6 best business prepaid cards to consider in Australia in 2026

The best business prepaid cards for independent ventures have reasonable charges and easy ways of reloading your balance. When choosing business prepaid cards, you must consider your spending habits and the number of cards you'll need for your employees.

Businesses should select the one that gives access to an online and versatile dashboard and allows them to control their company costs and employee cards.

What is a business prepaid card?

In contrast to regular business debit cards, which pull funds for payments directly from a linked business checking account, a business prepaid card requires you to preload money onto the card before you can use it.

Banks, credit card companies, and other financial service providers all offer prepaid business debit cards. Most of the time, these cards don't check your credit, come with digital tools for managing your finances, and they usually have low fees.

How does a business prepaid card work in Australia?

A business prepaid card functions as a preloaded payment solution for your company's expenses. You load funds onto the card in advance, then use it for business purchases, employee expenses, or vendor payments.

Unlike credit cards, you can only spend the amount you've preloaded, providing better budget control and eliminating the risk of overspending. Prepaid cards for business offer enhanced expense tracking through detailed transaction reports, making bookkeeping simpler.

You can distribute multiple cards to employees with preset spending limits, ensuring controlled access to company funds. The cards are widely accepted at merchants and ATMs across Australia, providing convenient payment flexibility while maintaining strict financial oversight for your business operations.

Best business prepaid card providers in Australia: A quick overview

Best prepaid cards in Australia for businesses

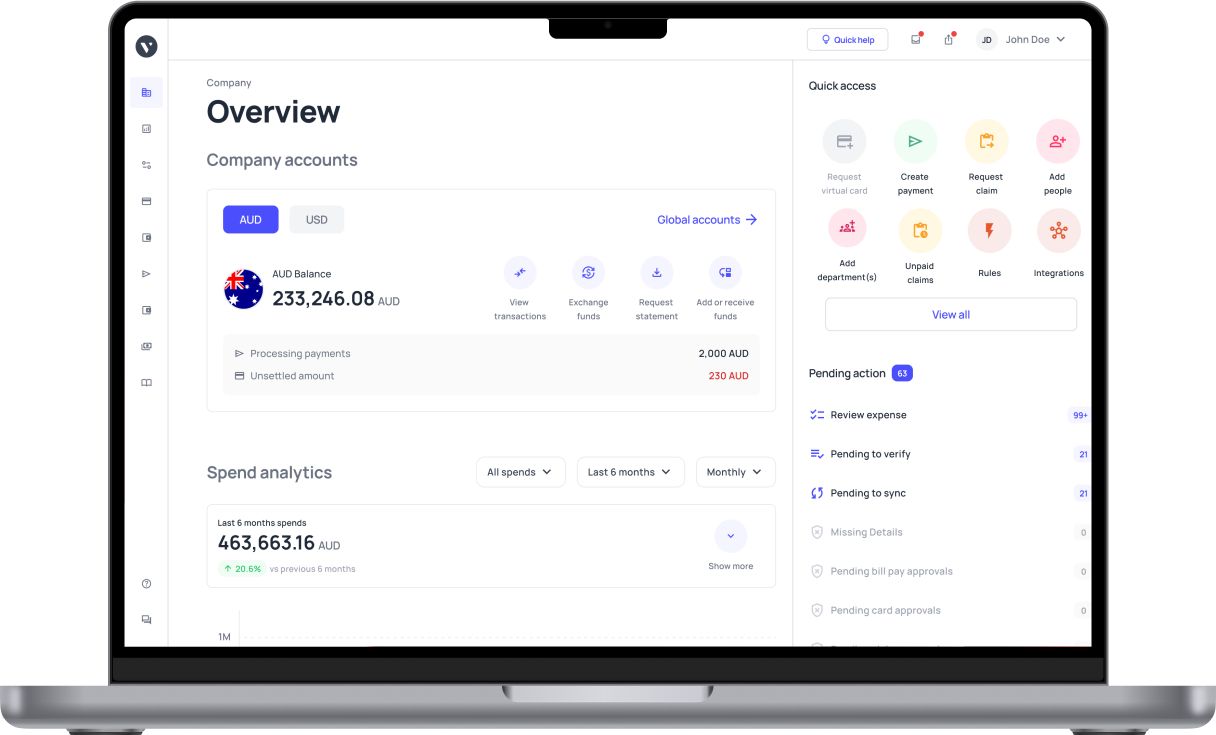

1. Volopay prepaid cards

● Overview

Get business prepaid cards through your Volopay account in just a few clicks. Make spending and managing expenses easy by assigning employees cards that are easily adjustable and can be topped up from anywhere.

● Features and benefits

Every Volopay card can be topped up accordingly before it is assigned to an employee. The cardholder won’t be able to spend more than the assigned amount, allowing you to have better control over your expenses.

All transactions are automatically recorded and can be directly synced with your accounting platform.

● Limitations

Volopay does not have a physical branch in Australia, meaning that you have to manage all your cards and expenses online. This requires you to have all the necessary devices and employee training to do it effectively.

● How to apply

Applying for a Volopay prepaid card is done fully online—no visiting necessary. You’ll need to fill out all the required details and attach supporting documents.

Get in touch with a Volopay representative to get more information and allow them to assist you with the process.

2. Weel corporate card

● Overview

Weel offers reloadable virtual Mastercards to manage business expenses. Day-to-day operational and employee expenses, for example, can be controlled with Weel’s virtual cards and dashboard.

● Features and benefits

Easily generate virtual cards from your Weel app. With your Apple or Android phone, they can be used to make in-store payments through Apple Pay or Google Pay. Virtual cards can be set for one-time payments or recurring usage.

● Limitations

The bigger your company is, the more expensive Weel gets for you because of its user add-on payment scheme.

You’ll have to pay close attention to how many users you’re adding to the platform to keep costs manageable. You also don’t get physical cards to assign to all employees.

● How to apply

Considering that a Weel corporate card is geared toward businesses, you will need to prove that you have a business and intend to use the card for business purposes.

For this reason, an ABN is required to open a Weel account, along with personal identity details. You can sign up online to get started.

3. Wise prepaid card

● Overview

The Wise card is an international debit card connected to your Wise multi-currency account to spend in more than 40 currencies in 170+ countries. It provides real-time currency conversion at mid-market exchange rates, making transactions cost-effective without hidden fees. Control your money easily with the Wise app.

● Features and benefits

Wise prepaid cards allow spending in more than 40 currencies abroad. Get mid-market exchange rates with no markups, low commissions, and free ATM withdrawals up to a certain limit. Get instant access to a digital card, activate spending limits, freeze/unfreeze your card, and get real-time notifications.

● Limitations

Wise only offers two free ATM withdrawals per month, after which there are fees. Funds in the account do not earn interest. The card is not provided in all countries, so check eligibility. As a prepaid card, it will not help build a credit history.

● How to apply

Sign up online or through an app for a free Wise account. Identify documents as per the requirements. Buy a digital or physical card upon identification. You can seamlessly deposit funds in your currency of choice. Activate the physical card upon receipt; digital cards are ready instantly.

4. Mastercard business debit card

● Overview

As one of the biggest card networks, you can ensure you have flexibility, convenience, and security by using a Mastercard business debit card for your payments. Debit Mastercards are accepted worldwide by a majority of merchants, making it easy for you to do business in Australia and overseas.

● Features and benefits

Mastercard allows you to manage your business cash flow and expenses better. With the Zero Liability program, you can also ensure that your funds are protected.

● Limitations

As a card network, you’ll have to find a Mastercard provider to be able to apply for a card for your business. This means that you’ll have to do thorough research to get the best card. Some features may not be available with some providers.

● How to apply

Get a Mastercard business debit through one of the Mastercard providers or issuers in Australia. Some providers include Citibank, Coles Mastercard, NAB, Westpac, Bendigo Bank, Qantas Money, and more.

5. Westpac business prepaid card

● Overview

Westpac customers in Australia can apply for business debit cards with the bank. There is also an option to get business prepaid cards with the New Zealand branch for businesses that also operate in New Zealand.

● Features and benefits

With a debit Mastercard, you won’t have trouble getting a wide range of merchants to accept your card. 24/7 transaction monitoring ensures that suspicious transactions get flagged and are investigated as soon as possible.

● Limitations

While business debit cards are impressive tools that can help you manage your business finances, you have to directly link them with a bank account, unlike a prepaid card.

● How to apply

If you’re not already a Westpac business bank account customer, you can start your application online as long as you are over 18 years old and have a business operating in Australia. In some cases, however, if you have a registered company with multiple directors, you may have to apply at a bank branch.

6. Airwallex corporate cards

● Overview

Airwallex offers Visa cards that can be used worldwide to manage your business expenses. You can adjust their spending limits accordingly through your Airwallex account.

● Features and benefits

An Airwallex corporate card allows you to spend in multiple currencies with ease. You can also control your Airwallex cards through an app to set spend controls, adjust limits, and freeze cards as needed.

Direct sync with Xero is available to streamline your accounting processes.

● Limitations

Airwallex doesn’t have a physical presence in Australia, meaning that managing your cards must all be done fully online. If the ability is important to you, keep in mind that you also can’t withdraw money with your Airwallex corporate cards.

● How to apply

Make sure that you are applying for Airwallex corporate cards for business purposes rather than personal ones. The application can be completed online and will require you to provide your company’s details as well as your own details.

Benefits of prepaid cards for businesses in Australia

Discover the benefits of prepaid cards for businesses in Australia, from streamlined expense management and better budget control to enhanced security, making financial operations simpler and more efficient for companies of all sizes.

Streamlined expense management

Eliminate traditional expense claim processes by providing employees direct access to company funds. Prepaid cards automate expense tracking, reduce paperwork, and minimize administrative overhead.

Your finance team spends less time processing receipts and reimbursements, while employees enjoy immediate access to business funds for legitimate purchases.

Control over employee spending

Set precise spending limits for each cardholder, preventing unauthorized purchases and budget overruns. Individual transaction limits, merchant category restrictions, and daily spending caps ensure employees only access approved amounts.

This granular control protects your company from excessive spending while maintaining operational flexibility for necessary business expenses.

Real-time transaction tracking

Receive instant notifications for every transaction, enabling immediate oversight of company spending. Real-time visibility helps you identify unusual spending patterns, track budget utilization, and make informed financial decisions quickly.

This transparency eliminates surprises during month-end reconciliation and provides continuous insight into your business's financial activities throughout each reporting period.

Reduced fraud risk

Minimize fraud exposure through enhanced security features, including PIN protection, transaction alerts, and instant card blocking capabilities. Unlike traditional corporate credit cards, prepaid cards limit potential losses to loaded amounts only.

Immediate spending notifications allow quick response to suspicious activities, protecting your business from unauthorized transactions and financial theft.

Easy budget allocation

Allocate specific budgets to different departments, projects, or employees by loading predetermined amounts onto individual cards. Best business prepaid card providers offer flexible loading options, enabling precise financial planning and preventing budget overages.

This approach simplifies budget management while ensuring each business unit operates within approved spending parameters for optimal financial control.

Simplified reconciliation and reporting

Access detailed transaction reports automatically categorized by merchant, date, and cardholder. Integration with accounting software eliminates manual data entry and reduces reconciliation time significantly.

Comprehensive spending analytics provide valuable insights into business expenses, helping you identify cost-saving opportunities and optimize your company's financial management processes efficiently.

Flexible multi-currency payments

Conduct international business transactions without traditional foreign exchange hassles. Multi-currency prepaid cards offer competitive exchange rates and eliminate overseas transaction fees typically associated with corporate credit cards.

This flexibility supports global operations, supplier payments, and employee travel expenses while providing transparent currency conversion rates for accurate financial planning.

Instant card issuance for teams

You provide new employees with immediate access to business funds through instant digital card creation. Physical cards typically arrive within days, while virtual cards activate immediately for online purchases.

This rapid deployment ensures business continuity, eliminates delays in employee onboarding, and maintains operational efficiency when expanding your team or replacing lost cards.

Common types of prepaid cards used by Australian businesses

1. Employee expense cards

Provide individual employees with dedicated cards for routine business expenses like office supplies, client meals, and professional services. These cards eliminate petty cash systems and streamline expense reporting.

Each employee receives predetermined spending limits aligned with their role requirements, ensuring controlled access to company funds while maintaining operational efficiency.

2. Travel and fuel cards

Equip traveling employees and company vehicles with specialized cards for transportation costs, accommodation, and fuel purchases. These cards often include merchant category restrictions, limiting usage to travel-related expenses only.

This targeted approach ensures business travel budgets remain controlled while providing employees with convenient access to necessary travel funds.

3. Gift and reward cards

Distribute prepaid cards as employee incentives, client gifts, or promotional rewards. These cards enhance your company's recognition programs and customer loyalty initiatives.

Unlike cash bonuses, gift cards can include spending restrictions and expiration dates, providing controlled value distribution while maintaining professional presentation for corporate gifting and employee motivation programs.

4. Project or department cards

Allocate specific budgets to individual projects or departments through dedicated prepaid cards. This approach enables precise financial tracking for distinct business initiatives, ensuring project managers stay within approved budgets.

Each card reflects allocated funds for particular objectives, simplifying cost accounting and providing clear financial boundaries for departmental spending activities.

5. Multi-currency cards

Conduct international business transactions efficiently using cards that support multiple currencies. Best business prepaid cards offer competitive foreign exchange rates and eliminate traditional overseas transaction fees.

These cards are essential for companies with global operations, international suppliers, or frequent overseas travel requirements, providing seamless cross-border payment capabilities.

6. Payroll cards

Distribute employee wages through prepaid payroll cards, which is particularly beneficial for casual workers or those without traditional banking relationships.

This payment method reduces payroll processing costs, eliminates check printing, and provides employees with immediate access to earned wages. Payroll cards offer a convenient alternative to direct bank deposits while maintaining secure payment distribution.

Alternatives to business prepaid cards in Australia

Corporate credit cards

Access extended credit facilities through traditional corporate credit cards, enabling larger purchases and flexible repayment terms.

These cards offer rewards programs, travel insurance, and higher spending limits than prepaid alternatives.

However, you face potential debt accumulation and require strong creditworthiness for approval, making financial control more challenging than prepaid solutions.

Virtual business cards

Generate digital-only payment cards for online transactions and vendor payments without physical card requirements.

Virtual cards provide enhanced security through single-use or limited-time functionality, reducing fraud risk for digital purchases.

These solutions integrate seamlessly with expense management systems while offering instant card creation and automatic transaction categorization capabilities.

Expense management cards

You combine payment functionality with comprehensive expense tracking through integrated expense management platforms.

These cards automatically capture transaction data, receipt images, and spending categories, streamlining your accounting processes.

Advanced features include policy enforcement, approval workflows, and real-time budget monitoring, providing superior expense oversight compared to traditional payment methods.

Business debit cards

You link directly to your business bank account through debit cards, enabling immediate fund access without credit facilities.

Unlike Best prepaid business cards, debit cards draw from existing account balances rather than preloaded amounts.

This approach provides familiar banking integration while maintaining spending control through available account funds and established banking relationships.

Purchasing cards

Streamline procurement processes through specialized purchasing cards designed for supplier payments and bulk purchases.

These cards often include enhanced reporting features, supplier integration capabilities, and automated purchase order matching.

Purchasing cards reduce administrative overhead in vendor management while providing detailed transaction tracking for procurement accountability and supplier relationship management.

Key considerations while choosing a business prepaid card

Card fees and hidden charges

You must evaluate all associated costs, including monthly maintenance fees, transaction charges, ATM withdrawal fees, and foreign exchange margins. Compare setup costs, replacement card fees, and inactivity charges across providers.

Transparent fee structures prevent unexpected expenses and ensure your chosen solution remains cost-effective for your business's specific usage patterns and transaction volumes.

Reload and withdrawal options

You need convenient funding methods, including bank transfers, direct deposits, and automated top-ups, to maintain card functionality. Consider withdrawal options through ATM networks and cash-back facilities at merchants.

Flexible reload scheduling and multiple funding sources ensure continuous card availability while supporting your business's cash flow requirements and operational preferences.

Spending limits and flexibility

Require customizable spending controls, including daily, weekly, and monthly limits tailored to employee roles and business needs. Evaluate merchant category restrictions, transaction size limits, and the ability to adjust parameters quickly.

Flexible spending controls protect against unauthorized usage while accommodating legitimate business expenses and varying operational requirements across different departments.

Network and merchant acceptance

You need widespread acceptance across Australian and international merchants through major payment networks. Consider online payment compatibility, contactless payment options, and ATM access availability.

Broad merchant acceptance ensures your cards function reliably for all business transactions, from local suppliers to international vendors and employee travel expenses.

Integration with accounting tools

You benefit from seamless connectivity with popular accounting software like Xero, QuickBooks, or MYOB for automated transaction categorization and reconciliation.

Prepaid cards for business should offer real-time data synchronization, customizable reporting features, and API integrations. This connectivity reduces manual bookkeeping tasks and ensures accurate financial record-keeping for your business operations.

Security and fraud protection features

Require robust security measures, including EMV chip technology, PIN protection, transaction alerts, and instant card blocking capabilities. Evaluate fraud monitoring systems, liability protection policies, and dispute resolution procedures.

Advanced security features protect your business funds while providing peace of mind for card usage across different locations and transaction types.

Customer support and dispute resolution

You need accessible customer service through multiple channels, including phone, email, and live chat, during extended business hours. Evaluate response times, dispute resolution procedures, and dedicated business support teams.

Reliable customer support ensures quick issue resolution, minimizes business disruption, and provides assistance when cards require replacement or account adjustments.

Scalability for growing teams

You require solutions that accommodate business growth through unlimited card issuance, bulk management features, and tiered access controls.

Consider user management capabilities, administrative controls, and pricing structures that support team expansion. Scalable platforms ensure your prepaid card solution grows with your business without requiring system changes or service disruptions.

Eligibility criteria for business prepaid cards in Australia

Valid Australian Business Registration (ABN/ACN)

You must possess current Australian Business Number (ABN) or Australian Company Number (ACN) documentation to establish business legitimacy. Providers verify registration status through government databases during application processes.

Valid business registration demonstrates legal operating status and enables compliance with Australian financial regulations, forming the foundation for business banking relationships and prepaid card eligibility.

Minimum operating tenure requirements

You typically need demonstrated business operations for at least three to six months before qualifying for business prepaid cards. Some providers require twelve months of trading history for enhanced features or higher limits.

Operating tenure requirements help providers assess business stability and reduce risk associated with newly established businesses seeking payment solutions.

Proof of business identity and ownership

You must provide comprehensive documentation, including company constitutions, partnership agreements, or sole trader declarations, to verify business ownership structure.

Directors' identification, shareholding certificates, and authorized signatory details establish legal authority for account management. Identity verification ensures compliance with anti-money laundering regulations and confirms legitimate business ownership before card issuance approval.

Director or owner credit standing

You may undergo a credit assessment of business directors or owners, particularly for enhanced features or higher spending limits. While less stringent than traditional credit applications, providers evaluate credit history to assess financial responsibility.

Strong personal credit standing can influence approval decisions and available card features, though prepaid solutions generally require minimal credit checks.

Minimum turnover or revenue criteria

You might need to demonstrate a minimum annual turnover ranging from $50,000 to $100,000, depending on the provider and card features desired. Revenue requirements help providers assess business viability and appropriate service levels.

Best business prepaid card providers often adjust eligibility criteria based on business size, industry sector, and requested card functionality for risk management purposes.

GST registration (if applicable)

You must provide GST registration details if your business turnover exceeds the mandatory registration threshold of $75,000 annually. GST-registered businesses access enhanced reporting features and tax-compliant transaction categorization.

This registration demonstrates compliance with Australian tax obligations and enables providers to offer appropriate business-grade services aligned with regulatory requirements.

Compliance with Australian financial regulations

You must meet Anti-Money Laundering and Counter-Terrorism Financing Act requirements through comprehensive due diligence processes, including beneficial ownership disclosure and source of funds verification.

Compliance ensures your business adheres to Australian financial regulations, enabling legitimate payment processing while preventing illegal activities. Regulatory compliance forms the basis for ongoing business banking relationships.

Documents required to apply for a business prepaid card in Australia

1. Business registration (ABN/ACN)

You must provide current Australian Business Number (ABN) or Australian Company Number (ACN) certificates as primary business identification. These documents verify your business's legal registration status with Australian authorities.

Providers cross-reference registration details through government databases to confirm business legitimacy and ensure compliance with regulatory requirements for prepaid card issuance.

2. Company setup documents

You need to submit foundational business documents, including company constitutions, partnership agreements, or sole trader declarations, depending on your business structure.

Trust deeds, shareholder agreements, and memorandums of association may be required for complex structures. These documents establish ownership structure, operational authority, and legal framework governing your business operations and decision-making processes.

3. Director/owner ID proof

Provide government-issued identification for all directors, partners, or business owners, including driver's licenses, passports, or identity cards. Additional verification may include utility bills or bank statements confirming residential addresses.

Identity verification ensures compliance with Know Your Customer requirements while establishing authorized personnel for account management and card administration responsibilities.

4. Proof of business address

You need current business address verification through commercial leases, property ownership documents, or utility bills addressed to your business premises.

Providers of the best prepaid business cards require confirmed business locations for risk assessment and regulatory compliance. Address verification establishes your business's physical presence and supports anti-money laundering obligations required under Australian financial regulations.

5. Financial statements or bank records

You should provide recent financial statements, profit and loss reports, or bank statements demonstrating business financial activity and stability. These documents help providers assess business viability, transaction patterns, and appropriate card limits.

Financial records support risk evaluation while demonstrating legitimate business operations and revenue generation for prepaid card application approval.

6. GST/tax registration

You must submit GST registration certificates if your business turnover exceeds mandatory registration thresholds, along with recent tax returns or business activity statements.

Tax compliance documentation demonstrates regulatory adherence and supports enhanced card features. GST registration enables appropriate transaction categorization and reporting capabilities for business expense management and tax compliance requirements.

7. Employee or payroll records

You may need to provide employee lists, payroll records, or organizational charts when requesting multiple cards for staff members. These documents establish legitimate business operations and justify card quantity requests.

Employee documentation supports risk assessment while ensuring appropriate card distribution aligned with genuine business needs and operational requirements across your organization.

8. Additional provider-specific documents

You might require supplementary documentation, including industry licenses, professional certifications, or regulatory permits, depending on your business sector and chosen provider requirements.

Some providers request references, banking relationships, history, or detailed business plans. Provider-specific requirements ensure comprehensive risk assessment while supporting specialized business needs and regulatory compliance across different industries.

Regulatory and compliance aspects for prepaid cards in Australia

AML and KYC verification standards

You must comply with the Anti-Money Laundering and Counter-Terrorism Financing Act requirements through comprehensive Know Your Customer procedures. Providers verify business identity, beneficial ownership, and source of funds during application processes.

These standards prevent financial crimes while ensuring legitimate business operations have access to prepaid card services within Australia's regulated financial framework.

AUSTRAC reporting obligations

Participate in Australia's financial intelligence system through automatic transaction reporting for amounts exceeding $10,000. Providers submit suspicious matter reports and threshold transaction reports to AUSTRAC on your behalf.

These obligations ensure transparency in financial transactions while supporting national security and law enforcement investigations without compromising legitimate business operations.

Consumer protection and fair use rules

The benefit from Australian Consumer Law protections, including fair contract terms, transparent fee disclosure, and dispute resolution rights. Providers must clearly communicate charges, terms, and conditions while offering reasonable complaint procedures.

These protections ensure equitable treatment and prevent unfair business practices in prepaid card service provision and ongoing account management.

Privacy Act and data security compliance

You receive protection under Australian Privacy Principles governing personal information collection, use, and disclosure by prepaid card providers. Strict data security measures safeguard your business and employee information from unauthorized access or breaches.

Compliance ensures confidential financial data remains protected while enabling necessary transaction processing and regulatory reporting requirements.

GST and tax record requirements

You must maintain accurate transaction records for GST reporting purposes, with providers offering detailed statements supporting tax compliance obligations. Prepaid card transactions require proper categorization and documentation for Australian Taxation Office requirements.

Comprehensive record-keeping ensures accurate GST calculations while supporting legitimate business expense claims during tax return preparation and audit processes.

Ongoing provider audits and monitoring

You benefit from continuous compliance monitoring through provider risk management systems that detect unusual transaction patterns and ensure regulatory adherence.

Regular audits verify ongoing compliance with Australian financial regulations while maintaining service quality standards. This monitoring protects both your business and the provider from regulatory breaches while ensuring continued access to services.

How to apply for a business prepaid card in Australia

Submit completed application

Begin by completing comprehensive online application forms detailing your business structure, intended card usage, and required features.

Applications typically request business registration details, director information, and expected transaction volumes.

Accurate completion expedites processing while ensuring providers can assess your business needs and recommend appropriate card solutions and spending limits.

Provide necessary details

Supply essential documentation, including ABN/ACN certificates, business registration proof, director identification, and financial statements.

Additional requirements may include bank statements, partnership agreements, or company constitutions, depending on your business structure.

Comprehensive documentation supports risk assessment processes while demonstrating legitimate business operations to prepaid card providers.

Complete KYC verification

Then you undergo Know Your Customer verification processes, including identity confirmation, address verification, and beneficial ownership disclosure.

Providers may conduct video calls, document authentication, and cross-reference checks against government databases.

Thorough KYC procedures ensure compliance with Australian regulations while protecting both parties from fraudulent activities and regulatory non-compliance issues.

Undergo provider risk assessment

Participate in comprehensive risk evaluation processes where providers assess your business model, transaction patterns, and compliance history.

Risk assessments determine appropriate spending limits, card features, and monitoring requirements based on your business profile.

This evaluation ensures suitable service provision while maintaining provider compliance with Australian financial regulations and risk management standards.

Receive approval and card issuance

Receive approval notification following successful application review and risk assessment completion.

Best business prepaid cards in Australia typically offer instant virtual card access with physical cards delivered within 3-5 business days.

Approval includes detailed terms, conditions, and fee schedules, enabling immediate card activation and business expense management capabilities upon receipt.

Activate and configure cards

Activate received cards through secure online portals or mobile applications, setting initial PINs and security preferences.

Configuration includes establishing spending limits, merchant restrictions, and transaction notifications according to your business requirements.

Proper activation ensures immediate card functionality while implementing appropriate security measures for business expense management and employee usage.

Assign to employees or teams

Distribute activated cards to designated employees or departments with specific usage guidelines and spending parameters.

Assignment processes include employee acknowledgment of card policies, spending responsibilities, and expense reporting requirements.

Clear assignment procedures ensure accountability while enabling efficient business expense management across different teams and organizational levels within your company.

Integrate with accounting tools

Connect prepaid card systems with existing accounting software through API integrations or automated data feeds.

Integration enables real-time transaction categorization, automatic reconciliation, and streamlined expense reporting processes.

Proper integration reduces manual bookkeeping tasks while ensuring accurate financial record-keeping and simplified month-end reconciliation procedures for your business operations.

Steps for effective prepaid card management for businesses

1. Assign cards to teams or individuals

Distribute cards strategically based on employee roles, responsibilities, and spending requirements. Consider department needs, travel frequency, and purchase authority levels when making assignments.

Clear assignment protocols ensure appropriate card distribution while maintaining accountability through designated cardholders who understand their spending responsibilities and expense reporting obligations within your organizational structure.

2. Set role-based spending limits

Establish customized spending limits reflecting individual job functions, seniority levels, and operational requirements. Senior executives receive higher limits than junior staff, while department-specific needs determine appropriate spending parameters.

Role-based limits prevent unauthorized purchases while ensuring employees have access to sufficient funds for legitimate business expenses aligned with their responsibilities and authority levels.

3. Enable multi-level approval flows

Implement approval workflows requiring manager authorization for expenses exceeding predetermined thresholds. Multi-level approvals ensure larger purchases receive appropriate oversight while maintaining operational efficiency for routine expenses.

Automated approval systems streamline processes while providing necessary controls for significant expenditures, protecting your business from unauthorized spending and ensuring proper expense authorization.

4. Monitor transactions in real time

Track all card activities through real-time notification systems and comprehensive dashboards displaying current spending patterns. Best business prepaid cards offer instant alerts for unusual transactions, spending limit approaches, and policy violations.

Continuous monitoring enables quick response to suspicious activities while providing immediate visibility into company-wide expense activities and spending trends.

5. Reconcile and audit regularly

Conduct systematic reconciliation processes comparing card statements with receipts, invoices, and expense reports. Regular audits identify discrepancies, ensure policy compliance, and verify expense legitimacy.

Consistent reconciliation practices maintain accurate financial records while detecting potential fraud or misuse, supporting proper accounting procedures and regulatory compliance requirements for your business operations.

6. Use dashboards for expense insights

Leverage comprehensive reporting dashboards to analyze spending patterns, identify cost-saving opportunities, and track budget performance across departments. Advanced analytics reveal expense trends, vendor spending concentration, and policy compliance rates.

Dashboard insights support informed decision-making while enabling proactive expense management and strategic planning for future business operations and budget allocation.

7. Review and adjust limits periodically

Evaluate spending limits quarterly or when business needs change, adjusting parameters based on employee performance, role changes, or operational requirements.

Regular reviews ensure limits remain appropriate for current business activities while preventing unnecessary restrictions or excessive permissions. Periodic adjustments maintain optimal spending control while supporting business growth and operational flexibility.

8. Revoke or reassign cards as needed

Manage card lifecycle through systematic revocation procedures for departing employees and reassignment protocols for role changes. Immediate card deactivation prevents unauthorized usage while reassignment ensures continued business operations.

Clear procedures protect company funds while maintaining operational continuity during staff transitions, ensuring appropriate expense management throughout organizational changes, and employee lifecycle management.

Why Volopay cards are the best solution for businesses?

Safe & secure

Volopay's corporate cards are protected with high-tech bank-grade security measures. Along with this, two-factor authentication, 3DS protocol for expense authentication, and spend controls like expense limit and transaction type specification.

All these measures make Volopay cards extremely safe and secure for storing and transferring money.

Instant approval

With Volopay cards, you get the option to set spending limits. Hence, all transactions under the spend limit are instantly approved. Plus, you can set who can access the card and the expense category.

This means employees will no more have to run around to get payment or expense approvals. It can easily be done on the system. Any expense over the limit can also be approved in seconds.

The expense request is displayed on the approvers' screen with all the necessary details. The approver just has to click approve or reject. It's that fast.

No hidden fee

Any charges or fees you pay for Volopay cards are disclosed upfront. Nothing is hidden or secretly charged to your chards.

You get complete transparency and clear visibility of all your spends and charges like international transaction fees, interest payments, etc.

Easy to use

Volopay cards are easy to create and use. You can create unlimited virtual cards from the cards section.

These cards get created instantly. Transfer money from the Volopay account to the card, and voila, you can start using it immediately.

Moreover, to make any payment, you just have to add some basic vendor details, enter the total amount and transaction currency and click on pay. The payment is initiated then and there.

Unlimited virtual cards

Customers can create unlimited virtual cards. No fees, costs, or charges. Unlimited virtual cards for free. These can be assigned to different employees, projects, departments, and vendors.

Specific virtual cards can help in better expense management and organization as the expense will be properly separated.

Integrate with accounting systems

All Volopay features on the platform are internally connected. All Volopay cards are integrated with the accounting system.

This means that every transaction made through the cards is automatically entered into the accounting sheets.

The expense information is entered under the right categories in the accounting books with the help of auto-categorization and expense mapping features.

Real-time tracking

One of the best features of Volopay cards feature is real-time tracking. Every transaction is tracked and recorded in real time.

Hence the managers will have a complete look into when the transaction was initiated, what is its current status and when will the end receiver get the money.

FAQs about business prepaid cards in Australia

Yes, you preload funds onto prepaid cards before spending, unlike credit cards, which offer borrowed money or debit cards that access bank accounts directly. Prepaid cards provide better spending control without debt risk.

Yes, you can apply with a valid ABN/ACN registration regardless of business size. Most providers accept startups and small businesses, often requiring minimal operating history compared to traditional credit products.

Many providers offer multi-currency support, enabling you to make international payments with competitive exchange rates. However, currency options vary by provider, so verify specific international payment capabilities before selection.

Yes, you can use Volopay cards for fuel purchases, software subscriptions, and recurring SaaS payments. The cards support various merchant categories, including online services and subscription-based business expenses.

You benefit from EMV chip technology, real-time transaction alerts, instant card freezing, spending limits, and fraud monitoring. Multi-factor authentication and encrypted data protection ensure comprehensive security for business transactions.

Yes, you can issue unlimited cards to team members with individual spending limits and controls. Each employee receives personalized cards with customized permissions aligned to their role requirements.

You set individual spending limits, merchant restrictions, and approval workflows for each card. Real-time monitoring, transaction categories, and automated expense tracking provide comprehensive control over employee expenditure.