How to choose the best virtual card provider for your business?

Virtual cards are digital payment tools that businesses can use to pay for a variety of business expenses while keeping their original physical company card safe and secured. This digital payment tool is ideal for controlling and managing your company's spending.

However, with so many options available in the market, choosing virtual card provider in Australia that meets your business needs and requirements can be a difficult task.

Before diving into how to choose the best virtual card provider for your business, it’s essential to understand what a virtual prepaid card is. Check out our article on "what is a virtual prepaid card" for a comprehensive overview.

Importance of virtual cards for businesses

1. Keep track of expenses

Virtual cards are excellent tools that businesses can use to track and manage their spending. By assigning individual virtual cards to each project or department you can get detailed information about how money is being spent in your organization.

These cards are typically attached to an expense management platform that lets you track card spending behavior in real-time.

2. Avoid overspending

Virtual cards can only be loaded with a certain amount of money. Once this money has been spent the card will typically expire. This means that these cards can only be used to spend the amount of money that has been predetermined.

Given that there will be excess funds available in the card the question of overspending won’t even come up.

3. Easy to use for business-related purchases

Virtual cards are extremely easy to use plus you don’t have to worry about carrying around a physical card. You can use these cards to make business-related purchases online as well as in-store.

Factors to consider when choosing a virtual card provider

Security and fraud prevention measures

Security and fraud prevention measures should be right up there with the most important factors to consider when choosing virtual card provider in Australia.

One of the main reasons why businesses choose to use virtual cards for payments is to protect their original credit card details.

However, if your virtual card is not secure enough then it is not a good option.

Card features and customization options

Many can be considered to be the best virtual card providers in Australia. However, not all of their offerings will have the same card feature and options for customization.

Make sure the virtual card provider you choose has the right set of features to help your company. These cards must also be easily customizable to fit business needs and requirements.

Integration with accounting and expense management software

Virtual cards are good payment tools but they become great payment tools when they are integrated and synchronized with accounting and expense management software.

By syncing with your existing software with virtual card use you can take a lot of manual labor out of your accounting processes.

Customer support and user experience

Problems can come up at any moment during the entire time your company spends using virtual cards.

Adequate customer support and a seamless user experience are both important factors to consider when choosing a virtual card for your business.

You need to choose a provider that not only provides hands-on support but also enables a smooth user experience.

Fees and pricing models

Different virtual card providers will offer different packages and features at various price levels. Some may offer a lot of features at high costs while others may offer only the basic, most fundamental features at affordable prices.

You need to consider which of these options suits your business needs the best.

Tips for choosing the best virtual card provider for your business

1. Identify your business needs and goals

Before you can go about the whole process of how to choose virtual cards for your business you need to first identify the business needs and google what you intend to satisfy with the help of these cards.

Ideally, you should conduct a company-wide card requirement test to know exactly what the cards will be used for and why you need them in the first place.

This will not only help you choose the right card provider but will also ensure you use the cards to their fullest potential.

2. Conduct thorough research and comparison of providers

Given how popular virtual cards have become there is no wonder that there are so many virtual card providers in the market today.

To ensure you make the right choice out of all the options available you need to conduct thorough research and comparison of several providers.

This will give you a good idea of the various offerings so that you can choose the best out of the lot for your business.

3. Consider user reviews and feedback

A great resource you can use to help inform how you go about choosing virtual card provider in Australia are the reviews and feedback given by previous or present users.

The reviews and feedback given by current or past users will give you unbiased information on how it is to work with the virtual card provider in question.

The best way to do this is to use online or offline reviews of these card providers.

4. Look for providers with flexible and scalable solutions

As your company will continue to grow so will its business requirements. You need to choose a virtual card that can keep up pace with how your business grows and scales up.

You should ideally look for virtual card providers who provide an offering that is both flexible in use and at the same time can be scaled up to fit your growing business requirements.

5. Negotiate with providers for customized solutions and better pricing

Once you have decided on a virtual card provider that fits your business needs and requirements you should consider negotiating with them to get better pricing and customized solutions.

This can not only help you save money in the long run but also ensure your virtual cards can be tailored to your business’s particular needs and requirements.

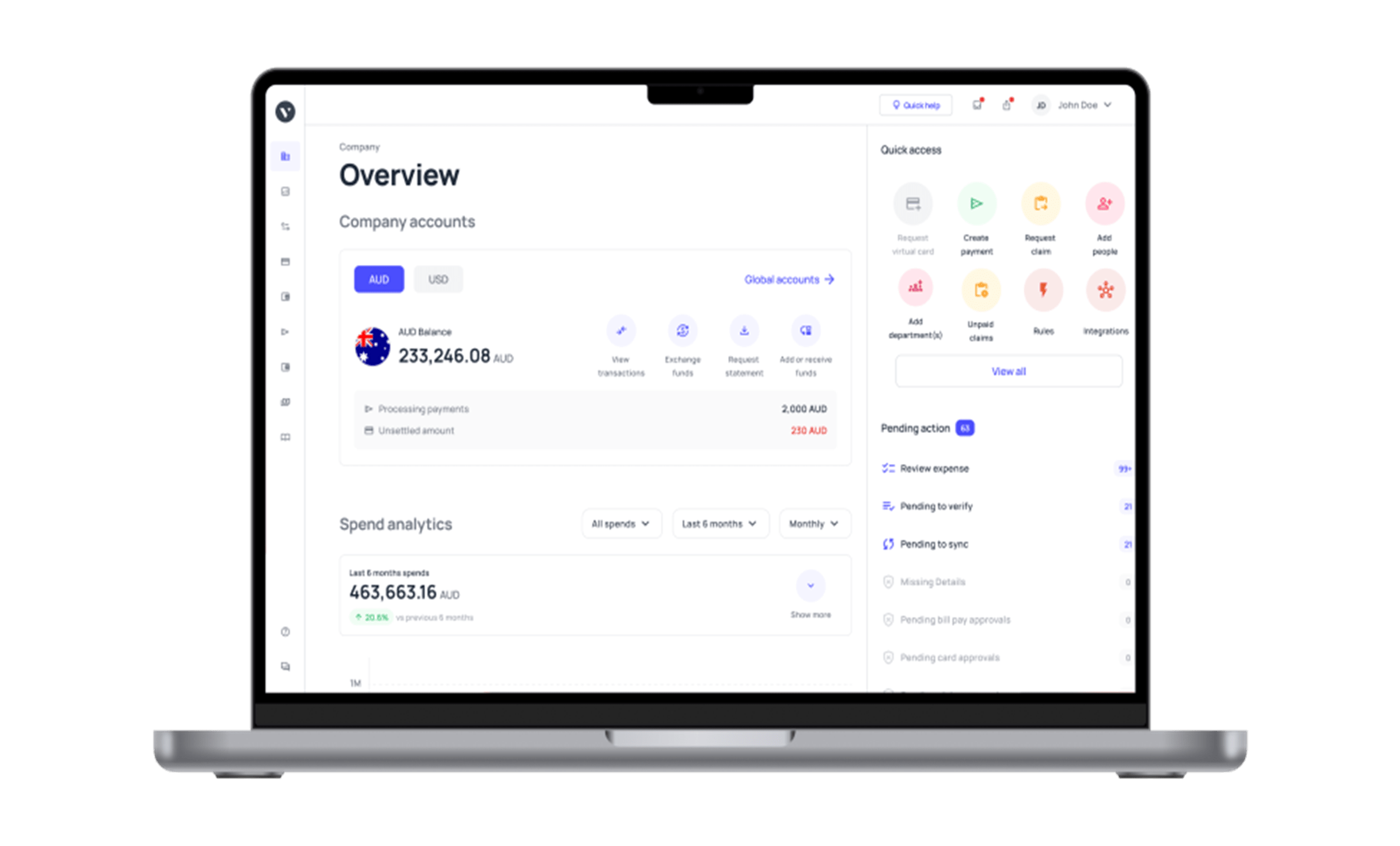

Why should you choose Volopay virtual cards for your business?

Security

Volopay virtual cards are protected by multiple layers of bank-grade security.

Additionally, you also get access to highly customizable internal card controls that you can use to manage how your virtual cards are being used strictly.

Credit limit

With Volopay virtual cards you can also avail of a highly flexible, easy-to-pay-back credit line.

Applying for and getting this credit line is extremely straightforward and you get to pay it back on a flexible timeline.

Multi-currency wallets

Volopay virtual cards also come attached with multiple multi-currency wallets. You can use these wallets to both holds and pay with multiple different currencies.

Automation of payments

With Volopay’s cards you can set up automated payments for repeat vendors, subscription payments, and other recurring purchases.

No hidden fees

There are no hidden fees charged by Volopay whatsoever.

You can issue an unlimited number of virtual cards at no added cost at all.

Track expenses

Volopay’s virtual cards come connected with a highly advanced expense tracking and management system.

This system enables you to track each transaction made by these cards, in real-time.