Benefits of prepaid cards for managing your business finances

Prepaid cards are versatile and secure payment instruments designed to streamline business expense management. Unlike credit cards, they do not necessitate credit checks, ensuring accessibility for businesses of all scales.

By allocating preloaded funds to each card, organizations can exercise greater control over budgets and employee expenditures. Whether managing travel costs, petty cash, or team reimbursements, the benefits of prepaid cards include simplifying your financial processes.

With features like real-time tracking and spending limits, they offer a contemporary alternative to traditional cash-based systems, enhancing oversight, reducing unexpected expenses, and fostering improved accountability throughout the organization.

What are prepaid cards for businesses?

Prepaid cards for businesses are payment cards that come preloaded with funds, allowing you to manage company expenses without tying them to a bank account or line of credit. These cards work similarly to prepaid debit cards in function, but with tighter controls—they only allow spending up to the loaded amount, helping maintain strict oversight.

You can use prepaid cards to cover a wide range of business costs, including travel, petty cash, office supplies, or even payroll disbursements.

Because they don’t require a credit check or a business credit score, they’re accessible to startups and small businesses that may not yet qualify for traditional business credit cards.

What sets prepaid cards apart is the level of control they give you. You decide how much money to load and where it can be spent, often with real-time visibility into every transaction. That’s one of the key benefits of prepaid cards, keeping finances transparent without complex processes.

For businesses looking for a straightforward, flexible, and secure way to manage operational costs, the benefits of prepaid debit cards make them a strong alternative to traditional systems.

How do prepaid cards work?

In essence, prepaid cards are cards that you have to load before you can use them to spend. They function similarly to corporate prepaid gift cards. If you assign prepaid cards to your employees, then you or your finance team will have to load the cards first before they can make payments with their assigned prepaid cards.

This means that your employees can only use their prepaid cards according to how much money you’ve loaded into them. When your prepaid cards have been loaded, you and your employees can use them to spend similarly to how a debit or credit card would be used.

Types of prepaid cards in Australia

Amongst all the types of prepaid cards in Australia, the best prepaid cards for Australian businesses are typically categorized based on their uses.

Rewards cards

A variety of prepaid cards allow you earn cashbacks, vouchers, and discount coupons after adding funds to the card. Also, some will enable you to earn reward points at the point of purchase.

Gift card

Corporations generally issue gift vouchers or gift cards to their employees during festive seasons or special occasions. Funds are pre-loaded and can be used up to the maximum amount available only.

General use card

The current version of prepaid cards allows easy loading of funds into the cards, anytime and anywhere available balance check with minimal fees. Hence, these cards are increasingly used for making daily purchases easier and hassle-free.

Prepaid travel card

Prepaid travel cards are loaded with company funds and used by employees while on a business trip. These cards can be used internationally. Australian dollars loaded in the employee travel card can be exchanged seamlessly around the globe.

Key benefits of prepaid cards for financial management

With prepaid cards, you control exactly how much each employee can spend by loading only a set amount.

You can assign cards for specific purposes like travel or supplies, ensuring that funds are used as intended.

One of the key benefits of prepaid cards is having tighter control over budget allocation at every level.

Since you can only spend what’s already loaded onto the card, there’s no risk of late fees, interest charges, or over-limit penalties.

This makes them ideal for businesses looking to avoid credit-based pitfalls or for teams without an established credit profile.

You stay in full control of your company’s cash flow, without having to manage repayment cycles or monitor credit limits.

Most prepaid card platforms offer real-time tracking of expenses through dashboards and mobile apps.

This level of visibility helps catch issues early, like unauthorized purchases or duplicate charges, and supports better decision-making.

You can track spending by employee, department, or project, and export data for further analysis.

Manual expense reports, receipt collection, and reimbursement processing waste hours of your finance team’s time. Prepaid cards automate much of this work.

Transactions are logged instantly, categorized automatically, and can be synced with accounting tools. That means fewer spreadsheets, faster month-end closes, and less back-and-forth with employees.

With less paperwork and fewer errors, your finance operations run leaner and more smoothly and efficiently.

Security is built into prepaid cards. You can set daily limits, lock or unlock cards instantly, and monitor usage in real time.

Many platforms offer features like PIN protection and purchase restrictions by category. If a card is lost or stolen, it can be deactivated with a click, protecting your company's funds.

This level of control helps prevent fraud before it starts and limits potential damage if something goes wrong, another clear example of the benefits of prepaid debit cards in action.

Benefits of prepaid cards for employee expenses

Managing employee expenses can often be a time-consuming and error-prone task, particularly when relying on cash or manual reimbursement processes. Utilizing prepaid cards streamlines the procedure, providing enhanced oversight while enabling your team to manage expenditures responsibly.

Simplified travel expenses

Prepaid cards eliminate the necessity for employees to cover expenses out of pocket during business trips.

Cards can be issued with preloaded amounts specifically allocated for travel-related costs such as accommodations, meals, or transportation. This approach eliminates reimbursement delays and allows employees to manage their travel without financial strain.

With spending controls implemented, oversight is maintained without requiring micromanagement of every transaction.

Petty cash replacement

Replacing petty cash with prepaid cards allows you to eliminate the risks of handling physical money. Whether it's for office supplies or small team expenses, cards provide a safer, trackable alternative.

You can load specific amounts, restrict spending categories, and view every transaction as it happens. Among the benefits of prepaid debit cards is the ability to reduce reliance on unsecured cash funds.

Employee empowerment

Prepaid cards give employees the flexibility to make decisions on the spot, within clear boundaries. Rather than waiting for approvals or reimbursements, team members can handle business needs quickly and independently.

This empowerment boosts efficiency while reducing operational bottlenecks. The benefits of prepaid cards extend to improving day-to-day decision-making while keeping spending under control.

Fast reimbursements

When employees cover costs out of pocket, it can take days, or even weeks, to reimburse them. Prepaid cards speed things up by letting you load funds instantly.

Whether it's a last-minute purchase or an emergency need, the process is fast and hassle-free. This approach reduces frustration and increases productivity, especially for field teams or remote workers who need immediate access to funds.

Reduced expense fraud

With prepaid cards, every dollar spent is accounted for. You can restrict how and where the cards are used, making unauthorized purchases much harder.

Real-time tracking helps catch irregularities early, and limited card balances reduce exposure. These safeguards make it easier to enforce company policies and protect your business from internal expense fraud.

Major benefits of prepaid cards for small businesses

Prepaid cards don’t require credit approvals or financial history checks. This makes them accessible to early-stage companies or businesses with limited credit backgrounds.

Issue cards to the team without waiting for bank approvals or risking credit rejections.

It’s a straightforward way to equip your team with the tools they need, even if your business is just starting out or rebuilding its financial track record.

As your business grows, your expenses change. Prepaid cards give you the flexibility to adjust spending limits per employee, team, or project.

Whether you're onboarding new hires or expanding operations, you can scale your expense controls without switching systems.

This adaptability means your financial tools grow alongside your business; no need to replace them as your needs evolve.

Prepaid card transactions can integrate with accounting platforms like QuickBooks, making expense tracking easier and less manual.

Every payment is recorded in real time, categorized automatically, and can be pulled into your financial reports.

This reduces errors, speeds up reconciliation, and lightens the workload on your finance team, which are critical advantages for small teams managing large responsibilities.

Need to pay suppliers or contractors? Prepaid cards offer a quick and secure method.

You can load funds and pay vendors directly, avoiding the delays of bank transfers or cheque processing.

This not only keeps your business agile but also improves your reputation with vendors through timely payments.

Compared to credit or business debit cards, prepaid cards usually come with fewer fees and no interest charges.

The benefits of prepaid debit cards include avoiding hidden fees, reducing financial overhead, and ensuring a predictable expense structure for businesses operating on tight budgets and aiming for long-term financial growth and stability.

Benefits of prepaid cards for compliance and security

Maintaining compliance and protecting financial data are essential for any business. Prepaid cards help you enforce internal policies and meet external regulations while minimizing risks tied to traditional payment methods.

Audit-ready records

Each transaction conducted with a prepaid card is automatically recorded, generating a clear and verifiable trail. This simplifies preparations for tax season or internal audits.

Logs can be exported with timestamps, merchant details, and spending categories, providing precisely the type of documentation auditors require.

Rather than searching for receipts, your business remains prepared with organized records that substantiate every expense.

Policy enforcement

Prepaid cards let you set rules on how and where funds can be used. Want to limit spending to specific categories or merchants? You can do that.

These built-in controls ensure employees follow your expense policies without constant oversight.

It’s a hands-off way to enforce guidelines while preventing misuse, one of the operational benefits of prepaid cards that helps maintain internal control.

PCI DSS compliance

Reputable prepaid card providers use systems that meet Payment Card Industry Data Security Standards (PCI DSS).

This means transactions are encrypted, data is protected, and customer information is stored securely.

If your business handles sensitive payment data, working with PCI-compliant tools helps you meet regulatory standards and avoid any costly penalties related to data breaches or non-compliance.

Fraud mitigation tools

Prepaid cards come with built-in safety features like card locks, spending caps, and real-time alerts.

If a card is lost or compromised, you can freeze it instantly to prevent further transactions.

Unlike traditional accounts, there’s no open credit line to exploit, which limits potential loss.

These features reinforce the numerous benefits of prepaid card solutions in reducing financial exposure.

Transparent reporting

With prepaid cards, reporting isn’t just fast, it’s detailed. You can track expenses by user, department, or vendor, helping you identify spending patterns and spot irregularities.

These reports can be shared across departments or with external accountants, reducing confusion and improving collaboration.

Clear reporting also supports compliance by making it easier to prove where and how funds were used.

How prepaid cards differ from other methods?

When deciding how to manage business expenses, it’s important to weigh your options. Prepaid cards offer a unique combination of control, cost efficiency, and ease of use, especially when compared to traditional methods like credit cards, debit cards, and cash.

Prepaid vs. credit cards

Credit cards allow borrowing, which inherently carries the risk of debt and interest charges. In contrast, prepaid cards require funds to be loaded in advance, ensuring that spending is limited to the amount available.

With no borrowing, repayment cycles, or credit checks involved, they eliminate the risk of incurring debt while providing the flexibility to issue cards to employees. Prepaid cards, including prepaid credit cards offers a safer, more controlled method for managing company expenses.

Prepaid vs. debit cards

Debit cards pull money directly from your business bank account, which increases your exposure to fraud or misuse. Prepaid cards are isolated from your main accounts, meaning if something goes wrong, your core funds stay protected.

There’s also no need to open a new business bank account to issue prepaid cards. This makes them more flexible and easier to roll out to multiple users without affecting your existing banking structure.

Related read: Business debit card - What is it and how to get one?

Prepaid vs. cash

Handling physical cash creates several problems: it’s hard to track, prone to theft, and creates extra administrative work. Prepaid cards eliminate these issues by offering a digital alternative with complete traceability.

Every transaction is logged, and you can monitor usage in real time. For businesses still relying on cash for petty expenses or travel reimbursements, prepaid cards offer a more secure and accountable solution that’s just as convenient, but far more efficient.

Cost efficiency

Prepaid cards typically come with fewer fees than credit or business debit cards. You avoid interest charges, overdraft fees, and monthly maintenance costs.

Plus, with better control over spending, you reduce the risk of budget overruns. For businesses watching every dollar, prepaid cards provide a more predictable and transparent cost structure. The result is less money lost to fees and more available for growth.

Control and flexibility

One of the biggest advantages of prepaid cards is the ability to customize how they’re used. Set spending limits, block certain merchants, and reload funds instantly.

You don’t get this level of control with credit or debit cards, and certainly not with cash. The benefits of prepaid card solutions also include scalable options for teams, departments, and projects, all without complex financial infrastructure.

Common use cases for prepaid cards in businesses

Prepaid cards can be used across different business functions to simplify payments, improve transparency, and speed up workflows. Their flexibility makes them useful in a variety of real-world scenarios where traditional methods fall short.

1. Employee travel

Prepaid cards are ideal for funding business trips. Instead of fronting personal cash or using corporate credit cards, employees can use preloaded cards with fixed budgets. This limits overspending and ensures that only approved expenses are covered.

You get real-time visibility into transactions, while employees avoid the hassle of reimbursement claims or delays, a key benefit of prepaid card use in travel-heavy roles.

2. Payroll for unbanked employees

Not every worker has access to a traditional bank account. Prepaid cards allow you to pay unbanked employees safely and efficiently.

Funds can be loaded directly onto a card, removing the need for paper checks or cash. It’s a faster, more secure solution that ensures your entire workforce, contract or full-time, is paid on time, with less friction and more reliability.

3. Marketing and event expenses

Marketing teams often need fast, flexible access to funds for campaigns, events, or last-minute purchases. Prepaid cards let you allocate specific budgets to individual cards, which keeps spending under control and clearly tracked.

You can assign cards for one-time events or ongoing use, depending on your team’s needs, ensuring transparency while giving your team the freedom to execute quickly.

4. Contractor payments

Freelancers and project-based workers often need to be paid outside the usual payroll cycle. Prepaid cards give you a simple way to issue payments instantly, without setting up full bank transfers.

This is especially helpful for short-term or remote contractors where speed and convenience matter. Another benefit of prepaid cards is smoother handling of flexible labor expenses.

5. Emergency expenses

When unexpected costs come up, equipment repairs, urgent travel, or supply shortages, prepaid cards let you act quickly.

You can issue or reload a card within minutes, avoiding delays caused by approvals or bank processes. This ensures you stay responsive in critical situations without putting your core accounts or credit lines at risk.

Challenges of using prepaid cards and solutions

While prepaid cards offer many advantages, they aren’t without limitations. The good news is that most challenges have practical solutions, especially when you're aware of them upfront.

Understanding both the obstacles and the benefits of prepaid cards helps you build a smarter, more efficient payment process.

Limited acceptance

Certain prepaid cards may face limitations in acceptance, particularly outside major networks. To mitigate potential issues, opt for cards supported by Visa or Mastercard.

These are broadly accepted by the majority of vendors, both online and offline, ensuring your team can make purchases without encountering unnecessary restrictions.

Reload fees

Certain providers charge fees when reloading funds onto cards, which can add up over time. To minimize this cost, compare options and select a provider that offers free or low-cost reloads.

Some platforms also offer unlimited reloads for a flat monthly rate, making it easier to predict and manage expenses.

Employee training needs

If your team isn’t familiar with prepaid cards, there may be a learning curve. Avoid confusion by creating a simple usage guide or hosting a short training session.

Cover basics like how to check balances, where cards can be used, and what kinds of expenses are approved. A little upfront education goes a long way in preventing mistakes.

Integration complexity

Some prepaid card systems don’t integrate smoothly with your existing accounting tools. This can cause delays in reconciliation and reporting.

To avoid these issues, look for providers that offer integrations with platforms like Xero, QuickBooks, or NetSuite. Seamless syncing helps you take full advantage of the benefits of prepaid card automation in finance operations.

Card management

Managing multiple cards manually can get messy fast. The solution? Use a platform that provides a centralized dashboard where you can issue, reload, lock, and monitor all cards in real time.

Automated controls reduce administrative burden and help you stay organized as your card program scales.

How to identify best prepaid cards for your needs?

Maximum load amount

Prepaid cards usually come with a maximum loading and unloading limit. Know the precise amount of funds added to the card and any transaction restrictions after a specific range or to certain vendors.

Security

Though the chances of prepaid card fraud are negligible, using a VISA or Mastercard-backed card proves helpful in the long run. Having their security helps merchants in building up their faith.

Fees

Prepaid cards are known for their heavy fees at every spend point, whether it is loading funds or withdrawing them from an ATM. Therefore, before finalizing the perfect prepaid card for you, know all the charges levied by the prepaid card issuers.

Currency support

All merchants or prepaid card companies support not all currencies. In Australia, the maximum amount of currencies supported is 10. Check which types of currency can be backed by your cards and the exchange rate and fees charged.

Card acceptance

Some prepaid cards are not accepted everywhere by merchants. Therefore, selecting the right card that can be used domestically and internationally at almost any time is very important. The eligibility of the prepaid cards is briefly described in the plan selected.

Best practices for maximizing prepaid card benefits

To get the most value from prepaid cards, it’s important to implement the right systems and habits. These best practices help ensure that you take full advantage of the benefits of prepaid cards in your day-to-day operations.

1. Set clear policies

Define how, when, and where prepaid cards should be used. Create spending rules for different roles or departments and make sure employees know what’s covered and what isn’t.

Clear guidelines reduce confusion and help prevent misuse, making your program more effective from day one.

2. Monitor transactions

Consistently reviewing spending activity ensures your budget remains on track. Utilize real-time dashboards to monitor card usage by employees or teams, and promptly identify any irregular activity.

Conducting weekly or bi-weekly check-ins is typically sufficient to address potential issues early and verify that spending aligns with established objectives.

3. Automate reloads

Instead of manually topping up each card, use automation tools to schedule reloads based on pre-set rules.

Whether you fund cards monthly or after certain thresholds are met, automation saves time and ensures your team always has access to the funds they need, without delays or bottlenecks.

4. Integrate with accounting

Connect your prepaid card system with accounting tools like Xero, NetSuite, or QuickBooks to streamline reporting and reconciliation.

Automated data syncing reduces manual entry, cuts down on errors, and gives your finance team a clearer picture of company spending, without extra admin work. These integrations bring out the long-term operational benefits of prepaid card use.

5. Educate employees

A successful prepaid card program depends on how well your team understands it. Offer short training sessions or quick-start guides to show employees how to use their cards properly.

The better informed they are, the smoother your processes will be, and the fewer issues you’ll need to fix later.

Experience prepaid card benefits powered by Volopay

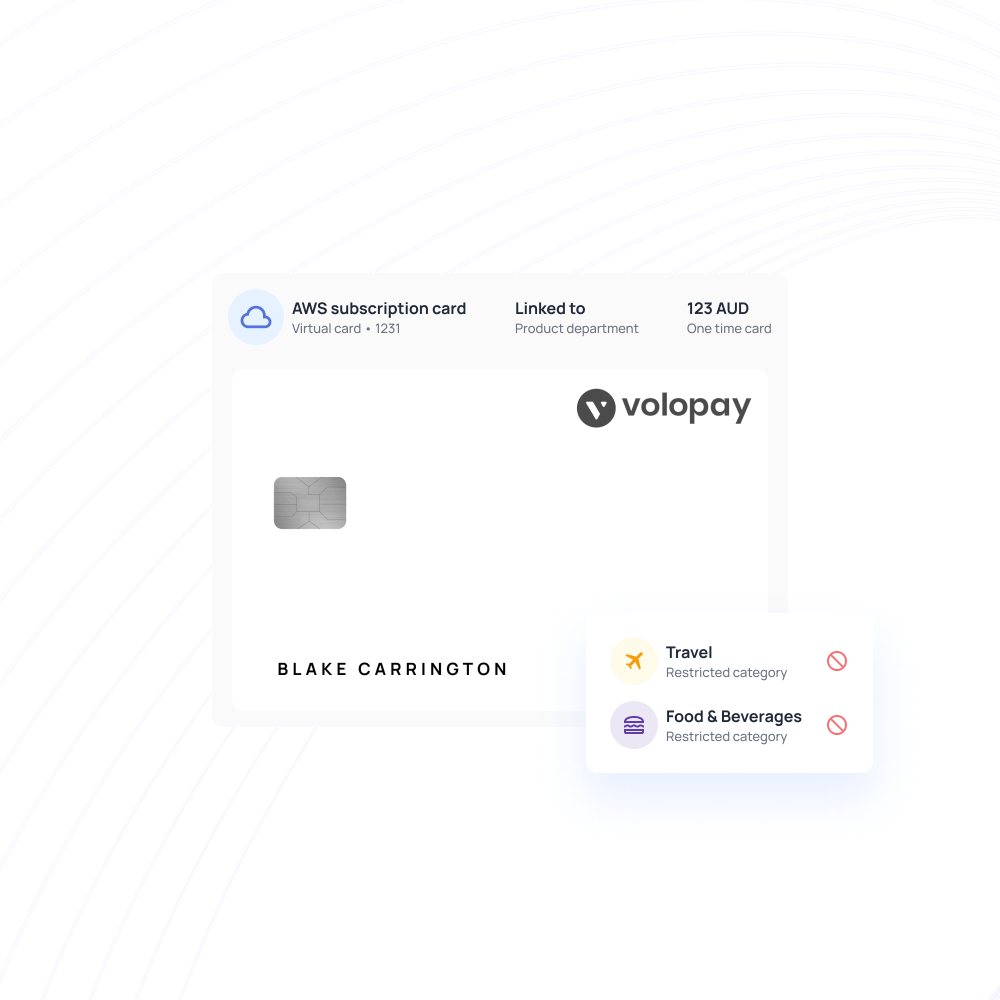

Volopay’s prepaid cards are built to give your business complete control over spending, without the headaches of traditional finance tools. You can set custom limits, track transactions in real time, and lock or unlock cards instantly.

Whether you're managing a small team or scaling operations, Volopay integrates smoothly with accounting platforms like QuickBooks, Xero, and NetSuite to automate expense tracking and reconciliation.

With built-in fraud protection and flexible controls, our cards help you stay compliant, efficient, and secure. If you're ready to simplify your expense management, Volopay’s prepaid card solution is designed to work the way your business does.

Trusted by finance teams at startups to enterprises.

Bring Volopay to your business

Get started now

FAQ's

Prepaid cards offer strong budget control, improved security, and zero credit risk. You load funds in advance and set usage limits, which reduces overspending and ensures transparency. Since there’s no borrowing involved, you avoid interest charges and debt. This makes prepaid cards a reliable tool for managing expenses across teams, departments, or projects.

Prepaid cards generally incur lower fees compared to credit or business debit cards and eliminate the risk of interest payments, overdrafts, and hidden charges. By offering improved spending control and reducing the need for manual processes, they save time, making them a cost-efficient option for small businesses aiming to maintain efficiency without compromising on control or flexibility.

Prepaid cards simplify compliance by keeping a detailed, automatic record of every transaction. You can enforce spending rules, restrict categories, and track usage in real time. These features help maintain alignment with internal policies and external regulations, making audits easier and helping your business avoid financial missteps. The benefits of prepaid debit cards in this area are both regulatory and operational.

Yes. Prepaid cards offer all the flexibility of cash without the risks. They’re secure, trackable, and easy to reload, unlike physical cash, which is hard to monitor and vulnerable to theft. Whether you're replacing petty cash or funding remote teams, prepaid cards are a safer, more efficient alternative.

Prepaid cards come with strong built-in security features like PIN protection, usage restrictions, and instant lock/unlock options. Since they’re not connected to your main accounts, any potential fraud is limited to the card’s balance. You also get real-time alerts and control settings, making it easier to catch and prevent unauthorized activity.