

Boost profits and reduce losses

A primary objective of management accounting is to maximize profitability while minimizing losses. By analyzing cost structures, identifying inefficiencies, and implementing effective pricing strategies, businesses can optimize their financial performance.

Management accountants focus on cost control, revenue generation, and risk reduction to improve the overall financial health of the organization. This objective ensures that companies remain competitive and financially stable in the long term.

Improve efficiency and streamline processes

Management accounting aims to enhance operational efficiency by identifying areas where processes can be streamlined or improved. Through cost analysis and performance metrics, management accountants pinpoint inefficiencies and recommend improvements.

This leads to reduced operational costs, faster workflows, and more effective use of resources. By continuously improving processes, businesses can increase profitability and maintain a competitive advantage in their industry.

Enable data-driven decision-making

One of the key objectives of management accounting is to provide accurate data analysis to support informed decision-making. By collecting and interpreting financial data, management accountants offer insights that guide management in making strategic choices.

These insights help managers understand financial trends, assess risks, and evaluate potential opportunities. Informed decision-making ensures that businesses are aligned with their financial goals and can adapt to changing market conditions.

Ensure regulatory and accounting compliance

Management accounting ensures that the organization complies with all relevant accounting standards and regulations. It involves maintaining accurate financial records, preparing reports in accordance with industry standards, and adhering to tax laws.

Compliance helps avoid legal penalties, ensures transparency in financial reporting, and builds trust with stakeholders. By ensuring adherence to regulations, businesses can protect their reputation and maintain ethical financial practices.

Foster organizational transparency and accountability

Another objective of management accounting is to promote transparency and accountability by providing clear, reliable financial information to management and other stakeholders. Transparent financial reporting helps build trust with investors, employees, and customers.

It also ensures that all financial decisions are made based on accurate and current data. Promoting accountability ensures that resources are used responsibly and in line with the organization’s objectives.

Manage and reduce financial risks

Management accounting plays a crucial role in identifying and mitigating financial risks that could affect the organization’s stability. Through regular analysis of financial data, management accountants spot potential risks such as cash flow issues, cost overruns, or market volatility.

By proactively addressing these risks, businesses can implement strategies to protect their financial health and ensure long-term sustainability. Risk mitigation also allows companies to adapt quickly to changes in the business environment.

Align with strategic goals

Management accounting contributes to achieving strategic goals by aligning financial planning and analysis with organizational objectives. By forecasting financial outcomes, managing budgets, and tracking performance, management accounting ensures that resources are allocated effectively to support strategic initiatives.

It helps business leaders stay focused on their goals while making adjustments as necessary to remain on track. This alignment between financial management and strategy is key to achieving sustained business growth and success.

What are the functions of management accounting?

Management accounting plays a vital role in guiding business decisions through strategic financial planning. By providing insights into financial performance, it supports resource allocation, forecasting, and decision-making. It ensures that a company is on track to meet its objectives while optimizing its financial resources.

Setting financial goals

Setting financial goals for business is a crucial function of management accounting that helps businesses define clear objectives for revenue, profits, and growth. These goals are based on historical data, market conditions, and strategic plans.

By setting financial goals, companies create benchmarks to measure success and drive performance improvements. These targets provide direction for decision-making, motivating teams to focus on measurable outcomes.

Effective goal-setting allows companies to stay aligned with long-term financial strategies.

Distributing resources effectively

Management accounting helps in allocating resources effectively by determining where capital and operational costs should be invested. It involves analyzing different departments, projects, and functions to ensure resources are used efficiently.

The process allows businesses to prioritize investments that generate the highest returns, thereby maximizing value. It also helps in optimizing operational efficiencies by reducing waste and ensuring that resources are deployed where they are most needed. Strategic allocation of resources is essential for sustainable business growth.

Projecting future trends and outcomes

Forecasting is an essential function in management accounting that involves predicting future financial performance based on current trends and data. It helps businesses anticipate challenges and opportunities in the market.

Accurate forecasting supports proactive decision-making, ensuring that companies can adjust strategies to address market shifts. Management accountants use historical data, industry trends, and predictive models to create realistic financial projections. By forecasting, companies can prepare for changes in demand, pricing, and other external factors.

Determining optimal pricing strategies

Management accounting plays a key role in determining the right pricing strategies for products and services. This process involves analyzing costs, competition, and consumer demand to set optimal price points.

By choosing the right pricing, companies can ensure they remain competitive while achieving desired profit margins. Management accountants assess factors like fixed and variable costs, market conditions, and customer perceptions to create pricing models. This function helps balance profitability and customer satisfaction.

Supporting informed decision-making

One of the primary functions of management accounting is to provide the data needed for informed decision-making. By analyzing financial data and performance metrics, management accountants offer insights that help leaders make strategic choices.

Accurate financial analysis allows businesses to evaluate risks, opportunities, and costs effectively. This function empowers decision-makers to align their choices with long-term organizational goals. Management accounting ensures that decisions are backed by reliable data, which reduces uncertainty and improves outcomes.

Monitoring progress toward goals

Management accounting plays a critical role in keeping track of a company’s financial progress by monitoring key performance indicators. By comparing actual results with established goals, businesses can assess their performance in real-time.

This continuous tracking allows for timely adjustments to strategies, ensuring that organizations remain on course to meet their financial targets. Regular progress monitoring enables proactive decision-making and helps businesses achieve their objectives more effectively.

Pinpointing opportunities for improvement

Management accounting helps identify areas for improvement by analyzing financial data and performance metrics. Through variance analysis and trend observation, businesses can pinpoint inefficiencies or underperforming sectors.

Recognizing these areas enables management to implement corrective actions, optimize resources, and enhance overall performance. Identifying weaknesses helps streamline processes, reduce costs, and improve profitability, ultimately contributing to the organization’s long-term success and competitiveness in the market.

Evaluating operational efficiency and effectiveness

Measuring efficiency and effectiveness is a fundamental function of management accounting, as it evaluates how well resources are utilized to achieve organizational goals. This involves assessing the output relative to the input, such as revenue generated per employee or cost per unit.

By analyzing these metrics, companies can determine whether their strategies and operations are yielding the expected results. Measuring efficiency and effectiveness guides decision-making and helps identify opportunities to enhance operational performance.

Predicting potential challenges

Management accounting helps anticipate potential problems by analyzing historical data, financial trends, and market conditions. By forecasting potential challenges, such as cash flow issues or cost overruns, businesses can take preventive actions before they become critical.

Proactive identification of risks allows companies to adjust strategies, secure resources, or implement contingency plans. This function enhances the organization’s ability to navigate uncertainties and mitigate financial disruptions, ensuring long-term sustainability.

Ensuring legal and regulatory compliance

Management accounting ensures that businesses stay compliant with relevant regulations and tax laws. It helps track financial transactions, ensuring accurate reporting and adherence to legal standards.

By maintaining compliance, companies avoid legal repercussions and financial penalties that could harm their reputation and financial health. Staying on the right side of the law also promotes ethical business practices, enhancing corporate responsibility and fostering trust with stakeholders.

Safeguarding organizational assets

One of the key roles of management accounting is protecting a company’s assets by managing financial risks and ensuring proper asset allocation. Through regular audits, financial controls, and risk assessments, management accounting helps safeguard physical, financial, and intellectual assets.

It also ensures that valuable resources are used effectively to drive business growth and profitability. Protecting assets reduces the likelihood of fraud, theft, or misuse and preserves the organization’s value over time.

Enhancing transparency and accountability

Management accounting improves transparency and accountability by providing accurate, timely financial data to stakeholders. Regular financial reporting and performance reviews ensure that all departments are aligned with company goals and that financial activities are conducted ethically.

This transparency helps build trust with investors, customers, and regulatory bodies. It also promotes accountability by clearly showing the financial decisions made and their impacts, enhancing decision-making at all levels of the organization.

What are the advantages of management accounting?

Management accounting provides businesses with key insights into their financial performance, helping them make better decisions. It improves planning, enhances cost control, and facilitates performance evaluation, all of which contribute to efficient operations and long-term profitability.

Better planning

Effective management accounting helps businesses create better financial plans by forecasting future trends and setting realistic targets. By analyzing historical data and market conditions, management accountants can provide insights that shape both short-term and long-term planning.

This leads to more precise budgeting and resource allocation, helping companies avoid overextending or underfunding projects. It also ensures that plans are adaptable to changes, allowing businesses to quickly pivot in response to unexpected financial developments.

Performance evaluation

Management accounting facilitates performance evaluation by establishing clear financial benchmarks and performance indicators. This enables organizations to track progress, identify strengths and weaknesses, and make necessary adjustments.

Regular performance assessments allow businesses to recognize areas of improvement, fostering a culture of continuous growth and efficiency. By linking performance evaluations to organizational goals, companies ensure that employees and departments stay aligned with strategic objectives, contributing to overall success.

Alignment with strategies

Management accounting ensures strategic alignment by providing financial data that supports the achievement of business objectives. By linking financial insights with corporate goals, companies can prioritize investments and initiatives that are most likely to drive success.

This alignment helps ensure that resources are directed towards high-impact areas, maximizing the value created from each decision. It also fosters a more cohesive strategy across departments, improving overall organizational focus.

Improved communication

Management accounting improves communication by providing clear, concise financial reports that can be easily understood by different departments. These reports help bridge the gap between financial and non-financial managers, ensuring that all stakeholders are informed about the company’s financial health.

Effective communication of financial insights helps ensure everyone is aligned and working toward the same goals. It also fosters collaboration, as teams can use the data to make better-informed decisions and drive positive outcomes.

Enhanced investor confidence

Management accounting boosts investor confidence by providing transparent, accurate, and timely financial information.

When investors have access to reliable data, they can assess the company’s financial health and growth potential more effectively. This transparency fosters trust and strengthens relationships with stakeholders.

Moreover, well-managed financial performance, backed by strong accounting practices, increases investor confidence in the company's ability to generate sustainable returns, attracting more capital for future growth.

What are the limitations of management accounting?

While management accounting provides valuable insights, it has its limitations. These limitations include overreliance on historical data, subjectivity in assumptions, and a limited scope.

Additionally, its complexity, potential delays in data accuracy, resistance to change, and high implementation costs can hinder its effectiveness in some cases.

Over-reliance on historical data

One limitation of management accounting is its reliance on historical data, which may not always reflect future trends. Past performance data is often used to forecast future financial outcomes, but it does not account for unforeseen market changes or emerging risks.

This dependence on historical data may limit its predictive accuracy, especially in dynamic and volatile industries. As a result, management may be slow to adapt to new market conditions, leading to missed opportunities or poor decision-making.

Limited scope

While management accounting provides valuable insights into financial performance, its scope can be limited.

It typically focuses on internal operations, excluding external factors like market conditions or competitor actions. This narrower focus means management accountants may miss broader business trends that impact strategic planning and long-term success.

As a result, important external influences might not be considered in the decision-making process, potentially reducing the accuracy of business strategies.

Resistance to change

Management accounting systems may face resistance from employees and managers who are accustomed to traditional methods. The introduction of new accounting techniques or technologies may be met with reluctance, especially if it requires significant changes in workflow or skills.

Overcoming this resistance can take time, hindering the efficiency of management accounting processes. In some cases, reluctance to change can result in suboptimal use of new tools, limiting their effectiveness and the organization's ability to fully leverage them.

Data accuracy and timeliness

The effectiveness of management accounting relies heavily on the timeliness and accuracy of the data collected. Delayed or inaccurate data can lead to poor decision-making and missed opportunities.

Furthermore, the need for real-time reporting in fast-paced environments can be challenging, particularly if the necessary systems and processes are not in place. This lag in data availability can lead to decisions based on outdated information, undermining the potential for timely action and course correction.

Implementation cost

The cost of implementing management accounting systems can be significant. Businesses may need to invest in new software, training, and ongoing support, which can be expensive.

Smaller companies, in particular, may find these costs prohibitive, and the return on investment may not always justify the expenses involved.

In addition to the direct financial costs, the implementation process may also disrupt existing operations, leading to temporary inefficiencies or even reduced productivity during the transition period.

What are some challenges faced in management accounting?

Management accounting faces several challenges that impact its ability to provide accurate and timely financial information. From adapting to technological advancements to maintaining compliance with global standards, businesses must navigate these obstacles to remain competitive and efficient in their decision-making.

Rapid technological advancements

Rapid technological advancements require management accountants to stay updated with new tools and software. Automation and artificial intelligence are reshaping financial reporting and analysis, demanding a higher level of technical proficiency.

Accountants must adapt to these changes to leverage technology effectively, improve accuracy, and enhance operational efficiency.

Data security and privacy

With increasing amounts of sensitive financial data being stored digitally, ensuring data security and privacy has become a major concern. Management accountants must implement strong cybersecurity measures to protect confidential information from breaches.

Compliance with privacy regulations, such as GDPR, is critical to avoid penalties and maintain trust with stakeholders.

Globalization

Globalization introduces complexities in managing finances across different countries with diverse currencies, tax regulations, and financial systems.

Management accountants must adapt to these challenges by understanding international markets and economic factors. This requires cross-border coordination, accurate currency conversion, and compliance with global standards to ensure financial stability and growth.

Regulatory compliance

Regulatory compliance is an ongoing challenge as companies must adhere to changing financial regulations and tax laws. Management accountants play a key role in ensuring that financial practices comply with local and international standards.

Failure to comply can result in legal consequences, financial penalties, and reputational damage to the organization.

Why is management accounting important across industries?

Management accounting plays a crucial role across various industries, helping organizations make informed decisions, optimize resources, and improve profitability. Each industry applies management accounting techniques differently, tailoring them to meet specific operational needs and challenges.

1. Manufacturing

In the manufacturing industry, management accounting is essential for cost control and process optimization. Techniques like activity-based costing (ABC) and standard costing are used to track production costs, identify inefficiencies, and enhance budgeting.

By analyzing cost drivers, manufacturers can streamline operations, reduce waste, and improve profitability through more accurate cost allocation and pricing strategies.

Additionally, management accountants help in evaluating the financial impact of process changes, ensuring that investments in new technologies or equipment provide a measurable return.

2. Retail

Retailers rely on management accounting to manage inventory, track sales performance, and set pricing strategies. They use tools such as margin analysis and break-even analysis to understand the profitability of each product line.

Retailers also employ budgeting and forecasting to anticipate demand fluctuations, ensuring stock availability while maintaining efficient cost management and maximizing profit margins.

Furthermore, management accounting helps retailers assess the impact of promotional campaigns and adjust their strategies to optimize overall sales performance and customer satisfaction.

3. Healthcare

In healthcare, management accounting helps in budgeting, cost allocation, and financial performance evaluation.

Healthcare providers use management accounting to assess the cost-effectiveness of different treatments, manage resources, and optimize operational efficiency.

Costing techniques like activity-based costing are used to allocate resources effectively across various departments, such as emergency, surgery, and outpatient care, ensuring quality patient care while controlling costs.

Additionally, management accounting helps evaluate the financial viability of new services or expansions, ensuring long-term sustainability.

4. Technology

In the technology sector, management accounting is vital for project cost management, pricing decisions, and performance measurement.

Software companies, for example, use management accounting tools like return on investment (ROI) analysis and forecasting to assess the profitability of new projects or product developments.

With rapid innovation, accurate forecasting allows tech firms to make strategic decisions on R&D investments, product launches, and market expansion.

5. Non-profit sectors

In the non-profit sector, management accounting focuses on budgeting, cost control, and financial reporting to ensure efficient use of donations and grants.

Non-profits often use variance analysis to track the budget versus actual expenditures, ensuring that funds are allocated effectively towards programs and initiatives.

Management accounting helps non-profits maintain transparency, accountability, and financial sustainability, enabling them to fulfill their missions more effectively while managing limited resources.

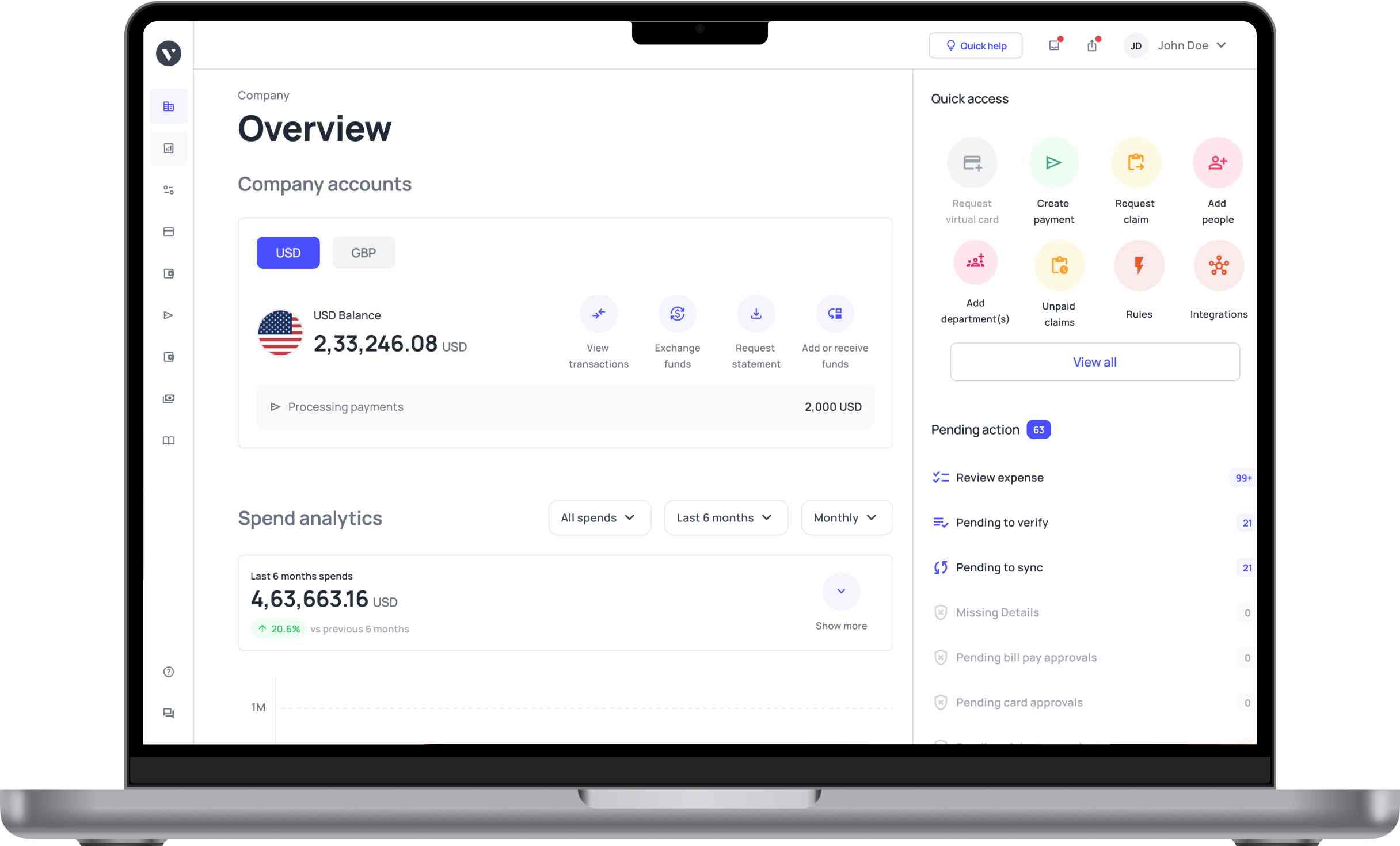

How can Volopay streamline accounting for busiesses?

Volopay's advanced accounting automation platform simplifies management accounting by automating expense tracking, budgeting, and reporting. Its integrated platform offers real-time visibility into company spending, enabling accurate cost control and strategic planning.

Features like multi-level approval workflows, automated invoice matching, and instant virtual cards reduce manual effort and improve financial accuracy. Volopay also ensures compliance with internal policies and supports data security.

Advanced analytics help identify cost-saving opportunities and streamline resource allocation. With seamless integration into accounting systems, Volopay accelerates month-end closings and enhances financial transparency. This helps businesses make informed decisions, improve operational efficiency, and stay adaptable in a dynamic economic environment.

Effortless accounting software integration

Volopay integrates seamlessly with popular accounting software like Xero, QuickBooks, and NetSuite, eliminating the need for manual data entry. This ensures that all financial data flows directly into your system, reducing errors and saving time.

Automatic syncing improves data consistency and simplifies audits. Volopay's integration supports real-time updates, ensuring accurate records for decision-making. It also streamlines workflow for finance teams, allowing faster reporting and financial management.

Improved budgeting and forecasting

Volopay's business budgeting software capabilities allow businesses to set department-specific budgets, monitor expenses in real-time, and forecast future financial performance. Managers can allocate funds efficiently based on past trends and current needs.

The platform helps detect budget variances early, enabling quick corrective action. Real-time data access improves financial planning accuracy. As a result, businesses can make proactive decisions and stay financially prepared for changing demands.

Enhanced compliance

Volopay ensures compliance through customizable approval workflows, audit trails, and policy enforcement features. Every transaction is logged with details such as purpose, approver, and supporting documents, reducing non-compliant spending.

The platform also supports regulatory audits by maintaining clear, organized financial records. This reduces the risk of penalties and increases transparency. With built-in controls, businesses can ensure adherence to internal and external financial regulations.

Automate manual tasks

Volopay automates routine finance tasks like data entry, invoice matching, and reimbursement processing. This reduces human error and frees up time for strategic work.

Automated reminders and approval flows ensure timely actions, improving efficiency. Employees can upload receipts via the mobile app, and the system extracts relevant data instantly. This simplifies invoice management and day-to-day operations for finance teams and improves overall productivity.

Quick reconciliation of expenses and receipts

With Volopay, matching expenses with receipts becomes fast and hassle-free through OCR-powered receipt scanning and real-time syncing.

The platform automatically tags and categorizes expenses, ensuring accurate bookkeeping. This reduces the reconciliation burden during month-end closures.

Finance teams can easily track missing documentation and resolve discrepancies quickly. Timely reconciliation improves reporting accuracy and maintains financial clarity at all times. It also shortens the financial close cycle, allowing faster access to monthly reports.

Gain insights into spending patterns

Volopay offers advanced analytics and detailed reports to help businesses understand how money is being spent across departments and vendors. Real-time dashboards highlight trends, anomalies, and cost-saving opportunities.

Managers can use these insights to make data-driven decisions and optimize budget allocation. Real-time spend visibility also helps in evaluating vendor performance and negotiating better deals. Overall, it supports smarter financial management and cost efficiency.

Conclusion

Management accounting plays a vital role in guiding businesses toward smarter financial decisions and strategic growth. It equips organizations with tools to analyze performance, control costs, and improve planning.

Across industries, its techniques help align operations with broader business goals. Platforms like Volopay enhance management accounting by automating tasks, improving accuracy, and providing real-time insights.

By embracing such solutions, companies can overcome common accounting hurdles, drive operational efficiency, and remain competitive in a dynamic business environment. As financial demands grow, strong management accounting practices will continue to be essential for long-term success.

FAQs on management accounting

By tracking performance and highlighting inefficiencies, it encourages ongoing adjustments. This fosters a culture of refining processes and achieving operational excellence.

Budgeting sets financial expectations and allocates resources effectively. It helps track actual performance against targets and identifies deviations for timely corrective actions.

It uses key metrics to evaluate efficiency, productivity, and financial health. This allows businesses to assess outcomes and align efforts with strategic goals.

Yes. Management accounting ensures that managers and executives have better data to work with when making decisions. This includes planning, budgeting, and forecasting. Make plans based on the historical data available.

Business executives will want to know what is management accounting as they will be able to make better forecasts with this particular accounting method. In turn, this allows businesses to mitigate risks in advance.

KPIs include gross profit margin, return on investment, cost variance, and inventory turnover. These indicators measure performance across various business functions.

With the right management accounting data, managers will be able to get an overview of all processes within the organization. This allows them to determine where they need to pour more resources.