👋Exciting news! UPI payments are now available in India! Sign up now →

Simplify reimbursements with smart employee debit cards in India

Tired of chasing receipts and handling endless reimbursement claims? With debit cards for employees, you can take full control of how your team spends. These cards let you automate expense limits, enforce policies, and simplify your accounting process. For growing businesses in India, they’re a smart way to eliminate reimbursement hassles and bring clarity to company spending.

Understanding employee debit cards in India

Employee debit cards mark a major shift from traditional corporate spending, giving businesses greater control over finances while equipping employees with the flexibility they need to do their jobs efficiently.

What is an employee debit card?

An employee debit card is a prepaid card issued to your team for business-related expenses. Instead of using their personal funds and waiting for reimbursements, employees can spend directly from a preloaded company balance. You decide how much to load, where the card can be used, and for what purposes.

This gives you full control, while your employees get the convenience of immediate access to work-related funds whether it's for travel, meals, or project costs.

The card is linked to your company’s account but protected with custom limits and category controls. You can also instantly freeze, block, or reload the card whenever needed through your expense management dashboard.

To make the most of employee debit cards and ensure you’re choosing a solution that aligns with your company’s spending needs, controls, and growth goals, explore our detailed guide to the best business debit cards in India.

Core advantages of employee debit cards

With employee debit cards, you gain real-time visibility into every transaction, so no more end-of-month surprises. You can enforce policy compliance automatically by setting spending limits and usage rules, ensuring that funds are only used as intended.

Your team benefits from greater spending flexibility within those guidelines, and you remove the need for manual reimbursements altogether. It's a faster, safer, and more efficient way to manage business expenses.

Plus, all transaction data syncs with your accounting system, reducing manual entry and errors. Over time, this helps you identify spending patterns, optimize budgets, and make smarter financial decisions.

Why your business needs employee debit cards

Conventional corporate spending methods add friction, increase financial risk, and drain administrative time. Today’s businesses need smarter solutions that safeguard finances and drive operational efficiency.

Lower costs & admin workload

Manual processes, paperwork, and delayed approvals drive up hidden costs. Employee debit cards streamline spending and replace reimbursements and petty cash.

Automation cuts down hours spent on tracking receipts and reconciling expenses. Fewer errors mean fewer corrections.

As time goes on, these cards help lower operational overhead and free up your finance team’s bandwidth.

Happier, more efficient employees

No one likes paying out of pocket and waiting weeks for reimbursements. Debit cards for employees let your team spend instantly and responsibly.

It removes financial pressure from staff, builds trust, and improves morale. When employees have access to the right tools, they can focus more on work and less on admin.

Ultimately, it boosts employee productivity company-wide.

Reduced fraud & overspending risks

Traditional methods like shared company debit cards or cash advances make tracking tough and create room for misuse. With individual cards, every transaction is tracked accurately.

Spending limits and category restrictions minimize the chance of fraud. You stay in control while keeping accountability clear.

Employee debit cards bring transparency to every rupee spent, helping prevent overspending and policy violations.

No more manual reimbursements

Reimbursements pile up quickly and bog down your accounting team. Employee debit cards replace this reactive process with proactive control.

Since spending happens in real time with built-in policy checks, there’s less to chase later. Expense data flows directly into your system.

This reduces your reconciliation backlog and gives your team more time to focus on important strategic tasks.

Empowered teams with spending control

Give employees the freedom to spend what they need, without losing control. You decide budgets, set limits, and monitor transactions live.

It’s the perfect balance between autonomy and control. With clear guidelines in place, your team can move faster while still aligning with your financial goals.

That’s the power of combining empowerment with smart oversight.

Streamline and modernize employee spending with Volopay debit cards

Traditional banking solutions in India often fall short when it comes to managing modern business expenses. Volopay is built to solve the real challenges Indian businesses face from tracking employee spending to simplifying reimbursements with smart features.

Instant card issuance for your team

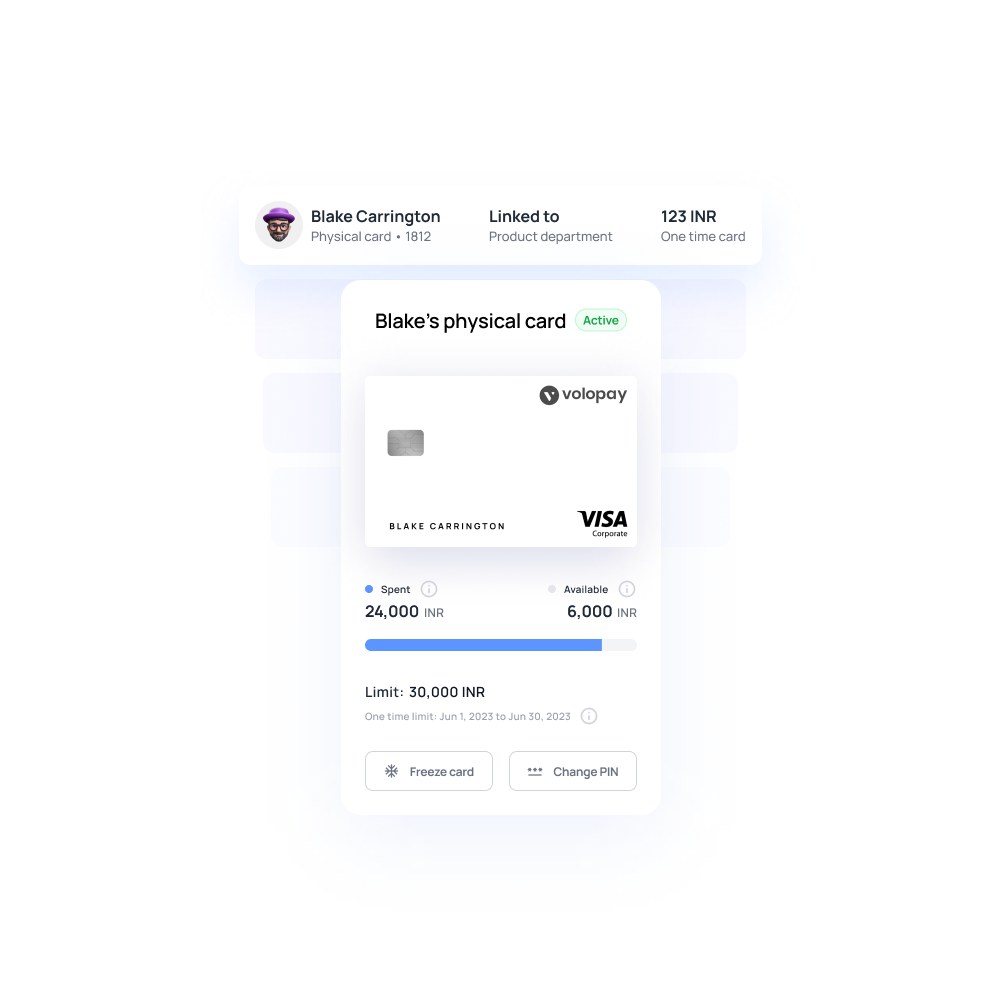

Volopay offers instant access to virtual cards and physical cards both, right from your dashboard. You can create and assign cards to employees in seconds no waiting or paperwork needed.

With just a few clicks, your team is ready to spend on approved expenses. It’s a fast, tech-powered alternative to outdated processes and traditional employee debit cards.

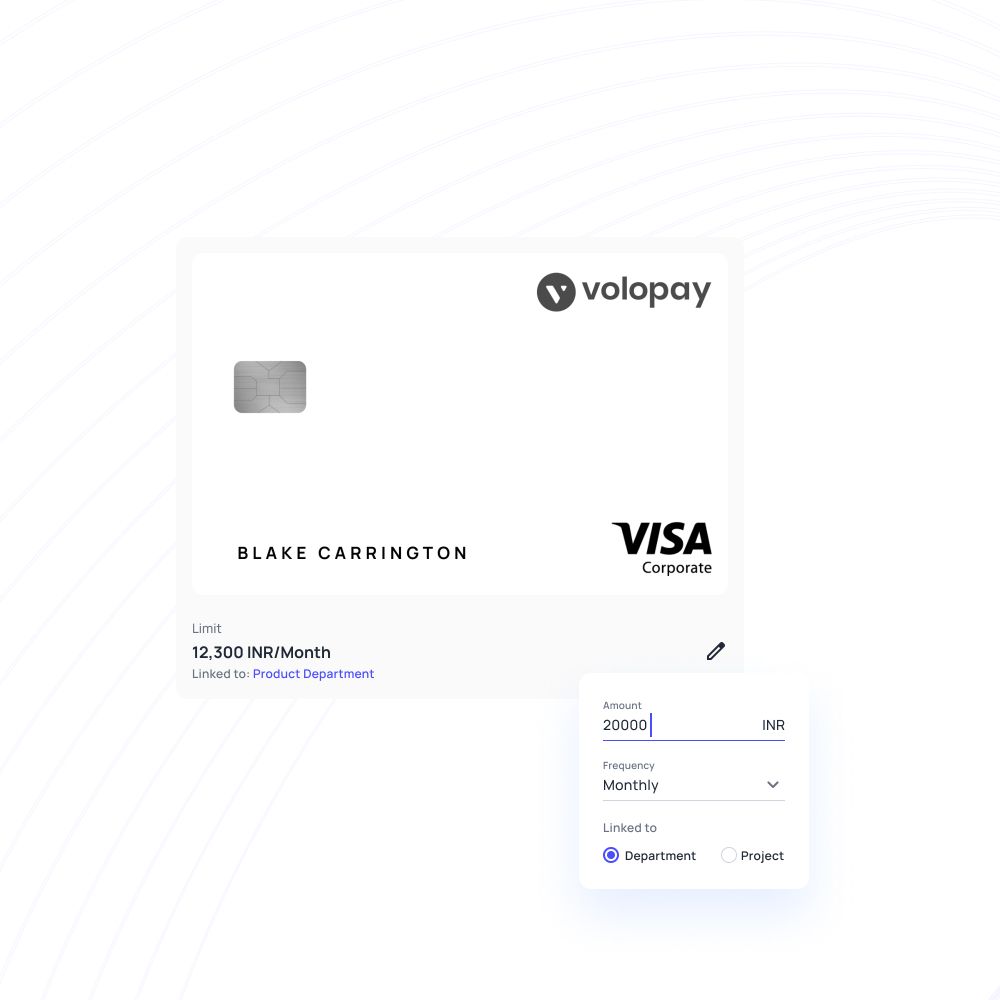

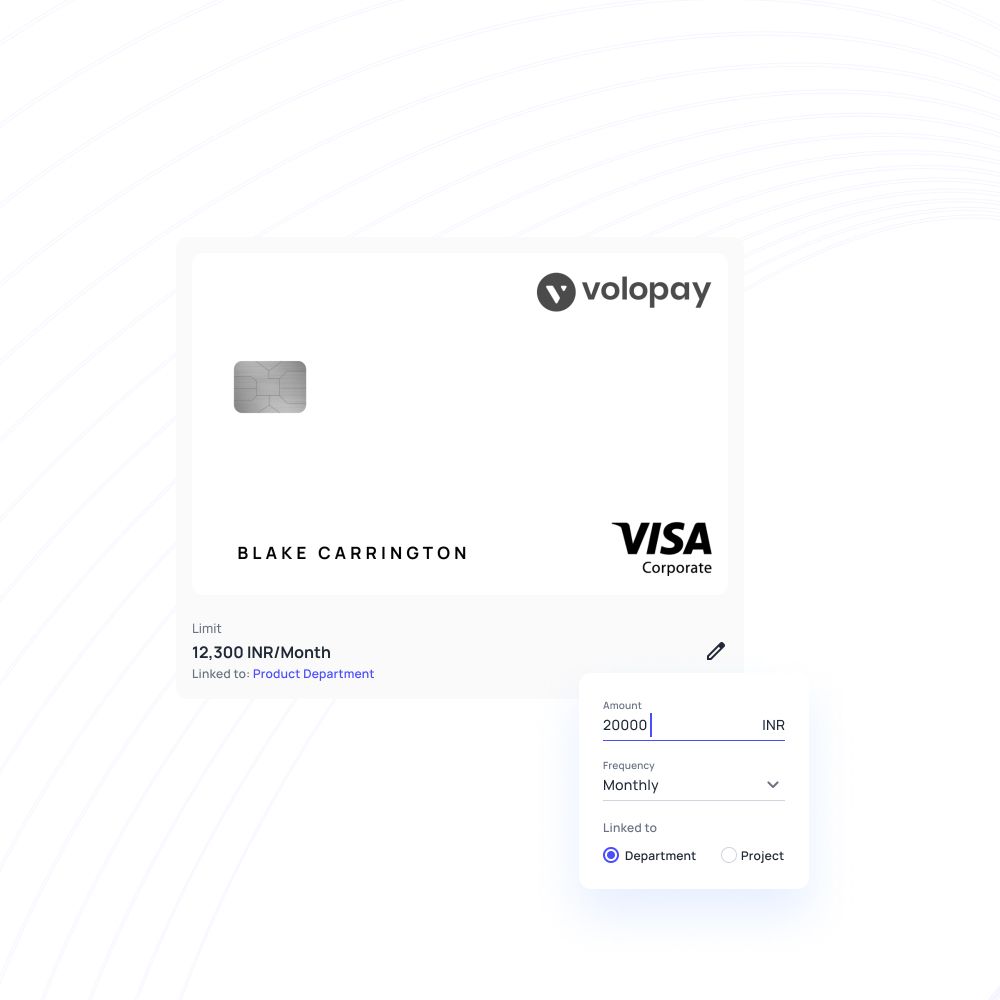

Customize spend limits, categories, and controls

Volopay lets you customize spending exactly how you need it. Set limits based on purpose, restrict certain merchant types, or define daily budgets by role.

You stay in control of every transaction without micromanaging. This level of precision helps prevent misuse and improve policy compliance.

It's smarter than conventional debit cards for employees and built for modern businesses.

Role-based access and multi-level approvals

Volopay ensures that only authorized users can spend company money. You can assign role-based access and set multi-level approvals for each card or department. That means junior employees can’t make high-value purchases without oversight.

It’s ideal for businesses that need tighter financial control without sacrificing speed or flexibility. Every layer adds security and accountability.

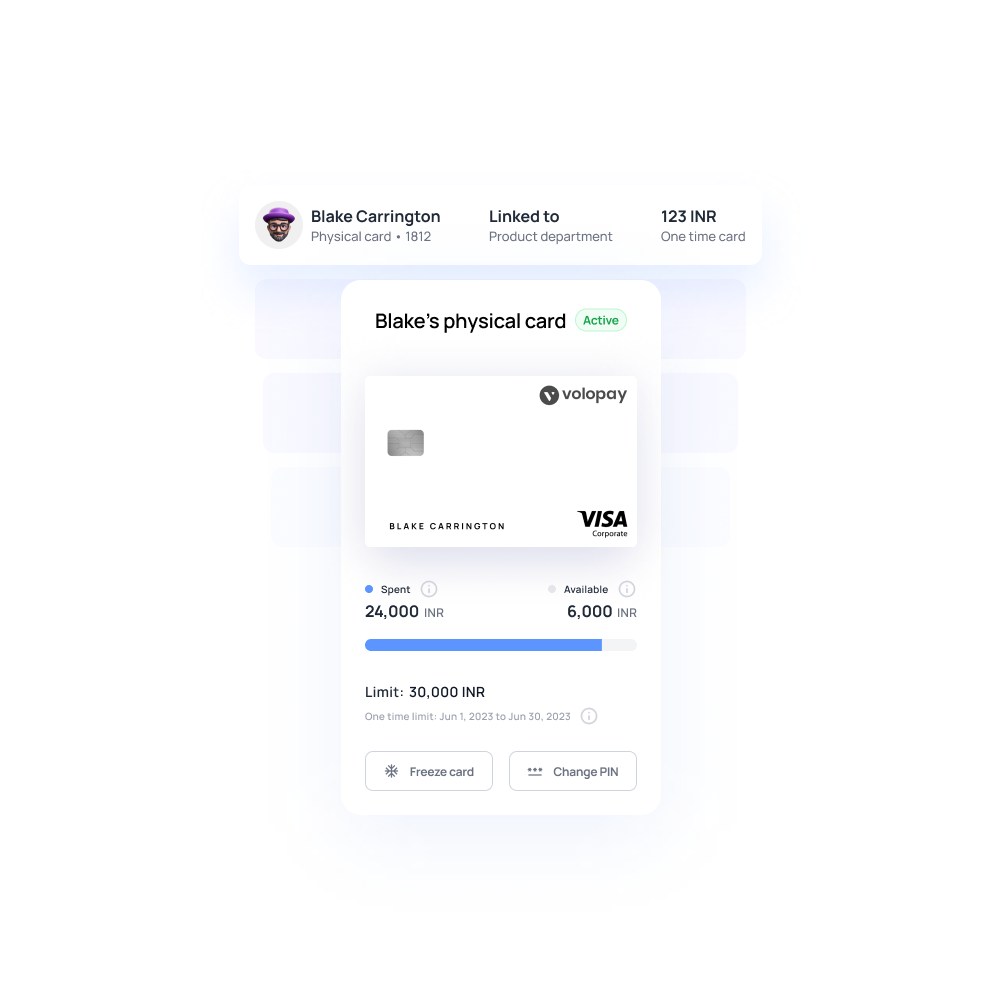

Instant card freeze or revoke options

If an employee leaves, changes roles, or misplaces a card, Volopay’s corporate cards let you instantly freeze or revoke access—no calls, no delays.

It’s a powerful safeguard that protects your finances in real time. Quick intervention minimizes risk and reinforces your internal spend control systems at every level.

Gain real-time visibility through Volopay’s employee debit cards

Financial visibility empowers smarter decisions and ensures adherence to company policies. Volopay offers powerful oversight tools that give you full control over your corporate spending.

Automated ledger synchronization for every transaction

Every time your team swipes a Volopay card, the transaction syncs directly with your accounting software. You no longer need to upload expense data or chase receipts manually.

This real-time integration ensures your books stay accurate and updated. For companies using debit cards for employees, this automation means less admin work and faster financial reporting.

Accessible tracking for managers via mobile and web

Volopay gives you the power to track spending anytime, anywhere. Through the Volopay mobile app or web dashboard, managers can view live transactions, check balances, and even approve or block expenses on the go.

Notifications help you stay informed without slowing down operations. It’s an always-on solution for leaders who need visibility and quick decision-making access.

Alert systems for budget overspend

Volopay helps you take immediate action when spending goes off course. You’ll get real-time alerts when a card approaches or exceeds set limits, or when unauthorized purchases are attempted.

These notifications allow you to catch issues early and take corrective steps. It’s proactive financial control that safeguards your budget without requiring you to monitor every detail manually.

Advanced reporting & analytics for strategic insights

Gain deeper insights into how your teams are spending with Volopay’s built-in reporting and analytics tools. You can view expense patterns, department-wise spend, and vendor-specific data over time.

These reports help you make informed budgeting decisions and uncover potential cost-saving opportunities. Smart data turns everyday transactions into strategic planning tools for your finance team.

Volopay’s seamless accounting integrations for employee debit card spend

Integrations with leading accounting platforms

Volopay connects with accounting platforms to automatically sync every transaction. No more manual data entry or spreadsheet errors.

Every swipe is instantly reflected in your books, reducing end-of-month reconciliation time. These integrations ensure your accounting stays accurate, compliant, and up to date, without the need for constant oversight from your finance team.

Automated receipt capture powered by OCR

Say goodbye to chasing receipts. Volopay's OCR (Optical Character Recognition) technology automatically matches and uploads receipts with the correct transactions. Employees simply snap a photo, and the system does the rest.

This eliminates hours of manual entry and minimizes human error. Finance teams can review matched data with ease, making expense tracking faster, cleaner, and more efficient.

Effortless export for audit preparedness

Preparing for audits is stress-free with Volopay’s built-in export tools. You can generate detailed reports on every card transaction, categorized and timestamped, within seconds. All supporting receipts and approvals are stored and ready to share.

This transparency helps meet compliance requirements without last-minute document collection. It’s a smarter way to stay audit-ready throughout the year, not just at crunch time.

Control, track, and manage business expenses – Volopay cards for your team

Volopay’s built-in security and compliance controls

Enterprise-grade security safeguards your business and employee data while ensuring compliance with Indian financial regulations. Volopay’s platform adheres to the security standards required for secure transactions in India.

Enterprise-grade security

Volopay is built with RBI guidelines and global data protection standards at its core. All employee debit card transactions are encrypted and processed on a secure, PCI-DSS-compliant infrastructure.

From role-based controls to audit trails, every layer is designed for safety. You can confidently manage company spending, knowing your financial data and employee usage are fully protected and regulation-ready.

Instant card locking & transaction alerts

Volopay lets you lock or freeze any card instantly if suspicious activity occurs or when access needs to be revoked. Real-time transaction alerts notify you of unexpected usage, helping you catch fraud early.

You don’t have to wait for monthly statements to spot problems. With this level of real-time spend control, risk is minimized before it becomes a serious issue, protecting your business from unnecessary losses.

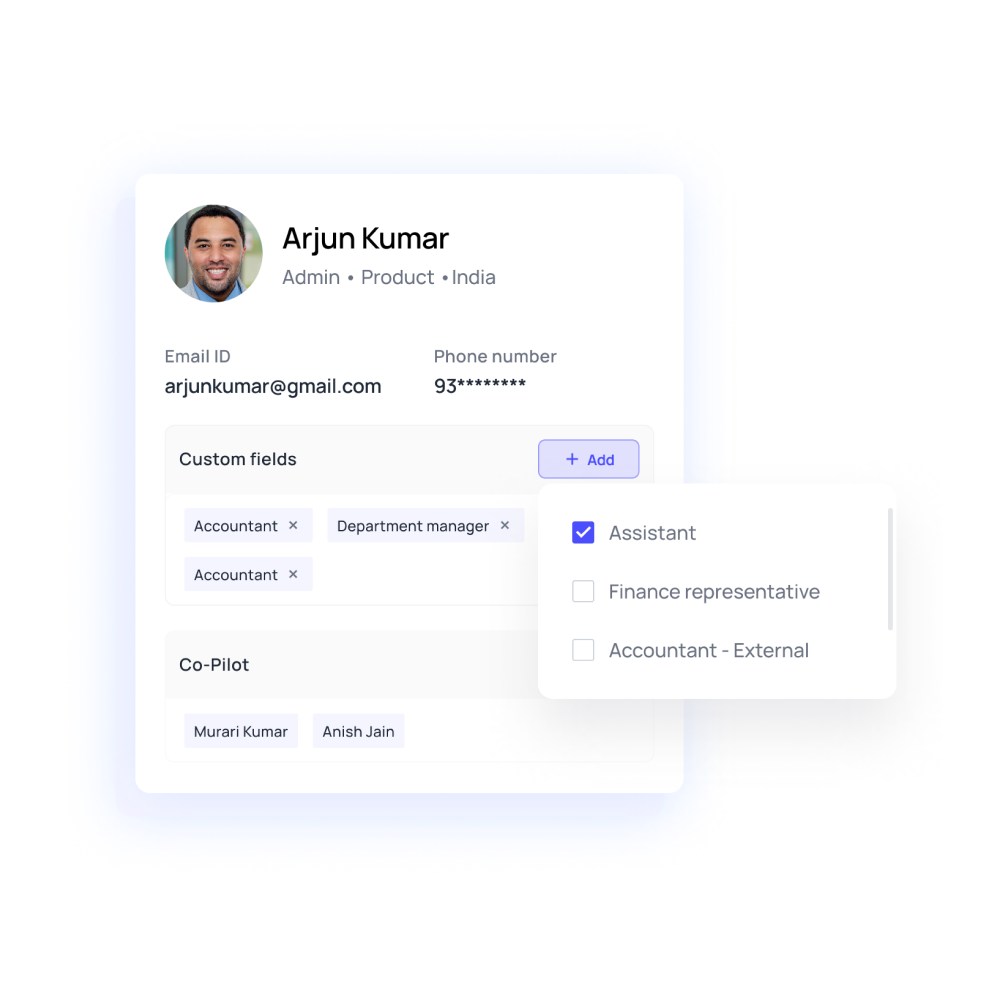

Customizable permissions

Whether you're a finance admin, manager, or employee, Volopay lets you control who sees and does what. You can assign specific roles with tailored permissions like card issuance, approvals, or transaction views based on job functions.

This avoids confusion, prevents misuse, and streamlines operations. Everyone gets the access they need nothing more, nothing less ensuring security without limiting productivity.

How Indian businesses use employee debit cards: Real-world examples

Employee debit cards seamlessly adapt to a wide range of business spending scenarios—whether it's travel expenses, vendor payments, team budgets, or remote workforce needs. They offer the operational flexibility your teams need to stay productive, while giving finance departments the visibility and control necessary to enforce policies, prevent overspending, and maintain budget discipline at every level of the organization.

Streamlining marketing and event expenditures

With employee debit cards, your marketing team can easily manage ad platform spends, vendor payments, and last-minute event costs without relying on shared cards or manual reimbursements.

Set limits for each campaign or employee and track usage in real time. This ensures accountability and enables faster execution, especially for time-sensitive activities like paid ads or event bookings.

Managing sales and travel costs

Equip your sales team with individual cards to cover meals, hotel stays, local travel, and flights—all within pre-approved budgets. No more reimbursement delays or out-of-pocket expenses.

You maintain full visibility into travel spending while your team gets the flexibility to focus on closing deals. Built-in controls ensure funds are used appropriately and in line with policy.

Optimizing operations and procurement

Operations teams can use role-specific cards to handle daily purchases, supplier payments, and inventory procurement. Instead of bottlenecks or request delays, empower your staff with controlled access to company funds.

This speeds up decision-making and builds efficiency across departments. You can restrict usage to authorized vendors, helping ensure compliance while simplifying purchasing workflows across the organization.

Handling IT and SaaS tool subscriptions

Assign employee debit cards to manage recurring software subscriptions, license renewals, and IT purchases. This removes the risk of expired services due to missed payments and keeps your tools running without interruption.

You’ll have a centralized view of all IT-related spend, making budgeting and vendor management easier. Automated tracking also eliminates the need for manual reconciliation.

Employee debit cards built for all business sizes

Startups move fast, and your spending tools should too. Volopay lets you instantly issue cards to employees, set limits, and monitor transactions without slowing down operations.

Stay agile with live insights and avoid the chaos of manual expense tracking.

It’s the perfect way to maintain control while keeping your team empowered and productive.

As your business scales, so does the complexity of managing expenses. Volopay helps you track spending by department, project, or team without adding complicated systems.

With centralized dashboards and detailed reporting, you get complete visibility without micromanagement, making it easier to manage growth without losing financial discipline.

Enterprises deal with hundreds of expense transactions daily. Volopay automates approvals, reconciliations, and accounting entries to reduce manual work and errors.

Role-based permissions and advanced controls ensure compliance at every level. You can manage thousands of employee cards from a single dashboard, driving accountability across departments, locations, and teams.

Enable seamless spending - Try Volopay employee cards

How Volopay outperforms traditional debit cards

No delays, branch visits, or paperwork

With Volopay, everything happens online—from issuing cards to reconciling expenses. There's no need to visit a bank branch or submit physical forms. Cards are generated instantly and activated within minutes.

You skip the red tape and start controlling spend immediately. It’s faster, simpler, and tailor-made for businesses that value agility and digital-first operations.

Superior control and customization capabilities

Traditional bank-issued cards offer limited flexibility. Volopay lets you define who can spend, where, how much, and on what, down to the last detail. Set limits by merchant, purpose, or even time of day.

You can freeze, unfreeze, or reload cards anytime. These advanced controls let you enforce policies without slowing down your teams, ensuring both freedom and accountability.

Designed for modern business requirements

Volopay is more than just a payment tool it’s a complete spend management solution. While bank cards are static and rigid, Volopay adapts to dynamic business needs. It integrates with your accounting tools, supports remote teams, and simplifies compliance.

Whether you’re scaling operations or managing multiple teams, the platform grows with you, built for today’s fast-paced work environment.

Get started with Volopay’s employee debit cards in minutes

With Volopay’s quick and hassle-free setup process, your business can start reaping the benefits almost immediately. Unlike traditional systems that take weeks to implement, Volopay gets you up and running in no time—saving you valuable hours, minimizing disruption, and accelerating your path to smarter expense management.

Book your personalized demo

Schedule a one-on-one demo with our experts to explore how Volopay fits your business. You’ll get a live walkthrough of the platform, see key features in action, and have your questions answered in real time.

It’s your chance to understand the full capabilities before committing. Expect clarity, not a sales pitch—just solutions tailored to your needs.

Quick account setup and policy configuration

Getting started with Volopay is seamless. Once onboarded, you can configure spend limits, approval flows, and team roles within minutes. No complex processes or long waits your account is ready for use right away.

Whether you need basic controls or advanced workflows, setup is simple. You’ll have your entire expense policy digitized and live in no time.

Issue cards instantly to your team

You can generate and distribute both Volopay's physical cards and virtual cards directly from the dashboard. Assign cards by role, department, or project with just a few clicks.

Each card can be customized with limits and spending rules. No paperwork or wait times involved. Your team gets access to funds immediately, while you stay in complete control of every transaction.

Begin tracking and controlling spend immediately

The moment your team starts using their cards, transactions flow into your dashboard in real time. You can monitor spend, review receipts, and approve or decline purchases instantly.

With automated alerts and live visibility, you’re always informed. There’s no need to wait for end-of-month reports Volopay gives you control from the very first swipe.

Bring Volopay to your business

Get started now

FAQs about Volopay prepaid cards

Yes, you can define individual spending limits, approved merchant types, and time-based controls for each card. This ensures every employee spends only within authorized boundaries, helping you enforce policies automatically while reducing the risk of overspending or misuse.

Cards can be issued instantly from your Volopay dashboard. Virtual cards are generated in seconds, while physical cards are shipped quickly after request. There’s no waiting period or branch visits your team can start using their assigned cards almost immediately after setup.

Each transaction is recorded and synced with your accounting system in real time. As soon as a card is used, the data appears in your Volopay dashboard. This eliminates manual reconciliation and keeps your books up to date with live financial activity.

Volopay integrates with leading platforms like Tally, Xero, NetSuite, and more. These integrations enable automatic expense syncing and reconciliation, helping you save time and reduce manual errors. It’s designed to fit seamlessly into your existing financial software stack.

Yes, Volopay cards support international transactions and multi-currency usage. You can set geographical limits or currency-specific controls if needed. This flexibility allows employees to make global purchases while you maintain visibility and control over all cross-border spending in real time.

If a card is lost or misused, you can instantly freeze or revoke access from your dashboard. Volopay also sends real-time alerts for suspicious activity. This allows you to act quickly, preventing unauthorized transactions and protecting your company’s financial resources.