Smart expense management cards built for Singapore businesses

Singapore’s business environment demands smarter financial tools—and expense management cards are stepping up to meet that need. These modern payment solutions, often issued as corporate cards, help companies maintain tighter control over business spending, optimize budgeting, and ensure compliance with local accounting regulations.

With features tailored to Singapore’s financial framework, such as support for IRAS tax filing and GST tracking, these cards provide real-time visibility and reduce manual errors. Businesses can now track expenses instantly, streamline reimbursements, and stay audit-ready with minimal effort. Whether you're a startup or an enterprise, this blog explores why these cards are transforming how companies handle their daily operational expenses.

What are expense management cards?

Expense management cards for business are payment tools tailored to help Singaporean companies monitor, limit, and reconcile employee expenses with ease. These cards can be issued as an employee business expense card or virtual prepaid cards, enabling controlled spending on travel, subscriptions, and operational needs.

Unlike traditional reimbursement systems, these cards offer real-time insights and automated accounting integration, helping businesses comply with IRAS requirements and GST reporting. They not only reduce administrative burden but also provide structured data for clearer financial decision-making.

Built specifically for efficient expense tracking, they ensure transparency and accountability across departments while aligning with Singapore’s regulatory and financial expectations.

Some businesses also pair these cards with payroll cards to streamline salary disbursement and ensure employees have dedicated, trackable access to their wages—further simplifying internal finance operations.

Benefits of expense management cards for businesses

Custom spend limits

With expense management cards, you can set custom spend limits based on each employee’s role or project needs. Whether it’s per transaction or monthly caps, you stay in full control of how company funds are used. This helps you prevent overspending while giving your team the flexibility to work efficiently.

Role-based access control

You decide who gets access to what. Role-based access control lets you assign permissions based on job responsibilities, so each team member can only spend within their approved scope. This keeps your spending secure, aligned with company policies, and easy to manage across departments and teams.

Automated expense reports

Say goodbye to manual spreadsheets. When you use expense management cards for business, your reports are generated automatically. Every transaction is categorized, receipts are uploaded in real time, and your expense data stays organized—saving you hours of admin work and helping you stay compliant without the stress.

Fast expense approvals

Speed through approvals with real-time notifications and built-in workflows. When someone uses their employee business expense card, you get an instant alert to approve or flag the expense. No more delays or endless email chains—just faster decisions, clearer visibility, and full control from wherever you are.

Real-time spend tracking

Get instant insights into every purchase. Expense management cards give you live updates on all spending activity, so you can catch issues early and make smarter financial decisions. You won’t have to wait for month-end reports you’ll always know where your money’s going, when, and why.

Easy account reconciliation

Close your books faster and with fewer errors. Each transaction from your expense management cards comes with detailed data receipts, vendors, categories automatically synced with your accounting software. You’ll spend less time matching records and more time focusing on strategy, knowing everything is accurate and audit-ready.

If you're looking to complement your expense management strategy with more advanced spend controls, custom workflows, and deeper integration with finance tools, explore our guide on the Best corporate credit cards in Singapore.

Start streamlining your expenses with Volopay's corporate cards

Simplify spending with Volopay's expense management cards

Full expense overview

Gain complete visibility into every transaction made with Volopay’s expense management cards. You can track spending in real time across teams, departments, and projects—all from a single dashboard. This gives you the power to manage budgets proactively, control costs, and make faster, better-informed financial decisions without the usual guesswork.

Detailed expense reports

Volopay automatically generates clear, itemized reports for every transaction, saving you time and effort. You’ll see who spent what, when, and why—complete with receipts and categories. These reports are audit-ready and easy to export, helping you simplify compliance while giving you deeper insights into your company’s financial activity.

Custom expense categories

Organize your spending with tailor-made categories that reflect your business structure. Whether it’s travel, software, or meals, Volopay lets you label each transaction for easier tracking. This helps you analyze expenses by department or purpose, making your budgeting process smarter, more accurate, and aligned with your company’s priorities.

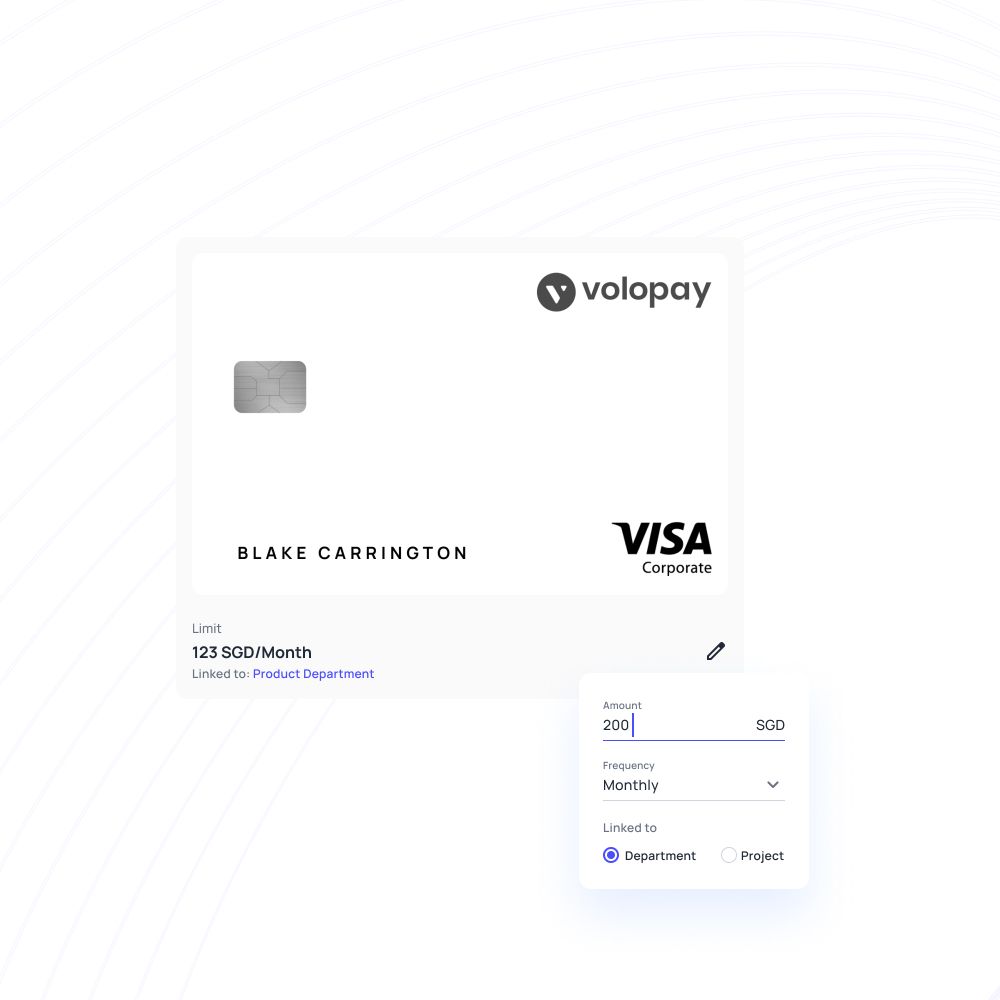

Smart card controls

With Volopay’s employee business expense card, you decide how and when your team can spend. Set transaction limits, merchant rules, and usage restrictions—all in a few clicks. These built-in controls reduce overspending, eliminate misuse, and let you empower employees while keeping full oversight of every dollar spent.

Instant expense reconciliation

Eliminate end-of-month chaos with real-time reconciliation. Every transaction from your expense cards for employees is synced instantly with your accounting system—complete with receipts and vendor details. This automation cuts down on manual data entry, reduces errors, and gives your finance team more time to focus on high-impact tasks.

24/7 local support

You’re never left in the dark. Volopay offers round-the-clock local support to help you resolve issues quickly. Whether you need assistance with a declined charge, card setup, or reporting, our team is always available to guide you—so your expense process stays smooth and interruption-free.

Role-based access

Control who can do what with role-based access settings. Whether it’s issuing cards, approving expenses, or managing budgets, Volopay lets you assign permissions based on each user’s role. This minimizes risk, maintains accountability, and ensures that only the right people can access the right financial functions.

Automated spend routing

Streamline how expenses move through your company with smart routing workflows. Volopay’s platform automatically sends spending requests to the right approvers based on amount, team, or policy. You save time, reduce approval delays, and maintain full compliance without needing to micromanage each individual transaction.

How Volopay empowers Singapore businesses with global-ready financial infrastructure

Volopay simplifies IRAS and GST compliance by automating tax-friendly transaction tracking and report generation. Every expense is categorized correctly with receipt capture, ensuring accuracy for filings.

This reduces manual work, helps avoid costly mistakes, and keeps your business aligned with Singapore’s regulatory standards—all while using expense cards for employees efficiently.

Operate seamlessly across borders with Volopay’s built-in multi-currency support. Whether you’re paying vendors in USD, EUR, or SGD, exchange rates are transparent and conversions are automatic.

This allows your team to make global payments confidently while reducing currency conversion fees and simplifying international finance management.

Manage global operations with streamlined approval workflows customized to your organization’s hierarchy. Volopay routes each expense to the right decision-maker, no matter where they’re based.

Whether it’s a Singapore team or an overseas branch, you get full control over approvals without slowing down international business transactions or travel-related spending.

Stay audit-ready all year long with detailed, time-stamped records for every transaction. Volopay compiles expense data, receipts, and approval logs in a centralized system, making audits faster and stress-free.

When using employee business expense card, you can ensure every detail is documented and easily accessible when needed.

Pay global vendors without delays or high fees. Volopay enables fast, low-cost international transfers with full transparency. Schedule payments, track statuses, and maintain compliance from one platform.

You gain better control over cash flow and build stronger supplier relationships—without relying on multiple systems or manual processes.

Getting started with Volopay’s expense management cards in Singapore

Choose card type

Start by selecting the right expense management cards based on your team’s needs. Volopay provides physical cards ideal for travel or in-person expenses.

It also offers virtual cards tailored for online subscriptions and digital transactions. You can issue cards that align with specific spending behaviors while maintaining full control over every transaction.

Set usage limits

Define exactly how much each cardholder can spend. Set daily, monthly, or per-transaction limits to prevent overspending and ensure budget discipline.

Volopay allows you to customize limits per employee, project, or department—so your business stays financially efficient while giving teams the flexibility they need to operate smoothly.

Configure workflows

Build custom approval workflows to match your internal processes. Volopay lets you route spend requests through multiple levels based on amount or team.

This ensures accountability, speeds up decision-making, and keeps your expense policy enforced—whether you're managing a local team or a cross-border finance structure.

Sync with accounting

Connect Volopay with your existing accounting software to automate reconciliation. Every transaction is categorized, matched with receipts, and pushed to your ledger in real time.

This reduces manual entry, minimizes errors, and helps you maintain accurate financial records—making month-end closing simpler and less time-consuming.

Enable spend tracking

Turn on real-time spend tracking to monitor every expense as it happens. With Volopay, you’ll see where money is going instantly helping you avoid budget overruns. Get alerts for unusual activity and stay proactive with your financial management by always knowing how company funds are being used.

Add role controls

Assign access based on roles to maintain spending discipline. Whether it’s who can approve, issue, or spend using an employee business expense card, Volopay lets you control permissions down to the user level. This keeps your financial processes secure, structured, and aligned with your internal policy.

Issue to teams

Easily distribute cards to employees across teams or departments. You can issue cards in seconds and instantly assign limits, workflows, and policies.

Whether it's for marketing, sales, or operations, Volopay gives each team the tools they need to manage their own spending while keeping finances in control.

Start managing expenses

Once setup is complete, you’re ready to start managing expenses effortlessly. With Volopay’s dashboard, you can track activity, approve transactions, and analyze reports all in one place. Say goodbye to outdated systems and start using smarter tools that help you scale faster with complete visibility and compliance.

Features of Volopay’s expense management cards

Direct fund loading

Top up your cards instantly with Volopay’s direct fund-loading feature. You can allocate budgets to teams or departments in just a few clicks.

This simplifies cash flow planning and gives your team faster access to funds—making expense management cards for business more efficient than traditional reimbursement methods.

Easy card access

Access your cards anytime, anywhere through Volopay’s intuitive web or mobile platform. Employees can view card details, request new cards, and track transactions easily.

Whether using physical or virtual cards, you maintain full control and visibility over how your team uses their expense cards for employees.

Mobile expense tracking

Stay in control of spending on the go with Volopay’s mobile expense tracking app. Employees can upload receipts, tag expenses, and view balances directly from their smartphones.

This ensures real-time visibility for finance teams and makes it easier for employees to manage and report expenses without delays or paperwork.

Instant card reloads

Need to increase a team’s budget? Volopay enables instant card reloads with no waiting time.

You can top up cards in seconds based on project needs, travel plans, or urgent expenses—ensuring your employees never face disruptions due to insufficient funds, even while operating across different time zones.

24/7 local support

Get round-the-clock assistance with Volopay’s dedicated local support team. Whether it’s a declined transaction or a card-related issue, help is always just a call or message away.

This ensures your team can work without interruptions, no matter the hour or the challenge, with expert support on standby.

Global card use

Use Volopay's corporate cards anywhere in the world with complete confidence. Accepted globally, these cards are ideal for international transactions, travel, and vendor payments.

Multi-currency support make it easy to stay compliant—even while expanding operations across multiple countries or markets.

High-grade security

Volopay ensures your funds and data are protected with enterprise-level security features. From dynamic spend limits to real-time fraud detection and two-factor authentication, your company’s finances are always safe.

Every transaction made using Volopay’s platform is encrypted and monitored—giving you peace of mind with every swipe or click.

Payroll integration

Simplify salary and reimbursement processes by integrating your payroll with Volopay. You can directly disburse employee benefits, bonuses, or approved expenses onto their cards—reducing the need for separate transfers.

This streamlines operations and keeps compensation, card usage, and reporting aligned in one secure, centralized platform.

How Volopay expense management cards work for Singaporean teams

Make a payment

Your team member uses a Volopay corporate card—physical or virtual—to pay for a business expense. Whether it’s travel, software, or office supplies, the business exoense transaction is processed smoothly and instantly.

Spend limits and merchant restrictions are already in place, ensuring each payment aligns with company policy from the moment it’s made.

Upload receipts

After the purchase, the employee uploads the receipt directly through the Volopay mobile app or web dashboard. The platform prompts for receipt submission immediately, reducing delays and missed documentation.

This creates a clear audit trail while encouraging timely reporting from employees, making compliance a routine part of spending.

Validate receipts

Once uploaded, Volopay scans and verifies the receipt against the transaction details. This automatic validation checks for mismatches in date, amount, and vendor.

Any discrepancies are flagged for review, ensuring that only accurate and policy-compliant expenses proceed through the system—without burdening your finance team with manual checks.

Route for approval

The validated expense is then routed to the appropriate approver based on your company’s pre-set workflow. Whether it's the employee’s manager or department head, Volopay ensures the expense follows the right path.

Approval rules can vary by amount, team, or expense type offering complete flexibility and control.

Approve or reject

Approvers receive a notification and can review the transaction details, receipt, and justification in one view. They can approve or reject the expense with a single click.

This fast, transparent process eliminates back-and-forth emails and ensures that only valid expenses are reimbursed or booked.

Sync with books

Once approved, the expense is automatically categorized and synced with your accounting software. Volopay integrates with popular accounting platforms ensuring real-time ledger updates.

This reduces the risk of manual errors and saves time during monthly closings and financial reporting.

Reconcile expenses

Volopay simplifies reconciliation by matching card transactions with approved receipts and accounting entries. Since everything is synced and validated, finance teams can quickly verify records without chasing employees.

This cuts reconciliation time significantly and ensures books are always accurate and audit-ready with minimal manual effort.

Generate reports

With all data captured and organized, generating reports is effortless. Volopay offers customizable reporting based on department, project, vendor, or time period.

These insights help finance teams identify trends, optimize budgets, and support strategic planning—while ensuring complete transparency across all business spending activities.

Volopay: Designed for every Singapore business

Volopay offers a unified expense management platform built to support companies at every stage of growth.

Whether you're a lean startup or an expanding small business, Volopay helps you control spending, stay compliant, and scale efficiently—without the complexity. Enjoy a smarter, faster, and more transparent way to manage business expenses.

1. Startups

● Quick team onboarding

Get your team up and running in minutes with Volopay’s intuitive interface. You can issue cards, assign roles, and set limits with just a few clicks. The platform is designed for speed, making it easy for growing startups to adopt without requiring any prior finance expertise or long learning curves.

● Simple setup process

Volopay’s platform is easy to implement—no complicated configurations or lengthy onboarding is needed. You can connect your accounting software, customize approval workflows, and start issuing cards right away. It’s designed so founders and small teams can launch without IT support or costly implementation services slowing them down.

● Minimal admin effort

Spend less time on manual tasks. Volopay automates receipt collection, expense categorization, and reporting, so your team can focus on growing the business. With built-in controls and real-time tracking, you avoid back-and-forth emails and reduce the need for constant oversight, streamlining your entire expense process.

2. Small-sized businesses

● Real-time expense visibility

Stay in control of every dollar with live tracking and instant notifications. Volopay provides complete visibility into team spending, allowing you to monitor purchases as they happen. This helps you stay on budget, spot issues early, and make quicker financial decisions with confidence and accuracy.

● Scales with growth

As your business grows, Volopay grows with you. Add users, issue more cards, and manage multiple teams without losing control. The platform adapts to your evolving structure, ensuring you maintain visibility and control even as operations expand across departments, clients, or regional offices.

● Automated spend workflows

Create approval flows that work for your business. Volopay routes expenses automatically based on your rules—saving time and ensuring compliance. Whether it’s team budgets or manager sign-offs, automation removes delays and keeps processes efficient, so you can focus on scaling without being slowed down by manual admin.

3. Medium-to-large sized businesses

● Advanced spend analytics

Volopay provides detailed analytics that help you break down spending by team, department, vendor, or project. These insights support smarter budgeting, identify cost-saving opportunities, and highlight unusual patterns. With customizable dashboards and exportable data, finance leaders gain the visibility needed to make data-driven decisions across large and distributed teams.

● Custom approval workflows

Tailor approval flows to match your company’s internal structure. Volopay lets you set multi-level rules based on amount, department, or role—ensuring all transactions are reviewed by the right people. This flexibility maintains compliance, reduces delays, and supports complex spending hierarchies without increasing manual workload or oversight.

● Global card acceptance

Empower your teams to spend anywhere in the world with Volopay’s globally accepted cards. Whether traveling for business, managing overseas vendors, or operating international teams, employees can use their cards confidently. Real-time currency conversion and expense tracking ensure full transparency, regardless of where the transaction takes place.

Bring Volopay to your business

Get started now

FAQs

They automatically record transactions with receipts, categorize expenses accurately, and sync with accounting systems—ensuring all financial records are organized, traceable, and compliant with IRAS and GST requirements for smooth audits.

Yes, Volopay allows you to issue cards to freelancers or part-time staff. You can control limits and access based on roles, ensuring secure, policy-compliant spending for non-permanent team members across different functions.

Absolutely. Volopay cards support multi-currency use, making them ideal for overseas purchases, travel, and international vendor payments. Real-time currency conversion ensures transparency and accuracy for global business transactions and expense tracking.

There is no fixed cap on card issuance. You can issue multiple cards based on your organization’s structure and needs, helping you scale and manage team spending without compromising control or visibility.

Volopay cards come with high-grade security features, including spend controls, real-time tracking, 2FA, and instant freezing. These tools help prevent unauthorized transactions and give you full control over card activity.