Best prepaid credit cards in Singapore for businesses in 2025

Prepaid credit cards have become the new normal among all business payment methods. The prepaid card market in Singapore is expected to reach US$11.89 billion by 2026. This is a CAGR of 11.5% from 2022 when the market value was estimated to be US$7.68 billion.

Naturally, the stark rise in the market value is not only because prepaid credit cards are easier to use but also because they enable more control and authority over business expenses. While using normal credit cards, you are basically borrowing money, whereas prepaid credit cards are already loaded with money.

What is a prepaid credit card?

Prepaid credit cards in Singapore come with funds already loaded in them. This means that you can spend up to the given credit card limit. In function and process, these cards are very similar to traditional credit cards.

However, the only difference is that while using a credit card, you are constantly borrowing from the bank or the financial institution.

But with a prepaid credit card, you already have the funds available in it. Think of it like a gift card; every transaction is subtracted from the existing balance.

6 best prepaid cards in Singapore for businesses in 2025

Now that you’ve seen the overview, let’s dive deeper into each card to explore their features, benefits, and limitations to help you make a more informed choice.

1. Volopay prepaid cards

● Overview

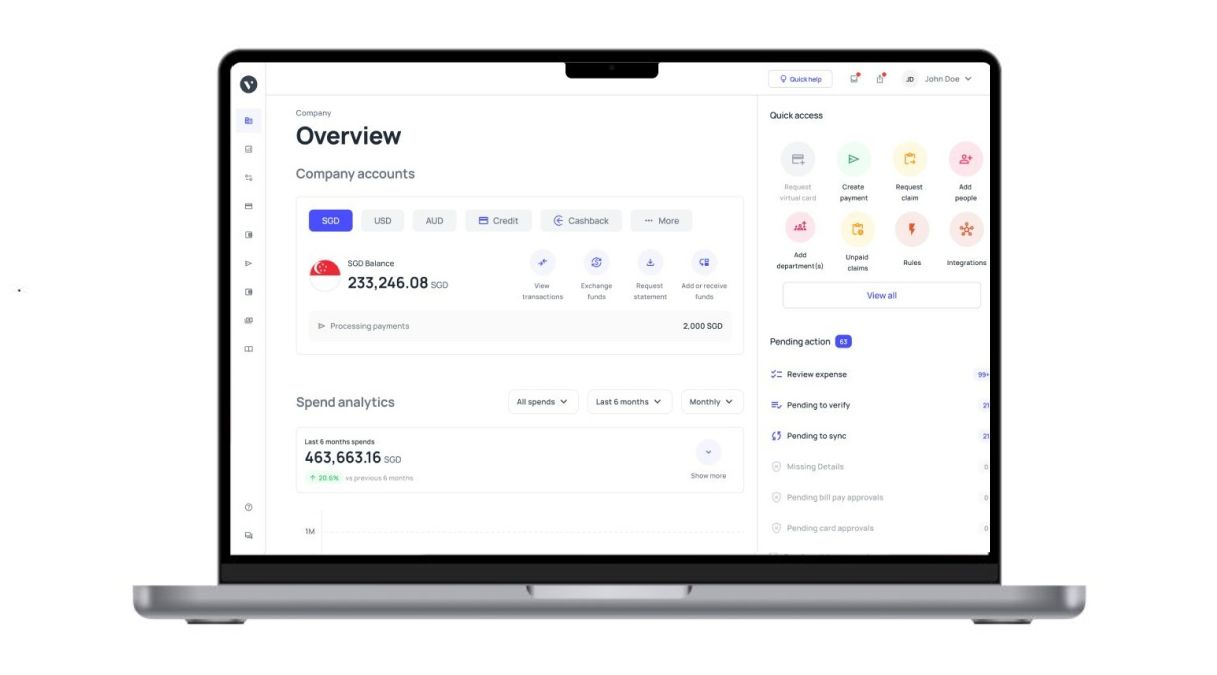

Volopay is a modern FinTech brand that provides an expense management platform for businesses along with various payment tools.

Volopay’s prepaid cards are designed for businesses looking to simplify their expense management. It's a smart prepaid card in Singapore offering full visibility over your spending, budgets, and approvals—all in one platform.

● Key features

Volopay provides physical and virtual prepaid cards, real-time spend tracking, and automated expense reporting. You can assign cards to employees with custom limits and categories.

This helps employees have easy access to budgets for business and expenses, and helps employers and managers control & monitor how budgets are being used by each employee with access to a prepaid company card.

● Advantages

With Volopay, you gain control over company expenses while reducing reliance on reimbursements and manual reporting. It is beneficial for both the employee and the employer as it reduces the amount of paperwork and also makes the process seamless for both parties. It’s ideal if you want a prepaid solution that complements accounting automation.

● Multi-currency support

The card supports SGD, USD, EUR, and more, letting you make international transactions with minimal FX charges—perfect for regional or global operations. The platform also supports sending money to over 130 countries through payment tools other than prepaid cards.

● Digital and ERP integration

Volopay integrates seamlessly with popular accounting and ERP tools like Xero, QuickBooks, and NetSuite, enabling real-time transaction syncing and cleaner bookkeeping. These integrations improve the overall accounting process for the finance team and make systems more efficient.

● Onboarding process

You’ll find the onboarding process fast and digital—sign up online, complete your KYC, and issue prepaid cards to your team in just a few days. A customer support executive will be in contact with you to help you along the way if you have any questions or queries about completing the onboarding process.

● Security features

Advanced security includes card freezing, spend limits, and transaction alerts. You can deactivate or restrict cards instantly via the dashboard if anything seems off. Volopay is SOC 2 certified, along with our existing ISO 27001 and PCI DSS certifications, recognizing how crucial data safety is to us.

● Target customers

This Singapore prepaid card is best for startups, SMEs, and regional businesses looking to scale with clear financial control. These businesses have the potential to get the most out of the prepaid card product provided by Volopay.

● Limitations

Currently, Volopay is only available to registered businesses, so it’s not suited for freelancers or sole proprietors seeking a personal-use card.

2. Revolut prepaid cards

● Overview

Revolut offers a versatile Singapore prepaid credit card that caters to both individuals and businesses. Their business prepaid cards come with global payment support and advanced budgeting tools, enabling better control over team spending.

With features like real-time notifications, multi-currency wallets, and custom card limits, you can easily manage international transactions and subscriptions.

● Key features

Features include corporate cards, expense categorisation, mobile banking, and multi-user access, making it easier to delegate financial responsibilities across teams.

You can set spending limits for each cardholder, manage recurring subscriptions, automate expense approvals, and monitor transactions in real time directly from the app, ensuring full visibility and control over your company’s finances.

● Multi-currency support

Revolut offers multi-currency support through its accounts and cards, allowing users to hold, exchange, and spend in multiple currencies. It allows you to hold and exchange over 30 currencies at competitive rates, which is ideal if your business deals with overseas vendors or international clients.

● Digital and ERP integration

While direct ERP integrations are limited, Revolut’s data exports work well with most cloud accounting platforms, offering enough flexibility for small businesses to maintain accurate records.

You can easily download transaction reports in various formats and upload them into software like Xero or QuickBooks, streamlining your reconciliation and bookkeeping processes without much manual effort.

● Onboarding process

The onboarding is app-driven and relatively quick. After your business verification, you can start issuing prepaid cards for your team instantly.

Revolut is also available for individual users, and the onboarding process for new users is similar where you must download the app, provide personal information (like name, date of birth, and address), verify identity (often with a photo ID and a selfie), and agree to the terms and conditions.

● Security features

Get real-time notifications for every transaction, freeze or unfreeze cards instantly, and set role-based permissions to control how different employees use their cards.

You can also restrict spending by category or merchant type. Revolut uses top-tier encryption, continuous fraud monitoring, and advanced authentication protocols to ensure your business funds stay safe at all times.

● Target customers

Revolut is best for freelancers, digital nomads, and small business owners needing a lightweight, internationally-friendly prepaid credit card in Singapore.

● Limitations

Revolut’s business plans can become pricey as you scale, especially if your company requires additional features like bulk payments, priority support, or API access, which are locked behind higher-tier subscriptions.

Additionally, customer support isn’t always as responsive as you'd expect for a financial service, with reported delays in resolving issues or receiving timely assistance during urgent situations. This can be a drawback for businesses that rely on round-the-clock support for financial operations.

3. Aspire cards

● Overview

Aspire offers a sleek, digital-first prepaid credit card in Singapore tailored for startups and SMEs aiming to streamline financial operations. It’s built for companies that want a simple, paperless way to manage spending, reimbursements, and budgets without relying on traditional banking processes.

With a strong focus on automation, Aspire eliminates manual expense tracking and provides real-time visibility into company spending. Its user-friendly platform empowers finance teams to issue virtual cards instantly, control budgets, and reconcile expenses.

● Key features

The Aspire product line includes several different platforms with distinct key features. You get to enjoy unlimited virtual cards, access to robust spend controls, real-time expense tracking, and cashback on qualifying categories like SaaS and digital marketing expenses.

● Multi-currency support

Aspire cards offer multi-currency support, allowing businesses to hold and transact in multiple currencies, reducing FX fees and optimizing international payments.

The cards support SGD and USD, with competitive exchange rates and zero foreign transaction fees—useful for cross-border expenses and paying overseas service providers.

● Digital and ERP integration

Aspire integrates seamlessly with Xero, QuickBooks, and other leading accounting software, making it easier to maintain accurate financial records without manual data entry. Automated transaction syncing ensures that every expense made with your prepaid credit card in Singapore is reflected in your books in real time.

Reconciliation becomes a smooth, hassle-free process with features like categorised transactions, matching rules, and real-time ledger updates. This reduces errors, saves valuable time for your finance team, and makes month-end closing significantly faster, cleaner, and more reliable—especially useful for businesses that handle high volumes of transactions.

● Onboarding process

You can sign up online with your ACRA and director details. Aspire’s digital KYC process usually completes within a few business days, with cards issued quickly. The registration process is a simple and straightforward one that you can easily access on their website.

● Security features

Enable and disable cards anytime with just a few clicks, giving you full control over who can spend and when. You can set detailed per-user permissions, such as spend limits by category, department, or project, to ensure compliance with internal budgets.

Monitor card activity in real time through the Aspire dashboard, helping you detect unusual transactions instantly. Aspire also uses bank-grade encryption, secure authentication layers, and two-factor verification to protect your data and funds. These enterprise-grade security features ensure that your Singapore prepaid credit card usage remains safe, even across large and distributed teams.

● Target customers

Perfect for tech-savvy startups, e-commerce brands, and service-based businesses in need of a lightweight, flexible Singapore prepaid credit card for team-wide use.

● Limitations

Aspire currently doesn't issue physical cards automatically—virtual cards come first, and physical ones are optional. It also lacks support for more complex ERP tools. The platform has also been known to have various bugs, including approval issues, currency issues, and geographical limitations, depending on your business’s use case and needs.

4. DBS prepaid cards

● Overview

DBS offers one of the most trusted options for prepaid credit card in Singapore, backed by the reputation and stability of a leading local bank. It’s an excellent choice if you value traditional banking reliability combined with the convenience of modern prepaid functionality.

With DBS, you get the assurance of dealing with a well-regulated financial institution, along with access to physical branches and in-person customer support—something many digital-only providers lack.

● Key features

DBS’s corporate prepaid cards offer reloadable balances, spending limits, and expense tracking. You also get access to ATM withdrawals and POS payments locally and overseas.

Whether you're looking to simplify corporate spending or issue controlled-use cards to employees, DBS’s solution provides peace of mind, especially for companies that prefer working with established banking partners.

● Multi-currency support

DBS cards primarily operate in SGD but offer multi-currency transaction capability with standard foreign exchange rates—suitable for occasional international use. The Corporate Multi-Currency Account allows businesses to hold and transact in multiple currencies, while the UnionPay debit card enables direct payments in 14 currencies without conversion fees.

● Digital and ERP integration

Integration is limited compared to fintech players that offer real-time syncing with cloud-based accounting platforms.

However, businesses using DBS IDEAL—the bank’s corporate banking platform—can still manage their finances effectively by exporting transaction data in various formats such as CSV or Excel. This data can then be manually uploaded into accounting systems like Xero, QuickBooks, or SAP.

While this process lacks automation, it allows for a reasonable degree of compatibility with existing workflows. For companies with an in-house finance team or those already using DBS for other services, this manual process can still be a workable solution.

● Onboarding process

The DBS business card onboarding process in Singapore involves an online application, potential paperwork, and card activation. DBS offers onboarding for DBS Business Accounts with online applications, and users can opt in for DBS IDEAL.

The approval might take slightly longer than fintech competitors. Once the account is ready, users can log in to DBS IDEAL via their mobile device. Card activation can be done through a QR code, website, DBS IDEAL, or by mailing a completed form.

● Security features

DBS cards come with comprehensive security features, including 24/7 fraud monitoring that continuously scans for suspicious activities to protect your business funds. The cards are equipped with EMV chip technology, providing an added layer of protection against counterfeit fraud.

Additionally, multi-level authentication safeguards your account access by requiring multiple verification steps during transactions or account changes. If you ever suspect any unauthorized use or simply want to control spending, you can instantly block or unblock cards directly through the DBS IDEAL online banking platform, giving you quick and convenient control over your prepaid card security anytime, anywhere.

● Target customers

Best for established businesses and SMEs that prefer a prepaid card tied to a reputable local bank with physical branches and customer service support.

● Limitations

ERP integration is minimal, and the onboarding process can feel cumbersome. Not as agile or real-time as fintech solutions like Aspire or Volopay.

5. Wise prepaid cards

● Overview

The Wise prepaid card is perfect if your business frequently transacts in foreign currencies, offering a hassle-free way to manage international payments without excessive fees.

It’s a globally trusted prepaid credit card in Singapore praised for its low foreign exchange (FX) fees, transparent pricing model, and real exchange rates, which means you get the fairest possible rates without hidden markups.

● Key features

You get real exchange rates, expense categorisation, mobile access, and virtual or physical card options. It's great for international online purchases and business travel.

Whether you’re paying overseas suppliers, reimbursing remote employees, or managing subscriptions in different currencies, Wise provides an efficient, cost-effective solution that helps your business save money and simplify cross-border transactions.

● Multi-currency support

Wise Business accounts support over 40 currencies and offer local account details in 160+ countries, making them ideal for businesses with international transactions. You can pay vendors, employees, or subscriptions globally with minimal FX costs and no hidden fees.

● Digital and ERP integration

Wise doesn’t offer direct ERP integration like some fintech competitors, which means it doesn’t automatically sync transactions with your accounting or enterprise resource planning software.

However, you can easily export your transaction data in widely used formats such as CSV or Excel. This exported data can then be manually imported or uploaded into popular accounting platforms like Xero, QuickBooks, or other Excel-based bookkeeping systems.

While it requires some manual effort, this flexibility still allows you to keep your financial records accurate and up to date, especially if your business uses multiple financial management tools.

● Onboarding process

To sign up for a Wise card, you'll first need to create a Wise account, which involves verifying your identity and setting up your account. The sign-up process is fully digital—just provide your business details and identity documents. Wise typically verifies your account within a few working days, with cards shipped soon after.

● Security features

You’ll benefit from enhanced security measures such as two-factor authentication, which requires an additional verification step to access your account, adding an important layer of protection against unauthorized access. You can instantly freeze or unfreeze your Wise prepaid card via the app if you suspect any suspicious activity or simply want to control usage.

Real-time spending notifications keep you informed of every transaction, helping you quickly spot any unusual charges. Additionally, Wise employs top-tier data encryption and advanced fraud prevention tools, ensuring that your funds and personal information remain secure from cyber threats and fraudulent activities at all times.

● Target customers

Ideal for freelancers, startups, and SMEs that make regular cross-border transactions. This Singapore prepaid credit card is especially useful for remote teams and global payments.

● Limitations

Wise doesn’t offer credit or expense control features, making it less suitable for team-wide corporate expense management compared to cards like Volopay or Aspire.

6. YouTrip card

● Overview

YouTrip is a travel-focused prepaid credit card in Singapore that has gained popularity for its low foreign exchange rates and user-friendly mobile app.

Although it’s primarily designed for personal travel use, many small business owners also rely on YouTrip for overseas payments due to its convenience and cost savings on currency conversions.

The card supports spending in multiple currencies without foreign transaction fees, making it a practical choice for entrepreneurs who frequently travel or make international online purchases.

● Key features

Enjoy fee-free FX across 150+ currencies, instant top-ups via PayNow, and in-app spend tracking. It’s a multi-currency wallet that works for both travel and online purchases. While it lacks some advanced business features, YouTrip remains a valuable option for those seeking an affordable and flexible prepaid card solution.

● Multi-currency support

YouTrip supports 10 wallet currencies and lets you spend in over 150 currencies globally with competitive exchange rates and no foreign transaction fees. It is designed for both personal and business travel, offering multi-currency support with competitive exchange rates and no foreign transaction fees.

● Digital and ERP integration

The YouTrip card doesn’t integrate with ERP or accounting systems, which means it lacks the automated expense tracking and reporting features that many businesses rely on for structured financial management.

This limitation makes it more suitable for ad-hoc or occasional use, such as individual overseas payments or travel expenses, rather than for ongoing, systematic expense management within a company.

● Onboarding process

Quick and fully mobile—you can download the app, submit your ID, and get approved in minutes. The physical card is mailed to your address shortly after.

● Security features

Lock or unlock your card instantly, receive real-time transaction alerts, and enjoy Mastercard's global fraud protection. YouTrip also uses encrypted logins and biometric security.

● Target customers

Best for solopreneurs or business travellers needing a simple, FX-friendly Singapore prepaid credit card for overseas trips or international purchases. YouTrip is ideal if you need a simple, low-cost prepaid card for personal or occasional business use.

● Limitations

YouTrip isn’t built for teams or expense controls. There’s no ERP sync, no budgeting features, and no way to issue multiple cards to employees. Without integration, businesses must manually reconcile transactions, which can be time-consuming and prone to errors.

Take control of your finances

Benefits of using a prepaid credit card

1. Help build a company credit score

Unlike regular credit cards, prepaid credit cards allow you to spend money that you loaded into the card. So it is not exactly borrowing credit from the provider.

Hence, prepaid credit cards do not affect your company credit score. Any spending or transactions made through the prepaid credit card is not reported or logged to the credit bureaus.

2. Helps manage and control spending

As you only get to spend the amount that is loaded in the prepaid credit card, only transactions up to that limit will be allowed. Once the funds are exhausted, non-reloadable prepaid credit cards do not allow any more spending.

However, some other prepaid credit cards can be reloaded. But for once, with the spend amount, there will be no overspending.

3. Improves cash flow

Prepaid credit cards help to improve the business cash flow as all expenses are tracked. Business payments and purchases can move quickly and efficiently using these cards.

As all expenses will be made through the card, streamlined transactions become a natural outcome. Ultimately, the business cash flow will remain stable, and the business will be able to make better spend decisions.

4. Convenient and widely accepted payment method

With the rising popularity of prepaid credit cards, it has become a common and widely accepted payment method. As these are also easy to use, every business uses a prepaid credit card and accepts payments through it.

Along with this, these cards are convenient and help businesses make quick and faster payments. Plus, all the payments can be managed through the mobile app.

5. Faster reconciliation

As all the prepaid credit card expenses are tracked and recorded, the accounting and finance team of the company can ease off a bit as reconciliation will no more be as taxing and cumbersome as it used to be.

All the expense data from the prepaid credit card app or system can be transferred or integrated with your existing expense management software. Hence, all the data will automatically be checked and reconciled according to the other payment aspects.

6. Improved expense tracking

Prepaid credit cards work on an already-loaded sum of money. All expenses incurred are deducted from the existing balance.

Every expense is tracked in real-time. This means the where, when, and how much of all the transactions are recorded in the app or software connected to the cards.

This means you can access that database anytime and look up any expense. No expenses will get mixed up, and no need to keep the physical receipts.

7. Enhanced security

One of the most amazing features of prepaid credit cards is that they are not directly connected to the business’s main spending account. This means there is no way any hacker will reach your business bank account.

Plus, these cards can be operated through your phone so that you can block or freeze these cards anytime.

8. Promotes financial discipline and helps in budgeting

As prepaid credit cards are loaded with a certain amount of funds so the employees and managers automatically will be more mindful of the expenses.

All expenses will have o be under the given spending limit. Hence financial discipline in spending behavior comes naturally. Along with this, adhering to the business budget will also no more be a difficult task.

Things to consider when choosing a prepaid credit card

Fees and charges

Understanding the fee structure is paramount. Prepaid credit cards in Singapore may have activation fees, monthly maintenance fees, ATM withdrawal fees, and transaction fees. Examine these charges closely to ensure they align with your usage patterns and budget.

Reload options

Consider the convenience of reloading funds onto the card. Some cards offer multiple reload options, including bank transfers, direct deposits, or cash reloads at specified locations. Choose a card with reload methods that suit your preferences and accessibility.

Rewards and benefits

While not all prepaid cards offer rewards, some come with cashback programs, discounts, or loyalty points. Evaluate whether the rewards align with your spending habits and if they provide tangible benefits that enhance the overall value of the card.

Security features

Security is non-negotiable. Assess the security features offered by the prepaid card, such as two-factor authentication, fraud protection, and the ability to set transaction alerts. These features contribute to a secure and worry-free usage experience.

Customer support

Reliable customer support is essential in case of issues or queries. Prioritize cards with responsive customer support channels, including phone, email, and live chat. Check user reviews to gauge the quality of customer service provided by the card issuer.

Currency conversion fees

If you anticipate using the card for international transactions, scrutinize the currency conversion fees. Some cards offer competitive rates, while others may impose higher fees. Opt for a card that minimizes additional costs for cross-border transactions.

Overseas usage

For frequent travelers, assessing the card's suitability for overseas usage is crucial. Check if the card is widely accepted internationally and inquire about foreign transaction fees. Cards designed for global use with favorable terms can be advantageous for those who frequently travel abroad.

Reviews and ratings

User reviews and ratings provide valuable insights into the practicality and reliability of a prepaid card. Assess feedback from existing users to understand their experiences, both positive and negative. Look for patterns in reviews that align with your priorities and concerns.

Mobile app and online account management

A user-friendly mobile app and robust online account management system can greatly enhance your prepaid card experience. Look for features such as real-time transaction tracking, budgeting tools, and the ability to freeze or unfreeze the card through the app for added security.

Load limits and maximum balance

Understand the card's load limits and maximum balance restrictions. Some prepaid credit cards in Singapore have limits on the amount you can load onto the card, and exceeding these limits may result in additional fees. Ensure these limits align with your financial requirements.

How to get a prepaid credit card in Singapore?

Businesses can get prepaid credit cards from either banks or other financial services-providing institutions. Every provider has a process in place to work on your request to get a prepaid credit card, and every provider might have different features on the card.

However, some basic requirements remain the same. Here is how you can get a prepaid credit card in Singapore.

1. Research and find the right provider

Before getting a prepaid card, elementary research is essential. When you decide to get a prepaid credit card, you know the loophole or pain points your business is looking to fulfill.

Hence, research the different options available in the market and shortlist those providers who align with your company's needs and demands. Choose the ones that offer the features you specifically want and are also price compatible.

2. Check the eligibility criteria

As stated above, each provider has its own way of processing your card request and has its own eligibility criteria set in place.

Once you have shortlisted the providers that align with your business demands, next look at the criteria and see: whose does your business match the best?

Look at the ones that fit the best and shorten the list.

3. Application process

Step 3 is to check out the application process. Now that you have the providers shortlisted look into their application process. Understand all the steps and make a note of all the documents required.

Gather those necessary documents; some of the common ones are business owner identity proof, annual revenue generation documents, business registration documents, etc.

4. Complete the application process

Now that you are armed with the necessary documents go ahead and fill out the application. Some providers conduct the whole process offline, whereas some facilitate an online procedure.

Complete the application process and make a note of the date by which the institution promises to send you the card.

5. Credit assessment and approval

If you decide to get a corporate credit card, there is a whole credit assessment and approval process.

To get a corporate credit card, there are various requirements for a business to fulfil, like a good credit score, ACRA registration, a valid UEN number, a minimum of 15 employees, an annual turnover should be more than $4 million, and $250,000 or more should be the annual company expense.

There might be other criteria that are subjective to the provider.

6. Setting credit limits and card usage policies

After your business profile check, you are given corporate credit cards with a certain limit of credit. Based on your credit score and repayment history, the credit amount is decided.

Along with this, you have to list down the card usage policies of your business and clearly share them with all the employees.

7. Card activation and distribution to employees

Once you get a corporate credit card, you can activate it using the mobile app or card software and give them to your employees.

Don’t worry; you are not giving up your entire control. You can set spending limits and align the card with the company spending policies to make sure that no employee overspends or charges the company for any of their personal expenses.

8. Monitoring the expenses and usage of company credit cards

After corporate credit cards smoothly fit into your system. You can easily track and manage your card expenses. You can monitor the transactions made through the card; you can check the details of any expenses at any time.

Along with this, if you get a corporate credit card through an expense management system, they provide you the feature of automatic creation of expense report creation and analytics.

Enjoy seamless financial control

Best tips for using prepaid cards wisely

1. Set clear spending limits

Define spending limits based on your budget and financial goals. Establishing clear limits helps prevent overspending and ensures that the prepaid card aligns with your financial plan.

2. Categorize expenses

Categorize expenses to gain a detailed understanding of where your money is going. This not only aids in budgeting but also enables you to analyze spending patterns and make informed financial decisions.

3. Track transactions in real time

Take advantage of the real-time tracking features offered by many prepaid cards in Singapore. Regularly monitoring transactions allows you to stay updated on your current balance and identify any unauthorized or suspicious activities promptly.

4. Implement spending policies

For businesses using prepaid cards, implement clear spending policies to guide employees in their usage. Define permissible expenses, spending limits, and any specific guidelines to ensure responsible use of the prepaid cards.

5. Regularly reconcile accounts

Regularly reconcile your prepaid card accounts with your budget or financial plan. This practice helps identify discrepancies, track your financial progress, and ensures that your spending aligns with your goals.

6. Utilize automation and software integration

Leverage automation and software integration to streamline financial management. Many prepaid card providers offer integration with accounting software, making it easier to track expenses, generate reports, and maintain accurate financial records.

7. Leverage security features

Familiarize yourself with the security features of your prepaid card and use them to enhance protection. Activate transaction alerts, enable two-factor authentication, and set up any additional security features provided by the card issuer.

8. Educate employees

For businesses using prepaid cards for employee expenses, invest in employee education. Ensure that your staff understands the proper use of the cards, security protocols, and any company-specific guidelines.

9. Consider multi-currency cards

If you engage in international transactions, consider using multi-currency prepaid cards. These cards minimize currency conversion fees and provide a convenient solution for businesses or individuals dealing with various currencies.

10. Regularly review usage and needs

Periodically assess your usage patterns and financial needs. As circumstances change, your spending requirements may evolve. Regular reviews help ensure that your prepaid card continues to meet your financial objectives.

11. Avoid ATM withdrawals

Prepaid cards often come with ATM withdrawal fees. Minimize these costs by avoiding unnecessary cash withdrawals. Instead, opt for electronic transactions whenever possible to save on fees.

12. Stay informed about fees

Be aware of all associated fees, including activation fees, monthly maintenance fees, and transaction fees. Understanding the fee structure allows you to make informed decisions and choose prepaid cards that align with your budget.

13. Report lost or stolen cards immediately

In case your card is lost or stolen, take immediate action. Report the incident promptly to the card issuer to minimize the risk of unauthorized transactions. Many prepaid cards in SIngapore provide liability protection if such incidents are reported without delay.

14. Regularly review card options

The prepaid card landscape evolves, with new features and offerings regularly introduced. Stay informed about the latest card options, features, and promotions. Periodically reviewing your card options ensures that you're using the most suitable financial tool for your needs.

How do Volopay prepaid cards help businesses?

There are numerous new tools to help businesses make quick and secure payments; one of them is a prepaid credit card. Prepaid credit cards in Singapore are the best to control overspending while avoiding a debt trap.

Now that we have you here, let us introduce you to the best player in the corporate cards game — Volopay! Along with being an extensive expense management software, it offers high-tech corporate cards.

Volopay cards help businesses make payments easily, track and record all activity in real-time, get access to unlimited virtual cards, integrate directly with accounting software for accounting automation, make quick international payments at the lowest FX rates, and a lot more. Here are the few reasons why you should use Volopay cards for your business:

1. Streamlining expense management

Volopay prepaid cards play a pivotal role in streamlining expense management for businesses. The platform offers real-time expense tracking and reporting, providing businesses with unprecedented visibility into their spending patterns.

This feature ensures that companies can effectively monitor and control expenses, facilitating a more efficient and accountable financial management process. By centralizing expense-related data on a single platform, Volopay empowers businesses to make informed decisions and optimize their spending strategies.

2. Enhanced security

Security is a top priority for any business, and Volopay prepaid cards are designed with robust security features. The platform incorporates advanced security measures such as transaction alerts, approval workflows, two-factor authentication, and fraud protection.

This not only safeguards the financial assets of the business but also provides peace of mind to business owners and financial managers. The enhanced security measures ensure that only authorized transactions are processed, mitigating the risks associated with unauthorized access and fraudulent activities.

3. Convenience

Volopay prioritizes user-friendly features to boost overall convenience for businesses. The prepaid cards in Singapore, available both virtually and physically, cater to the diverse needs of businesses.

This flexibility enables businesses to select the card type that aligns with their preferences and operational requirements. Moreover, the easy integration of Volopay cards with popular accounting software adds to the platform's convenience, facilitating a seamless financial management experience.

4. Helps in fast and secure payments

Volopay excels in facilitating fast and secure payments for businesses. The platform ensures that transactions are processed in real-time, reducing delays in payment cycles. Additionally, the security features embedded in Volopay prepaid cards contribute to the overall speed and safety of transactions.

This is particularly valuable for businesses that prioritize efficiency and reliability in their payment processes.

5. Proven spend controls

One of the standout features of Volopay prepaid cards is the implementation of proven spend controls. Businesses can customize spending limits and permissions for each card, tailoring the controls to match the unique needs of their teams or departments.

This level of customization empowers businesses to enforce budgetary constraints and prevent unauthorized or excessive spending. The result is a more disciplined and controlled approach to corporate spending.

6. Better bookkeeping

Volopay significantly contributes to better bookkeeping practices for businesses. The integration of the prepaid cards with accounting software ensures that transaction data is seamlessly recorded and categorized.

This automation not only saves time but also minimizes the risk of manual errors in record-keeping. Businesses can generate detailed and accurate financial reports effortlessly, aiding in better decision-making and compliance with accounting standards.

7. Get unlimited virtual cards

Volopay provides businesses with the benefit of unlimited virtual cards at no added costs whatsoever. This attribute is especially advantageous for enterprises managing various departments or projects, enabling them to distribute virtual cards tailored to specific needs without the limitations of physical availability.

The unrestricted access to virtual cards affords businesses the flexibility to adjust their financial instruments to the ever-changing and progressive aspects of their operations.