6 best expense management software in Australia to consider in 2025

Companies around the world are shifting away from manual expense reporting processes and choosing expense management systems instead. But with so many options in the market, choosing the right software for you can be difficult.

To make the right decision, some of the best expense management software for small businesses in Australia have been listed below.

How does an expense management software work?

An expense management software essentially centralizes all the expense tracking and controlling processes onto a real-time collaborative digital platform using the internet. This makes communication, coordination, and compliance with tasks related to expense management extremely easy.

6 best expense management software in Australia

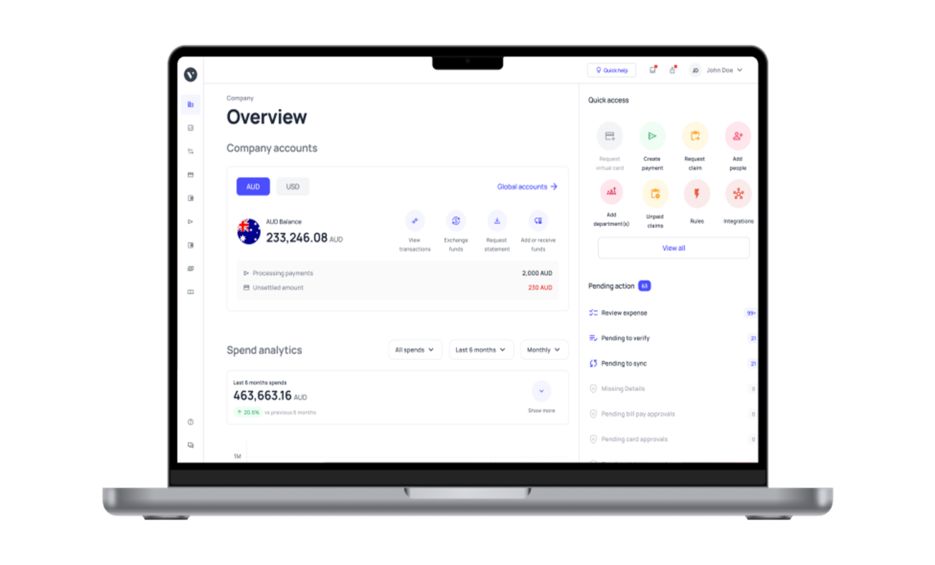

1. Volopay

● Overview

Volopay introduces a novel approach to expense management by combining traditional financial management with smart spending tools. This software positions itself as an all-in-one platform for expense tracking, corporate cards, and bill payments.

● Key features

Volopay's standout feature is its integrated corporate card, which can be assigned to employees with preset spending limits. The platform also offers automated expense tracking, invoice processing, receipt capture, and approval workflows.

Integration with accounting software ensures seamless data synchronization.

● Pros

• Integration of corporate cards simplifies spending control.

• Comprehensive approach covering expenses, cards, and bills.

• Competitive pricing with clear plan differentiation.

● Cons

• Might not be suitable for businesses with minimal expense management needs.

• Some users may prefer more specialized solutions for specific functions.

● Customer reviews

Customers applaud Volopay's simplicity and the convenience of the integrated corporate card. The platform's comprehensive approach to expense management and bill payments receives positive feedback.

Some users, however, noted that the platform's capabilities might be more extensive than necessary for smaller businesses.

2. SAP Concur Australia

● Overview

SAP Concur has an extensive suite of features that businesses can use to manage their budgets and expenses effectively and efficiently. It allows you to automate and streamline spending and reporting processes.

● Key features

With SAP Concur Expense, you can easily capture payment data from many different sources. Get automated reporting tools and reimbursement features that can streamline the process for you. SAP Concur also has tools for managing travel expenses.

● Pros

It’s easy to automate expense reporting tasks with SAP Concur. With its travel solution and mobile app, even travel expenses are easy to track and manage.

● Cons

While SAP Concur Australia has many features that are useful for businesses, you may also find that the user interface can be complex and a little difficult to navigate.

● Customer reviews

Averaging 4.3 out of 5 stars with around 2,000 reviews on Capterra, customers think that SAP Concur Australia is a solid expense management system. Most seem to have a generally positive experience with it.

3. Zoho Expense

● Overview

As part of the Zoho suite, Zoho Expense can be used in tandem with other systems in the Zoho suite to maximize its impact as the best expense management software for your business.

● Key features

Use the Zoho Expense mobile app to easily snap pictures and scan receipts, streamlining your company’s receipt management. With other expense management features like simplified approvals, expense report management, and mileage tracking, you’ll have better visibility of your expenses.

● Pros

You can try Zoho Expense out for free, which is a plus point for many small businesses. The platform is easy to use and offers the basic functionalities you’ll need to manage employee expenses.

● Cons

The receipt scanning feature could use improvements. While it’s useful for taking photos of receipts to keep them in one place, the scanning process still proves to be inaccurate sometimes.

● Customer reviews

With an average of 4.6 out of 5 stars and around 1,000 reviews on Capterra, Zoho Expense is received positively by its customer base. Many consider the platform modern and easy to use.

4. Weel expense management

● Overview

Weel is branded as a spend management solution that can streamline processes such as compliance, expense reporting, reimbursement management, and more.

● Key features

Aside from standard features like bill and reimbursement management, you can get access to virtual cards to help manage your expenses. Weel can be the right employee expense management software for your organization if you’re looking for a modern solution with card features.

● Pros

Weel offers good integration capabilities with accounting software and allows you to directly sync records between platforms.

● Cons

Weel’s virtual cards are great tools for managing your expenses, but its card acceptance rate may not be able to rival bank cards, especially as it is virtual and on a prepaid model.

● Customer reviews

While Weel only has over 30 reviews on Capterra, it has an average rating of 4.5 out of 5 stars. The corporate card offering has received positive reviews from customers.

5. MYOB

● Overview

Australian-based MYOB Business is an accounting software suite that can also be used by businesses to monitor and manage their expenses and cash flow. It allows you to make and track expenses in real-time easily.

● Key features

While primarily an accounting solution, MYOB Business offers expense tracking features and allows you to scan and store receipts easily. You can also manage your cash flow and use analytic tools to make budget forecasts.

● Pros

MYOB is relatively easy to use and has a layout that is user-friendly. It is also simple to get started with and understand, meaning that you can implement this platform without the hassle.

● Cons

Although MYOB Business is an easy-to-understand platform, it may have limited functionality compared to its competitors. It is also considerably expensive given the features, especially for small businesses.

● Customer reviews

On Capterra, MYOB has an average rating of 3.8 out of 5 stars from over 120 reviewers. Customers have generally expressed that MYOB is a solid product.

6. Expensify

● Overview

As an expense management software suite and corporate card provider, Expensify is a fairly easy-to-use platform that streamlines the expense management process. Its corporate card offering sets it apart from competitors.

● Key features

Boasting a robust receipt tracking and management system, Expensify offers features such as one-click receipt scanning, credit card transaction updates, card reconciliation, automated approval workflows, tax tracking, and more. You can also use analytics tools to analyze company-wide spending trends.

● Pros

Features like uploading receipts, expense report submission, and the mobile app are easy to understand and utilize. You also get corporate Expensify cards to manage your expenses along with the platform’s user-friendly interface.

● Cons

While Expensify is a great choice of expense management software in Australia, expense syncing can be a little complicated to set up. You may also find the admin customization options a little lacking.

● Customer reviews

Out of 5 stars, Expensify has an average rating of 4.4 stars with over 1,000 reviews on Capterra. Many customers consider Expensify easy to use but feel like some features could be added or improved.

Importance of expense management software

Expense management software has become an indispensable tool for modern businesses, revolutionizing the way companies handle their financial processes.

In the fast-paced world of fintech, where precision, efficiency, and security are paramount, the best expense management software emerges as a crucial asset for companies:

1. Insights to control cost

Top expense management software offers in-depth insights into company spending patterns. As an individual working in finance, you understand the importance of maintaining a streamlined budget.

With expense management software, you can track expenses in real time, identify unnecessary costs, and implement strategies to control expenditures.

By having a clear view of where the funds are being allocated, you can make informed decisions to optimize your financial resources.

2. Increased efficiency

Efficiency stands as a fundamental principle within the realm of fintech. Expense management software eradicates the necessity for manual procedures like gathering physical receipts and manually inputting data.

Automation expedites the progression of expense reporting, approval workflows, and reimbursement procedures, enabling your team to dedicate attention to tasks of greater significance.

This heightened efficiency culminates in elevated productivity across the entirety of the organization.

3. Gives real-time insights

The significance of real-time information is clearly evident in the pace at which this industry works. Expense management software provides you with up-to-the-minute data on expenditures, enabling you to make timely decisions.

This level of responsiveness empowers you to adapt quickly to changing financial scenarios and capitalize on emerging opportunities.

4. Improved accuracy

Exacting precision holds immense importance, particularly in the realm of financial management. Expense management software mitigates the potential for human mistakes linked with the manual input and calculation of data.

Reliable and precise data guarantees that financial statements are dependable and faithfully represent the company's authentic expenditures, thereby enhancing the process of informed decision-making.

5. Integration with accounting systems

Seamless integration between expense management software and accounting systems is crucial for maintaining a coherent financial ecosystem.

By having data flow seamlessly between these systems, you can ensure that financial records are accurate, up-to-date, and synchronized.

This integration simplifies reconciliation, reduces the risk of discrepancies, and enhances overall financial transparency.

6. Auditing and compliance

In the highly regulated fintech industry, adherence to auditing and compliance standards is non-negotiable. The best software for expense management always provides a comprehensive trail of financial transactions, making audits smoother and more transparent.

This capability ensures that your company remains compliant with industry regulations and internal policies.

7. Policy compliance

Expense management software can be configured to enforce company expense policies. This feature aligns with the needs of an organization to enforce compliance, ensuring that all expenditures related to the organization’s work adhere to the stipulated guidelines.

Policy compliance not only promotes responsible spending but also minimizes the potential for disputes and discrepancies.

8. Multi-currency support

The fintech landscape often involves international transactions and multi-currency operations. Expense management software equipped with multi-currency support accommodates these complexities seamlessly.

This functionality is invaluable for a business organization, enabling them to manage expenses across different currencies accurately.

9. Data security

As someone working for a fintech software company, you understand the paramount importance of data security. Expense management software employs robust encryption and security protocols to safeguard sensitive financial information.

This ensures that confidential data, including employee reimbursement details and financial records, remains protected from unauthorized access and potential breaches.

How can expense management software address the challenges?

Expense management within the fintech industry presents a unique set of challenges that demand innovative solutions. Fortunately, expense management software emerges as a powerful tool to address these challenges effectively and streamline the financial processes of your company.

1. Receipt management and data entry

Challenge

Gathering and handling physical paper receipts can result in mistakes, time delays, and operational inefficiencies. The process of manually entering data is both labor-intensive and susceptible to errors.

Solution

Expense management software revolutionizes receipt management by allowing users to capture receipts digitally using mobile devices. Optical character recognition (OCR) technology swiftly extracts relevant information, eliminating the need for manual input. This not only reduces errors but also expedites the data entry process, enabling employees to focus on more value-added activities.

Additionally, integrating an employee savings scheme within the system can enhance financial well-being by helping employees allocate savings efficiently while managing expenses.

This streamlined process of receipt management is particularly advantageous for frequent business travelers. You can explore our guide on the best travel and expense management software to discover top solutions that can help you in streamlining your process and eliminate the challenges of manual receipt management.

2. Policy compliance and approval workflows

Challenge

Ensuring policy compliance and streamlining approval workflows can be challenging, especially in a dynamic fintech environment.

Solution

Expense management software enforces company expense policies by configuring automated approval workflows. It validates expense claims against predefined policies, ensuring that every expense adheres to established guidelines.

Additionally, the software facilitates a transparent and traceable approval process, reducing bottlenecks and ensuring timely reimbursements.

3. Lost receipts and documentation

Challenge

Lost or misplaced receipts can lead to discrepancies, hinder audit trails, and delay reimbursement processes. They can present a significant challenge to any system streamlining efforts.

Solution

Expense management software combats this challenge by offering a secure repository for digital receipts and documentation. Users can upload and attach receipts directly to expense claims, creating a comprehensive and easily accessible record. This digital trail ensures that all expenses are adequately documented, aiding in audits and minimizing the risk of lost documentation.

4. Currency conversion and international transactions

Challenge

In the global fintech landscape, dealing with currency conversions and international transactions can introduce complexity, extra costs as well as potential inaccuracies.

Solution

Expense management software with multi-currency support handles currency conversions seamlessly. It automatically converts expenses into the company's base currency using real-time exchange rates. This eliminates manual calculations and ensures accurate reporting of international transactions, maintaining financial accuracy and transparency.

5. Integration with accounting systems

Challenge

Seamlessly aligning expense data with accounting systems can be a daunting task, leading to discrepancies, errors, and inefficiencies. Manual data transfer between these systems is time-consuming and prone to errors.

Solution

Expense management software offers robust integration capabilities. It bridges the gap between expense tracking and accounting by automatically syncing data. This ensures that financial records are accurate, up-to-date, and consistent across all platforms. Integration also streamlines reconciliation processes, reducing the risk of errors and ensuring a seamless financial ecosystem.

6. Lack of real-time visibility

Challenge

Traditional expense management methods often lack real-time visibility into expenditures, making it challenging to make informed decisions promptly. Delayed access to expense data can lead to missed opportunities and hinder agile financial decision-making.

Solution

Expense management software provides real-time insights into expenses. With up-to-the-minute data, businesses can monitor spending patterns, identify trends, and proactively manage costs.

This immediate visibility empowers organizations to react swiftly to changing financial scenarios, optimizing resource allocation and capitalizing on emerging opportunities.

7. Expense fraud and misuse

Challenge

Expense fraud and misuse remain persistent concerns for businesses, leading to financial losses and reputational damage. Detecting fraudulent or unauthorized expenses can be a time-consuming and complex process.

Solution

Expense management software incorporates advanced fraud detection algorithms and audit trails. It automatically analyzes expense data, flagging anomalies and suspicious activities. With built-in controls and automated approval workflows, the software enforces policy compliance, minimizing the risk of fraud and misuse.

Additionally, digital receipts and documentation enhance transparency and accountability.

8. Employee productivity and user experience

Challenge

Manual expense reporting processes can be cumbersome and frustrating for employees, hampering their productivity. Cumbersome workflows and complex submission procedures can discourage timely and accurate expense reporting.

Solution

Expense management software enhances employee productivity and user experience. Mobile apps allow employees to submit expenses on the go, capturing receipts through their smartphones.

Features to consider when selecting expense management software

The best expense management software for small businesses will at least have the following features:

1. Seamless expense reporting process

If your company chooses to follow a process of reimbursements, then Volopay allows users to instantly create reimbursement claims using our mobile app or the web app.

You can even move away from this process if you choose to opt for Volopay corporate cards that can be issued to each employee. You also get to create unlimited virtual cards to manage all online expenses.

2. Real-time expense tracking

Instead of waiting for weekly or monthly updates on expense reports from all employees, using Volopay, you’ll be able to get a real-time update of all expenses that people are making throughout the organization.

3. Automated workflows

For making payments to vendors, you can easily set up approval workflows to ensure compliance with the expense policies of your companies. Volopay lets you set up to 5 levels of approvers depending on a custom expense range.

This allows you to assign the necessary managers for expenses as the degree of payment increases.

4. Integrated corporate credit card management platform

The best expense-tracking software for small businesses comes with the option to let its users issue corporate cards for their employees.

Not only does it remove the need for reimbursements but also allows the finance and accounting team to control budgets in a better way using the custom spending limits on cards.

Another great thing is that these controls can be adjusted whenever needed.

5. Digital audit trails

Every accounting team knows how important it is to maintain an audit trail for all transactions in their ledger.

Using an expense management system, the hassle of maintaining one is removed as all the actions taken on a transaction are automatically recorded in the digital ledger.

6. Advanced data analytics, insights, reports

Another useful element of an expense management system is its ability to create specific reports as per your requirements, give data analytics for you to derive insights, and sometimes also give insightful data directly when a certain behavior or spending pattern is observed by the system.

7. Easy expense approval process

Rather than communicating over email and waiting a day or two for confirmation or rejection, an expense management system allows for instant approval notification to necessary approvers so that there is no delay in business operations due to slow approval processes.

For small and petty expenses, you can also assign smaller budgets to employee corporate cards and avoid having to approve every small payment.

8. Easy reimbursement system

The biggest benefit of using expense management software for reimbursement is that you can immediately submit an expense claim after you make it rather than waiting till the end of the week or month to submit your expense claims.

This is especially useful for travel expense claims, allowing employees to quickly record and submit costs incurred during business trips, ensuring faster reimbursements and better expense tracking. This reduces the need for employees to constantly carry around a bunch of receipts.

9. Compatible with any accounting software

Lastly, the expense management platform you choose should be able to integrate easily with your existing accounting software. You should be able to easily export and sync all the expense data into your accounting tool without much hassle.

Expense management software implementation - Best practices

Define objectives and requirements

Before you embark on the process of implementation, it is crucial to meticulously outline the objectives you intend to reach through the utilization of expense management software.

Take the time to pinpoint areas of concern, whether they involve labor-intensive manual data entry or navigating complex compliance issues.

By precisely defining your distinct requirements, you lay a solid foundation that will not only steer the entire implementation process but also facilitate the assessment of its effectiveness in achieving your desired outcomes.

This proactive approach ensures that the implementation journey is purposeful and the results can be measured against well-established benchmarks of success.

Research and choose the right software

Thoroughly research and evaluate different expense management software options available in the market.

Consider factors such as features, scalability, user-friendliness, integration capabilities, and pricing. Choose software that aligns with your business's unique needs and growth trajectory.

Appoint a project team

Establish a specialized project team with the primary responsibility of supervising the implementation process. This team should comprise professionals from diverse departments, including finance, IT, and HR, fostering a comprehensive approach.

Assign explicit roles and responsibilities to each team member, ensuring clarity and accountability. Additionally, establish robust communication channels to facilitate seamless information flow and collaboration throughout the implementation journey.

This collaborative effort ensures a well-rounded perspective and efficient execution of the expense management software integration.

Data migration and integration

Smooth data migration is essential to avoid disruptions and maintain historical expense data. Ensure that the chosen software allows for seamless data migration from existing systems.

Additionally, prioritize integration with other relevant systems, such as accounting software, to streamline workflows and enhance data accuracy.

Customization and configuration

Tailor the expense management software to match your company's unique workflows and policies. Customize expense categories, approval hierarchies, and reporting structures to reflect your business processes.

This ensures that the software becomes a tailored solution rather than a one-size-fits-all approach.

Employee training and onboarding

Extensive training plays a pivotal role in optimizing user acceptance and reducing reluctance during transitions. It is imperative to conduct in-depth training sessions for employees tasked with utilizing the software.

These sessions should encompass not only fundamental navigation but also delve into the intricacies of advanced functionalities. Furthermore, crafting user-friendly guides or manuals for convenient reference can prove invaluable in reinforcing learning.

To foster a supportive environment, continuous assistance should be provided to address any queries or apprehensions that arise, ensuring a seamless and confident integration of the expense management software into the daily operations of the business.

Pilot testing

In preparation for the full-scale implementation of expense management software across the entire organization, it is prudent to commence with a pilot test involving a select group of users.

This preliminary phase serves as a valuable opportunity to detect and address potential issues, while also affording the chance to gather constructive feedback that can be instrumental in refining the software's functionality.

You could also craft comprehensive user guides and documentation that serve to streamline the pilot testing procedure, ultimately fostering a more intuitive comprehension of the software's nuances among the participants.

Communicate and promote

Effective communication is vital to garnering buy-in from employees. Craft engaging procedures that outline the benefits of the expense management software, addressing concerns and showcasing its value.

By creating persuasive and informative materials, you can ensure that employees understand the software's significance and are motivated to adopt it.

Provide ongoing support

Continuous support is essential for a seamless transition. Develop comprehensive training materials, including user manuals, video tutorials, and FAQs.

The extent to which you provide support can play a crucial role in enabling users to navigate the expense management software effectively and feel confident in its usage.

Monitor and evaluate

Regularly assess the software's performance and usage patterns. Utilize analytics to identify any areas of improvement or user challenges.

Enforcing this practice can aid in disseminating reports on the software's impact and encouraging users to provide valuable feedback for ongoing enhancements.

Compliance and policy enforcement

Align the software's features with company expense policies. Provide training and parameters that educate users on how to adhere to these policies and enforce the same while using the software.

Clearly articulate the importance of compliance and reinforce it through persuasive communication materials.

Stay updated

Technology evolves rapidly, and you should work towards keeping your employees informed about updates and new features.

Regularly share information about software enhancements and improvements, showcasing how these changes contribute to their efficiency and overall experience.

You should also make sure the software itself is kept updated and in tune with the latest technological trends.

Manage your business expenses efficiently with Volopay

Volopay is an all-in-one expense management software for businesses. It is a centralized system to help manage the budget for teams and employees across the organization.

Here are some of the core benefits of using Volopay to manage your business expenses:

• Real-time tracking

Track all expenses as they happen. This helps in resolving any issue immediately rather than waiting an entire month to spot compliance issues.

• Complete visibility

A central system to manage all expenses gives the senior management and finance executives the visibility they need in order to make crucial financial decisions.

• Custom controls

Be it spending through corporate cards or sending money via Volopay’s Bill Pay feature, you can ensure compliance by setting spending limits for each card and creating custom approval policies for Bill Pay transfers.

• Corporate cards

Using Volopay you can issue unlimited virtual cards to manage all online payments and issue a physical card for each employee that needs one.

• Multicurrency business account

Whether you have domestic or international vendors, you can easily pay them through Volopay thanks to the platform’s multi-currency business account.

It allows you to hold money in 60+ currencies and pay in over 100 countries. This helps you avoid the FX fees that can add up to a lot of money over time.

• Vendor management

Volopay lets you store all important payment details about your vendors in one place so that you can easily create recurring payments rather than having to manually enter their details each time you want to make a payment to them.

• Accounting integration

Any expense management software for small businesses should have the ability to integrate with accounting tools. Volopay has native integrations with Xero, Netsuite, Quickbooks, MYOB, Deskera, and Tally.

We also have the Universal CSV feature that allows you to integrate with other accounting tools.

FAQs

Instead of making your employees create long expense reports at the end of the month, a company using Volopay can simply let its employees use our mobile app to instantly create a reimbursement claim, add the necessary info, and attach the relevant receipts.

If your company uses Volopay corporate cards or our money transfer feature to make payments, then all these transactions are automatically recorded in ledgers within our system with all the necessary details. This automated expense reporting helps employees and finance & accounting teams save a lot of time.

Since Volopay is a completely online platform, the need to maintain a physical paper trail is completely eliminated. All the tracking, approval, rejection, and management of expenses are done within the platform itself.

Yes, any purchase you make using Volopay virtual cards is instantly recorded and reflected on your dashboard. Real-time tracking of expenses across the organization helps the finance and accounting team maintain visibility over budget utilization.