👋Session Alert! How the Top 1% Finance Leaders Think - 11th Feb. Register Now→

The best small business line of credit in Singapore for 2026

Running a successful business requires consistent cash flow, but even the most profitable companies face temporary financial gaps. Whether you need to cover seasonal inventory purchases, manage payroll during slower months, or seize unexpected growth opportunities, having access to flexible financing can make the difference between thriving and merely surviving.

Traditional bank loans often come with rigid terms and lengthy approval processes that don't match the dynamic needs of modern businesses. The best small business line of credit offers the perfect solution by providing you with on-demand access to funds when you need them most, without the constraints of traditional lending.

This comprehensive guide explores the top credit line providers in Singapore, helping you make an informed decision that aligns with your business goals and financial requirements.

What is a business line of credit?

A business line of credit functions as a flexible financing arrangement that gives your company access to a predetermined amount of funds whenever needed. Unlike traditional loans, where you receive a lump sum upfront, a credit line allows you to draw money as required and only pay interest on the amount you actually use.

This revolving credit facility automatically replenishes as you repay the borrowed funds, creating a continuous source of working capital for your business operations.

The beauty of this financing option lies in its adaptability to your business cycle.

During peak seasons, you can access more funds to purchase inventory or hire temporary staff, while during quieter periods, you can reduce your usage and minimize interest costs.

This makes a line of credit for business particularly valuable for companies with fluctuating cash flow patterns, seasonal demands, or those looking to capitalize on growth opportunities without the burden of fixed monthly loan payments.

Best small business line of credit in Singapore in 2026

The Singapore market offers diverse credit line solutions ranging from traditional bank facilities to innovative fintech platforms designed for modern businesses.

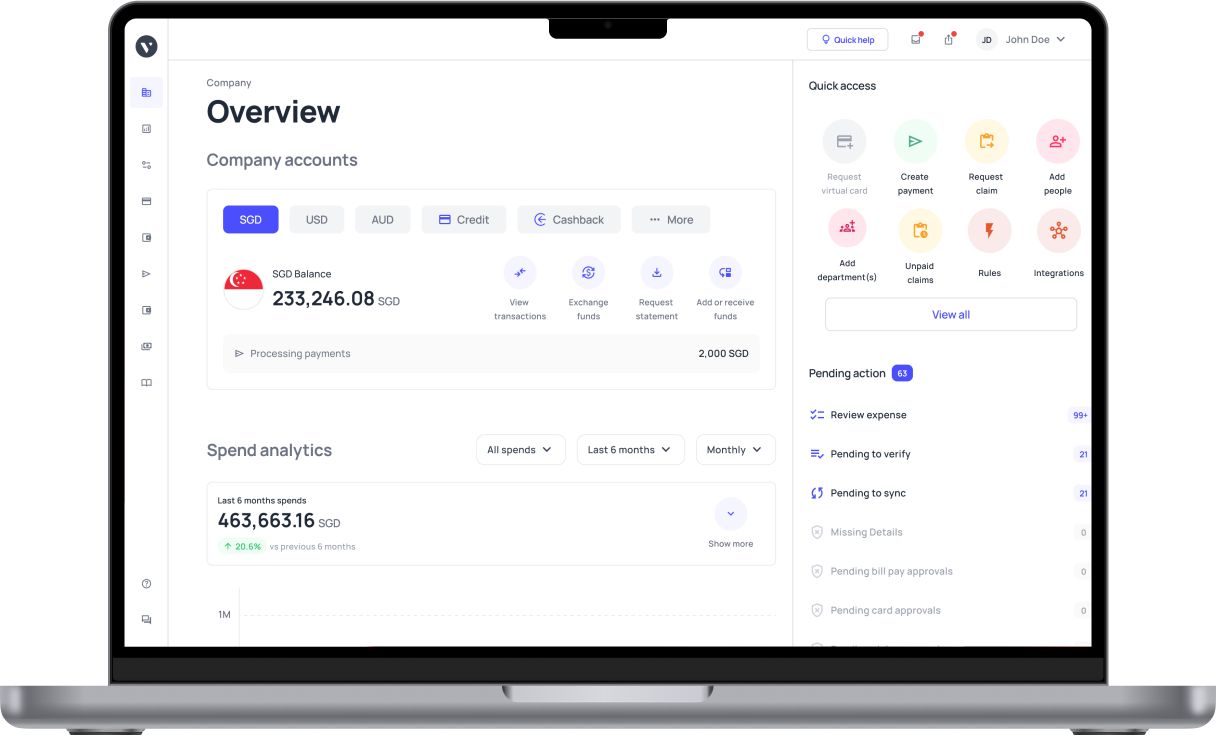

1. Volopay

Volopay revolutionizes business financing by combining a flexible credit line with comprehensive spend management tools, creating an all-in-one financial platform for modern SMEs.

Our company focuses on digital-first businesses that require both funding flexibility and robust financial controls.

● Key features

Volopay's credit line integrates seamlessly with their spend management platform, allowing you to access funds instantly while maintaining complete visibility over company expenses. The platform offers real-time transaction monitoring, automated expense categorization, and customizable spending controls that help finance teams maintain budgetary discipline.

You can set individual spending limits for team members, track vendor payments, and generate detailed financial reports that simplify bookkeeping and tax preparation.

● Application process

The entire application process is conducted online through Volopay's digital platform, typically taking just 24–48 hours from submission to approval. You'll need to provide basic business information, recent financial statements, and banking details.

The platform uses advanced algorithms to assess creditworthiness quickly, eliminating the need for lengthy documentation processes or multiple bank visits that traditional lenders often require.

● Customer support

Volopay provides dedicated account managers who understand your business needs and offer personalized guidance throughout your journey.

The support team is accessible through multiple channels, including chat, email, and phone, ensuring you receive timely assistance whenever questions arise.

● Best for

Digital startups, e-commerce businesses, and SMEs that value integrated financial management tools alongside flexible credit access.

Particularly those looking to streamline their entire financial operations under one platform.

2. Anext Bank

Anext Bank positions itself as a digital banking solution specifically designed for SMEs, offering competitive credit line products with a focus on relationship banking and personalized service delivery.

● Key features

Anext Bank's business line of credit comes with competitive interest rates and flexible repayment terms tailored to your cash flow patterns. The bank offers both secured and unsecured options, with credit limits that can scale as your business grows.

Their digital banking platform provides real-time access to account information, transaction history, and credit utilization metrics, helping you make informed financial decisions throughout your business cycle.

● Application process

Applications can be submitted online or through their business banking centers, with preliminary approvals typically provided within 3–5 business days.

The bank assigns dedicated relationship managers who guide you through the documentation process and help structure the credit facility according to your specific business requirements and industry characteristics.

● Customer support

Anext Bank emphasizes relationship banking with dedicated business advisors who understand your industry and provide ongoing support.

Their customer service team offers extended hours and specialized business banking assistance to ensure your operational needs are met promptly.

● Best for

Established SMEs with consistent revenue streams looking for traditional banking relationships combined with modern digital banking conveniences and competitive pricing structures.

3. Funding Societies

Funding Societies operates as a peer-to-peer lending platform that connects businesses with investors, offering revolving credit lines through their innovative marketplace lending model designed specifically for Southeast Asian markets.

● Key features

Their revolving credit facility allows you to access funds up to your approved limit and repay according to your cash flow schedule. Funding Societies uses alternative credit scoring methods that consider factors beyond traditional banking metrics, making them accessible to businesses with limited credit history.

The platform provides transparent pricing with no hidden fees, and you can track your credit utilization through their user-friendly dashboard.

● Application process

The online application process typically takes 2–3 business days for initial approval, with funds available shortly after final documentation is completed.

Their platform uses technology-driven assessment methods that can evaluate creditworthiness more quickly than traditional banks, particularly beneficial for businesses with strong operational metrics but limited collateral.

● Customer support

Funding Societies provides dedicated account managers who understand the marketplace lending model and can help optimize your credit facility usage.

Their support team offers guidance on best practices for maintaining good standing within their lending community.

● Best for

SMEs seeking alternative lending solutions, particularly those with strong business fundamentals but limited traditional credit history or collateral to offer conventional lenders.

4. Bizcap

Bizcap specializes in providing fast, flexible credit solutions for Australian and Singapore businesses, focusing on revenue-based credit lines that align with your business performance and cash flow patterns.

● Key features

Bizcap's credit line product uses revenue-based assessment methods, meaning your credit limit and terms are determined by your business's actual performance rather than just traditional credit metrics.

This approach allows growing businesses to access higher credit limits as their revenue increases. The platform offers same-day approvals for qualifying businesses and provides flexible repayment options that can adjust based on your seasonal business patterns.

● Application process

Their streamlined online application can be completed in minutes, with approval decisions typically provided within 24–48 hours.

Bizcap requires minimal documentation and focuses on your business's forward-looking potential rather than extensive historical financial records, making the process particularly efficient for growing companies.

● Customer support

Bizcap assigns dedicated business finance specialists who understand your industry dynamics.

Provide ongoing support to help optimize your credit facility usage throughout different business cycles.

● Best for

Fast-growing businesses with strong revenue trends that need quick access to working capital and prefer revenue-based lending criteria over traditional asset-based lending requirements.

5. Cash-IN-Asia

Cash-IN-Asia focuses on providing working capital solutions for businesses across Asia, offering trade finance and credit line products specifically designed for import-export businesses and companies with regional operations.

● Key features

Their credit facilities are particularly well-suited for businesses involved in international trade, offering multi-currency options and trade finance capabilities alongside traditional credit lines.

Cash-IN-Asia provides flexible repayment terms that can accommodate the longer cash conversion cycles common in import-export businesses. The platform integrates with trade documentation systems and provides specialized reporting for businesses managing complex supply chains.

● Application process

The application process typically takes 3–5 business days and involves assessment of both local business operations and international trade activities.

Their team understands the complexities of cross-border business and can structure credit facilities that align with international payment cycles and currency fluctuations.

● Customer support

Cash-IN-Asia provides specialized support for trade finance and international business operations.

With advisors who understand regulatory requirements across different Asian markets and can help navigate complex international transactions.

● Best for

Import-export businesses, companies with significant regional operations, and SMEs requiring trade finance capabilities alongside traditional credit line access for their international business activities.

6. OCBC

OCBC Bank offers comprehensive business overdraft facilities as part of its extensive SME banking services, providing established businesses with traditional banking relationships and competitive credit terms.

● Key features

OCBC's business overdraft facility functions as a traditional credit line with competitive interest rates and established banking infrastructure. The bank offers both secured and unsecured options with credit limits that can be substantial for qualifying businesses.

Their digital banking platform provides comprehensive account management tools, and you can access funds through multiple channels, including online banking, mobile apps, and ATM networks throughout Singapore.

● Application process

Applications are processed through OCBC's business banking centers with dedicated relationship managers who assess your business comprehensively.

The approval process typically takes 5–7 business days and involves thorough documentation review, but results in well-structured credit facilities with competitive terms for qualifying businesses.

● Customer support

OCBC provides extensive business banking support through relationship managers, specialized business banking centers, and comprehensive online resources.

Their established banking infrastructure ensures reliable service and ongoing relationship management for growing businesses.

● Best for

Established businesses seeking traditional banking relationships with comprehensive service offerings, particularly those that value the stability and extensive infrastructure of major local banks.

7. DBS Bank

DBS Bank offers overdraft facilities specifically designed for SMEs, combining traditional banking strengths with digital innovation to provide flexible working capital solutions for Singapore businesses.

● Key features

DBS overdraft facilities come with competitive rates and flexible terms that can be customized based on your business profile and banking relationship. The bank's digital banking platform provides real-time access to credit facilities, comprehensive reporting tools, and integration with other DBS business banking services.

You can access funds instantly through their extensive digital infrastructure while benefiting from the stability of Singapore's largest bank.

● Application process

DBS streamlines the application process through dedicated SME banking specialists who understand local business needs and can expedite approvals for qualifying companies.

The typical process takes 5–7 business days and includes a comprehensive assessment of your business operations and financial position.

● Customer support

DBS provides specialized SME banking support with dedicated relationship managers, comprehensive business banking centers, and extensive digital support resources.

Their customer service infrastructure is designed to handle complex business banking needs efficiently.

● Best for

SMEs seeking the reliability and comprehensive services of Singapore's largest bank, particularly businesses that value extensive digital banking infrastructure combined with traditional banking relationship management.

8. Aspire

Aspire combines business accounts, expense management, and credit facilities into a comprehensive financial platform designed specifically for modern businesses that prioritize digital-first banking solutions.

● Key features

Aspire's credit line integrates with their complete business financial platform, allowing you to manage supplier payments, employee expenses, and working capital needs from a single dashboard.

The platform offers real-time spending controls, automated expense categorization, and comprehensive reporting tools that simplify financial management. You can set spending limits, track vendor payments, and maintain complete visibility over company finances while accessing flexible credit when needed.

● Application process

The entirely digital application process typically provides approval decisions within 24–48 hours, with minimal documentation requirements and streamlined verification procedures.

Aspire focuses on forward-looking business metrics and operational efficiency rather than extensive historical financial documentation.

● Customer support

Aspire provides dedicated customer success managers who understand the integrated nature of their platform.

It can help to optimize your entire financial operations, not just the credit facility usage.

● Best for

Digital-native businesses, startups, and SMEs that want integrated financial management tools combined with flexible credit access, particularly those prioritizing streamlined operations and modern financial infrastructure.

Business line of credit vs. business loans

Understanding the fundamental differences between credit lines and traditional business loans helps you choose the financing option that best matches your operational needs and financial strategy.

Repayment flexibility

● Business line of credit

Credit lines offer maximum repayment flexibility, allowing you to pay interest only on the funds you actually use. You can repay the principal at your own pace, provided you meet minimum payment requirements, and the credit automatically becomes available again as you repay.

This revolving structure means you're never locked into fixed monthly payments that might strain your cash flow during slower business periods.

● Business loans

Traditional business loans require fixed monthly payments that include both principal and interest, regardless of your current cash flow situation.

Once you repay the loan, the credit arrangement ends, and you would need to apply for new financing if additional funds are required for future business needs.

Speed of funding

● Business line of credit

Once approved, credit lines provide instant access to funds whenever needed, typically through online banking platforms or business debit cards.

This immediate availability makes credit lines ideal for addressing unexpected opportunities or urgent business needs without waiting for loan approval processes.

● Business loans

Business loans involve application and approval processes each time you need funding, often taking days or weeks to receive funds.

This timing makes loans better suited for planned investments or purchases where you can anticipate funding needs well in advance.

Interest and cost structure

● Business line of credit

You pay interest only on the amount you draw from your credit line, not on the entire approved limit.

This usage-based interest structure can result in significant cost savings during periods when you don't need the full credit amount, making it an economical choice for businesses with variable funding needs.

● Business loans

Traditional loans charge interest on the entire loan amount from the disbursement date, regardless of whether you immediately need all the funds.

However, loan interest rates are often lower than credit line rates, making them more cost-effective for large, planned expenditures.

Use case differences

● Business line of credit

Credit lines excel for managing working capital fluctuations, seasonal inventory purchases, emergency cash flow needs, and ongoing operational expenses.

They're particularly valuable for businesses with unpredictable funding requirements or those looking to maintain financial flexibility.

● Business loans

Business loans work best for specific, planned investments such as equipment purchases, business expansion projects, real estate acquisitions, or other substantial one-time expenditures.

Where you know the exact funding amount needed and can plan for fixed repayment schedules.

Benefits of a business line of credit in Singapore

1. Flexible access to working capital

The best business credit line provides on-demand access to funds without requiring you to predict exact funding needs months in advance. This flexibility allows you to respond quickly to market opportunities, seasonal demands, or unexpected challenges without the delays associated with traditional loan applications.

You can access small amounts for minor expenses or larger sums for significant opportunities, all within your approved credit limit.

2. Only pay interest on what you use

Unlike traditional loans, where you pay interest on the entire borrowed amount, credit lines charge interest only on the funds you actually draw. This usage-based pricing model can result in substantial cost savings, particularly for businesses with fluctuating capital needs.

During periods when you don't need additional funding, your interest costs remain minimal while maintaining access to the full credit facility.

3. Supports ongoing operational needs

Credit lines align perfectly with the ongoing nature of business operations, providing continuous access to working capital for inventory purchases, payroll management, supplier payments, and other recurring business expenses.

This ongoing availability eliminates the need to constantly monitor cash flow and apply for new financing, allowing you to focus on growing your business.

4. Improves purchasing power

Having a credit line enhances your negotiating power with suppliers by enabling bulk purchases, early payment discounts, and better trade terms.

You can take advantage of seasonal discounts, volume pricing, or limited-time offers without depleting your cash reserves, potentially improving your profit margins through strategic purchasing decisions.

5. Builds business credit history

Regular use and timely repayment of your credit line helps establish and strengthen your business credit profile, making it easier to access larger credit facilities or more favorable terms in the future.

This credit-building aspect is particularly valuable for newer businesses looking to establish strong financial relationships with lenders.

6. Quick and repeatable access to funds

Once established, your credit line provides immediate access to funds through online banking, business debit cards, or direct transfers.

This instant availability eliminates waiting periods and allows you to respond quickly to time-sensitive opportunities or urgent business needs without complex approval processes.

7. No need for repeated loan applications

Credit lines eliminate the administrative burden and time delays associated with repeatedly applying for individual loans.

Once approved, you can access funds as needed throughout the credit term without additional applications, documentation, or approval processes, streamlining your financial management.

8. Adaptable to seasonal or cyclical demand

Businesses with seasonal fluctuations or cyclical demand patterns benefit tremendously from credit lines that can accommodate varying capital needs throughout the year.

You can increase usage during peak seasons and reduce it during slower periods, aligning your financing costs with your revenue patterns.

9. Can be used alongside other financing options

Credit lines complement other financing arrangements such as equipment loans, term loans, or investor funding, providing additional flexibility without conflicting with existing financial commitments.

This versatility allows you to create a comprehensive financing strategy that addresses different aspects of your business needs.

Types of business lines of credit in Singapore

Secured business line of credit

Secured credit lines require collateral such as business assets, real estate, or cash deposits to guarantee the credit facility. These arrangements typically offer higher credit limits and lower interest rates due to the reduced risk for lenders.

The collateral requirement makes secured credit lines suitable for established businesses with substantial assets that need large credit facilities for significant operational needs or growth initiatives.

Unsecured business line of credit

Unsecured credit lines don't require specific collateral but rely on your business's creditworthiness, cash flow, and financial stability for approval. While credit limits may be lower and interest rates higher than secured options, unsecured lines offer greater flexibility and faster approval processes.

They're particularly attractive for service businesses or companies with limited physical assets but strong operational performance.

Revolving credit facilities

Revolving credit facilities, such as revolving lines of credit, automatically replenish as you repay borrowed amounts, creating a continuous source of working capital throughout the credit term.

These facilities typically come with annual reviews and renewal options, providing long-term financial stability for ongoing business operations. The revolving nature makes them ideal for businesses with consistent, ongoing capital needs.

Fintech-backed digital credit lines

Digital lending platforms offer technology-driven credit solutions with streamlined applications, faster approvals, and integrated financial management tools. These platforms often use alternative credit scoring methods and provide transparent pricing with fewer traditional banking requirements.

They're particularly suitable for modern businesses that value digital-first banking experiences and integrated financial platforms.

Bank overdraft facilities

Traditional bank overdraft facilities allow you to withdraw more than your account balance up to an approved limit, essentially functioning as an automatic credit line tied to your business checking account.

These facilities offer the convenience of automatic access when needed but may have higher per-transaction fees compared to dedicated credit lines.

Checklist: Are you ready to apply for a business line of credit?

Proper preparation significantly improves your chances of approval and helps you secure better terms for your credit facility.

1. Have you reviewed your credit profile?

Check both your personal and business credit reports to understand your current credit standing and address any errors or negative marks before applying.

Lenders will evaluate both your personal creditworthiness and your business's payment history, so ensuring both profiles are accurate and strong improves your approval chances and may result in better terms and higher credit limits.

2. Are your financial statements updated?

Prepare current financial statements, including profit and loss statements, balance sheets, and cash flow statements for at least the past 12–24 months.

Lenders use these documents to assess your business's financial health, stability, and ability to service debt, so having accurate, up-to-date financials is crucial for demonstrating creditworthiness.

3. Do you have a defined funding need?

Clearly articulate how you plan to use the credit line and how it will benefit your business operations or growth.

Lenders want to see that you have specific, legitimate business purposes for the credit facility rather than seeking funding without a clear plan, as this demonstrates responsible financial management.

4. Are you prepared to manage repayments?

Develop a realistic repayment strategy that aligns with your cash flow patterns and business cycles.

Understanding your ability to service the debt and having contingency plans for slower periods shows lenders that you're a responsible borrower who takes debt obligations seriously.

Eligibility criteria for business credit lines in Singapore

Business registration and incorporation requirements

Your business must be legally incorporated and registered with ACRA (Accounting and Corporate Regulatory Authority) to qualify for most credit facilities.

Lenders typically require businesses to be registered as private limited companies, partnerships, or sole proprietorships with valid business licenses and regulatory compliance. The business structure affects available credit options and terms.

Minimum operating history

Most lenders require businesses to have been operating for at least 6–12 months, though some may accept newer businesses with strong founders or unique circumstances.

Established businesses with longer operating histories generally qualify for better terms and higher credit limits due to demonstrated stability and track record.

Revenue or cash flow benchmarks

Lenders typically establish minimum annual revenue requirements, often ranging from $100,000 to $500,000, depending on the credit facility size and terms.

Consistent positive cash flow and growing revenue trends strengthen your application and may result in more favorable credit terms and higher limits.

Credit score and financial health

Both personal and business credit scores factor into approval decisions, with lenders generally preferring scores above 650–700 for optimal terms.

Financial health indicators such as debt-to-income ratios, current liabilities, and payment history with existing creditors significantly influence approval decisions and credit terms.

Documents required to apply for a credit line in Singapore

ACRA business profile

Provide current ACRA business profile documents that verify your company's legal status, registration details, and authorized signatories.

These documents confirm your business's legal standing and provide lenders with essential corporate information needed for credit assessment and account setup.

Recent bank statements

Submit 3–6 months of recent business bank statements that demonstrate cash flow patterns, transaction volumes, and account management practices.

Lenders analyze these statements to understand your business's financial behavior, seasonal patterns, and overall financial stability.

Financial statements (P&L, balance sheet)

Prepare comprehensive financial statements, including profit and loss statements and balance sheets for the past 12–24 months, preferably prepared by qualified accountants.

These statements provide detailed insights into your business's financial performance, profitability, and overall financial health.

Tax documents (NOA)

Include recent Notice of Assessment (NOA) documents and tax returns that verify your reported income and demonstrate tax compliance.

These documents help lenders verify the accuracy of your financial statements and assess your business's actual performance and regulatory compliance.

Director's NRIC or passport

Provide identification documents for all company directors and authorized signatories, including NRIC for Singapore residents or passport copies for foreign nationals.

This documentation is required for identity verification and regulatory compliance purposes.

How to apply for a business line of credit in Singapore

Research and compare lenders

Thoroughly research different lenders, including traditional banks, fintech platforms, and alternative lender,s to understand their credit products, terms, and eligibility requirements.

Compare interest rates, fees, credit limits, and additional features to identify lenders that best match your business needs and qualify for their criteria.

Assess your credit needs

Determine the appropriate credit limit based on your working capital requirements, seasonal fluctuations, and growth plans.

Consider both your immediate needs and future requirements to ensure the credit facility can accommodate your business's evolution without requiring frequent limit increases or refinancing.

Prepare documentation

Gather all required documents well in advance and ensure they're current, accurate, and professionally prepared.

Having complete documentation ready speeds the application process and demonstrates your organization and preparedness to potential lenders, potentially improving your approval chances.

Submit application

Complete the application process according to each lender's requirements, whether online, in-person, or through business banking representatives.

Provide accurate information and respond promptly to any additional requests for information or clarification to maintain momentum in the approval process.

Review and accept offer

Carefully review all terms and conditions of approved offers, including interest rates, fees, repayment requirements, and any restrictive covenants.

Negotiate terms where possible and ensure you fully understand all obligations before accepting the credit facility to avoid future complications or misunderstandings.

How does a business line of credit work in Singapore?

1. Credit limit approval

Once approved, you receive a maximum credit limit based on your business's financial profile, creditworthiness, and assessed needs.

This limit represents the maximum amount you can borrow at any time, though you're not obligated to use the entire amount. The credit limit may be reviewable and adjustable based on your business performance and payment history.

2. Accessing funds

You can access funds through various methods, including online banking transfers, business debit cards, checks, or direct bank transfers to suppliers or vendors.

Most lenders provide multiple access options for convenience, allowing you to use the credit line in ways that best fit your business operations and payment needs.

3. Repayment structure

Repayment terms typically require minimum monthly payments based on your outstanding balance, with flexibility to pay more to reduce interest costs.

You can choose to pay interest-only payments, make principal reductions, or pay off the entire balance, depending on your cash flow situation and financial strategy.

4. Revolving credit cycle

As you repay borrowed amounts, the credit becomes available again for future use, creating a revolving cycle of borrowing and repayment.

This revolving nature provides ongoing access to working capital without requiring new applications or approval processes each time you need additional funding.

5. Renewal or extension options

Most credit lines come with annual or multi-year terms that can be renewed or extended based on your continued creditworthiness and payment performance.

Successful management of your credit line often leads to improved terms, higher limits, or more favorable pricing upon renewal.

Tips for managing a business credit line responsibly

Use the credit line strategically

Deploy your credit line for specific business purposes that generate returns or solve critical operational needs rather than using it as permanent working capital.

Strategic usage includes inventory purchases before peak seasons, taking advantage of supplier discounts, or bridging temporary cash flow gaps rather than covering ongoing operational shortfalls that might indicate deeper business issues.

Avoid maxing out your limit

Maintain credit utilization below 70–80% of your available limit to preserve borrowing capacity for emergencies and demonstrate responsible credit management to lenders.

High utilization rates can negatively impact your credit profile and may trigger concerns from lenders about your business's financial stability or cash flow management.

Make timely repayments

Establish automatic payment systems or calendar reminders to ensure you never miss minimum payment deadlines, as late payments can result in fees, increased interest rates, and negative impacts on your credit profile.

Timely payments demonstrate reliability and may qualify you for better terms or increased limits in the future.

Monitor usage and interest

Regularly review your credit line statements and track interest costs to understand the true cost of borrowing and identify opportunities to reduce usage or optimize repayment timing.

Understanding your borrowing patterns helps you make informed decisions about when to use credit versus cash flow management.

Plan for renewals in advance

Begin renewal discussions with your lender several months before your credit line expires to ensure continuity of access and potentially negotiate improved terms based on your payment history and business growth.

Early planning prevents gaps in credit availability that could disrupt business operations.

Common use cases for credit lines in SMEs

1. Purchasing inventory

Small business line of credit facilities excel for inventory purchases, allowing you to stock up before peak seasons, take advantage of bulk pricing, or respond quickly to unexpected demand spikes.

This use case is particularly valuable for retail businesses, e-commerce companies, and seasonal operations that need flexible inventory financing without depleting cash reserves.

2. Managing payroll during slow periods

Credit lines provide crucial support for maintaining consistent payroll during seasonal downturns, economic uncertainties, or temporary business disruptions.

This ensures you can retain valuable employees and maintain business continuity even when revenue temporarily decreases, preserving your team and operational capacity for recovery periods.

3. Emergency cash flow support

Unexpected business challenges such as delayed customer payments, equipment failures, or sudden market changes can create urgent cash flow needs that credit lines address immediately.

Having pre-approved credit available eliminates the stress and delays associated with emergency loan applications when time is critical.

4. Short-term marketing campaigns

Marketing opportunities often arise at short notice, requiring immediate funding for advertising campaigns, promotional activities, or seasonal marketing pushes.

Credit lines allow you to capitalize on these opportunities without lengthy approval processes, potentially generating returns that more than offset the borrowing costs.

5. Supplier payments and trade credit

Early payment discounts from suppliers can provide significant cost savings that exceed credit line interest costs, making strategic use of credit profitable.

Additionally, credit lines help manage supplier payment timing when customer payment cycles don't align perfectly with your accounts payable schedules.

Why fintech lenders are gaining popularity among SMEs

Faster approval and disbursement times

Fintech lenders leverage technology and automated underwriting systems to provide approval decisions within hours or days rather than weeks, addressing the urgent nature of many business funding needs.

This speed advantage is particularly valuable for time-sensitive opportunities or urgent cash flow situations where traditional banking timelines are impractical.

Minimal paperwork and digital-first processes

Digital lending platforms streamline documentation requirements and allow entirely online application processes, eliminating the need for multiple bank visits, physical document submission, or lengthy paperwork that traditional lenders often require.

This efficiency saves valuable time for busy business owners and reduces administrative burden.

Customized credit lines for diverse business needs

Fintech platforms can offer more flexible credit products tailored to specific industries, business models, or operational patterns that traditional banks might not accommodate.

This customization includes features like revenue-based pricing, seasonal payment adjustments, or integration with business management software that traditional lenders typically don't provide.

Integrated tools for spend and finance management

Many fintech lenders provide comprehensive financial platforms that combine credit facilities with expense management, accounting integration, and financial reporting tools.

This integration creates value beyond just lending by helping businesses manage their entire financial operations more efficiently.

Greater accessibility for new and small businesses

Fintech lenders often use alternative credit assessment methods that consider factors beyond traditional credit scores and collateral requirements.

Making credit more accessible to newer businesses, startups, or companies with limited traditional credit history but strong operational metrics.

Transparent pricing with fewer hidden fees

Digital lending platforms typically provide clearer, more transparent pricing structures with fewer hidden fees or complex terms compared to traditional banking products.

This transparency helps business owners make more informed decisions and budget more accurately for borrowing costs.

Choosing the right business credit line provider in Singapore

1. Assess your business needs and use cases

Clearly define how you plan to use the credit line, whether for seasonal inventory, emergency cash flow, growth investments, or ongoing working capital needs.

Different lenders specialize in different use cases, so understanding your specific requirements helps identify providers whose products align with your operational patterns and strategic objectives.

2. Compare interest rates and fee structures

Analyze the total cost of borrowing, including interest rates, setup fees, maintenance fees, and transaction charges to understand the true cost of each credit option.

Pay attention to variable rate structures, penalty fees, and how rates might change based on utilization levels or market conditions over time.

3. Evaluate credit limits and repayment terms

Ensure the available credit limits meet both your current needs and anticipated future requirements, while confirming that repayment terms align with your cash flow patterns.

Consider whether limits can be increased over time and how repayment flexibility supports your business's seasonal or growth patterns.

4. Check for application speed and approval time

If you need quick access to credit, prioritize lenders known for fast approval processes and immediate fund availability.

Consider whether the lender can provide emergency access to funds and how quickly they can process limit increases or other account modifications when business needs change.

5. Consider collateral requirements and flexibility

Evaluate whether you prefer secured credit with potentially better terms or unsecured options with more flexibility but possibly higher costs.

Consider how collateral requirements might affect your business operations and whether you have suitable assets to secure credit if needed.

6. Review customer support and account management

Assess the quality of ongoing customer support, availability of dedicated account managers, and the lender's reputation for service quality.

Consider whether the lender provides business advisory services, financial guidance, or other value-added services that could benefit your business beyond just lending.

7. Look for integration with financial tools and platforms

If your business uses specific accounting software, payment systems, or financial management tools, prioritize lenders whose platforms integrate seamlessly with your existing systems.

This integration can streamline financial management and provide better visibility into your borrowing and spending patterns.

Volopay business credit line: Smart financing for modern SMEs

Volopay transforms traditional business financing by creating an integrated platform that combines flexible credit access with comprehensive spend management capabilities designed specifically for modern businesses.

Fast approval, no collateral needed

Volopay's streamlined digital application process typically provides approval decisions within 24–48 hours without requiring traditional collateral or extensive documentation.

Our technology-driven assessment methods focus on your business's operational performance and forward-looking potential rather than historical asset accumulation, making credit accessible to growing businesses that might not qualify for traditional bank facilities.

Flexible credit line tailored to business needs

The platform offers customizable credit limits and repayment terms that can adapt to your specific business model, whether you're a seasonal retailer, growing SaaS company, or service-based business with irregular cash flows.

This flexibility extends to usage patterns, allowing you to increase or decrease utilization based on actual business needs rather than fixed borrowing schedules.

Integrated with Volopay's spend management platform

Unlike standalone credit products, Volopay's credit line integrates seamlessly with our comprehensive expense management system, providing unified control over both incoming credit and outgoing expenses.

This integration allows you to track spending in real-time, set departmental budgets, and maintain complete visibility over your company's financial operations from a single dashboard.

Real-time visibility and control for finance teams

Finance teams gain unprecedented visibility into company spending through detailed reporting, automated categorization, and customizable approval workflows that prevent unauthorized expenses.

The platform provides real-time alerts, spending analytics, and budget tracking that help maintain financial discipline while providing operational flexibility.

Transparent terms with no hidden fees

Volopay maintains transparent pricing with clearly disclosed interest rates and fees, eliminating the surprise charges or complex fee structures common with traditional banking products.

This transparency allows for accurate budgeting and cost planning, helping you make informed decisions about credit utilization and financial management strategies.

Volopay vs. other providers: Why Volopay stands out

Paperless, fast application

While traditional banks require extensive documentation and multiple meetings, Volopay's completely digital process eliminates paperwork and reduces approval time from weeks to days.

This efficiency is particularly valuable for businesses that need quick access to credit or want to avoid the administrative burden of traditional banking relationships.

All-in-one finance stack with credit line + spend tools

Unlike providers that offer only lending services, Volopay combines credit facilities with expense management, corporate cards, and financial reporting in one integrated platform.

This comprehensive approach eliminates the need to manage multiple financial service providers and creates synergies that improve overall financial efficiency.

Better suited for digital-first startups and SMEs

Volopay's platform design and features cater specifically to modern, technology-driven businesses that prioritize digital solutions and integrated financial management.

Our platform understands the unique needs of startups and growing SMEs, offering features like team spending controls, automated expense reporting, and scalable credit facilities that grow with your business rather than requiring constant renegotiation.

Transparent pricing, no hidden charges

While many traditional lenders include complex fee structures with hidden charges for maintenance, transactions, or account management, Volopay maintains straightforward pricing that you can understand and budget for accurately.

This transparency builds trust and allows for better financial planning without unexpected costs that can strain cash flow.

Ongoing credit access, not one-time disbursement

Unlike term loans that provide lump-sum funding, Volopay's revolving credit facility provides continuous access to working capital as your business needs evolve.

This ongoing availability eliminates the need to repeatedly apply for new financing and provides the flexibility to scale your borrowing up or down based on actual business requirements.

FAQs about business credit lines in Singapore

Collateral requirements vary significantly among lenders, with many fintech platforms and some banks offering unsecured credit lines based on business performance and creditworthiness.

Many modern lenders, particularly fintech platforms, accept startups with as little as 6-12 months of operating history, focusing on revenue trends, business model viability, and founder credentials rather than extensive historical data. Some providers even consider pre-revenue startups with strong business plans and experienced management teams.

Responsible use of a business line of credit can positively impact both your business and personal credit scores by establishing a positive payment history and demonstrating effective debt management. However, late payments, high utilization rates, or defaults can negatively affect your credit profile, making responsible management crucial.

Most modern credit line providers, especially fintech lenders, allow early repayment without penalties, giving you flexibility to reduce interest costs when cash flow permits. However, some traditional banks may include prepayment restrictions, so it's important to review terms carefully before committing to any credit facility.

Regular use and timely repayment of your credit line creates a positive payment history that strengthens your business credit profile over time. This improved credit standing can lead to better terms on future financing, higher credit limits, and greater access to various business financial products as your company grows and establishes stronger banking relationships.