👋Exciting news! UPI payments are now available in India! Sign up now →

Volopay’s spend management software for Indian D2C brands

Handling expenses across your direct-to-consumer brand shouldn't feel like balancing spreadsheets, receipts, and vendor invoices. As your business expands, scattered spending across marketing channels, fulfillment partners, SaaS tools, and team members creates blind spots that slow you down.

D2C expense management needs to be as flexible as your brand, giving you real-time visibility into where every rupee goes without adding administrative overhead. Volopay consolidates your entire expense ecosystem into one unified platform.

From Facebook Ads spend to packaging vendor payments, from Shopify subscriptions to employee travel costs, you get complete control and clarity. Designed specifically for growing ecommerce brands, Volopay helps you track, control, and optimize spending while your team focuses on scaling revenue.

All-in-one D2C expense management

Running your D2C brand means managing dozens of expense categories simultaneously. Your marketing team runs campaigns across Google and Meta. Operations handles packaging, warehousing, and logistics. Your tech stack includes analytics platforms, email tools, and inventory systems.

Traditional expense management for e-commerce brands forces you to use multiple tools, creating data silos that hide your financial picture. Volopay's comprehensive expense management platform brings everything together with corporate cards, bill payments, invoice approvals, reimbursements, and accounting integrations in a single dashboard. You see exactly what each department spends and track budget utilization in real-time.

The platform adapts to your workflows rather than forcing rigid processes. Set up custom approval hierarchies, create spending policies by team, and automate routine tasks. As your brand expands, Volopay scales with you without requiring system overhauls.

Control marketing spend across multiple channels

Marketing typically represents your largest expense category, spread across numerous platforms. Between paid social, search advertising, influencer partnerships, and content production, tracking becomes critical for understanding customer acquisition costs and ROI. Without controls, marketing budgets can spiral beyond thresholds.

Volopay lets you issue dedicated virtual cards for each marketing channel. Your social media manager gets a card for Meta Ads with preset spending limits. Your performance lead receives separate cards for Google Ads campaigns. Each transaction automatically categorizes itself, providing granular visibility into channel spending.

You can modify card limits instantly without waiting for finance approvals. Real-time alerts notify stakeholders when budgets approach thresholds. At month-end, you have clean data showing channel consumption and optimization opportunities.

Track vendor payments end-to-end

Your vendor network forms the backbone of product delivery, yet managing these relationships involves scattered invoices, payment schedules, and reconciliation headaches. Packaging suppliers, fulfillment centers, and logistics providers all require timely payments with proper documentation.

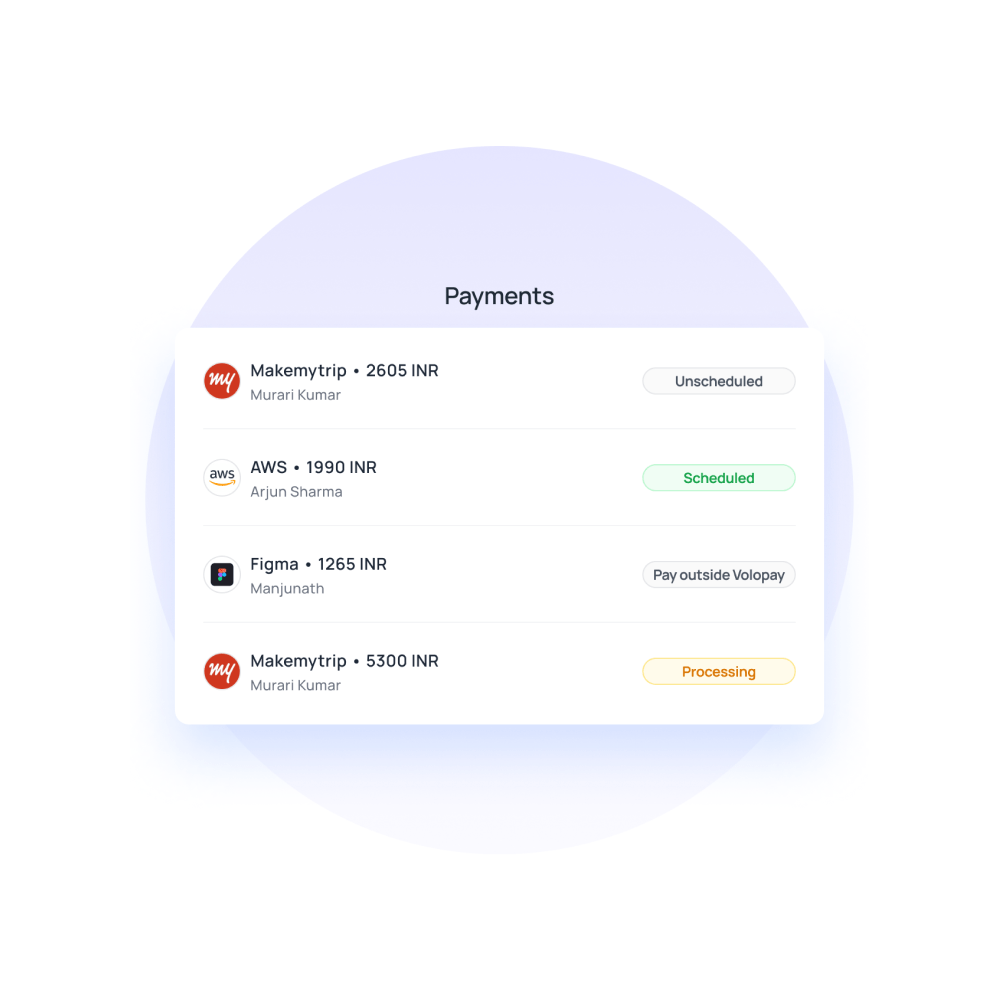

D2C business expense software from Volopay digitizes your vendor payment workflow. Upload invoices directly, route them through approval chains, and schedule payments according to cash flow needs. Every vendor gets its own payment history for easy review and audit.

The platform supports one-time and recurring vendor payments. Set up automatic monthly payments for warehouse rent or packaging orders. All payment documentation stored securely, ready for audits or GST reconciliation.

Manage digital expenses & SaaS subscriptions

D2C brands run on software. Shopify for your storefront, Klaviyo for email marketing, Gorgias for support, Shiprocket for logistics, and countless other tools power operations. These subscriptions renew monthly or annually on different cards and currencies, making tracking difficult.

Volopay's D2C spend management platform gives complete visibility into your SaaS ecosystem. Assign virtual cards to specific software categories. When tools renew, transactions appear in your dashboard with proper categorization. You instantly see costs and identify unused subscriptions draining your budget.

The platform prevents service disruptions from expired cards or failed payments. Set up backup payment methods for critical tools. Receive alerts before renewals so you can evaluate whether to continue, downgrade, or cancel services.

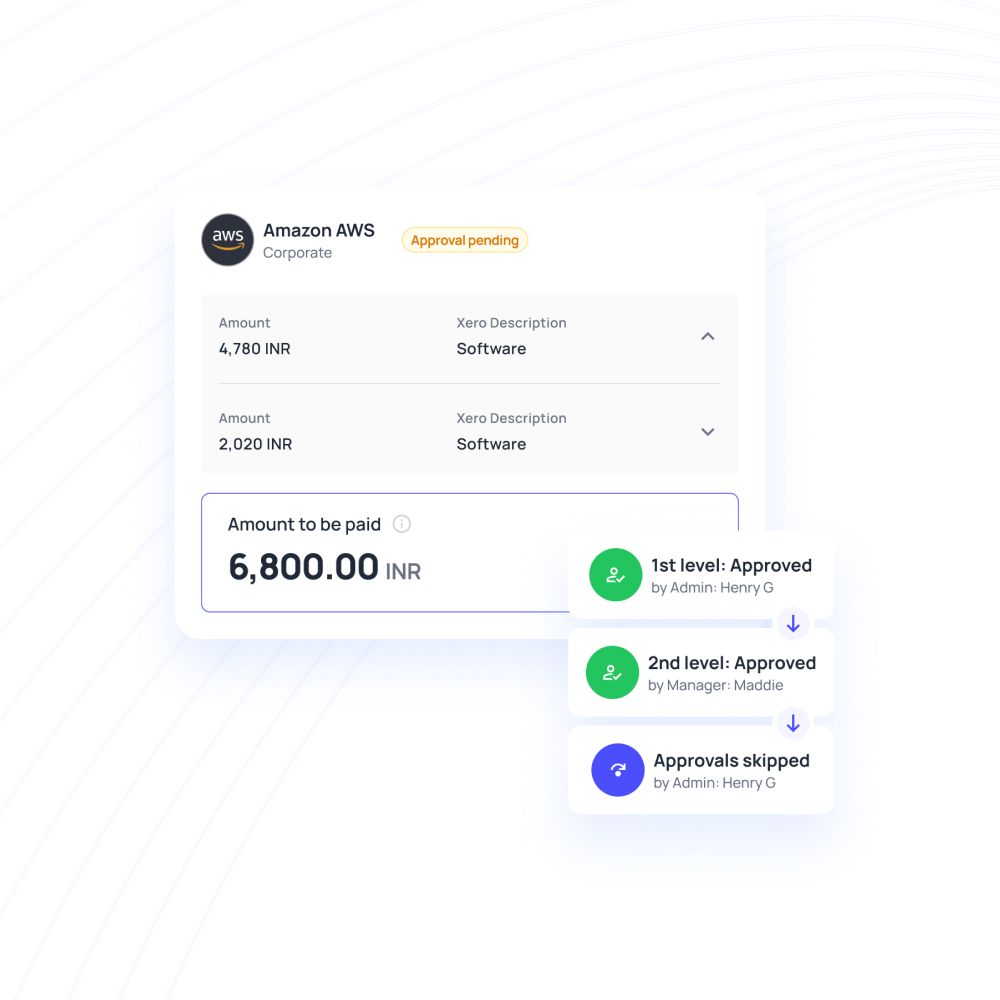

Automate invoice processing and approvals

Manual invoice management consumes finance team hours while creating bottlenecks that frustrate vendors. Invoices arrive via email or paper. Finance teams manually enter data, chase approvals, and reconcile payments across accounts.

With expense management for D2C brands, Volopay automates invoice workflows from receipt to payment. Vendors submit invoices through email or portal. OCR technology extracts key data automatically. Invoices route to appropriate approvers based on predefined rules.

Approvers receive notifications to make quick decisions. Once approved, schedule payments immediately or batch them strategically. The audit trail shows who submitted, approved, and paid invoices, simplifying month-end close and GST filing.

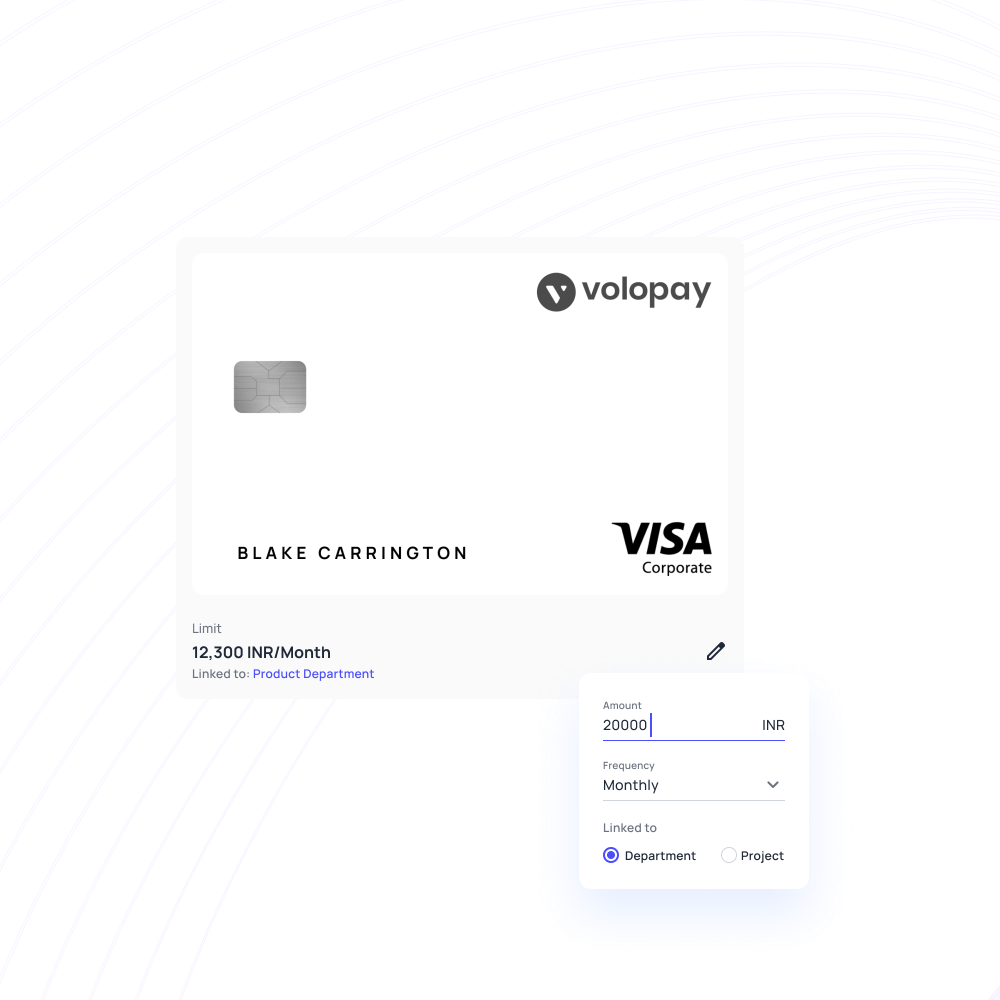

Issue corporate cards with built-in controls

Empowering your team with corporate cards accelerates operations but traditionally comes with control trade-offs. Shared cards create confusion. Individual cards without limits risk overspending. Reimbursement processes slow down expenses and frustrate employees.

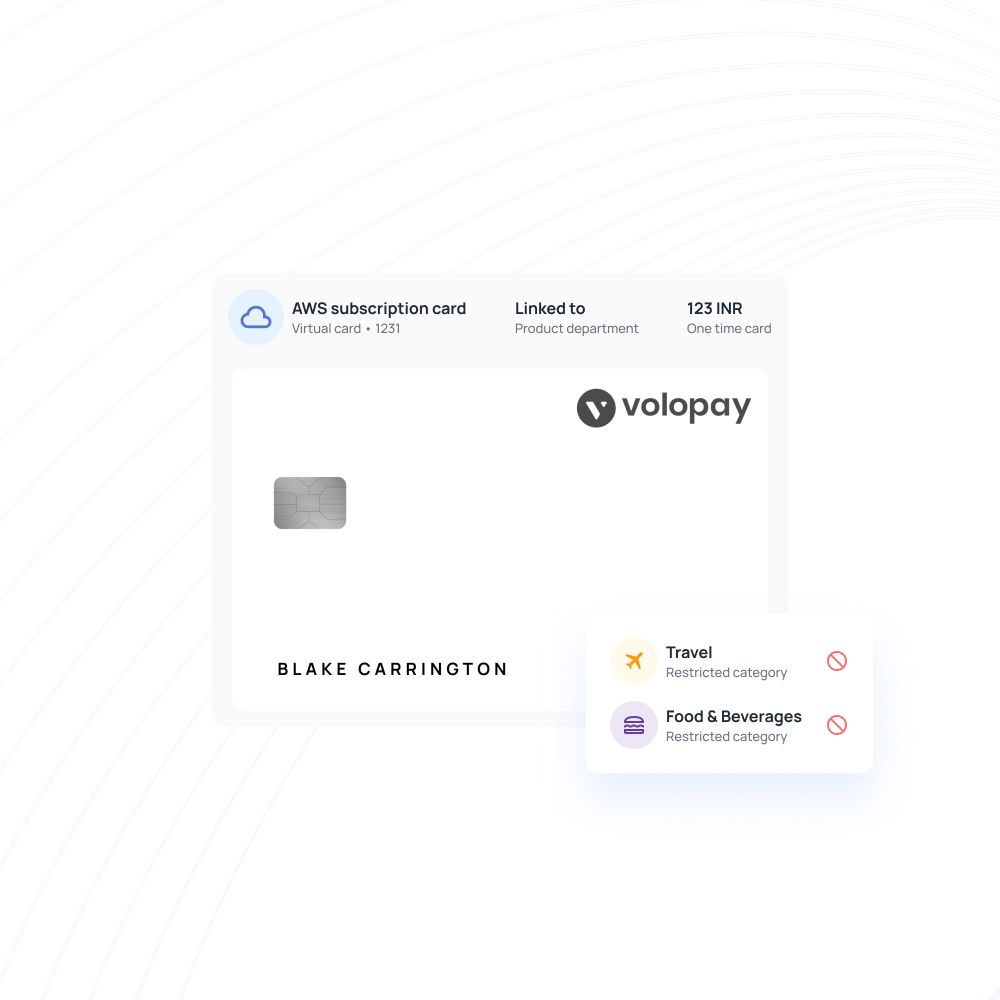

Volopay's corporate card program provides programmable spending controls. Issue physical or virtual cards to any team member with custom limits, merchant restrictions, and validity periods. Your content creator gets a card for stock photography. Your operations manager receives a card for supplier purchases.

Each transaction appears in real-time with automatic categorization and receipt requirements. Employees snap photos of receipts through the mobile app for instant reconciliation. Finance gains complete visibility without processing expense reports manually.

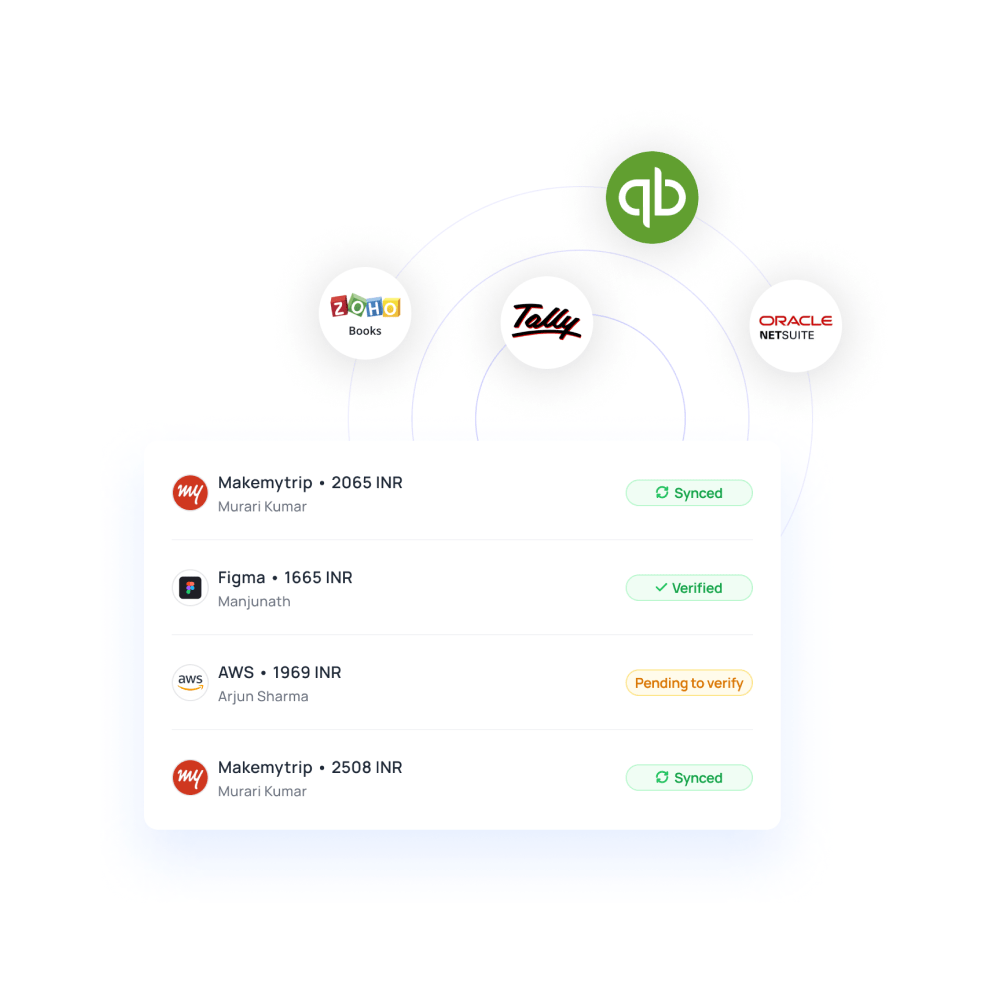

E-commerce accounting system integration

Financial data trapped in isolated systems creates reconciliation nightmares and reporting delays. Your direct-to-consumer expense tracking platform needs to communicate with accounting software and business systems to create a single source of truth.

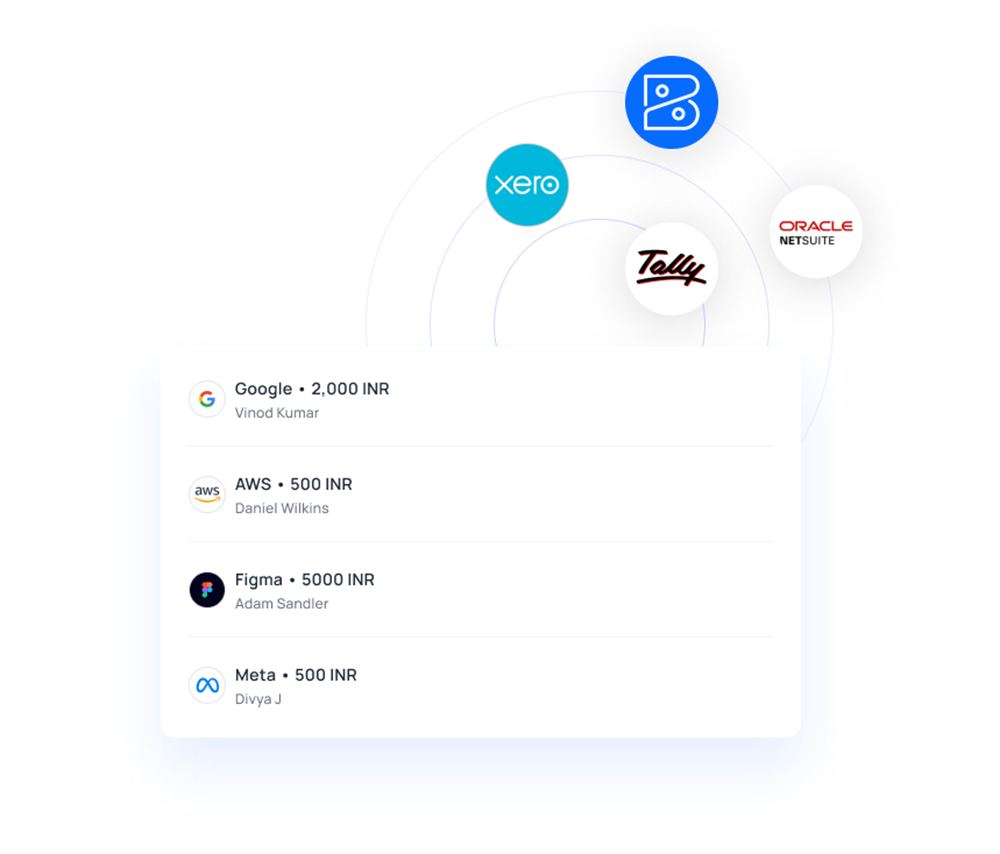

Volopay integrates directly with popular platforms like Zoho Books, Tally, QuickBooks, Xero, and more. Transactions sync automatically with proper categorization, eliminating duplicate data entry and reducing month-end close time. Custom fields map to your chart of accounts.

Beyond accounting, the platform connects with your e-commerce stack. Pull revenue data from Shopify to understand spending relative to sales. Connect with inventory systems to align purchasing with stock levels.

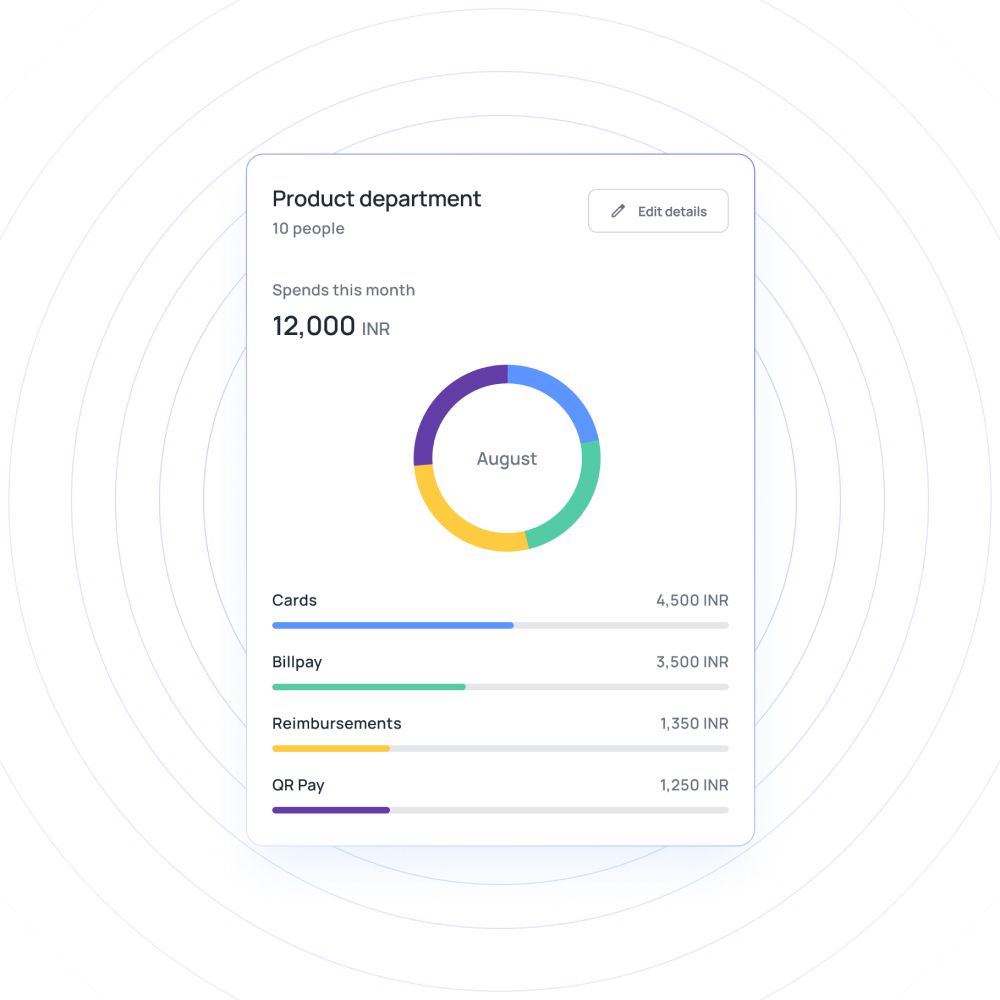

Gain visibility into cash flow and burn rate

Understanding your financial runway is critical, whether you're bootstrapped, managing tight margins, or venture-backed, monitoring burn rate for investors. Traditional accounting provides backward-looking reports arriving weeks after the month-end.

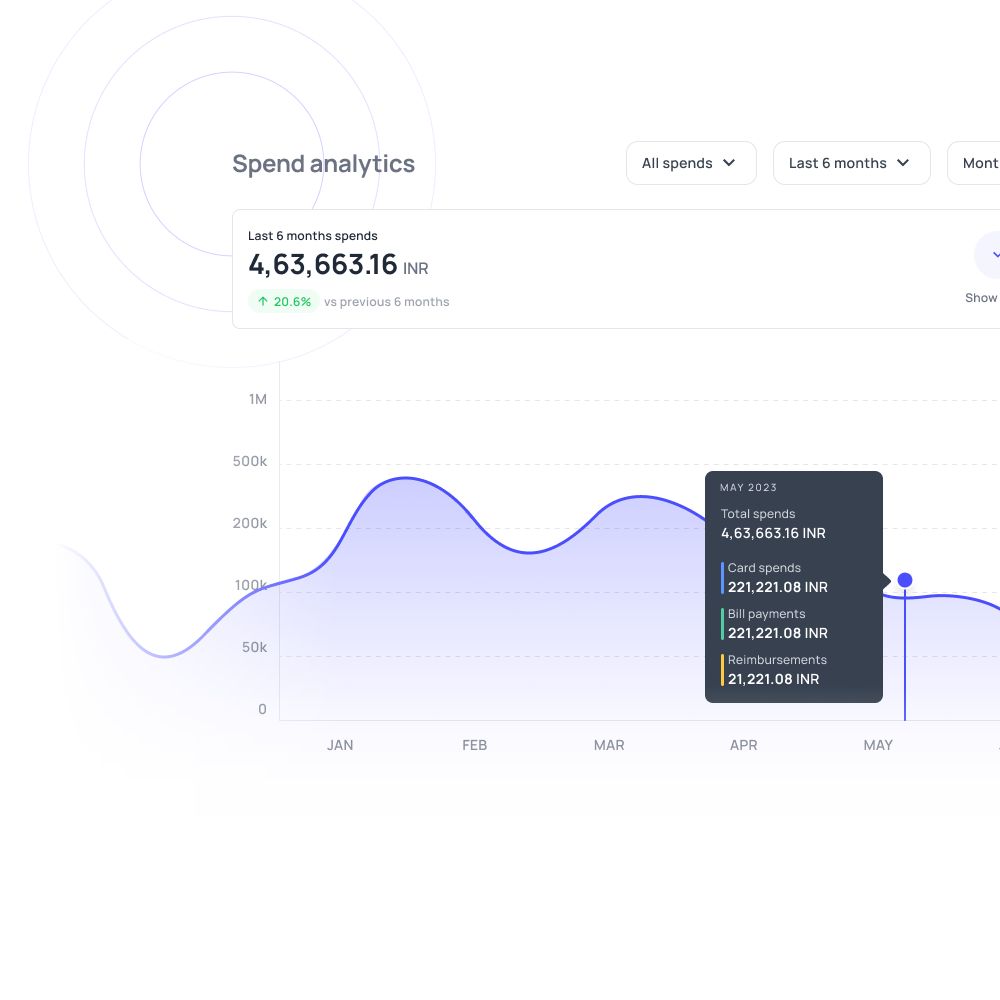

Volopay's real-time dashboards show exactly where your money flows. See daily spending across all categories, compare expenses against budgets, and project the runway based on the current burn rate. Filter views by department, vendor, or expense type.

These insights enable proactive cash management rather than reactive firefighting. If marketing spend accelerates beyond plan, adjust budgets before consuming critical runway. During fundraising, pull accurate reports showing capital deployment and results.

D2C success stories with Volopay

Urban Company improved visibility and reduced procurement overruns with Volopay.

Bring Volopay to your business

Get started now

FAQs

Volopay assigns unique virtual cards to each SaaS subscription, automatically categorizing renewals and providing visibility into your entire software stack to identify unused subscriptions.

Yes, Volopay handles vendor bill payments, invoice approvals, corporate card expenses, and employee reimbursements in one platform.

You can set up virtual cards for recurring digital expenses with automatic renewals. The platform tracks subscription costs and alerts you before renewals.

Absolutely. Volopay allows custom spending policies, budgets, and card limits for each department, project, or individual team member.

Real-time dashboards show daily spending patterns, budget utilization, and runway projections, enabling proactive adjustments before cash burns beyond planned thresholds.

Yes, you can create unlimited virtual cards with custom limits, merchant restrictions, and validity periods tailored to specific use cases.

The platform digitizes vendor invoice submission, approval workflows, and payment scheduling while maintaining complete payment history and documentation.

Volopay connects with QuickBooks, Xero, NetSuite, and other major accounting platforms. Transactions sync automatically with proper categorization.

Most D2C brands complete implementation within a few days, including setting up your chart of accounts, configuring approval workflows, and integrating with existing systems.