Top 7 fintech trends to watch out for in 2025

The advent of technology, specifically the internet, has enabled pretty much every industry in this world to be more connected. When institutions use technology to provide financial services it becomes a part of the Fintech world.

The financial services industry is one of the most rapidly growing niches thanks to modern technology. This sector is constantly evolving and we get to see new Fintech trends every year. The future of digital finance for businesses looks promising with new technologies emerging and old ones being updated.

In this day and age of cut-throat competition, companies have to adopt the latest technological systems to stay in the race.

How is fintech a crucial part of business operations

Finance is the fuel for any business. Without it, it’s impossible to carry out other operations in the company. Fintech allows organizations to make the most efficient utilization of their capital so that they can not just survive but also thrive.

Fintech payment trends such as using a spend management system and not relying on outdated processes help a company save a lot of money and push them forward.

There are so many global Fintech trends that businesses are adopting including the use of digital banks, embedded finance, remote accounting, artificial intelligence, machine learning, and so much more.

7 fintech industry trends to watch out for in the new fiscal year

1. Artificial intelligence (AI) and machine learning (ML)

From the various B2B Fintech trends, artificial intelligence and machine learning are definitely seeing a major uptick

Among the business payments space, OCR (optical character recognition) is a great example of a machine learning software that helps companies scan receipts for reconciliation of financial statements and bill generation.

Many Fintech products also use AI systems to predict customer behavior. They don’t just show you what your customers are doing on the platform, but also give you deep insights regarding their usage patterns and suggest actions for the users to take based on all of this.

2. Contactless payments

The future of Fintech will definitely include more and more contactless payments. This payment method goes beyond the ease of use and the convenience it provides. With the pandemic we face, it is very obvious why paying without touching another object is helpful.

Many businesses use corporate credit cards to manage all their employee expenses. These cards can be added by the employees on common payment platforms such as GPay and Apple Pay that can conduct contactless payments.

By the looks of it, this trend is here to stay for the foreseeable future.

3. Digital banks

Digital banks, also known as neo-banks are financial institutions that provide people with banking facilities without a physical branch. Many such organizations have popped up in the recent past and among all the fintech technology trends, this one seems to be rising in popularity with more and more people trying it out.

The benefit of choosing a digital bank for businesses is the ease of application with less paperwork and usage of a digital platform. The lack of a physical branch significantly reduces the cost of dealing with a bank.

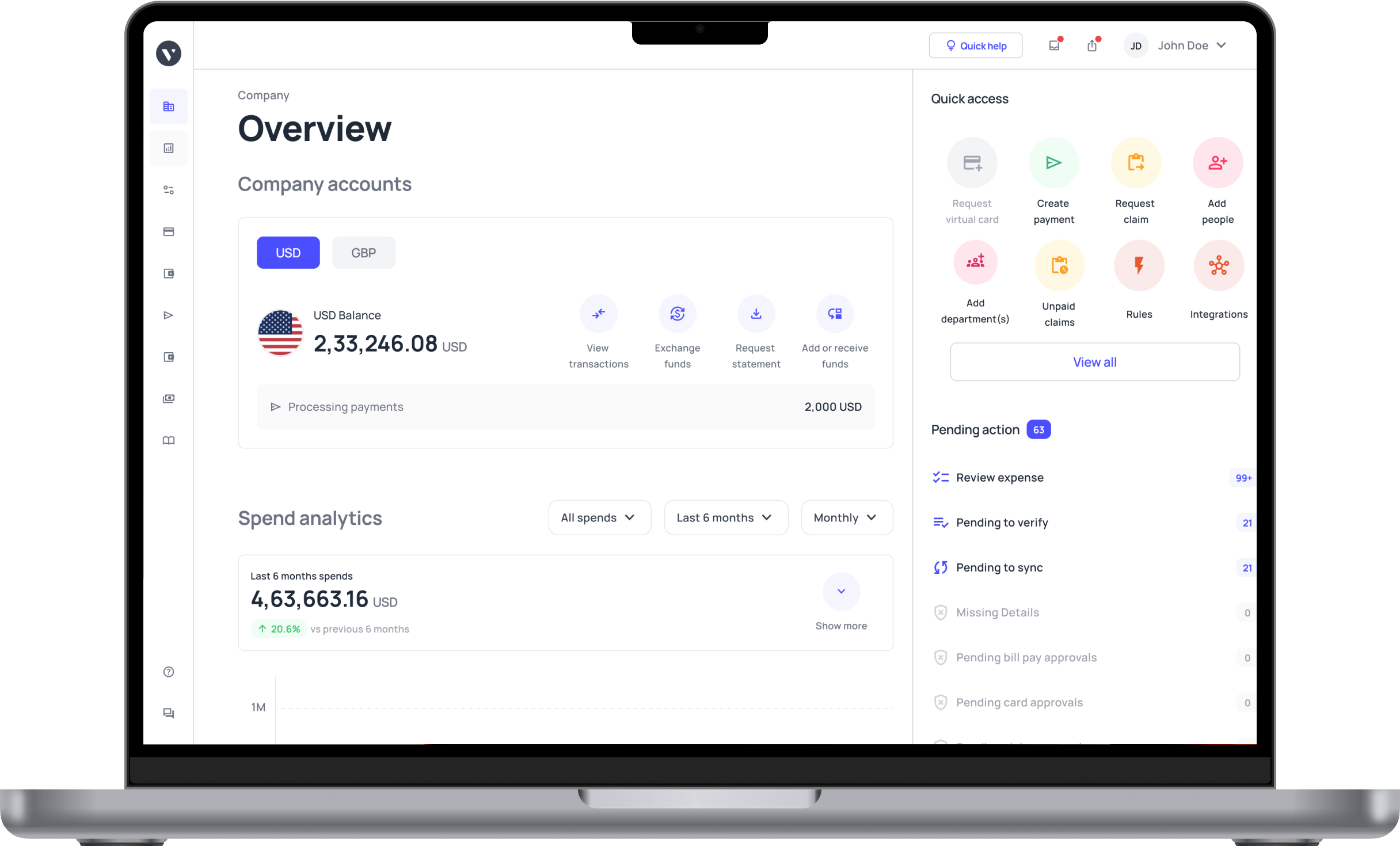

These institutions can offer enhanced banking services without the extra costs that came with traditional banks. Some great benefits that many digital banks offer include digital receipts, corporate credit cards with expense management systems that help you track and control company budgets and more.

The addition of a system to control and a platform to monitor funds are a part of Fintech that drastically differentiates modern online banking solutions from traditional banks. Over a long period, these reduced costs help businesses maintain their financial health and stability.

4. Platform as a Service (PaaS) solutions

While new Fintech startups keep emerging, the old banks and traditional financial institutions are not just going to sit back and watch. They too have understood the benefits of going digital and implementing many of the Fintech trends.

But it is not easy to develop a Fintech solution from scratch. It takes a lot of time, effort, and prior expertise.

Given that traditional financial institutions and banks already have a large customer base who want to provide these modern services, but can’t afford to wait for too long, they end up opting for PaaS (Platform as a service) Fintech solutions.

These platforms have the foundational structure of online banking services built-in and allow users to customize certain elements as per their needs to offer a white-labeled Fintech service.

5. RPA

RPA stands for Robotic Process Automation. As the name suggests, this technology will help businesses automate all the robotic processes that finance professionals have to do daily. There are many activities that accountants and finance professionals need to do that are important but take a lot of time.

These tasks are often repetitive and don’t need conscious processing of information. RPAs act as bots that you manipulate to do tasks in a specific manner.

RPA technology will help finance teams and businesses save time by automating tasks and leave more room for work that needs contextual human intellect such as budget planning and forecasting.

6. Blockchain

Ever since the rise of cryptocurrencies and NFTs, the blockchain platform has gained some serious attention for all the benefits it has. The blockchain with its decentralized mechanism is panning out to be a great use case for financial services.

While it is still in its infancy, the road ahead looks very promising and we will likely see a lot of advancements with regard to how businesses can start using the blockchain for financial operations worldwide.

Based on reports, from a $3 billion market size in the year 2020, the global blockchain market value is expected to go up to $39.7 billion by the year 2025. Many would claim that the blockchain is the future of digital finance because of the way transactions are carried out on it without a central authority who controls it and makes the rules.

7. Embedded finance

Embedded finance is the integration of financial services using tech into a non-financial platform. A simple way to understand this is to look at ride-hailing apps like Uber, Lyft, or food delivery apps like UberEats, Zomato, etc. These businesses do not offer financial services but need the ability to receive payments on their platforms.

So startups that build backend systems to easily pay and receive money through another platform are part of the embedded finance ecosystem. They essentially enable startups to collect money for the service that they’re providing.

Among the different global Fintech trends, this one will keep evolving as and when newer and better Fintech platforms arise.

The future of fintech

Fintech has become a very important part of the world. The future of startups and how they manage all their financial operations will be affected by the Fintech tools they use or don’t use. It is always a good idea to keep an eye out for the latest Fintech trends.