Best Karbon Alternative in 2025

Business processes are never fully optimized. Companies scout for platforms that provide unblinkered visibility into their finances to minimize errors and streamline workflows. But often, they fall prey to false marketing gimmicks.

By serving hundreds of companies, Volopay has helped businesses redefine the way they manage and report expenses. Our second to none expense management platform handles domestic and international payouts, subscription management, reimbursements, accounting and bookkeeping, and financial reporting.

Trusted by finance teams at startups to enterprises.

Features designed for your business needs

- Reimbursements

- USD cards

- Accounting integrations

- Submission policy

- Expense reports

- Spend analytics

- Accounts payable automation

What sets Volopay apart from Karbon?

Paperless and automated reimbursements

Switching and juggling between paper receipts are one of the most tedious office tasks. And it multiplies as the company grows and hires new talents. Similarly, manual reimbursements soak up a lot of time of the accounting department. The manual verification and approval process keeps the employees occupied for a long time. While Karbon does not offer reimbursements, Volopay has an in-built dynamic claim settlement system.

Our automated reimbursement system eases out employees’ burden, allowing them to focus on revenue-generating activities. Our software automates everything by being paperless, from raising expense claims, uploading receipts, and receiving them in their bank accounts. With real-time tracking, employees can track the status of their claims, whereas employers can approve them.

Effortless accounting integrations

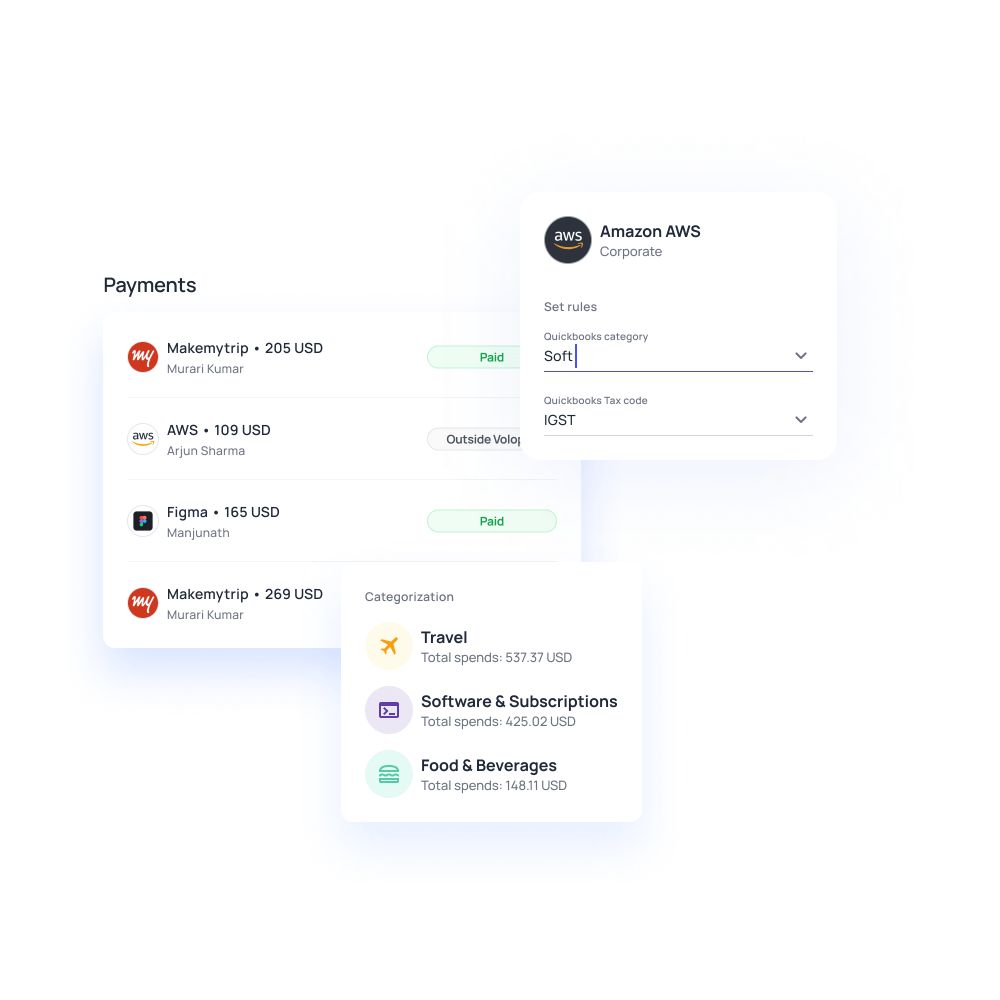

Integration between accounting software promotes data consistency and helps maintain similar data sets across all the platforms. The manual data entry in two different software increases the chances of mismatch and does not provide up-to-date information. Volopay offers seamless integrations with accounting software like Tally, Quickbooks, Xero, Zoho, and Netsuite to allow users to maintain data integrity.

Create smart workflows that auto-categories transactions and sync them automatically, helping you close books faster. The two-way syncing enables the reflection of data simultaneously in both the software – ensuring the latest information across the platforms.

No more hefty transaction fees

Karbon charges transaction fees for vendor payouts made via their standard corporate cards. The fixed fee is charged for all merchant payments along with an additional applicable GST rate. Paying such hefty charges per transaction is definitely an expensive affair for a business. More the payments, more budget Karbon squeezes.

On the contrary, our platform charges no transaction fees for any domestic vendor payouts. Users can swiftly initiate unlimited amounts at no cost and without paying GST or hidden charges. Thus, helping you in cost-cutting.

Negligible FX rates for international transactions

Through Volopay’s comprehensive expense management software, remittances to foreign countries are made inexpensive and secured. Our multi-currency wallet enables storing, receiving, and paying in foreign currencies all under one roof. Hence, eliminating the need to maintain various currency accounts.

Users can use our platform to make transfers to more than 100 countries in 65 major currencies. While Karbon does not support international transactions, we help you escape the painful process by charging no remittance fee and FX conversion charges.

Data-driven expense reports

Expense reports help understand the spending patterns of your organization based on different expense categories. They provide accurate visibility of your company finances – enabling you to draw conclusions and identify trends. Volopay enables companies to generate automated expense reports based on the data collected, which is primarily free from errors and miscalculations.

The analytical reports provide a holistic view of your income and expenses and also assist during the tax filing period. On the other hand, Karbon fails to provide automated expense reports that lay the foundation for expense management. Clients looking for this usability might have to prepare manual expense reports, which are time-consuming and exposed to human errors.

Smart spend analytics

Spend snapshots in Volopay’s platform provide an instant comparison of your card and Bill pay expenses for the current and previous month. It can further be broken down according to vendors, expense categories, departments, and locations. These figures help in internal performance assessment and come in handy for an immediate glance.

Additionally, the platform displays the change in spending from the previous month — enabling you to uncover the reasons for this change. Clean and accurate spend snapshots allow you to undertake quick decisions. Missing out on this crucial information can impact your budgeting and expense policy enforcement, hurting cash flow and working capital.

Superlative accounts payable automation

Our platform’s unparalleled accounts payable automation help users with invoicing, reconciliation, purchase order management, invoice discounting, bill generation, and more, offering an all-in-one financial control solution. Our multi-level approval workflow, stretching five-level deep, allows instant payment approval. We provide accounting triggers that automatically classify and auto-fills fields for similar transactions to eliminate repetitive categorization.

With two-syncing of transactions, your accounts department is not required to merge data between the software manually. The auto-sync scheduling helps to sync transactions on a future date without monthly manual commands. The GST and TDS fields are auto-populated based on the invoice total – relieving another pain point.

Submission policy

To add another layer of authentication to your expenses and claims, managers can enable a submission policy. By doing so, they can make it mandatory to submit receipts or notes. In the custom fields, they can add additional requirements like expense details, departments, general ledger code, and more.

This proves to be extremely useful for managers to know which legitimate expenses can be processed further. Moreover, it establishes employee accountability and compels them to make only necessary expenses. Managers can also enable push notifications where they are notified of expenses above a certain threshold.

Better bet: Volopay or Karbon?

Karbon stood up to its expectations for corporate cards, but for companies looking for an all-inclusive expense management software, Volopay is a better fit. Our blanket of business solutions covers everything from corporate card payments to financial accounting. A super interactive dashboard that swiftly navigates ensures high performance without delays. And when AI and automation are at the core of our spend management software, everything just flows.