👋Exciting news! UPI payments are now available in India! Sign up now →

How Indian retail businesses use Volopay for smarter procurement

Managing payments across multiple suppliers is a daily challenge for medium to large retail businesses in India dealing with high transaction volumes and geographically dispersed operations.

As vendor networks grow, manual processes often lead to payment delays, reconciliation errors, and revenue leakages. Retailers need a centralized system that simplifies procurement payments while maintaining control across stores and regions.

Volopay's retail expense management system helps streamline approvals, automate vendor payments, and deliver real-time visibility across teams. With effective retail expense management, you can confidently manage bulk purchase orders, recurring operational expenses, and regulatory compliance while scaling without financial blind spots.

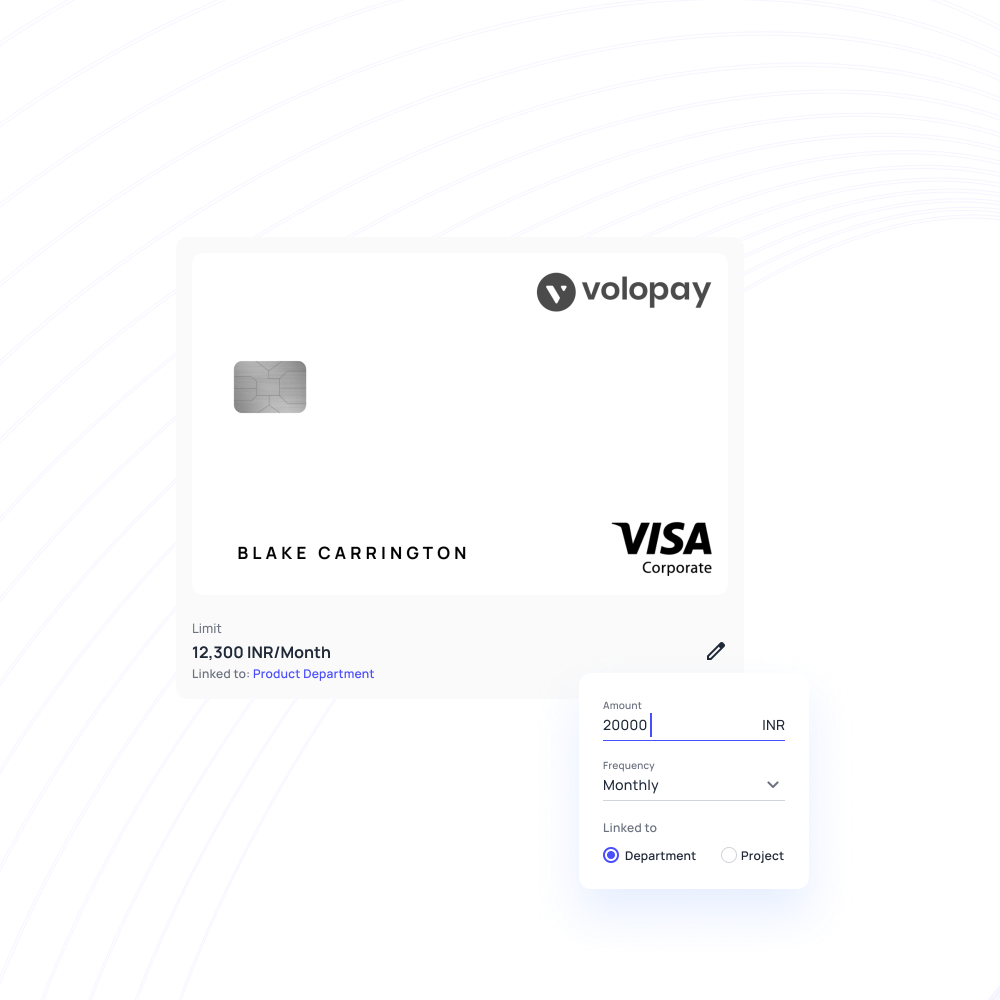

Corporate cards built for retail teams

Corporate cards tailored for retail businesses in India help manage frequent vendor and operational payments with greater control.

With Volopay, you can issue cards by store, department, or supplier category, ensuring spends align with internal procurement and compliance policies. Custom spending limits and automated approvals support bulk and seasonal purchasing without constant manual intervention.

Integrated with retail spend management software, transactions are captured in real time, categorized accurately, and synced with accounting systems—reducing reconciliation effort and strengthening vendor relationships.

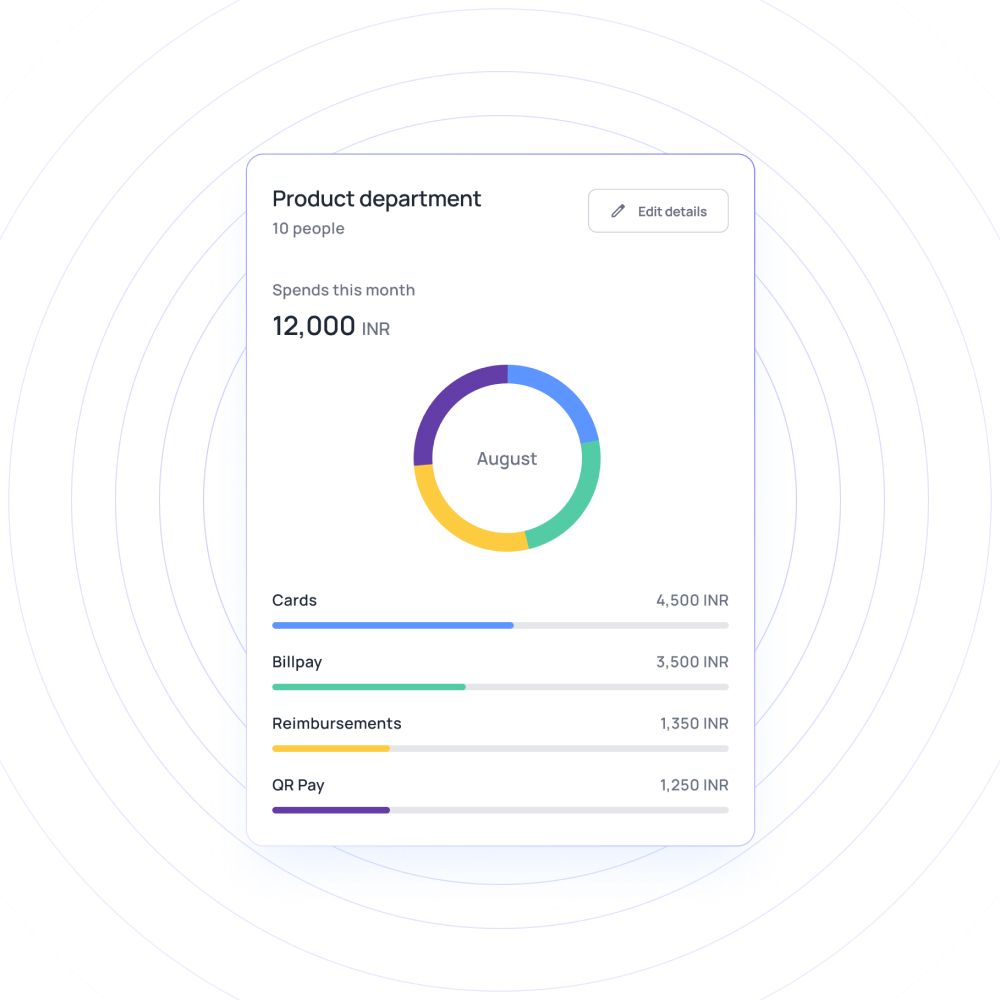

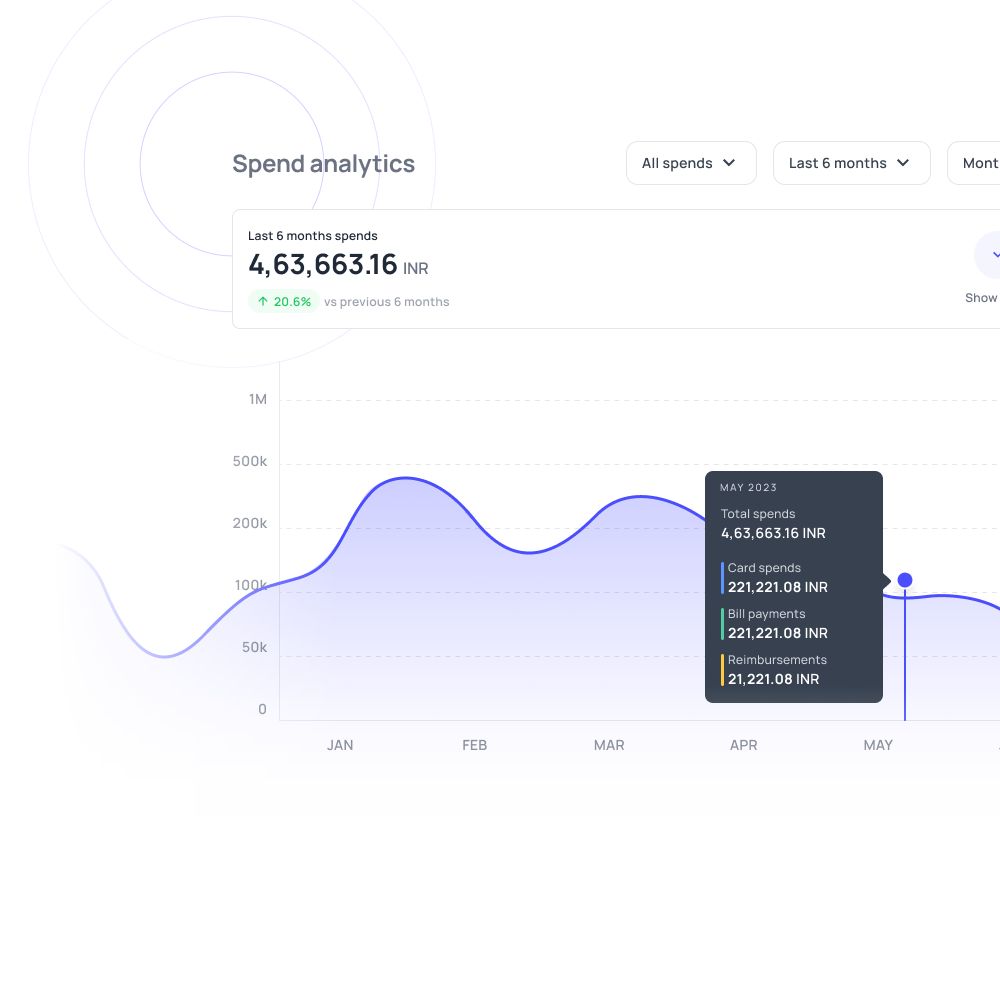

Real-time expense tracking and reporting

Real-time visibility is essential for Indian retailers managing multiple vendors, cities, and store formats. Volopay enables you to track spending as it happens, helping prevent budget overruns and unplanned expenses.

Centralized dashboards bring together vendor payments, approvals, and procurement data in one place.

Expense management for retail businesses becomes more strategic when finance teams gain clear insights into spending trends, enabling faster decisions, tighter control, and better cost negotiations across expanding retail operations.

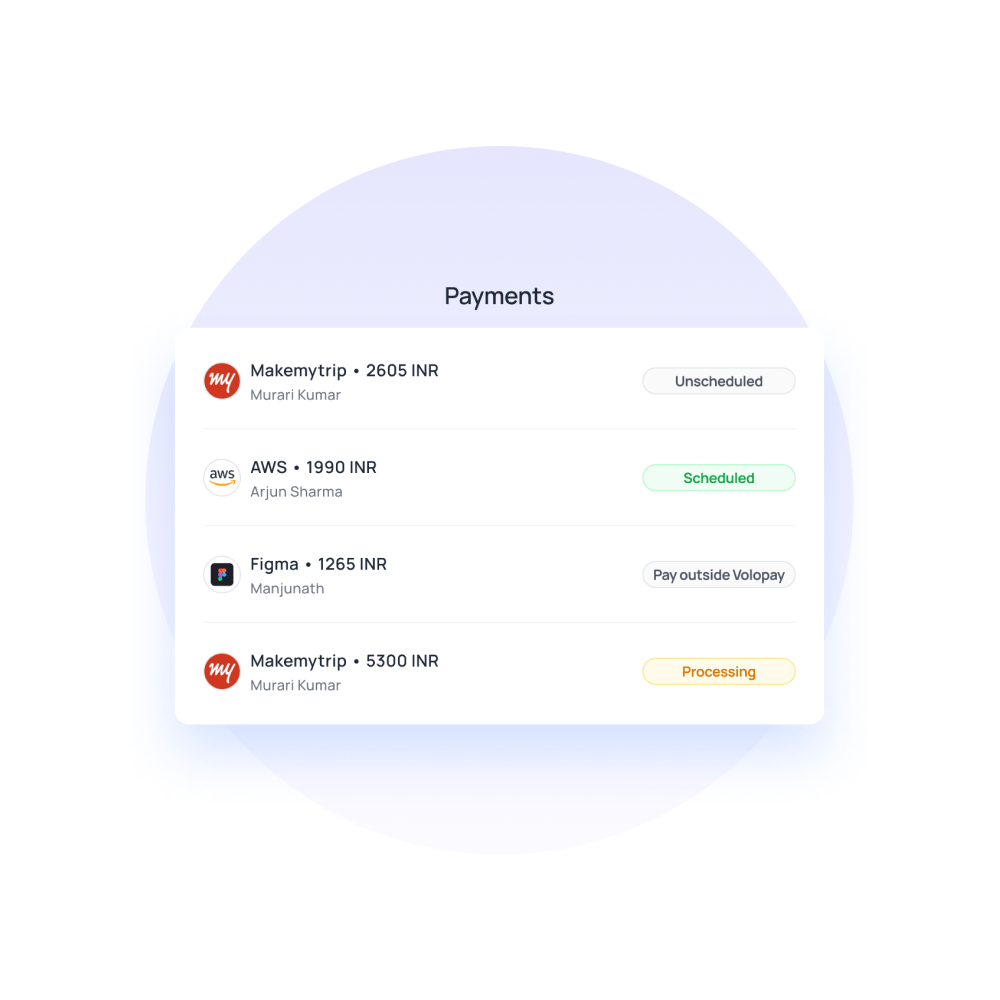

Streamlined automated vendor payments

Manually handling hundreds of supplier invoices—often with GST compliance requirements—can slow down retail finance teams. Volopay automates invoice capture, matching, and payment scheduling from a single platform, reducing processing time and errors.

Volopay's retail accounts payable automation capabilities helps standardize payment cycles, avoid missed due dates, and improve vendor confidence. By removing repetitive tasks, finance teams can focus on compliance, cash-flow planning, and strategic oversight instead of constant follow-ups.

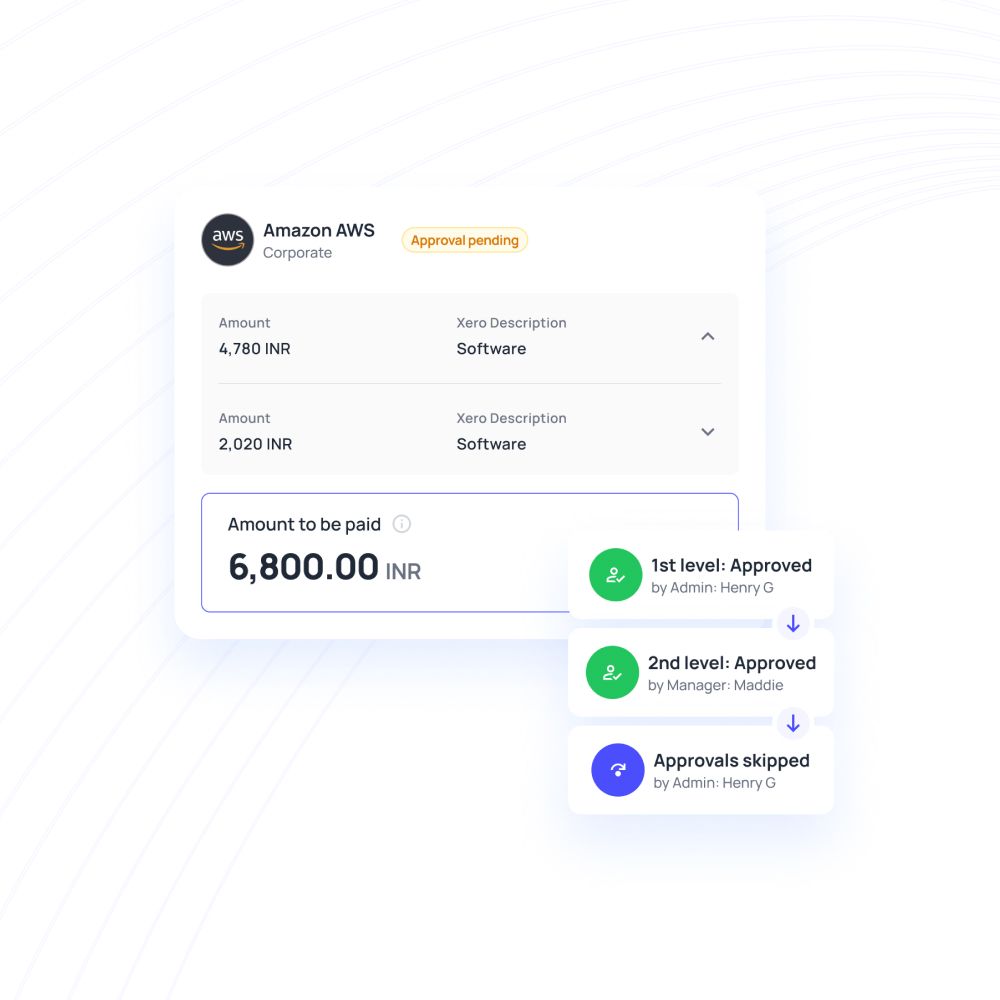

Advanced purchase order approval workflows

Retail procurement often involves multiple stakeholders, locations, and budget owners. Volopay allows you to set up flexible, multi-level approval workflows that mirror your internal controls without slowing operations.

Purchase orders can be routed based on value, category, or vendor type, ensuring accountability at every stage.

Automated and auditable approvals help reduce unauthorized spending while maintaining the agility needed for bulk orders and time-sensitive supplier commitments.

Centralized control with decentralized spending

Indian retail operations require speed at the store level while maintaining strong financial governance. Volopay enables finance teams to define budgets, spending rules, and approval policies centrally, while store and regional managers spend independently within set limits.

This approach ensures consistency without disrupting daily operations. With retail vendor payment management unified in one platform, you gain real-time spend visibility across locations.

This helps improve compliance, control costs, and empower teams to act quickly while staying aligned with company-wide financial objectives.

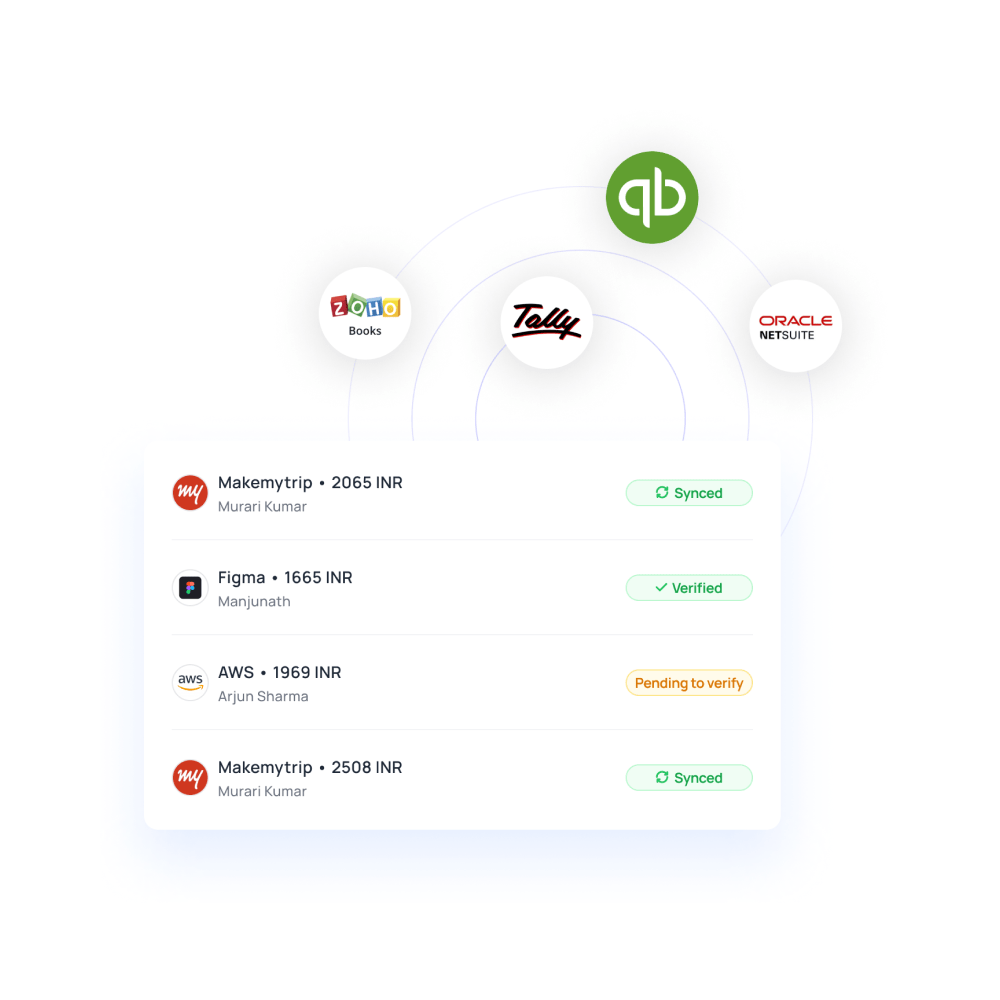

Retail ERP and accounting integration

Seamless system integration is critical for Indian retailers handling high transaction volumes and GST reporting. Volopay integrates with leading accounting and ERP systems, ensuring expenses, invoices, and payment data sync automatically. This eliminates duplicate entries, reduces reconciliation errors, and accelerates the month-end close.

Automated data flow also supports accurate GST classification and reporting, reducing compliance risks during audits and filings. Finance teams benefit from real-time, system-aligned records that improve cash-flow visibility and decision-making across stores and regions.

With a unified financial view across systems, retailers gain better accuracy, audit readiness, and operational efficiency across complex, multi-location retail environments.

Retail success stories with Volopay

BlueStone streamlines vendor payments and petty cash management, boosting efficiency with Volopay.

Bring Volopay to your business

Get started now

FAQs

Volopay centralizes vendor payments, invoices, and approvals in one platform, helping you streamline communication, avoid payment delays, and maintain consistent processes across suppliers, locations, and procurement teams.

Yes, you can assign customized spending limits by store, department, or role, allowing local teams to operate independently while ensuring all spending stays aligned with centrally defined budgets.

Volopay automates bulk purchase order approvals using predefined rules, routing requests to appropriate approvers based on value, category, or supplier, ensuring speed, accountability, and full audit visibility.

Implementation is typically fast and scalable, allowing you to onboard multiple locations quickly without complex infrastructure changes, ensuring minimal disruption to ongoing retail procurement and payment operations.

Yes, Volopay tracks vendor payments and employee expenses in one dashboard, giving you unified visibility into procurement costs, operational spending, reimbursements, and card transactions across teams.

Volopay improves cash flow control by providing real-time insights into outgoing payments, scheduled liabilities, and spending trends, helping you plan vendor settlements and avoid unexpected budget strain.

Volopay adapts easily to seasonal demand by allowing flexible budgets, temporary limit adjustments, and real-time monitoring, helping you manage peak procurement periods without losing financial control.

You can fully customize approval workflows based on purchase type, amount, vendor, or department, ensuring the right stakeholders review transactions while maintaining speed and policy compliance.

Volopay provides real-time dashboards instead of delayed reports, giving you instant visibility into spending, approvals, and vendor payments, enabling faster decisions and proactive cost control.