The 8 best accounts payable software to consider in 2025

Accounts payable is one of the most important tasks for the finance and accounting teams of a company.

It is a crucial aspect of the business function that helps operations keep running smoothly with on-time payments. Any hiccup in payments to vendors can halt business operations and delay timelines.

This can especially be a problem for small businesses, as they have to work with a few groups, and making sure that nothing goes wrong with them is paramount to business development and growth.

This is where accounts payable software can be a super helpful tool to ensure that all payments are made on time without any problems.

What is accounts payable software?

Accounts payable software is a tool that helps companies use a central system to execute and handle all their accounts payable related tasks.

This can include things like processing invoices, making domestic & international money transfers, creating and managing a vendor database, and setting up compliance policies for employees to spend allocated budgets.

Some of the best accounts payable software for small businesses are the ones that also provide some form of automation to help finish AP tasks much faster.

Rather than having AP team members in your company do everything manually, automation helps fast-track processes while also reducing the errors that are commonly overlooked or created by humans.

The 8 best accounts payable software to consider

You will find many accounts payable software for businesses in the market and choosing the right one for you might often come down to the ease of use of the application or the price that you have to pay for it.

Listed below are some of the best accounts payable software in Singapore in 2025.

1. Volopay

● Overview

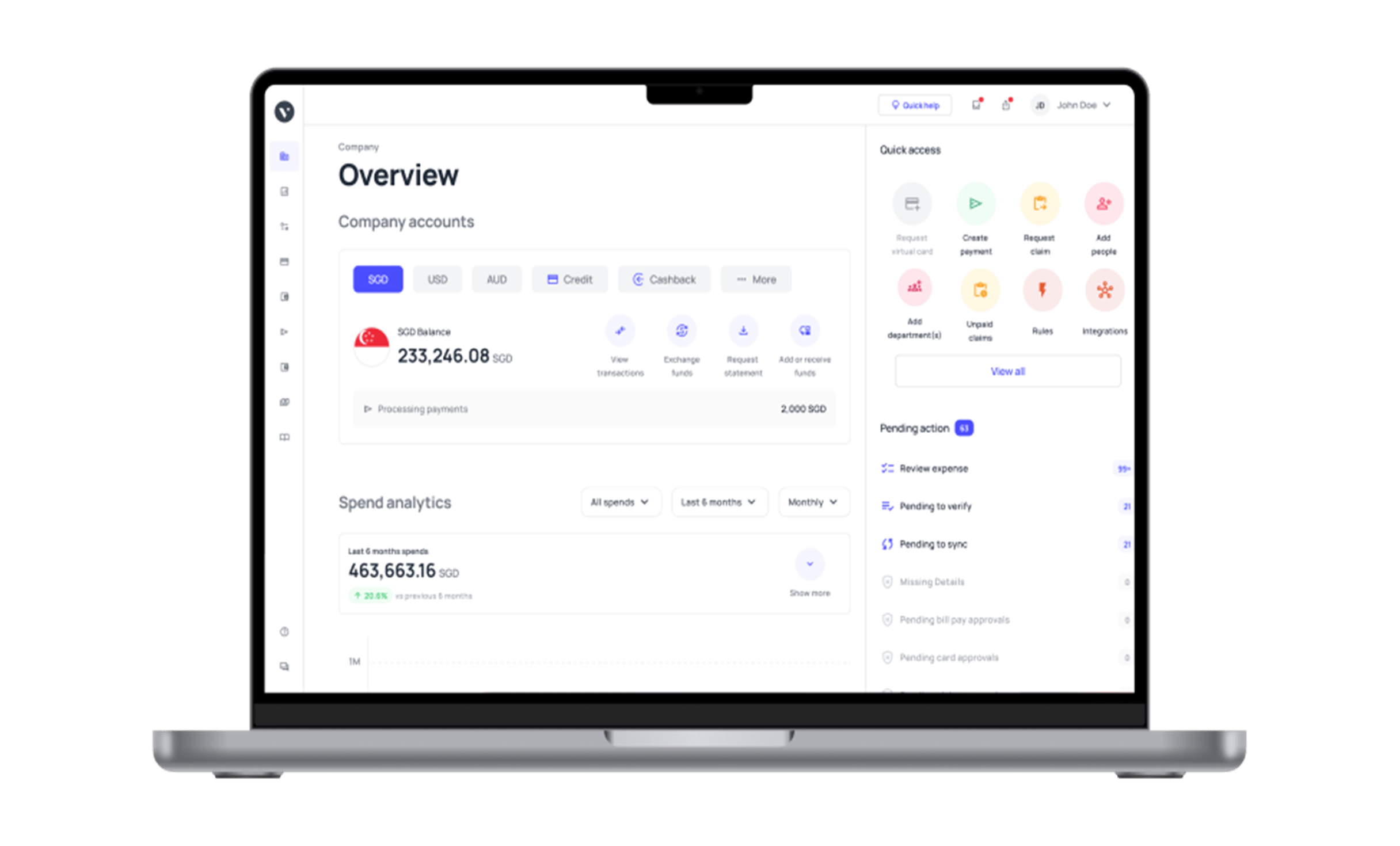

Volopay is an integrated financial platform designed to simplify business spending, invoice processing, and corporate card usage. Tailored for fast-growing companies, it combines accounting tools, real-time tracking, and automation.

With its intuitive interface and mobile access, Volopay helps businesses in Singapore improve financial control and streamline their payment workflows across departments and vendors.

● Features

Volopay includes smart invoice capture, multi-level approval workflows, automated payment scheduling, and real-time spend tracking. It offers virtual and physical corporate cards, automatic accounting integration, and customizable user permissions. Built-in controls help enforce policy compliance.

The accounts payable automation software allows finance teams to manage vendors and expenses seamlessly from a single, unified dashboard with real-time alerts. Its OCR technology also minimizes data entry errors by extracting key invoice details instantly.

● Pros

Volopay automates repetitive AP tasks, significantly reducing processing time. Its user-friendly dashboard ensures transparency and control over spending. Integration with popular accounting tools simplifies reconciliation and reduces errors.

The platform also supports global payments, which is ideal for businesses with international vendors. Its scalability makes it a strong choice for companies planning to grow quickly and maintain financial discipline. Volopay also offers responsive customer support, helping businesses resolve queries without delay.

● Cons

Volopay may lack advanced reporting features required by large enterprises. Customization options for complex workflows can be limited. Users may also experience a learning curve when adopting multiple modules at once.

While suitable for many companies, some may find it less robust than larger ERP solutions for handling highly complex payables structures.

● Ideal business type/size

Volopay is best suited for startups, small to mid-sized businesses, and fast-growing enterprises looking for a modern, easy-to-use AP solution. It supports companies aiming to digitize their payment processes without the complexity of a full ERP system, making it especially useful for finance teams with limited resources seeking efficiency.

● G2 rating

Volopay has an average rating of 4.3 out of 5 on G2.

2. Xero

● Overview

Xero is a cloud-based accounting platform known for its simplicity and powerful features that are designed for small businesses. It offers seamless bookkeeping, invoicing, and accounts payable management.

With an intuitive interface and real-time financial tracking, Xero helps businesses in Singapore stay organized, make informed decisions, and manage their payments with improved accuracy and efficiency.

● Features

Xero includes automated invoice processing, payment reminders, bill tracking, and bank reconciliation. It supports multi-currency transactions and integrates with over 1,000 business apps. Users can upload bills via email or mobile, and Xero extracts the data instantly.

The accounts payable system simplifies vendor management and helps maintain visibility into outstanding payables and upcoming due dates with real-time dashboards and alerts. It also allows easy categorization of expenses for better reporting.

● Pros

Xero is user-friendly and easy to navigate, even for non-accountants. Its automation features reduce manual entry and speed up the payment process. Integration with local banks allows faster transaction matching. It supports mobile access for on-the-go invoice approval.

As one of the best accounts payable software options for small businesses, it delivers reliability and control at an affordable price. Xero’s regular updates ensure it stays current with local compliance needs.

● Cons

Xero has limited customization options for complex workflows. Some users report slow customer support response times. It may not meet the advanced needs of large enterprises. Batch payment processing is basic compared to other platforms. While highly functional for smaller firms, Xero may require third-party add-ons to scale for more complex operations.

● Ideal business type/size

Xero is ideal for startups, freelancers, and small to mid-sized businesses looking for a cost-effective, cloud-based solution. It's perfect for those who need basic to moderate AP capabilities without heavy system integration. The platform suits finance teams seeking ease of use and quick setup while managing daily payables efficiently.

3. Netsuite

● Overview

NetSuite is a robust, enterprise-level ERP solution offering comprehensive financial management, including advanced accounts payable tools. Designed for growing and large-scale businesses, it automates complex workflows, integrates accounting with inventory and procurement, and provides complete financial visibility. Its cloud-based infrastructure ensures scalability and flexibility across all operational functions.

● Features

NetSuite offers automated three-way matching, role-based dashboards, approval routing, and global tax compliance. It integrates AP with procurement, budgeting, and inventory for a unified financial view.

Real-time reporting and customizable workflows allow detailed process control. As a full ERP, the accounts payable system handles multi-subsidiary and multi-currency environments, streamlining payables across global operations with accuracy and efficiency. Users can also set automated controls to prevent duplicate or fraudulent payments.

● Pros

NetSuite provides end-to-end financial visibility and full process automation. Its customization capabilities allow businesses to tailor workflows and reporting to specific needs. Integration with other ERP modules improves cross-departmental efficiency.

Automated reminders and compliance features help reduce errors. It’s one of the best accounts payable software choices for companies needing powerful analytics and scalable infrastructure. Role-based access control also improves security and accountability across finance operations.

● Cons

NetSuite can be costly for small businesses and requires a longer setup period. The learning curve may be steep for new users. Customization often needs developer support. Some users find the interface less intuitive. While robust, it may be too complex for businesses seeking a simple AP tool without broader ERP functionality.

● Ideal business type/size

NetSuite is best suited for mid-sized to large enterprises or fast-growing companies with complex financial structures. It’s ideal for businesses operating across multiple regions or subsidiaries.

Organizations requiring advanced reporting, tight internal controls, and deep system integration will benefit most from NetSuite’s scalable and customizable AP capabilities.

4. Sage

● Overview

Sage offers flexible accounting and financial solutions tailored to businesses of all sizes. It simplifies managing accounts payable, payroll, and compliance while ensuring real-time visibility into cash flow.

With cloud and desktop options, Sage is suitable for companies in Singapore looking for scalable software with strong local support and regulatory alignment.

● Features

Sage provides automated invoice tracking, payment approvals, real-time reporting, and bank reconciliation. It supports multi-currency processing, tax compliance, and user-specific access controls. The system integrates with various business tools for end-to-end accounting. Its dashboards deliver clear visibility into payables and cash flow.

Alerts and reminders keep tasks on track, while centralized document management ensures secure recordkeeping for audit readiness. Sage also offers customizable workflows to meet the specific needs of different industries.

● Pros

Sage is known for its strong compliance features and scalability. It simplifies AP workflows with automation and centralized controls. Users benefit from accurate financial tracking and customizable reports. The interface is intuitive, even for those with limited accounting knowledge.

Sage’s flexibility in deployment—cloud or desktop—makes it accessible to a wide range of users. Localized features ensure businesses in Singapore meet reporting and tax obligations with ease.

● Cons

Sage may require time for users to learn all its features. The desktop version can be less convenient than cloud alternatives. Updates may disrupt workflows if not scheduled properly.

Integration with third-party apps is limited compared to newer platforms. Smaller businesses may find it overwhelming without in-house accounting expertise.

● Ideal business type/size

Sage is best suited for medium to large businesses or those with growing financial needs. It fits companies that require multi-user access, local compliance support, and flexible deployment.

Businesses needing both payroll and accounting tools in one platform will find Sage especially useful for managing financial operations efficiently.

5. FreshBooks

● Overview

FreshBooks is an easy-to-use cloud-based accounting solution designed for freelancers and small businesses. It streamlines invoicing, expense tracking, and accounts payable tasks.

Known for its clean interface and automation features, FreshBooks supports quick payment processing and financial reporting, helping businesses in Singapore manage their daily operations with minimal complexity.

● Features

FreshBooks includes automated invoice capture, payment scheduling, and expense categorization. Users can approve bills, track vendor payments, and receive reminders on due dates. It integrates with popular apps like Stripe and PayPal.

Customizable reports offer insights into spending trends. FreshBooks supports mobile access for real-time updates, and its secure cloud storage ensures data integrity and accessibility on the go. The platform also offers easy tax reporting, making it useful for businesses handling sales tax or VAT.

● Pros

FreshBooks offers an intuitive dashboard ideal for non-accounting professionals. Its automation features reduce manual tasks and improve accuracy. The platform helps small businesses maintain vendor relationships with timely payments.

Expense and time tracking tools are helpful for service-based businesses. Users appreciate its fast setup and responsive customer support. Frequent updates improve functionality and keep features aligned with user needs. Additionally, FreshBooks’ strong invoicing system allows businesses to send branded invoices with ease.

● Cons

FreshBooks may lack advanced features needed by larger companies. Reporting options are limited compared to full-fledged accounting systems. It does not support complex approval hierarchies. Integration choices are fewer than with ERP systems. Some users find pricing plans restrictive as business needs grow.

● Ideal business type/size

FreshBooks is ideal for freelancers, consultants, and small business owners needing simple, efficient AP and invoicing tools. It’s best for service-oriented businesses that value ease of use and mobility.

Companies with limited accounting staff will benefit from its automation and minimal learning curve.

6. QuickBooks

● Overview

QuickBooks is a popular cloud-based accounting software designed for small and medium-sized businesses. It streamlines bookkeeping, invoicing, and accounts payable management, offering real-time financial tracking and reporting.

With flexible features and scalability, QuickBooks is an excellent choice for business owners looking to automate their accounting tasks and maintain organized financial records.

● Features

QuickBooks includes automated bill payments, expense tracking, and bank reconciliation. Users can generate customizable financial reports, manage invoices, and track cash flow. It integrates with numerous third-party apps, offering flexibility for diverse business needs.

The accounts payable system automates payment approval workflows and supports multi-currency transactions for global businesses. Mobile access ensures that users can manage finances on the go.

● Pros

QuickBooks is intuitive, offering a user-friendly interface suitable for both small business owners and accountants. The software supports automation to reduce manual entry, saving time and minimizing errors.

It’s also highly customizable, with multiple integrations available. Real-time financial data provides clear insights into cash flow and financial health. QuickBooks offers excellent customer support and is known for its reliability and ease of use.

● Cons

QuickBooks may become expensive as a business grows and requires additional features. Some users report limited customer support during high-demand periods. The interface can feel cluttered with too many features, leading to potential confusion for beginners.

Advanced reporting options are restricted in lower-tier plans, limiting customization. Some users also report difficulty with syncing bank accounts accurately.

● Ideal business type/size

QuickBooks is ideal for small to mid-sized businesses, startups, and freelancers needing a cost-effective, cloud-based solution for managing their finances.

It suits companies looking for a user-friendly system that simplifies accounting, invoicing, and tax reporting, but can scale as the business expands.

7. Tipalti

● Overview

Tipalti is a comprehensive accounts payable automation platform designed for growing companies. It simplifies global payment processing, invoice management, and supplier onboarding.

Tipalti streamlines the entire AP workflow, ensuring compliance, improving operational efficiency, and offering seamless integration with ERP and accounting systems. It is ideal for businesses handling large volumes of supplier payments.

● Features

Tipalti offers automated supplier onboarding, invoice processing, and global payment capabilities. It integrates with major accounting software and supports over 190 countries and multiple currencies.

The platform automates tax compliance, including 1099 and VAT reporting. With real-time reporting and analytics, users can track payments, monitor vendor performance, and ensure error-free processing. The accounts payable automation software provides a single platform for both domestic and international payments.

● Pros

Tipalti offers robust automation that reduces manual work and minimizes human error in processing payments. It ensures global payment compliance, making it ideal for businesses with international suppliers. The platform’s integrations with major accounting systems simplify financial workflows. It supports multi-currency and multi-country transactions, which is helpful for businesses with global operations. Tipalti’s comprehensive reporting tools provide valuable insights into payment performance.

● Cons

Tipalti may be expensive for small businesses or those with fewer AP transactions. Its setup can take time and may require dedicated support. The platform’s wide range of features may overwhelm businesses that only need basic accounts payable automation.

Some users report that the mobile app’s functionality could be improved. Customization options can also be limited for some workflows.

● Ideal business type/size

Tipalti is perfect for medium to large businesses or enterprises with high volumes of supplier payments, particularly those operating internationally. It is especially beneficial for companies in industries like e-commerce, media, and technology, where managing multiple global transactions efficiently is crucial for scaling operations.

8. SAP Concur

● Overview

SAP Concur is a leading travel and expense management solution that automates expense reporting, invoice processing, and travel bookings. The platform integrates with accounting systems to provide accurate, real-time financial data. SAP Concur is designed to optimize corporate spending, streamline processes, and ensure compliance for businesses of various sizes.

● Features

SAP Concur automates expense reporting, including receipt capture, approval workflows, and policy compliance checks. It also offers invoice processing with automated matching and approval routing. The platform integrates with ERP and accounting systems for seamless financial data management. It supports mobile access, enabling employees to submit expenses and approvals on the go. Real-time insights into spending and budget management help businesses optimize their expenditures.

● Pros

SAP Concur provides seamless integration with accounting systems, reducing the need for manual data entry. It automates and streamlines travel and expense processes, saving time and improving accuracy. The platform’s mobile functionality allows for quick expense submissions, ensuring timely approvals. It enhances visibility into company spending, helping businesses maintain compliance and manage budgets effectively. SAP Concur’s reporting features offer valuable insights into employee and departmental spending.

● Cons

SAP Concur can be costly, especially for small businesses or those with limited budgets. Some users report that its interface can be challenging to navigate, particularly for new users. The platform’s customization options may not suit every business’s needs. Certain functionalities may require additional setup time, making implementation more complex. Some features may not be available in all regions.

● Ideal business type/size

SAP Concur is best suited for medium to large businesses with complex travel and expense needs. It is ideal for companies that require automated expense management, travel booking, and compliance tracking across multiple departments. It is particularly valuable for businesses operating in global markets with frequent travel and high employee spending.

Benefits of accounts payable software for businesses

1. Automation and efficiency

Accounts payable software automates routine tasks such as data entry and invoice processing, reducing manual errors and saving time. Other important steps like the payment invoice and payment approval workflows can also be automated using accounts payable software.

This efficiency allows your finance team to focus on strategic financial decisions rather than repetitive tasks.

2. Improved accuracy

Even a small error in data entry of numbers can lead to a huge loss to the company. With automated data capture and validation, accounts payable software minimizes human errors in data entry and calculations.

This results in more accurate financial records and reduces the risk of costly mistakes.

3. Streamlined approval workflows

In the traditional process, getting payment approvals through emails from co-workers can be very time-consuming depending on different schedules. These software solutions offer customizable approval workflows, ensuring invoices are routed to the right people for review and approval.

This streamlines the process, reduces delays, and enhances accountability.

4. Audit trail

Accounts payable software maintains a comprehensive audit trail of all financial transactions. This transparency is invaluable during audits, as it provides a detailed history of transactions, approvals, and changes.

This digital audit trail is a much better option than a paper trail as it is accessible across different devices and there are fewer chances of losing the data this way.

5. Enhanced visibility

Modern AP software offers real-time visibility into your financial data. You can monitor outstanding invoices, track expenses, and gain insights into cash flow, helping you make informed financial decisions.

It gives you a complete view of payments that are pending, payments that are scheduled, and those that have been cleared.

6. Security

Security is a top priority in finance. Accounts payable software employs robust security measures to protect sensitive financial data. Encryption, user authentication, and role-based access control ensure data integrity and compliance with regulations.

The automated approvals are also a primary level of security to ensure that no unauthorized payments are processed.

Features to consider when choosing accounts payable software

1. Matches with the accounts payable workflow of the enterprise

When you’re choosing an AP software for your business, you should make sure that it is flexible enough to cater to the accounts payable workflows that your organization has set for itself.

This will help employees and users adjust quickly to a new platform as the process would still be similar.

2. Accurate data capture

One of the accounts payable software features that you should look for is whether it gives you the ability to automatically and accurately capture data from important documents such as invoices for payment processing.

This feature can save a lot of time and also reduce manual data entry errors.

3. Easy invoice approvals

Custom approval workflows will ensure that whenever an employee is trying to make an invoice payment for a vendor, it will always go through senior managers who are set as approvers.

This helps in making sure that unverified payments are not made.

4. Real-time monitoring and tracking of invoices

Knowing the status of the payment is important in order to provide peace of mind to yourself and to your vendors. Being unaware of payment status can also cause undue stress.

Most AP software tools are equipped with accurate payment tracking mechanisms that let you know the exact status of the transaction.

5. Integration with the existing accounting system

Once payments are made through the accounts payable software system, it should also be able to integrate easily with your existing accounting system and sync the expense data into your ledger.

6. Automation of payments

The ability to schedule and create recurring payments is a form of automation that helps to avoid missing out on payments and deal with any late payment fees.

7. Centralized information storage and management

AP software also acts as a centralized dashboard for the finance and accounting team to view and track all transactions.

Rather than having transactions scattered across platforms, a central view of all the expense activity gives a clear picture of budget utilization and cost efficiency.

How to automate your AP process?

Now that we've explored the benefits of accounts payable software, let's delve into the steps for effectively automating your AP process.

Assess your current process

Begin by evaluating your existing AP process. Identify bottlenecks, manual tasks, and pain points. Understanding your current workflow is the first step in streamlining it.

Once you know the problems your current accounts payable process has, then you can take steps to eradicate them.

Choose the right AP software

Selecting the appropriate accounts payable software is paramount. Consider factors like scalability, integration capabilities, and the features that align with your business needs.

Going for the lowest pricing may not always be the best option. So evaluate with factors in mind rather than just the price.

Data entry automation

Implement data entry automation tools to reduce errors and save time. Optical character recognition (OCR) technology can extract data from invoices automatically.

This will drastically reduce the errors you see while processing invoices and making the respective payments.

Invoice approval workflows

Customize approval workflows to match your organization's hierarchy and requirements. Ensure invoices are routed efficiently for review and authorization.

Many AP automation tools will let you set multilevel approval workflows. This helps to set more than one approver for a payment.

Electronic invoicing

Encourage suppliers to send electronic invoices. E-invoicing reduces paper waste, accelerates processing, and enhances accuracy. It can be time-consuming too.

Printing issues can also cause problems in understanding the details and getting them scanned.

Invoice matching

Manually matching invoices with the relevant purchase order and receipts can be taxing on the finance professional. Due to the heavy workload, they may even miss out on an error.

Automate the process of matching purchase orders, invoices, and receipts. This ensures consistency and minimizes discrepancies.

Accounting software integration

Seamlessly integrate your AP software with your accounting system. This allows for real-time data synchronization and eliminates manual data entry.

It ensures that the transaction details present in the accounts payable software are the same as in the accounting system.

Invoice tracking and reporting

Leverage the reporting capabilities of your AP software to track invoice status, outstanding payments, and cash flow. Access to insights helps in informed decision-making.

You can use the analytics tool in the software to generate customized reports based on what you need to know.

Automated payments

Set up automated payment processes for approved invoices.

This can include ACH transfers, wire transfers, or electronic checks. Most AP software will also let you schedule payments in advance so that you don’t miss out on any due dates and have to deal with late payment fees.

Employee training

Invest in training your finance team to effectively use the AP software.

Ensure they are proficient in navigating the system and understanding its features. Even if the platform is meant to automate most tasks, they need to be set up by the employees as per their needs.

Compliance and security

Prioritize compliance with financial regulations and data security. Accounts payable software should adhere to industry standards and employ encryption and access controls.

Monitor and optimize

Regularly monitor the performance of your automated AP process. Analyze metrics, gather feedback, and make continuous improvements to maximize efficiency.

Manage your accounts payable efficiently with Volopay

Volopay is the best accounts payable software that you will ever have to look for. We provide a complete expense management ecosystem to help you manage all your business expenses.

The platform comes with a suite of financial tools that enables you to handle all your accounts payable requirements easily. Some of the major accounts payable software features that we provide include the following:

Multicurrency wallet

Our platform has the capability to let its users hold money in 60+ currencies and make payments with them in 100+ countries. This solves a major problem that many AP teams face.

Rather than having to make payments through different portals by creating different bank accounts for your international vendors, now you can simply use Volopay’s platform to have all the transaction details in one place and save money on high forex fees.

Approval workflows

If compliance was the issue that your finance and accounting team faced, then you’d be delighted to know that Volopay comes with the ability to let you set up custom approval workflows.

This ensures that whenever an employee is making a payment, it is always sent to a senior manager for approval before the payment is processed. Volopay lets you set up to 5 levels of approvers.

Vendor management

Volopay lets you create a vendor database and manage all their crucial information in one single dashboard.

This helps to make faster payments each time rather than having to put in their details manually for each payment. This also lets you create recurring payments to vendors.

Electronic invoicing

Encourage suppliers to send electronic invoices. E-invoicing reduces paper waste, accelerates processing, and enhances accuracy. It can be time-consuming to scan paper invoices. Printing issues can also cause problems in understanding the details and getting them scanned.