Accounts payable days: Formula, examples & how to calculate

Accounts payable days, or Days Payable Outstanding (DPO), is a key metric that shows how long your business takes to pay its suppliers after receiving invoices. It directly impacts your cash flow and vendor relationships, making it essential for financial planning.

A high or low DPO can signal different things about your payment behavior. This metric also reflects how efficiently you process invoices and manage outgoing payments. By monitoring DPO, you can optimize working capital while keeping supplier trust intact.

To manage it effectively, you need to calculate accounts payable days regularly and analyze your payment patterns over time.

What are accounts payable days?

The average number of days it takes you to pay your suppliers after receiving their invoices is measured by accounts payable days, commonly called Days Payable Outstanding (DPO). This indicator shows how effectively you handle cash flow and process payments.

To calculate DPO, divide your average accounts payable by the cost of goods sold, then multiply by the number of days in the period (typically 365 for a year).

A higher DPO suggests you take longer to pay, which can help preserve cash but may strain supplier relationships. Conversely, a lower DPO indicates faster payments, potentially strengthening vendor trust but reducing available cash.

To stay financially healthy and maintain trust with vendors, you need to calculate accounts payable days regularly. This involves dividing your average accounts payable by the cost of goods sold (COGS) and multiplying the result by the number of days in the period.

When you calculate accounts payable days, you gain insight into your payment patterns and can identify opportunities to optimize your vendor payment process. Keeping this metric in check ensures a balance between financial flexibility and strong supplier ties.

Why is it important to calculate accounts payable days?

You should calculate accounts payable days to keep your business financially healthy and manage invoices effectively.

Tracking this metric helps you understand your payment behavior, control cash flow, and improve decision-making. It also ensures you're not harming vendor relationships.

1. Cash flow management

Monitoring your accounts payable days helps you decide the best time to release payments. When you align payment cycles with cash inflows, you maintain liquidity and avoid cash shortages. This control allows you to cover essential expenses, invest in growth opportunities, and handle emergencies without disruption.

A well-managed DPO supports a steady cash flow that keeps your business agile and financially resilient even during slow revenue periods. By monitoring DPO, you can time payments to optimize liquidity, ensuring sufficient cash for operations. This prevents shortages, supports strategic investments, and maintains financial stability.

2. Supplier relationship health

Timely payments, guided by DPO, build trust with suppliers. This strengthens partnerships, secures favorable terms, and avoids penalties or strained relations. Consistent payment practices enhance your reputation, ensuring reliable supply chains and long-term collaboration.

This builds trust with vendors, which can lead to more favorable payment terms, discounts, or priority service. Late payments, on the other hand, may damage your reputation and limit future opportunities. Keeping your accounts payable days within a healthy range ensures long-term partnerships that support your business operations.

3. Operational efficiency

DPO highlights inefficiencies in invoice processing workflows. By analyzing payment cycles, you can identify bottlenecks, streamline approvals, and automate tasks. This reduces errors, saves time, and improves overall accounts payable performance, boosting operational productivity.

Streamlining these processes helps you process invoices faster, reduce errors, and avoid late payment fees. Improved operational efficiency not only saves time and money but also ensures your finance team runs more smoothly and supports overall business productivity.

4. Financial forecasting

DPO data informs accurate budgeting and investment planning. Understanding payment cycles helps you predict cash outflows, align expenses with revenue, and make informed strategic decisions, ensuring financial stability and supporting long-term business growth.

This helps you plan expenses, allocate resources, and identify the best times to invest in growth initiatives. Using accounts payable data as part of your financial forecasting also enables you to prepare for seasonal changes or unexpected costs with more confidence.

5. Benchmarking performance

Comparing your DPO to industry averages gauges your competitiveness. A balanced DPO shows efficient cash management without straining supplier relations. This insight helps you adjust strategies to align with best practices and maintain a market edge.

If your accounts payable days are significantly higher or lower, it may signal issues that need attention. For example, a much higher DPO could mean cash flow strengths or strained vendor ties. Benchmarking allows you to stay competitive, align with industry norms, and adjust your payment strategy to reflect best practices in your field.

Formula for calculating accounts payable days

To calculate Days Payable Outstanding (DPO), use the formula:

DPO = (Average Accounts Payable ÷ Cost of Goods Sold) × Number of Days.

This shows how long it takes to pay suppliers, with a clear example below.

1. The DPO formula

To calculate Days Payable Outstanding (DPO), use this formula:

DPO = (Average Accounts Payable / Cost of Goods Sold) × Number of Days

Start by finding the average accounts payable:

(Beginning Accounts Payable + Ending Accounts Payable) ÷ 2

Use the cost of goods sold (COGS) value from your income statement. The number of days typically refers to a fiscal year (365 days).

This formula allows you to measure the efficiency of your payables process and assess how long your business takes, on average, to settle its debts with suppliers. A consistent DPO value helps maintain good vendor relationships and manage working capital effectively.

2. Step-by-step calculation

To perform an accurate accounts payable days calculation, begin by collecting your financial data. First, determine the beginning and ending accounts payable balances from your balance sheets.

Then calculate your cost of goods sold (COGS) using this formula:

COGS = Beginning Inventory + Purchases – Ending Inventory

Once you have average accounts payable and COGS, apply the accounts payable days formula:

(Average AP ÷ COGS) × 365

This gives you the accounts payable turnover days calculation, showing how long you typically take to pay suppliers. Accurate calculation ensures better forecasting, improved vendor management, and more informed financial decision-making.

3. Practical example

Let’s walk through a real-world accounts payable turnover days calculation. Suppose your company’s beginning accounts payable is $500,000, and the ending accounts payable is $600,000. The COGS for the year is $4,000,000. First, calculate average accounts payable:

($500,000 + $600,000) ÷ 2 = $550,000

Now, apply the accounts payable days formula:

($550,000 ÷ $4,000,000) × 365 = 50.19 days

This means your business takes approximately 50 days to pay its suppliers. This accounts payable days ratio offers valuable insight into your company’s cash management and operational efficiency, guiding smarter financial strategies and decisions.

4. Alternative method

An alternative accounts payable days calculation involves using the ending accounts payable balance instead of the average.

This method is quicker and offers a snapshot view. Use the accounts payable days formula:

(Ending AP ÷ COGS) × 365

Using our previous data:

($600,000 ÷ $4,000,000) × 365 = 54.75 days

While less precise than using an average, this version of the accounts payable turnover days calculation is useful for monthly or quarterly analysis.

It helps you monitor payment trends and adjust strategies quickly. However, always pair it with the full formula for long-term planning and consistency checks.

How to calculate accounts payable turnover days?

Calculating Accounts Payable (AP) turnover days, or Days Payable Outstanding (DPO), helps you understand how often you pay suppliers and complements DPO analysis. By measuring how quickly you settle credit purchases, it provides insights into cash flow management and supplier relationships.

To better understand how often you pay suppliers, use the accounts payable days formula and perform an accounts payable turnover days calculation. It enhances your analysis of the accounts payable days ratio.

1. AP turnover ratio

Start by calculating the AP turnover ratio:

AP Turnover Ratio = Total Supplier Credit Purchases ÷ Average Accounts Payable

Find total supplier credit purchases from your financial records, typically the cost of goods sold (COGS) or purchases made on credit.

Calculate average accounts payable by adding the beginning and ending AP balances from your balance sheet and dividing by 2.

For example, if credit purchases are $4,000,000 and average AP is $550,000, the ratio is $4,000,000 ÷ $550,000 = 7.27. This shows how many times you pay off AP annually.

2. Turnover in days

Once you have the AP turnover ratio, you can convert it into days using this formula:

Accounts Payable Turnover Days = 365 ÷ AP Turnover Ratio

For instance, if your AP turnover ratio is 8, the accounts payable turnover days calculation would be:

365 ÷ 8 = 45.63 days

This result tells you how long, on average, your business takes to pay off supplier invoices. Understanding this metric enhances your application of the accounts payable days formula and gives clarity to your accounts payable days ratio, allowing you to fine-tune your vendor payment strategy and improve working capital management.

3. Why it matters

Knowing your accounts payable turnover days calculation matters because it reveals how often you settle payables, which directly impacts your cash flow. If you pay suppliers more frequently, cash leaves your business sooner, which might reduce liquidity.

On the other hand, less frequent payments may harm supplier relationships. By analyzing this metric alongside the accounts payable days formula and the accounts payable days ratio, you can evaluate whether your business is balancing cash retention with timely payments.

This calculation also improves your ability to negotiate better payment terms with vendors and strengthens your financial forecasting and decision-making processes.

Best ways to reduce your accounts payable days

To lower your Days Payable Outstanding (DPO), streamline invoice processing, and strengthen supplier relations. If you want to improve vendor relationships and strengthen your cash position, it's essential to reduce your accounts payable days.

By focusing on efficient workflows and reliable payments, you can lower your DPO. Start by understanding how to calculate accounts payable days and apply targeted strategies to reduce them.

1. Balance cash outflow/inflow

One of the most effective ways to reduce your accounts payable days is to align your cash outflows with inflows. You should analyze your revenue cycles and match supplier payment schedules with your income timelines.

By doing so, you ensure that you have sufficient cash on hand when payments are due, reducing late fees and improving vendor trust. Additionally, negotiate with suppliers to modify payment terms based on your cash flow projections.

This allows you to manage liabilities more proactively, avoid delays, and maintain a consistent payment rhythm. A balanced approach ensures financial stability and a healthier DPO metric.

2. Cut invoice processing time

Manual invoice processing is time-consuming and prone to delays and errors. By automating your accounts payable workflow, you can cut down the time it takes to review, approve, and pay invoices.

Use software tools that offer automatic data capture, approval routing, and digital archiving to make the process seamless. Faster invoice approvals mean vendors are paid on time, which reduces DPO and strengthens relationships.

Automated alerts and dashboards also keep you informed of due dates. This strategy ensures smooth operations, fewer missed deadlines, and more control over your payables. In turn, your accounts payable days decrease significantly over time.

3. Save on processing costs

Reducing accounts payable days doesn't have to be costly. In fact, you can save processing expenses by digitizing your AP business processes. Handling invoices by hand adds unnecessary expenses for labor, paper, and printing.

By moving to a digital procedure, those expenses are removed, and approvals may happen more quickly. The efficiency of your team increases since there are fewer bottlenecks and less dependence on paper documentation.

Also, it frees up time for high-value activities like budgeting and vendor negotiations. Quicker payments are possible when your procedures are more efficient and economical. In addition to increasing vendor trust, this permanently lowers your DPO.

4. Pay suppliers on time

Reducing accounts payable days requires timely payments. Paying suppliers on time or early each time demonstrates your dependability and expertise. This practice keeps credit good, avoids late penalties, and makes early payment savings available.

To keep track of deadlines and ensure prompt payout, use reminders or AP automation solutions. Making on-time payments also enables you to renegotiate better terms with suppliers who have confidence in your payment practices.

In the long term, this method minimizes your DPO and aids in the development of a solid market reputation. Making consistent payments is an easy yet effective method to maximize your AP cycle.

5. Streamline AP processes

Implement accounts payable software to streamline invoice management. Integrate accounts payable software with your financial system to optimize processes. Check out options that include vendor portals, automatic approvals, and real-time invoice tracking.

By reducing approval delays and doing away with manual data entry, these solutions improve the efficiency of the entire process. With the use of centralized dashboards, you can better manage cash flow and see outstanding invoices.

Naturally, your accounts payable days will decrease as your operation becomes more efficient and predictable. Speed is only one aspect of streamlining; other factors include control, consistency, and long-term effectiveness.

How does Volopay help in reducing your accounts payable days?

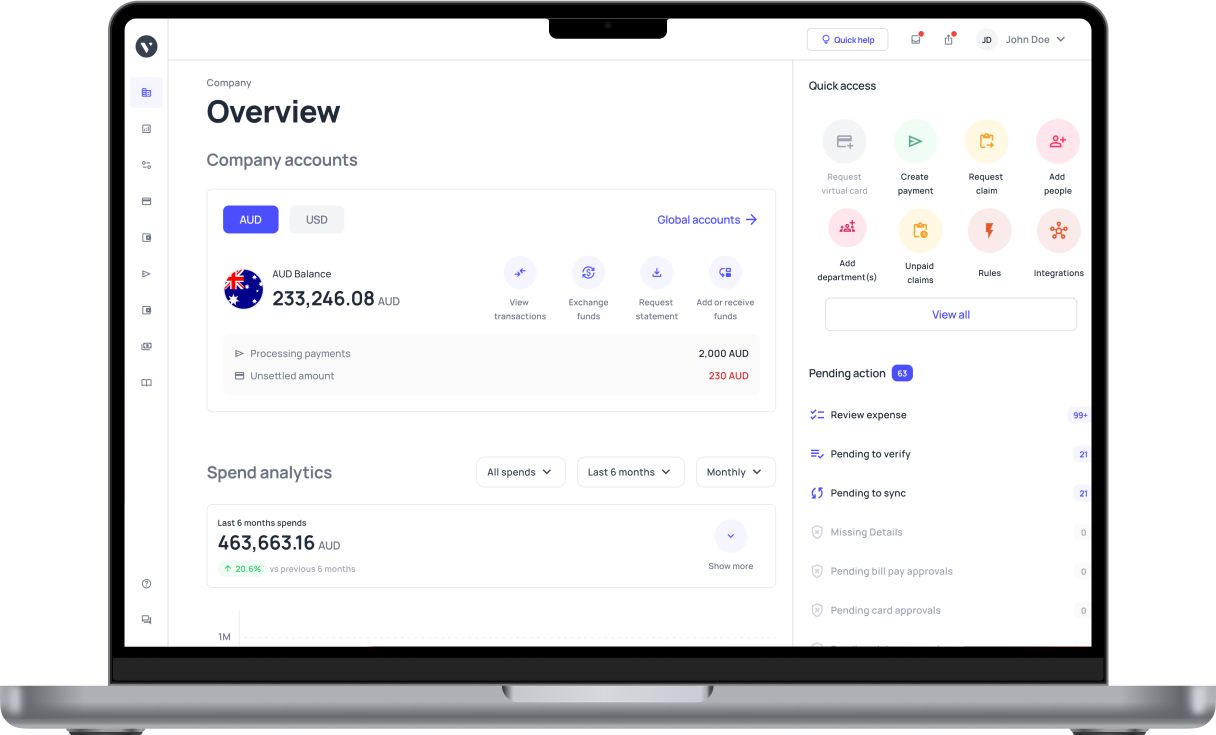

Volopay’s accounts payable automation platform is designed to streamline your accounts payable process, making it faster and more efficient. Volopay ensures that you can reduce your accounts payable days effectively. The accounts payable days formula is no longer a burden to calculate manually, as Volopay’s platform handles data entry and invoice processing quickly.

Volopay’s automation platform revolutionizes your accounts payable (AP) process, helping you reduce DPO and optimize cash flow for your small business. With OCR technology, you can scan invoices to automatically extract data, eliminating time-consuming data entry and reducing errors.

This speeds up invoice capture, allowing you to process bills faster and shorten payment cycles. Real-time tracking provides full visibility into every invoice and payment status, enabling you to monitor due dates, avoid late fees, and seize early payment discounts, further lowering DPO.

Automated invoice approvals reduce the time spent on manual approvals and eliminate bottlenecks. This leads to faster payment cycles, helping you lower your accounts payable days ratio and decrease DPO. As a result, your business can optimize cash flow without compromising supplier relationships.

Volopay’s seamless integrations with QuickBooks, NetSuite, and other ERP systems ensure smooth data flow, automating expense syncing and reconciliation. This cuts manual workload, letting you close books up to 10 times faster. Customizable approval workflows and bulk invoice uploads enhance efficiency, while multi-currency support simplifies international vendor payments, reducing delays.

Additionally, with its integration into your existing financial systems, you can monitor your accounts payable turnover days calculation and identify areas for further optimization. By automating tedious tasks and providing actionable insights, Volopay helps you align payments with cash inflows, maintain strong supplier relationships, and optimize liquidity.

Trusted by startups and enterprises, Volopay’s user-friendly platform empowers your small business to manage AP effortlessly, reduce DPO, and focus on growth.

FAQ's

A high number of accounts payable days means your business takes more time to pay vendors after receiving invoices. This improves your cash flow by keeping funds longer, which can be beneficial for short-term liquidity. However, relying on longer payment terms may negatively affect supplier relationships. Vendors might see your business as a late payer, making them hesitant to offer discounts or flexible credit terms in the future.

A low DPO means your business pays suppliers quickly after receiving invoices. This shows strong financial discipline and builds trust with vendors, which can lead to better payment terms or preferred service. However, paying too early reduces your ability to hold onto cash for other needs. Balancing your accounts payable days formula wisely ensures you don’t lose liquidity while still maintaining strong vendor relationships and operational efficiency.

When you extend your accounts payable turnover days calculation, you increase the time taken to settle supplier invoices. This may improve your business’s cash reserves temporarily, helping cover other expenses or investments. However, longer payment cycles can attract late fees, damage your credit rating, and strain vendor trust. Using the accounts payable days formula helps monitor the impact of increased DPO, ensuring you don’t compromise long-term supplier reliability or financial reputation.

There’s no one-size-fits-all answer—it depends on your business strategy. A higher DPO supports cash flow by delaying payments, which can be useful in tight financial periods. A lower DPO, on the other hand, boosts supplier relationships by ensuring timely payments. To determine what works best, evaluate your business goals and use the accounts payable days ratio to find the ideal balance between cash retention and vendor trust.