👋 Exciting news! UPI payments are now available in India! Sign up now →

What is break even analysis, its benefits and how to calculate?

Every business owner aspires to achieve heights in the competitive world. They come up with ideas to accelerate growth in their businesses. They may either plan to introduce new products in the market or hire additional professionals.

However, it is significant to consider all the associated risk factors before introducing something new. Break even analysis is beneficial for businesses before investing in new prospects.

This article will cover the meaning and importance of break even analysis, and go over the formula for break-even point calculation.

What is break even analysis?

It is very important to what is break even analysis. In simple terms, the break even analysis is nothing but a financial calculation. It analyzes whether the unit price of the product is able to meet the expense of new ventures, goods, and services.

The break-even point calculation reveals how much sales target businesses must meet to cover the cost of running a business. It reveals whether you have sold enough goods or not. Break even analysis is significant because it informs at what point businesses will neither earn profit nor face losses. Market demand is not considered by the break-even point for businesses.

Every business should undergo a break even analysis before introducing new services or investing in new ventures.

Components of break even analysis

There are two different components associated with break-even point calculation. Both fixed costs and variable costs are taken into consideration by the break-even point formula. The components are mentioned beneath.

1. Fixed cost

Fixed cost remains constant throughout the business activities. It does not depend on the sale of goods & services. It includes the salary of employees, expense of equipment, premium on interest, capital interest, and others.

2. Variable cost

The sum of expenses spent on labor and materials to produce a unit of goods & services is known as Variable cost. It keeps fluctuating depending on the units of goods & services sold. It has a direct connection with company sales. It includes commission earned on sales, shipping expenses, cost of payroll, hourly wages to laborers, etc.

Total variable cost is calculated by multiplying the price spent on producing one unit by the total units produced.

How does break even analysis work?

The production level and desired sales target can be determined using break even analysis. Because the metric and calculations are not used by regulators, investors, or financial institutions, the break-even point calculation is only for the management of businesses.

The break-even point (BEP) is calculated in this kind of analysis. Divide the total fixed costs of production by the price per unit minus the variable costs of production to determine the break-even point for the business. Costs that don't change no matter how many units are sold are known as fixed costs.

The level of fixed costs in relation to the profit generated by each additional unit produced and sold is examined in the break even analysis. A business that has lower fixed costs will typically have a lower break-even point of sale. For instance, assuming that variable costs do not exceed sales revenue, a business with no fixed costs will automatically have reached profitability upon the first product sale.

You won't be earning any profit or losing any money at the break-even point, but it assists in covering all of your business's expenses. Your company's sales are pure profit after a break even analysis. In a nutshell, break even analysis helps you figure out when your business or goods & services will become profitable, and investors use it to figure out when they will start earning profit and regain their investment.

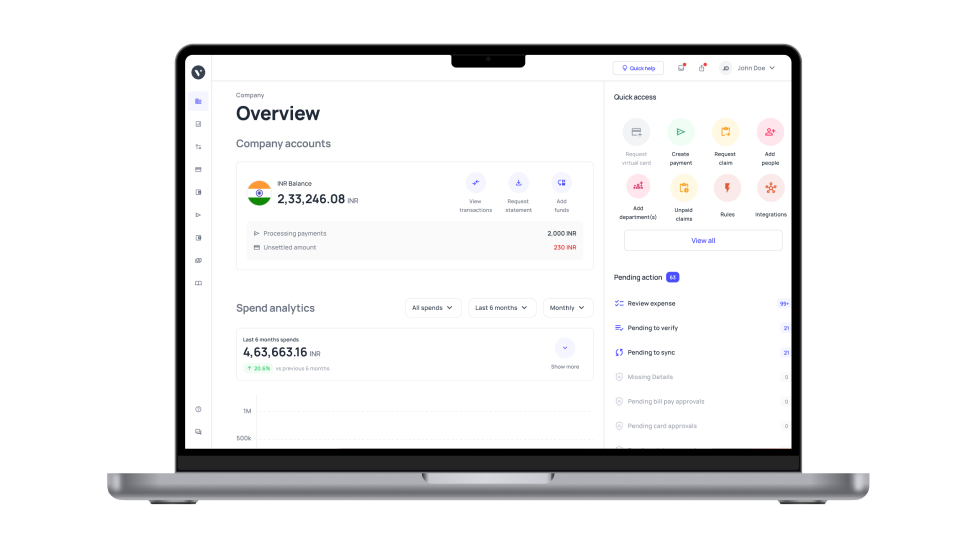

Benefit your business with smart corporate cards

Why is break even analysis important?

By itself, a break even analysis has numerous applications. However, it is also an essential component of financial projections for startups and expanded or new product lines. Businesses utilize it to determine whether you will require a bank loan and how much startup capital you will require.

Break-even point analyses are used by more established businesses to assess the risks associated with a variety of activities, including the transition of innovative ideas into production, the addition or removal of products from the product mix, and other scenarios.

Budgeting for an additional employee is one example. A break even analysis will show how many more sales are needed to cover the costs of hiring the new employee.

Every business owner should know the significance of break even analysis due to the following points.

1. Controls the number of units that can be sold

The business owner learns how many units must be sold to cover the cost with the assistance of break even analysis. The break even analysis can only be evaluated using the variable cost, the selling price of each product, and the total cost.

2. Goal-setting and budgeting

It is simple for entrepreneurs to set a goal and a budget for the company based on that goal because they know when the company can break even. A company's realistic goal can also be established using the break-even analysis.

3. Control the safety margin

A company's sales tend to fall when its finances fail. The break even analysis assists the business in determining the minimum number of sales required to achieve profitability. The management can carry out a high-level business decision with the help of the margin of safety reports.

4. Controls and monitors the cost

Both fixed and variable costs can have an effect on a business's profit margin. Therefore, management can determine whether any effects are altering the cost using break-even analysis.

5. Aides in the creation of pricing strategies

If a product's price changes, it can have an impact on the break-even point. For instance, the quantity of the product required to break even will decrease if the selling price is increased. In a similar vein, for a business to break even, the selling price must be reduced.

When to use break even analysis?

If any of these things occur, you should use a break even analysis to figure out the risk and value of any business investment.

1. Expanding your business

Break-even points (BEP) will aid business owners and Chief Financial Officers in determining how long it will take for an investment to turn a profit.

For instance, figuring out or modeling the minimum number of sales that are needed to cover the costs of launching a new branch or introducing new products & services.

2. Price reduction strategy

Sometimes, businesses must reduce their pricing strategy in order to compete with competitors in a particular product or market segment.

As a result, before lowering prices, businesses need to determine how many additional units they need to sell to make up for them.

3. Narrowing down business scenarios

While making amendments in the business, there are a lot of different scenarios and what-ifs that can happen, making it hard to decide which one to choose.

BEP will assist business leaders in simplifying decision-making by reducing it to a series of yes/no questions.

Break even analysis formula

The break-even point analysis can be done by dividing the fixed costs of a business by the per unit price of sales (minus per unit variable cost).

Let’s understand this with a practical example.

A company runs a business manufacturing and selling shoes. Their fixed cost amounts to $300000. The variable cost involved in manufacturing one shoe is $200. Each shoe is sold for $500.

Businesses can do the break even analysis by the following method.

300000/(500-200) = 3000

Therefore, the company needs to sell 3000 shoes to reach the break-even point.

A break even analysis is used to figure out a company's cost structure or the number of units that need to be sold to cover expenses. When a company achieves the break-even point, it not only recovers all of its expenditures but also does not incur any losses. The relationship between revenue, fixed cost, and variable cost is examined using the break-even calculation.

A business with low fixed costs typically has a low break-even point of sale. A break even analysis is crucial for a new venture. It is cost-effective and serves as a pricing strategy guide for management.

Additionally, this analysis indicates whether the new company is successful. Before launching a new product, an established business must conduct a break even analysis to determine whether the product will necessitate additional costs.

Manage your business expense with ease

FAQs

A low break-even point means your business will earn a profit anytime in the near future.

On the other hand, a higher break-even point means you will need to sell more goods to reach the break-even point.

Therefore, a lower break-even point is better than a higher break-even point.

A lower break-even point can be achieved by reducing fixed expenses and per unit variable cost of manufacturing goods

PV ratio is calculated by dividing the Contribution from Sales. It determines the profitability of running a business.