What is a business charge card and how does it work?

The only time when you should pick a card at random, is when a magician asks you to; not when choosing a card for your business. The payments and banking infrastructure has evolved significantly over the past couple of decades, specifically when it comes to business cards.

Credit cards, debit cards, prepaid cards, corporate cards, and so much more. The variations are enough to put companies in a dilemma of choice. Among these different types of cards, is one that has been quite popular in the past few years known as a business charge card.

Many organizations across the globe have taken a liking to this type of card for its unique value proposition that fits in with the needs of many businesses. But they aren’t meant for everyone. Let’s dive a bit deeper to understand what charge cards are, how they work, their benefits when you should choose them, and how they differ from credit cards.

What are business charge cards?

If you're managing your company’s finances, understanding what business charge cards are — and how they differ from traditional credit cards — can help you spend smarter.

A business charge card is a powerful financial tool designed to streamline business expenses, offer spending flexibility, and encourage responsible cash flow management.

1. Business charge cards definition

A business charge card requires you to pay off the entire balance each month. Unlike credit cards, there’s no preset spending limit, though your spending ability adjusts based on factors like payment history and cash flow. This business charge card’s meaning emphasizes disciplined spending — ideal if you want to avoid revolving debt.

2. How they work for businesses

When you make a purchase using a business charge card, the transaction is recorded and added to your monthly statement. At the end of each billing cycle, you're required to pay the balance in full. These cards simplify tracking business purchases while helping you maintain control over spending behavior.

3. Key features of business charge cards

Some standout features of business charge cards include no interest charges, since balances must be paid in full monthly, and flexible spending limits, which scale with your business’s financial health. These features give you both predictability and agility when managing company expenses.

4. Who uses business charge cards

Business charge cards are best suited for companies with strong, predictable cash flow. If your business can handle monthly payments without fail, a business charge card can be a strategic asset — enabling larger purchases, consolidating expenses, and strengthening supplier relationships without the risk of accumulating interest-bearing debt.

How do charge cards work?

A charge card has a repayment cycle just like a credit card, but it is of much shorter duration; usually, 30 to 60 days depending on the provider you choose. Another aspect of it is that you cannot make part payments of the credit you use. You must pay the full balance you have utilized during each cycle on the due date.

The spending limit on a charge card is typically much higher than a normal credit card, and in many cases, there is no pre-set limit. Transactions are approved based on your financial history, spending habits, and business credit score, making charge cards ideal for companies with larger expenses than those allowed by most credit cards.

Make secure and convenient business payments with corporate cards

How do business charge cards differ from other cards?

To choose the right financial tool for your business, it's essential to understand how business charge cards compare to other common card types. While they may look similar, the way they function — and the benefits they offer — are quite different.

Charge cards vs. credit cards

The main difference between a business charge card and a credit card lies in repayment. With a charge card, you're required to pay off the full balance each month. Credit cards, on the other hand, let you carry a balance and pay interest over time.

If you're looking to avoid interest and maintain financial discipline, a business charge card might suit you better.

Charge cards vs. debit cards

Business charge cards let you spend based on your creditworthiness, not on the balance in your bank account. Debit cards deduct funds directly from your business checking account at the time of purchase.

If your goal is to build a business credit profile and manage larger expenses flexibly, a business charge card offers more strategic advantages than a debit card.

Charge cards vs. prepaid cards

Unlike prepaid cards, which are loaded with a fixed amount of money, business charge cards don’t have a preloaded balance.

They provide flexible spending power based on your payment history and business health. This makes them better suited for businesses with evolving needs and regular operating expenses.

Cost structures

Business charge cards typically come with annual fees and potential late payment fees, but they don’t charge interest, because you’re required to pay in full each month. In contrast, credit cards may have lower annual fees but can cost more over time due to interest charges.

With charge cards, you're paying for control and flexibility rather than long-term borrowing.

Want to dive deeper into these comparisons? Our blog Business credit cards vs charge cards: What’s the difference? expands on these distinctions to help you make the right financial choice for your business.

Overview of charge card vs credit card

- Pre-set credit limit

- Annual fees

- Allowance of part payment

- Does it affect your business credit score

- Are interest charges applicable?

- Late payment fees

Who qualifies for a business charge card?

Charge cards aren’t suitable for every business due to their strict eligibility criteria. Issuers perform an in-depth financial review to confirm your company’s cash flow stability, reputation, and creditworthiness.

You’ll typically qualify only if your business demonstrates consistent positive cash flow and a strong credit score. This ensures you can manage the card responsibly without defaulting.

Benefits of using business charge cards

Choosing the right payment solution can have a direct impact on how well you manage your business’s financial health. Business charge cards offer a range of benefits that go beyond simple transactions — they help you control spending, reduce costs, and improve overall financial discipline.

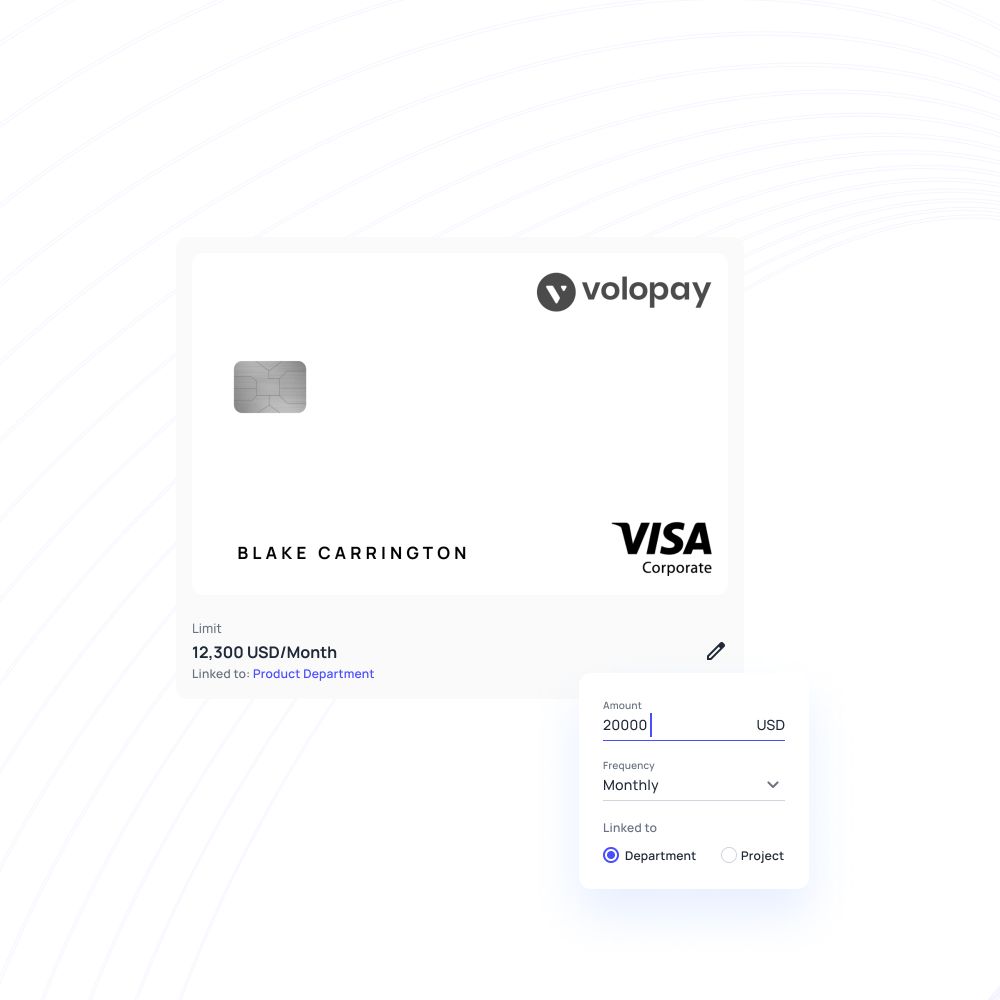

1. Flexible spending limits

Unlike traditional credit cards with hard limits, business charge cards offer dynamic spending limits that adjust based on your company’s financial profile, payment history, and cash flow.

This gives you room to scale spending when needed, without the limitations of a fixed credit ceiling — a valuable asset as your business grows.

2. No interest charges

Since business charge cards require full repayment each billing cycle, you avoid interest entirely. This structure promotes cleaner, more predictable finances.

By not carrying balances, you can reinvest more of your revenue directly into operations or growth, saving money compared to credit card users who incur ongoing interest.

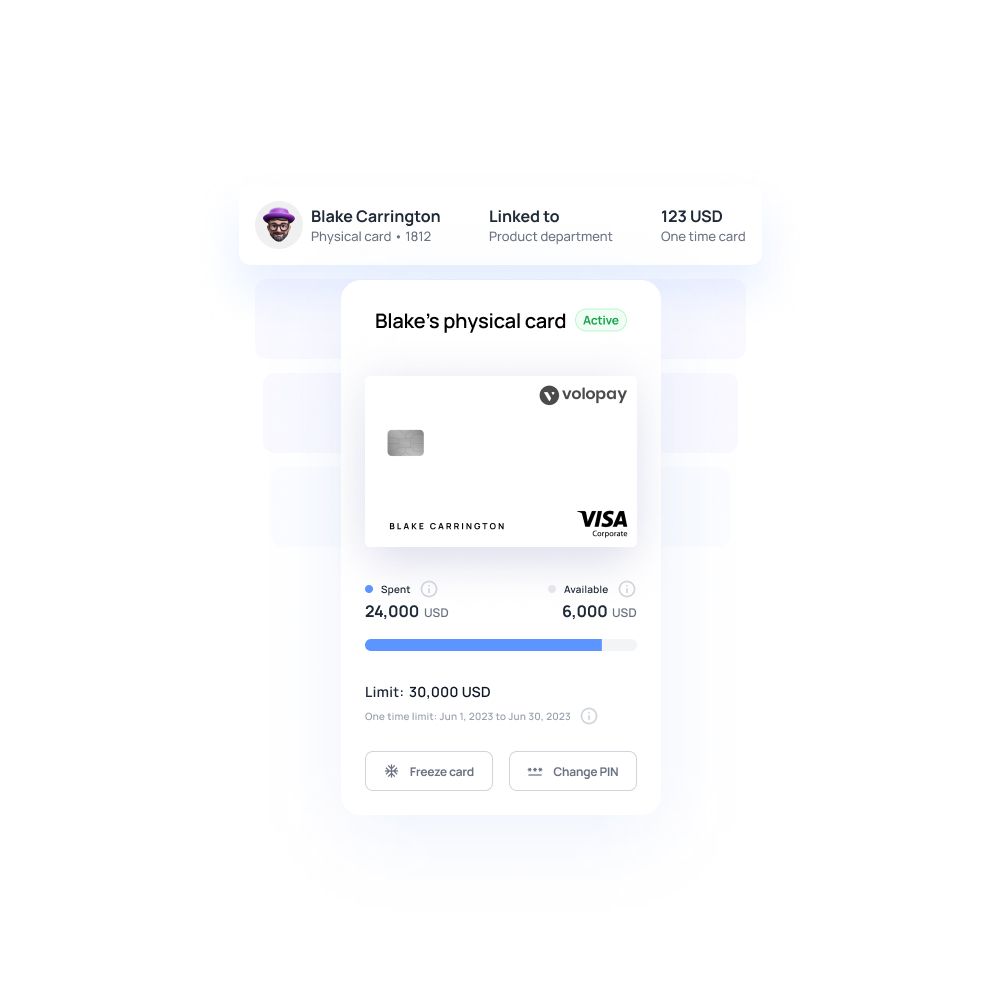

3. Enhanced spend management

Most business charge cards come with tools that let you track spending across teams, set individual employee limits, and categorize expenses in real time. This gives you more visibility and control over your budget, helping you ensure compliance and reduce the risk of unauthorized or out-of-policy purchases.

4. Improved cash flow discipline

Because you’re required to pay your business charge card bill in full every month, these cards naturally promote better cash flow discipline. This helps your team plan spending more thoughtfully, avoid debt accumulation, and build a healthier long-term financial strategy — all without the temptation of minimum payments.

5. Rewards and perks

Many business charge cards offer valuable incentives, including cashback, travel rewards, or discounts with key vendors. These perks turn everyday purchases into cost-saving opportunities, helping you earn more value from the money you’re already spending. Depending on your card, you might also access premium support or travel protections.

Challenges of business charge cards

While business charge cards offer numerous advantages, they’re not the perfect fit for every company. Understanding their potential limitations can help you make a more informed financial decision based on your business’s needs and capabilities.

1. Full payment requirements

With business charge cards, you must pay the full balance by the due date. Failing to do so often results in steep late payment fees and possible suspension of the card.

If your business sometimes experiences tight cash flow, this payment structure may pose a risk rather than a benefit.

2. High annual fees

Many premium business charge cards come with high annual fees, especially those that offer travel perks, cash back, or concierge services.

While these costs may be worthwhile for high-spending businesses, they can be excessive for smaller companies or those that don’t take full advantage of the card’s benefits.

3. Limited flexibility

One key drawback of business charge cards is the inability to carry a balance. This makes them less useful as financing tools in times of need.

If your business prefers the option to spread payments over time or manage cash flow with more flexibility, a traditional credit card may be a better fit.

4. Eligibility barriers

Getting approved for a business charge card isn’t always easy. Lenders typically assess your company’s revenue, cash reserves, and payment history.

If your business is a startup or has inconsistent income, you might face challenges meeting the qualification requirements, especially for cards with higher spending power.

5. Lack of consumer protection

Unlike personal credit cards, business charge cards often don’t offer the same consumer protections.

For example, purchases made with a business charge card aren’t covered under Section 75 of the Consumer Credit Act, which means you could have fewer legal rights in the event of fraud or disputes.

Simplify your business expenses with Volopay

Best practices for managing business charge cards

Once you’ve chosen a business charge card, using it effectively is just as important as selecting the right one. These best practices will help you optimize usage, maintain control, and maximize value for your business.

Set clear spending policies

Start by creating clear, written policies that define how employees can use business charge cards. Outline approved expense categories, spending limits, and procedures for submitting receipts.

When everyone knows the rules upfront, you reduce the risk of misuse and help ensure card usage aligns with your company’s budget and goals.

Monitor transactions regularly

Don’t wait until the end of the month to review expenses. Schedule weekly transaction reviews to catch irregularities early and ensure compliance with your spending policies.

Regular monitoring also helps identify trends, cut unnecessary costs, and promote accountability among your team.

Automate receipt collection

Manual receipt tracking is time-consuming and error-prone. Use mobile apps or integrated platforms that let employees upload receipts instantly after each transaction.

This not only saves time but also helps keep expense records organized and audit-ready, reducing the workload for your finance team.

Train employees on usage

Every cardholder should understand how to use the business charge card responsibly. Provide training that covers your spending policy, receipt submission process, and what to do in case of lost or stolen cards.

A well-informed team is key to preventing misuse and ensuring smooth operations.

How to choose the right business charge card

Assess your cash flow

Before applying for a business charge card, take a hard look at your cash flow. These cards require full monthly payments, so your business should have steady, reliable revenue to meet those demands.

If your cash flow fluctuates, you might want to explore whether a charge card aligns with your financial cycles or if another option is more sustainable.

Compare fees and rewards

Annual fees can vary widely between business charge cards, especially those offering premium features. Make sure you weigh these fees against the potential rewards, like cashback, travel perks, or vendor discounts.

If the benefits align with your company’s spending patterns, the rewards can easily offset the card’s cost over time.

Check integration capabilities

For smoother financial management, look for business charge cards that integrate with your accounting software, like QuickBooks, Xero, or NetSuite.

These integrations can automate expense reporting, simplify reconciliation, and help reduce administrative overhead. The right card should support the tools your finance team already relies on.

Evaluate spend controls

A great business charge card should give you the ability to manage employee spending with ease.

Look for cards that allow you to set individual limits, restrict merchant categories, or track expenses by department. These controls not only prevent overspending but also promote accountability across your organization.

Review eligibility requirements

Before applying, review the eligibility criteria for each business charge card. Issuers often require proof of business income, operating history, or a minimum bank balance.

Make sure your company meets these benchmarks to improve your chances of approval and avoid unnecessary credit checks or rejections.

Why choose Volopay’s prepaid cards for business spending?

If you’re seeking an alternative to traditional business charge cards, Volopay’s prepaid cards offer a versatile solution for managing your business expenses. These cards provide full control over spending, real-time tracking, and seamless integration with your accounting tools, making them an excellent choice for businesses of all sizes.

Customizable spending controls

With Volopay’s prepaid cards, you can set customizable budgets for individual cards, ensuring that employees stay within their spending limits.

You can also restrict specific vendors or categories, ensuring compliance with company policies. This level of control helps you optimize expenses while preventing unauthorized or unnecessary purchases.

Real-time expense tracking

Volopay’s prepaid cards offer real-time tracking through intuitive dashboards that give you immediate insights into spending.

You can monitor expenses as they occur, keeping you up-to-date and allowing you to make quick adjustments if needed. This visibility helps with budgeting and prevents overspending, ultimately saving you time and money.

Seamless accounting integrations

Volopay integrates seamlessly with accounting software such as QuickBooks and Xero, streamlining your financial management.

Automatic syncing of transaction data reduces manual data entry, ensures accuracy, and helps with reconciliation. This integration simplifies your accounting process and keeps your financial records organized and up-to-date.

No credit checks required

One major benefit of Volopay’s prepaid cards is that they don’t require a credit check, making them accessible even to startups and businesses with limited credit history.

Since funds are pre-loaded onto the card, you won’t need to worry about meeting credit requirements or the impact on your business credit score.

Bring Volopay to your business. Get started for free.

FAQs

Yes, although a charge card does not track your credit utilization rate, it does track other factors that affect your credit score such as your payment history and how old your credit account is.

Using a business charge card can impact your business credit score. Timely payments can help build a positive credit history, which could improve your business’s borrowing capacity in the future.

On the other hand, missing payments or carrying overdue balances may negatively affect your score, making it harder to secure future financing.

When repaying credit used from a charge card, there is no option to make part payments. So if you’re not able to pay the full amount, it will count as a late payment and the card issuer will charge you a late payment fee.

Unlike a credit card, a charge card does not have a pre-set spending/credit limit. The limit is usually kept so high that businesses won’t face any problems carrying out transactions with large sums of money.

If you miss a payment on your business charge card, you’ll likely incur late fees and risk having your account suspended or closed.

Additionally, missed payments can be reported to credit bureaus, which can negatively affect your business credit score. To avoid this, set reminders or automate payments to stay on top of your balance.

Charge cards usually require a credit score above 670. The better your credit score is the higher your ceiling for spending through charge cards will be.