👋Exciting news! UPI payments are now available in India! Sign up now →

Types of GST returns in India

If you're running a business in India, understanding GST returns is essential to staying compliant with tax regulations. GST returns are documents that you need to file with the tax authorities, outlining your sales, purchases, tax collected, and tax paid. These filings ensure that the government has a clear record of your transactions and that you are paying the correct amount of tax.

Depending on your business type, nature of transactions, and turnover, different types of GST returns apply to you. Knowing the right return to file and when to file it can save you from penalties and compliance issues.

What are GST returns?

GST returns are periodic statements you file to report your business transactions under the Goods and Services Tax (GST) system. Learn about the various types of returns in GST to file them correctly. They are the official documents you must regularly file to report your business’s income, expenses, and tax liability under the Goods and Services Tax system.

As a registered taxpayer, you're required to submit different types based on your business category. Understanding GST return types helps you stay compliant and avoid penalties.

Who needs to file GST returns?

You need to file GST returns if you're a registered business under the GST system, including suppliers, manufacturers, traders, freelancers, e-commerce sites, or service providers with an annual turnover exceeding the threshold (typically INR 20 lakh or INR 10 lakh in special category states).

You must file GST returns regularly if you are registered for GST, even if there is no business activity for a period. Depending on your turnover and registration type, you may be required to file various GST return types, including GSTR-1, GSTR-3B, and others.

Why filing GST returns is crucial

Filing GST returns is crucial because it ensures your business complies with tax regulations, avoiding hefty penalties and legal issues. Maintaining your company's financial stability and legal compliance involves submitting GST returns.

In addition to avoiding penalties, timely filing of returns guarantees the processing of input tax credit claims, improving cash flow, and fostering stakeholder trust. They provide transparency in your transactions, building trust with authorities and clients. Timely submissions prevent interest charges and maintain your GST compliance rating, which can impact your business reputation.

Additionally, regular filing supports seamless audits and reconciliations, minimizing errors. For businesses integrated with digital platforms, consistent GST filing ensures smooth operations and eligibility for government schemes or benefits tied to compliance.

Comparison of GST return types

Common types of GST returns for normal taxpayers

GSTR-1: Outward supplies (sales)

● Purpose

GSTR-1 is where you report all your outward supplies, meaning the sales or services you provide. It includes details like invoices, debit/credit notes, and advances received, ensuring the government tracks your taxable supplies accurately. This return helps your buyers claim input tax credit based on your reported sales.

● Who files

You, as a registered taxpayer under the regular GST scheme (not composition dealers), must file GSTR-1. This applies to businesses with an annual turnover above ₹20 lakh (or ₹10 lakh in special category states).

● Frequency

You file GSTR-1 monthly if your turnover exceeds ₹1.5 crore. If your turnover is below this, you can opt for quarterly filing under the QRMP (Quarterly Return Monthly Payment) scheme.

● Due date

For monthly filers, it’s the 11th of the next month. For quarterly filers, it’s the 13th of the month following the quarter.

Accurate and timely filing of GSTR-1 ensures your buyers’ input tax credits are processed smoothly, avoiding discrepancies during audits. Errors or delays can lead to notices or penalties, so double-check your invoices before submission.

GSTR-3B: Summary return

● Purpose

GSTR-3B is a monthly summary return where you report your total sales, purchases, tax paid, and input tax credit claimed. It’s a self-declared summary that simplifies GST compliance by consolidating your tax liabilities and credits for the period, ensuring you settle your tax dues.

● Who files

You file GSTR-3B if you’re a registered taxpayer under the regular scheme, except for specific categories like Input Service Distributors or non-resident taxpayers. Even if you have no transactions, a nil return is mandatory.

● Frequency

You file GSTR-3B monthly, regardless of your turnover.

● Due date

The due date is the 20th, 22nd, or 24th of the next month, depending on your state or turnover (check your GST portal for specifics).

Filing GSTR-3B on time helps you avoid interest on late tax payments (18% per annum) and penalties (₹50/day or more). It’s a critical return for maintaining compliance and ensuring your input tax credit aligns with GSTR-1 and GSTR-2A/2B. Always reconcile your data to prevent mismatches.

GSTR-9: Annual return

● Purpose

GSTR-9 is your annual return that consolidates all your transactions for the financial year. It summarizes your outward and inward supplies, taxes paid, input tax credits availed, and any amendments made during the year. This return ensures your GST records align with your financials.

● Who files

You, as a registered taxpayer under the regular scheme, must file GSTR-9, unless you’re a casual taxpayer, non-resident, or under specific exemptions. It’s mandatory even if you had minimal activity.

● Frequency

You file GSTR-9 annually.

● Due date

The due date is December 31st of the following financial year.

Filing GSTR-9 accurately helps you avoid scrutiny during GST audits and ensures compliance with annual reporting requirements. It’s a chance to correct minor errors from monthly filings, but major discrepancies can attract penalties. Use GSTR-2A and GSTR-3B data to prepare this return carefully, as it’s a comprehensive reflection of your GST activities.

GSTR-9C: Reconciliation statement

● Purpose

GSTR-9C is a reconciliation statement where you certify that your GST returns (like GSTR-9) align with your audited financial statements. It identifies discrepancies between your GST data and books of accounts, ensuring transparency and accuracy in tax reporting.

● Who files

You must file GSTR-9C if your annual turnover exceeds ₹2 crore. It requires a chartered accountant or a cost accountant to audit and certify the statement.

● Frequency

You file GSTR-9C annually, along with GSTR-9.

● Due date

The due date is December 31st of the following financial year.

This return is crucial for large businesses, as it minimizes errors and ensures your tax calculations match your financial records. A certified GSTR-9C reduces the risk of GST audits or notices. Work closely with your auditor to reconcile any differences and file on time to avoid penalties, which can be ₹25,000 or higher for non-compliance.

Types of GST returns for specific schemes and entities

CMP-08: composition scheme payment statement

● Purpose

CMP-08 is a quarterly statement in which you report your tax liability under the composition scheme. You declare your total turnover, outward supplies, and self-assessed tax, making it easier to comply with GST without detailed invoice-wise reporting. It simplifies tax payments for small businesses.

● Who files

You file CMP-08 if you’re a taxpayer registered under the composition scheme, typically with an annual turnover up to ₹1.5 crore (or ₹75 lakh in special category states).

● Frequency

You file CMP-08 quarterly.

● Due date

The due date is the 18th of the month following the quarter.

Filing CMP-08 on time ensures you pay your tax liability (1% or 5% of turnover, depending on your business type) without interest or penalties. It’s a streamlined process, but you must ensure your turnover calculations are accurate to avoid notices. Keep records handy, as discrepancies can lead to scrutiny during audits.

GSTR-4: Composition scheme annual return

● Purpose

GSTR-4 is your annual return under the composition scheme, summarizing your outward supplies, tax paid, and any amendments for the financial year. It consolidates your quarterly CMP-08 filings, ensuring your GST compliance aligns with your business activities.

● Who files

You, as a composition scheme taxpayer, must file GSTR-4. This applies to small businesses opting for the simplified tax regime.

● Frequency

You file GSTR-4 annually.

● Due date

The due date is the 30th of April following the financial year.

Accurate GSTR-4 filing helps you avoid penalties (up to ₹25,000 for non-compliance) and ensures your annual turnover and tax payments are correctly reported. Cross-check your CMP-08 submissions to prevent mismatches. Even if you have no transactions, filing a nil return is mandatory to maintain compliance and avoid legal issues.

GSTR-5: Non-resident taxable person return

● Purpose

GSTR-5 is for reporting your supplies as a non-resident taxable person in India. You declare details of outward and inward supplies, taxes paid, and any input tax credit availed during your temporary business operations in India.

● Who files

You file GSTR-5 if you’re a non-resident taxable person registered under GST, typically for short-term business activities like exhibitions or projects.

● Frequency

You file GSTR-5 monthly.

● Due date

The due date is the 20th of the next month or within 7 days after your GST registration expires, whichever is earlier.

Timely GSTR-5 filing ensures compliance during your limited stay in India. You must pay taxes on all supplies before filing, as input tax credit is limited for non-residents. Errors can lead to penalties or issues with future registrations, so maintain accurate records of your transactions.

GSTR-5A: OIDAR service providers return

● Purpose

GSTR-5A is for reporting your supplies of online information and database access or retrieval (OIDAR) services to non-taxable persons in India. You detail your taxable supplies and the tax collected, ensuring compliance with GST for cross-border digital services.

● Who files

You file GSTR-5A if you’re a non-resident providing OIDAR services (e.g., streaming, cloud services) to Indian consumers or unregistered businesses.

● Frequency

You file GSTR-5A monthly.

● Due date

The due date is the 20th of the next month.

Filing GSTR-5A accurately ensures you collect and remit GST on digital services, avoiding penalties (₹50/day or more). You must register under GST even if you’re based abroad, so track your supplies carefully to comply with Indian tax laws and avoid disputes with authorities.

GSTR-6: Input Service Distributor (ISD) return

● Purpose

GSTR-6 is used to distribute input tax credit among your branches or units. You report the credit received on input services and allocate it based on turnover or other prescribed methods, ensuring accurate credit distribution within your organization.

● Who files

You file GSTR-6 if you’re registered as an Input Service Distributor, typically a head office receiving invoices for services used by multiple branches.

● Frequency

You file GSTR-6 monthly.

● Due date

The due date is the 13th of the next month.

Timely GSTR-6 filing ensures your branches receive their rightful input tax credit, optimizing tax efficiency. Errors in distribution can lead to credit mismatches, attracting penalties or audit scrutiny. Maintain detailed records of invoices and allocations to streamline compliance and avoid issues.

GSTR-7: Tax Deducted at Source (TDS) return

● Purpose

GSTR-7 is for reporting tax deducted at source (TDS) on payments you make to suppliers under GST. You detail the TDS deducted (typically 2%) on contracts above ₹2.5 lakh, ensuring suppliers receive credit for the deducted amount.

● Who files

You file GSTR-7 if you’re a government entity, PSU, or specified organization required to deduct TDS under GST.

● Frequency

You file GSTR-7 monthly.

● Due date

The due date is the 10th of the next month.

Filing GSTR-7 on time ensures your suppliers can claim TDS credits, maintaining good vendor relationships. Late filing incurs penalties (₹100/day, up to ₹5,000) and interest. Keep accurate records of payments and TDS certificates to avoid discrepancies during reconciliations or audits.

GSTR-8: E-commerce operator return (TCS)

● Purpose

GSTR-8 is for reporting tax collected at source (TCS) by you as an e-commerce operator. You detail the supplies made through your platform and the TCS (1% of net taxable supplies) collected from sellers, ensuring compliance with GST rules.

● Who files

You file GSTR-8 if you’re an e-commerce operator (e.g., Amazon, Flipkart) facilitating sales for third-party sellers.

● Frequency

You file GSTR-8 monthly.

● Due date

The due date is the 10th of the next month.

Accurate GSTR-8 filing ensures sellers on your platform receive TCS credits, avoiding disputes. Late filing attracts penalties (₹100/day, up to ₹5,000) and interest. Maintain clear records of transactions and TCS deductions to streamline compliance and support sellers during GST reconciliations.

Other essential GST filings

GSTR-10: Final return

● Purpose

GSTR-10 is your final return, filed when you cancel your GST registration. You report all your supplies, stock details, and any tax liabilities up to the date of cancellation. This return ensures you settle all pending GST obligations, including taxes on closing stock, and finalize your compliance with the GST authorities.

● Who files

You file GSTR-10 if you’re a registered taxpayer voluntarily surrendering your GST registration or if it’s canceled by the authorities due to non-compliance or business closure.

● Frequency

You file GSTR-10 once, upon cancellation of your GST registration.

● Due date

The due date is within three months from the date of cancellation or the issuance of the cancellation order, whichever is later.

Filing GSTR-10 accurately is critical to avoid penalties (up to ₹10,000) or legal issues post-cancellation. You must account for any remaining stock or assets and pay taxes on them. Ensure all records are updated to prevent discrepancies during audits, as errors can delay closure and attract notices from GST authorities.

GSTR-11: Inward supplies by UIN holders

● Purpose

GSTR-11 is for reporting your inward supplies (purchases) as a Unique Identification Number (UIN) holder. You detail the goods or services received to claim a refund of GST paid, as UIN holders (like foreign diplomatic missions or UN organizations) are exempt from paying GST on their purchases.

● Who files

You file GSTR-11 if you’re a UIN holder, such as a foreign embassy, consulate, or international organization recognized under the GST law.

● Frequency

You file GSTR-11 monthly or as per the refund claim schedule, depending on your transactions.

● Due date

There’s no fixed due date; you file GSTR-11 when applying for a GST refund, typically aligned with your refund claim submission.

Timely and accurate GSTR-11 filing ensures you recover GST paid on purchases without delays. You must include invoice-wise details and match them with the supplier GSTR-1 data to avoid rejections. Maintain proper documentation, as errors can lead to refund denials or audits, impacting your organization’s financial processes

9 step GST return filing process

Data collection & reconciliation

Before you start filing, gather all relevant data—sales, purchases, and expenses for the tax period. It’s crucial to reconcile this data with your bank statements and vendor invoices. This ensures accuracy and helps avoid discrepancies that could delay return processing or lead to penalties.

Accessing the GST portal

Visit www.gst.gov.in and log in using your GSTIN (Goods and Services Tax Identification Number) and password. This portal is where all GST-related filings and payments are done. After logging in, navigate to the ‘Returns Dashboard’ to begin your filing process.

Uploading invoice details

For returns like GSTR-1 (outward supplies) and GSTR-3B (summary return), you need to upload or manually enter sales and purchase data.

You can upload invoices individually or in bulk using tools like Excel utilities or third-party software. Make sure the details are correctly categorized under CGST, SGST, or IGST.

Verifying auto-populated data (GSTR-2A/2B)

GSTR-2A and GSTR-2B are auto-populated with input tax credit (ITC) details based on your supplier filings.

Cross-check these figures with your actual purchase records to ensure consistency. This step is essential before filing GSTR-3B, as mismatches could lead to ITC rejections or notices from the tax department.

Calculating tax liability

Once all data is entered and verified, calculate your GST liability. The system helps in auto-calculating the net tax payable after deducting ITC.

You’ll see the breakup of Central GST (CGST), State GST (SGST), and Integrated GST (IGST) applicable to your transactions.

Making GST payments

You can pay your GST liability directly on the portal using multiple methods—net banking, UPI, NEFT/RTGS, credit/debit card, or through a corporate bank account. After payment, a challan is generated, which you should save for future reference.

Review and rectification

Before submitting, carefully review all the details you’ve entered. Check for errors in invoice numbers, GSTINs, tax amounts, and ITC claims.

Rectify any mistakes immediately. Accurate data entry reduces the chance of notices or penalties and ensures smoother processing.

Submitting returns

After confirming everything is correct, proceed to file the return. Use a Digital Signature Certificate (DSC) for companies, or an Electronic Verification Code (EVC) for others.

EVC requires OTP authentication sent to your registered email or mobile number.

Downloading acknowledgment

Once submitted, the system generates an Acknowledgment Reference Number (ARN). Download and save this acknowledgment receipt as proof of successful filing. It serves as a confirmation and can be used in case of future disputes or audits.

Best practices for GST return filing

To ensure efficient and compliant GST return filing, adopt these actionable strategies to streamline your processes and avoid penalties.

1. Timely bookkeeping

Maintain accurate, up-to-date records of all your transactions, including sales, purchases, and expenses. Record invoices, debit/credit notes, and payments promptly in a reliable accounting system. This ensures your data is ready for filing returns like GSTR-1 and GSTR-3B, reducing errors and last-minute stress.

Set a weekly schedule to update your books, especially if your business handles high transaction volumes. Consistent bookkeeping minimizes discrepancies and ensures smooth preparation for monthly or quarterly filings.

2. Regular reconciliation

Reconcile your GST data monthly with GSTR-2A/2B and supplier invoices to catch discrepancies early. Cross-check your input tax credit (ITC) claims against supplier filings to avoid mismatches that could lead to notices or ITC denials.

Use reconciliation tools or spreadsheets to compare purchase records with GSTR-2A, ensuring your GSTR-3B and GSTR-9 filings are accurate. Regular reconciliation prevents audit issues and maintains your compliance rating.

3. Digital solutions & automation

Invest in GST-compliant accounting software like Tally, Zoho Books, or ClearTax to automate return preparation and filing. These tools integrate with the GST portal, minimizing manual errors and saving time.

Automation ensures accurate calculations for tax liabilities and ITC, especially for complex returns like GSTR-9C. Regularly update your software to align with GST portal changes, ensuring seamless submissions and compliance.

4. Staying updated

Keep abreast of GST law changes, notifications, and deadlines through the GST portal or trusted sources like CBIC. Subscribe to newsletters or join business forums to stay informed about rate revisions or compliance updates. This helps you adapt your filings, such as GSTR-1 or CMP-08, to new requirements, avoiding penalties for non-compliance, which can be ₹50/day or more.

5. Professional guidance

Engage a GST consultant or chartered accountant, especially if your turnover exceeds ₹2 crore or you file complex returns like GSTR-9C. They can review your filings, ensure compliance, and handle audits.

For small businesses, periodic consultations can clarify doubts and optimize ITC claims, saving costs in the long run. Professional guidance ensures accuracy and reduces the risk of notices or penalties.

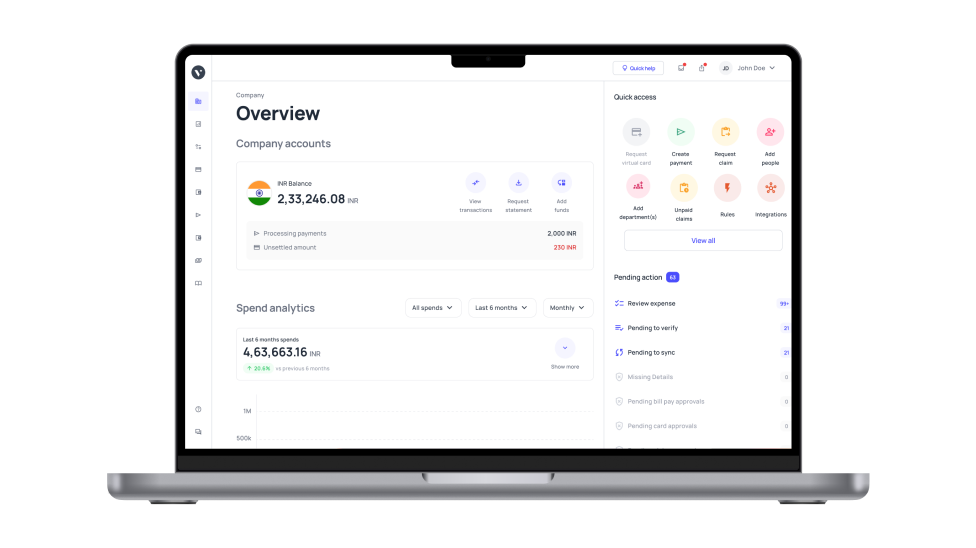

Why choose Volopay for streamlined expense management

Managing business expenses and GST compliance can be challenging, especially when done manually. That’s where Volopay steps in, offering an all-in-one solution for automated and efficient expense management.

Automated expense management

Volopay automates your entire expense workflow, from capturing receipts to categorizing spending. This saves you hours of manual work and reduces the risk of errors, helping you stay compliant with tax regulations, including various types of GST returns.

Simplified invoice processing

With Volopay, you can upload and track invoices in one centralized platform. The system automatically extracts key information, matches it with corresponding payments or purchase orders, and flags discrepancies, making invoice reconciliation easier than ever.

Real-time financial visibility

Gain complete visibility into your company’s finances with real-time dashboards. Monitor spending patterns, department-wise expenses, and cash flow trends instantly. This allows you to make informed decisions without waiting for month-end reports.

Integration with accounting systems

Volopay seamlessly integrates with popular accounting platforms like QuickBooks, Xero, NetSuite, and Tally. This ensures that all your financial data, including transactions relevant to GST returns types, flows directly into your accounting system, eliminating manual data entry and enabling accurate filings.