8 key accounting department functions to master in 2025

Accounting activities in an organization are the carrier of the entire company. Every business activity in the company must pass through the accounting function at one point or another. Apart from taking care of the financial aspect of a business, the accounting team shares responsibility with almost every team of the organization– classifying it as the– lifeblood of the organization.

Owing to its massive importance for the survival of a business, accounting techniques need to be evolutioned time and again. The age-old manual accounting practice was disrupted by automated accounting, which provided an upper hand to companies that adopted them. These companies availed themselves of faster invoice processing, better accounting structure and workflow, and enhanced reporting capabilities.

With the sudden advent of Covid-19, the entire business sphere has witnessed an immense transformation. The work from home model has significantly impacted the employee workforce and all departments as a whole. Management, too, had to devise new ways to calculate expenses and ensure employee benefits reached them amidst such situations.

In a locus like this, the accounting team, too, needed a revamp. The previous strategies to estimate expenses and spending seemed dormant and futile. This article walks you through accounting department functions in a company and the expectations this team needs to fulfill for the year ahead.

Accounting department functions

Let’s begin with the basic accounting department functions. For a layperson, an accounting department only does the work related to numbers and data entries. But in reality, the accounting team needs to fulfill a broad scope of responsibilities daily.

We kick start by diving deeper into the accounting department structure and responsibilities.

1. Invoicing and billing

The primary function of the accounting team is to keep a record of the invoices and maintain bills. The accounts team is the sole issuer of any kind of paper document. Due to the sensitivity of paper invoices and receipts and complex invoicing processes, companies have shifted towards automated invoicing.

The accounts team no longer needs to manually create invoices, approve them, and enter them into the software. The automated billing process streamlines the entire workflow and removes the accounting blindspots.

You no longer have to enter invoices manually you can quickly scan the invoice, and the OCR technology will automatically convert the text identified into data entries.

Also, the invoice approval process allows faster payment processing. Overall, a robust expense management system optimizes the invoicing process and makes it more intuitive and unchallenging.

2. Budgeting

The accounting team is responsible for creating and revising the company's budgets. Because the unit keeps track of each department's spending, they understand what amount of funding should be allocated to which departments. They enforce policies to ensure all the departmental work is happening in accordance with the budget.

Furthermore, the department also considers unforeseen events; therefore, the budgets can be revised accordingly. Making strict budgets limits the creativity and capabilities of the department.

Benefits of budgeting to the company:

● Better cash management.

● Complete expense visibility.

● The easy attainment of financial goals.

3. Financial reporting

Access to all financial information, the department analyses and prepares financial reports and statements. These statements outline the overall picture of the entire financial year. The future financial decisions and course of action are determined based on the reporting.

The company is not the only party supposed to examine the financial statements and reports. These reports are incredibly critical to shareholders, partners, investors, tax authorities, and the government.

A careful analysis of these statements gives them an insight into the company’s operations and how well it is doing in the foreseeable future. Therefore, financial statements need to be prepared with utmost honesty and accuracy. Any fallacy in them can cost the company an arm and a leg.

4. Internal reporting and analysis

Apart from preparing the financial reports, the accounting department must prepare profitability reports to analyze liquidity, inventory, solvency, and valuation ratios. Each of the ratios serves a different purpose.

Liquidity ratios assess the company’s ability to pay liabilities. It shows how well the company’s assets can meet its expenses.

Solvency or leverage ratios depict the company’s ability to pay its long-term debt obligations.

Valuation ratios reflect whether the company is reliable and worthy enough for investors to invest in the company.

5. Accounts receivables and payables

They are responsible for ensuring the company pays all supplier invoices in time. And look if all the company pays all supplier invoices in time. They are expected to take action for preparing expense reports.

Companies, now – no longer depend on manual accounting systems. The accounts payable automation unloads all the burden of managing accounts payables and receivables.

The AP and AR automation software helps businesses manage invoices and communications between the vendor and the company. The software enables easy creation of invoices, sending them to the concerned party, and checking up on the order status. The vendor portal allows effective communication between the two parties in case of any query or doubt.

Benefits of AP automation:

● Faster invoice processing.

● Easy creation of invoices and their approval.

● Enhanced reconciliation.

6. Payroll

The financial accounting department issues employee and worker compensation. After being informed by the HR team, the team starts working on their monthly payroll.

After deductions, the net salary is credited to the employee’s account or is issued a cheque. Moreover, it includes the calculation of employee benefits like bonuses and commissions.

7. Tax reporting

The accounting department functions include collecting and preparing all the documents necessary for tax filing. They calculate the company’s taxable income if they are qualified for any tax deductions and the type of taxes to be paid like sales tax, income tax, and property tax.

Tax duties of accounting team:

● Calculate the taxable income for the financial year and pay it in time to avoid penalties.

● Keep track of the changing tax laws and how these changes might affect the company’s environment.

● Filing for taxes on behalf of the company but keeping the higher authorities in loop while in the entire process.

8. Interest payments

The department keeps a record of the company’s liabilities. Availability of these liabilities comes with a cost; the company pays through EMI and interest.

The accounting department ensures the interest amount is duly paid as any delay in the payment impacts the credit score heavily.

Accounting department organizational structure

The accounting department's work is not one-man-does-it-all. Being a labor-intensive and time-consuming task, it involves a variety of personnel to accomplish the accounting goals.

Because the accounting department responsibilities cannot be narrowed down to one person, there are specific duties for each person in the department.

With diverse responsibilities, tasks are achieved at a much higher level, the accounting activities in an organization have a streamlined process, and better performance is attained.

Chief financial officer

The CFO is in the accounting department hierarchy. All the major decisions are implemented with the CFO’s approval.

Some of its responsibilities include:

● Providing the company with timely financial advice.

● Laying down the path to achieve the financial goals.

● Ensuring the accounting and finance department functions are in alignment with each other.

Accounting manager

The accounting manager or chief accountant oversees the accounting activities and reports financial information. He ensures all the work is going smoothly in the department and provides the personnel under him with the necessary resources.

Financial controller

Broadly, the work of a finance controller is not directly related to accounting. He manages the financial aspects of the business alongside the CFO.

A financial controller is responsible for preparing financial reports, budgets, inventory reports, and so on.

Accountants

Accountants are the actual people dealing with accounting work.

Key responsibilities include:

● Day-to-day invoicing and billing.

● Reconciliation of books of accounts.

● Creating purchase orders and making vendor payments.

Accounting clerk

Though there isn’t much difference between the responsibilities of accountants and accounting clerks, one significant difference is that clerks are comparatively on the lower end of the accounting funnel compared to accountants.

Their duties include:

● General accounting activities like invoice filing.

● Performing clerical duties.

● Updating and maintaining.

File clerk

Considered as the lowest-level personnel in the accounting hierarchy.

Their essential duties include:

● Printing invoices and receipts, arranging them in sequential order.

● Maintaining digital copies of financial records.

● Collecting documents from other employees/departments.

How can accounting software improve accounting department roles and responsibilities?

The role of accounting department in a company is to implement and master the accounting functions mentioned above. But mastering it alongside efficient expense management software will make all the difference.

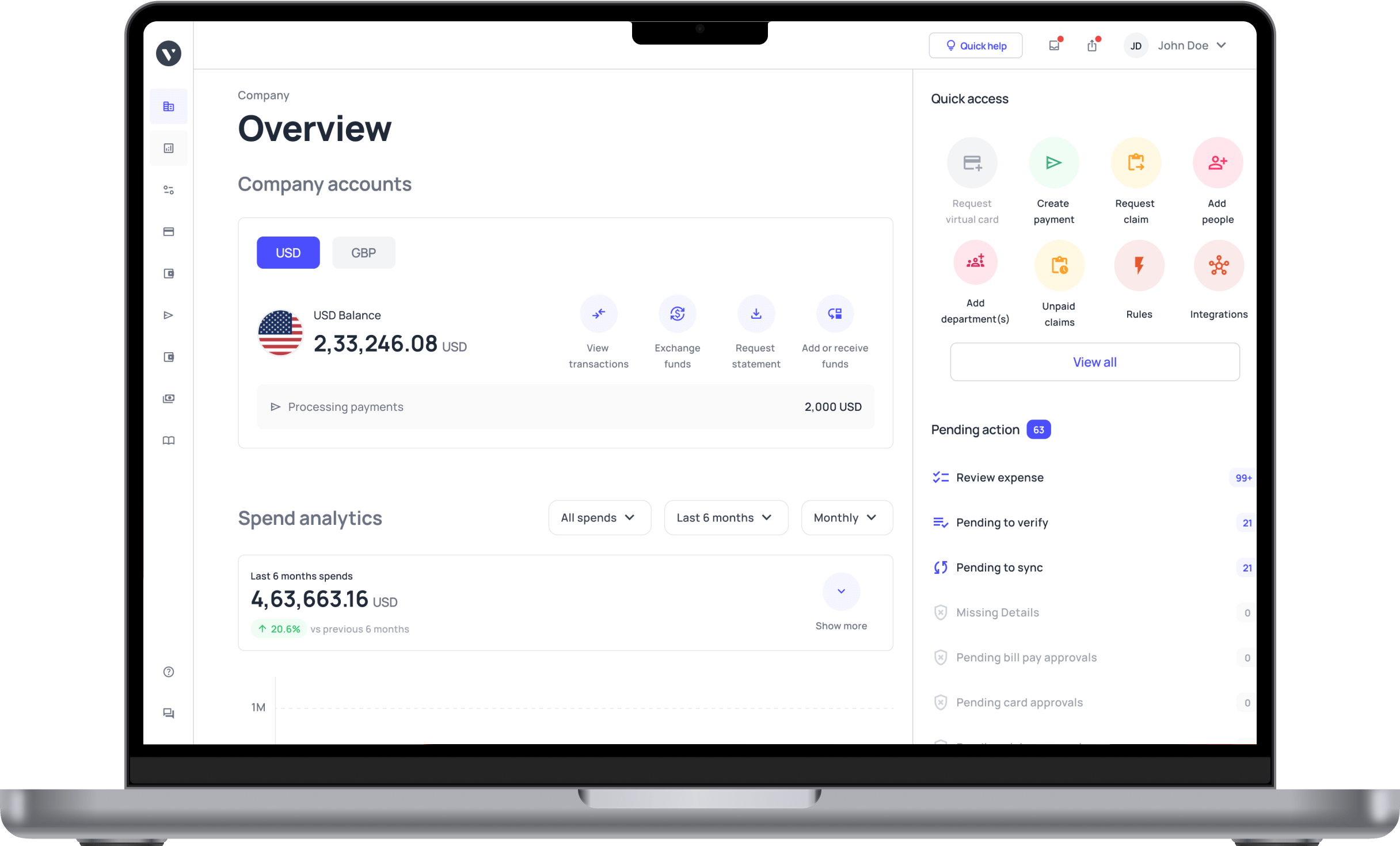

Volopay’s best-in-class expense accounting software offers users a seamless accounting experience. Our fully automated system provides a wide range of accounting functions. With Volopay, companies can manage employee spending, vendor payments, software subscriptions, and accounting on a single platform.

Volopay’s expense management solution:

1. Corporate cards

Issue physical prepaid cards to employees for better spending analysis. Create objective-focused virtual cards instantly.

2. Digital ledgers

A general ledger, a collective view of all the ongoing transactions. Individual ledgers display all the trade transactions between the company and its vendors.

3. Real-time tracking

With Volopay, you can gain real-time visibility of the activities going on throughout the company.

4. Instant invoice approvals

The approvers can effortlessly approve the invoices with a few clicks.

5. Payment scheduling

Through Volopay’s software, one can schedule vendor payments for a future date.

6. Timely payments

The system automatically notifies the administrator of the upcoming payments, ensuring sufficient funds are available to complete the transaction.

6. Early-payment discounts

With timely payments, suppliers tend to offer early-payment discounts as a reward.

7. Pending for approval

The system timely notifies you about the pending requests for approval.

8. Spend analysis

The dashboard analyzes all the spending done on a monthly basis.

9. Accounting integrations

We offer integrations with software like Xero, Quickbooks, Netsuite, and Deskera.

FAQs

Having your payroll software significantly impacts your business. You can have a dedicated accounting team for this purpose and can move back and forth anytime. Outsourcing might limit your autonomy.

Ideally, accounting softwares can handle massive amounts of data entries without jumbling up. But it is always recommended to keep a backup of your accounting records.

Automated accounting software will instantly create reports required for tax filing. The software safeguards all the data fed into it – increasing accuracy.

Yes, accounting softwares is enabled with inventory management functions. You can easily upload and track inventory through the software.

Yes, accounting software allows multiple users to access simultaneously without causing any delay in response.