👋Exciting news! UPI payments are now available in India! Sign up now →

F&B businesses manage expenses smarter with Volopay

Smooth financial tech stacks play a critical role in managing expenses in the food and beverage industry, which demands accuracy across multiple cost centers. From placing high-volume ingredient orders and settling invoices with packaging suppliers to managing daily operational spend, finance teams often struggle with fragmented workflows and limited visibility.

Volopay brings everything together in one unified platform, helping food and beverage businesses control costs, automate accounts payable, and gain real-time insight into spending across the entire supply chain.

Whether you manage a single production unit or multiple outlets across regions, Volopay streamlines the process of approving, paying, tracking, and analyzing expenses without slowing down operations while ensuring adherence to India-specific tax and regulatory requirements, including GST compliance under CGST and SGST frameworks.

Automate PO workflows and vendor payments

Food and beverage companies deal with frequent, high‑value payments to manufacturers, distributors, and wholesalers. Manual invoice handling and disconnected approvals often delay payments and strain supplier relationships.

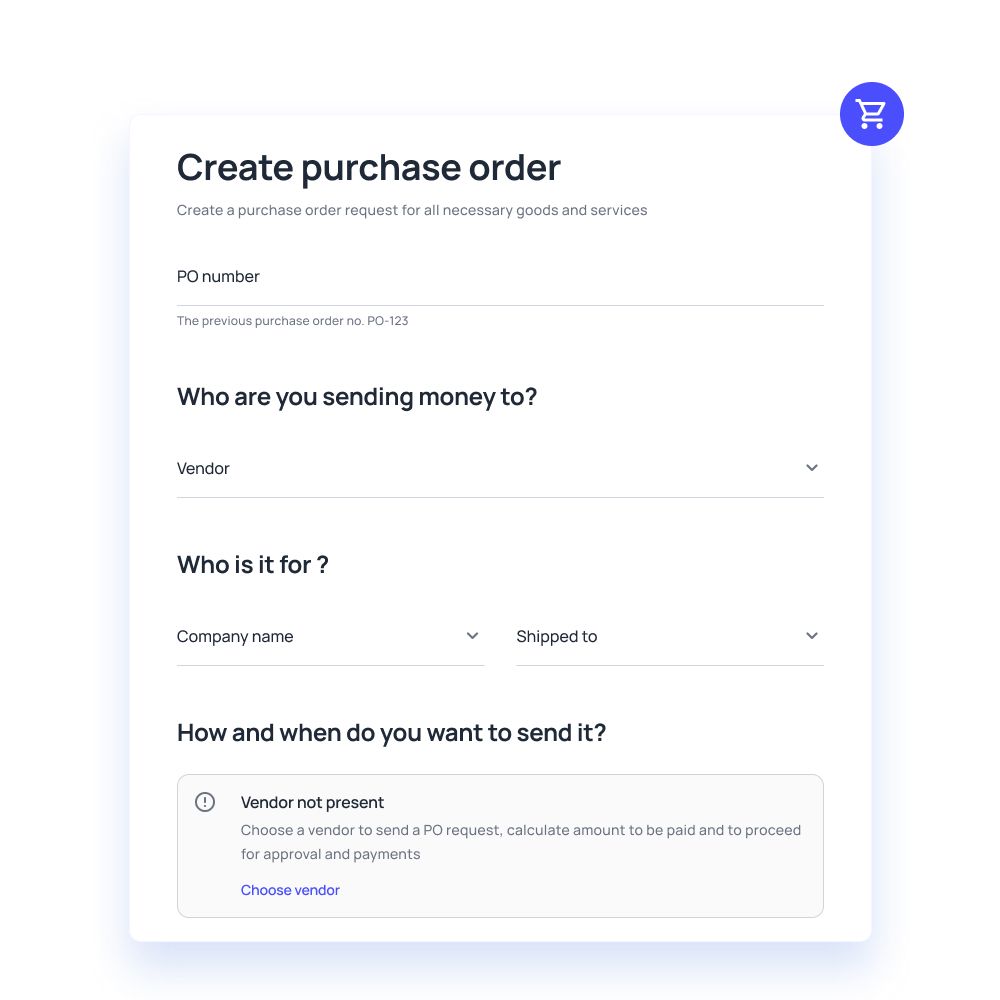

Volopay automates the full accounts payable workflow, from purchase order creation to invoice matching and payment execution with GST-compliant invoicing and documentation.

You can route vendor bills through predefined approval workflows, schedule payments based on agreed terms, and reduce manual errors. With food and beverage accounts payable automation built into the platform, finance teams gain consistency and control while ensuring vendors are paid accurately and on time through standard Indian payment methods such as NEFT, RTGS, IMPS, and UPI.

Track raw material and ingredient procurement

Raw material and ingredient purchases make up a significant portion of COGS for food businesses. Without structured tracking, costs can fluctuate without clear explanations.

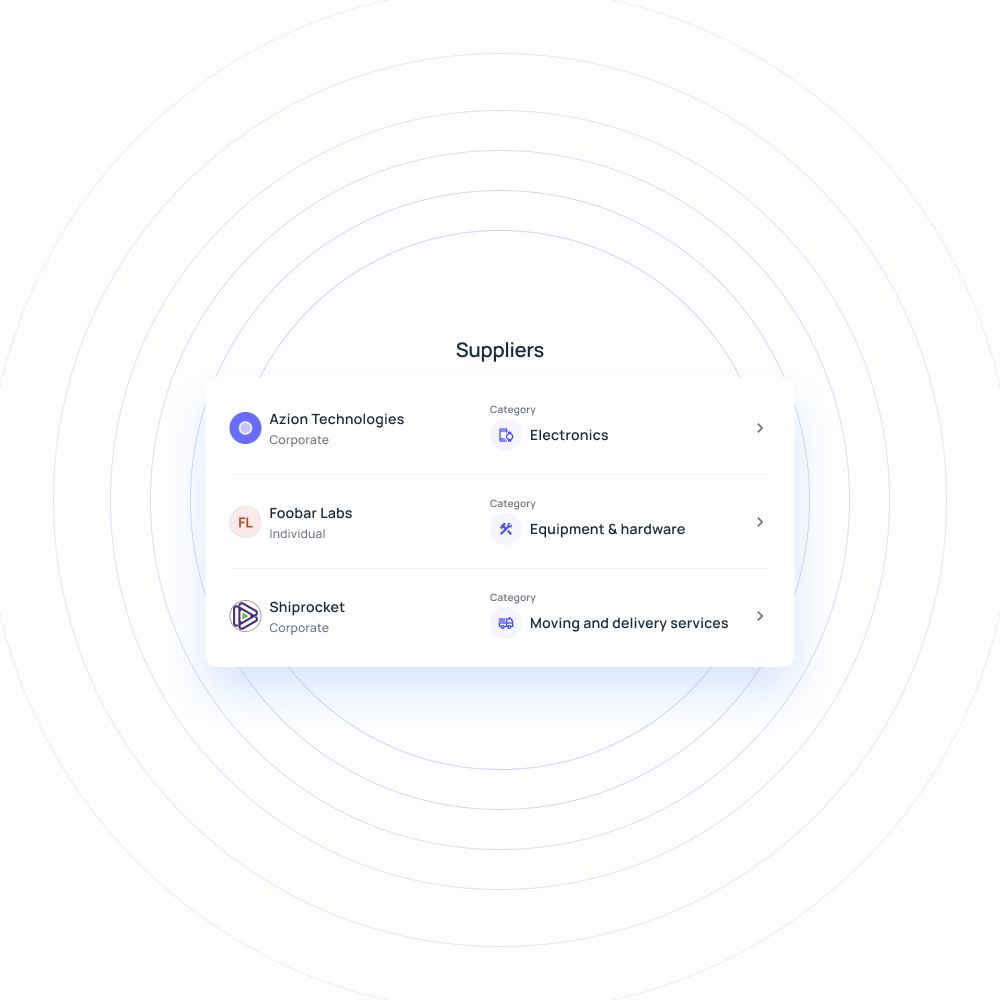

Volopay's procurement software enables you to categorize and monitor ingredient procurement expenses by supplier, product type, or location across all production units and outlets in India.

By centralizing purchase data, teams can compare planned versus actual spend and identify cost spikes early. This level of food business expense tracking supports better forecasting, improved vendor negotiations, and tighter control over food costs while maintaining accurate GST input credit records.

Packaging and material supplier management

Packaging materials, labels, and disposables are essential but often overlooked cost centers. Volopay helps you manage these supplier relationships by consolidating contracts, invoices, and payment schedules in one place with proper GST documentation for packaging suppliers.

You can track recurring orders, enforce approval rules for bulk purchases, and maintain a clear record of supplier spend over time. This structured approach makes it easier to analyze packaging costs, avoid duplicate payments, and maintain accountability across procurement and finance teams for audits by Indian tax authorities.

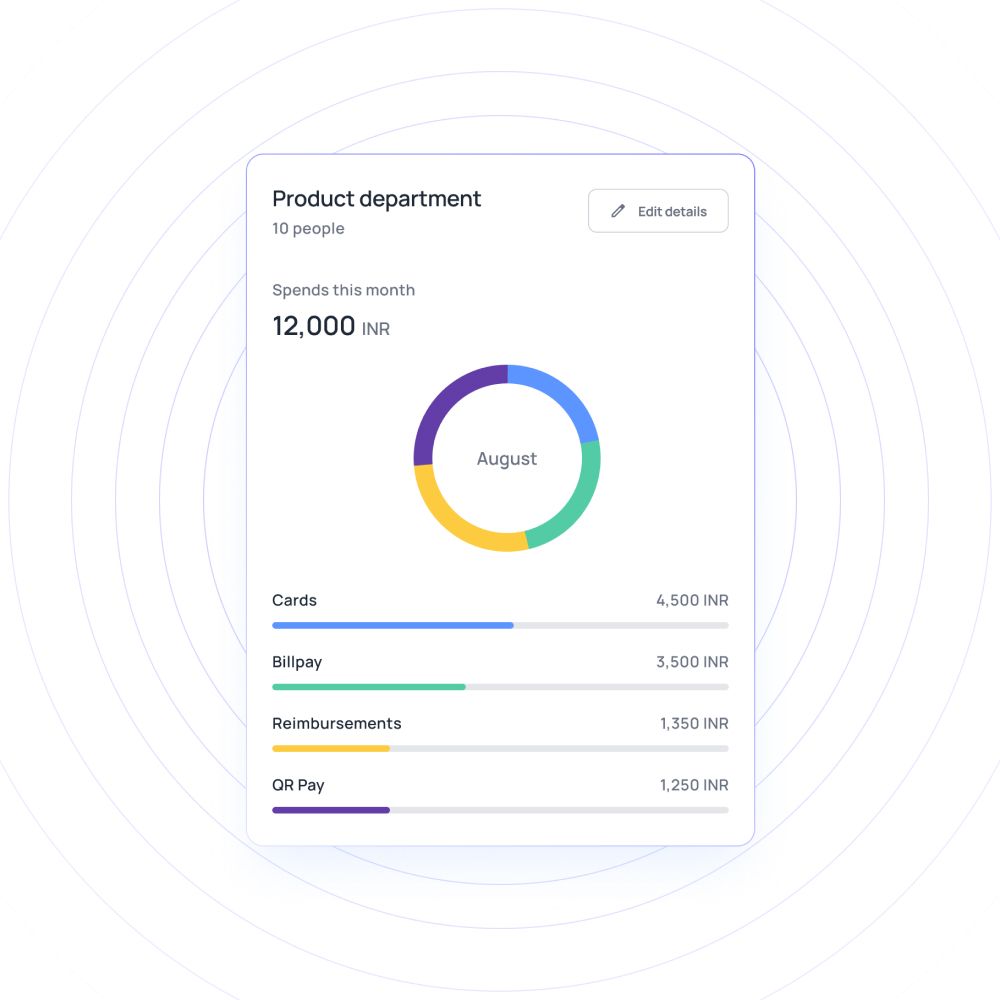

Control operational and facility expenses

Operational costs such as utilities, equipment maintenance, cleaning services, and facility rentals add up quickly across kitchens, warehouses, and outlets. Volopay centralizes these expenses, giving you a clear view of recurring and variable operational spend across multiple locations in India.

By setting budgets and approval thresholds, finance leaders can prevent overruns while allowing teams to operate efficiently. Centralized visibility also helps identify cost-saving opportunities and ensures operational expenses align with overall financial plans.

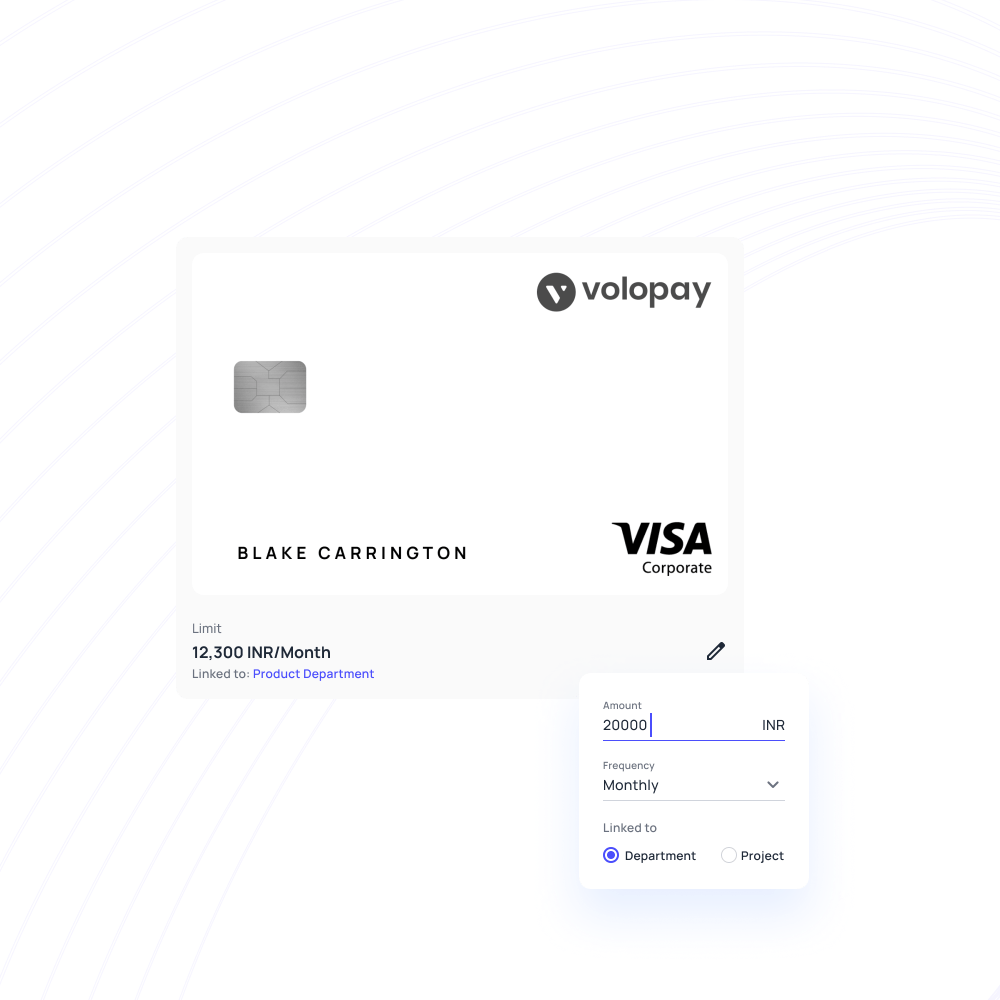

Issue corporate cards for employee & business use

Employee spending for travel, client meetings, urgent purchases, or local sourcing is common in the food and beverage industry. Volopay's corporate card program allows you to issue physical and virtual corporate cards with predefined spending limits and category controls in INR for India-based employees.

Employees can pay directly using their assigned cards, upload receipts instantly, and eliminate manual reimbursement claims. This simplifies expense management for food and beverage companies while reducing policy violations and improving transparency with full compliance to Indian financial regulations and internal audit requirements.

Track SaaS subscriptions & technology expenses

Modern food businesses rely on multiple software tools for POS, inventory, delivery, analytics, and workforce management. Volopay helps track SaaS subscriptions and technology expenses in a single dashboard for tools used across Indian operations.

Finance teams can monitor renewals, prevent unused subscriptions, manage current subscriptions and allocate software costs accurately across departments or locations. This ensures technology spend remains aligned with business growth and operational needs.

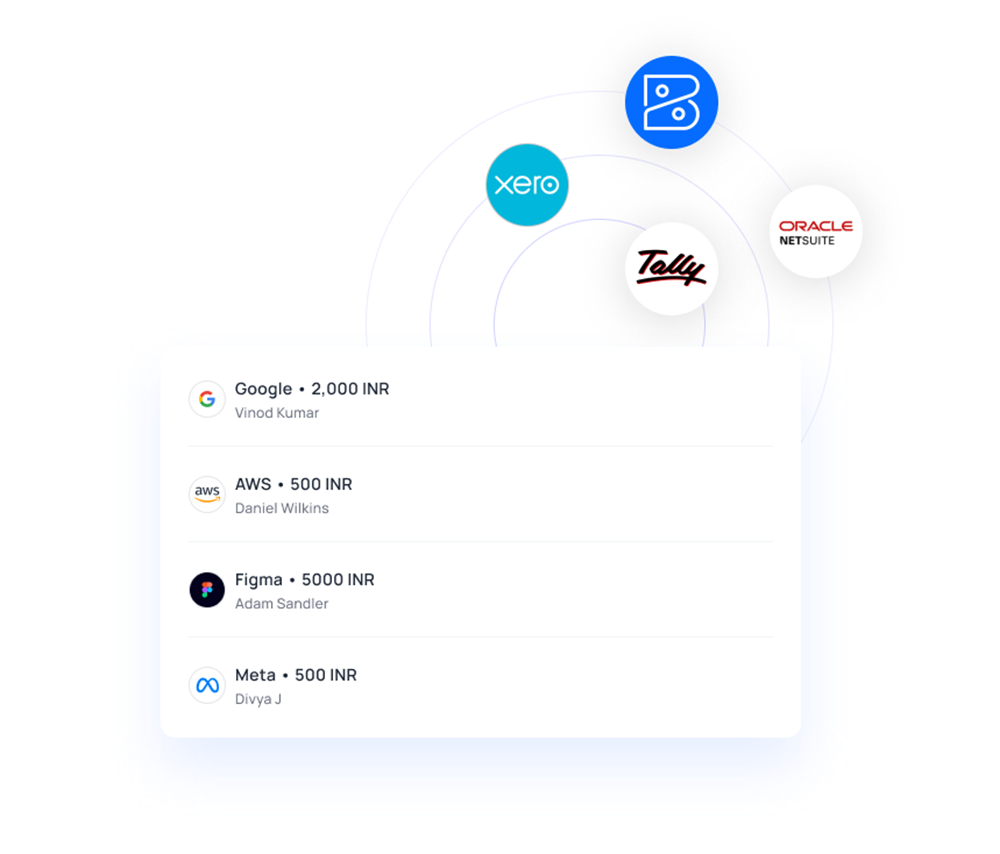

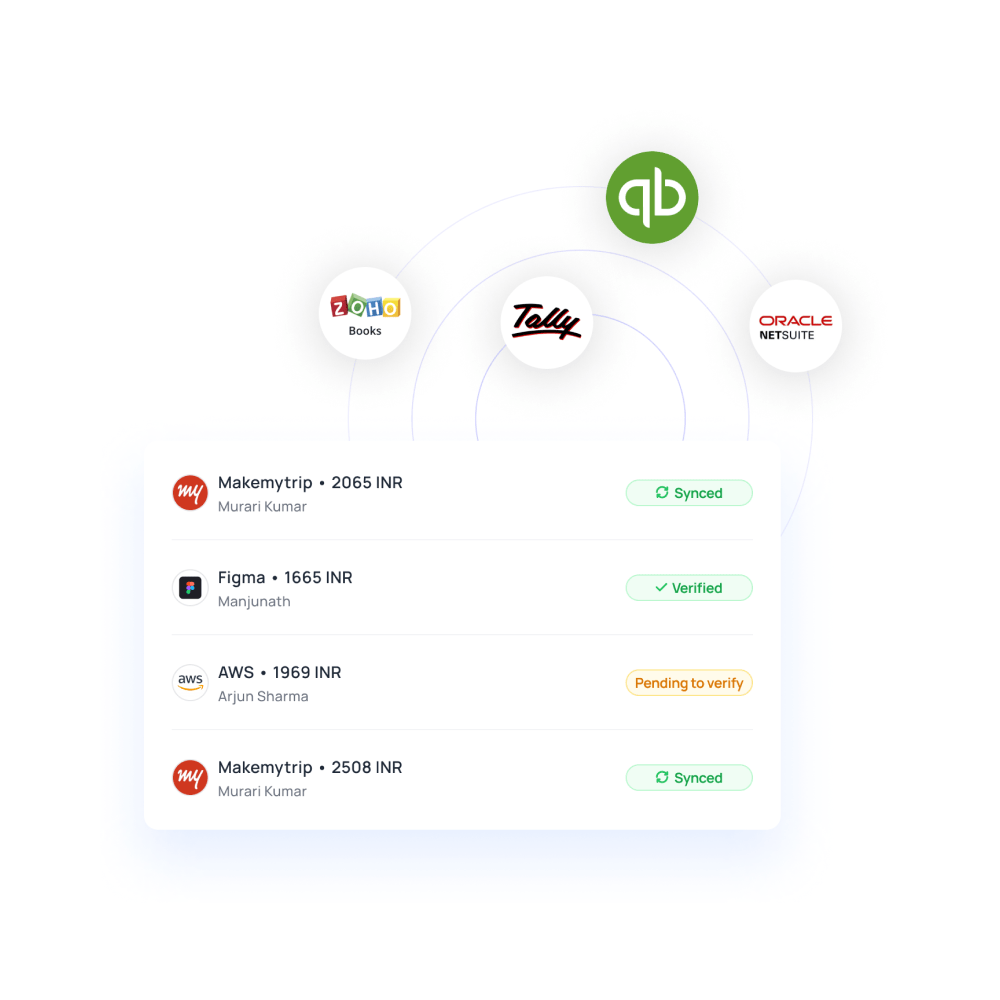

Integrate with food and beverage ERP systems

Volopay integrates with leading accounting and ERP systems used by food and beverage companies, reducing manual data entry and reconciliation efforts and supporting Indian accounting standards (Ind AS) and GST-compliant reporting. Transactions, bills, and expense data sync automatically with your accounting software.

This seamless integration improves accuracy, speeds up month-end close, and gives finance teams confidence in their numbers. With F&B spend management software working alongside your accounting stack, reporting becomes faster and more reliable while maintaining GST reporting readiness for Indian tax filings.

Gain cash flow and payment visibility

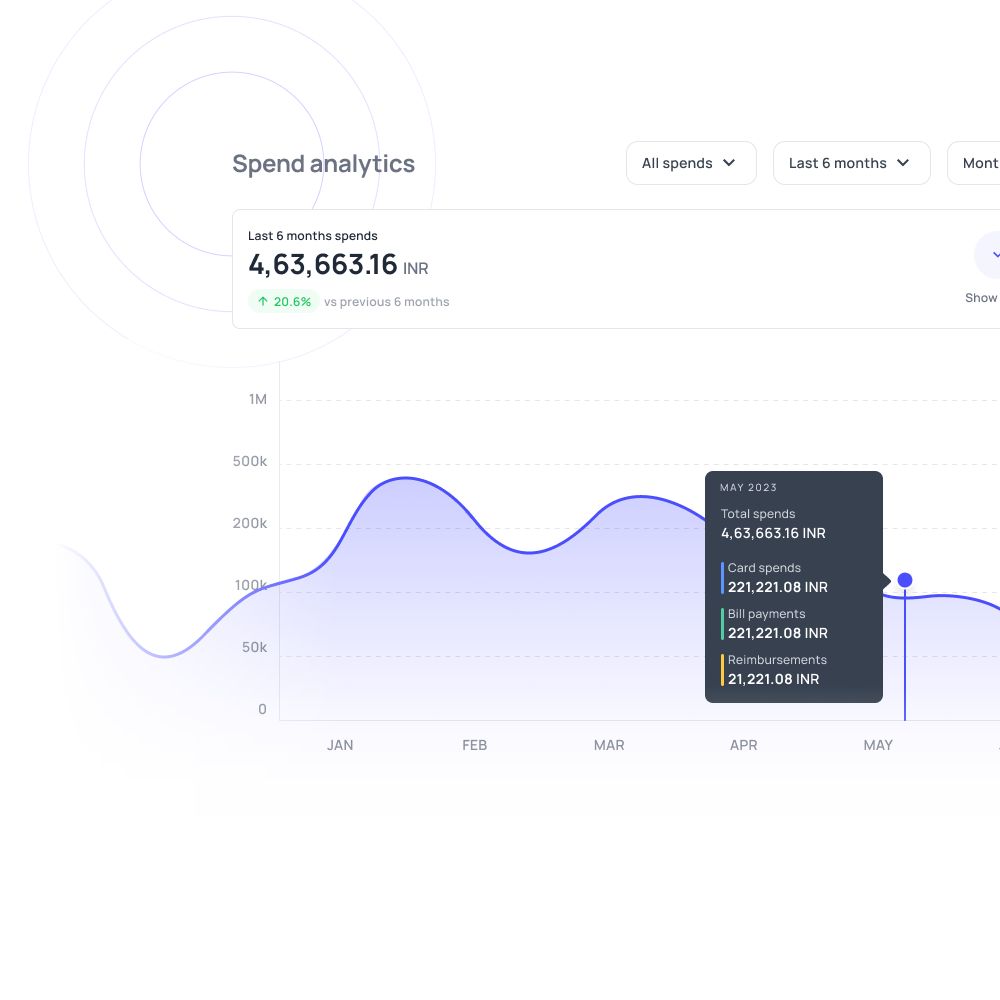

Cash flow management is especially important when dealing with bulk purchases and extended payment terms. Volopay provides real‑time visibility into approved expenses, upcoming vendor payments, and committed spend for India-based finance teams dealing with staggered payment terms common in Indian F&B businesses.

Finance leaders can forecast cash requirements more accurately, avoid last‑minute funding gaps, and make informed decisions. A centralized view of liabilities and expenses strengthens financial planning across the organization.

F&B success stories with Volopay

Burger Singh enhanced procurement control and simplified settlement reconciliation.

FreshMenu streamlined petty cash, automated expenses, and simplified bill payments.

Bring Volopay to your business

Get started now

FAQs

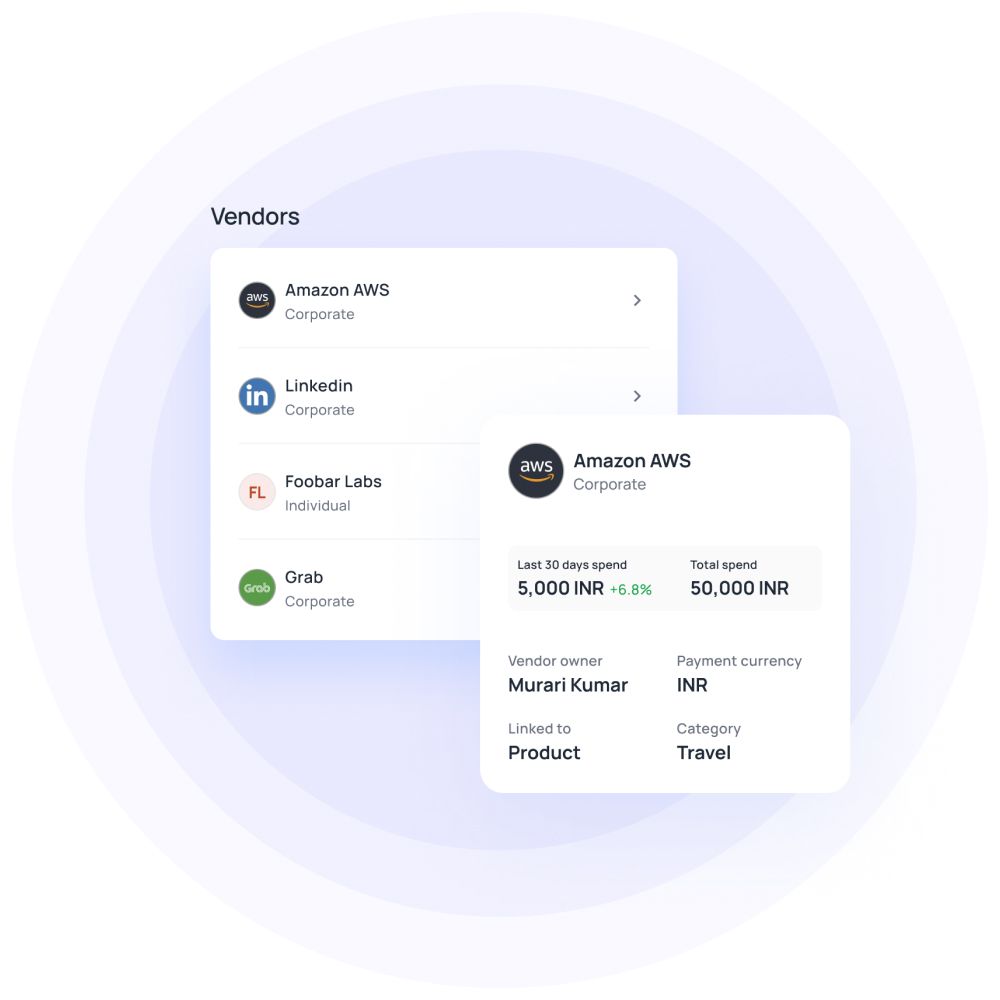

Volopay automates invoice approvals, schedules payments based on agreed terms, and consolidates vendor data. This helps manage high-value bulk payments efficiently while maintaining strong supplier relationships and clear audit trails for US compliance needs.

Yes. Volopay allows you to categorize and track ingredient procurement, packaging costs, utilities, maintenance, and other operational expenses in one unified system.

You can schedule payments in advance, track outstanding liabilities, and align cash flow planning with longer payment cycles, all without manual follow-ups.

Volopay lets you define budgets, approval workflows, and spending limits based on category, department, or role, ensuring policy compliance across the business.

Yes. Volopay integrates with popular accounting and ERP platforms used in the US, enabling automatic data sync and faster reconciliation.

All supplier invoices and payments are centralized, making it easy to analyze spend trends, manage contracts, and avoid duplicate or unapproved purchases.

Volopay supports corporate card spending as well as employee reimbursements, giving you flexibility while maintaining full visibility and control.

Real-time dashboards show approved spend, pending payments, and upcoming commitments, helping finance teams plan cash flow with confidence.

You can generate detailed reports by category, vendor, location, or time period to support COGS analysis and cost optimization efforts aligned with US financial reporting requirements.

Most food and beverage businesses can get started within a few days, with guided onboarding and integrations to existing systems.