👋Exciting news! UPI payments are now available in India! Sign up now →

Customizable prepaid corporate cards with UPI

Managing business expenses across teams and departments can be challenging for growing Indian companies. Traditional payment methods often lead to overspending, delayed approvals, and complex reconciliation processes.

Prepaid corporate cards offer a revolutionary solution that helps you control spend, automate expense controls, and simplify accounting while maintaining complete visibility over your company's financial activities. Volopay provides the perfect platform to implement these modern payment solutions for businesses of all sizes across India.

What is a prepaid corporate card?

A prepaid corporate card is a pre-funded, reloadable payment solution designed specifically for business use. Unlike traditional credit cards, these cards eliminate the risk of overspending by limiting transactions to the amount loaded onto the card.

This innovative approach helps Indian businesses maintain strict budget control while streamlining their expense management processes. The cards function seamlessly across online and offline transactions, making them ideal for diverse business needs in India's dynamic market environment.

1. Controlled funding for teams and departments

Your business can allocate specific amounts to different teams, such as marketing, travel, HR, and operations, through dedicated cards. This departmental allocation system allows you to monitor usage patterns effortlessly while maintaining budget discipline.

Each team receives exactly the funding they need, preventing unauthorized spending and ensuring that your financial resources are utilized according to planned budgets and strategic priorities.

2. Common use cases in businesses

Indian businesses typically use prepaid corporate cards for various essential activities, including digital advertising campaigns, software subscriptions, corporate travel bookings, and vendor payments. These cards are particularly effective for managing freelancer payments, employee reimbursements, and recurring service charges.

The flexibility of these cards makes them suitable for everything from small office supplies to large-scale marketing campaigns, providing comprehensive payment solutions across different business functions.

Benefits of prepaid corporate cards for business

Your company can start using prepaid corporate cards immediately without undergoing traditional banking approval processes or credit assessments.

This independence from conventional banking procedures enables faster business setup and eliminates the bureaucratic delays commonly experienced with Indian financial institutions.

You can begin issuing cards and managing expenses within hours rather than waiting weeks for credit approvals, significantly improving your operational efficiency.

The prepaid nature of these cards ensures that spending is limited to the loaded amount, completely eliminating the risk of accumulating debt or incurring interest charges.

Your business will never face unexpected financial shocks from overdraft fees or late payment penalties.

This controlled spending environment helps maintain predictable cash flow and prevents budget overruns that could impact your company's financial stability.

Real-time visibility into spending patterns keeps your finance teams in complete control of company expenses.

You receive instant notifications for every transaction, allowing immediate identification of unusual spending patterns or unauthorized usage.

This transparency ensures that your financial oversight remains comprehensive and enables quick corrective actions when necessary, maintaining the integrity of your expense management system.

What makes Volopay prepaid card the smart choice for businesses

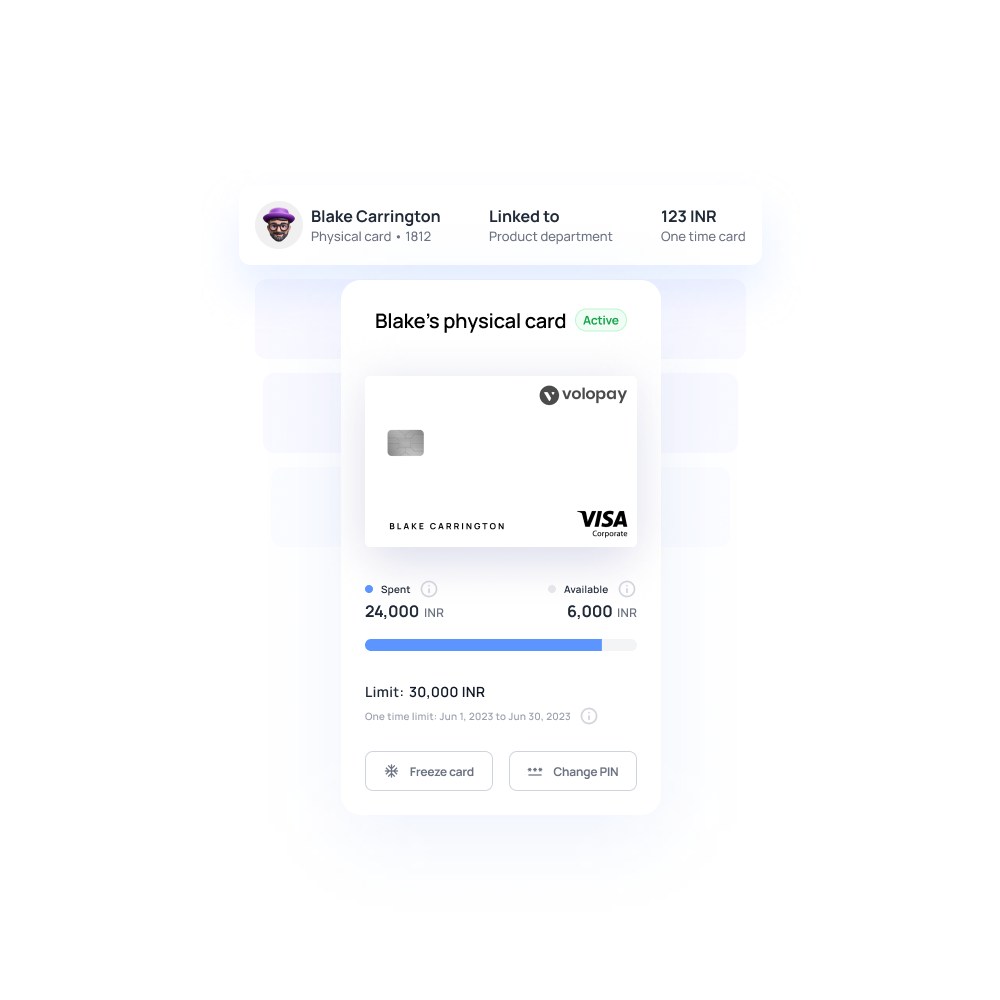

Physical & virtual cards, instantly issued

Volopay enables you to issue both physical and virtual prepaid corporate cards on demand for employees, teams, and specific projects directly from your dashboard. This instant issuance capability ensures that your business operations never face payment delays due to card availability.

Whether you need cards for immediate online purchases or physical transactions, the platform provides immediate solutions that match your operational requirements.

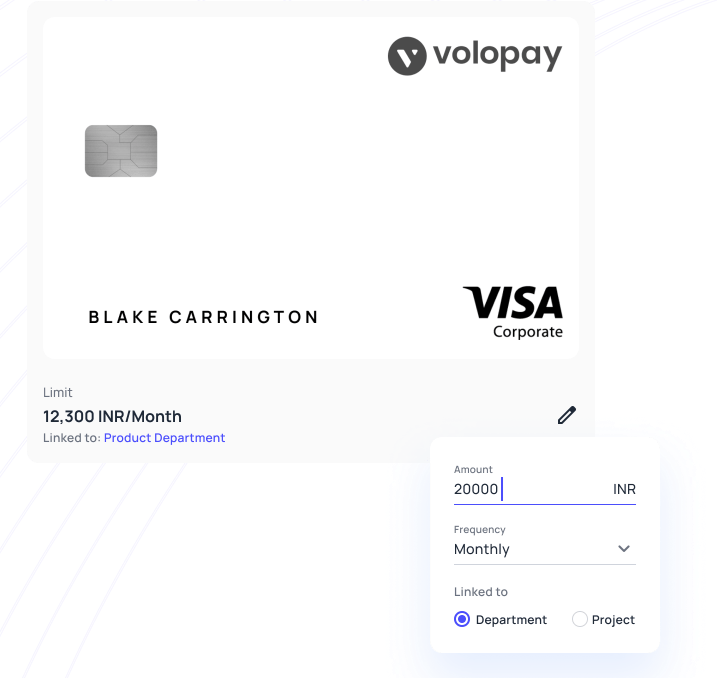

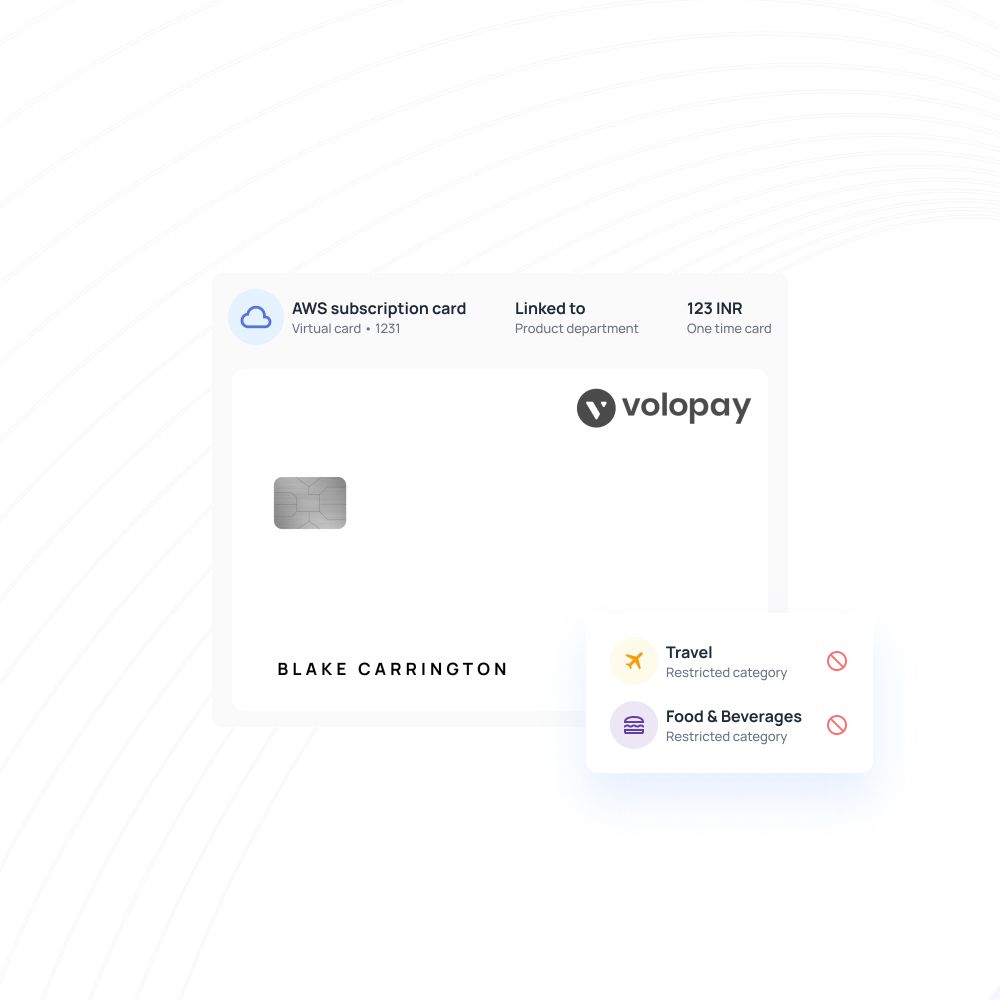

Spend rules aligned with internal policies

You can define category-level restrictions, usage timing parameters, and vendor access controls to ensure complete compliance with your internal financial policies. These customizable spend rules automatically prevent unauthorized purchases and maintain adherence to your company's financial guidelines.

The system enforces your policies automatically, reducing the need for manual oversight while maintaining strict financial discipline across all card usage.

Freeze or modify cards in seconds

Suspected misuse or suspicious activity can be addressed immediately by disabling or adjusting any card with a single click. This instant control capability provides peace of mind and immediate response to potential security threats.

You can temporarily freeze cards for suspected issues and reactivate them once concerns are resolved, ensuring continuous protection of your company's financial resources.

Get the perfect prepaid card for your business!

Powering financial discipline with built-in controls

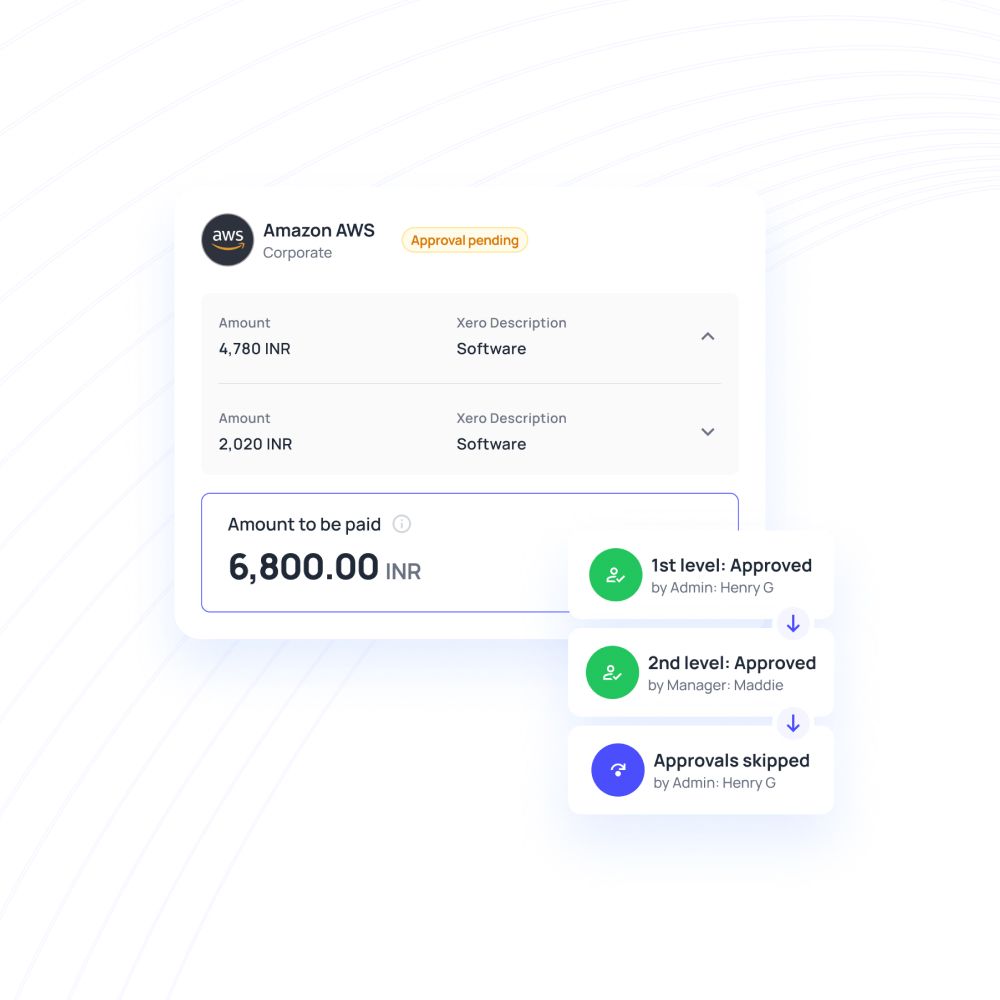

Predefined approval flows

Your organization can create comprehensive approval hierarchies, ensuring that no card top-up or significant transaction occurs without proper oversight. These predefined workflows maintain financial discipline by requiring appropriate authorization levels for different spending categories.

The system automatically routes requests through the correct approval channels, preventing unauthorized spending while maintaining operational efficiency for legitimate business expenses.

Role-based access for admins and managers

Access control features allow you to restrict card creation, funding, and monitoring capabilities based on specific team responsibilities and organizational hierarchy. This role-based system ensures that only authorized personnel can perform sensitive financial operations.

You can assign different permission levels to various team members, maintaining security while enabling efficient expense management across your organization.

Secure infrastructure with global compliance

Volopay's prepaid corporate cards are powered by PCI-DSS compliance standards and enterprise-grade encryption protocols, ensuring maximum security for your business transactions. The platform maintains international security standards while accommodating India-specific regulatory requirements.

This robust security infrastructure protects your company's financial data and ensures compliance with both local and global financial regulations.

Fueling Indian businesses of all sizes—startups to enterprises

Startups: launch fast, track faster

Emerging Indian startups can eliminate their dependence on traditional credit facilities and begin spending within hours rather than weeks. This rapid deployment capability enables faster market entry and operational scaling.

Your startup can allocate funds to essential activities like marketing campaigns, software tools, and vendor payments without waiting for lengthy credit approval processes, maintaining the agility necessary for competitive advantage.

MSMEs: optimize every rupee

Medium and small enterprises can avoid overpayments, manage vendor bills effectively, and monitor campaign ROI through real-time tracking capabilities. These prepaid corporate cards help MSMEs maintain tight budget control while scaling their operations.

You can track every transaction's impact on your business objectives, ensuring that marketing spend generates measurable returns and operational expenses remain within planned budgets.

Large enterprises: built for scale

Enterprise-level organizations can manage thousands of cards simultaneously, automate comprehensive reporting, and enable inter-department transparency across complex organizational structures. The platform scales seamlessly to accommodate large-scale operations while maintaining granular control over individual transactions.

Your enterprise can implement sophisticated expense management policies while providing departments with the autonomy they need for efficient operations.

Automate vendor & recurring payments with prepaid cards

Schedule regular payments with zero manual input

Your business can automate subscription renewals, utility payments, and SaaS tool charges from designated prepaid corporate cards without manual intervention. This automation eliminates the risk of missed payments and reduces administrative overhead.

The system handles recurring charges automatically while maintaining complete transaction records for accounting purposes, ensuring operational continuity and financial accuracy.

Allocate vendor-specific cards for granular tracking

Individual cards can be assigned to specific vendors to prevent misuse and simplify reconciliation processes. This vendor-specific allocation provides clear audit trails and prevents unauthorized spending across different supplier relationships.

You can track vendor-specific expenses easily, negotiate better terms based on actual spending data, and maintain transparent financial relationships with all your business partners.

Avoid payment failures or overcharges

Automated top-up features and usage alerts ensure that your business never misses payment due dates or faces service interruptions. The system monitors card balances and automatically replenishes funds when needed, preventing payment failures.

You receive advance notifications about upcoming payments and low balances, enabling proactive financial management and preventing operational disruptions.

Why finance teams rely on Volopay corporate cards

Modern Indian businesses require sophisticated financial tools that support rapid growth while maintaining strict compliance standards. Volopay's prepaid corporate cards provide finance teams with precision tools designed for contemporary business environments.

Our platform combines automated record-keeping with audit-ready documentation, enabling finance professionals to maintain comprehensive oversight while supporting business agility and growth objectives across diverse industry sectors.

Auto-capture invoices & receipts for every spend

Employees receive automatic prompts to upload receipts and invoices immediately after each transaction, ensuring complete documentation for every expense. This automated capture system helps your finance team close books faster with all supporting documents properly organized.

The system maintains digital records that are easily accessible for auditing purposes, eliminating the common problem of missing or lost expense documentation.

GST-ready expense categorization

All transactions are automatically tagged with GST-compliant labels and categories, reducing compliance complexities and simplifying monthly return preparations. This automated categorization system ensures that your business maintains accurate tax records without manual intervention.

The system understands Indian tax requirements and applies appropriate classifications, reducing the risk of compliance errors and simplifying interactions with tax authorities.

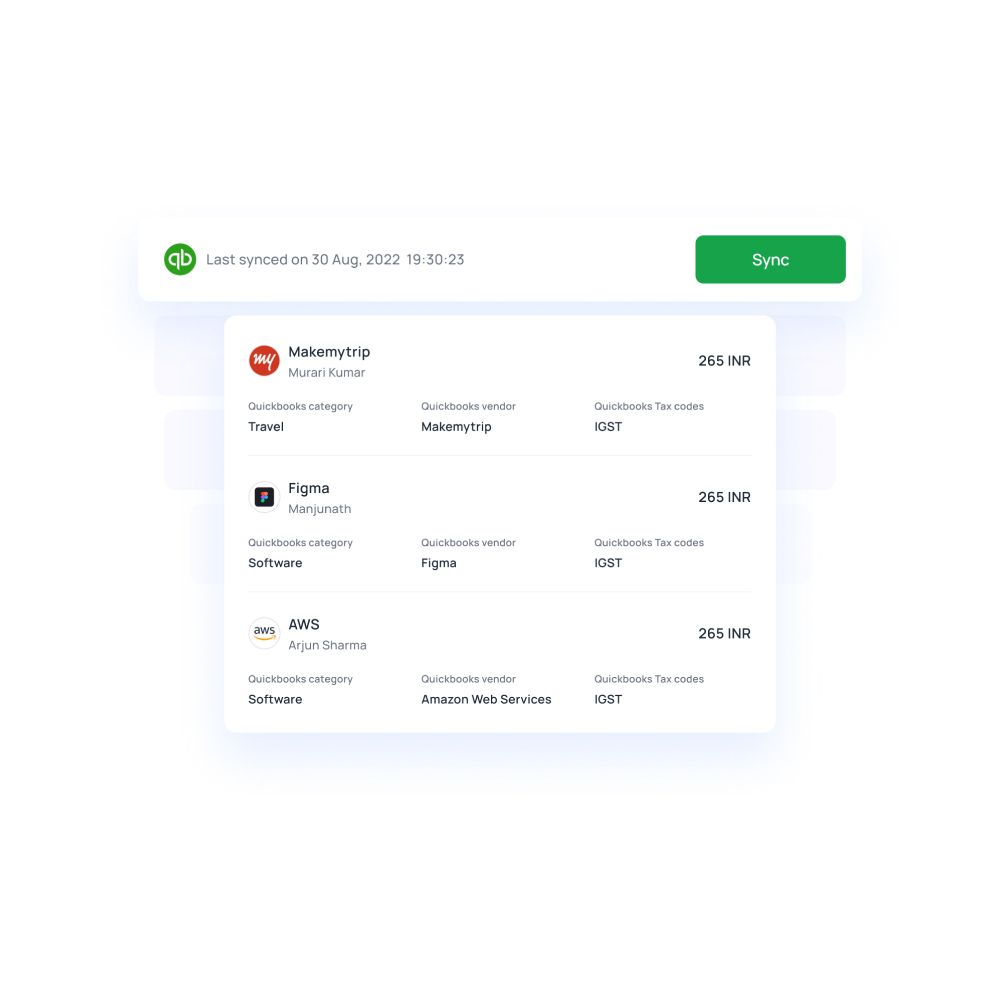

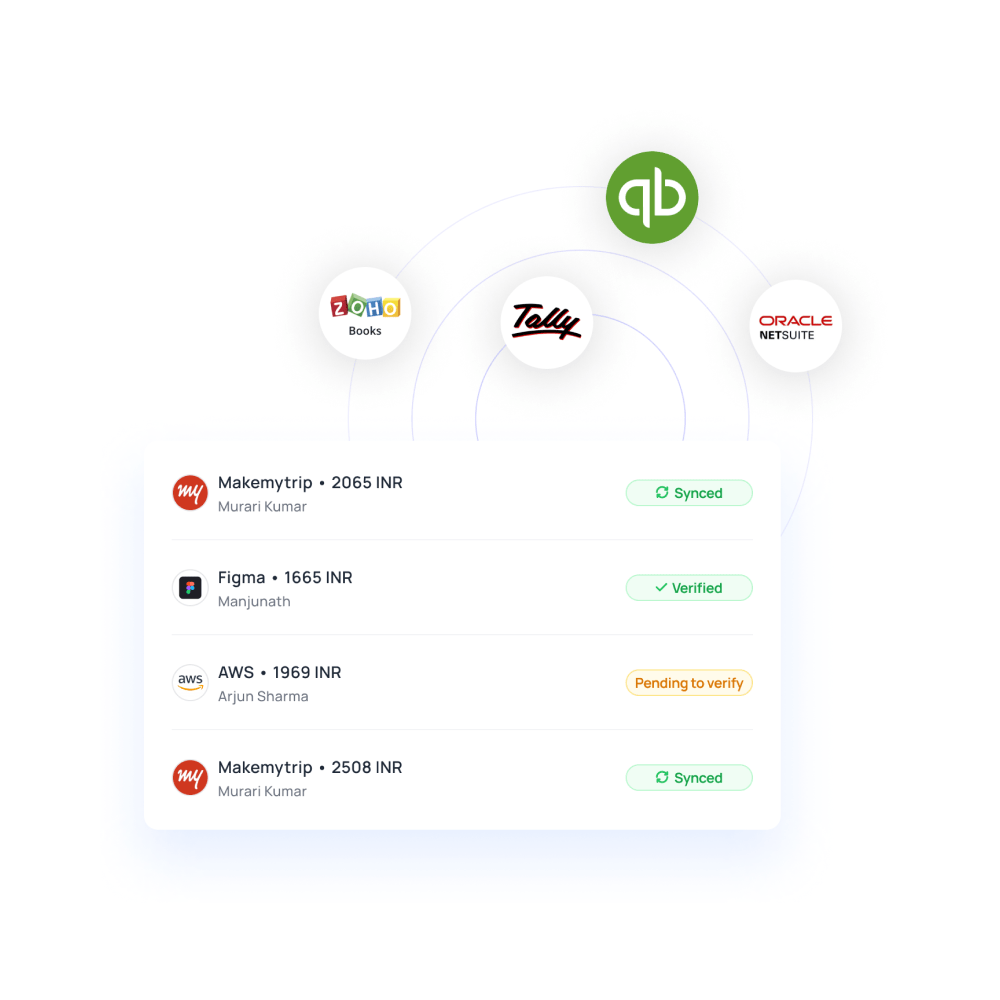

One-click export for audits or reconciliation

Generate comprehensive ledger-ready reports and export all card-related data into Xero, NetSuite, Tally, or other accounting software with complete audit trails in seconds. This seamless integration capability eliminates manual data entry and reduces the risk of transcription errors.

Your finance team can prepare audit documentation quickly and maintain accurate records for regulatory compliance and internal financial analysis.

Start using prepaid corporate cards in your business

Managing company expenses doesn't require complex processes or delayed card issuance when you choose the right platform. Volopay enables you to equip your teams with secure, policy-bound prepaid corporate cards that align perfectly with your internal finance rules.

The platform is designed to integrate seamlessly with existing workflows while providing enhanced control and visibility over all business expenses across your organization.

Issue cards in minutes without bank dependence

Skip traditional approval timelines and create allocated prepaid corporate cards instantly from your Volopay dashboard. This immediate issuance capability ensures that your business operations never face payment delays due to administrative processes.

You can respond quickly to changing business needs and provide teams with payment tools exactly when they need them, maintaining operational agility and competitive advantage.

Empower departments with purpose-built cards

Assign specialized cards for travel expenses, software subscriptions, vendor payments, or marketing campaigns, each configured with unique spending rules and limits. This departmental approach ensures that each team has appropriate payment tools while maintaining centralized oversight.

You can customize card parameters to match specific departmental needs while enforcing company-wide financial policies and spending guidelines.

Built for India's high-growth business landscape

Designed specifically to support fast-scaling companies across various Indian industries, Volopay adapts to your unique workflows and requirements.

Whether you're managing a lean startup team or coordinating a distributed enterprise workforce, the platform scales to match your organizational complexity. The system accommodates India's diverse business environment while providing the flexibility necessary for rapid growth and expansion.

FAQs about prepaid corporate cards

Yes, you can issue unlimited prepaid corporate cards for different teams, departments, or specific purposes. Each card can be configured with unique spending limits, merchant restrictions, and approval workflows. This flexibility allows you to maintain granular control over departmental expenses while providing teams with appropriate payment tools for their specific needs.

Prepaid corporate cards are widely accepted across online and offline merchants in India and internationally. They work seamlessly with major payment networks, enabling your teams to make purchases from virtually any vendor. The cards support both domestic and international transactions, providing comprehensive payment flexibility for diverse business requirements.

Absolutely, you can establish detailed usage policies and approval workflows for each prepaid corporate card. The system allows you to define spending categories, transaction limits, vendor restrictions, and approval hierarchies. These policies are automatically enforced, ensuring compliance with your financial guidelines while providing teams with necessary spending flexibility.

Yes, Volopay's prepaid corporate cards are fully compliant with RBI regulations and Indian financial standards. The platform adheres to all regulatory requirements for corporate payment solutions, ensuring that your business maintains compliance with local financial regulations. Regular audits and compliance updates ensure continued adherence to evolving regulatory standards.

You can reload cards instantly through the Volopay dashboard using various funding methods, including bank transfers, UPI, or automated top-up rules. The platform provides flexible reloading options that match your cash flow patterns and operational requirements. Automated reloading ensures that cards maintain adequate balances for continuous business operations without manual intervention.

Bring Volopay to your business

Get started now