Business credit cards vs charge cards: What's the difference?

As a business owner, you rely on efficient financial tools to manage expenses, and business credit cards and charge cards are designed for this purpose.

A business credit card offers a revolving credit line, allowing you to borrow up to a set limit, pay off balances over time, and accrue interest on unpaid amounts. It’s ideal for flexible spending, covering daily operational costs or unexpected expenses.

What is a business credit card?

A business credit card is a financial tool designed specifically for companies to manage expenses, streamline purchases, and separate business spending from personal finances.

Unlike credit cards, a business charge card requires full payment of the balance each month. With a business credit card, you access a revolving credit line, meaning you can borrow up to a predetermined limit and carry a balance month-to-month.

Payments include a minimum amount, but unpaid balances accrue interest, often at higher rates than personal cards. This flexibility supports ongoing business needs like inventory or marketing.

What is a business charge card?

A business charge card is a payment option tailored for businesses that prefer to manage expenses without incurring revolving debt.

A business charge card requires you to pay the full balance each month, with no option to carry debt. It has no preset spending limit, but your spending is based on your financial profile and payment history. This encourages disciplined budgeting and avoids interest, ideal for stable cash flows.

There’s typically no preset spending limit, but limits adjust based on your business’s financial health.

Historical context

Business credit cards emerged in the 1950s, with issuers like American Express offering revolving credit for corporate expenses. Charge cards, pioneered by Diners Club in 1950, targeted business travelers, requiring full monthly payments.

Both evolved to meet growing commercial needs, with rewards and expense tracking becoming standard by the 1980s. Today, both options support various business needs, from budgeting to scaling operations.

Comparison of core features

Business credit cards have fixed credit limits, offering predictable borrowing boundaries. Charge cards lack preset limits, providing flexible spending based on your financial health.

Credit cards allow carrying balances with interest, while charge cards demand full monthly payments, promoting fiscal discipline but requiring consistent revenue.

Your decision should depend on cash flow consistency, spending patterns, and the need for financial flexibility.

Key differences between business credit and charge cards

Understanding the distinct mechanics of business credit card vs charge card can help you choose the right financial tool for your company. Business credit cards provide a revolving credit line, letting you borrow up to a fixed limit and pay over time with interest on unpaid balances.

They’re ideal for flexible spending but require careful management to avoid debt. Business charge cards demand full payment each month, with no preset spending limit, aligning with disciplined budgeting and stable cash flow.

Payment structures

With a business credit card, you can carry a balance month-to-month, paying at least a minimum amount while interest accrues on the remainder.

This flexibility suits businesses with variable cash flow. In contrast, a charge card requires you to pay the full balance by the due date, with no option to carry debt. This enforces strict financial discipline, ideal for businesses with predictable revenue but less forgiving during cash shortages.

While there’s no interest on a charge card, failing to pay in full can result in severe penalties. This gives businesses more flexibility but can lead to debt accumulation if not managed properly.

Spending limits and approvals

Business credit cards come with a fixed credit limit based on your creditworthiness, providing a clear borrowing ceiling. Charge cards have no preset limit; instead, spending is approved dynamically based on your payment history, financial health, and issuer policies.

While this offers flexibility for large purchases, approvals aren’t guaranteed, and overspending can strain your ability to pay the full balance monthly. Instead, the limit is dynamic, adjusting based on your business’s financial health and usage history.

While this offers more flexibility, it also requires a well-managed cash flow to ensure payments can be made in full each month.

Interest, fees, and penalties

Credit cards charge interest (APRs typically 15-25%) on carried balances, with additional fees for late payments or cash advances.

Charge cards don’t accrue interest since balances must be paid in full, but late payments incur steep penalties, and repeated delays may restrict future spending. Both may have annual fees, though charge cards often have higher ones due to premium perks.

However, failing to make full payments on time can result in hefty late fees and possible account suspension. Additionally, credit cards may have annual fees, while charge cards can sometimes come with higher fees based on their premium nature.

Impact on business credit

Using a business credit card responsibly—paying on time and keeping balances low—can boost your business credit score, as issuers report to credit bureaus. Charge cards also impact credit but focus on payment history since there’s no revolving debt.

Late payments on either can harm your score, but credit cards offer more opportunities to demonstrate credit management through consistent partial payments. Since full monthly payments are required, consistent on-time payments can help establish a positive credit history.

However, if you miss a payment, charge card providers may take stricter actions, impacting your credit score more significantly than with credit cards.

Rewards and incentive structures

Credit cards often provide cashback, points, or travel miles, with bonuses for categories like office supplies or fuel. Charge cards, especially premium ones, emphasize travel perks—like lounge access or hotel upgrades—and may offer higher reward rates for large spenders.

Your spending patterns determine which rewards structure maximizes value. Charge cards, while sometimes offering fewer reward categories, often focus on premium perks, such as exclusive access to airport lounges, concierge services, or vendor discounts.

Additionally, rewards from credit cards can often be redeemed for cash, statement credits, or travel expenses. Charge card rewards tend to cater to business owners looking for more premium, high-value benefits.

Common use cases for business credit and charge cards

Understanding when to use a business charge card vs credit card helps you align financial tools with operational needs. As a business owner, you need financial tools tailored to your operational needs, and business credit and charge cards serve distinct purposes.

Business credit cards shine when you require flexibility, allowing you to manage irregular expenses or carry balances during tight cash flow periods. Your choice hinges on your cash flow, spending patterns, and industry demands—credit cards for versatility, charge cards for structure.

1. Credit cards for flexible spending

When your business faces unpredictable costs—like emergency equipment repairs or sudden marketing opportunities—a credit card’s revolving credit line is invaluable. You can cover high expenses up to your limit, paying over time if needed.

This flexibility helps manage cash flow gaps, especially for seasonal businesses, while rewards like points or cashback add value to your spending. Plus, many credit cards offer rewards or cashback on such variable expenses, further supporting your financial agility while managing unpredictable operational demands.

2. Charge cards for disciplined spending

If your business has predictable, high-volume purchases, like monthly inventory restocks or vendor payments, a charge card excels. With no preset limit, you can handle large transactions, provided you pay the full balance monthly. This enforces budgeting discipline, avoids interest costs, and suits businesses with consistent cash flow, ensuring financial clarity.

The lack of interest charges encourages budgeting and accountability while still providing high dynamic limits based on financial strength. This setup supports companies with solid cash flow who want to avoid long-term debt while maintaining access to significant spending power.

3. Startups and small businesses

As a startup or small business owner, you often face limited credit history, making business credit cards more accessible. They allow you to cover initial costs like office supplies or software subscriptions, and build credit with timely payments.

The ability to carry balances helps navigate early cash flow challenges, fostering growth without immediate financial strain. While charge cards may require stronger financials, credit cards offer a practical starting point for businesses still building revenue stability and seeking to manage smaller, varied operational expenses.

4. Large enterprises

For large enterprises with robust cash flow, charge cards are a natural fit. You can manage substantial expenses—like corporate travel or equipment purchases—without worrying about preset limits.

The requirement to pay in full each month aligns with stable revenue streams, streamlining expense tracking, and leveraging rewards for high-volume spending. With no interest accrual and a full-payment model, they reinforce financial discipline while offering perks suited to high-spend operations, such as dedicated account managers or travel benefits.

5. Industry-specific uses

In retail, credit cards fund inventory purchases during peak seasons, with flexible payments easing cash flow. Tech firms use charge cards for predictable software licensing fees, benefiting from no interest. Travel-heavy businesses leverage either card for booking flights, with charge cards ensuring disciplined budgets and credit cards offering rewards tailored to frequent travel.

The travel industry benefits from charge cards offering luxury perks and global access, while freelancers or consultants may lean on credit cards for everyday flexibility. Understanding your industry’s spending rhythm guides the best card choice.

Benefits of business credit cards vs. charge cards

As a business owner, selecting the right financial tool is crucial, and business credit cards and charge cards offer unique advantages.

Business credit cards provide flexibility, allowing you to carry balances and manage cash flow during lean periods, though interest applies. Business charge cards promote discipline, requiring full monthly payments with no interest, ideal for stable finances.

1. Credit card payment flexibility

With a business credit card, you gain the ability to carry balances, paying only a minimum amount each month while interest accrues. This flexibility is a lifeline for managing uneven cash flow, letting you cover expenses like inventory or marketing campaigns without immediate full payment.

It’s especially valuable for startups or seasonal businesses, giving you breathing room to align payments with revenue cycles, though careful budgeting prevents costly interest accumulation. This revolving credit structure gives you room to breathe financially during lean periods or delayed receivables.

2. Charge card financial discipline

Business charge cards require you to pay the full balance monthly, eliminating interest charges and encouraging disciplined spending. This structure suits businesses with consistent cash flow, as it prevents debt buildup and aligns expenses with revenue.

You can make large purchases without worrying about interest, provided you clear the balance on time, making charge cards ideal for maintaining financial clarity and avoiding long-term liabilities. It helps you maintain a clean financial record and potentially strengthen your business credit score.

3. Advanced spend management

Both card types offer robust spend management tools. Credit cards provide detailed statements, categorizing expenses like travel or supplies, and often include software integrations for accounting.

Charge cards excel in reporting, offering real-time tracking, and customizable employee card limits. These features help you monitor budgets, detect overspending, and simplify tax preparation, ensuring transparency and control over your business’s financial operations. It’s a smart way to boost transparency and stay audit-ready at all times.

4. Tailored rewards programs

Credit cards offer rewards like cashback, points, or miles, often tailored to common expenses such as office supplies or fuel, maximizing savings for smaller businesses.

Charge cards, particularly premium ones, focus on travel perks—think airport lounge access or hotel upgrades—ideal for businesses with frequent travel.

Both provide vendor discounts, but your spending habits determine which card’s rewards deliver the most value to your bottom line. Choose one that aligns with your spending habits to get the most value from your card usage.

5. Accessibility for diverse businesses

Business credit cards are more accessible, with issuers offering options for startups or businesses with limited credit history, making them a go-to for new entrepreneurs. Charge cards often require strong financials and consistent cash flow, limiting eligibility to established firms.

This makes credit cards a versatile choice for diverse businesses, while charge cards cater to those with proven revenue stability. Choosing the right card depends on where your business is in its growth journey.

Challenges of business credit and charge cards

When choosing between business credit and charge cards, you must weigh their drawbacks to make informed decisions. Business credit cards can burden you with high interest on unpaid balances, escalating costs if mismanaged. Business charge cards demand full monthly payments, risking steep penalties if you miss deadlines.

High interest costs for credit cards

Business credit cards often carry high APRs, typically 15-25%, applied to unpaid balances. If you carry debt month-to-month, interest charges can quickly accumulate, straining your budget. This is especially risky for businesses with irregular revenue, as prolonged reliance on credit increases costs.

To mitigate this, you must prioritize timely payments or pay in full when possible to avoid escalating debt that impacts profitability. Late or minimum payments can also negatively impact your business credit score, leading to higher borrowing costs in the future.

Charge card payment demands

Charge cards require you to pay the full balance each month, leaving no room for carrying debt. If your cash flow falters, missing a payment triggers hefty late fees and potential spending restrictions.

This rigidity can strain businesses with unpredictable revenue, making it critical to maintain sufficient liquidity to cover large monthly balances and avoid penalties that disrupt financial stability. Missing a due date typically results in hefty late fees and potential account suspension.

Approval and eligibility barriers

Getting approved for either a business charge card vs credit card can be challenging. Securing either card involves credit checks, but requirements differ. Credit cards may be accessible with moderate credit scores, though better terms require strong financials.

Charge cards often demand higher revenue and proven cash flow, limiting access for startups or smaller firms. You’ll need to provide business revenue details and personal credit history, which can exclude newer businesses or those with inconsistent earnings.

Hidden fees and costs

Both cards may carry hidden costs. Credit cards often charge annual fees, foreign transaction fees (2-3%), or cash advance fees. Charge cards, especially premium ones, have higher annual fees ($100-$600) and steep penalties for late payments.

You may also face over-limit fees with credit cards or foreign exchange fees with either, requiring careful review of terms to avoid unexpected expenses. Always read the fine print and factor in all potential charges before committing to a card.

Limited purchase protections

Unlike personal credit cards, business credit and charge cards typically lack Section 75 coverage under UK law, which protects purchases over £100 if goods or services fail. This leaves you vulnerable to losses from faulty products or undelivered services.

While some cards offer limited warranties or dispute resolution, the absence of robust legal protections means you must rely on issuer policies, which vary widely. Understanding these limitations is essential to minimizing risks and ensuring your purchases are protected.

Debunking myths about business credit and charge cards

Navigating business credit and charge cards can be confusing due to common myths. As a business owner, you need clarity to choose wisely. When considering the business charge card vs credit card choice, misconceptions can cloud your judgment.

Understanding the truth behind these cards helps you make informed decisions tailored to your business needs. Let’s clear up some of the most common myths and get the facts straight.

1. Charge cards offer unlimited spending

You might think charge cards allow unlimited spending, but that’s a myth. While they lack preset limits, issuers set dynamic caps based on your financial history, revenue, and payment patterns.

For example, a $10,000 purchase may be declined if it exceeds your assessed capacity. You must maintain strong financials to maximize spending flexibility, ensuring timely full payments to avoid restrictions. If you’re financially stable and have a track record of timely payments, your purchasing power increases.

2. Credit cards are always costlier

It’s not true that credit cards are inherently costlier. They charge interest (15-25% APR) on carried balances, which can add up if mismanaged. However, charge cards often have higher annual fees ($100-$600) and steep late payment penalties.

If you pay your credit card in full monthly, you avoid interest, potentially making it cheaper than a premium charge card with hefty fees. So when comparing a business charge card vs credit card, your usage patterns and payment discipline determine the actual cost.

3. Only large firms qualify

You don’t need to run a large firm to qualify for these cards. Many credit cards are accessible to small businesses and startups, with issuers offering options for limited credit history. Charge cards may require stronger financials, but some cater to growing SMEs.

You can find cards suited to your business size by comparing eligibility criteria and credit requirements. Whether you’re a freelancer, early-stage founder, or SME owner, there’s likely a card that fits your profile, making the business charge card vs credit card decision more about strategy than size.

4. No credit score impact

Both card types affect your business credit score, debunking the myth of no impact. Credit cards report payment history, balances, and utilization to business credit bureaus, while charge cards focus on payment timeliness due to full monthly settlements.

Late payments or high credit card debt can lower your score, so you must manage both responsibly to build positive credit. If the card is personally guaranteed, it may also impact your credit score.

5. Cards are essentially the same

Assuming credit and charge cards are identical is a mistake. Credit cards offer revolving credit with fixed limits, allowing balance carryover with interest. Charge cards require full monthly payments and have no preset limits, relying on dynamic approvals.

These differences in payment structure and spending flexibility mean you must choose based on your cash flow and budgeting preferences. Understanding these distinctions is key when weighing your business charge card vs credit card options—choosing the wrong one could hinder your cash flow or limit your flexibility.

Managing business credit and charge cards effectively

To optimize your business credit or charge card, you need proactive strategies that align with your financial goals. Whether using a business credit card for flexible payments or a charge card for disciplined spending, effective management minimizes risks and maximizes benefits.

Set employee spending limits

When issuing cards to employees, define specific spending limits based on their roles. For example, set a $500 monthly cap for a sales rep’s travel expenses or $1,000 for a manager’s vendor payments.

Use your card issuer’s online portal to customize budgets per user, preventing overspending. Regularly review these limits to align with project needs or revenue changes, ensuring accountability without stifling operational flexibility.

Clear limits help you maintain control while empowering employees to make necessary purchases without constant approvals.

Monitor transactions in real time

Track card activity weekly to catch issues early. Most issuers offer mobile apps or dashboards showing real-time transactions, letting you spot unauthorized charges or budget overruns. Set aside time each week to review expenses, categorizing them for accuracy.

For charge cards, this helps ensure you’re on track to pay the full balance, while credit cards benefit from early detection of high-interest debt accumulation. This proactive approach helps you catch errors, detect fraud early, and ensure spending aligns with your company’s goals and budget.

Automate receipt collection

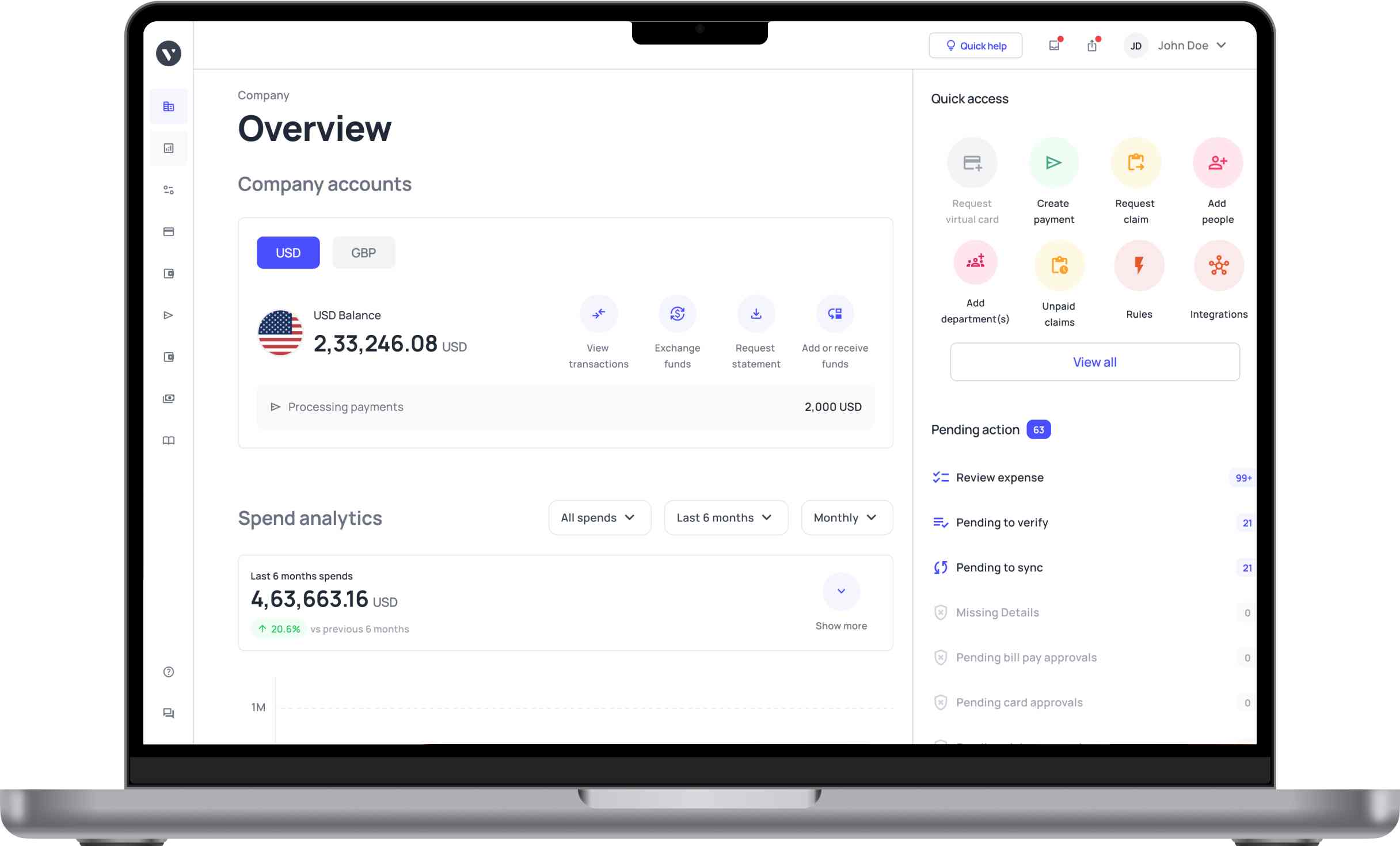

Simplify documentation by using tools like Volopay. It lets you or your employees snap photos of receipts, automatically uploading them to your expense system using OCR technology.

Linking tools like these to your card helps with instant transaction matching, reducing manual entry errors. This streamlines tax preparation and ensures compliance, especially for charge cards requiring detailed records to justify high spending.

By automating this process, you’ll reduce paperwork, improve audit readiness, and eliminate gaps in your financial records.

Train employees on policies

Educate your team on card usage policies to prevent misuse. Conduct training sessions outlining approved expenses, spending limits, and receipt submission processes.

Emphasize the importance of timely reporting and adherence to budgets, particularly for charge cards where full payments are non-negotiable. Regular refreshers and clear written guidelines reinforce compliance, reducing the risk of errors or policy violations.

Well-informed staff are more likely to use cards responsibly, reducing the chances of policy breaches or unintentional misuse.

Integrate with accounting tools

Sync your cards with accounting software like NetSuite or Xero for seamless financial management. These platforms automatically import transactions, categorize expenses, and reconcile accounts, saving time and reducing errors.

For credit cards, track interest and balances to manage debt; for charge cards, ensure full payments align with cash flow. Integration enhances reporting accuracy, simplifies audits, and keeps your financial data organized.

With seamless integration, you get accurate financial reports, faster month-end closings, and better insights into spending trends.

Compliance and security for business cards

As a business owner, you need business credit and charge cards that prioritize compliance and security to protect your finances and meet regulatory standards. Both card types offer robust tools to ensure adherence to tax laws, prevent fraud, and safeguard sensitive data.

By leveraging automated checks, detailed logs, and advanced security features, you can maintain trust, streamline audits, and focus on growth without worrying about compliance or data breaches.

Automated policy checks

Both credit and charge cards feature systems that flag non-compliant spending in real time. You can set policies—like limiting travel expenses to $500 per employee—and the card’s software alerts you to violations, such as unapproved vendor purchases.

This automation ensures adherence to your budget and regulatory requirements, reducing manual oversight and helping you correct issues before they escalate. It’s a critical feature for staying on top of compliance, regardless of whether you choose a business charge card vs credit card.

Audit-ready transaction logs

Card issuers provide detailed transaction logs, essential for IRS compliance. Each purchase is recorded with timestamps, merchant details, and categories, accessible via online portals.

For charge cards, logs support high spending justification; for credit cards, they track interest and payments. These records simplify audits, ensuring you’re prepared for tax season with accurate, exportable data for accounting software. If you’re ever audited, having a clean record ensures faster resolution and fewer headaches.

Fraud prevention measures

To combat fraud, both cards use encryption for transactions and offer card-locking features. If you suspect unauthorized use, you can freeze your card instantly via an app.

Credit cards often include zero-liability policies for fraudulent charges, while charge cards monitor high-volume spending for anomalies. Real-time alerts for unusual activity further protect your funds, giving you peace of mind.

These layers of security drastically reduce the risk of unauthorized spending or data breaches, keeping your business finances safe and protected at all times.

Multi-level approval workflows

You can implement multi-level approval workflows for significant expenses. For example, employee purchases above $1,000 may require your authorization through the card’s platform. This is particularly useful for charge cards with no preset limits, ensuring large transactions align with your budget.

These workflows enhance oversight, prevent overspending, and maintain compliance with internal policies. Whether you're using a prepaid solution or a traditional card, layered approvals reinforce both internal control and financial compliance.

Data security standards

Both card types adhere to PCI DSS, ensuring secure payment processing, and many issuers comply with SOC 2 for data handling. Your sensitive information, like account details, is encrypted, and access is restricted to authorized users.

Regular security audits by issuers minimize breach risks, allowing you to trust that your financial data remains protected. These certifications guarantee that your card data is handled with top-tier security protocols.

Which card is best for your business?

Selecting the right card for your business hinges on aligning its features with your financial needs. Choosing between a business credit card vs charge card depends on your financial habits and operational needs.

By evaluating your cash flow, spending habits, and growth goals, you can choose a card that supports your operations while maximizing rewards and minimizing costs.

Analyze your cash flow

Start by assessing your cash flow. If your revenue fluctuates, a credit card’s ability to carry balances offers breathing room, though you’ll need to manage interest costs. If you have consistent income, a charge card’s requirement to pay in full monthly aligns with your stability, avoiding debt but demanding liquidity.

Review your monthly cash inflows to ensure you can meet either card’s payment terms without strain. If you're frequently dealing with uneven revenue or delayed client payments, a business credit card can help you manage short-term gaps without hurting your operations.

Match spending patterns

Consider your expense frequency and size. For irregular or high expenses—like seasonal inventory or one-off equipment purchases—a credit card’s fixed limit and flexible payments suit your needs.

For predictable, high-volume spending, like regular vendor payments, a charge card’s lack of preset limits supports large transactions, provided you clear the balance monthly. Always align your card type with your purchasing behavior to avoid limitations or penalties and to make the most of available credit.

Balance rewards and costs

Weigh each card’s rewards against its fees. Credit cards offer cashback or points on everyday purchases, but high APRs and annual fees can erode benefits if you carry balances. Charge cards provide premium perks like travel rewards, but higher annual fees ($100-$600) require significant spending to justify.

Calculate your average spend to ensure rewards outweigh costs, prioritizing cards with perks that match your business’s priorities. Choose a card where the value of the rewards genuinely offsets the cost of maintaining it.

Evaluate software compatibility

Check how each card integrates with accounting software like QuickBooks or Xero. Credit cards typically sync seamlessly, auto-categorizing expenses for easy bookkeeping. Charge cards often provide detailed reporting and integrations, streamlining expense tracking and employee card management.

Choose a card with robust compatibility to reduce manual data entry, ensuring your financial systems remain efficient and accurate. When comparing a business credit card vs charge card, ensure the provider offers API support or native integrations to streamline accounting tasks.

Plan for business growth

Think about scalability. Startups benefit from credit cards’ accessibility and flexibility, supporting early growth despite limited credit history. Established enterprises with strong cash flow leverage charge cards for high-volume spending and premium perks.

As your business grows, reassess your card choice to ensure it scales with your revenue, expense complexity, and credit-building needs, aligning with long-term goals. Consider scalability, spending limits, and reward tiers that grow with your company. Selecting the right card today should support—not limit—your expansion tomorrow.

Why choose Volopay’s prepaid cards as an alternative?

As a business owner, you need a spending solution that offers control without the complexities of traditional business credit or charge cards. Volopay’s prepaid cards provide a flexible alternative, letting you preload funds for secure, controlled spending.

Unlike credit cards with interest or charge cards requiring full monthly payments, Volopay’s corporate cards eliminate debt risks and offer customizable limits, real-time tracking, and global usability.

Customizable spending controls

Volopay lets you set precise budgets for each prepaid card, ensuring employees don’t overspend. You can assign a $500 limit for travel or $1,000 for vendor payments and restrict usage to specific merchants, like only allowing software subscription purchases.

Features like temporary freezes or permanent blocks enhance security, giving you granular control over expenses via an intuitive dashboard, accessible anytime. You’ll know exactly where your money is going, reducing the chances of misuse and helping departments stay aligned with overall financial goals.

Real-time expense tracking

With Volopay’s prepaid cards, you gain instant real-time visibility into spending through a centralized dashboard. Every transaction, whether online or in-store, is logged in real time, showing details like merchant and amount.

You can filter ledgers to review specific card activity, helping you spot trends or discrepancies. This transparency simplifies budgeting and ensures you’re always in control of your company’s finances. This proactive approach to expense management keeps your financial strategy responsive and accurate.

No credit checks required

Unlike credit or charge cards, Volopay’s prepaid cards don’t require credit checks, making them accessible to startups, SMEs, or businesses with limited credit history. Since they're not tied to credit lines, there are no credit checks involved.

You simply preload funds, and approval is based on your account setup, not your financial background. This inclusivity lets you equip employees with cards for expenses without navigating stringent eligibility barriers. You can start using the cards immediately without waiting for approvals or undergoing financial scrutiny.

Seamless accounting integrations

Volopay's robust integration capabilities help it sync natively with accounting tools like QuickBooks, Xero, and NetSuite, syncing transactions automatically to streamline bookkeeping. You can export card ledgers via Universal CSV for other platforms like MYOB, reducing manual data entry.

This ensures your financial records stay accurate and up-to-date, saving time and minimizing errors during audits. With cleaner books and faster reconciliation, your finance team can close accounts with greater speed and accuracy, freeing up time for strategic planning and analysis.

Multi-currency expense support

Volopay’s prepaid cards excel in global business money transfers, supporting payments in multiple currencies with competitive exchange rates. You can use them for international vendor payments or employee travel expenses without high foreign transaction fees.

Their worldwide acceptance ensures your team can spend seamlessly, wherever business takes them. You can load, spend, and track expenses in various currencies without relying on expensive international credit lines. This feature ensures smoother cross-border payments and lets your global teams function efficiently without financial bottlenecks.

FAQs about business credit cards vs. charge cards

For startups, a business credit card often makes more sense. It's generally easier to qualify for and offers a set credit limit with flexible repayment options. This can be crucial when your cash flow is unpredictable.

A business charge card vs credit card may offer more purchasing power, but charge cards usually require a strong financial history and full monthly repayment, which can be difficult for new businesses. Starting with a credit card builds your credit profile while giving you room to grow.

Both cards can impact your business credit score. A business credit card reports your usage, balances, and payment behavior to credit bureaus regularly, which helps build credit over time, if used responsibly.

A charge card also reports activity but focuses more on payment consistency since balances must be cleared monthly. Whether you use a business charge card vs credit card, timely payments and low utilization will strengthen your credit profile and improve your chances of securing future financing.

Rewards can be valuable if your spending habits align with the card’s benefits. Business credit cards often offer cashback or points on categories like office supplies or travel, while charge cards may offer premium rewards, concierge services, or business tools.

However, annual fees and interest (on credit cards) can offset those perks. When comparing a business charge card vs credit card, evaluate your typical expenses and repayment habits to ensure the rewards truly outweigh the costs.

Yes, using both can be a smart strategy. You can rely on a business credit card for purchases you might want to pay off over time, and use a charge card for predictable monthly expenses that you can pay in full.

This mix allows you to manage cash flow efficiently, maximize rewards, and build credit from multiple sources. A dual approach to the business charge card vs credit card debate offers greater flexibility and stronger financial control for your business.