The best RazorpayX Alternative in India

In a comparison between different expense management systems, it’s easy to get confused and overwhelmed with information. Choosing the right platform for your organization requires you to lay all the cards on the table – to truly understand how many of them differ.

Take RazorpayX, for example. A powerful suite of business financial management, it can be a tempting option. But let’s dive into the finer details and create a comparison to see how Volopay might just be the better, smarter platform for you to choose.

Trusted by finance teams at startups to enterprises.

Comparing the two platforms – should you choose Volopay or RazorpayX?

- Business account

- Multi-currency wallets

- Low remittance rates

- Low FX rates

- Virtual cards

- Invoice and AP automation

- USD cards

- Wider merchant coverage

- Accounting integrations

- Approval workflows for all transactions

- All in one dashboard

- Department expenses

- Dedicated account managers

Why Volopay is better than RazorpayX?

Single dynamic dashboard

Volopay’s single dashboard is probably one of our most impressive features. Unlike a complex suite that utilizes multiple dashboards, all of Volopay’s features are available from the same portal. The interface is easy to use and requires no technical know-how to operate. Your wallets, account, and credit limit are visible to approved users, along with the general ledgers and transaction lists. Cards can be accessed at any time from the same menu, as can reimbursements and accounting.

The dashboard gives you complete detail on departments, as well. Departments can be created by administrators, with every employee belonging to a specific department. This allows for project-specific expense forecasting, accurate accounting, and a better understanding of how the entire company’s expenses flow. Additionally, the approval workflow on a department level ensures that approvals are timely, and provided by department managers (to avoid the delays associated with a singular approver entity).

Approval workflows for all transactions

The maker-checker workflow is one of the most foolproof workflows to exist in the expense management world. RazorpayX knows it – they employ it in their business center and current account tools. However, Volopay employs it everywhere. The administrator dashboard has the option to create company-wide expense policies and depart-specific expense policies that automatically apply to every payment or card created within them. This means that you can set up auto-declines and auto-approvals for most amounts.

Aside from this, there is a tiered approval workflow (with the ability to set up to 5-tiers). All transactions, card reload requests, vendor payments, and reimbursements are approved through this workflow (which also lets you set up multiple members for each tier, in the case of an absence). The result? A smooth accountability process that can take place within minutes. Approvers of any level can also flag transactions and request details attached to the same data in order to further verify payments.

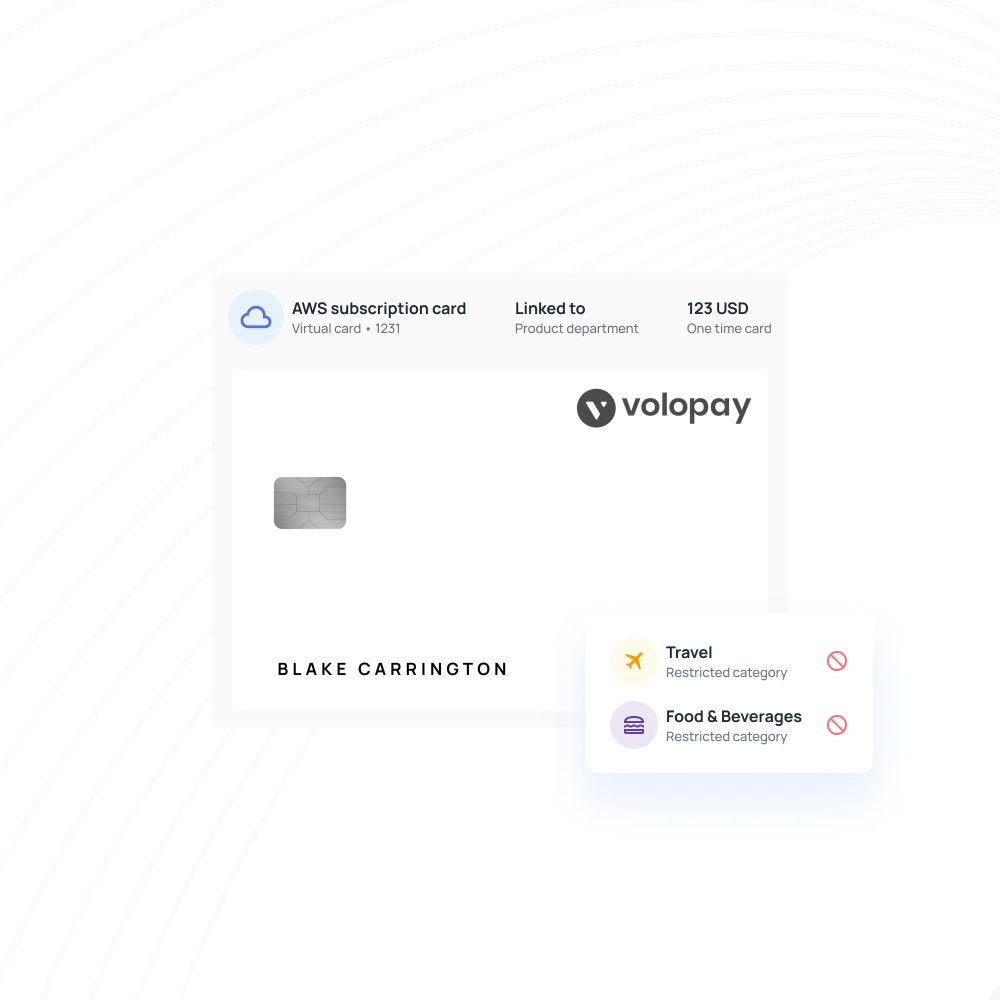

Corporate cards

Corporate cards are not a new or unique invention – but our approach to them definitely makes them more user-friendly and accessible. Aside from our physical cards, you can also generate unlimited virtual cards for employees. These cards are fully customizable. What does that mean? It means you can link a card to a specific wallet, or a specific department, and decide exactly who approves its reload.

Cards can be one-time use, burner cards, vendor-specific cards for SaaS management, and even gift cards or allowance cards for remote employees! You decide the amount, the expiration date, and who gets to use it. Non-transferrable in nature, they’re not only easy to use but also foolproof – especially since they’re not linked to your bank account details and your data remains secure.

Accounting integrations with the best, global accounting software

Bookkeeping is made easier with Volopay, since we integrate with popular accounting software and ERPs worldwide. Quickbooks, Zoho, Tally are all integrations you can set up from your Volopay account. Sounds the same as RazorpayX? We’ve got more. You can also set up your accounting with Netsuite, MYOB, Deskerra, Xero, and more. There are also options to export and download your ledgers if needed.

These integrations prevent any kind of manual line entry or mistakes in tallying the numbers. As soon as a transaction happens, it can be verified and synced to your books. And this automated data feed works both ways. Make changes on one software, and it reflects in the other.

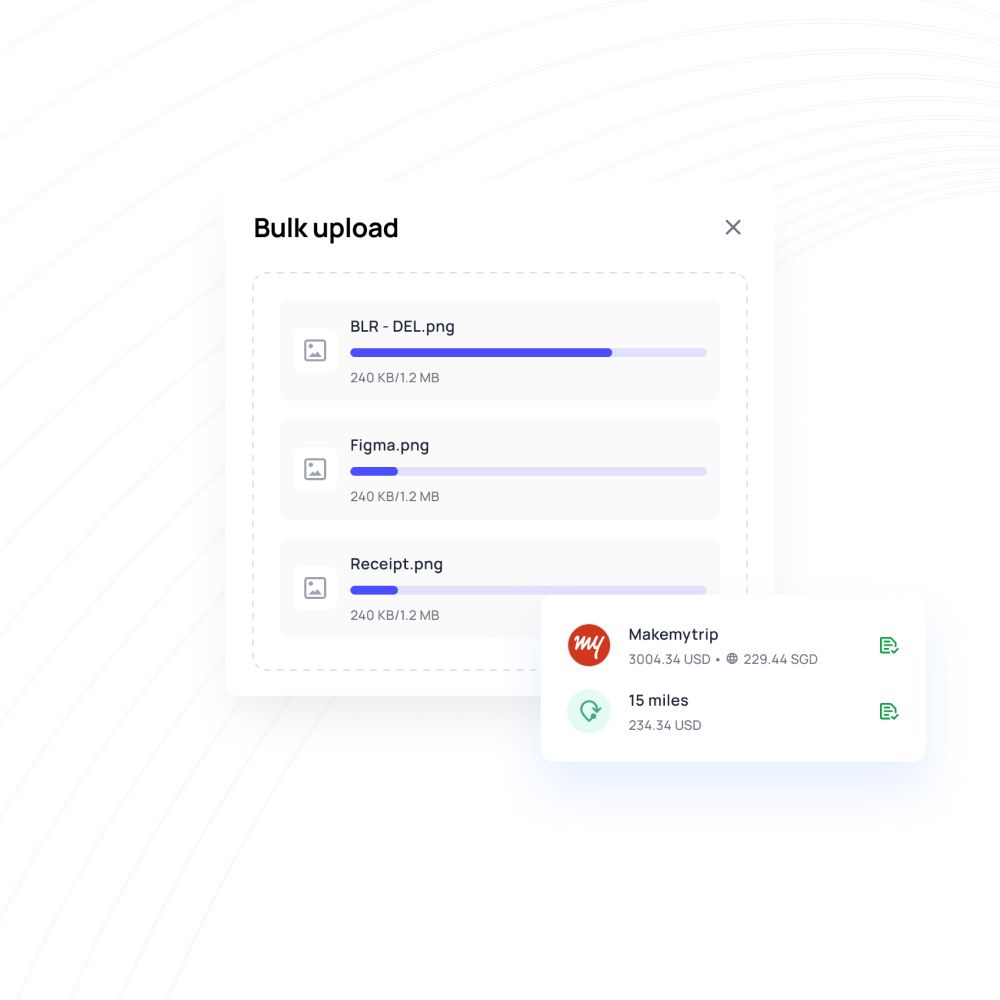

Accounts payable automation

Accounts payable is one of the most important aspects of business finances. It also requires a lot of hard work, manual effort, and endless piles of sheets/paperwork. Even the digitization of AP hasn’t prevented it from being a productivity killer (not to mention the time and dollars spent). RazorpayX, unfortunately, doesn’t allow end-to-end automation to smoothen this process. While there are options to create and send invoices, set up payment links, or enable payroll – ultimately it still requires a manual trigger to initiate.

With Volopay, everything is a one-time setup process for an easier tech-based intervention. Invoices use OCR and three-way matching systems to automatically create bills. Recurring and advance payments can be automated, and reminders set up for clients. Instead of manually creating payment links, vendors and freelancers can be onboarded. Their data is saved to prevent manual link creation or data entry in the future.

The best part? All of it is updated in real-time. Every card payment, every transfer, every wallet, and every reimbursement is recorded live in the general ledger (GL). This allows for an eagle-eye view of the company expenses and also lets department-specific dashboards view their allowance patterns.

Volopay features that will give your business an added advantage

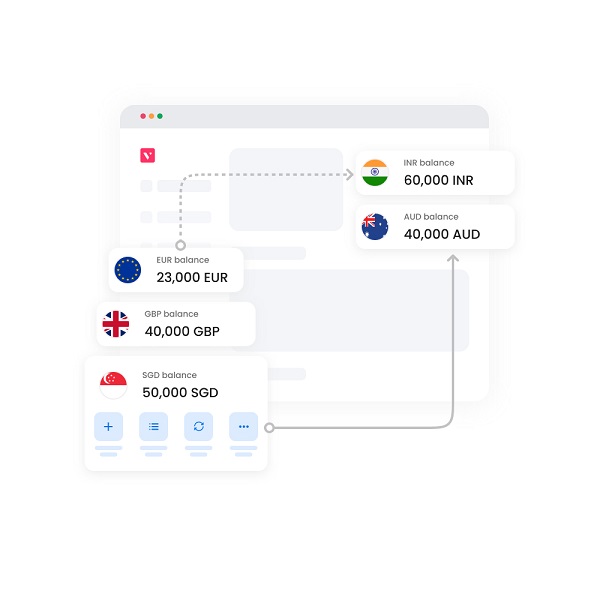

Multi-currency wallets and super low FX rates

One of the largest benefits of opting for Volopay is the access to multi-currency accounts. Business accounts on RazorpayX equip you to be able to make wire transfers. However, wire transfers are not always the most feasible option for payments. Particularly if you’ve got a global team that needs frequent payroll transfers, or international vendors/clients who receive repeated payouts.

In order to combat this, Volopay gives you the option to set up a multi-currency account. Aside from being enabled to make foreign transactions from your home currency account, if you frequently make/receive payments in a different currency, you can set up an account in that currency to minimize remittance charges and high FX fees. Pay in USD, receive in USD.

These multi-currency wallets can also be linked to the corporate cards to enable direct card payments in foreign currencies.

Reimbursements and out-of-pocket settlements

We know it’s not easy to give everyone a corporate card – especially if you’ve got thousands of employees. But traditional processes of reimbursements can be a headache to approve and file. Even with RazorpayX’s payout options involving simply entering an employee’s UPI ID, or creating payment links, those are still payment processes that require inquiry, approval, and execution.

Not with Volopay. Our reimbursements tab is dedicated to the out-of-pocket expenses employees sometimes incur. Anyone can submit a claim request, along with the details of their invoice and receipt. With the help of the maker-checker approval process, the claim can be processed as quickly as a few minutes.

The payout? Directly to the employee’s bank account as soon as the ‘Approve’ button is clicked. No need to set up a different payment or make a list of pending payouts. Employees get paid on time, and you have all the records synced.

Corporate travel management

T&E can be one of the most complicated aspects of employee expense management. There are too many moving parts, and a pile of receipts to take care of. Volopay knows this, and we’ve addressed it. Our tools allow employees to arrange all the expenses associated with T&E without trying to juggle a million different resources.

Corporate cards make it possible for employees to make all travel-related payments without having to file for reimbursements. Give your frequently traveling employees physical cards, and equip your on-off travelers with one-time virtual cards (for contactless merchant payments). These cards can also be used to book any travel and accommodation online.

If you’re relying on reimbursements, then our easy reimbursement option lets employees reclaim expenses and mileage on the go. Focus on work and productivity, instead of petty cash and paperwork.

Volopay – the consolidated platform for all your expense management needs

You can see now which experience might be better for you. RazorpayX is a complex, powerful suite of tools. But the ultimate drawback with suite tools is that they can be confusing to run together – and opting for the entire suite can burn a hole in your wallet.

Volopay offers the same features, optimized specifically for businesses looking to scale and enhance their operations. Same platform, no additional charges. All the facilities and tools are available to you as soon as you sign up and there is no need to set up a different software tool. And as a Volopay client, all product optimizations and rollouts are offered to every customer without having to onboard again.