👋Exciting news! UPI payments are now available in India! Sign up now →

Provisions in accounting : Meaning, process, examples & journal entries

Accurate financial reporting is crucial for making informed decisions and maintaining stakeholder confidence. One of the fundamental concepts that ensures this accuracy is the proper understanding and application of provisions in accounting.

Whether you're a finance professional, business owner, or student, understanding what are provisions in accounting is essential for maintaining robust financial records and complying with regulatory requirements.

This comprehensive guide will walk you through everything you need to know about provisions in accounting, from their basic definition to complex implementation strategies, helping you navigate the intricacies of modern accounting practices with confidence and expertise.

What are provisions in accounting?

Provisions in accounting represent estimated liabilities that businesses create to account for future expenses or losses that are probable but uncertain in timing or amount. These financial reserves act as a safety net, ensuring that your company's financial statements accurately reflect potential obligations and maintain transparency with stakeholders.

When you create a provision, you're essentially acknowledging that your business will likely face certain costs in the future, even though you cannot determine the exact amount or timing with complete certainty.

This proactive approach to financial management helps you prepare for anticipated expenses while adhering to fundamental accounting principles like conservatism and matching.

Why are provisions important in accounting?

Understanding the importance of provisions in accounting is crucial for maintaining accurate financial records and making informed business decisions. These accounting provisions serve multiple purposes that directly impact your company's financial health and regulatory compliance.

1. Ensures accurate financial reporting

Provisions help you present a true and fair view of your company's financial position by accounting for probable future liabilities.

When you create provisions, you're ensuring that your financial statements don't overstate profits or understate liabilities, which could mislead investors and stakeholders about your company's actual financial health.

2. Supports better decision-making

By setting aside funds for anticipated expenses, provisions provide you with a clearer picture of your available resources and future cash flow requirements.

This enhanced visibility enables you to make more informed strategic decisions about investments, expansions, and operational changes.

3. Aids in regulatory and legal compliance

Accounting provisions are mandatory under various accounting standards, including Indian Accounting Standards (Ind AS) and International Financial Reporting Standards (IFRS).

Creating appropriate provisions in accounting ensures that your business remains compliant with regulatory requirements and avoids potential penalties or legal issues.

4. Enhances investor and stakeholder confidence

When you consistently maintain proper provisions, you demonstrate prudent financial management and transparency to investors, creditors, and other stakeholders.

This practice builds trust and confidence in your company's financial reporting and overall management capabilities effectively.

5. Helps manage risk and uncertainty

Provisions act as a financial cushion that helps you navigate uncertain economic conditions and unexpected expenses.

By anticipating potential liabilities, you can better manage risks and maintain financial stability during challenging periods.

How do provisions in accounting work?

Provisions in accounting function as a bridge between current financial reporting and future obligations, operating on the principle of matching expenses with the periods in which they're incurred.

When you identify a probable liability, you estimate its financial impact and record it as an expense in your current period's profit and loss account while simultaneously creating a corresponding liability on your balance sheet.

This process ensures that your financial statements reflect the economic reality of your business operations, even when exact amounts and timing remain uncertain. The provision amount is typically based on historical data, expert judgment, and available information about the underlying obligation.

Purpose and objectives of provisions

The creation and maintenance of provisions serve several critical purposes in modern accounting practices, each contributing to the overall integrity and usefulness of financial statements.

Reflect anticipated liabilities accurately

Provisions enable you to acknowledge and account for future obligations that arise from past events or current business activities. By recognizing these anticipated liabilities, you ensure that your financial statements provide a comprehensive view of your company's financial commitments.

Maintain financial statement integrity

Through proper provisioning, you preserve the reliability and credibility of your financial statements by avoiding the manipulation of profits through timing differences.This practice ensures that stakeholders receive accurate information about your company's financial performance and position.

Align with the matching principle in accounting

Provisions in accounting help you match expenses with the revenues they help generate, ensuring that costs are recognized in the same period as the related income. This alignment provides a more accurate representation of your company's profitability and operational efficiency.

Prepare for future obligations

By setting aside funds for anticipated expenses, provisions help you prepare financially for future cash outflows. This preparation reduces the risk of financial strain when these obligations become due and payable.

Ensure compliance with accounting standards

Proper provisioning ensures that your financial statements comply with applicable accounting standards and regulatory requirements. This compliance is essential for maintaining your company's reputation and avoiding potential legal or regulatory issues.

Examples of provisions in accounting

Understanding how business accounting provisions work in practice is essential for effective financial management. Here are several common examples that illustrate how businesses utilize provisions to manage their financial obligations and maintain accurate reporting.

Provision for employee bonuses

Companies often create provisions for employee bonuses when they have a legal or constructive obligation to pay performance-based compensation. For example, if your company has a policy of paying annual bonuses based on performance metrics, you would create a provision throughout the year to match this expense with the periods in which employees earn these bonuses.

Provision for bad debts

When you extend credit to customers, there's always a risk that some debts may become uncollectible. A provision for bad debts allows you to estimate and account for these potential losses based on historical data and current economic conditions, ensuring your accounts receivable are stated at their net realizable value.

Provision for legal disputes

If your company faces ongoing litigation or legal claims, you may need to create provisions for potential settlement costs or legal fees. These provisions help you account for the financial impact of legal proceedings while maintaining transparency with stakeholders about potential liabilities.

Provision for product warranties

Manufacturing companies typically provide warranties on their products, creating an obligation to repair or replace defective items. A warranty provision allows you to estimate and account for these future costs based on historical warranty claim patterns and product reliability data.

Provision for tax liabilities

Tax provisions help you estimate and account for income tax obligations that arise from current-period earnings. These provisions ensure that your financial statements accurately reflect your tax liabilities, even when final tax calculations haven't been completed.

Provision for restructuring costs

When planning significant organizational changes like plant closures or workforce reductions, you may need to create provisions for associated costs. These include employee severance packages, lease termination fees, and asset write-offs.

Provision for inventory obsolescence

Companies holding inventory may create provisions for items that become obsolete or unsaleable due to technological changes, market conditions, or expiration dates. These provisions ensure that inventory is valued at the lower of cost or net realizable value.

What are the types of provisions in accounting?

Understanding different types of provisions in accounting is crucial for comprehensive financial management. Each type serves specific purposes and follows distinct recognition and measurement criteria under accounting standards.

1. Provision for bad and doubtful debts

This provision accounts for the estimated amount of accounts receivable that may not be collected from customers. You calculate it based on historical collection patterns, current economic conditions, and individual customer assessments.

The provision is typically expressed as a percentage of total receivables or calculated using an aging analysis method. Recognition occurs when collection becomes doubtful, and measurement involves estimating the uncollectible amount based on available evidence and past experience.

2. Provision for depreciation

Depreciation provisions systematically allocate the cost of fixed assets over their useful lives, reflecting the consumption of economic benefits. You calculate depreciation using methods like straight-line, reducing balance, or units of production, depending on the asset's nature and usage pattern.

Recognition begins when the asset is ready for use, and measurement involves determining the depreciable amount and useful life based on management estimates and technical assessments.

3. Provision for taxation

Tax provisions estimate the income tax liability arising from current-period earnings. You calculate these provisions based on taxable income, applicable tax rates, and relevant tax regulations.

Recognition occurs when taxable income is earned, and measurement involves applying current tax laws and rates to determine the estimated liability. These provisions may require adjustments when actual tax assessments differ from estimates.

4. Provision for employee benefits

These provisions cover various employee-related obligations, including gratuity, pension, leave encashment, and other post-employment benefits. You calculate them using actuarial methods that consider factors like salary growth, discount rates, and employee turnover.

Recognition depends on the specific benefit plan and occurs when employees render services. Measurement involves complex actuarial calculations performed by qualified professionals.

5. Provision for restructuring

Restructuring provisions account for costs associated with significant organizational changes like business closures, relocations, or workforce reductions. You recognize these provisions only when you have a detailed formal plan and have created valid expectations among affected parties.

Measurement includes direct costs of restructuring such as employee termination benefits, lease cancellation costs, and asset impairments.

6. Provision for contingent liabilities

These provisions address potential obligations that depend on future events outside your control. Recognition requires that the obligation is probable and can be measured reliably.

Common examples include legal claims, environmental remediation costs, and product liability issues. Measurement involves estimating the most likely outcome and associated costs based on available information and expert assessments.

7. Loan loss provision

Financial institutions create loan loss provisions to account for potential defaults in their lending portfolios. You calculate these provisions based on historical loss experience, current economic conditions, and individual loan assessments.

Recognition follows regulatory guidelines and accounting standards, while measurement involves sophisticated models that consider various risk factors and the probability of default.

8. Provision for warranties

Warranty provisions cover the estimated costs of honoring product warranties and guarantees. You calculate them based on historical warranty claim patterns, product reliability data, and current warranty terms.

Recognition occurs when products are sold with warranties, and measurement involves estimating future warranty costs using statistical models and engineering assessments.

9. Environmental or decommissioning provisions

These provisions account for environmental cleanup costs, asset decommissioning expenses, and restoration obligations. You recognize them when legal or constructive obligations exist, typically at the time of asset installation or environmental impact creation.

Measurement involves complex calculations considering future costs, discount rates, regulatory requirements, and potential risks and uncertainties.

10. Provision for legal claims

Legal provisions cover potential costs associated with litigation, regulatory penalties, and legal settlements. You recognize these provisions when legal proceedings are probable and outcomes can be reasonably estimated.

Measurement involves assessing potential settlement amounts, legal fees, and other associated costs based on legal advice and case precedents.

Provisions vs reserves

Understanding the distinction between provisions and reserves is essential for accurate financial reporting and compliance with accounting standards. While both represent amounts set aside from profits, they serve different purposes and have distinct characteristics.

Key differences between provisions and reserves

Provisions are created for specific, probable liabilities that arise from past events, while reserves are appropriations of profits for general purposes or future contingencies. Provisions in accounting are mandatory under accounting standards when recognition criteria are met, whereas reserves are typically voluntary and depend on management discretion or regulatory requirements.

Accounting provisions represent actual liabilities or expenses that reduce your company's net worth, while reserves are part of shareholders' equity and don't affect the overall net worth. The creation of provisions is governed by strict recognition and measurement criteria, while reserves follow more flexible guidelines based on business needs and regulatory requirements.

When to create a provision vs. a reserve

You should create a provision when you have a present obligation arising from past events, the outflow of economic resources is probable, and you can make a reliable estimate of the amount.

Create reserves when you want to strengthen your financial position, comply with legal requirements, or set aside funds for specific future purposes like expansion or dividend distribution.

Impact on financial statements

Provisions appear as liabilities on the balance sheet and corresponding expenses in the profit and loss account, directly reducing reported profits. Reserves appear in the equity section of the balance sheet and represent an appropriation of retained earnings without affecting the current period's profit or loss.

Treatment under accounting standards

Accounting standards like IAS 37 and AS 29 provide specific guidance for provision recognition and measurement, while reserve treatment follows more general principles outlined in companies' legislation and accounting standards related to equity transactions.

How to recognize provisions

Evaluating probable liabilities

You must assess whether a present obligation exists as a result of past events and whether it's more likely than not that an outflow of economic resources will be required to settle the obligation.

This evaluation requires careful consideration of available evidence, legal advice, and management judgment. The probability threshold typically requires more than a 50% likelihood of occurrence for recognition purposes.

Measuring reliable estimates

Recognition requires that you can make a reliable estimate of the obligation's amount. This involves gathering relevant information, analyzing historical data, and applying appropriate estimation techniques.

When a range of possible outcomes exists, you should use the most likely amount or, if no single amount is more likely, the expected value of the range.

Assessing the timing of financial obligations

You need to determine when the obligation will likely be settled and whether it represents a current or long-term liability.

This assessment affects the presentation in financial statements and may influence the measurement of the provision, particularly when time value of money considerations are significant.

Applying the recognition criteria

The recognition criteria under IAS 37 require that all three conditions be met simultaneously: present obligation from past events, probable outflow of resources, and reliable measurement.

If any criterion is not met, you should disclose the item as a contingent liability rather than recognizing a provision.

Requirements for creating provisions

Creating provisions requires adherence to specific requirements that ensure consistency, reliability, and compliance with accounting standards. These requirements form the foundation for proper provision accounting.

1. Legal or constructive obligation

You must have a present obligation that arises from past events, either through legal requirements or constructive commitments. Legal obligations arise from contracts, legislation, or court decisions, while constructive obligations result from established patterns of behavior, published policies, or specific statements that create valid expectations among stakeholders.

2. Probability of outflow of economic resources

The obligation must be probable, meaning it's more likely than not that an outflow of resources will be required to settle the obligation. This assessment requires careful evaluation of available evidence and the circumstances surrounding the obligation. Remote possibilities don't warrant provision recognition but may require disclosure as contingent liabilities.

3. Ability to make a reliable estimate

You must be able to make a reliable estimate of the amount required to settle the obligation. This requirement involves gathering relevant information, analyzing historical data, and applying appropriate estimation techniques. When exact amounts are unknown, you should use the best estimate available based on management judgment and available evidence.

4. Documentation and audit trail requirements

Proper documentation is essential for supporting provision recognition and measurement decisions. You should maintain detailed records of the underlying obligations, estimation methods, key assumptions, and supporting evidence. This documentation facilitates audit procedures and ensures that provision accounting can be verified and validated by external parties.

The process of creating provisions in accounting

The process of creating provisions in accounting involves systematic steps that ensure accuracy, consistency, and compliance with accounting standards. This structured approach helps maintain the integrity of financial reporting while managing business risks effectively.

Identifying liabilities and trigger events

The first step involves identifying potential liabilities that arise from past events or current business activities. You need to monitor legal proceedings, contractual obligations, regulatory changes, and business operations that may create future obligations.

This identification process requires collaboration between finance, legal, and operational teams to ensure comprehensive coverage of potential liabilities.

Estimating financial impact

Once you've identified potential liabilities, you must estimate their financial impact using available information, historical data, and expert judgment.

This estimation process may involve complex calculations, or actuarial assessments, depending on the nature of the obligation. You should consider various scenarios and use conservative estimates when uncertainty exists.

Reviewing supporting documentation

Proper documentation is crucial for supporting provision decisions and ensuring audit trail integrity. You should gather and review relevant contracts, and historical data that support the provision's recognition and measurement.

This documentation provides evidence for the provision's validity and helps justify the estimation methods used during audits and reviews.

Approvals and internal controls

Provision creation should follow established approval processes and internal controls to ensure accuracy and prevent unauthorized adjustments.

You should implement segregation of duties, requiring multiple levels of review and approval for significant provisions. This control framework helps maintain the integrity of financial reporting and reduces the risk of errors or fraud.

Updating or reversing provisions periodically

Provisions require regular review and adjustment based on new information, changed circumstances, or revised estimates. You should establish periodic review procedures to assess the continued validity and accuracy of existing provisions.

When provisions are no longer needed or require adjustment, you should reverse or modify them accordingly while maintaining proper documentation of the changes.

How to record provisions

Journal entry format for provisions

Recording provisions in accounting requires understanding proper journal entry formats and their impact on financial statements. This process ensures that business accounting provisions are accurately reflected in your accounting records and comply with applicable accounting standards.

The standard journal entry for creating a provision involves debiting an expense account and crediting a provision liability account.

The format typically appears as: Debit [expense account] and Credit [provision account]. This entry increases both expenses and liabilities, reflecting the obligation's recognition in your financial statements.

Debit and credit treatment

When you create a provision, you debit the appropriate expense account in the profit and loss statement and credit the corresponding provision account on the balance sheet.

This treatment ensures that the expense is recognized in the current period while creating a liability for future settlement.

The specific accounts used depend on the provision's nature and your chart of accounts structure.

Recording changes in provisions

Changes in provisions require careful handling to ensure accurate financial reporting. When you increase a provision, you debit additional expenses and credit the provision account.

When you decrease a provision, you debit the provision account and credit a reversal of expense or income account.

These adjustments reflect updated estimates and changed circumstances.

Year-end adjustments and reversals

Year-end procedures require careful review of all provisions to ensure they remain appropriate and accurately measured.

You should adjust provisions based on updated information, changed circumstances, or revised estimates.

When provisions are no longer needed, you should reverse them by debiting the provision account and crediting an income account or expense reversal.

Impact on profit & loss and balance sheet

Provisions directly impact both the profit and loss account and the balance sheet.

The expense recognition reduces current period profits, while the provision liability increases total liabilities.

This dual impact ensures financial statements reflect operations costs and future obligations, providing stakeholders comprehensive information about your company's financial position.

Accounting principles and guidelines for provisions

Understanding the fundamental accounting principles that govern provision recognition and measurement is essential for accurate financial reporting and compliance with accounting standards. These principles provide the theoretical foundation for provision accounting practices.

1. The matching principle

The matching principle requires that expenses be recognized in the same period as the related revenues they help generate. When you create provisions in accounting, you're applying this principle by matching anticipated costs with the periods in which the underlying activities occurred.

This ensures that financial statements accurately reflect the true cost of operations and maintain consistency in profit measurement across periods.

2. Prudence and conservatism in accounting

Prudence or conservatism requires that you recognize potential losses and liabilities as soon as they become probable, while gains should only be recognized when realized.

This principle supports provision creation by encouraging early recognition of potential obligations, even when exact amounts remain uncertain. Conservative estimates help protect stakeholders from overstated financial positions.

3. Accrual basis of accounting

The accrual basis of accounting requires that transactions be recorded when they occur, regardless of when cash flows take place. Provisions exemplify this principle by recognizing expenses and liabilities when obligations arise, not when payments are made.

This approach provides more accurate financial reporting and better reflects the true economic reality of core business operations.

4. Materiality and consistency

Materiality requires that provisions be recognized only when they're significant enough to influence user decisions. Consistency requires that similar transactions be treated uniformly across periods and entities.

These principles guide provision recognition decisions and ensure that financial statements remain relevant, reliable, and comparable over time.

5. Application of IAS 37 and AS 29

International and Indian accounting standards provide specific guidance for provision recognition, measurement, and disclosure. IAS 37 and AS 29 establish criteria for distinguishing between provisions, contingent liabilities, and contingent assets.

These standards ensure global consistency in provision accounting and provide detailed implementation guidance for complex situations.

Accounting treatment of provisions

The accounting treatment of provisions in accounting involves specific procedures for recognition, measurement, and presentation in financial statements. Understanding these treatments ensures compliance with accounting standards and accurate financial reporting.

Recognition in the profit & loss account

Provisions are recognized as expenses in the profit and loss account when the recognition criteria are met. The expense amount reflects the estimated cost of settling the obligation and is recorded in the period when the obligation arises. This recognition reduces reported profits and ensures that financial statements reflect the true cost of operations.

Presentation in the balance sheet

Provisions appear as liabilities on the balance sheet, classified as current or non-current based on their expected settlement timing. Current provisions are those expected to be settled within one year, while non-current provisions have longer settlement periods. This classification helps users understand the timing of cash flow impacts and liquidity requirements.

Changes in estimates and reversals

Changes in provision estimates require careful accounting treatment to ensure accurate financial reporting. Increases in provisions are recorded as additional expenses, while decreases are recorded as expense reversals or income. When provisions are no longer needed, they should be reversed entirely, with the reversal affecting the current period's profit or loss.

Tax implications of provisions

Provisions may have different treatments for tax and accounting purposes, creating temporary differences that require deferred tax accounting. Some provisions may be tax-deductible when created, while others become deductible only when actual payments occur. These differences affect the calculation of current and deferred tax liabilities.

Differences between GAAP and IFRS treatments

While both GAAP and IFRS require similar recognition criteria for provisions, there may be differences in measurement, presentation, and disclosure requirements. Understanding these differences is important for companies operating in multiple jurisdictions or considering transitions between accounting frameworks.

Journal entries for common provisions

Understanding how to record journal entries for common provisions in accounting is essential for accurate financial reporting. These practical examples demonstrate the application of provision accounting principles in real-world scenarios.

1. Journal entry for provision for bad debts

When creating a provision for bad debts, you debit "Bad Debt Expense" and credit "Provision for Bad Debts.

For example, if you estimate ₹50,000 of receivables may become uncollectible, the entry would be: Dr. Bad Debt Expense ₹50,000, Cr. Provision for Bad Debts ₹50,000.

This entry increases expenses and creates a contra-asset account that reduces net receivables.

2. Journal entry for provision for taxation

Tax provisions require estimating income tax liability based on current period earnings.

The journal entry typically involves: Dr. Income Tax Expense ₹200,000, Cr. Provision for Income Tax ₹200,000.

This entry recognizes the tax expense in the current period while creating a liability for future tax payments.

3. Journal entry for provision for bonuses

When creating a provision for employee bonuses, you debit "Bonus Expense" and credit "Provision for Bonuses.

For instance, if you estimate ₹100,000 in bonus payments, the entry would be: Dr. Bonus Expense ₹100,000, Cr. Provision for Bonuses ₹100,000.

This entry matches the bonus expense with the periods in which employees earned these bonuses.

4. Journal entry for warranty provisions

Warranty provisions involve estimating future warranty costs based on historical data and product reliability.

The journal entry typically appears as: Dr. Warranty Expense ₹75,000, Cr. Provision for Warranties ₹75,000.

This entry recognizes the expected warranty costs in the period when products are sold.

5. Year-end adjusting entries and reversals

Year-end procedures may require adjusting or reversing provisions based on updated information.

To increase a provision, you debit additional expenses and credit the provision account.

To reverse an unnecessary provision, you debit the provision account and credit "Provision Reversal Income" or reduce the related expense account.

Industry applications of provisions in accounting

Different industries face unique challenges and requirements when implementing provisions in accounting. Understanding these industry-specific applications helps ensure appropriate provision recognition and measurement across various business sectors.

1. Provisions in the manufacturing industry

Manufacturing companies typically create provisions for product warranties, environmental cleanup costs, and employee benefits.

Warranty provisions are particularly significant, requiring detailed analysis of product reliability, historical claim patterns, and regulatory requirements.

Environmental provisions may be needed for pollution cleanup, waste disposal, and facility decommissioning costs.

2. Provisions in the banking and financial sector

Banks and financial institutions focus heavily on loan loss provisions, which represent their largest provision category.

These business accounting provisions require sophisticated models that consider credit risk, economic conditions, and regulatory requirements.

Other common provisions include provisions for legal claims, operational risk losses, and employee benefits.

3. Provisions in IT and SaaS companies

Technology companies often create provisions for software maintenance, customer support, and intellectual property disputes.

SaaS companies may need provisions for service level agreement penalties, data security breaches, and subscription refunds.

These provisions require careful consideration of contractual obligations and service delivery commitments.

4. Provisions in healthcare and pharma

Healthcare and pharmaceutical companies face unique provision requirements related to product liability, regulatory compliance, and clinical trial costs.

Drug manufacturers must consider provisions for product recalls, adverse event settlements, and regulatory penalties.

Healthcare providers may need provisions for malpractice claims and patient care obligations.

5. Sector-specific regulatory considerations

Each industry operates under specific regulatory frameworks that influence provision requirements.

Financial services companies must comply with banking regulations, while pharmaceutical companies face FDA requirements.

Understanding these sector-specific regulations is essential for appropriate provision recognition and measurement.

Understanding IFRS (International Financial Reporting Standards)

Understanding IFRS requirements for provisions is crucial for companies operating in global markets or following international accounting standards. These standards provide comprehensive guidance for provision recognition, measurement, and disclosure.

Introduction to IAS 37—provisions, contingent liabilities, and contingent assets

IAS 37 provides the primary guidance for provision accounting under IFRS. This standard defines provisions as liabilities of uncertain timing or amount and establishes recognition criteria requiring present obligation, probable outflow, and reliable measurement.

The standard also addresses contingent liabilities and contingent assets, providing guidance for items that don't meet provision recognition criteria.

Recognition and measurement criteria under IFRS

IFRS requires that provisions be recognized when three criteria are met simultaneously: present obligation from past events, probable resource outflow, and reliable measurement capability.

Measurement should represent the best estimate of expenditure required to settle the obligation, considering risks, uncertainties, and the time value of money when material.

IFRS vs. Indian accounting standards

While Indian Accounting Standards (Ind AS) are largely converged with IFRS, some differences exist in provision accounting. These differences may relate to measurement requirements, disclosure obligations, or transition provisions.

Understanding these differences is important for companies operating under Indian GAAP or considering transitions to IFRS.

Common compliance challenges

Companies often face challenges in applying IFRS provision requirements, particularly in areas like measurement uncertainty, disclosure obligations, and judgment documentation.

Common issues include determining appropriate discount rates, assessing probability thresholds, and maintaining adequate supporting documentation for complex provisions.

Examples of provisions disclosed under IFRS

IFRS requires comprehensive disclosure of provision movements, including opening balances, additions, utilizations, and reversals.

Companies must also disclose the nature of obligations, expected settlement timing, and uncertainties surrounding amounts or timing. These disclosures help users understand the company's risk profile and financial obligations.

Challenges and issues in provision accounting

Provisions in accounting present various challenges that can impact financial reporting accuracy and compliance. Understanding these challenges helps companies develop effective strategies for managing provision-related risks and complexities.

1. Difficulty in estimating accurate amounts

One of the primary challenges in provisions in accounting is estimating accurate amounts for uncertain future obligations. This difficulty arises from limited historical data, changing economic conditions, and the inherent uncertainty of future events. Companies must balance the need for accuracy with the practical limitations of estimation techniques.

2. Inconsistent application of accounting standards

Different interpretations of accounting standards can lead to inconsistent provision recognition and measurement across companies and industries. This inconsistency may result from complex standard requirements, limited implementation guidance, or varying professional judgments about similar situations.

3. Risk of over- or under-provisioning

Companies face the risk of creating excessive provisions that reduce reported profits unnecessarily or insufficient provisions that understate liabilities. Both scenarios can mislead stakeholders and affect decision-making. Finding the right balance requires careful analysis, conservative judgment, and regular review procedures.

4. Manual tracking and calculation errors

Many companies still rely on manual processes for provision calculation and tracking, increasing the risk of errors and inconsistencies. These manual processes are time-consuming, prone to mistakes, and difficult to audit. The lack of automated systems can also limit the frequency and accuracy of provision reviews.

5. Complexities in industry-specific provisions

Different industries face unique provision requirements that may be difficult to understand and implement. Industry-specific accounting provisions often require specialized knowledge, complex calculations, and detailed regulatory compliance. These complexities can overwhelm finance teams and increase the risk of errors or non-compliance.

6. Regulatory and audit scrutiny

Provisions often receive significant attention from regulators and auditors due to their subjective nature and potential impact on financial statements. This scrutiny requires companies to maintain detailed documentation, justify their estimation methods, and demonstrate compliance with applicable standards.

Stay compliant with smarter accounting processes

Best practices for navigating provision accounting complexities

Implementing effective strategies for managing provisions in accounting complexities can significantly improve accuracy, compliance, and efficiency. These best practices help companies develop robust provision management processes that support reliable financial reporting.

Maintain clear documentation and assumptions

Comprehensive documentation is essential for supporting provision decisions and facilitating audit procedures. You should maintain detailed records of underlying obligations, estimation methods, key assumptions, and supporting evidence.

This documentation should be updated regularly and reviewed by appropriate personnel to ensure accuracy, reliability, and completeness at all reporting stages.

Use historical data for reliable estimates

Historical data provides valuable insights for estimating future obligations and should be used whenever available. You should analyze trends, patterns, and relationships in historical data to develop more accurate estimates.

However, you should also consider changes in business conditions, regulations, or operations that may significantly affect future financial outcomes and performance.

Review and update provisions regularly

Regular review and updating of provisions is essential for maintaining accuracy and relevance. You should establish periodic review procedures that assess the continued validity of existing provisions and the need for new provisions.

These reviews should consider new information, changed circumstances, and revised estimates to ensure accuracy, relevance, compliance, transparency, and reliability in financial reporting practices.

Align provisioning with business strategy

Provisions in accounting should support broader business objectives and strategic planning. You should consider how provisions affect cash flow planning, risk management, and performance measurement.

This alignment ensures that provision accounting effectively supports strategic business decision-making rather than operating in isolation across different departments.

Train finance teams on compliance and standards

Adequate training is essential for ensuring that finance teams fully understand the provision accounting requirements and best practices in detail.

You should provide regular training on accounting standards, industry-specific requirements, and company policies. This training should be updated as standards change and new challenges emerge.

Use automation tools where possible

Automation can significantly improve the accuracy and efficiency of provisions in accounting processes, reducing risks, saving time, enhancing compliance, and supporting better financial management.

You should consider implementing automated systems for calculation, tracking, and reporting of provisions. These tools can reduce manual errors, improve consistency, and provide better visibility into provision activities.

The role of automation in managing provisions efficiently

Modern businesses increasingly rely on automation to manage provision accounting complexities and improve financial reporting accuracy. Technology solutions can streamline processes, reduce errors, and provide better insights into provision activities.

1. Automating journal entries and calculations

Automated systems can streamline the creation and posting of provision-related journal entries, reducing manual effort and minimizing errors.

These systems can calculate provisions based on predefined rules, historical data, and current business conditions. Automation ensures consistency in calculation methods and reduces the risk of computational errors.

2. Real-time tracking of provision balances

Automated systems provide real-time visibility into provision balances, movements, and aging. This visibility enables finance teams to monitor provision activities continuously and identify issues quickly.

Real-time tracking also supports better cash flow planning and risk management by providing up-to-date information about potential obligations.

3. Integration with ERP and accounting software

Integration between provision management systems and existing ERP or accounting software eliminates data silos and improves process efficiency.

This integration ensures that provision data flows seamlessly between systems, reducing manual data entry and improving accuracy. Integrated systems also provide better reporting capabilities and audit trails.

4. Reducing manual errors and audit risks

Automation reduces the risk of manual errors that can occur in provision calculations, data entry, and reporting, thereby improving efficiency, accuracy, reliability, and overall compliance significantly.

Automated systems apply consistent rules and calculations, eliminating the variability that comes with manual processes. This consistency improves audit efficiency and reduces the risk of compliance issues.

5. Enhancing scalability and reporting accuracy

Automated systems can handle larger volumes of provisions and more complex calculations than manual processes. This scalability is particularly important for growing businesses or those operating in multiple jurisdictions.

Automated reporting also provides more accurate and timely information for strategic decision-making and strict regulatory compliance purposes.

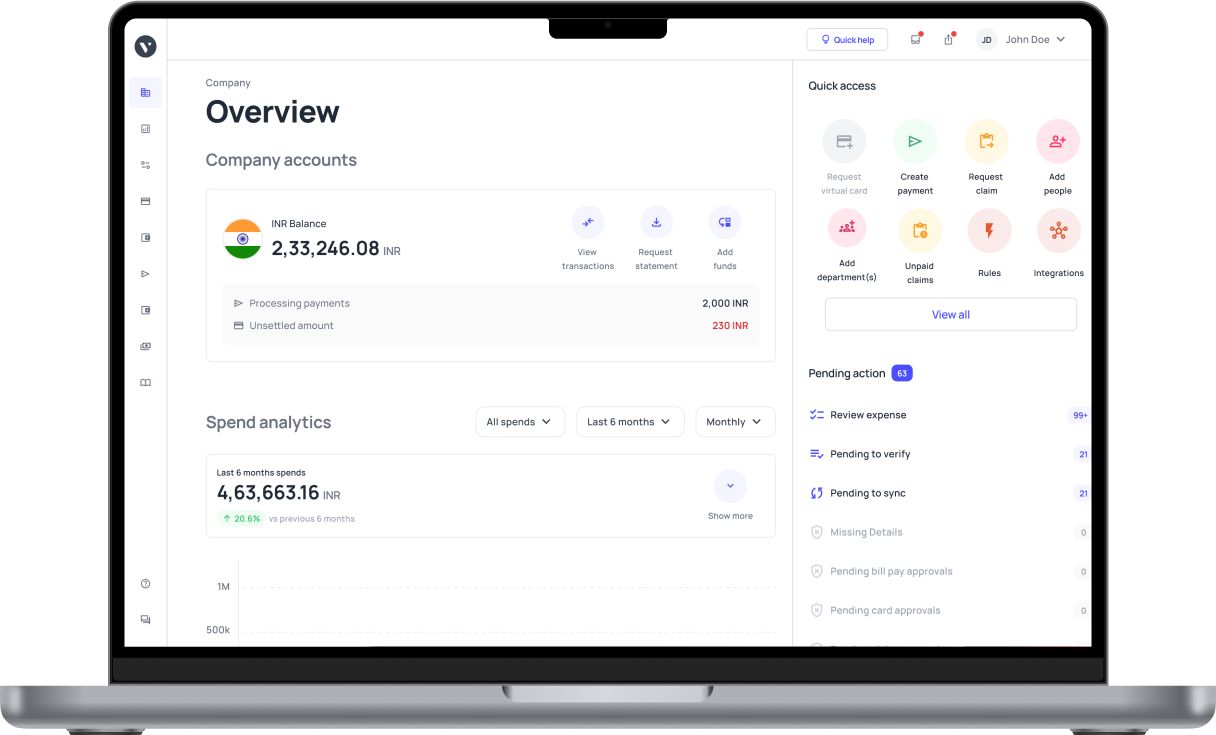

6. Case for finance automation tools like Volopay

Modern finance automation platforms like Volopay offer comprehensive solutions for managing various aspects of financial operations, including provision-related processes.

These platforms can automate expense tracking, approval workflows, and integration with accounting systems, providing end-to-end visibility and control over financial processes.

Streamlining provision accounting with Volopay: A smarter way to work

Volopay's comprehensive accounting automation software helps modern businesses streamline their provision accounting processes and improve overall financial management efficiency. The platform provides integrated tools that address many common challenges in provision accounting while supporting broader financial management objectives.

Automates expense tracking and categorization

Volopay automatically tracks and categorizes expenses, providing valuable reporting software capabilities for accurate provision calculations and estimates.

The platform captures expense information in real-time, eliminating manual data entry and reducing the risk of errors. This automation provides finance teams with accurate, up-to-date information for creating and updating provisions.

Offers real-time visibility into spend and liabilities

The platform provides real-time dashboards and reporting that offer comprehensive visibility into spending patterns and potential liabilities.

This visibility enables finance teams to identify provision requirements early and make more informed decisions about provision amounts and timing. Real-time data also supports better cash flow planning and risk management.

Streamlines approvals and enforces policy controls

Volopay's approval workflows ensure that provision-related transactions strictly follow established company policies and procedures consistently.

The platform can enforce spending limits, require multiple approvals for significant provisions, and maintain audit trails for all transactions. These controls help ensure compliance with internal policies and accounting standards.

Integrates seamlessly with major accounting software

The platform integrates with popular accounting software systems, ensuring that the provision data flows seamlessly between systems.

This integration eliminates manual data entry and reduces the risk of errors while providing consistent data across all financial systems. The seamless integration supports accurate provision calculations and reporting.

Enables customizable workflows for provision management

Volopay allows you to create customized workflows that align with your specific provision management requirements. You can configure approval processes, set up automated notifications, and establish review procedures that match your company's policies and procedures.

These customizable workflows ensure that provision accounting follows established processes while maintaining flexibility for unique business needs and situations.

Maintains audit-ready records for compliance and transparency

The platform automatically maintains comprehensive audit trails for all provision-related transactions and activities, ensuring accuracy, transparency, accountability, and compliance with regulatory standards at all times.

These records include detailed information about approvals, changes, and supporting documentation, ensuring that your provision accounting meets audit requirements. The audit-ready records also support compliance with accounting standards and regulatory requirements.

Bring Volopay to your business

Get started now

Frequently asked questions

The main difference lies in their purpose and certainty. Provisions are created for probable future liabilities with uncertain timing or amounts, while accruals represent expenses that have been incurred but not yet recorded. Provisions in accounting address future obligations from past events, whereas accruals capture current period expenses.

Yes, provisions are classified as liabilities on the balance sheet because they represent obligations to transfer economic resources in the future. They appear as current or non-current liabilities depending on their expected settlement timing and significantly impact your company's financial position assessment.

Yes, provisions can be reversed when the underlying obligation no longer exists or when the probability of resource outflow becomes remote. The reversal is recorded by debiting the provision account and crediting income or expense reversal, affecting the current period's profit or loss.

Common errors include inadequate documentation, incorrect probability assessments, inappropriate measurement methods, and failure to review provisions regularly. Other frequent mistakes involve misclassifying contingent liabilities as provisions and using inconsistent estimation methods across periods or similar obligations.

Tax provisions are specifically created for estimated income tax liabilities based on current period earnings and applicable tax rates. Unlike other provisions, tax provisions follow specific tax regulations and may have different recognition criteria. They also require frequent updates based on changing tax laws and assessments.

Yes, Volopay can automate various aspects of provision-related journal entries through its integration with accounting software. The platform streamlines expense tracking, approval workflows, and data transfer, reducing manual effort and improving accuracy in provision accounting processes.

Yes, Volopay is designed to support Indian companies following local accounting standards, including Indian Accounting Standards (Ind AS) and Companies Act requirements. The platform's flexibility allows customization to meet specific compliance requirements while maintaining integration with popular Indian accounting software systems.

Volopay enhances compliance through automated audit trails, policy enforcement, approval workflows, and comprehensive documentation. The platform ensures that provision-related transactions follow established procedures while maintaining detailed records for audit and compliance purposes, reducing the risk of regulatory issues.