7 best accounts payable software in Australia to consider in 2025

At its core, accounts payable refers to the outstanding debts and financial obligations that a business owes to its suppliers, vendors, or creditors. These liabilities encompass a wide array of expenditures, ranging from raw materials and inventory to services rendered.

Effectively managing these payables and ensuring timely payments is paramount for maintaining financial stability and fostering healthy business relationships. To manage this process efficiently, many companies use AP automation software in Australia.

The 7 best accounts payable software to consider

1. Volopay

Overview

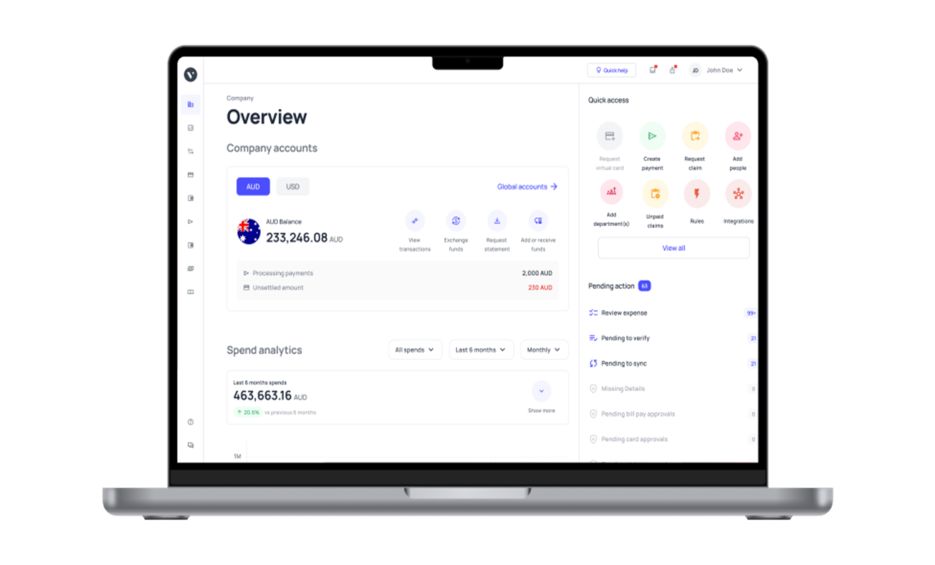

Volopay is a comprehensive spend management platform that offers automated accounts payable, corporate cards, and expense tracking & controlling.

Features

● Volopay’s invoice processing lets you seamlessly transfer money internationally and domestically to your vendors. You can create custom approval workflows for payments that are made through the platform.

● Companies can also issue corporate cards with custom spending controls that make sure that there is no overspending. All the expenses are tracked in real time on the centralized dashboard.

● You can also integrate the platform with any accounting software and export the expense data into your company ledger.

Pros

● End-to-end spend management.

● User-friendly interface.

● Enhanced control over expenses.

Cons

● May not suit businesses exclusively seeking AP solutions.

● Pricing plans vary based on features that are offered on the platform.

Target audience

Volopay is an excellent choice for businesses seeking an all-in-one spend management solution.

Ratings and reviews

Users appreciate Volopay for its comprehensive approach to spend management and ease of use.

2. SAP Concur

Overview

SAP Concur is a renowned name in financial software. It streamlines accounts payable by automating expense and invoice management, providing real-time visibility, and ensuring compliance.

Features

● SAP Concur is a good AP management platform for automated invoice processing, expense tracking, and reimbursements.

● You can also integrate the system with your company’s ERP system. This allows for better inventory management and seamless invoice verification as it makes invoice matching much easier.

● You also get access to deep analytics to understand spending patterns and use these insights for data-driven decisions.

Pros

● Robust automation capabilities.

● Extensive reporting options.

● Scalable for businesses of all sizes.

Cons

● May require training for full utilization.

● Higher pricing for advanced features.

Target audience

SAP Concur caters to medium to large enterprises seeking comprehensive accounts payable automation.

Ratings and reviews

Highly rated for its automation and expense management features, SAP Concur is a go-to choice for businesses with complex financial needs.

3. Zahara

Overview

Zahara is an intuitive accounts payable platform designed for streamlined purchase approval workflows and vendor management.

Features

● Zahara is a great AP software solution that helps companies with purchase order creation and approvals. You can easily process invoices and make payments through the platform.

● You also get access to a vendor portal for collaboration with your suppliers and vendors. Here you can easily store their payment details so that you don’t have to enter them each time you need to make a payment to them.

● The platform also has great reporting and analytics features to help an organization understand their spending behavior and how they can make their systems more efficient.

Pros

● Easy-to-use interface.

● Effective approval workflows.

● Affordable pricing.

Cons

● Limited to accounts payable functions.

● May not suit large enterprises with complex needs.

Target audience

Zahara is an excellent choice for small to medium-sized businesses seeking efficient AP management.

Ratings and reviews

Users praise Zahara for its simplicity and effectiveness in managing purchase orders and invoices.

4. Lightyear

Overview

Lightyear focuses on digitizing accounts payable processes, offering features like invoice scanning, data extraction, and expense tracking.

Features

● Lightyear is an accounts payable software with automated invoice capture and also extracts important details from it for payment processing.

● Companies using the platform can also use it to communicate with their suppliers.

● All the payments made via Lightyear are tracked in real-time and you can integrate it with your accounting software to ensure that there is uniformity of data between both platforms.

Pros

● Effortless invoice data extraction.

● Efficient expense tracking.

● Cost-effective solution

Cons

● Limited customization options.

● May lack advanced financial features

Target audience

Lightyear suits businesses of various sizes looking for an easy-to-use, automated AP solution.

Ratings and reviews

Lightyear receives positive reviews for its time-saving automation features and user-friendly interface.

5. Tipalti

Overview

Tipalti specializes in global payables automation, providing end-to-end AP solutions, from invoice processing to tax compliance.

Features

● Tipalti is a great AP software for invoice and payment automation. You can set up invoice processing and payment automation workflows that will save the finance team time and money.

● The platform also doubles as a supplier onboarding and communication tool to stay on top of payments and keep the suppliers updated at all times.

● The platform comes built-in with major tax compliance features to help you better manage your payments. And the best part is that you can do all this for cross-border payments as well.

Pros

● Comprehensive global payables support.

● Robust compliance features.

● Suitable for high-growth businesses.

Cons

● Complex implementation for some businesses.

● Pricing may be higher for smaller companies.

Target audience

Tipalti is ideal for businesses with international operations and complex payment needs.

Ratings and reviews

Users appreciate Tipalti's capabilities in managing cross-border payments and tax compliance.

6. Procurify

Overview

Procurify offers a spend management platform that includes accounts payable automation, purchase order management, and expense tracking.

Features

● Companies that deal with a lot of logistics and transport of goods will find Procurify extremely useful for its purchase order creation and approval system along with invoice processing for the same.

● The platform also offers expense tracking and analytics. It is a great system overall for building and managing supplier relationships.

Pros

● Streamlined spend management.

● User-friendly interface.

● Scalable for growing businesses.

Cons

● Limited to spend management functions.

● May not suit larger enterprises.

Target audience

Procurify is suitable for small to medium-sized businesses looking for efficient spending and AP management.

Ratings and reviews

Users commend Procurify for its intuitive interface and ease of use in managing the overall expenses of the company.

7. Stampli

Overview

Stampli focuses on AI-powered invoice processing and communication, making AP tasks more efficient and transparent.

Features

● Stampli’s AI-driven invoice data extraction is great for businesses that want to reduce the time spent by finance professionals manually entering invoice details into their system for payment processing. Collaborative invoice approvals help payments get approved faster.

● You can also create customizable workflows for payments and approvals as per your needs.

● Lastly, you can sync Stampli with accounting software to export the data into the company accounting books.

Pros

● Intelligent invoice processing.

● Enhanced communication and collaboration.

● Flexible workflow customization

Cons

● There is a learning curve for advanced features.

● May not cover all AP functions

Target audience

Stampli suits businesses looking for AI-driven invoice automation and improved communication in AP.

Ratings and reviews

Stampli receives praise for its innovative AI features and collaborative invoice approval process.

Effortlessly streamline your payables with Volopay!

Importance of effective accounts payable management

1. Cash flow optimization

One of the primary benefits of streamlined accounts payable management is optimized cash flow. The company may face a cash crunch if its cash inflow is slower than its cash outflow. Recognizing the difference between accounts payable and accounts receivable is crucial for effective cash flow management.

By ensuring timely and accurate payments, businesses can strike a balance between outgoing funds and incoming revenue, preventing potential cash flow crunches.

2. Maintaining supplier relationships

Your accounts payable system and processes that are set in place have a direct impact on the overall productivity of employees and the completion or incompletion of operations.

Effective accounts payable management nurtures positive supplier relationships. Timely payments not only cultivate goodwill but also establish a sense of reliability, which can lead to favorable terms, discounts, and priority access to goods and services.

3. Avoiding late fees and penalties

Late payments can lead to unnecessary fees and penalties, adversely affecting the bottom line. This may occur if you do not have good AP automation software with features like due date reminders so that you can make payments on time.

A robust accounts payable software can provide reminders and automation features, reducing the likelihood of missing payment deadlines.

4. Preserving creditworthiness

Consistent and timely payments enhance a company's creditworthiness. A consistent record of any payments that are due periodically to vendors or suppliers showcases that your company is financially stable.

This is crucial for securing favorable credit terms if you opt for financing in the future and also helps maintain a strong financial reputation in the market.

5. Accurate financial reporting

Accurate financial reporting relies on precise accounts payable data. A reliable AP automation software solution can help you generate comprehensive and custom reports as per your needs.

This ensures that financial statements reflect the true and latest financial standing of the company, facilitating better decision-making.

6. Compliance and audit preparedness

Regulatory compliance and audit readiness are non-negotiable aspects of financial management. Advanced accounts payable software aids in maintaining accurate records and documentation, simplifying the audit process.

The auditor will be able to complete the audit process much faster and more accurately thanks to the AP software solution that allows for detailed reports and documentation of all transactions.

7. Efficiency and productivity

Manual accounts payable processes are time-consuming and prone to errors. Even if you have multiple people handling different parts of your company finances, the chances of errors occurring are quite high.

Automation through software not only improves efficiency but also frees up valuable resources that can be allocated to more strategic tasks.

8. Fraud prevention

Accounts payable departments are susceptible to fraudulent activities. This fraudulent activity can be internal or external.

In either case, a comprehensive software solution includes security measures that minimize the risk of fraud, safeguarding company assets. It ensures that payments are verified and authorized before being processed so that no undue payments are made.

9. Strategic decision-making

Data-driven decisions are the cornerstone of successful businesses. Managerial executives within a company can only make good decisions if they have the most amount of information available to them.

With accurate and up-to-date accounts payable information, organizations can make informed choices that drive growth and profitability.

10. Long-term sustainability

Efficient accounts payable management contributes to the overall sustainability of a business. By managing cash flow, maintaining supplier relationships, and mitigating financial risks, companies can ensure their longevity in a competitive market.

Over a long period, a well-thought-out AP management system catering to your company’s needs not only makes things easier but also saves you a lot of money.

Accounts payable software and its role in optimizing financial processes

The evolution of technology has brought forth sophisticated accounts payable software that goes beyond traditional bookkeeping methods. These modern solutions play a pivotal role in optimizing financial processes, offering a multitude of advantages that resonate with businesses across various sectors.

Streamlining invoice management

Companies that do not have a proper invoice processing system might miss out on payments as the invoices may get lost within long threads and lists of emails. Even if the invoices are stored on time, the accountant has to manually enter all the information to process the invoice payments.

Accounts payable software eliminates the need for manual data entry by digitizing invoices. This not only speeds up the processing time but also reduces the likelihood of errors associated with manual input.

Enhancing workflow efficiency

Automation is the cornerstone of enhanced workflow efficiency. From routing invoices for approval to facilitating seamless payment disbursement, software solutions ensure a streamlined and error-free workflow.

Instead of manually having to send an invoice for approval or cross-check with the relevant team’s manager, AP automation software directly routes the necessary invoice to the correct individual for verification and approval once an employee initiates an invoice payment process.

Scalability and growth

As businesses expand, so do their financial operations. Accounts payable software is designed to accommodate growth by handling larger volumes of invoices, payments, and vendor interactions without compromising efficiency.

This isn’t always possible if you only rely on humans. Even if you do, the chances of errors occurring are quite high and there will be a lot of time and money wasted in rectifying the mistakes.

Accuracy and compliance

Modern software tools incorporate validation checks and rule-based workflows that ensure accuracy and compliance with regulatory standards. Features like invoice matching help cross-check the information on an invoice with relevant documents such as purchase orders or delivery receipts.

This process verifies invoice legitimacy and prevents fraud or duplicates. This significantly reduces the risk of errors and non-compliance issues.

Cost savings and financial visibility

By automating routine tasks, accounts payable software effectively frees up valuable human resources and enhances overall productivity. An accountant or an employee who is part of the finance team no longer has to sit and manually enter invoice details to make payments.

They also don’t need to manually reach out to managers for verification and authorization as there are approval workflows that can be set in place.

Additionally, the software's ability to identify early payment discounts and avoid late fees contributes to tangible cost savings.

Vendor management and communication

Even small companies nowadays tend to deal with multiple vendors or suppliers. It can be tough to manage all communication and confidential information between both parties. Effective vendor management entails timely communication along with clearly defined payment terms.

Many accounts payable software solutions integrate a vendor management system that enables businesses to manage suppliers, promoting transparency and collaboration.

This ensures payments are made on time and that vendor relationships are upheld for better business performance.

System integrations

The synergy of software systems is pivotal for comprehensive financial management. Accounts payable software often integrates seamlessly with other tools such as ERP systems, enabling a holistic view of financial operations.

Integration with accounting tools is also important as all transactions should be noted in the company ledger. An integration between your AP automation software and your company’s accounting tool will help in uniformity by seamlessly exporting and syncing data between both platforms.

Data analytics and reporting

Data holds immense power in decision-making. Accounts payable software provides insightful analytics and reporting functionalities that allow businesses to gain deeper insights into spending patterns, cash flow trends, and vendor relationships.

The best part is that companies can filter the data to create custom reports as per their needs and understand how their accounts payable function is performing. You can generate reports for specific vendors, during a specific period and compare them with others.

Discover the best accounts payable software today!

How to choose the right accounts payable software for your business?

Selecting the most suitable accounts payable software for your business is a critical decision that requires careful consideration. With a plethora of options available, it's essential to evaluate your specific requirements and align them with the capabilities of the software. Here are key factors to contemplate:

1. Assess your needs

Begin by identifying your business's unique requirements. Consider factors such as the volume of invoices, the complexity of payment workflows, and the integration needs with existing systems.

Depending on these needs you may want or not want a particular software as all the different providers may not have all the features you need.

2. Scalability

Choose a software solution that can grow alongside your business. Scalability ensures that the software remains effective even as your accounts payable operations expand.

A dynamic platform that can be updated and can tweak processes as you use it over time is necessary for any business.

3. Integration capabilities

Seamless integration with other tools, such as ERP systems and accounting software, is essential for a cohesive financial ecosystem. Verify the software's compatibility and ease of integration with other tools that you are already using within the organization.

4. User-friendliness

A user-friendly interface enhances efficiency and reduces the learning curve for your team.

The best AP automation software will be so user-friendly that it will hardly take any time for your employees to get used to the new system. Intuitive software fosters quicker adoption and smoother operations.

5. Cloud-based vs. on-premises

Decide whether a cloud-based solution or an on-premises deployment suits your business better.

Cloud-based options offer flexibility and remote accessibility, while on-premises solutions provide greater control. Most modern companies choose to go with a cloud-based solution as it is extremely convenient to access and operate from any compatible system.

6. Security and compliance

Security is paramount when dealing with financial data. Ensure the software adheres to stringent security measures and compliance standards to safeguard sensitive information.

You should look for standardized certification for information security and also look into all the security and safety features the platform offers to safeguard your monetary transactions.

7. Customer support

Reliable customer support is invaluable. Assess the software provider's support offerings, response times, and availability to address any technical or operational issues.

A quick and responsive customer support system or team will help you save a lot of time instead of trying to troubleshoot any issues yourself.

8. Pricing and budget

Understand the software's pricing structure and how it aligns with your budget. Factor in not just the initial costs but also ongoing expenses and potential cost savings.

Doing this will give you the most accurate picture of how it affects your finances rather than just looking at the software’s pricing plan.

Explore our blog best budgeting software for businesses to optimize your business's pricing structure and effectively manage budgets.

9. Customization

No two businesses are identical. Opt for a software solution that can be tailored to suit your unique processes and requirements.

You may want to set up stringent approval processes for invoice payments. Check if that feature is available and gauge whether it meets your needs or not.

10. Future updates and innovation

The technology landscape evolves rapidly. Choose a software provider known for consistent updates, innovation, and adaptability to stay ahead of industry trends.

One way to figure this out is to check how long a provider has been in the market or how new the provider is in the market compared to others.

11. ROI and efficiency

Evaluate the potential return on investment (ROI) the software offers. You can do this by figuring out how it will help you save time and money through faster processes and better systems.

Look beyond the immediate benefits to gauge how it will enhance efficiency, reduce costs, and contribute to long-term growth.

How to implement accounts payable software for your business?

1. Define goals and objectives

Identify the specific goals and objectives you intend to achieve through the implementation of the software.

It can be to decrease the time taken to complete AP processes, save money through more economical payment methods, or both. This clarity will guide your decisions and measure success.

2. Assess current accounts payable processes

Thoroughly assess your current accounts payable processes. Understand pain points, bottlenecks, and areas for improvement that the software can address.

This may include things like missed payments, slow approval processes, and a need for better verification and authorization of payments.

3. Choosing the right software

Select a software solution that aligns with your needs and objectives, as determined in the previous steps. Consider factors such as features, scalability, and integration capabilities.

Going for the lowest-priced solution may not always be ideal as it may not have all the features that you need to solve problems your company faces.

4. Plan the implementation

Develop a comprehensive implementation plan that outlines timelines, responsibilities, and key milestones. This plan serves as a roadmap for the entire process.

Implementing the software solution gradually helps employees adjust without it feeling like an overwhelming change.

5. Data migration

Ensure a smooth transition of data from your existing systems to the new software.

While shifting to a new system, you should ensure that all previous data is not lost in a hurry to implement the new system. Accurate data migration is critical for maintaining continuity and avoiding occurrence of errors.

6. Configure the software

Tailor the software settings to match your business's processes. Customize fields, workflows, and approval hierarchies to mirror your established procedures.

Doing this will help you and your employees quickly adapt to the new system and start using it efficiently.

7. Test and train

Thoroughly test the software in a controlled environment before rolling it out company-wide.

Additionally, provide training to your team to ensure they are well-versed in using the software. Train employees to use the platform effectively for their needs.

8. Implement workflows

Integrate the software into your accounts payable workflows. Ensure that processes are well-defined, roles are assigned, and everyone understands their responsibilities.

Set up the custom approval workflows and make sure to set multilevel approvers for payments of various volumes if needed.

9. System integrations

If applicable, integrate the accounts payable software with other tools like ERP systems or accounting software. This integration ensures data consistency across your financial ecosystem.

Don't hesitate to take the customer support team’s help if you get stuck anywhere in the integration process.

10. Monitor and track regularly

After implementation, closely monitor the software's performance and impact on your operations. Regular tracking allows you to identify any issues that the system might have and make necessary adjustments.

Keep periodic checks every two weeks to a month to measure how the system is impacting all operations.

11. Make continuous improvement

The implementation process is not static; it's an ongoing endeavor. Continuously gather feedback from users, assess the software's effectiveness, and make necessary improvements based on collected output.

The periodic checks will help you notice any problems quickly and solve them by making the necessary changes.

Use Volopay - the all-in-one software for your business AP management

Volopay is a complete expense management software solution for businesses that also has a specific module to handle all of your accounts payable needs. These are some of the core aspects of Volopay’s platform that will help an organization make its AP processes and system efficient:

Vendor management database

Volopay lets you create a database of vendors with all their crucial vendor payment information in one place within the platform so that you don’t have to enter their details every time you need to process their invoices. This, in turn, saves time and effort.

Domestic and international payments

Volopay is an accounts payable software in Australia that lets businesses make payments internationally and domestically to vendors and suppliers. This helps in ensuring that all payments are centralized and easily trackable rather than being scattered in different places.

Expense management

Due to Volopay's accounting automation feature, all transactions are automatically recorded in a ledger that you can access at any time. This makes tracking and controlling expenses much easier.

Accounting integration

Lastly, you can easily sync Volopay with any accounting tool that you use so that you can easily export and sync data between the two platforms, ensuring less interruptions and seamless data transfer.

Automate payables effortlessly with Volopay

FAQs

Yes, accounts payable can be effectively automated using dedicated software. Automation streamlines invoice processing, payment approvals, and reporting, improving efficiency and reducing errors.

AP platforms are software solutions designed to manage accounts payable processes. They automate tasks like invoice processing, payment scheduling, and reporting, enhancing efficiency and accuracy.

The two types of payments in accounts payable are electronic payments (e.g., bank transfers, ACH) and physical checks. Electronic payments are preferred for their speed and security.

The four main functions of accounts payable are invoice processing, payment disbursement, vendor management, and financial reporting.

Volopay offers a comprehensive platform that automates accounts payable tasks. It digitizes and manages invoices, facilitates seamless approvals, ensures timely payments, and provides insightful analytics for better decision-making.

Businesses choose Volopay for its advanced automation capabilities, user-friendly interface, integration with accounting systems, robust security measures, and exceptional customer support. It simplifies accounts payable processes, promoting efficiency and growth.