👋Exciting news! UPI payments are now available in India! Sign up now →

Factors to consider when choosing a corporate card program in India

Choosing the right corporate card program gives you the control and visibility your business needs for managing expenses effectively. With an increasing number of financial tools available today, you need to assess options that align with your company’s spending structure, compliance needs, and scalability.

As businesses grow, the ability to manage and track employee expenses efficiently becomes critical. By shifting from manual processes to automated systems, your business unlocks real-time expense insights, curbs excessive spending, and boosts internal coordination between departments, finance teams, and stakeholders.

What is a corporate card program?

A corporate card program provides your business with a structured system to distribute cards to employees for official expenses. These corporate cards come with tailored controls that let you monitor, limit, and approve spending in real time. A good program also automates reconciliation, tracks GST, enables approvals, and syncs with your accounting tools.

A structured system increases trust within your team and removes ambiguity around business spend policies. It supports scalable financial infrastructure, empowering your finance department to operate efficiently and securely.

Corporate card types available in India

1. Credit cards

Corporate credit cards let you extend short-term credit to employees for business expenses. You receive a consolidated statement each billing cycle, giving you time to settle payments. Banks may offer reward programs or cashback on spends. However, interest charges can apply if you delay repayments.

This option is suitable for businesses needing flexibility in cash flows. You can assign cards to specific teams and track every expense on a centralized dashboard. The provider often offers customer support and liability protection, reducing financial risk.

2. Prepaid cards

You can load funds in advance onto prepaid cards and assign them to your employees. These cards limit spending to the loaded amount, helping you control budgets effectively. There’s no risk of overdraft, making them suitable for businesses focused on strict cost management.

Many fintechs offer real-time loading, tracking, and budget assignment. You can freeze or unfreeze cards, restrict vendors, or create spending rules to match policy. Prepaid cards help promote budgeting discipline and offer better visibility without creating credit liabilities.

3. Debit cards

Corporate debit cards connect directly to your business current account. Your employees can spend only what's available in the account, giving you better financial discipline. This card suits businesses that want direct access without incurring interest or credit liability.

However, real-time transaction controls and reporting features may be limited compared to other card types. Debit cards still serve as an easy way to track expenses centrally and ensure fund availability without delay. You avoid loan-based systems while staying operationally efficient.

4. Virtual cards

Virtual cards are ideal for online payments and remote work setups. You can instantly issue and manage them through a digital dashboard. These cards offer features like expiration control, spend limits, and merchant restrictions. Since there’s no physical card, the risk of loss or theft is minimized.

They are widely used for SaaS subscriptions, advertising, and vendor payments. These cards can be created on demand, cancelled easily, and tagged to specific departments or purposes, giving you strong control over digital transactions.

Key benefits of corporate card programs for businesses

Using a corporate card program, you can track every business expense as it happens. Real-time insights empower you to monitor spending patterns, flag irregularities, and intervene when necessary. Instead of waiting for month-end reports, you can make instant financial decisions. This level of visibility helps you maintain tighter control over your company’s cash flow and budgeting goals.

Detailed tracking also ensures timely approvals and allows for instant blocking in case of unauthorized use, which strengthens internal compliance. To explore various card solutions designed to optimize your company's spending, learn more about expense management cards.

Track business expenses in real-time

Using a corporate card program, you can track every business expense as it happens. Real-time insights empower you to monitor spending patterns, flag irregularities, and intervene when necessary. Instead of waiting for month-end reports, you can make instant financial decisions.

This level of visibility helps you maintain tighter control over your company’s cash flow and budgeting goals. Detailed tracking also ensures timely approvals and allows for instant blocking in case of unauthorized use, which strengthens internal compliance.

Optimize cash flow management

Your ability to manage cash flow improves significantly with a structured corporate card program. Credit-based cards offer short-term liquidity while prepaid cards restrict overspending. By assigning cards with specific budgets, you avoid surprise cash shortfalls.

Also, consolidated billing cycles let you forecast and allocate funds better, reducing your dependence on ad hoc reimbursements or untracked payments. Predictable cash flows give you more power over financial planning and resource management, helping your business meet all short-term commitments.

For a deeper understanding of how these cards can specifically enhance your company's overall financial stability, refer to our article on corporate cards for cash management.

Streamline employee expense reporting

You simplify expense tracking for employees by replacing manual claims with card-based transactions. A corporate card program automatically captures and categorizes transactions, allowing employees to upload receipts instantly. Finance teams spend less time validating and processing claims.

This automation reduces errors and accelerates approvals, keeping your accounting processes agile and audit-ready. Employees appreciate the ease of use, and finance managers gain clarity on who spent what, when, and where—all with just a few clicks.

Earn valuable reward points

Your business can accumulate reward points or cashback when employees use corporate credit cards. These rewards can offset future business expenses or be redeemed for benefits. Some banks and fintech companies offer travel miles, airport lounge access, or cashback deals tailored for high-volume spending.

You turn every eligible expense into potential savings. Over time, these rewards add value and can fund future purchases, making your program more than just a payment solution—it becomes a financial asset.

Boost operational expense efficiency

A well-managed corporate card program minimizes operational inefficiencies caused by reimbursements, cash disbursals, or cheque usage. You gain centralized oversight, which reduces paperwork and errors. With features like spend category controls and departmental budgets, you align expenses with business goals, ensuring optimal use of company resources.

Smart automation replaces human delays and brings transparency. All expenses can be tracked against project codes, department allocations, or event budgets, strengthening your internal accountability and planning.

Looking for the best corporate cards for your business?

Essential factors for choosing a corporate card program

The points mentioned below are the factors to consider or the features corporate card programs should offer.

1. Consider low annual card fees

Many providers charge an annual maintenance fee per card. When issuing multiple cards, these fees can quickly add up. You should evaluate these charges against the benefits offered, such as expense tracking or reward programs. Look for providers that offer bulk discounts or waive fees for high usage.

A transparent pricing structure allows your finance team to allocate budget without uncertainties. Make sure there’s clarity on renewal fees, upgrade costs, and cancellation charges upfront.

2. Evaluate transaction processing fee structures

Review fees associated with domestic and international transactions. Some providers charge higher margins for foreign currency transactions or add processing charges beyond a fixed limit.

Understanding the fee structure upfront will prevent surprises on your monthly statements.

Always request a full breakdown of all transaction fees. Having cost visibility lets you decide whether the card fits your usage pattern, especially when managing multiple cardholders across teams or departments.

3. Compare competitive foreign exchange rates

If your business deals with international travel or cross-border payments, review the provider’s forex markup. Even small differences in exchange rates can significantly affect your costs. Select a corporate card program offering competitive forex rates with low markups and transparent currency conversion policies.

Ask about mid-market rate access, real-time conversion, and any hidden fees that may apply. This helps you make informed payment decisions without financial surprises later.

4. Avoid hidden service charges, penalties

Hidden charges like late payment fees, card inactivity penalties, or charges for replacing lost cards can escalate your costs. Always check the full fee structure before choosing a provider. Opt for cards with clear terms and responsive customer support in case of disputes.

Evaluate terms related to penalty interest, limit breaches, or out-of-network transactions to ensure you don’t face unanticipated liabilities in everyday usage.

5. Ensure provider offers data encryption

Ensure your provider follows industry-standard encryption like PCI DSS to protect cardholder data. This helps safeguard against hacking, phishing, and data breaches.

Ask about the provider’s encryption, tokenization, and security audit processes to ensure maximum protection for your business. Strong data encryption protects both your financial information and employee credentials from unauthorized access or manipulation.

6. Verify real-time fraud monitoring tools

Modern fraud detection uses AI and machine learning to track unusual transactions instantly. You need a provider offering real-time alerts and auto-blocking of suspicious activities. This protects your funds and improves compliance.

Choose systems that monitor merchant behavior and transaction patterns actively. A good fraud tool flags attempts before damage occurs, maintaining financial integrity.

7. Confirm instant card control features

Your admin team should be able to freeze, unfreeze, block, or restrict cards instantly via a central dashboard. These controls help you react to emergencies, card misuse, or security threats without delay.

Look for platforms that also allow location-based restrictions. Instant controls reduce time-to-response and help maintain strict internal governance and operational safety.

8. Check unauthorized transaction liability coverage

Review how your provider handles fraud liability. Are you liable for unauthorized spends, or does the provider offer zero-liability protection?

Confirm the dispute resolution process and timelines so your business is protected from accidental or malicious transactions. This helps reduce losses in case of theft or compromised credentials.

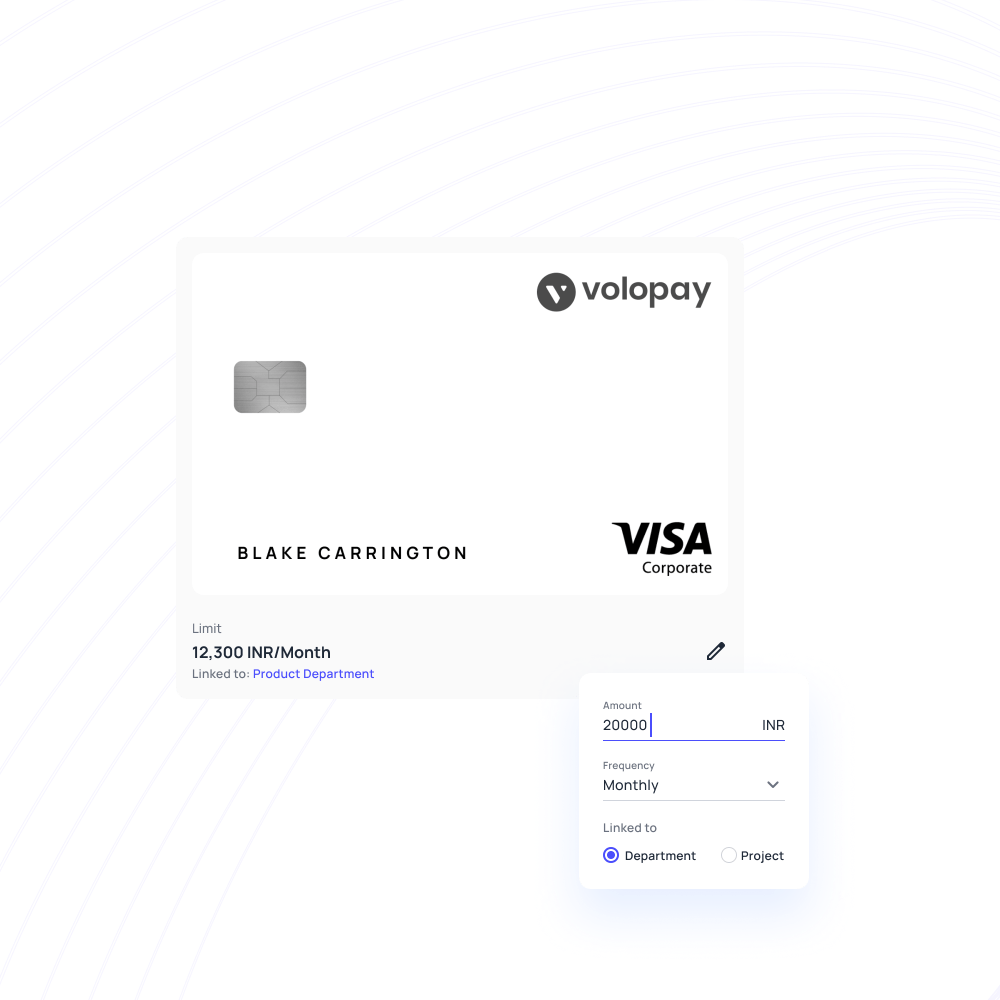

9. Set customizable individual card budgets

You must be able to assign custom spending limits for each employee’s card. These limits can be daily, weekly, or monthly, based on roles or departments.

This ensures budgetary discipline and prevents overspending across teams. Dynamic controls improve overall budgeting flexibility and align spending with operational goals.

10. Allocate flexible departmental expense budgets

The platform should let you assign budgets by department or project. This helps you track functional expenses precisely and reduces cross-department billing conflicts.

You gain a clearer picture of spending patterns by business unit. You can shift funds quickly if priorities change.

11. Restrict spending to approved categories

Merchant Category Code (MCC) restrictions let you block purchases outside of predefined categories. If your employees only need to spend on travel, lodging, or fuel, restrict card usage accordingly. This keeps expenses aligned with company policy. It ensures compliance with internal control policies.

12. Adjust card budgets dynamically

Business needs change frequently, and your platform must allow dynamic budget adjustments. Increase limits during peak business periods or restrict access temporarily.

This flexibility is key for responding to real-time needs without manual intervention. Dynamic adjustment helps your teams operate without disruptions.

13. Integrate seamlessly with accounting software

Your corporate card program should integrate with accounting tools like Tally, Zoho Books, or QuickBooks. Syncing expenses directly into your ledger minimizes errors and manual entry, saving valuable time for your finance team.

Integration ensures data accuracy and audit compliance.

14. Simplify GST compliance data reporting

The system should generate categorized expense data that can be exported into GST returns. With ready-to-use reports, you avoid last-minute reconciliations.

Ensure the platform supports GST tagging and HSN code mapping. It streamlines returns and lowers tax filing stress.

15. Instant employee cards issuance

Instant issuance helps you onboard employees faster without waiting for physical cards.

A good platform should allow you to generate cards instantly and assign them to users directly from your admin dashboard. Fast deployment helps avoid operational delays.

16. Availability of both physical and virtual corporate cards

You should have the option to issue either physical cards for in-store payments or virtual cards for online use. This dual offering suits businesses with both travel and remote spending needs.

It increases operational coverage across use cases.

17. Support UPI payments

UPI is widely accepted, and your corporate card program should support UPI-linked transactions. This is especially useful for vendor payments, taxi fares, or local business expenses where card machines aren’t available. Supporting UPI increases acceptance.

18. Assign employee card access roles

You must be able to assign different access levels, such as cardholder, approver, or finance manager. This layered access improves accountability and secures operations.

Only authorized users should modify limits or approve transactions. Role-based control reduces misuse.

19. Centralize account management via dashboard

Your admin team should access one dashboard to track all payments, view approvals, change card settings, and generate expense reports. This centralized control reduces administrative delays and improves decision-making. Centralization enhances internal coordination.

Leverage these features and more—explore our article on the best corporate card for Indian businesses.

Why choose Volopay’s corporate card program in India?

Unified platform

Volopay offers an all-in-one expense management solution, bringing corporate cards, reimbursements, approvals, and vendor payments into one system. This unified structure helps your team manage every rupee efficiently while maintaining full visibility over spending.

A single login powers control across all financial activities. You reduce fragmentation and increase collaboration. Your finance team saves time through automation, ensuring financial consistency and better strategic focus.

Seamless sync

Volopay integrates easily with major accounting software like Tally, Zoho Books, and QuickBooks. This saves time on reconciliations, helps you maintain accurate books, and reduces manual intervention. Expense categories sync automatically.

The API-first approach means faster implementation. Your accounting process becomes smoother, smarter, and compliant. You eliminate duplication and reduce processing timelines significantly.

Robust security

You benefit from bank-grade encryption, PCI DSS compliance, and real-time fraud alerts. Volopay helps you safeguard every transaction and protect business-sensitive data from breaches, giving you peace of mind.

Every login, card usage, or approval is logged and protected. Security updates are proactive and continuous, aligning with global benchmarks.

Scalable features

Whether you're running a startup or scaling globally, Volopay supports your growth. The platform lets you issue unlimited cards, manage cross-border expenses, and customize workflows according to your business structure and compliance needs.

As your team grows, you can add departments, assign controls, and keep oversight strong. Your financial system grows with your vision.

Bring Volopay to your business

Get started now