6 best business account for eCommerce needs

If you’re running a business in Australia, your main concern may lie in the growth and management of cash flow. Business owners require the best business bank account for eCommerce. While many bank account providers claim to be the best, it becomes tough to decide on the eCommerce business bank account for you.

The article covers the best business bank accounts for eCommerce businesses and its alternatives. You’ll know what features, fees, and benefits you should have with your eCommerce business bank account.

Factors to consider before opening a business bank account

Businesses in Australia should consider some factors before selecting the best business bank accounts for eCommerce. The main considerations for opening a business bank account in Australia are mentioned below.

1. Evaluate the bank’s policies to accommodate small eCommerce business needs

For acquiring the best business bank account for eCommerce, you must first consider the bank policies. Some banks’ policies are rigid and do not comply with the requirements of eCommerce businesses. Therefore, evaluate policies before selecting the eCommerce business bank account.

2. Chargeback policies of banks

Suppose you fall into a dispute with your customers over the quality of goods & services. In this case, your eCommerce business bank account will have to refund the amount to the customer’s account.

It is important to check policies related to chargeback. The best business bank accounts for eCommerce inform the merchant before initiating a chargeback to the buyer’s account.

3. Are bank services tailored for the e-comm industry?

The most important factor to consider is that the eCommerce business bank account suits your business requirements. The needs of eCommerce businesses vary from other merchants. Therefore, it is essential to ensure that the bank services match your demands for the e-comm industry.

4. Hassle-free loan process

The growing businesses in Australia constantly look for investment opportunities. It is not always easy to initiate business funds for the same. Therefore, eCommerce businesses apply for loans.

Businesses should make sure that their bank provides a hassle-free loan process. The best business bank account for eCommerce can meet the loan requirements of the customers.

5. Additional perks/incentives

Another important factor is that the eCommerce business bank account offers additional incentives and perks. It has proved beneficial for businesses operating in Australia.

Check if your business bank accounts assist you with tax deductions. It allows you to look more professional and establish relationships with banks.

6. Cash flow requirements

The best business bank accounts for eCommerce are those that can meet the requirements of cash flow. Cash flow is necessary for the smooth functioning of businesses in Australia.

The eCommerce business bank account should allow you to check transaction limits on a daily, weekly, and monthly basis.

For an eCommerce business, these banking services are essential

The best business bank accounts for eCommerce offer the following bank services to customers. Before selecting the eCommerce business bank account, ensure that it offers these features to your business.

1. Checking account

As an eCommerce business owner, you may require to deposit and withdraw funds on a daily basis. The best business bank account for eCommerce offers you the feature of checking accounts.

It is liquid in nature and can be accessed using ATMs and checks. Checking accounts often have no limit on withdrawals and deposits.

2. Savings accounts

This is a must-have banking service if you decide on the best business bank account in Australia. It allows you to store excess funds earned by the business operations.

Your funds are kept safe in savings accounts and can be withdrawn when you require them. The savings account is the most basic banking service offered by the eCommerce business bank account.

3. Credit/Debit card

The best business bank account for eCommerce is the one that comes with a credit/debit card for the customers. The debit card is linked to your bank account and allows easy access to the business funds.

Meanwhile, credit cards allow you to borrow funds from bank account providers.

4. Checks & checkbook

Another important service that the best business bank account for eCommerce offers is checks & checkbooks. Checks help in the deposit and withdrawal of business funds.

Checkbook is issued by the eCommerce business bank account providers. They are significant in keeping a record of business transactions.

5. Online business banking

The most important banking service that the eCommerce business bank account should offer is online business banking. Online banking eliminates the need of visiting ATMs and banks.

It saves a lot of time for growing businesses in Australia. Therefore, the best business bank accounts for eCommerce have online banking facilities.

6. Payroll account

Accounts payable are an important aspect of growing businesses in Australia. It is essential to automate the payroll processes of eCommerce stores. It brings effectiveness and efficiency. Also, it saves time for the finance department.

Volopay can assist you with the automation of accounts payable processes in your business.

Get the best business account for your eCommerce

6 best business account for eCommerce needs

Following are the accounts that meet eCommerce business financial needs in Australia.

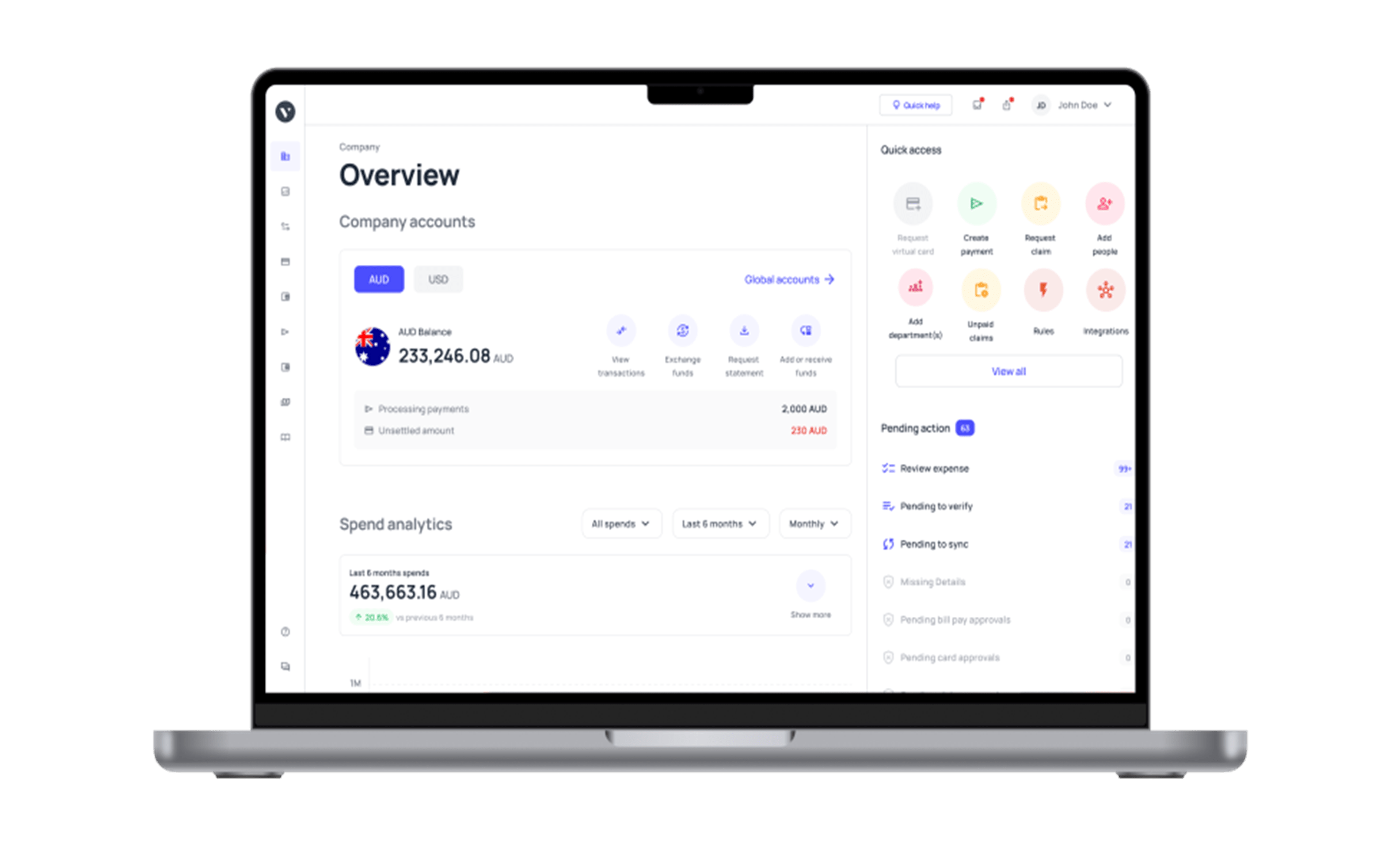

1. Volopay

Volopay serves as one of the best business accounts for eCommerce. It helps in saving business funds by offering automated account processing, money transfers, and corporate cards.

Volopay ensures that your finance team is free from hectic admin functions. Either petty cash to vendor payouts, Volopay has sorted everything.

2. National Australia Bank – Business Everyday Account

NAB is known to provide the best business banking account for eCommerce. It does not charge a monthly fee from the customers.

Another benefit is that this eCommerce business bank account facilitates unlimited electronic bank transactions. Customers have 24/7 access to banking facilities without hidden charges.

3. Commonwealth Bank – Business Transaction Account

This is another best eCommerce business bank accounts. Just like NAB, Commonwealth Bank does not charge a monthly account fee for Business Transaction Account.

Also, a Visa Debit Card is associated with this eCommerce business bank account. It allows customization of balance notifications.

4. Heritage Bank- Body Corporate

If you're running a corporate organization in Australia, this eCommerce business bank account is designed for you. It doesn't charge ATM withdrawal charges or hidden fees on the account. These are two distinct accounts.

One is an interest-bearing transaction account. The other has no interest but lower fees. You can choose the best business bank account for eCommerce.

5. Great Southern Bank- Everyday Business Account

This eCommerce business bank account was designed to serve as the hub of your daily business spending. Customers are not required to bear any associated transactional charges.

You get easy access to online banking. It allows you to initiate electronic payments without limit. If you require additional funds for business purposes, you can enable overdraft facilities.

6. Australia-New Zealand Bank- Business Extra

Another best business bank account for eCommerce is Business Extra by Australia-New Zealand Bank. It charges a monthly fee of $22. The monthly fee also includes $15 for access to online banking.

However, this eCommerce business bank account allows transactions regardless of the limit. Entrepreneurs can do unlimited business transactions with this account.

The bottom line

The above-mentioned banks offer the best business bank accounts for eCommerce in Australia. Before selecting an eCommerce business bank account, customers should go through the pros and cons of each of them.

You must check if these accounts offer every feature that you require for your eCommerce store. Volopay is a one-stop solution for all your business needs. It automates the accounts payable processes so that the businesses can focus on other important operations.