Prepaid expenses vs accrued expenses: Major differences

When managing your business finances, understanding the differences between prepaid and accrued expenses is essential. These two accounting concepts determine when and how you record transactions, affecting everything from your cash flow to your tax filings.

Prepaid expenses are payments you make in advance for goods or services you’ll receive in the future—think rent, insurance, or annual software subscriptions. In contrast, accrued expenses are costs you’ve already incurred but haven’t yet paid for, such as salaries, utilities, or vendor invoices due next month.

Grasping the prepaid expenses vs accrued expenses distinction helps you maintain accurate financial statements and avoid compliance issues.

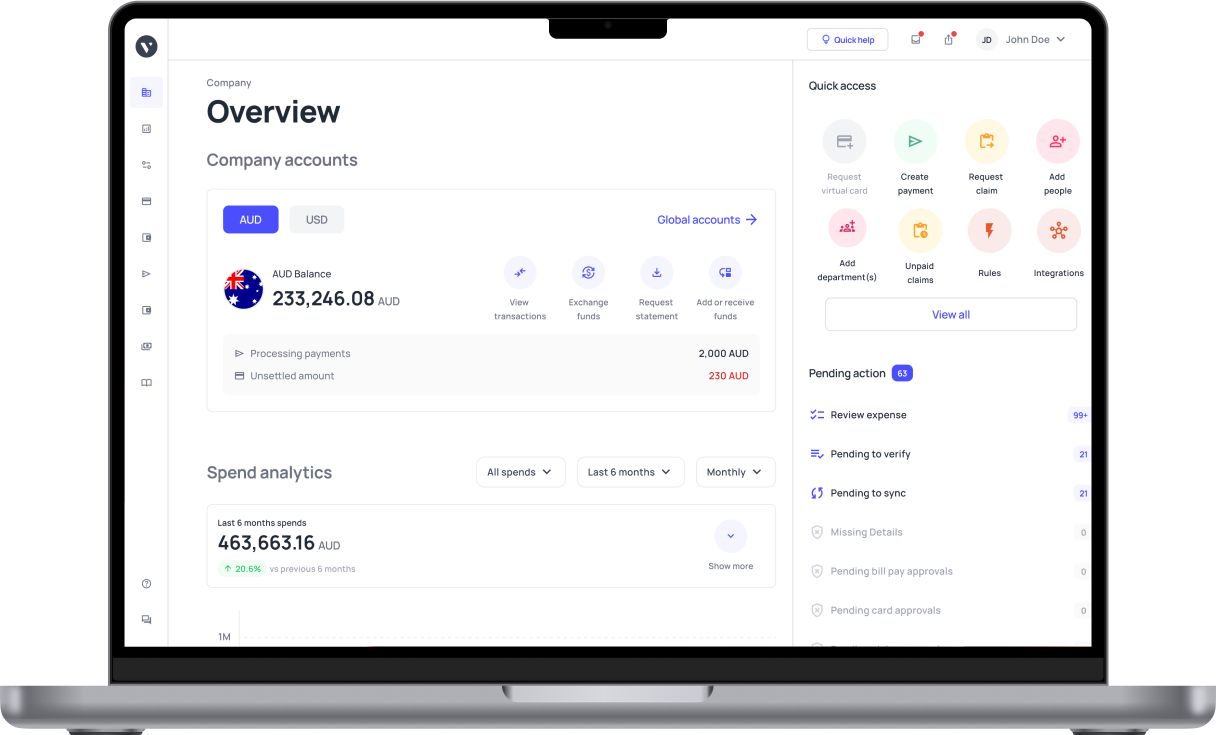

Tools like Volopay’s prepaid cards make it easier for you to manage prepayments efficiently, offering real-time tracking, budget controls, and improved cash management. Whether you're a startup or scaling business in Australia, staying on top of these financial categories strengthens your decision-making and financial clarity.

What are prepaid expenses?

When you pay for goods or services before using them, you’re dealing with prepaid expenses. These are costs like rent, insurance, or subscriptions paid in advance, recorded as assets on your balance sheet under accrual accounting.

Why? Because you haven’t yet consumed the benefit. As you use the service—say, each month of a year-long insurance policy—you gradually expense the cost, moving it from an asset to an expense on your income statement. This ensures your financials accurately reflect when benefits are received, aligning with accrual accounting principles.

Prepaid expenses help you manage cash flow and plan for future obligations. For example, paying rent upfront secures your space and avoids monthly payments, while prepaying insurance might lock in coverage at a fixed rate. Prepaid cards can simplify these transactions.

By loading funds onto a card, you control spending, avoid overspending, and track expenses easily. Businesses often use prepaid cards for employee travel or operational costs, ensuring budget discipline.

The key is timing: you pay now, benefit later. This approach not only organizes your finances but also provides peace of mind by covering essential costs upfront. Whether it’s a small business or personal budget, prepaid expenses, often facilitated by prepaid cards, keep you financially proactive and in control.

What are accrued expenses?

When you incur costs for goods or services but haven’t paid for them yet, you’re dealing with accrued expenses. These include things like utilities, salaries, or interest that you’ve used or owe but haven’t settled by the end of your accounting period.

Under accrual accounting, you record these as liabilities on your balance sheet because they represent obligations you’re committed to paying. This ensures your financial statements accurately reflect what you owe, even if the cash hasn’t left your account.

For example, if your employees work the last week of the month but get paid the following month, you accrue their salaries as an expense for that period. Similarly, if you use electricity but the bill arrives later, you estimate and record the cost. This approach matches expenses with the period they’re incurred, giving a clearer picture of your financial health.

Accrued expenses help you avoid surprises by acknowledging debts as they arise. They’re crucial for budgeting and planning, ensuring you’re prepared for upcoming payments.

By tracking these liabilities, you maintain transparency in your financials, which is vital for stakeholders or lenders. Whether you’re running a business or managing personal finances, recognizing accrued expenses keeps your records accurate and your obligations in check, preventing cash flow missteps.

Differences between prepaid and accrued expenses

Understanding the distinctions between prepaid and accrued expenses is essential for managing your finances effectively.

These concepts, rooted in accrual accounting, differ in how they’re timed, recorded, and impact your financial statements, cash flow, and management strategies. Below, we break down the critical differences to help you navigate them with clarity.

Timing of payments

With prepaid expenses, you pay for goods or services before you use them. Think of paying rent for the year or an insurance premium upfront.

The cash leaves your account first, securing future benefits. In contrast, accrued expenses arise when you incur costs but haven’t paid them yet. For example, you owe salaries for work done this month or utilities used but billed later.

Payment follows the expense, often in the next accounting period. This fundamental timing difference—pay now versus pay later—shapes how each affects your financial planning and obligations.

Accounting treatment

Prepaid expenses are recorded as assets on your balance sheet because they represent future economic benefits. As you consume the service, like monthly rent, you amortize the cost, moving it to expenses on your income statement.

Conversely, accrued expenses are logged as liabilities since they reflect debts you owe but haven’t settled. When you pay them, the liability decreases, and cash reduces.

For instance, accrued salaries are a liability until payday. This distinction—asset versus liability—ensures your financial records align with when benefits are received or obligations are incurred, adhering to accrual accounting principles.

Impact on financial statements

Prepaid expenses primarily affect the asset side of your balance sheet. When you prepay, say, a year’s insurance, the asset increases, and as it’s used, expenses rise on your income statement. Your liabilities and equity remain largely unaffected initially.

Accrued expenses, however, boost liabilities on your balance sheet, reflecting unpaid obligations like utilities or interest. They also increase expenses on your income statement in the period incurred, impacting net income.

This difference—prepaid hitting assets, accrued hitting liabilities and expenses—shapes how your financial health appears to stakeholders, highlighting either prepayments or pending debts.

Effect on cash flow

Prepaid expenses require upfront cash payments, which can strain your cash flow immediately. Paying rent or subscriptions in advance reduces available cash, even though the expense is spread over time in your books.

Accrued expenses, on the other hand, delay cash outflows. You incur costs, like salaries or taxes, but pay them later, preserving cash in the short term. This can ease immediate cash flow pressures but requires planning for future payments.

The contrast—upfront cash drain versus delayed outflow—demands careful budgeting to balance liquidity and obligations effectively.

Tools for management

Prepaid expenses are often managed using prepaid cards, which allow you to load funds and control spending. These cards simplify tracking and budgeting for prepayments like travel or subscriptions, ensuring discipline.

Accrued expenses require robust liability tracking systems. You need to estimate and record costs like utilities or wages accurately, often using accounting software to monitor due dates and amounts.

While prepaid cards offer proactive spending control, managing accrued expenses demands reactive oversight to avoid missed payments or cash flow surprises. Choosing the right tools ensures both are handled efficiently.

Key principles in accounting for prepaid vs accrued expenses

Properly accounting for prepaid and accrued expenses ensures your financial records are accurate and compliant with accrual accounting principles. These processes involve distinct bookkeeping steps, from recording entries to integrating tools like prepaid cards.

Below, we outline how you handle each, emphasizing practical steps and software integration for seamless management.

Recording prepaid expenses

When you prepay for services like rent or insurance, you record the transaction by debiting the prepaid expense account, reflecting an asset, and crediting cash or your prepaid card account.

Example

Paying $12,000 for annual rent via a prepaid card means debiting prepaid rent for $12,000 and crediting cash/card for $12,000. This captures the future benefit you’ve secured.

Prepaid cards streamline this by limiting vested funds onto the card, ensuring controlled spending. Regularly reconcile card transactions to confirm payments align with recorded prepayments, keeping your books accurate.

Recording accrued expenses

For expenses incurred but unpaid, like utilities or salaries, you debit the relevant expense account and credit an accrued liability account.

Example

Suppose you owe $5,000 in salaries for the month. You debit salaries expense for $5,000 and credit accrued salaries for $5,000, recognizing the liability. No cash or card is involved yet, as payment is pending.

You must estimate costs accurately, often using invoices or usage data, and record them in the period incurred. This ensures your financial statements reflect obligations in a timely manner, maintaining transparency for stakeholders or lenders.

Amortization vs settlement

Prepaid expenses are amortized over their benefit period.

Example

For that $12,000 prepaid rent, you debit rent expense for $1,000 monthly and credit prepaid rent, gradually reducing the asset. This spreads the cost as you use the service. Accrued expenses, however, are settled when paid. When you pay the $5,000 accrued salaries, you debit accrued salaries, clearing the liability, and credit cash.

Prepaid card integration simplifies tracking prepayments, as you can monitor card balances, while accrued expenses require diligent liability tracking to ensure timely settlement without cash flow disruptions.

GAAP compliance

Both prepaid and accrued expenses adhere to Generally Accepted Accounting Principles (GAAP), which mandate accrual accounting. You recognize prepaid expenses as assets until consumed, ensuring expenses match the period of benefit.

Similarly, you record accrued expenses as liabilities when incurred, not when paid, aligning costs with revenue generation. This matching principle ensures your financial statements accurately reflect your financial position.

Whether using prepaid cards for prepayments or estimating accrued costs, GAAP compliance enhances credibility with investors and regulators.

Software integration

Integrating prepaid card transactions with accounting software like QuickBooks streamlines prepaid expense tracking. You can sync card payments, categorize them as prepaid assets, and automate amortization schedules.

For accrued expenses, software like Xero excels at tracking liabilities. You can set up recurring entries for estimated costs, like utilities, and reconcile them when invoices arrive.

Both platforms support GAAP-compliant reporting, generating balance sheets and income statements that reflect prepaid assets and accrued liabilities accurately. Regular reconciliation ensures your software reflects actual card balances and outstanding obligations.

Advantages of prepaid and accrued expenses

Effectively managing prepaid and accrued expenses strengthens your business’s financial health.

By handling these costs strategically, you gain clarity, control, and efficiency, ensuring smoother operations and better decision-making. Below are the key advantages of mastering these processes.

Financial accuracy

Properly managing prepaid and accrued expenses ensures your financial statements reflect reality. You record prepaid expenses as assets and amortize them as they’re used, matching costs to the periods they benefit.

Similarly, you log accrued expenses when incurred, not when paid, aligning liabilities with revenue. This adherence to accrual accounting produces reliable reports, giving you, your investors, and lenders a clear picture of profitability and obligations, which builds trust and supports informed strategic planning.

Budget control

Prepaid expenses can strain cash flow, as you pay upfront for services like insurance. Accrued expenses, while delaying outflows, can pile up, creating future cash crunches. To manage prepayments, use prepaid cards to allocate specific funds, preventing overcommitment.

For example, load a card with $5,000 for travel expenses to cap spending. For accruals, forecast liabilities to plan payments. Prepaid cards ensure disciplined budgeting, while staggered accrual settlements maintain liquidity, balancing your cash flow effectively.

Tax optimization

Managing these expenses lets you time deductions strategically. Prepaid expenses, like insurance, can be deducted as amortized, while accrued expenses, like interest, are deductible when incurred, per IRS rules.

By aligning these with your tax strategy, you maximize deductions within compliant periods, potentially lowering your taxable income. This requires careful record-keeping but can yield significant savings, freeing up funds for reinvestment or operational needs while staying aligned with tax regulations.

Cash flow planning

Balancing prepaid and accrued expenses optimizes cash flow. Prepaid expenses require upfront cash, so using prepaid cards helps you plan outflows without draining reserves. Accrued expenses delay payments, preserving liquidity until settlement.

By forecasting prepayments and tracking accruals, you avoid cash crunches, ensuring funds are available for critical operations or investments. This proactive approach keeps your business agile and financially stable, even during tight periods.

Vendor relations

Effective management strengthens vendor relationships. Using prepaid cards for prepayments, like annual software licenses, ensures timely, controlled payments, fostering trust with suppliers.

For accrued expenses, tracking liabilities like utility bills prevents late payments, avoiding penalties or strained relations.

Consistent, punctual payments—whether prepaid or settled later—demonstrate reliability, potentially securing better terms or discounts, which enhances your business’s reputation and operational efficiency.

Pitfalls in managing prepaid and accrued expenses

Managing prepaid and accrued expenses can be tricky, presenting obstacles that demand careful attention. From tracking complexities to compliance risks, these challenges can disrupt your financial operations.

Below, we explore these hurdles and offer solutions, highlighting how prepaid cards can simplify the process.

Tracking complexity

Keeping tabs on prepaid and accrued expenses is complex. You must amortize prepaid costs, like rent, over their benefit period, while monitoring accrued liabilities, such as unpaid wages, to ensure timely recognition.

Manual tracking risks oversights. Automate prepaid amortization with accounting software like QuickBooks, which schedules expense recognition.

For accrued expenses, use Xero to log and monitor liabilities. Prepaid cards help by providing clear transaction records, making it easier to align prepayments with amortization schedules.

Cash flow strain

Prepaid expenses can place a strain on cash flow, especially if large upfront payments are required. This makes effective budgeting essential for managing liquidity. Using prepaid cards offers a practical solution by enabling businesses to set clear budgets for prepayments, allocate funds efficiently, and track spending.

With better control over cash outflows, businesses can avoid the negative impact on cash flow, making it easier to maintain liquidity and plan for future expenses without disrupting daily operations or financial stability.

Error risks

Mistakes in recording prepaid or accrued expenses—like misallocating amortization or underestimating accruals—can skew financials. Manual entries heighten this risk.

Prepaid cards reduce errors by providing detailed transaction logs, ensuring prepayments are accurately recorded. Sync these with accounting software to automate entries.

For accruals, cross-check estimates against invoices. Regular reconciliation of card transactions and liability accounts minimizes discrepancies, keeping your books accurate and reducing the need for costly corrections.

Compliance issues

Failing to adhere to GAAP or IRS rules can lead to penalties. Prepaid expenses must be amortized correctly, and accrued expenses recognized when incurred.

Missteps, like expensing prepayments too early, violate standards. Prepaid card records provide a clear audit trail, ensuring GAAP-compliant amortization.

For accruals, software tracks recognition timing. Regular audits of card transactions and liability entries ensure IRS compliance, safeguarding your business from fines and enhancing financial credibility.

Vendor disputes

Disputes arise when prepayment or accrual terms are unclear. Vendors may question prepaid amounts or delayed accrual payments.

Prepaid cards help by documenting exact prepayment amounts, like software licenses, and clarifying terms upfront. For accruals, maintain open communication about payment schedules.

Use card logs to verify prepayments and software to track accrual settlements, ensuring transparency. Clear terms and timely payments prevent conflicts, fostering strong vendor relationships.

Applications of prepaid and accrued expenses in small businesses

As a small business owner, managing prepaid and accrued expenses is critical for financial efficiency. These expense types apply in distinct scenarios, with prepaid cards streamlining prepayments. Below are practical use cases and benefits, tailored to small and medium enterprises (SMEs).

Prepaid expenses

You can prepay for SaaS subscriptions, like accounting or marketing tools, using prepaid cards.

For example, load a card with $1,200 to cover a year’s subscription to QuickBooks. This secures the service upfront, locks in pricing, and controls spending.

Prepaid cards also work for annual rent or insurance, ensuring funds are allocated specifically for these costs, simplifying budgeting and avoiding overspending.

Accrued expenses

Accrued expenses arise when you incur costs but haven’t paid yet. For instance, you accrue utility bills throughout the month, recording the estimated cost as a liability until the billing cycle ends.

Similarly, if you pay employee wages biweekly, you accrue salaries for days worked before payday. This ensures your financials reflect obligations, like taxes or interest, accurately in the period they’re incurred.

While accrued expenses are internal accounting entries for unpaid liabilities, tools like a bill of exchange may be used in formal trade scenarios to document and settle such obligations at a future date.

Combined scenarios

You might use prepaid cards for upfront costs while tracking accruals simultaneously. For example, prepay a year’s internet service with a $600 card transaction, recorded as an asset, and accrue monthly employee bonuses as liabilities.

Prepaid cards provide clear records for prepayments, while accounting software tracks accruals, ensuring both are managed efficiently. This dual approach keeps your cash flow balanced and financials transparent.

Small business benefits

Prepaid cards simplify prepayments for SMEs with limited budgets. They let you allocate funds for specific expenses, like trade show fees or bulk supplies, without dipping into operational cash.

According to web sources like NerdWallet, cards reduce administrative overhead, freeing you to focus on growth. Accrual tracking ensures you’re prepared for liabilities, enhancing financial discipline.

Compliance support

Prepaid card transaction logs provide an audit trail, supporting GAAP and IRS compliance. When amortizing prepaid expenses or recognizing accruals, these records verify proper timing and amounts.

For example, card statements confirm a prepaid insurance payment, while accrual entries align with tax deductions. This documentation streamlines audits, ensuring your SME meets regulatory standards.

How prepaid cards help streamline prepaid expense management

Prepaid cards revolutionize how you manage prepaid expenses, offering efficiency and control for costs like rent or subscriptions.

By leveraging these cards, you streamline processes, reduce risks, and enhance financial oversight, as noted in web sources like Investopedia and NerdWallet. Here’s how they transform prepaid expense management.

Budget control

Prepaid cards allow businesses to set specific limits for prepayments, such as rent or insurance. This ensures that the spending remains within budget, preventing overspending. By allocating a defined amount to each category, businesses can better manage cash flow and avoid unexpected financial strain.

Additionally, these limits can be adjusted easily as business needs change, providing flexibility to accommodate fluctuating expenses while maintaining financial discipline.

Real-time tracking

With prepaid cards, you monitor transactions instantly via online dashboards or mobile apps. Platforms like Visa’s prepaid solutions provide real-time updates, showing exactly how much you’ve spent on prepayments, such as travel or subscriptions.

This eliminates manual tracking, letting you verify expenses on the go. Web sources highlight that such visibility ensures you stay informed, reducing the risk of untracked prepayments.

Fraud protection

Prepaid cards enhance security for prepayments. Features like PINs, transaction locks, and zero-liability policies, as noted by Investopedia, protect against unauthorized use.

If a card is compromised, your prepaid funds for expenses like event deposits remain safe, unlike cash or traditional accounts. This security gives you confidence when making large prepayments, minimizing financial risks.

Simplified bookkeeping

Prepaid cards integrate seamlessly with accounting tools like QuickBooks, automating bookkeeping. Transaction data syncs directly, categorizing prepayments as assets and scheduling amortization.

This reduces manual entry errors, ensuring accurate records. Per web insights, this integration saves time, letting you focus on operations while maintaining GAAP-compliant financials for prepaid expenses.

Vendor flexibility

Many prepaid cards, branded with Visa or Mastercard, are widely accepted, offering flexibility to pay suppliers. You can use them for prepayments like annual memberships or bulk supplies, as vendors prefer card payments for their reliability.

Sources like PayPal note that this broad acceptance simplifies transactions, ensuring smooth vendor interactions and timely prepayments without cash or check hassles.

Volopay prepaid cards for seamless expense management

Volopay’s prepaid cards streamline your prepaid expense management, offering unmatched control and efficiency. Set budgets, track spending in real time, secure funds, pay vendors globally, and ensure compliance with ease, making them the ideal solution for small businesses handling prepayments.

Control budgets

Volopay’s prepaid cards empower you to manage prepaid expenses like insurance or SaaS subscriptions with precision.

You can set custom spending limits, such as $5,000 for annual rent, ensuring funds are allocated without overspending. This prevents cash flow strain, aligns with your budget, and promotes financial discipline.

Volopay's business budgeting software features let you top up cards as needed, keeps your prepayments controlled and predictable, allowing you to focus on core business operations without worrying about unexpected costs.

Track expense in real-time

With Volopay’s dashboard, you gain instant visibility into prepaid card transactions for expenses like subscriptions or travel.

Monitor spending in real time and sync data seamlessly with accounting tools like QuickBooks, Xero, or NetSuite. This eliminates manual tracking, ensuring accurate expense records.

Volopay’s real-time update feature provide insights into spending patterns, helping you adjust budgets proactively and maintain transparency across your financial operations.

Security

Volopay’s prepaid cards secure your prepayments with robust features like PIN protection, card lock/unlock options, and multi-level approval workflows. For expenses like rent or event deposits, these safeguards prevent unauthorized use.

Advanced encryption and fraud prevention, compliant with SOC 2 standards, ensure funds remain safe. Volopay’s security measures protect your business from breaches, giving you confidence in managing large prepaid expenses.

Vendor flexibility

Volopay’s prepaid cards offer global acceptance, letting you prepay suppliers for services like software or bulk inventory effortlessly. Whether domestic or international, vendors prefer these cards for their reliability.

Virtual cards for one-time or recurring payments, streamline transactions, ensuring flexibility and speed while maintaining clear records for all prepaid vendor payments.

Compliance

Volopay’s prepaid cards generate audit-ready reports, simplifying GAAP and IRS compliance. Transaction histories provide clear documentation for prepaid expenses, like insurance, ensuring proper amortization timing.

Integrations with accounting software automate expense categorization, reducing errors. Volopay’s platform, supports compliance with detailed, traceable records, making audits efficient and keeping your business aligned with regulatory standards.

FAQs prepaid and accrued expenses

The key difference lies in timing. Prepaid expenses are payments you make in advance for future services—like rent or insurance. In contrast, accrued expenses are costs you’ve incurred but haven’t paid yet—like wages or utilities. Prepaid expenses are assets, while accrued expenses become liabilities on your financial statements.

Prepaid cards give you more control over prepaid expenses. You can load only the required amount, preventing overspending. These cards also offer real-time expense tracking and budgeting tools, helping you monitor where and how your business is spending in advance. They’re especially useful for managing subscriptions, travel bookings, or vendor payments.

Prepaid expenses appear as assets on your balance sheet and shift to expenses over time. Accrued expenses, on the other hand, are recorded as liabilities since you owe money for services already received. Both affect your income statement, but at different stages of the financial reporting cycle.

Prepaid expenses can tighten your short-term cash flow because you’re paying in advance. Accrued expenses offer more flexibility since payments happen later, keeping cash in your account longer. However, too many accrued liabilities can build up and strain your finances when payments come due.

To stay compliant, maintain accurate records for every prepaid or accrued transaction. Use prepaid card reports and automated accounting software to document all activities. These tools simplify audits, tax filing, and financial reviews by ensuring every expense is traceable and correctly categorized.