👋Exciting news! UPI payments are now available in India! Sign up now →

What is financial accounting? A complete guide for Indian businesses

Every successful business rests on a foundation of clear, trustworthy numbers. Financial accounting is the language that turns daily transactions into meaningful insights. Capturing and organizing financial data helps business leaders and investors see the true picture of an organization’s health.

It’s not just about balancing books it’s about building confidence and driving better decisions. For companies in India, mastering financial accounting means staying ahead in compliance, attracting investment, and laying a roadmap for long-term success in a dynamic economy.

What is financial accounting?

Understanding what is financial accounting unlocks a world of clarity for any business. At its core, financial accounting is the structured process of recording, classifying, and presenting financial activities in a way everyone can trust. It translates complex transactions into standardized reports like balance sheets and income statements.

The financial accounting meaning goes deeper than record-keeping it ensures that stakeholders have reliable information to judge performance and make smart moves. A robust system keeps companies transparent and investors well-informed, forming a core foundation of effective corporate accounting.

Why financial accounting matters for Indian businesses

In India’s business landscape, financial accounting is far more than a statutory formality it’s a strategic necessity. Accurate financial records help companies stay compliant with tax laws and changing regulations, avoiding costly penalties. Transparent reporting attracts investors and builds trust with banks and partners.

For management, it’s a vital tool for planning budgets and controlling expenses wisely. In a country with growing global trade, strong financial accounting practices give businesses credibility and a competitive edge, paving the way for sustainable growth and expansion.

Primary objectives of financial accounting

Providing reliable financial information

Financial accounting offers a true and fair view of a company’s financial position, performance, and cash flows. Reliable data builds confidence among stakeholders like investors and regulators.

Clear reports help demonstrate profitability and stability, encouraging sustainable growth. Without dependable information, businesses risk losing trust and facing poor financial decisions.

Assessing solvency and liquidity

A key goal of financial accounting is to help users evaluate a company’s ability to meet its financial obligations. Financial statements show liquidity, indicating if short-term debts can be settled on time.

They also reveal solvency, showing if the business can sustain operations in the long run. This reassures creditors and banks that the company can handle immediate and future commitments responsibly.

Facilitating informed decision-making

Financial accounting equips stakeholders with the facts needed to make sound financial choices. Investors rely on accurate reports to decide where to allocate funds, while lenders examine statements to approve loans.

By understanding the financial accounting meaning, stakeholders can interpret reports confidently and negotiate contracts with a clear picture of financial health.

Ensuring compliance and accountability

Financial accounting ensures businesses comply with India’s regulatory frameworks, like the Companies Act and SEBI rules. Accurate books show that a company respects legal and ethical standards, promoting trust and accountability.

Transparent reporting minimizes the risk of fraud and strengthens corporate governance. Proper compliance avoids penalties and preserves a company’s reputation.

Reporting to external stakeholders

A core purpose of financial accounting is to produce reports for people outside the organization who lack direct access to internal records. Investors, authorities, creditors, and analysts depend on these reports to evaluate a company’s health.

Standardized formats ensure information is clear and comparable across businesses. Accurate reporting supports market confidence and fair valuation.

Supporting strategic growth

Financial accounting drives strategic business growth by highlighting trends, strengths, and problem areas. Analyzing data helps companies plan future investments, expansions, or cost-saving measures more effectively.

Clear records attract funding and partnerships needed to scale operations. Strong financial accounting practices give businesses a competitive edge in India’s market.

Fundamental principles and concepts guiding financial accounting

1. Accrual concept

The accrual concept is a core principle that ensures financial transactions are recorded when they occur, not when cash is exchanged. Revenues are recognized when earned, and expenses are matched when incurred.

This provides a realistic view of a company’s financial performance during a specific period. It helps present an accurate profit or loss figure, aligning financial statements with actual business activities.

2. Going concern concept

The going concern concept assumes that a business will continue operating in the foreseeable future without the intention or need to liquidate. This principle allows assets to be valued based on historical costs rather than liquidation value.

It reassures stakeholders that the company can meet its obligations and continue operations. Financial statements prepared under this concept promote stability and trust among investors and creditors.

3. Monetary unit concept

Under the monetary unit concept, only transactions measurable in money are recorded in the books. It assumes that the currency used remains stable over time, ignoring inflation or deflation. This principle simplifies accounting by providing a common financial denominator.

It ensures consistency when recording, comparing, and interpreting data. By using a single unit of measure, companies provide clear and understandable financial reports.

4. Business entity concept

The business entity concept distinguishes the business’s financial affairs from those of its owners or other businesses. It ensures that only the company’s transactions are recorded in its accounts. This clear separation enhances accountability and accuracy in financial reporting.

Stakeholders can analyze the company’s true performance without confusion. This principle is vital in explaining what is financial accounting to those new to the field.

5. Cost concept (Historical cost)

The cost concept, or historical cost principle, states that assets should be recorded at their original purchase cost. It disregards market fluctuations or estimated values after acquisition. This principle provides objective, verifiable data that reduces manipulation.

By relying on factual cost figures, businesses ensure consistency and comparability across periods. Stakeholders trust financial statements more when asset valuations are based on documented historical transactions.

6. Full disclosure principle

The full disclosure principle requires businesses to provide all relevant financial information that could impact users’ decisions. This includes notes, supplementary data, and any significant details not evident in primary statements.

Transparency builds trust among investors, creditors, and regulators. It reduces uncertainty and prevents misleading financial reporting. By disclosing material facts, companies maintain credibility and comply with legal and ethical standards in financial communication.

7. Consistency principle

The consistency principle ensures that once a company adopts an accounting method, it should use it continuously from one period to another. This allows for meaningful comparisons over time, helping stakeholders analyze trends accurately.

Changing methods frequently can distort financial results and mislead users. However, if a change is necessary, it must be clearly explained. Consistency builds reliability in financial statements and strengthens stakeholders’ confidence in reported figures.

8. Prudent reporting

Prudent reporting, or the conservatism principle, advises accountants to stay cautious when estimating under uncertainty. It means recording expenses and liabilities quickly, but recognizing revenues only when certain.

This prevents overstating income or assets and readies the business for losses. By being conservative, companies protect stakeholders from unrealistic expectations. Prudent reporting ensures statements present a realistic, balanced view of the company’s finances.

9. Matching principle

The matching principle dictates that expenses be recorded in the same period as the revenues they help generate. This aligns costs with related income, giving a clearer picture of profitability. It prevents misstated earnings by stopping expenses from being delayed or rushed.

Accurate matching improves income measurement and comparability. It supports reliable profit and loss statements that stakeholders trust for decisions.

10. Revenue recognition principle

The revenue recognition principle governs when and how revenue is recorded in statements. It says revenue should be recognized when earned and realizable, regardless of cash receipt timing. This ensures income reflects actual activity for a period.

Following this prevents premature or late reporting of sales. It aligns reported revenue with obligations met, providing stakeholders with truthful information about operational performance.

The financial accounting cycle: A step-by-step process

Transaction identification

Transaction identification is the first step in the financial accounting cycle. Businesses must analyze each event to decide if it has a measurable financial impact. Only transactions affecting assets, liabilities, equity, income, or expenses are recorded.

Proper identification ensures that no significant transaction is missed or misclassified. This step lays the groundwork for accurate records and trustworthy financial reporting throughout the accounting cycle.

Journal entries

Journal entries follow transaction identification and serve as the initial record of each event. Transactions are documented chronologically in the general journal, showing debits and credits for each account impacted. Proper narration supports each entry for clarity.

Accurate journalizing prevents mistakes from carrying forward into later stages. This step maintains a complete history of financial activities, supporting transparency and easy tracking of all transactions.

Ledger posting

After transactions are journalized, they are transferred to individual ledger accounts through ledger posting. Each account like cash, sales, or expenses organizes related entries to show cumulative balances. This step sorts raw data into clear categories, aiding financial statement preparation.

Consistent ledger posting keeps balances updated and simplifies locating transaction details. It ensures information is properly classified for the next phases of the accounting cycle.

Unadjusted trial

Once all transactions are posted, the unadjusted trial balance is prepared to test the ledger’s mathematical accuracy. It lists all accounts and balances, ensuring total debits equal total credits. This check helps catch recording or posting errors before adjustments.

An accurate trial balance confirms the books are in order for steps like adjustments and financial statement preparation. Preparing an unadjusted trial balance strengthens confidence in the company’s financial data.

Adjusting entries

Adjusting entries update accounts to reflect revenues earned and expenses incurred during the period. They handle accruals for unpaid items and deferrals for prepaid items or unearned revenue. These adjustments ensure financial statements show a company’s true financial condition.

Without them, income and expenses may be misstated. This step is vital for compliance with accounting standards and for providing accurate, timely information to stakeholders.

Adjusted trial

After adjustments are made, an adjusted trial balance is prepared to verify that debits still equal credits. It combines the original unadjusted balances with the new adjustments. This updated list ensures accuracy before creating financial statements.

Preparing this trial balance catches errors that might have occurred during adjustments. It confirms that the books remain balanced. An adjusted trial balance acts as the final check before moving to statement preparation.

Financial statements

Using the adjusted trial balance, companies prepare financial statements such as the balance sheet, income statement, and cash flow statement. These reports summarize a company’s financial performance and position for the period. Stakeholders rely on them to make informed decisions.

Each statement serves a unique purpose, but together they provide a full financial overview. Accurate statements build trust and meet regulatory requirements.

Closing entries

Closing entries are made at the end of the accounting cycle to transfer balances from temporary accounts to permanent ones. Revenue and expense accounts are reset to zero by moving their balances to retained earnings. This process readies accounts for the next accounting period.

Closing ensures that income and expense accounts report only current-period activity. It helps maintain a clear separation between financial periods for accurate performance measurement.

Post-closing trial

Once closing entries are recorded, a post-closing trial balance is prepared. This balance confirms that all temporary accounts have been closed and only permanent accounts carry forward. It checks that debits equal credits after closing.

The post-closing trial balance ensures that the ledger is ready for the next cycle. It provides a final accuracy check before new transactions begin. This step keeps financial records clean and organized.

Reversing entries

Reversing entries are optional steps taken at the start of the new period to simplify accounting for accrued items. They cancel certain adjusting entries made in the previous period. This makes recording payments or receipts easier and avoids double-counting.

Reversing reduces errors and streamlines bookkeeping. Not all adjustments need reversing, but when used properly, they save time. This step supports smoother transaction recording in the new cycle.

Key financial statements: The output and analytical tools of financial accounting

The balance sheet

● Purpose and structure

The balance sheet shows a company’s financial position at a particular date, summarizing what the business owns, owes, and the owner’s interest. It lists assets on one side and liabilities plus equity on the other, ensuring both sides balance.

This snapshot helps track financial health over time. Stakeholders use it to evaluate solvency, stability, and operational soundness efficiently.

● Assets

Assets are resources a business controls that provide future economic benefits. They are categorized as current assets like cash, inventory, and receivables expected to convert into cash within a year, and non-current assets like property, equipment, and intangible assets held for longer periods.

Proper classification of assets helps measure liquidity and operational capability. Understanding assets guides effective asset management and investment planning.

● Liabilities

Liabilities represent the company’s financial obligations to external parties. They are classified as current liabilities, which include accounts payable, short-term loans, unearned revenue, and the current portion of long-term debt due within a year.

Non-current liabilities cover long-term loans, bonds payable, and deferred tax liabilities extending beyond one year. Knowing these helps gauge a company’s debt burden and repayment capacity.

● Equity

Equity, also called shareholders’ funds, represents owners’ residual interest after liabilities are settled. It includes share capital, which is the money invested by shareholders, and retained earnings, which are profits kept in the business after dividends.

This section shows how much value belongs to the owners. Tracking equity helps investors judge profitability, reinvestment decisions, and overall shareholder value.

● Interpretation for stakeholders

The balance sheet allows stakeholders to assess a company’s solvency, liquidity, and capital structure at a glance. It reveals if the firm can cover short-term debts and maintain financial flexibility.

Investors and creditors use this information to evaluate risk and funding strategies. It’s a crucial tool for analyzing long-term sustainability and helps stakeholders make sound financial decisions with confidence.

The profit & loss statement

● Purpose and structure

The profit & loss statement provides a summary of a company’s revenues, expenses, gains, and losses during a defined period, such as a month, quarter, or year. It illustrates how effectively the company generates profit from its operations.

By comparing income with expenses, stakeholders can assess operating efficiency. This statement complements the balance sheet by showing performance over time, helping users evaluate profitability trends.

● Revenue recognition

Revenue includes income earned from core activities like product sales, service fees, and other operating sources. Recognizing revenue properly ensures it reflects actual earnings within the period it was earned, not necessarily when cash is received.

This principle aligns income with related efforts and costs. Clear revenue recognition prevents inflated earnings and maintains transparency. It helps management and investors track whether revenue streams are sustainable and growing appropriately.

● Cost of goods sold (COGS)

Cost of goods sold represents the direct costs incurred to produce products or deliver services that generate sales. It includes raw materials, direct labor, and production overheads directly tied to output. COGS is vital for calculating gross profit, which is sales revenue minus COGS.

Analyzing COGS helps businesses control production expenses and improve margins. A well-managed COGS can indicate efficient operations and competitive pricing strategies in the market.

● Operating expenses

Operating expenses are the costs a company incurs while running its daily business activities. These include administrative expenses, salaries, rent, utilities, marketing, selling and distribution expenses, and depreciation of assets. Operating expenses are deducted after gross profit to determine operating profit.

Keeping these costs under control is crucial for profitability. Stakeholders analyze these expenses to ensure the company is spending wisely and maintaining healthy margins that support growth and sustainability.

● Non-operating income and expenses

Non-operating income and expenses cover financial activities not related to the main business operations. Common examples include interest income from investments, interest expenses on borrowings, dividend income, and gains or losses from selling assets.

Although they do not affect operational results directly, they influence the bottom line. Tracking non-operating items helps understand other financial influences on profit. Investors review them to distinguish core performance from incidental gains or losses.

● Net profit/loss

Net profit or loss is the final outcome after deducting all expenses, taxes, interest, and other costs from total revenue. It shows how much profit the company retained or how much loss it incurred in the period.

This figure is a key indicator of overall operational success and management effectiveness. A consistent net profit demonstrates strong business fundamentals. It influences dividends, reinvestment decisions, and market valuation of the company.

● Earnings per share (EPS)

Earnings per share indicate how much profit is attributed to each outstanding share of common stock. It’s calculated by dividing net profit available to common shareholders by the average number of shares during the period.

EPS is a critical measure for investors as it helps compare profitability between companies and track performance over time. Higher EPS generally signals financial strength and potential for shareholder returns through dividends or stock appreciation.

The cash flow statement

● Purpose and structure

The cash flow statement outlines the actual inflows and outflows of cash over a set accounting period, highlighting a company’s ability to manage liquidity and meet financial obligations.

Unlike the profit and loss statement, which uses accrual accounting, this report focuses purely on cash transactions. It helps stakeholders gauge how effectively a business generates and uses cash.

● Operating activities

Day-to-day business operations generate or use cash through sales receipts, supplier payments, and employee salaries. This section reflects the core revenue-producing activities and indicates if a company’s main business can sustain itself without needing extra financing.

Strong cash from operations suggests healthy performance, stable working capital, and reliable internal funding for growth or debt repayment.

● Investing activities

This part shows where money is spent on or gained from long-term investments. Typical items include buying or selling property, equipment, or investment securities. Spending here often signals expansion or modernization, while inflows may come from asset disposals.

Understanding this section helps investors see management’s plans for future growth and how wisely capital is reinvested.

● Financing activities

Raising or repaying funds appears under financing activities. It includes proceeds from issuing shares, securing or paying off loans, and distributing dividends to shareholders. These transactions reveal how the business finances its operations and expansion, and how it returns profits to investors.

Monitoring this area shows if the company depends heavily on external funding or generates enough internally.

● Reconciliation of cash

At the end, the statement reconciles the cash balance at the beginning and end of the period. This summary ties together the net effects of operating, investing, and financing flows, ensuring transparency and accuracy.

By explaining how cash changed, it provides stakeholders with a complete picture of the company’s liquidity position and its ability to meet future cash needs.

Statement of changes in equity

The statement of changes in equity gives a detailed account of how each component of shareholders’ equity has changed during a reporting period. It tracks movements in share capital, retained earnings, reserves, and other equity items resulting from profits earned, dividends paid, new share issues, or other comprehensive income.

By showing these reconciliations, it helps stakeholders understand exactly how profits are reinvested, distributed, or adjusted, providing deeper insight into ownership value and corporate policies.

Notes to accounts

Notes to accounts are an integral part of a company’s financial statements, providing additional details and explanations that clarify figures presented in the main reports. They disclose accounting policies, assumptions, and any significant events that impact the financial results.

These notes help users interpret the numbers accurately by offering context about contingent liabilities, pending litigation, related party transactions, or unusual items. By enhancing transparency and completeness, they enable investors, creditors, and regulators to make well-informed assessments and comparisons.

What is the importance of financial accounting for Indian businesses?

Ensuring regulatory compliance and avoiding penalties

Financial accounting ensures businesses follow India’s Companies Act, SEBI norms, and tax laws. Accurate books reduce errors and avoid costly penalties or legal issues.

Proper compliance also builds trust with regulators and strengthens governance. Staying updated with changing rules maintains market reputation and smooth operations without interruptions from disputes or fines.

Informed strategic decision-making and business planning

Reliable financial information allows managers to make sound strategic choices. Data-driven planning improves resource allocation and market expansion.

Financial statements highlight profitable segments and areas needing attention. Decision-makers can forecast trends and adjust plans quickly. This proactive approach keeps the business competitive and adaptable to market shifts, enhancing long-term success.

Attracting investors and securing funding

Transparent financial reports give potential investors confidence in the company’s management and performance. Banks and venture capitalists demand audited accounts before approving funding.

Consistent reporting shows stability and sound governance. Investors use this data to weigh returns and risks. Credibility widens access to capital and helps negotiate better terms.

Performance measurement, analysis, and benchmarking

Regular reporting measures profitability, liquidity, and operational efficiency. Comparing these with industry standards helps benchmark performance against competitors.

Managers track improvements, analyze costs, and monitor key metrics. This enables informed decisions to boost productivity and cut waste. Clear metrics provide a realistic picture, highlighting strengths and weaknesses to address.

Effective tax planning and management

Proper accounting helps businesses calculate accurate tax liabilities, avoiding disputes with authorities. Well-maintained records ensure companies claim legitimate deductions and exemptions.

Timely tax payments prevent penalties. Insightful data allows planning of investments and expenses to optimize tax burdens legally. Efficient tax planning contributes to better cash flow and maximizes post-tax earnings.

Enhanced budgeting and future forecasting

Historical financial data builds realistic budgets and forecasts. Companies predict revenue, plan expenditures, and allocate resources effectively.

Accounting highlights trends and cash flow cycles, guiding managers to prepare for slow periods or peak demand. Robust budgeting ensures funds are used wisely, helping businesses stay financially healthy and ready for unexpected costs.

Fraud detection, prevention, and risk mitigation

Accurate record-keeping and regular audits discourage fraudulent activities. Transparent systems make it harder to conceal unauthorized transactions. Timely reviews help identify anomalies and risks early.

Detecting fraud promptly protects assets and investor trust. Internal controls reduce vulnerabilities. By minimizing fraud and errors, businesses safeguard profits and maintain high ethical standards.

Facilitating mergers, acquisitions, and disposals

Prepared financial statements simplify mergers, acquisitions, or sales. Buyers and investors rely on clear data to assess true asset values. Transparent books speed up due diligence and negotiations.

Accurate records secure better terms and ensure smooth post-transaction integration. Detailed reports reduce surprises and build trust, ensuring fair and successful deals.

Building stakeholder trust and credibility

Consistent, reliable reporting enhances a company’s reputation among investors, creditors, employees, and regulators. Transparent records show management is accountable and ethical. This builds confidence that resources are used responsibly.

Trust attracts loyal customers and skilled employees. Credibility helps secure better credit terms from suppliers and lenders, establishing the business as dependable.

Effective communication of financial health

Financial accounting communicates a business’s financial condition to stakeholders clearly. Reports help investors, lenders, and regulators understand revenue generation and cost control. This transparency supports funding, partnerships, or compliance decisions.

It reassures stakeholders about stability and growth prospects. Accurate communication reduces misunderstandings and strengthens relationships with all interested parties.

Financial accounting vs. management accounting: Key distinctions

Primary purpose and target audience

The main goal of financial accounting is to present an accurate financial picture for external parties like investors, regulators, and creditors, relying on historical data for compliance and transparency.

In contrast, management accounting serves the internal management team, offering tailored reports that support planning, performance evaluation, and strategic decision-making to drive operational success. Both functions complement each other in keeping a business financially sound.

Nature of information

Historical, quantitative, and monetary details form the core of financial accounting, ensuring standard statements clearly reflect performance and position for outsiders. Management accounting, however, blends past data with projections, budgets, and qualitative insights.

It also includes non-financial indicators like productivity metrics or customer satisfaction, delivering a broader context for internal analysis and strategy. This diverse information supports proactive management.

Adherence to standards and regulations

Reports generated for financial accounting must comply with generally accepted accounting principles, such as Ind AS or IFRS in India, and statutory rules like the Companies Act. On the other hand, management accounting operates without mandatory external standards.

Companies have the freedom to customize internal reports to address specific managerial needs, improving relevance and flexibility. This adaptability helps managers stay agile.

Periodicity of reporting

Standard intervals define when financial reports are produced typically quarterly or annually to satisfy legal, tax, and investor obligations. By comparison, management reports are created whenever management requires them.

They can be daily, weekly, or monthly, delivering real-time insights that help leaders respond swiftly to market changes and internal business developments. Timely data keeps operations aligned with goals.

Focus and level of detail

External reports emphasize the financial condition of the entire company, summarizing figures for general understanding. Management accounting dives deeper into departments, products, or projects. It provides granular details on costs, variances, and individual performance metrics.

Such depth helps managers pinpoint inefficiencies and make tactical improvements, boosting overall organizational performance. Detailed reports enhance accountability at all levels.

Time orientation

While formal accounting focuses on reporting what has already happened by recording historical transactions, management reporting looks ahead. Using past trends, current data, and assumptions, it forecasts future outcomes and plans budgets.

This forward-looking perspective equips managers to set realistic goals, prepare for challenges, and seize opportunities for sustainable growth. Future-focused data empowers better resource allocation.

Common challenges faced by Indian businesses in financial accounting

Complexity of tax laws

India’s tax structure involves multiple layers, including GST, direct taxes, and state-specific levies, creating complexity for businesses to interpret and apply correctly. Frequent changes, notifications, and amendments add to the confusion, increasing the risk of errors.

Small and medium enterprises especially struggle to keep up without expert guidance or robust accounting systems in place. Staying updated requires constant vigilance.

Compliance burden

Meeting the diverse compliance requirements imposed by regulatory bodies such as the MCA, Income Tax Department, RBI, and SEBI can overwhelm businesses. Each has separate filing deadlines, formats, and documentation needs.

Coordinating all these while focusing on core business activities demands dedicated resources and robust systems. Non-compliance can result in heavy fines and reputational damage. It puts extra pressure on finance teams.

Data accuracy and integrity

Ensuring that financial data remains accurate and free from inconsistencies is a continuous challenge for businesses of all sizes. Human errors, outdated systems, and a lack of standardized processes often lead to misstatements.

Inaccurate data affects financial statements, compliance, and decision-making. Companies must invest in skilled staff and reliable software to maintain clean books. Regular audits can help catch discrepancies early.

Transition to Ind AS

Shifting from old Indian Accounting Standards to the Ind AS framework demands significant adjustments in reporting practices. Companies need to retrain accounting teams, modify systems, and update policies to meet new recognition, measurement, and disclosure requirements.

This transition can be time-consuming and costly but is essential for aligning with global financial reporting standards. Proper planning makes the shift smoother.

Cash vs. accrual basis discrepancies

Although financial reporting follows the accrual basis, businesses must also manage real-time cash flows to ensure daily operations run smoothly. Balancing recorded revenues and expenses with actual cash inflows and outflows can be difficult, particularly for SMEs with tight liquidity.

Poor cash flow planning may lead to payment delays and operational disruptions. Effective cash forecasting becomes vital for survival.

Role of technology and accounting software in India

Automation of processes

Modern accounting software transforms routine tasks like data entry, ledger posting, and report generation by automating them, saving valuable time and effort. Automation reduces human errors that often lead to discrepancies in financial statements.

It allows accounting staff to focus on analysis and strategy instead of repetitive work. As a result, overall efficiency and productivity significantly improve for Indian businesses.

Improved accuracy and compliance

Advanced accounting tools help maintain high levels of accuracy by minimizing calculation mistakes and standardizing data processing. Built-in compliance features keep businesses aligned with evolving tax laws, GST norms, and regulatory requirements.

Automatic updates ensure the software reflects current legal changes. This reduces the risk of penalties and audit issues. Companies gain confidence knowing their financial records meet statutory standards.

Real-time reporting

With cutting-edge accounting software, businesses can access up-to-date financial data at any time, without waiting for month-end reports. Instant dashboards and customizable reports present key figures clearly.

This empowers managers to make timely, informed decisions backed by real numbers. Real-time visibility into revenue, expenses, and cash flows enhances agility. Quick insights help identify trends and opportunities faster than traditional methods.

Data security and backup

Reliable accounting solutions offer strong data encryption, role-based access controls, and multi-level authentication to safeguard sensitive financial information. Regular backups ensure that even in the event of system failures or cyberattacks, data can be restored with minimal disruption.

Many platforms also include disaster recovery options. Such security measures build trust with stakeholders. Businesses stay resilient and protected against data breaches.

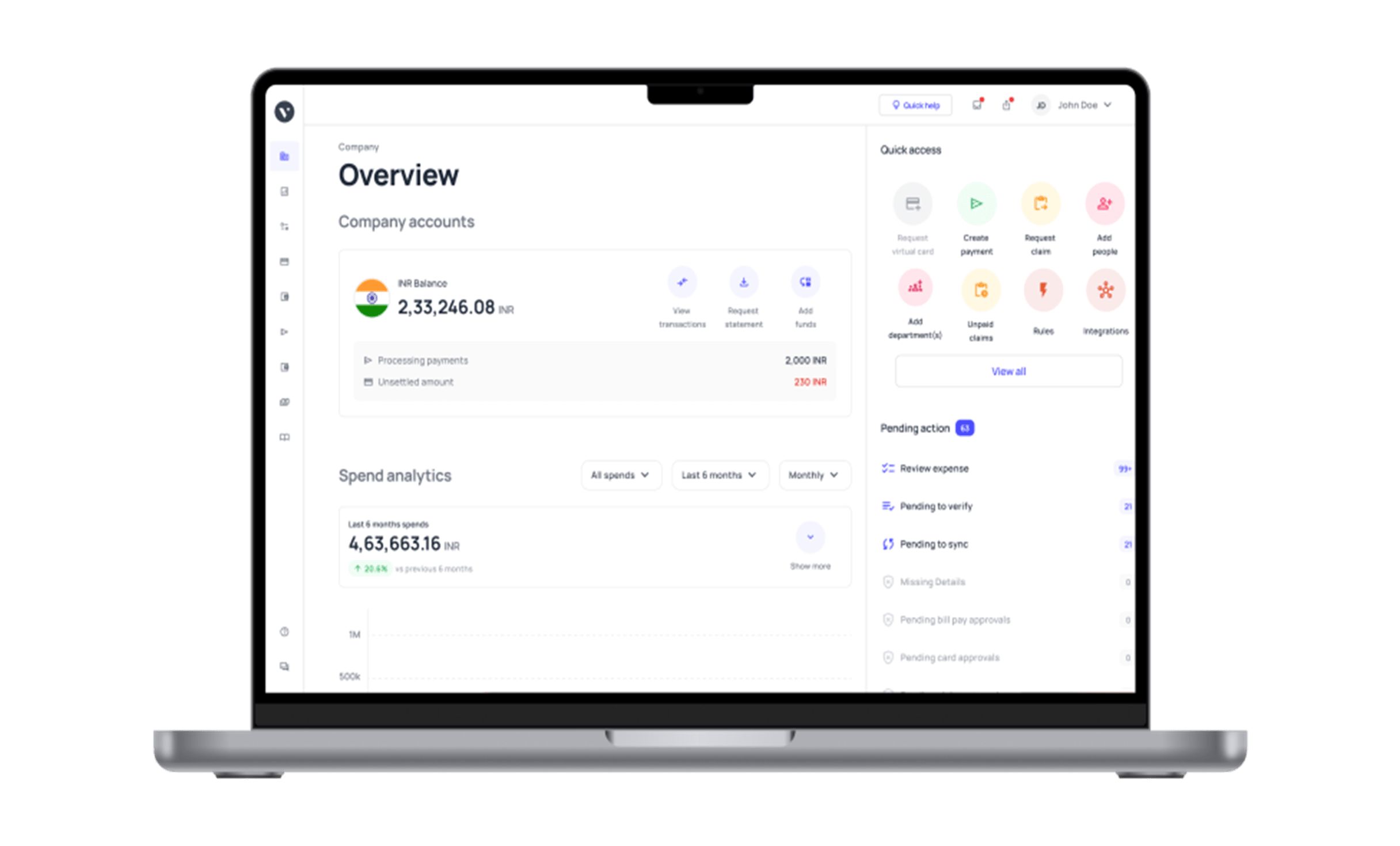

Experience streamlined financial operations with Volopay

Automation of accounting processes

With Volopay, you can automate tedious financial tasks through powerful accounting automation and connect effortlessly with trusted tools like Tally and Zoho Books. The platform records, categorizes, and reconciles expenses in real time, freeing you from manual entry.

Access up-to-date financial information whenever you need it for faster decisions. Reduce errors and gain clearer insights into your company’s spending patterns.

More than expense tracking: Complete financial management

Volopay offers more than expense tracking it’s a complete financial control system for your business. Issue physical and virtual corporate cards for employees, automate approvals, manage budgets, and monitor spending across departments easily.

Integrate your systems with accounting software and reporting all in one place for better oversight. Empower your team with tools that adapt as your company grows and scales operations smoothly.