Net cash flow - Definition, importance, and formula

Net cash flow is an important measure that is used to ascertain the financial health of a business. It represents the total sum of money that is being generated and spent by a business within a certain period of time. This metric represents the difference between the amount of money going out (expenses) and the amount of money coming in (income).

Net cash flow is a key indicator of whether a business is able to meet its financial obligations such as paying off debt, funding operations, and investing in assets. By understanding net cash flow, businesses are better able to make informed decisions about their financial future.

What is net cash flow?

To understand what is net cash flow you must first understand that it is a measure of the amount of cash generated or spent over a certain period of time. It is the difference between the cash inflows and outflows of a business entity.

This metric is used to determine the company's financial health and can be used in comparison with the income statement. It is also useful in assessing the liquidity of a company. Net cash flow is a particularly important metric for investors and creditors as it is an indicator of the company's ability to generate sufficient cash to meet its dues and obligations.

Importance of net cash flow

Net cash flow is a measure of a business’s financial performance and health. It is an important metric for assessing the liquidity, solvency, and financial stability of a company.

1. Liquidity

This metric provides an indication of a business’s ability to generate cash and pay back its liabilities. By tracking the flow of cash, a business can determine whether it is generating enough money to meet its financial obligations and maintain its operations.

2. Solvency

This cash flow metric is also important in measuring a company’s solvency, or its ability to pay its debts. By calculating the difference between cash inflows and outflows, a business can determine if it is generating enough money to cover its debts and liabilities.

3. Financial stability

Net cash flow is a crucial indicator of a business’s financial stability. It can be used to determine the company’s financial health and can help investors assess the company’s ability to meet its short and long-term obligations.

Overall, net cash flow is an important financial metric used to measure the financial performance and well-being of a business. It is used to assess a company’s liquidity, solvency, and financial stability and can be used to inform important business decisions.

Formula to calculate net cash flow

The net cash flow formula involves subtracting the sum of all outflows of cash, such as capital expenditures and operating expenses, from the sum of all inflows of cash, such as investments and sales.

For example, if a company has earned $500,000 via sales in a year, spent $350,000 on expenses, and has investments worth $50,000, then the calculation of the net cash flow of this company would be:

Net cash flow = cash inflows - cash outflows

= ($500,000 + $50,000) - $350,000 = $200,000

This calculation shows that the company in question, for the given period, has been able to generate a total of $200,000 in net cash flow. The net cash flow calculator or formula is a useful tool for businesses to determine their overall financial position.

This formula is also used to calculate a company’s return on investment (ROI) and debt-to-equity ratio, which are important metrics for investors to evaluate the performance of a company.

Limitations of net cash flow

Net cash flow does, however, come with its own limitations.

● Firstly, it does not take into account all the components of the company's financial performance such as non-cash expenses, depreciation, and amortization.

● Secondly, it is not an exact indicator of the company's overall financial health as it does not account for other factors such as investments, liabilities, and equity.

● Thirdly, it does not provide an accurate picture of the company's liquidity position as it does not include non-cash transactions such as inventory and accounts receivable.

● Lastly, it does not include future cash flow projections, which can be important when considering the company's long-term prospects.

Volopay - The best solution to manage your business cash flow

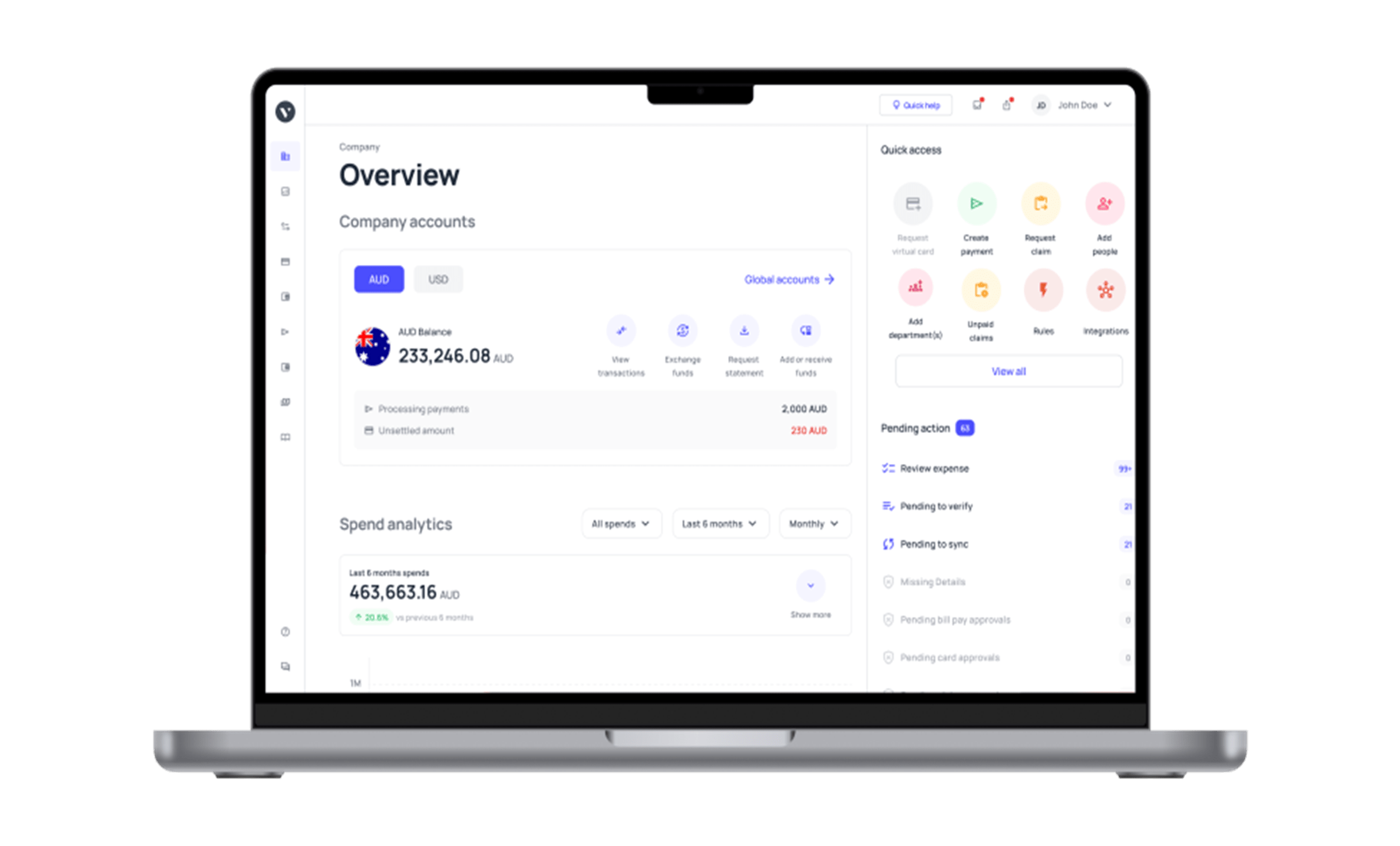

Volopay is the perfect solution for businesses looking to manage their cash flow. The platform provides an intuitive, user-friendly platform to help streamline cash flow management, reduce manual work, and ultimately improve cash visibility.

With a simple and easy-to-use interface, businesses can easily plan and manage their cash flow, and get real-time insights into their cash position.

Volopay's expense management software offers a range of automation features, such as automated reconciliation and payment reminders, so businesses can maintain constant visibility and control over their finances.

Volopay also makes it extremely easy to identify trends and uncover opportunities by providing powerful insights into company spending, i.e. cash outflow. The platform provides detailed reports on cash flow and can produce customized reports on demand.

In conclusion, the net cash flow of a business is an important metric to keep track of and one that should be managed accurately to ensure the financial stability of your business. Using automated tools and software to manage this task can help your business a lot in the long run.

Manage your business cash flow easily with Volopay

FAQ's

No, they are two different metrics used in business management.

Yes, it is possible for net cash flow to be negative.

No, the two metrics are not the same. Cash flow is used to calculate the net cash inflow of running, investing, and financing activities of the company, while free cash flow is used to determine the current worth of the business.

The net cash formula is: Net Cash = Cash Receipts - Cash Payments.