What is enterprise value? Meaning, importance & how to calculate

The term “enterprise value” is often used in relation to business acquisitions. If you are planning to grow your business through acquisition or you’re planning on selling, it’s important that you know one of the key metrics used when calculating acquisition costs.

Even if you aren’t quite there yet, enterprise value is still a metric that has relevance to your business. Get yourself acquainted with what is enterprise value, how to calculate it, and why it’s important.

What is enterprise value (EV)?

As its name suggests, enterprise value, or EV, is the value of a company financially. It considers your company’s current market capitalization, total debt, and cash. This way, all your finances are accounted for.

Like many other formulas, enterprise value measures a company’s standing in the market. In this case, it’s done by calculating its total value.

One thing that the enterprise value formula can help determine is the acquisition cost of a company, which is key in mergers and acquisitions.

The formula for EV and how to calculate it

While you may know what is enterprise value, how to calculate it is a different matter. To calculate what a company’s enterprise value is, the formula you’ll have to use is:

EV = Market capitalization + Total debt - Cash

In the enterprise value calculation above, market capitalization refers to the company’s share price multiplied by the outstanding shares. Total debt includes both long and short-term debt, while cash also includes liquid assets.

This enterprise value formula can be quite confusing in the beginning, considering that adding debt to a company’s value may not immediately make sense. However, keeping in mind that EV is often used to help determine the acquisition cost of a company, it’s understandable that a company’s short-term and long-term debt is added to the total value.

The enterprise value refers to the amount that you have to pay to get the company, as well as the cash that you’ll immediately get on hand after the acquisition.

What does enterprise value tell you?

While simply calculating the market capitalization or equity value of a company can give you a broad overview of the company’s value, the number that you get from calculating its enterprise value is closer to its true value and a more accurate measure of it.

Used as a tool in corporate financing, the enterprise value of a company will tell you how much you’ll need to pay in order to purchase the company. This is useful and oftentimes used in mergers and acquisitions.

If a company’s enterprise value is in the negatives, it can also be an indicator that the company is not using its cash effectively. When the total cash is bigger than the market cap and total debt, then the company should be using those assets to pay off debts or reinvest in order to grow the business.

What are the components of enterprise value?

The enterprise value formula is made up of several components. To calculate it, you need to understand all these components and what roles they play in the enterprise value calculation.

Market cap

In short, market cap, or capitalization, is the current value of a company’s shares. It is calculated by multiplying the current share price by the number of outstanding shares.

A higher market cap, sometimes also referred to as equity value, denotes a bigger company. Companies with higher market capitalization will naturally have a higher enterprise value as well.

Debt

Debt in this case refers to any money that the company owes lenders, creditors, or banks.

The total debt included in the enterprise value calculation encompasses both a company’s short-term and long-term debt, meaning that any debt that the company has recorded will go into the calculation.

The more debt a company has, the more expensive its acquisition cost will be.

Unfunded pension liabilities (if any)

While unfunded pension liabilities are not always present when calculating enterprise value, if any is present it should be added to the market cap in the calculation.

Essentially, unfunded pension liabilities are any pension payouts that the company must make but has not set aside any funds for.

Minority interest

If the company that you are calculating enterprise value for has a subsidiary with less than 50% ownership, the equity value of this subsidiary is considered a minority interest. This minority interest value should also be added to the market cap in the formula.

Cash and cash equivalents

When you acquire a company, you will immediately get some of its value back in the form of cash or liquid assets as soon as the ownership changes hands. Cash includes money in physical and digital forms, starting from paper currency to savings accounts.

Drafts, bonds, and liquid assets are also considered cash equivalents. The only liquid asset that is not included in the cash bracket is stocks, as that is counted in the market cap component of the EV.

Limitations of enterprise value

Enterprise value can measure your company’s value numerically from a financing perspective. However, it isn’t without limitations.

For example, EV includes the total debt a company has, meaning that it does show an all-encompassing view of it. At least, it does numerically.

At first glance, it may seem like the more debt a company has, the more value it has.

After all, if you plan to acquire a company with more debt, you’ll have to pay more for it. But one thing EV doesn’t tell you is how the company is managing and utilizing its total debt.

When considering companies from different industries, you’ll also have to take into account what their respective markets look like. Some industries are more capital-intensive than others, meaning that it’s likely companies in those industries will have more debt.

This doesn’t necessarily mean that those companies are ultimately bigger than those in other industries.

While enterprise value is useful in determining the acquisition cost of a company and will help you in merger and acquisition decisions, it’s important to note that context matters. It’s recommended to compare companies in the same industry when using EV as a metric.

Why is enterprise value important for your business?

There are many ways a company can grow. It’s undeniable that one way is through mergers and acquisitions. At some point, you may look to merge with or acquire another company to accelerate your business growth.

However, deciding on what companies to look at as potential acquisitions or mergers is not something to be taken lightly. There’s a lot of consideration that goes into it.

This is where enterprise value comes in. It helps you categorize which components you need to be looking at and will eventually be an essential tool in determining the acquisition cost.

With the enterprise value calculation, you’ll be able to make better decisions when it comes to acquisitions. This is true on the flip side as well, where you’ll be able to consider acquisition offers more strategically.

You can also use enterprise value to calculate valuation multiples, such as EV to EBITDA, to compare your own company’s performance with other businesses that are similar to yours.

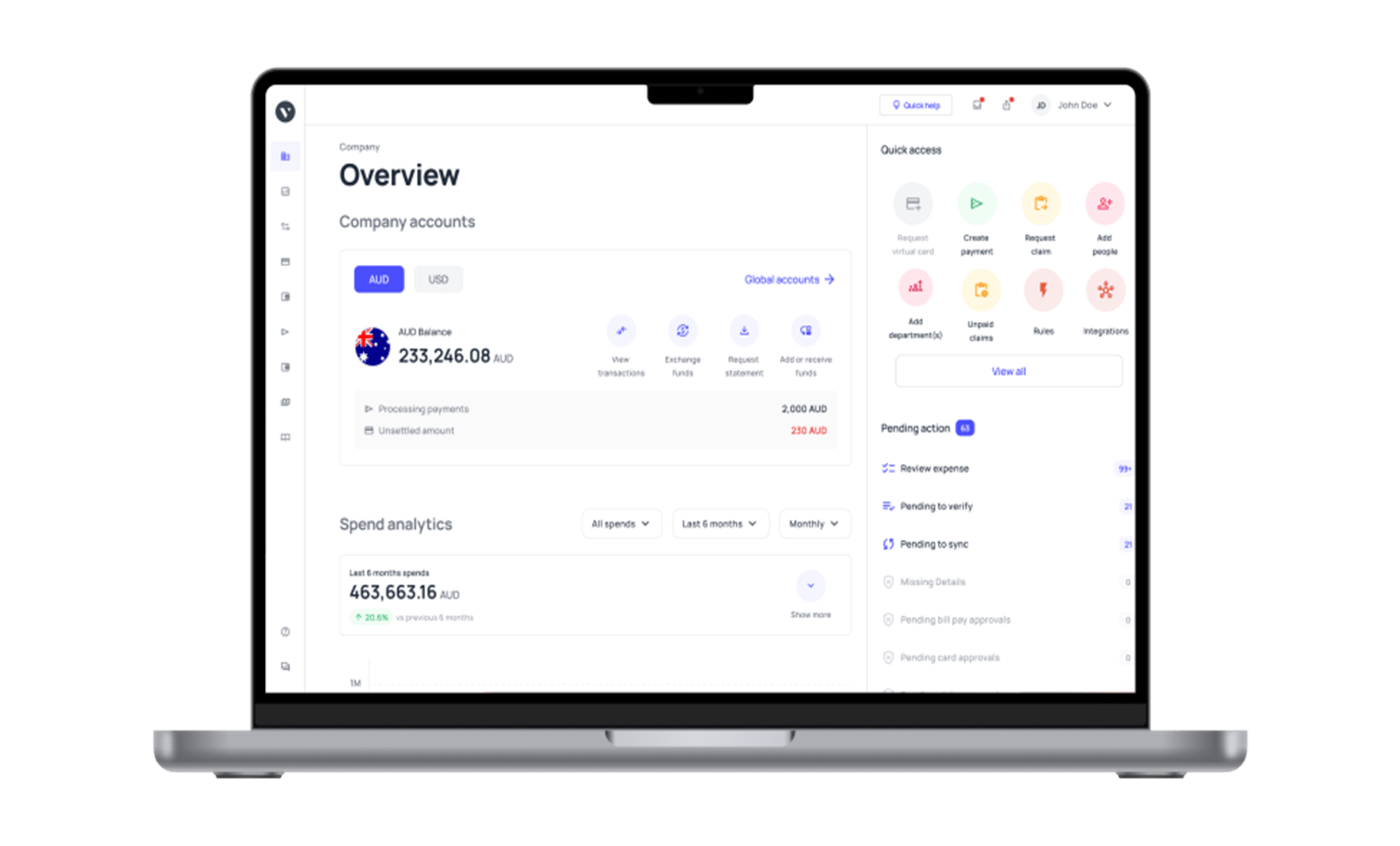

Volopay - the best financial management solution for your business

Regardless of whether you’re looking to acquire another company, sell your own, or you’re simply just arming yourself with more information for the future, it’s undeniable that what you do with your business finances and how you manage them will impact your business in the long run.

It’s important to have full visibility of your business finances at any given time, especially considering that no single decision exists in a vacuum.

If you were misinformed about your finances or have no clarity on where your financial health is at, you could be making fatal decisions for your business. Ultimately, this could affect how you do business in the future.

While metrics like enterprise value are important, it’s also necessary to remember the components that go into them and what they are used for.

When you look at EV, acquisition costs, and growth strategies holistically, you’ll find that what you do now in your day-to-day business operations all matter.

This is why business financial management tools like Volopay are essential in running your day-to-day operations. With Volopay, you’ll never need to worry about expenses that are unaccounted for.

Get full visibility of your expenses and your financial health at any time from anywhere. You’re guaranteed to make better business decisions when you have a more complete view of your finances.